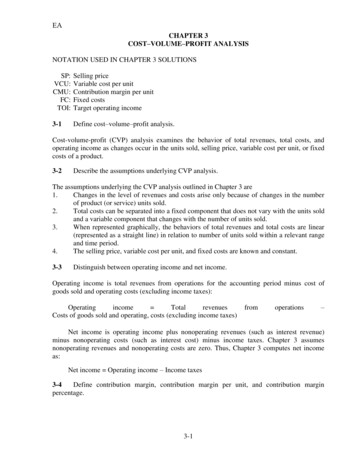

Transcription

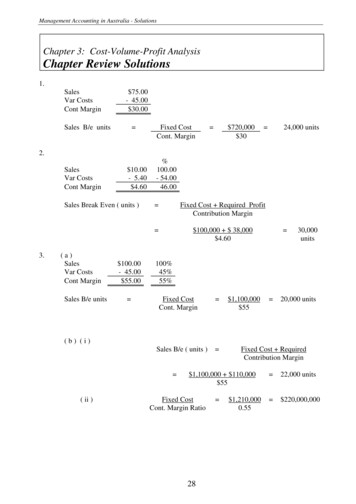

Management Accounting in Australia - SolutionsChapter 3: Cost-Volume-Profit AnalysisChapter Review Solutions1.SalesVar CostsCont Margin 75.00- 45.00 30.00Sales B/e units Fixed CostCont. Margin 720,000 30 24,000 units2.SalesVar CostsCont Margin 10.00- 5.40 4.60Sales Break Even ( units )3.(a)SalesVar CostsCont MarginSales B/e units 100.00- 45.00 55.00 %100.00- 54.0046.00 Fixed Cost Required ProfitContribution Margin 100,000 38,000 4.60 30,000units100%45%55%Fixed CostCont. Margin 1,100,000 55 20,000 units(b) (i)Sales B/e ( units ) ( ii ) Fixed Cost RequiredContribution Margin 1,100,000 110,000 55Fixed CostCont. Margin Ratio28 1,210,0000.55 22,000 units 220,000,000

Chapter 3: Cost-Volume-Profit Analysis4.(a)SalesVar CostsCont Margin 25.00 Sales- 15.00 Var Costs 10.00 Cont Margin 31.00- 15.00 16.00Sales B/e units Fixed CostCont. Margin 10,000 10 1,000 units(b)Sales B/e units Fixed CostCont. Margin 10,000 16 625 units5.Selling Price- Var. Cost- man 1.20- sell0.40 Contribution Margin(a)Sales B/e units Fixed CostCont. MarginSales B/e (b)Sales B/e 6. 4.00100.00%- 1.60 2.4040.00%60.00% 60,000 2.40 25,000 units Fixed Cost Cont. Margin Ratio 60,0000.60 100,000Fixed Cost Req. ProfitCont. Margin Ratio 60,000 30,0000.60 150,000(a) Selling PriceVariable CostContribution MarginSales Break Even ( units ) 65.00- 39.00 26.00 100 %60 %40 %Fixed CostContribution Margin 13,000 26.00 500 unitsFixed Cost 13,0000.40 32,500 Contribution Margin Ratio(b)Sales Break Even ( units ) Fixed Cost Required ProfitContribution Margin 13,000 26,000 26.0029 1,500 units

Management Accounting in Australia - Solutions7.RevenueVariable CostContribution MarginFixed 000Selling price per unitVariable cost per unit6.004.002.00 Total RevenueUnits Sold 6 per unit Total Variable CostUnits Produced 4 per unit(c)Total RevenuesLess Total Variable CostsContribution Margin(d)At breakeven, profit NIL Therefore,Breakeven (s) Units Required4,200,0002,800,000 1,400,000 4,200,000700,000 2,800,000700,000Contribution Margin per unit 2Fixed CostContribution Margin (e)100.0066.6733.33 1,400,0002 700,000 Fixed Cost Required Profit before TaxContribution Margin 1,400,000 1,000,000 21,200,0008.Raw MaterialDirect LabourVariable O/H 8,960 11,200 2,560Minimum Price to accept 7.1030C.P.U. 2.80 3.50 0.80 7.10

Chapter 3: Cost-Volume-Profit Analysis9.SalesVariable CostContribution MarginFixed CostProfit752550300,000? 100.0033.3366.67Fixed Cost Contribution Margin(a)Breakeven (s)(b)To make an operating profit of 15,000Fixed Costs Required Profit Contribution Margin(c)(d)300,000 15,00050 SalesLess Costs: Variable CostsEquals Contribution MarginLess Fixed CostsOperating Profit7,000 x 757,000 x 25525,000175,000350,000300,000 50,000SalesLess Variable CostEquals Contribution Margin60- 2535100.0042.0058.00 Fixed Cost Contribution MarginSalesLess Variable CostEquals Contribution MarginBreakeven (s)(f)6,300 UnitsAt 7,000 units,Breakeven (s)(e) 300,000 6,000 units50 New fixed costsBreakeven (s)Fixed Cost Contribution Margin 75- 1560 297,500 8,500 units35100.0020.0080.00 300,000 5,000 units60300,000 50,000 350,000 per annumFixed Cost Contribution Margin31 350,000 7,000 units50

Management Accounting in Australia - Solutions10.SalesVariable CostContribution MarginFixed CostProfit(a) Fixed Cost Contribution Margin 25,000 212,500 unitsOperating profit of 50,000Fixed Costs Required Profit Contribution Margin(c)100.0083.3316.67At breakeven profit NILBreakeven (s)(b)1210225,000?25,000 50,0002 37,500 UnitsOperating profit - 10% of sales revenue ( C.M. 12 – 10 – 1.2 )Breakeven (s) Fixed Cost Contribution Margin(d)SalesVariable Cost MfgVariable Cost MktContribution MarginFixed CostProfitBreakeven (s)9.202.00 25,000 0.8031,250 units12.00100.0011.200.8093.336.6725,000? Fixed Cost Contribution Margin( e ) At 10,000 unitsSalesLess Costs and expensesVariable Manufacturing costsVariable marketing costsEquals Contribution MarginFixed manufacturing costsFixed marketing and admin costsOperating Loss 25,000 0.8010,000 x 1210,000 x 810,000 x 2120,00080,00020,00015,00010,0003231,250 units100,00020,00025,000- 5,000

Chapter 3: Cost-Volume-Profit Analysis11.RevenueVariable CostContribution MarginFixed d Sales 20.0011.508.5010,2000.4250100.0057.5042.50 24,000 sales must increase by 24,000 (154,000 - 130,000)(b)New Variable Exp. per Unit 10.3511.50 x 0.90New Contribution Margin 9.65 20.00 - 10.35New Sales Volume 6,1756,500 units x 0.95 new net profit Contribution Margin - Fixed Expenses(6,175 x 9.65) - (48,100 5,000)59,588.75 - 53,100 6,488.75 the company should not reduce sales commissions as the net profit would reducefrom 7,150 to 6,488.75.(c)New Variable Expenses 12.6511.50 x 1.1New Fixed Expenses 40,88548,100 x 0.85New Sales Volume 7,800 units6,500 x 1.2Contribution Margin Ratio 0.36751-(Break-even 111,252New Sales 8,320 units6,500 x 1.28New Contribution Margin 70,7208,320 x 8.50Expected Net Profit Contribution Margin - Fixed Expenses70,720 - 48,10022,620Actual Net Profit 25,025(d) the company did better than expected.3312.6540,885/20.00)/0.36757,150 (7,150 x 2.5)

Management Accounting in Australia - Solutions12.SalesVariable CostContribution MarginFixed CostProfit(a)600420180360,000?Breakeven Sales (units)Breakeven Sales ( )100.0070.0030.00 Fixed CostsContribution Margin 360,000180 Fixed CostsContribution Margin Ratio 360,0000.30(b)Contribution Margin (1,800 machines x 180)less: Fixed CostsNet Less(c)Workings:Selling Price/unitVariable Cost/unitContribution Margin Breakeven Sales (units) (e)Sales (units)1.2.3.4. 2,000 units 1,200,000 324,000360,000- 36,000 600425 175360,0001752,057 units x 600(d) 2,057 units 1,234,200 Fixed Costs Desired ProfitContribution Margin 360,000 180,000180 540,000180 3,000 unitsAll costs can be classified into fixed and variable costs.All costs are linear in the relevant range, i.e., variable basis change in totalwith a change in volume and fixed costs in total remain constant.Selling price will not charge over the range of sales activity.Cost efficiencies remain the same for each product.34

Chapter 3: Cost-Volume-Profit Analysis13.(a)Selling PriceLess Variable costsContribution margin per unitLess Fixed CostsEquals Profit576,000216,000360,000200,000160,000 per unit8.003.005.00(b)Break-even point ( units ) 200,000 5.00 Break-even point ( ) 200,0000.625 200,000 320,000 5.00 576,000 – 320,000 (c)Sales req for profitof 320,000(d)Margin of Safety %100.0037.5062.5040,000 units 320,000104,000 units 256,000(e)Selling PriceLess Variable costsContribution margin per unit(i)Sales B/even per unit8.002.006.00 250,000 4.00 %100.0025.0075.0062,500 units(f)Selling PriceLess Variable costsVariable selling costsContribution margin per unitBreak-even point ( ) 100.0037.5012.5050.00 200,0000.535 400,000

Management Accounting in Australia - Solutions14.SalesVariable CostContribution MarginFixed CostProfit40152545,000?(a)Fixed CostsContribution Margin(b)Fixed Costs Required Profit. 45,000 25.00 1,800 Units 125,000 25.00 5,000 Units 137,500 25.00 5,500 UnitsContribution Margin(c)Fixed Costs Required ProfitContribution Margin100.0037.5062.50( 64,750 / 0.7 ) 92,500(d)Sales( 4,400 x 40.00 )Less Variable Costs ( 4,400 x 15.00 )Equals Contribution MarginLess Fixed CostsEquals Profit 176,000- 66,000110,000- 45,000 65,000(e)Sales( 4,000 x 44.00 )Less Variable Costs ( 4,000 x 15.00 )Equals Contribution MarginLess Fixed CostsEquals Profit 176,000- 60,000116,000- 45,000 71,00036

Chapter 3: Cost-Volume-Profit Analysis15.(a)RevenueVariable CostContribution MarginFixed ixed CostsContribution Margin(b)RevenueVariable CostContribution MarginFixed CostProfit. 100.0060.0040.00 80.0060.0020.00 600,0000.25 18,750 2,400,000 1,920,00080 24,000 hrsVariable costHours 1,152,00024,000 48Selling PriceVariable CostContribution Margin 500300200%100.0060.0040.00Fixed Costs(a) Fixed CostsContribution Margin Ratio 900,0000.40 (b)Fixed CostsContribution Margin 900,000200.00 (c) -SalesVariable CostsContribution MarginFixed Costs(d)Sales ActualSales Breakeven 2,500,000 2,250,000Margin of Safety 250,000 2,500,000 5,000 x 5005,000 x 30037Units100.0075.0025.00Hours16. 600,000 321,920,0001,152,000768,000600,000168,000Fixed Costs.Contribution Margin Ratio(c)80.0048.0032.00 900,000 2,250,0004,500 Units 2,500,000 1,500,000 1,000,000 900,000 100,00010.00%

Management Accounting in Australia - Solutions(e)(f) Net Profit after TaxTax RateNet Profit Before Tax F.C. Required Profit B. TaxContribution Margin Ratio 1,040,000200.00 Selling PriceVariable CostContribution Margin500325175Fixed CostsContribution Margin(g).Fixed Costs.Contribution Margin Ratio98,00030.00%140,000 5,200 Units100.0065.0035.00 900,000 175.00 1,000,0000.405,143 Units 500 x 300 x 1,000,000 200 x 1,000,000 2,500,0005,000 Units 2,500,00017.SalesVariable CostContribution MarginFixed CostProfit(a)Selling priceLess Variable Cost4,8001,8003,0001,6501,350 0.800.300.50100.0037.5062.50 0.80( Laundry 1,380 / 6,000 )( Admin420 / 6,000 ) 0.23 0.07Contribution Margin(b)(c)Fixed CostsContribution MarginFixed Costs Required Profit Fixed Costs 6,300 Kgs 1,6500.25 6,600 KgsSalesVariable CostContribution Margin 0.800.550.25Profit before tax ( 1,225 / 0.70 ) 1,750 / 0.50Fixed Costs Required Profit1,650 1,7500.50Contribution Margin3,300 Kgs1,650 1,5000.50Contribution Margin(e) Contribution Margin(d) 1,6500.50- 0.30 0.50 38100.0068.7531.25 6,800 Kgs

Chapter 3: Cost-Volume-Profit SalesLess Variable costsContribution marginFixed CostsGross ProfitC.P.U.5.003.002.00%1006040(a)Break-even point ( Q ) 60,000 / 2.00 Break-even point ( ) 60,000 / 0.40 30,000 units 150,000(b)Margin of Safety 100,000 – 30,000100,000x100 (c)Sales req for profitof 90,000 before tax 60,000 90,000( 0.40 ) 375,000 60,000 60,000( 0.40 ) 300,000 100,000 60,000( 0.40 ) 400,000(d)Sales req for profitof 42,000 after tax(e)Sales req for addfixed costs 40,0003970.00%

Management Accounting in Australia - Solutions19.(a)360,000 / 1.80200,000 units(b)(220,000 x 1.8) - 360,000 36,000(c)(360,000 167,940) / 1.80(d)before tax profit(360,000 180,000)/1.8(e)293,300 units 1,759,800180,000300,000 units360,000 / 1.50240,000 units 1,440,000(f)(g)break even 200,000budget 300,000MOS100,000/300,00033.33%Costs are either fixed or variableFixed costs are fixed per periodSales are uniform throughout the periodProduction is held constant20.(a)Selling priceLess Variable costContribution margin 251015Break-even point (units) 115,800 15 7,720 units(b)Sales required (units) 115,800 75,000 15 12,720 units(c)Sales required (units) 115,800( 15 - 2.50) 9, 264 units(d)Sales increase (units) 36,000 15 2,400 units40

Chapter 3: Cost-Volume-Profit Analysis21Selling PriceVariable CostContribution Margin(a)(b)(c)(d)16.008.008.00Break-even point (units) 55,000 8 6,875 unitsBreak-even point ( ) 55,0000.50 110,000Profit before tax 28,000Sales required (units) 55,000 28,000 8 10, 375 unitsProfit after tax 31,500Sales required (units) 55,000 45,000 8 12, 500 unitsMargin on Safety 12,900 - 6,875 6,025 units 6,025 x 16 96,40041%100.0050.0050.00

Chapter 3: Cost-Volume-Profit Analysis 31 9. Sales 75100.00 Variable Cost 25 33.33 Contribution Margin 50 66.67 Fixed Cost 300,000 Profit ? ( a ) Breakeven (s) Fixed Cost Contribution Margin 50 300,000 6,000 units ( b ) To make an operating profit of 15,000