Transcription

IssuerDoctor Care Anywhere Group PLC(Company Number 08915336)(ARBN 645 163 873)PROSPECTUSProspectus for the initial public offeringof CDIs over fully paid ordinary sharesin the CompanyLead ManagerCo-Manager

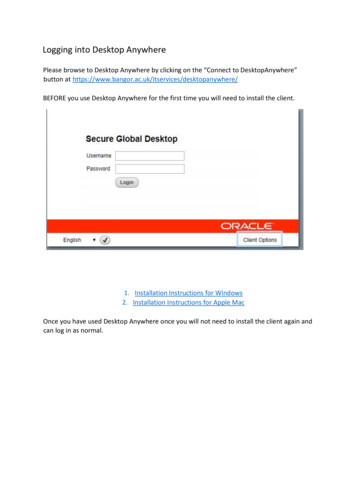

b ospectus Important NoticesOfferThis Prospectus is issued by Doctor Care Anywhere Group PLC,a public limited company registered in England and Wales withEnglish company number 08915336 and registered as a foreigncompany in Australia (ARBN 645 163 873) (Company or DOC)and DCA SaleCo PLC, a public limited company registered inEngland and Wales with English company number 12852833and registered as a foreign company in Australia (ARBN 645161 495) (SaleCo). The Offer contained in this Prospectus isan invitation for you to apply for CHESS Depositary Interests(CDIs) over fully paid ordinary shares in the Company (Shares).The issue of CDIs is necessary to allow investors to trade theShares on ASX and settle transactions through the ClearingHouse Electronic Subregister System (CHESS). CDIs give aholder similar, but not identical, rights to a holder of Shares.See Section 7 for further information on the Offer, including asto details of the securities that will be issued and transferredunder this Prospectus.Lodgement and ListingThis Prospectus is dated Friday, 30 October 2020 and waslodged with ASIC on that date (Prospectus Date).The Company has applied to the ASX for admission of theCompany to the Official List and quotation of the CDIs on theASX (Listing).Neither ASIC nor the ASX takes any responsibility for thecontent of this Prospectus or for the merits of the investment towhich this Prospectus relates.As set out in Section 7.14, it is expected that the CDIs will bequoted on ASX. The Company, SaleCo, Computershare InvestorServices Pty Limited (CDI Registry) and the Lead Managerdisclaim all liability, whether in negligence or otherwise,to persons who trade CDIs before receiving their holdingstatement or allotment confirmation advice.Expiry dateNo CDIs will be issued or transferred on the basis of thisProspectus after the expiry date, being 13 months after theProspectus Date.Note to ApplicantsThis Prospectus is issued by the Company and SaleCo for thepurposes of Chapter 6D of the Australian Corporations Act 2001(Cth) (Corporations Act). The Company is offering to issue newCDIs (New CDIs) under this Prospectus and SaleCo is offering tosell CDIs over Existing Shares (Sale CDIs) under this Prospectus.The information contained in this Prospectus is not financialproduct advice and does not take into account the investmentobjectives, financial situation or particular needs (includingfinancial and tax issues) of any prospective investor.It is important that you read this Prospectus carefully and inits entirety before deciding whether to invest in the Company.In particular, in considering the prospects of the Company,you should consider the risk factors that could affect theperformance of the Company. You should carefully considerthese risks in light of your investment objectives, financialsituation and particular needs (including financial and taxissues) and seek professional guidance from your stockbroker,solicitor, accountant, financial adviser or other independentprofessional adviser before deciding whether to invest in theCDIs. Some of the key risk factors that should be consideredby prospective investors are set out in Sections 1.2 and 5.There may be risk factors in addition to these that should beconsidered in light of your personal circumstances.You should also consider the assumptions underlying theForecast Financial Information set out in Section 4.9 and therisk factors set out in Section 5 that could affect the Company’sbusiness, financial condition and results of operations.Except as required by law, and only to the extent required,no person named in this Prospectus, nor any other person,warrants or guarantees the performance of the Company orthe repayment of capital by the Company or any return oninvestment in CDIs made pursuant to this Prospectus.Exposure PeriodThe Corporations Act prohibits the Company from processingapplications to subscribe for, or acquire, CDIs offered underthis Prospectus (Applications) in the seven-day period afterlodgement of this Prospectus with ASIC (Exposure Period).This Exposure Period may be extended by ASIC by up to afurther seven days.The purpose of the Exposure Period is to enable this Prospectusto be examined by market participants prior to the raising offunds. The examination may result in the identification ofdeficiencies in this Prospectus, in which case any Applicationmay need to be dealt with in accordance with section 724 of theCorporations Act.Applications received during the Exposure Period will not beprocessed until after the expiry of the Exposure Period. Nopreference will be conferred on any Applications receivedduring the Exposure Period.Photographs and diagramsPhotographs and diagrams used in this Prospectus that do nothave descriptions are for illustration only and should not beinterpreted to mean that any person shown in them endorsesthis Prospectus or its contents or that the assets shown in themare owned by the Company. Diagrams used in this Prospectusare illustrative only and may not be drawn to scale or accuratelyrepresent the technical aspects of the products.Disclaimer and forward-lookingstatementsNo person is authorised to give any information or make anyrepresentation in connection with the Offer which is notcontained in this Prospectus. Any information or representationnot so contained may not be relied on as having beenauthorised by the Company, SaleCo, the Directors, the SaleCoDirectors, the Lead Manager or any other person in connectionwith the Offer. You should rely only on information in thisProspectus when deciding whether to invest in CDIs. Exceptas required by law, and only to the extent so required, neitherthe Company nor any other person warrants or guaranteesthe future performance of the Company, or any return on anyinvestment made pursuant to this Prospectus.

doctor care anywhere. prospectus 1This Prospectus contains forward-looking statements whichare statements that may be identified by words such as “may”,“will”, “would”, “should”, “could”, “believes”, “estimates”,“expects”, “intends”, “plans”, “anticipates”, “predicts”, “outlook”,“forecasts”, “guidance” and other similar words that involverisks and uncertainties. The Forecast Financial Information isan example of forward-looking statements. These statementsare based on an assessment of present economic and operatingconditions and on a number of best estimate assumptionsregarding future events and actions that, at the ProspectusDate, are expected to take place (including the key assumptionsset out in Section 4.9).No person who has made any forward-looking statements inthis Prospectus (including the Company) has any intention toupdate or revise forward-looking statements, or to publishprospective financial information in the future, regardless ofwhether new information, future events or any other factorsaffect the information contained in this Prospectus, other thanto the extent required by law.Such forward-looking statements are not guarantees offuture performance and involve known and unknown risks,uncertainties, assumptions and other important factors,many of which are beyond the control of the Company,and the directors and management of the Company andSaleCo. Forward-looking statements should therefore beread in conjunction with, and are qualified by reference to,Sections 4 and 5, and other information in this Prospectus.The Company and SaleCo cannot and do not give any assurancethat the results, performance or achievements expressed orimplied by the forward-looking statements contained in thisProspectus will actually occur and investors are cautioned notto place undue reliance on these forward-looking statements.The Company, SaleCo, the CDI Registry and the Lead Managerdisclaim all liability, whether in negligence or otherwise,to persons who trade CDIs before receiving their holdingstatement or allotment confirmation advice.Financial information presentationThe monetary amounts contained in this Prospectus areexpressed in Australian Dollars (A or ), unless otherwisestated. However, all financial amounts in Section 4 (FinancialInformation) are expressed in Pound Sterling (GBP or ),unless otherwise stated.Section 4 sets out in detail the Financial Information referredto in this Prospectus. The basis of preparation of the FinancialInformation is set out in Section 4.2.As described in more detail in Section 4.2, the HistoricalFinancial Information has been prepared and presented inaccordance with the recognition and measurement principlesof the International Financial Reporting Standards (IFRS)issued by the International Accounting Standards Board (IASB),which are consistent with the Australian Accounting Standards(AAS) and interpretations issued by the Australian AccountingStandards Board (AASB).This Prospectus includes Forecast Financial Information basedon the best estimate assumptions of the Directors. The basisof preparation and presentation of the Forecast FinancialInformation, to the extent relevant, is consistent with the basisof preparation and presentation for the Historical FinancialInformation. The Forecast Financial Information presented inthis Prospectus is unaudited.The Financial Information in this Prospectus should be readin conjunction with, and it is qualified by reference to, theinformation contained in Sections 4 and 5.Industry and market dataThis Prospectus, including the Industry Overview in Section 2,contains statistics, data and other information (includingforecasts and projections) relating to markets, market sizes,market shares, market segments, market positions and otherindustry data pertaining to the Company’s business and markets.Bell Potter has acted as Lead Manager to the Offer and hasnot authorised, permitted or caused the issue or lodgement,submission, dispatch or provision of this Prospectus and thereis no statement in this Prospectus which is based on anystatement made by the Lead Manager or by any of its affiliatesor Related Bodies Corporate, (as defined in the CorporationsAct), or any of their respective officers, directors, employees,partners, advisers or agents. To the maximum extent permittedby law, the Lead Manager, their respective affiliates andRelated Bodies Corporate, and any of its officers, directors,employees, partners, advisers or agents expressly disclaim allliabilities in respect of, make no representations regarding, andtake no responsibility for, any part of this Prospectus otherthan references to their name and make no representationor warranty as to the currency, accuracy, reliability orcompleteness of this Prospectus.The Company has obtained significant portions of thisinformation from sources prepared by third parties. Investorsshould note that market data and statistics are inherentlypredictive and subject to uncertainty and not necessarilyreflective of actual market conditions. There is no assurancethat any of the forecasts or projections in the reports that arereferred to in this Prospectus will be achieved. The Companyand SaleCo have not independently verified and cannot giveany assurances to the accuracy or completeness of this marketand industry data or the underlying assumptions used ingenerating this market and industry data. Estimates involverisks and uncertainties and are subject to change based onvarious factors, including those discussed in the risk factors setout in Section 5.Statements of past performanceThis Prospectus is available in electronic form toAustralian residents on the Company’s offer website,http://doctorcareanywhere.com/ir. The Offer constituted bythis Prospectus in electronic form is available only to Australianresidents accessing the website within Australia and is notavailable to persons in any other jurisdictions, including theUnited States.This Prospectus includes information regarding the pastperformance of the Company. Investors should be aware thatpast performance should not be relied upon as being indicativeof future performance.Obtaining a copy of this Prospectus

2doctordoctor carecare anywhere.anywhere. prospectusprospectusNotices Important A hard copy of the Prospectus is available free of charge duringthe Offer Period to any person in Australia by calling theDOC Offer Information Line on 1300 095 732 (toll free withinAustralia) or 61 3 9415 4294 (outside Australia) between 8:30amand 5:00pm (Sydney time), Monday to Friday.Applications for CDIs may only be made on the ApplicationForm attached to, or accompanying, this Prospectus in itshard copy form, or in its soft copy form available online athttp://doctorcareanywhere.com/ir, together with an electroniccopy of this Prospectus. By making an Application, you declarethat you were given access to the Prospectus, together with anApplication Form.The Corporations Act prohibits any person from passing theApplication Form on to another person unless it is attached to,or accompanied by, this Prospectus in its paper copy form or thecomplete and unaltered electronic version of this Prospectus.No cooling off rightsCooling off rights do not apply to an investment in CDIspursuant to the Offer. This means that, in most circumstances,you cannot withdraw your Application once it has beenaccepted.No offering where illegalThis Prospectus does not constitute an offer in any place inwhich, or to any person to whom, it would not be lawful tomake an offer. No action has been taken to register or qualify theCDIs or the Offer under this Prospectus, or to otherwise permit apublic offering of CDIs, in any jurisdiction other than Australia.The distribution of this Prospectus (including in electronic form)in jurisdictions outside Australia may be restricted by law andpersons who come into possession of this Prospectus shouldseek advice and observe any such restrictions. Any failure tocomply with such restrictions may constitute a violation ofapplicable laws.In particular, this document does not constitute an offer to sell,or a solicitation of an offer to buy, securities in the U.S. or to anyU.S. Person. The U.S. Offer Securities have not been, and willnot be, registered under the U.S. Securities Act or the securitieslaws of any state or other jurisdiction of the U.S., and may notbe offered, sold, pledged or otherwise transferred, whetherdirectly or indirectly, in the U.S., or to or for the account ofany U.S. Person, unless the U.S. Offer Securities have beenregistered under the U.S. Securities Act or an exemption fromthe registration requirements of the U.S. Securities Act and anyother applicable securities laws is available. There will be nopublic offering of the U.S. Offer Securities in the U.S.Accordingly, the U.S. Offer Securities may only be offered orsold: (a) in the U.S. to investors that are (i) a QIB (ii) an Eligible U.S.Fund Manager; and (b) outside the U.S. to non-U.S. Persons in“offshore transactions” (as defined in Regulation S under the U.S.Securities Act) in compliance with Regulation S under the U.S.Securities Act and in accordance with any other applicable laws.See Section 10.18 for more detail on selling restrictions thatapply to the Offer and sale of CDIs in certain jurisdictionsoutside Australia.The return of a duly completed Application Form (or, in thecase of investors in the U.S., a confirmation letter provided bythe Lead Manager) will be taken by the Company to constitutea representation and warranty made by the Applicant to theCompany that there has been no breach of such laws and thatall necessary approvals and consents have been obtained.PrivacyBy completing an Application Form, you are providing personalinformation to the Company and SaleCo through the CDIRegistry, which is contracted by the Company to manageApplications. The Company and SaleCo, and the CDI Registry onits behalf, and their agents and service providers may collect,hold, disclose and use that personal information to processyour Application, service your needs as a Shareholder or CDIHolder (as applicable), provide facilities and services that yourequest and carry out appropriate administration, and for otherpurposes related to your investment listed below.If you do not provide the information requested in theApplication Form, the Company, SaleCo and the CDI Registrymay not be able to process or accept your Application.The Company may require information about you (includingyour name, address and details of the CDIs you hold) for thepurposes of maintaining these registers. More informationabout these registers is included in Section 7.14.The Company and the CDI Registry may disclose your personalinformation for purposes related to your investment to theiragents and service providers including those listed below oras otherwise authorised under the Privacy Act 1988 (Cth) theGeneral Data Protection Regulation ((EU) 2016/679) (GDPR) andthe Data Protection Act 2018 (UK): the CDI Registry for ongoing administration of theShare Register;the Lead Manager to assess your Application;printers and other companies for the purposes ofpreparation and distribution of documents and forhandling mail;market research companies for analysing the Company’sshareholder base; andlegal and accounting firms, auditors, managementconsultants and other advisers to the Company foradministering, and advising on, the CDIs and for associatedactions.The Company’s agents and service providers may be locatedoutside Australia where your personal information may notreceive the same level of protection as that afforded underAustralian law.You may request access to your personal information held byor on behalf of the Company and SaleCo. You may be requiredto pay a reasonable charge to the CDI Registry in order to accessyour personal information.

doctor care anywhere. prospectus 3You can request access to your personal information or obtainfurther information about the Company’s privacy practices bycontacting the CDI Registry as follows:Telephone: (outside Australia) 1300 850 505 (within Australia)(toll free within Australia) 61 3 9415 4000Address:Yarra Falls, 452 Johnston StreetAbbotsford VIC 3067, Melbourne, AustraliaThe Company aims to ensure that the personal informationit retains about you is accurate, complete and up-to-date.To assist with this, please contact the Company or the CDIRegistry if any of the details you have provided change.Financial Services GuideThe provider of the Investigating Accountant’s Report on theFinancial Information is required to provide Australian retailclients with a financial services guide in relation to that reviewunder the Corporations Act. The Investigating Accountant’sReport on Historical Financial Information and the InvestigatingAccountant’s Report on Forecast Financial Information andaccompanying financial services guides are provided inSection 8 and Section 9 (respectively).Intellectual PropertyThis Prospectus may contain trademarks of third parties,which are the property of their respective owners. Third-partytrademarks used in this Prospectus belong to the relevantowners and use is not intended to represent sponsorship,approval or association by or with the Company.Company websiteAny references to documents included on the Company’swebsite are provided for convenience only, and none of thedocuments or other information on the Company’s website, orany other website referred in this Prospectus, is incorporated inthis Prospectus by reference.Defined terms and abbreviationsDefined terms and abbreviations used in this Prospectus, unlessspecified otherwise, have the meaning given in the glossary.Unless otherwise stated or implied, references to times in thisProspectus are to Sydney, Australia time.Unless otherwise stated or implied, references to dates or yearsare calendar year references.QuestionsIf you have any questions in relation to the Offer, contact theDOC Offer Information Line on 1300 095 732 (toll free withinAustralia) or 61 3 9415 4294 (outside Australia) between 8:30amand 5:00pm (Sydney time), Monday to Friday.This document is important and should be read in its entirety.ContentsImportant NoticesbImportant Dates4Key Offer Statistics5Chairman’s Letter618Investment Overview2 Industry Overview233 Company Overview354 Financial Information535 Risk Factors846 Key Individuals, Interests and Benefits947111Details of the Offer8 Investigating Accountant’s Reportfor Historical Financial Information1259 Investigating Accountant’s Reportfor Forecast Financial Information13310 Additional Information14111 Glossary175Appendix A. Significant accounting policies183Corporate Directoryibc

4doctordoctor carecare anywhere.anywhere. prospectusprospectus Important DatesImportant datesDate of this ProspectusFriday, 30 October 2020Offer Period opens9.00am (Sydney time)Monday, 16 November 2020Offer Period closes5.00pm (Sydney time)Friday, 20 November 2020SettlementTuesday, 1 December 2020Issue and Transfer of CDIs (Completion)Wednesday, 2 December 2020Expected dispatch of holding statements and allotment confirmation advicesFriday, 4 December 2020Expected commencement of trading of CDIs on ASX on a normal settlement basisFriday, 4 December 2020Dates may changeThe dates above are indicative only and may change without notice.The Company, in consultation with the Lead Manager, reserves the right to vary the times and dates of the Offer includingto close the Offer early, extend the Offer or to accept late Applications or bids, either generally or in particular cases, or tocancel or withdraw the Offer before Settlement, in each case without notification to any recipient of this Prospectus or anyApplicants. Applications received under the Offer are irrevocable and may not be varied or withdrawn except as required bylaw. If the Offer is cancelled or withdrawn before the issue or transfer of CDIs, then all Application Monies will be refundedin full (without interest) as soon as possible in accordance with the requirements of the Corporations Act. Investors areencouraged to submit their Applications as soon as possible after the Offer opens.How to investApplications for CDIs can only be made by completing and lodging the Application Form (other than as expressly providedin this Prospectus).Instructions on how to apply for CDIs are set out in Section 7 and on the back of the Application Form.QuestionsIf you have any questions in relation to the Offer, contact the DOC Offer Information Line on 1300 095 732 (toll free withinAustralia) or 61 3 9415 4294 (outside Australia) between 8:30am and 5:00pm (Sydney time), Monday to Friday. If youare unclear in relation to any matter, or you are uncertain as to whether the Company is a suitable investment for you,you should seek professional guidance from your solicitor, stockbroker, accountant or other independent and qualifiedprofessional adviser before deciding whether to invest.

doctor care anywhere. prospectus 5Key Offer StatisticsKey Offer StatisticsOffer PriceA 0.80 per CDIRatio of CDIs per Share1:1Total proceeds under the OfferA 102.0 millionTotal number of CDIs available under the Offer127.5 millionTotal number of New CDIs to be issued by the Company under the Offer81.25 millionTotal proceeds from the issue of New CDIs under the OfferTotal number of Sale CDIs to be sold by SaleCo under the OfferTotal proceeds from the Sale CDIs under the Offer(which will be paid to the Selling Shareholders)A 65.0 million46.25 millionA 37.0 millionNumber of Shares/CDIs to be held by Existing Shareholders after the Offer190.8 millionTotal number of Shares/CDIs on issue at Completion*318.5 millionMarket capitalisation at the Offer Price1Pro forma Net Cash at Completion2Enterprise Value at Completion3Indicative Enterprise Value/CY2020 Forecast Revenue4A 254.8 millionA 82.4 millionA 172.4 million8.7xNotes:* CDI numbers assume that all Shares on issue are held in the form of CDIs.1. The indicative market capitalisation is determined by multiplying the total number of Shares on issue at completion of the Offer by the Offer Priceper CDI. The CDIs may not trade at the Offer Price after Listing. If the CDIs trade below the Offer Price after Listing, the market capitalisation willbe lower.2. Pro forma net cash reflects pro forma cash of 45.2 million as shown in the 30 June 2020 Pro Forma Historical Statement of Financial Position,converted at the Indicative Exchange Rate. No adjustments have been made for the cash impact of operations since 30 June 2020.3. The indicative Enterprise Value is calculated as the indicative market capitalisation at the completion of the Offer less the pro forma net cash at thecompletion of the Offer.4. The indicative Enterprise Value calculated per note 3 above, divided by DOC’s forecast revenue for CY2020, which was approximately 10.9 millionconverted at the Indicative Exchange Rate.

6doctordoctor carecare anywhere.anywhere. prospectusprospectus Chairman’s Letter“We see DOC’s initial public offering as the nextstep in driving the Company’s growth strategy.”Dear Investor,On behalf of the directors of Doctor Care Anywhere Group PLC (DOC or Company), it is my great pleasure to inviteyou to become a holder of CDIs in our Company. Each CDI represents a Share in the Company as described inthis Prospectus.DOC is a UK-based telehealth company that is committed to delivering high-quality, effective and efficient care toour patients, whilst reducing the overall cost of providing clinical services.The Company was founded in 2013 to address the fragmentation prevalent in traditional healthcare systems.We have built a technology platform and recruited our own clinicians to bring together Primary Care and SecondaryCare as follows: Virtual GP Consultations in the form of video or phone consultations with GPs directly employed by DOC(an example of Primary Care); and Diagnostic referrals and Specialist reviews across the key clinical specialties (an example of Secondary Care).These are both underpinned by our cloud-based health patient record.We believe that this integration of Primary Care and Secondary Care, enabled by technology, delivers substantialbenefits to patients, clinicians and third-party payors, including private health insurers. The Company has a clear andambitious growth strategy that aims to create value for investors in the rapidly growing digital health market.Over time, as DOC expands, there are a range of potential opportunities available to us; this includes more accessibleand innovative approaches to care delivery and the potential to expand into markets outside the UK. The impactof COVID-19 on all our lives has demonstrated the vital role that technology can and must play in the future ofhealthcare. We see DOC at the forefront of this exciting revolution.DOC has grown rapidly since its inception, providing services to more than 1,500 corporate and SME clients whichare accessed via its major channel relationships. These channel relationships with leading global companies suchas AXA PPP healthcare Group Limited (AXA) (a UK subsidiary of AXA S.A., the world’s second largest insurancecompany) and HCA Healthcare UK (a part of HCA Healthcare Inc, one of the leading providers of healthcare in the US).DOC aims to deliver its health insurance partners a reduction in claims costs of up to 20% by joining up Primary Careand Secondary Care and, in doing so, reduce unnecessary appointments and diagnostic tests. Our service is currentlyavailable to over 2 million lives. Monthly consultation volumes have grown from approximately 5,600 per month inDecember 2019 to over 20,000 per month in September 2020.

doctor care anywhere. prospectus 7We see DOC’s initial public offering as the next step in driving the Company’s growth strategy. The Offer willraise A 102.0 million through the issue and transfer of 127.5 million CDI’s at an issue price of 0.80 for each CDI. 37.0 million of the funds raised will be used to make payments to Selling Shareholders (being Existing Shareholderswho sell their CDIs to SaleCo to transfer to successful applicants under the Offer), and the rest of the funds will beused to pay the costs of the Offer, and over time, build capability in the following areas of focus: invest in our marketing and engagement capabilities to drive consultation growth through existing relationships;further integrate along the care pathway to improve the patient journey and capture value at multiple patienttouch points;invest in process automation and optimisation to ensure sustainable and safe growth;invest in new propositions such as Mental Health and Virtual Specialist Services;build international business development capabilities to pursue growth in new markets; andinvest in administration and provide working capital.This Prospectus contains detailed information about the Offer and the financial and operating performance of DOC.It also includes a description of the key risks associated with an investment in the Company. I encourage you to readthe Prospectus carefully and in its entirety before making your investment decision. You should seek professionaladvice as necessary. In particular, the risks of investing in an early stage, loss making company must be considered infull. The key risks for the Company are set out in Section 5.I would like to thank our doctors, staff and directors for their exceptional dedication, expertise, and commitment tothe Company and most importantly our patients who trust us with their care. We believe this is an exciting Offer forinvestors and on behalf of the Board, we look forward to welcoming you as a holder of CDIs.Yours sincerely,Jonathan BainesChairman

8doctor care anywhere. prospectusSection 1.InvestmentOverview

doctor care anywhere. prospectus 91.1 IntroductionTopicSummaryWho is theCompany?Doctor Care Anywhere

Prospectus for the initial public offering of CDIs over fully paid ordinary shares in the Company Issuer Doctor Care Anywhere Group PLC (Company Number 08915336) (ARBN 645 163 873) Lead Manager Co-Manager. b doctor care anywhere. prospectus doctor care anywhere. prospectus ortant otce