Transcription

2014 Global Top Five TotalRewards Priorities SurveyEmployers around the world continue to prioritizeTalent – finding it, motivating it, and retaining it

ContentsOverview 4Talent is the top global challenge6Modifying Rewards program and strategy7Global perspectives 10Fine tuning compensation 12Administration and delivery 14Methodology and demographics 17As used in this document, “Deloitte” means Deloitte Consulting LLP, a subsidiary of Deloitte LLP. Please see www.deloitte.com/us/about for a detaileddescription of the legal structure of Deloitte LLP and its subsidiaries. Certain services may not be available to attest clients under the rules and regulations ofpublic accounting.This report is based solely upon the survey responses from the organizations participating in the Deloitte/ISCEBS/IFEBP survey conducted in December 2013.

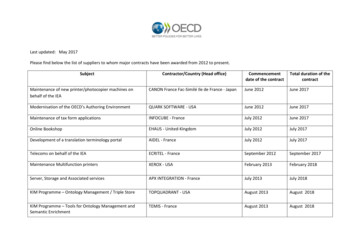

Overview“Employers recognize the criticalnature of total rewards as aprimary way to attract, motivate,and retain employees. Equallyimportant is for employees tounderstand the value of theirtotal rewards. Employer-providededucation and communicationis imperative for employees tobetter understand and make useof their rewards. Additionally,employers are educating beyondbenefits literacy to include topicssuch as personal finance, healthand wellness.”Michael Wilson, CEO, IFEBP andISCEBSThe Global Top Five Total Rewards Priorities Survey servesto help identify the main talent issues facing employersaround the world and their priorities in addressing thesecritical business challenges. This year’s survey, producedin seven different languages, received responses fromHuman Resources professionals from around the world,representing employers in 22 countries across the Americasand EMEAP (Europe, Middle East, and Asia Pacific).What Total Rewards1 issues are on the minds of employersfrom around the world? And what are employersconcerned with today and in the years ahead? As thebusiness landscape continues to become more globalized,the need to attract, engage, and retain top talent is ahighly pressing issue. Once again, the survey reveals thatthe top challenge of the next three years for HR leadershipacross the globe is Talent — finding it, motivating it,and keeping it. This challenge was once again cited byemployers as the number one challenge by a plurality ofemployers in the Americas (38%) and EMEAP (30%).For purposes of this report, “Total Rewards” is defined as everythingabout the work experience that affects or is available to an employee,including such tangibles as compensation and benefits, as well as suchintangibles as learning and development opportunities, deployment,workforce flexibility, leadership communication, and job training.1Sponsored jointly by Deloitte, the International Societyof Certified Employee Benefit Specialists (ISCEBS), andthe International Foundation of Employee Benefit Plans(International Foundation), the 2014 Top Five Surveysuggests that there are many similarities to the challengesfaced amongst employers around the world despite thedifferent political and geographic climates in which theyoperate. Here is how the respondents from 22 differentcountries ranked the Top Five priorities for 2014:1. Aligning Total Rewards with business strategy byattracting, motivating, and retaining employees2. Costs of providing benefits to employees3. Motivating staff when pay increases are flat ornon-existent4. Demonstrating appropriate return on investment forreward expenditures5. Creating a rewards program that reflects the culture andgoals of the organizationWhen viewed by geography, the Top Five priorities showslight variations as displayed in Exhibit 1:Exhibit 1. Top Five Priorities by geography:Rank4GlobalAmericasEMEAPAligning Total Rewards with business strategy by attracting,motivating, and retaining employees#1#1#1Costs of providing healthcare and other non-cash benefitsto employees#2#2#19Motivating staff when pay increases are flat/non-existent#3#9#2Demonstrating appropriate return on investment for rewardexpenditures#4#6#3Creating a rewards program that reflects the culture andgoals of the organization#5#8#5

Keeping with the focus for the near future, the toppriority for all geographic regions is the alignment ofTotal Rewards to finding, motivating, and keeping talent.These findings clearly point to the need for effective talentstrategies as employers struggle to fill technical and skilledjobs during a period of stubbornly high unemployment. Atthe same time, because of this shortage of the right talent,motivating and retaining this talent becomes all the moreimportant.Europe in recent years — recession, currency uncertainty,as well as the general difficulty of replacing low performersin organizations. The pressure to balance talent and theconstraints of pay budgets and competitive pressures tomodernize and compete in the Total Rewards space areconverging. In addition, the regulatory environmentsin EMEAP generally decrease differentiation of benefitsacross companies, making compensation a more criticaldifferentiator in competing for talent.One of the key differences in priorities amongst thegeographies is the emphasis that the Americas regionplaces on the cost of providing benefits to employees. InEMEAP, this is less of a concern, with very few respondentsin EMEAP citing this as a top five priority. In the UnitedStates, this comes as no surprise, as the Affordable CareAct has most, if not all, employers focused on healthcarebenefits and costs. There is a great deal of uncertaintyaround healthcare benefits and the role it could play onthe incentive structure for talent in the United States.EMEAP, in addition to the issues listed above, prioritizesmatching the growth of the competitive market and talentpressures with maintaining competitive pay for employees.There was additional attention around finding ways todemonstrate an appropriate return on investment for theexpenditures on rewards in a rapidly growing competitivemarket.In EMEAP, compensation concerns are highly prioritizedas a concern, as effectively motivating staff when payincreases are flat or non-existent is the second highestpriority. This sentiment reflects the economic turmoil acrossOverall, organizations (even within their geographicregions) varied in degrees on ranking the priorities, butthe areas of focus are very similar in most cases. The 2014Top Five Survey highlights where employers are facingchallenges related to Total Rewards along with the actionsthey are taking to address those challenges.2014 Global Top Five Total Rewards Priorities Survey 5

Talent is the top global challengeIdentifying and retaining top talent — along withcost concerns — are key future challengesWhen asked to identify the most significant challengefacing their organizations over the next three years, HRleaders across the globe are focused on talent. Keepingwith last year’s survey results, shortage, motivation, andretention of qualified talent far outpaced all other choices,with the plurality of all respondents (35%) choosing it asthe #1 challenge. In fact, breaking the total responsesdown by region, it was easily the most significant challengefor each region, as 38% of respondents in the Americas,and 30% in EMEAP selected this as their top priority.This top concern reflects the talent paradox companiesaround the world continue to face – in a period ofstubbornly high unemployment, employers still facechallenges filling technical and skilled jobs. The pressuremounts as employers compete for a group of skilledworkers that is smaller than the market, creating concernsabout attracting, inspiring, and keeping talent.Rising cost of Total Rewards, while the second largestconcern overall (16%), was a lesser concern in EMEAP asthey prioritized other concerns. However, with the recentfocus on employee benefits and long-term costs, as wellas recent legislative changes in the United States, it is notsurprising that it was a significant concern in the Americas(19%). The growth in costs of Total Rewards has generallyoutpaced other costs affecting organizations’ bottom linesin the Americas, and is receiving additional focus.EMEAP continues to find difficulty with providingmeaningful pay increases in a cost reduction environment.While this was a limited concern in the Americas (under10%), EMEAP ranked this as their second most significantconcern (20%). Once again, this reflects the issues aroundhaving significant constraints with payroll budgets whilecompeting for talent.Exhibit 2. Which of these do you see as the most significant challenge facing your organization in the nextthree years? (Choose only one)Shortage, motivation, and retention of qualified talent35%16%Rising cost of Total RewardsProviding meaningful pay increases in a cost reductionenvironmentUncertain economic conditions/pending tax andregulatory requirementsTotal Rewards administration that meets or exceedsexpectations for cost efficiency, service quality,compliance, and scalability/flexibility612%10%9%

Modifying Rewardsprogram and strategyFinding the right balance requires adjustingstructure and strategyIn an ever-changing economic environment, organizationscontinue to review and evaluate the Total Rewardsprograms they have in place to understand the return oninvestment for an area of significant spend. Companies areevaluating whether specific rewards programs are goodfits for their employees, gauging the value the employeesplace on the benefits, and assessing the complianceimpact on the rewards structure, to name a few waysorganizations evaluate the effectiveness of their TotalRewards programs.The Top Five Survey revealed general alignment acrossregions with respect to actions that organizations haveundertaken within the past 12 months, or expect toundertake within the next 12 months in Exhibit 3. Overall,companies continue to look for new ways to increase theimpact total reward spend has on their business results.in the Americas. This is a new focus as organizationsattempt to reap the longer-term cost savings and benefitsfrom a healthier working population. Employers hopethat improved health will lower healthcare costs, improveproductivity, and enhance job satisfaction. However, thesuccess of these programs is difficult to measure in theshort-term.In line with prior years, definition, mix of components,and/or redesign of overall rewards strategy was a topaction for EMEAP (#1) and the Americas (#2). Rewardsare a critical component of the employment packageoffered to employees in virtually every region of theworld. With the focus on attracting and retaining qualifiedtalent, employers should regularly assess their programsto determine whether they are hitting the value target ofemployees. This value must then be balanced against therewards costs, all within the context of the population’schanging needs and broader organizational strategy.Increasing health and well-being initiatives was identifiedas the #1 action across all regions, being favored especiallyExhibit 3. Please identify actions that your organization has undertaken relative to the redesign of youroverall Total Rewards Strategy/Program within the past 12 months or expects to undertake over the next12 months (choose all that apply):GlobalAmericasEMEAPIncreasing health and well-being initiatives43%50%27%Definition, mix of components, and/or redesign of overallrewards strategy40%38%44%Alignment with organization strategy and brand34%32%37%Differentiation by employee group (workforce segmentation)23%21%27%Differentiation by business unit14%14%14%Significantly reducing Total Rewards investment8%7%10%None of the above – we have not undertaken any redesign ofour Total Rewards Strategy18%18%20%2014 Global Top Five Total Rewards Priorities Survey 7

Being able to look ahead, anticipate challenges, and planaccordingly to manage those reward challenges was animportant concern HR professionals identified in the TopFive Survey. When asked how they would manage againstthose challenges, respondents ranked the areas listed inExhibit 4.Exhibit 4. If your organization is planning (or has recently planned) changesto your overall Total Rewards Strategy/Program, please select all options yourorganization is considering (or has considered):50%Increasing employee communication and educationRedesigning some of our reward programs to better alignthe interest of employees42%Creating a more consistent structure for our Total RewardsPrograms on a global basis35%31%Re-evaluating vendors/ providers and delivery systems31%Packaging, branding, and/or communications26%Adjusting mix of Total Rewards Program componentsMeasuring the return on investment of our rewardprogramsAdding benefit programs to the Total Rewards program23%19%Increasing employee communications/education was onceagain rated the top planned change to Total Rewardsprograms globally, with the Americas (52%) and EMEAP(45%) responding with nearly equal emphasis. In EMEAP,this may relate to cultural or statutory requirements tocommunicate with employees through works councilsor other employment bodies that dominate the EMEAPlandscape. In the Americas, employees may have higherexpectations of employers to be transparent and openlyshare key organizational information. In addition, thecomplexity of these programs continues to escalate aroundthe world and aging workforces are more and moreconcerned with retirement security and their health. Finally,the importance of employee communication also supportsthe renewed focus to motivate current talent and boostemployee morale.8Redesigning some reward programs to better align withthe interest of employees was second with 42% of therespondents selecting it globally. There was relativelyhigher emphasis on this in Americas (45%) compared toEMEAP (35%), but it was still identified as one of the topthree action items for each of these regions. This wasalso the second-rated planned change to Total Rewardsprograms in last year’s survey, as the focus on change isdriven by employers’ desires to motivate and retain theirtalent.Since employers are focused on redesigning rewardsprograms, it follows that the #3 planned change globallywas creating a more consistent and strategically alignedstructure for Total Rewards Programs. This increasedsignificantly from the past year, as roughly one-third ofrespondents in each region indicated that this wouldbe something their organizations would focus on in thefuture. Employers understand there needs to be balancebetween the goals of their organizations and the interestsof the employees, and the Total Rewards programs mustfigure centrally into achieving the right balance to facilitateenhanced business outcomes.In looking at the areas being considered for change,references to the redesign, re-evaluation or adjustmentof reward programs and their supporting delivery systemsaccount for the top five results. When asked to identifywhich programs would receive more or less emphasis inthe coming year, Top Five Survey respondents indicatethat Wellness & Disease Management and CompensationPrograms are to receive greater emphasis. This is consistentwith responses elsewhere in the survey indicating thegrowing emphasis on wellness programs. Respondentsalso suggest that programs with significant financialimplications are to receive the most attention, indicatingthat programs with the highest cost to the organization aregiven greater scrutiny, as opposed to programs which areperceived the best by employees.

Exhibit 5. If you plan to adjust the mix of your Total Rewards Program, please indicate which programs areanticipated to receive more or less emphasis:Wellness & Disease ManagementCompensation ProgramsLearning & Development ProgramsHealth Programs (medical/dental/vision)6%3%Welfare Programs/Risk Benefits58%42%55%50%45%6%44%47%9%Retirement ProgramsExecutive Compensation Programs36%34%53%13%33%60%7%21%68%12%Less EmphasisIn fairly close overall results, wellness and diseasemanagement led the way this year in terms of receivingthe highest emphasis (58%). However, when looked atacross regions, there are significant differences, with 69%of the Americas placing more emphasis on it compared to27% of EMEAP. This can be explained by the absence of orlimitations of government-sponsored healthcare systems inmany parts of the Americas. In addition, the rising cost ofhealthcare each year, specifically in the U.S., has resulted inan increasing trend of employers sharing more of this costburden with employees and looking for ways beyond costsharing to manage total spend and improve productivity.The end result is a growing interest among both employersand employees in the U.S. to provide and participate inwellness and disease management programs.Compensation programs are a close second, as theyare generally the most visible and costly component ofa rewards strategy. A breakdown of the results showedthat compensation programs were anticipated to receivethe highest emphasis in EMEAP (76%) compared to theAmericas (46%). In EMEAP, this is perhaps the primaryfocus of Total Rewards programs as there is a greaterpresence of government-sponsored healthcare and socialsecurity.No Change or N/AMore EmphasisLearning and development ranked third globally with50% of respondents indicating more emphasis would beplaced on these programs in the coming year. The resultshere were relatively consistent across the Americas, whileEMEAP placed greater emphasis at 61%. This reflectsrecognition of the value employees place on theseprograms from a career development perspective, as wellas the continued need for employers to train and educatetheir workforce with an eye for staying current, remainingcompetitive and developing the next generation of leaders.The results here show that employers recognize theimportance of compensation as a component of the TotalRewards strategy, but at the same time are also consciousof other initiatives that can be taken to reduce costs whilealso developing the workforce.While a hot topic across the globe, respondents indicateda relatively lesser emphasis on executive compensationprograms than other Talent Rewards programs listed.Despite recent public pressures, a significant majority ofrespondents (60%) indicated that there is no anticipatedchange in their executive compensation programs. WhileEMEAP saw slightly more emphasis on these programsthan the Americas, executive compensation was only in themiddle of the rankings of the priorities shown in Exhibit 5across all geographies.2014 Global Top Five Total Rewards Priorities Survey 9

Global perspectivesGenerational considerationsOrganizations across the globe are facing significantlydifferent challenges related to the generations participatingin the workforce. Some workforce populations are aging,such as the U.S. and much of Europe, while others, suchas India and Brazil, are growing rapidly with a high influxof youth. Regardless of the dynamics within the globalworkforce – or the organization – the reality is thatthe expectations and needs of employees vary acrossgenerations. As this is perhaps the first time in historywhere four generations of people can be seen in the sameworkforce, the challenge of designing rewards programsthat motivate, attract and retain all employees is significant.In an effort to gauge global perspectives on fouroverarching Total Rewards topics, the Top Five Surveyasked HR professionals whether they agree/disagree withfour statements, detailed in Exhibit 6.Exhibit 6. Indicate how much you agree or disagreewith the following statementsMy organization’s leadership team understandsthe Total Rewards perspectives and valuesof the different generations in our workforce4%My organization would consider a menu-drivenrewards mix that allows employees fromdifferent generations to build a Total Rewardspackage to fit their individual needs12% 22%My organization has the correct Total Rewardsstrategy in place to recruit and retain thetalent we need in our workforceMy organization has integratedInternet-based social mediatools into our Total Rewardscommunication mewhat DisagreeStrongly DisagreeSomewhat AgreeStrongly AgreeWhile consideration of the varying needs and values ofdifferent generations in the workforce is a fairly recentconcept, 60% of respondents say they either somewhatagree or strongly agree their organization’s leadership teamunderstands these differing values. This figure is consistentacross the Americas (63%) and EMEAP (56%).Different generations of employees have different TotalRewards needs and priorities. To that extent, the numberof organizations who would consider a menu-drivenapproach versus those who would not is split evenly whenlooked at globally.As it relates to the #1 priority as defined by the globalrespondents – attraction, motivation, and retention oftalent – one in four (25%) indicated that they somewhatdisagree or strongly disagree that their organization hasthe correct Total Rewards strategy in place to recruit andretain the talent needed in their workforce while only 12%strongly agree. Broken out across geographic regions,the survey found that EMEAP is more likely to agree withthis statement than the Americas. Overall, this suggestsorganizations continue to struggle with finding the rightway to align Total Rewards with the overall businessstrategy, which is further bolstered by the variety of newapproaches companies are looking at with respect totraditional compensation and benefits offerings.Surprisingly, even though the reach of social mediacommunications continues to grow each year,organizations continue to lag behind and have not beenquick to identify and adopt methods of integratingsocial media tools into Total Rewards communicationscampaigns. About two-thirds of respondents (64%) inall geographic regions disagree that their organizationhas integrated social media tools into their Total Rewardscommunication campaigns.

This slow rate of adoption is expected to improve asemployees continue to look for immediate access toinformation delivered in a manner in which many alreadyspend significant amounts of time, and employers andbenefits service providers continue to seek out methodsto communicate efficiently with targeted groups ofemployees. This trend will also likely accelerate as wesee younger generations of workers become a largerpercentage of the workforce. One trend in this area isgamification, which embeds game mechanics and gamethinking in non-game settings. As the growing digitalrevolution continues to disrupt traditional methods ofcommunicating and delivering training, gamification hasdemonstrated itself to be effective in engaging employees,solving problems, and driving measurable results.2014 Global Top Five Total Rewards Priorities Survey 11

Fine tuning compensationDigging Deeper into RedesignAs survey respondents indicated, motivating staff whenpay increases are flat/non-existent is a Top Five priority,and compensation will continue to fall under the spotlightas the most visible and immediately tangible of rewardsprograms. The Top Five survey asked respondents toidentify areas where actions have been taken by theirorganization relative to the redesign of some or all of theircompensation and equity plans within the past 12 monthsor those that they expect to undertake over the next 12months. The results are shown in Exhibit 7.Variable pay is once again the leading global area of focusregarding compensation program redesign as employersshift pay structures towards pay for performance. Herethe major challenges are flexibility around variable pay —especially in jurisdictions where pay is contractual — andproviding methods for differentiating rewards for topperformers even while rewards budgets are stagnant oreven contracting.Exhibit 7. At a high level, please identify the areas where actions have been taken by your organization relativeto the redesign of some/all of your compensation and equity plans within the past 12 months or expects toundertake over the next 12 months (choose all that apply):12GlobalAmericasEMEAPVariable Pay45%38%61%Compensation Philosophy/Strategy37%34%42%Base Pay23%19%31%Sales Commission Plans22%19%28%Equity17%17%17%Non-Qualified Deferred Compensation Plans14%16%10%Employee Stock Purchase Plans7%5%13%

As further evidence of the shift towards pay forperformance, among those that are consideringcompensation plan redesign, seven of the top nine choicesselected were directly related to performance-based payand/or incentive compensation, as shown in Exhibit 8.Of the respondents considering (or who have recentlyconsidered) compensation and equity plan redesign,a plurality of respondents indicated they would placean increased emphasis on performance-based pay. Inthe Americas, the margin between the top three areasidentified was small, with 33% indicating they wouldincrease their emphasis on performance-based pay, 25%indicating they would improve performance managementtracking and administration, and 24% indicating theyplanned to modify merit distribution guidelines to drivemore pay to higher performers. In EMEAP, the focuswas on modifying merit distribution/annual pay increaseguidelines to drive more pay to higher performers thanother compensation priorities.Exhibit 8. If you are considering (or have recently considered) compensation/equity plan redesign, pleasechoose all options you are considering (or have considered):32%Increase emphasis on performance-based payModify merit increase and distribution guidelines to drive more pay to higher performers27%26%Revise base pay structuresImprove performance management trackingand administration25%23%Change incentive plan targets22%Modify incentive plan formula or eligibilityShift compensation mix toward moreincentive pay for specific job levels18%Change target competitive positioningagainst market15%Modify performance management distribution guidelines to drive differentiation inworkforce15%2014 Global Top Five Total Rewards Priorities Survey 13

Administration and deliveryExecution vital to administering effective RewardsprogramsWhile the design of Total Rewards programs are the mostimportant aspect in driving value, correctly administeringand delivering these programs continues to be extremelyimportant from a talent and risk management perspective.More and more, the communication and delivery of theTotal Rewards programs is how success will be perceivedand measured. The administration should be aligned bothwith the capabilities of the organization and the goals ofthe Total Rewards strategy. When asked to identify theactions being taken relative to the restructuring of theadministration of some or all reward programs within thepast 12 months (or over the next 12 months) respondentsindicated the focus areas identified in Exhibit 9.the overall respondents indicated a focus on increasingthe use of employee self-service technologies, this wasprimarily driven by the Americas (49%); EMEAP (30%) hadrelatively fewer respondents select this as an action. This isindicative of the increased focus on providing employeesgreater autonomy in attempting to retain and motivatetalent in the Americas, and particularly in the United States.Improve governance and administrative compliance wasthe second-rated overall current or future action. EMEAPdrove this, as 45% selected this option, versus 37% forthe Americas. With ever increasing regulatory and othercomplexity, more and more multinational organizationsare moving to centralize governance of Total Rewardsprograms to enhance cost management, compliance, andoverall effectiveness.There were differences in how the different geographicregions responded to this survey question. While 43% ofExhibit 9. Please identify actions that your organization has undertaken relative to the restructure of theadministration of some/all of our reward programs within the past 12 months or expects to undertake overthe next 12 months (choose all that apply):Increase the use of employee self-service technologies, including decision support tools to help employeesmake informed rewards program decisions43%Improve our governance and administrative compliance39%Renegotiate with existing provider(s)/vendor(s) to receive more favorable contract terms31%Increase the use of outsourced administration providers22%Centralize internal administration into a shared service model21%Undertake comprehensive transformation of HR delivery model, covering process, technology, structure,and provider(s)/vendor(s)21%Investigate a change in outsourced provider(s)/vendor(s)20%Improve processes for monitoring and managing outsourced administration providers14%Consolidate the number of outsourced administration providers10%Introduce strategies to place provider/vendor fees at risk for measurable performance outcomes10%Reduce the use of outsourced administration providers, including moving current services that areoutsourced back “in-house”149%

Rounding out the top three is renegotiating with existingprovider(s)/vendor(s) to receive more favorable contractterms. About 3 out of 10 respondents indicated that thiswas an action that they have recently undertaken or willundertake soon, as employers seek to find the best valueand return for their costs.One ongoing issue that impacts Total Rewards programbudgets is finding that balance between performingrewards-related activities in-house versus making use ofpartnerships, vendors/providers, and outsourcing. Exhibit10 shows the responses when the survey asked employersto choose the option that most closely described thecurrent service delivery model for a list of benefit programsThe greatest deviation amongst geographic regions wasseen when looking at absence management servicedelivery model results. While 86% use an insourced servicedelivery model in EMEAP, the Americas only saw 61% ofrespondents indicate the same. The Americas had about29% indicat

evaluating whether specific rewards programs are good fits for their employees, gauging the value the employees place on the benefits, and assessing the compliance impact on the rewards structure, to name a few ways organizations evaluate the effectiveness of their Total Rewards programs. The Top Five Survey revealed general alignment across