Transcription

September 21, 2020Review of Federal,State, and Regional TaxStrategies andOpportunities for CO2EOR-Storage and theCCUS Value Chain

Review of Federal, State, and Regional Tax Strategies and Opportunities for CO2-EOR-Storage and the CCUS Value ChainREVIEW OF FEDERAL, STATE, AND REGIONAL TAXSTRATEGIES AND OPPORTUNITIES FOR CO2-EORSTORAGE AND THE CCUS VALUE CHAINPROMOTING DOMESTIC AND INTERNATIONAL CONSENSUSON FOSSIL ENERGY TECHNOLOGIESPrepared for:United States Department of Energy Office of Fossil Energyand United States Energy AssociationSub-Agreement: USEA/DOE-002415-19-04Authors:Peter Connors, OrrickKen Ditzel, FTI ConsultingJoshua Emmett, OrrickFengrong Li, FTI ConsultingUnited States Energy Association1300 Pennsylvania Avenue, NWSuite 550, Mailbox 142Washington, DC 20004 1 202 312-1230 (USA)The contents of this report are the responsibility of the United States Energy Association anddo not necessarily reflect the views of DOE-FE or the United States Government.

Review of Federal, State, and Regional Tax Strategies and Opportunities for CO2-EOR-Storage and the CCUS Value ChainDISCLAIMERThe analysis and findings expressed herein are those of the author(s) and do not necessarily reflect theviews of FTI Consulting, Inc. and Orrick Herrington & Sutcliffe LLP (“Orrick”), their management, theirsubsidiaries, their affiliates or their other professionals.

Review of Federal, State, and Regional Tax Strategies and Opportunities for CO2-EOR-Storage and the CCUS Value ChainPRINCIPAL AUTHORSPeter Connors, a tax partner in the New York office of Orrick, focuses hispractice on cross-border transactions. He also has extensive experience inmany areas of tax law, including corporate transactions, financial transactionsand tax controversy matters. Peter serves as President of the American Collegeof Tax Counsel and Executive Vice President of the International FiscalAssociation. He has also served on the Executive Committee of the New YorkState Bar Association Tax Section since 2006.Ken Ditzel is a Managing Director at FTI Consulting and is based out of FTI’sMcLean, Virginia office. He has 20 years of experience in energy marketanalysis and consulting. He began his work in CCUS in 2004, working on behalfof the National Energy Technology Laboratory on Integrated GasificationCombined Cycle market penetration scenarios. Ken’s work has covered thebiofuels, coal, electricity, liquefied natural gas, manufacturing, oil and gas,petrochemical, and renewables industries.Joshua Emmett, an associate in Orrick's New York office, is a member of theTax Group. Joshua focuses his practice on a broad range of federal income taxmatters, with an emphasis on renewable energy investment and energy taxcredits. He has represented sponsors and investors in tax equity financingsacross the renewable energy sector.Fengrong Li, CFA is a Managing Director at FTI Consulting and is based out ofFTI’s McLean, Virginia office. She has spent over 20 years in the energy sectorand in commodity trading, holding senior positions with global energy andtrading companies. She specializes in market advisory, strategy development,utility resource planning, due diligence, financial modelling, investmentanalysis, and asset valuation across the energy value chain, including power,gas, and liquefied natural gas.Special thanks go to Chris Gladbach who, while a former partner in Orrick’s Energy & Infrastructuregroup, was instrumental in the development of our relationship with USEA.

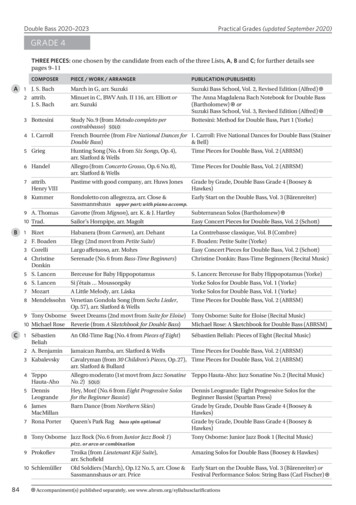

Review of Federal, State, and Regional Tax Strategies and Opportunities for CO2-EOR-Storage and the CCUS Value ChainTable of ContentsExecutive Summary. 1Introduction . 7Federal Incentives, Programs, and Agencies . 845Q Credit . 8Section 43 Federal Enhanced Oil Recovery Credit. 10Department of Energy. 12USDA Funding Under the Rural Economic Initiative . 14State Incentives, Programs, and Agencies. 14California . 16Illinois . 18Kansas . 18Kentucky . 19Louisiana . 21Michigan . 21Mississippi . 21Montana . 22New Mexico . 22North Dakota . 24Oklahoma . 25Oregon . 25Pennsylvania . 26Texas . 27Wyoming . 30Examples of Deal Structures . 30Profiles of Sectors and Stakeholders . 31Financial Stakeholders . 31Owners and Operators . 32Regulatory Agencies. 35

Review of Federal, State, and Regional Tax Strategies and Opportunities for CO2-EOR-Storage and the CCUS Value ChainNon-Regulatory Government Agencies . 36Roadblocks, Hurdles, and Solutions . 36Governmental and Regulatory . 37Market and Financial . 43Technical Improvements . 49Public Perception . 54Corporate Social Responsibility and Environmental, Societal Governance . 58What is CSR? What is ESG? . 58How prevalent are CSR and ESG statements? . 58Environmental Responsibility and Electricity Markets . 59How could a PPA apply to CCUS? . 60Case Studies . 60San Juan Generation Station CCUS Project . 60Petra Nova W.A. Parish CO2 Capture and Sequestration Project . 61Warrior Run Generating Station . 64Appendix A: Levelized Cost of Electricity Assumptions for 2026 Online Date . 65Appendix B: Discussion on Class II and Class VI Wells for Long-term Storage . 66Appendix C: Abbreviations . 71

Review of Federal, State, and Regional Tax Strategies and Opportunities for CO2-EOR-Storage and the CCUS Value ChainList of FiguresFigure ES- 1: U.S. CCUS Power Projects Under Development . 1Figure ES- 2: Capture-only Costs for Coal-fired Generator Retrofits . 2Figure ES- 3: States Active in CCUS Incentives . 3Figure ES- 4: LCOE Comparison for 2026 Online Date (includes Capacity Credit Value). 4Figure ES- 5: The Interconnected Nature of Major Roadblocks and Hurdles . 6Figure 1: U.S. GHG Emissions and GHG Emissions . 7Figure 2: Representative Tax Equity Partnership Flip Structure . 31Figure 3: Partnership Flip Structure – Assignment of 45Q to Project Company . 31Figure 4: Assignment of 45Q to Offtaker . 31Figure 5: CCUS Value Chain . 33Figure 6: The Interconnected Nature of Major Roadblocks and Hurdles . 37Figure 7: U.S. CCUS Power Projects Under Development . 43Figure 8: Coal-fired Generation Capture-only Costs. 44Figure 9: LCOE Comparison for 2026 Online Date – Includes Capacity Credit Value . 45Figure 10: Current CCUS Facilities Around the World . 50Figure 11: IChemE Energy Centre Ranking of CCUS Technologies from Concept to Commercial . 51Figure 12: Current and Future Portfolio of CCUS Technologies . 52Figure 13: Global CO2 Emissions Reductions by Technology Area: RTS to 2DS . 56Figure 14: Global CO2 Emissions Reductions by Technology Area: 2DS to B2DS . 56Figure 15: Structure of PPA . 59Figure 16: SJGS CCUS Project Schematic . 61Figure 17: Petra Nova CO2 Capture and Sequestration Project Timeline . 62Figure 18: Petra Nova CO2 Capture and Sequestration Project Layout . 63Figure 19: Petra Nova CO2 Capture and Sequestration Project Funding Structure . 63Figure 20: CO2 Storage Potential by Reservoir Type (Gt) . 67

Review of Federal, State, and Regional Tax Strategies and Opportunities for CO2-EOR-Storage and the CCUS Value ChainList of TablesTable ES- 1: 45Q Credit for Qualifying Facilities . 3Table ES- 2: Indicative Timelines and Costs for Class II vs. Class VI Wells .

Review of Federal, State, and Regional Tax Strategies and Opportunities for CO2-EOR-Storage and the CCUS Value Chain . REVIEW OF FEDERAL, STATE, AND REGIONAL TAX STRATEGIES AND OPPORTUNITIES FOR CO 2-EOR-STORAGE AND THE CCUS VALUE CHAIN . PROMOTING DOMESTIC AND INTERNATIONAL CONSENSUS ON FOSSIL ENERGY TECHNOLOGIES .