Transcription

Date: 20th July 2022To,BSE LimitedDepartment of Corporate ServicesPhiroze Jeejeebhoy Towers,25th Floor, Dalal Street,Mumbai - 400 001Dear Sir/Madam,Sub: Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements)Regulations, 2015Pursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements)Regulations, 2015, we are hereby enclosing Investors’ Presentation for the year 2021- 2022.The above said presentation is also made available on the Company’s websitewww.asmltd.comKindly, take the same on record of your esteemed Exchange.Thanking you,Sincerely,For ASM Technologies LimitedVanishree KulkarniCompany Secretary

FY22Presentation

QUARTERLY & FY22 UPDATE01ABOUT THE COMPANY02KEY MANAGEMENT03ASM VENTURES04EXPANSION05OUR STRATEGY06THE WAY AHEAD : OUTLOOK07FINANCIAL OVERVIEW08ANNEXURES09

Safe HarborThis presentation has been prepared by ASM Technologies Ltd based on information and data which the Companyconsiders reliable, but the Company makes no representation or warranty, express or implied, whatsoever, and no relianceshall be placed on, the truth, accuracy, completeness, fairness and reasonableness of the contents of this Presentation.Certain matters discussed in this presentation may contain statements regarding the Company’s market opportunity andbusiness prospects that are individually and collectively forward-looking statements. Such forward looking statements arenot guarantees for future performance and or subject to known and unknown risks, uncertainties, and assumptions that aredifficult to predict.These risks and uncertainties include but are not limited to, performance of the Indian economy and of the economies ofvarious international markets, the performance of the industry in India and worldwide, competition, the company’s ability tosuccessfully implement its strategy, company’s future levels of growth and expansion, technological implementation,changes and advancements, changes in revenue, income or cash flows, withdrawal of governmental fiscal incentives, thecompany’s market preferences and its exposure to market risks, as well as other risks.You can find us at: www.asmltd.com

FY22 HighlightsStandaloneTotal Income (INR Mn.)PAT (INR Mn.)EBIDTA(INR edFY22Total Income ( INR Mn.)FY21FY22EBIDTA(INR Mn.)FY21FY22PAT (INR Mn.)279.61391986201.51406FY21You can find us at: www.asmltd.comFY22FY2186FY22FY21FY22

Quarterly HighlightsStandaloneTotal Income (INR Mn)EBIDTA( INR Mn)PAT (INR otal Income (INR Mn)Q4FY21Q4FY22EBIDTA( INR Mn)569Q4FY21Q4FY22PAT (INR Mn)52.514.841547.2Q4FY21You can find us at: www.asmltd.comQ4FY22Q4FY2112.6Q4FY22Q4FY21Q4FY22

Quarterly SnapshotStandalone - Profit and LossRs mnQ4FY22 Q4FY21 Q3FY22IncomeConsolidated - Profit and LossRs mnQ4FY22 Q4FY21 Q3FY22IncomeIncome from OperationsOther Income381.512.6324.510.334138.6Income from OperationsOther Income547.121.94087476.238.9Total Income% YoY grwth394.117.7334.824.8379.540Total Income% YoY grwth569.137.141547.551532.6Cost of Good SoldEmployee ExpensesFinancial ExpensesDepreciationOther 35.9325.711.411.361.3Total .413.5%20.6-19.819.5-3.716.44.3Total Taxes0.715.820.7% loyee ExpensesFinancial ExpensesDepreciationOther otal Expenditure364.6283313.2Profit Before Taxes (PBT)% Margin29.57.551.815.566.317.5Share of net profit/loss of jointy controlledProfit Before Taxes (PBT)% MarginTax ExpenseCurrent TaxDeferred Tax/(credit)Total TaxesProfit After Taxes (PAT)% MarginYou can find us at: 1.694211.1Tax ExpenseCurrent TaxDeferred Tax/(credit)Profit After Taxes (PAT)

FY22 SnapshotRs mnStandalone - Profit and LossRs 661397FY22IncomeIncome from OperationsOther IncomeTotal IncomeIncomeIncome from OperationsOther IncomeTotal ureExpenditureEmployee ExpensesFinancial ExpensesDepreciationOther ExpensesTotal ExpenditureProfit Before Taxes (PBT)% loyee ExpensesFinancial ExpensesDepreciationOther ExpensesTotal ExpenditureShare of net profit/loss of jointly controlledProfit Before Taxes (PBT)% MarginTax ExpenseCurrent TaxDeferred Tax/(credit)Total Taxes126.5131.8Profit After Taxes (PAT)119Tax ExpenseCurrent TaxDeferred Tax/(credit)Total TaxesProfit After Taxes (PAT)% MarginYou can find us at: www.asmltd.com% Margin

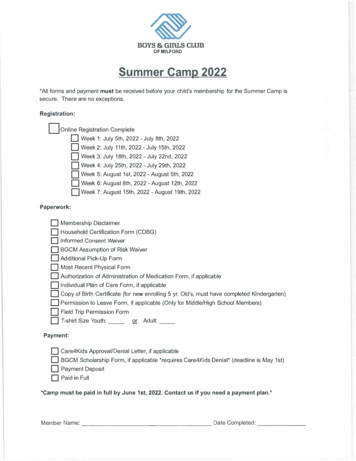

About the CompanyASM Technologies incorporated in 1992.Company specializes in the areas of ER&D with successful offshoredevelopmentOver Three decades of experiencePresence in pan India with global presence in USA, Singapore, UK, Canada, Mexico and Japan.Support Centre's in India and overseasASM Ventures an arm of company, use to make strategic minority investments in early-stagetechnology-oriented companies in India and overseasConsistent Dividend Paying CompanyYou can find us at: www.asmltd.com

Key Industries ServicedSEMICONDUCTOR& ELECTRONIC EQUIPMENTYou can find us at: www.asmltd.comAUTOMOTIVEPRODUCT R&D

Geographical PresenceYou can find us at: www.asmltd.com

Key Management PillarsMr. M. R. VikramChairmanMr. Rabindra SrikantanManaging DirectorA Chartered Accountant (ICAI) with 41 yrs. ofexperience Audit & Assurance Services, Bankingand is an expert on Finance and Regulatory issuesMS in Computer Engineering and ComputerScience-University of Louisiana, USA with over20 years of building successful businessventuresFew Current Board Positions:Facebook India Online Services Pvt LtdGVPR Engineering LtdGTN Industries LtdChettinad Cement Corporation LtdYou can find us at: www.asmltd.comMr. M LakshminarayanDirectorM-Tech from Indian Institute of Technology, Mumbaiwith 30 years in leading automotive OEM’sFew Current Board Positions:Current Board Positions:President – ASM Digital Technologies Inc, USADirector – ASM Digital Technologies Pte Ltd,SingaporePresident – ESR Associates Inc, USAZF Commercial Vehicle Control Systems India LtdTVS Electronics LtdKirloskar Oil Engine LtdSuprajit Engineering LtdBrose India Automotive Systems Pvt Ltd

Key Management PillarsMr. Shekar ViswanathanDirectorMr. Ramesh RadhakrishnaDirectorMs. Preeti RabindraDirectorA Chartered Accountant (ICAI) with 38financial services and project financeexperienceB.E. from the Indian Institute of Technology(IIT), Chennai, India and an M.E. in ille, USA with 20 years ofoperational and business experience in thehigh technology industryMasters in Commerce – University of DelhiMs Preeti Rabindra is involved in all the CSRactivities of the companyCurrent Board Positions:L&T – MHPS Boilers Pvt LtdL&T – MHPS Turbine Generators Pvt LtdRe-connect Energy Solutions LtdDesignated partner at IDS Systems LLPCurrent Board Positions:Artiman Capital IndiaYou can find us at: www.asmltd.comCurrent Board Positions:

ASM Ventures ; Key Strategic Investments

Affiliate ProgramASM Technologies Limited is an industry partner with CeNSE, IISc and aims to jointly focus on innovation inareas of micro-electromechanical system (MEMS)Salient highlights of the program such are : Joint Research & Development (R & D) CeNSE Facilities utilization Interactions with the faculty and student community at CeNSE Training ASM team on Semiconductor processes, technology and systems from CeNSE repute faculties/professorsYou can find us at: www.asmltd.com

Joint Venture : ASM- HHV EngineeringASM-HHV ASM-HHV Engineering is a 50:50 jointventure between ASM Technologies andHind High Vaccum (HHV Group)MANUFACTURING FACILITIESEXPERTISE The company would provide servicesindesigning and manufacturingsemiconductor tools, sub-systems,systems components and providingfield supportcan find us at: www.asmltd.comIndia’s firststate of artsemiconductor focused equipmentmanufacturing facility. ISO 7& ISO 8 Clean roomsLithography labsExtensive metrology testing facilityGas Management for Pyrophoric gasesPowder coating and Painting booths

ExpansionSalem, Tamil Nadu The company has opened a new facility inSalem, Tamilnadu in collaboration withNextWealth Entrepreneurs Pvt LtdWhitefield, Bangalore ASM Digital Engineering Pvt Ltd, whollyowned subsidiary of ASM Technologies has anew facility expansion at Whitefield,Bangalore. It would help the company inscaling up in coming yearsYou can find us at: www.asmltd.com

Our StrategyZero in on opportunities in key Industries & verticalsAcquire New LogosRetain skilled employees, Attract and develop talentStrategic acquisitions of companies in Niche segment and marketContinuous focus towards Investment in Emerging Technologies e.g., digital techExpand Footprint and client base with core capabilitiesSemiconductor Equipment, Medical Devices, Hi –Tech, Automotive, Telco – remain key growth verticalsEngineering Solutions to reduce Product Life Cycle and time to market, increasing yields and throughputs

Way ForwardSEMICONDUCTOR, ELECTRONICSYSTEM, SUB SYSTEM,COMPONENTYou can find us at: www.asmltd.comFOCUSING ON DESIGN LEDMANUFACTURINGGROW DIGITALENGINEERING BUSINESSSTRATEGIC ACQUISITION

FINANCIALS HIGHLIGHTS

Continuously Rewarding its ShareholdersDividend Paid (incl ddt) ( INR Mn)Standalone Profit After Tax ( INR Y19FY22FY20Dividend Payout (%)170.0%68.0%47.0%25.0%FY19You can find us at: www.asmltd.comFY20FY21FY22FY21FY22

Head Count1107630FY18You can find us at: www.asmltd.com580629FY19FY20FY211191FY22

Quarterly Consolidated Profit and 4Tax ExpenseCurrent TaxDeferred Tax/(credit)Total 8)0.7Profit After Taxes r(INR. Mn)IncomeIncome from OperationsOther IncomeTotal IncomeExpenditureCost of Good SoldEmployee ExpensesFinancial ExpensesDepreciation/AmortizationOther ExpensesTotal ExpenditureShare of net profit/loss of jointlycontrolled entityProfit Before Taxes (PBT)You can find us at: www.asmltd.com

Historical Consolidated Profit and LossParticular(INR. 3.9(23.9)39.970.17.086.0139.0IncomeIncome from OperationsOther IncomeTotal IncomeExpenditureCost of Good SoldEmployee ExpensesFinancial ExpensesDepreciation/AmortizationOther ExpensesTotal ExpenditureShare of net profit/loss of jointly controlled entityProfit Before Taxes (PBT)Tax ExpenseCurrent TaxDeferred Tax/(credit)Total TaxesProfit After Taxes (PAT)You can find us at: www.asmltd.com

Historical Consolidated Balance SheetParticulars (mn)FY19FY20FY21FY22Share capital5050100100Other Equity464.57454.06468.168.913.45523.48Non- Current LiabilitiesLong Term BorrowingsNon-Controlling InterestShareholder’s FundsFY19FY20FY21FY22Property Plant & Machinery54.0494.9784.63196.47557.3Intangible Assets53.9955.7690.0482.724.33-2.64Goodwill on consolidation--0.730.73507.51572.49654.66Financial Assets1.9861.95124.24143.04a. b. Loans5.561.154.294.73--Deferred tax assets (net)39.1233.6241.9758.6813.0716.28Other Non-Current Assets73.49126.2361.1665.93--Total Non Current 659.5993.39Investment154.8175.1991.17111.49Other financial liabilitiesProvisions1.492.64Deferred Tax LiabilitiesOther Non Current LiabilitiesCurrent ncial LiabilitiesParticulars (mn)Financial AssetsShort Term Borrowings145.37151.02242.63379.07Trade receivables269.92211.68502.1569.03Trade Payables85.5336.01110.75152.34Cash & Bank104.5466.66101.9792.65Other financial liabilities7.7116.647.047.780.596.176.377.14Other Current Liabilities94.859.0282.2291.01Other Financial Assets16.77526.159.81Current Tax Liability----Other Current al Current 61.09Total Assets858.87832.151156.91461.09Total Equities & LiabilitiesYou can find us at: www.asmltd.comLoans

Key RatiosConsolidatedProfitability RatiosFY19FY20FY21FY22Gross Profit MarginsEBITDA MarginsEBIT MarginsEBT Margins/Pre-Tax MarginsNet Profit MarginReturn on Investment RatiosReturn on Assets 110.06.328.614.112.29.37.31.091.161.181.31Return on Stockholder's Equity (ROE)1.791.891.221.36Debtors DaysWorking Capital TurnoverFixed Asset TurnoverTotal asset ssets RatioDebt-to-Equity Ratio0.160.270.230.390.260.510.300.68Net Profit MarginTotal Asset TurnoverFinancial .31.42.2Activity RatiosLiquidity RatiosCurrent RatioQuick RatioDebtors to Creditors %Debt RatiosDu-pont AnalysisYou can find us at: www.asmltd.com

CSR ActivityDVG Higher Primary School – OSAAT Educational Charitable TrustASM Technologies in association with OSAAT Educational Charitable Trust is building a classroom along with benches & desks atGovernment DVG Higher Primary School, Mulbagal town, Kolar district, Karnataka, India as to honor, preserve and cherish thememory of Shri D V Gundappa (DVG), the doyen of modern Kannada literature.You can find us at: www.asmltd.com

CSR ActivitySRI SATHYA SAI SARLA MEMORIAL HOSPITALASM Technologies in association with Sathya Sai Sarla Memorial Hospital will support Multi Specialty Hospitaldedicated with ICU oxygenated & HDU beds , Hub for medical and para medical education and training locatedin Muddenahalli Village, ChikkabalapuraYou can find us at: www.asmltd.com

Annexures31st Mar 202210 mn SharesM.Cap Full (INR Cr.)565BSE CODE526433BLOOMBERG CODEASM INRelative Stock Price Returns vs BSE Small Cap IndexShareholding Pattern as on 31st Mar 2022Relative Stock Price vs BSE Small Cap IndexASM Tech34.38BSE Small Cap 2Financial InstitutionsSource: BSEYou can find us at: www.asmltd.com-200Corp Bodies573.7IEPFRetail174.3

Thank You!Ms.Vanishree KulkarniSahil ShahCompany SecretaryKFintech IRASM Technologies LimitedPhone: 91-8828362795vanishree.kulkarni@asmltd.comEmail: Sahil.shah@kfintech.com

The above said presentation is also made available on the Company's website www.asmltd.com Kindly, take the same on record of your esteemed Exchange. Thanking you, Sincerely, For ASM Technologies Limited . Employee Expenses 254.1 194.8 240 Financial Expenses 9.9 6.1 6.9 Depreciation 5 1.6 5.4 Other Expenses 95.5 80.5 60.9 Total Expenditure .