Transcription

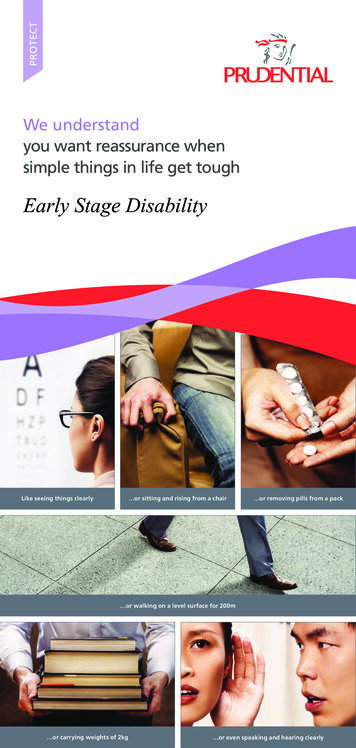

PROTECTWe understandyou want reassurance whensimple things in life get toughEarly Stage DisabilityLike seeing things clearly or sitting and rising from a chair or removing pills from a pack or walking on a level surface for 200m or carrying weights of 2kg or even speaking and hearing clearly

Sometimes unexpected twists in life may affect your ability toperform some of the simplest tasks, such as walking, seeingclearly, sitting and rising from a chair, communicating, liftingand carrying and removing tablets from a pack.Early Stage Disability is Singapore’s first and only insuranceplan that covers you against partial and temporarydisablement as a result of an illness or injury based on yourability to carry out daily tasks affecting your quality of life.These tasks are Quality of Life Conditions (QLC) which canpotentially have a major impact on your lifestyle — andprobably your finances. Early Stage Disability offers payoutif one satisfies at least 2 of the 6 Quality of Life Conditions(QLC) which will affect your quality of life1.This plan provides comprehensive coverage with Partial orFull Payout2 on early disabilities. It also covers you for Totaland Permanent Disability2 and for disabilities as a result ofselected hazardous activities under the Special Risk benefit2.Upon the first claim made under Partial Payout2, the futurepremiums will be waived so you can concentrate on recovery.For PRUearly stage disability (standalone plan)3, a benefit of 3,000 is payable in the event of death.Early Stage Disability offers early assistance that allows youto focus on recovery. The policy may help you: supplement potential loss of income and extra expensesincurred to adapt to partial and temporary disability andcope with the change in lifestyle offset some ongoing treatment and nursing expensesbrought on by the disability provide some relief on your financial commitments reduce your family’s financial burdenPartial Payout2 of 50% of sum assured4When a twist of fate results in one satisfying 2 out of 6 Qualityof Life Conditions1 (QLC) — Walking, Fine Hand Control, Sittingand Rising from a chair, Lifting and Carrying, Communicatingand Eyesight — you will find comfort in a lump sum payment.

Definitions of Quality of Life Conditions (QLC):WalkingThe inability to walk morethan 200m on a level surfacecontinuously with or withoutaids and adaptations, within5 minutes, because ofbreathlessness or severe pain.Fine HandControlThe inability to remove 5paracetamol pills from a blisterpack within 60 seconds, usingyour hand(s) with or without aidsand adaptations.Sitting andRising fromchairThe inability to sit and riseto a standing position from awheelchair or chair (both witharms) of 40cm to 45cm inheight without the help ofanother person.Lifting andCarryingThe inability to lift (from a benchheight of 1m) and carry a 2kgweight for 10m and then placing itback down at bench height, withor without aids and adaptations.Communicating5As a result of an illness or injury,the inability to hear soundsof below 60 decibels in allfrequencies of hearing or theinability to speak withsufficient clarity.Eyesight6When tested with visual aids,vision is measured at 6/60 or worsein one of the eyes using a Snelleneye chart.

Remaining 50% of sum assured4If the condition deteriorates, such that a third Quality of LifeConditions1 (QLC) becomes a difficulty, the balance of the 50%sum assured4 will be paid, so you can concentrate on gettingback to your life.Waiver of premiums after the first Partial Payout2Upon the first lump sum payout of 50% of sum assured4, futurepremiums on Early Stage Disability will be waived so you canenjoy the reassurance of continued disability coverage.100% payout2 should Total and Permanent Disabilityhappen7Upon Total and Permanent Disability, be rest assured that youare well covered with a 100% payout2 to help you to cope7.Cover for hazardous activities under Special Risk benefit8If disability results from selected covered risks such as scubadiving, rock climbing, sky diving, or while serving NationalService8 and you satisfy any of the 3 out of 6 Quality of LifeConditions1 you’ll receive an 20% payout2 of the sum assuredsubject to a maximum of 20,000.Available till age 70 next birthday9Early Stage Disability is one of the few plans available in themarket to provide longer disability protection till age 70 nextbirthday, ensuring you stay protected for the longer term.Available as a standalone plan (PRUearly stage disability)3or a supplementary benefit (Early Stage Disability) toyour Prudential insurance planYou can choose to purchase Early Stage Disability either asa standalone3 plan with death benefit or as a supplementarybenefit. As a supplementary benefit, Early Stage Disabilitycan be attached to any regular premium Prudential mainplan.

Also available as a supplementary benefit for childrenbelow the age of 15The peace of mind of Early Stage Disability is not just for adults— you can even add this on as a supplementary benefit toprotect children below the age of 15.Affordable Premiums10 at a glanceEarly Stage Disability available as a supplementary benefit(Based on Sum Assured of 50,000)Life Assured,Occupation Class 1CoverageTermPremiumPer Day11Male non-smoker,age 30 next birthday40 0.60Female non-smoker,age 30 next birthday40 0.70Male non-smoker,age 40 next birthday30 1.00Female non-smoker,age 40 next birthday30 1.30For more information about Early Stage DisabilityCall your Prudential Financial Consultant or ourPruCustomer Line at 1800 333 0 333.www.prudential.com.sg

Footnotes:1 If the life assured is more than 15 years old as at the date of hisdisability and, as a result of illness or injury, satisfies any 2 or 3of the Quality of Life Conditions under the covered benefits. Wewill honour the claim provided that any 2 or 3 of the Quality ofLife Conditions are certified to be existing conditions suffered bythe life assured at least 90 days after the confirmed diagnosis ofthe illness or injury directly leading up to the development of therelevant Quality of Life Conditions.If the life assured is between 28 days and 15 years old at dateof disability, and is disabled as a result of illness or injury andis confined to a home, Hospital or other institutions requiringconstant care and medical attention for the relevant stipulatedperiod required under the covered benefits. Therefore, the Qualityof Life Conditions will not be used.2 Each benefit is subject to a “Deferment Period” prior to a claimbeing paid out. “Deferment Period” varies accordingly to eachbenefit and is defined as the period between the confirmeddiagnosis of illness or injury and the date of disability. Please referto the product summary for details.3 PRUearly stage disability is not available for sale to non-incomeearners such as housewives, home-maker, students and children.4 In the case of a claim is made on a life assured below age 1 year,the claim payable would be 20% of the claimable sum assuredunder each disability benefit.5A claim under this section must be supported by evidence such asaudiometric and sound threshold tests and that the condition hasbeen investigated and is being managed by an Ear, Nose, Throat(ENT) specialist or a specialist in the relevant field.6 A claim under this section must be supported by evidence thatthe condition has been investigated and is being managed by anophthalmologist.7 The total claims paid under the Partial Payout benefit, Full Payoutbenefit, Total and Permanent Disability benefit and Special Riskbenefit shall not exceed the Early Stage Disability Benefit sum assured.

8 Please refer to the product summary for the full list of coveredrisks and activities. Special Risk benefit pays out 20% of the sumassured subject to a maximum claim of 20,000, is payable only ifthe Early Stage Disability Benefit has not terminated and the totalpayout has not exceeded the sum assured.9 For new policies, the minimum policy term is 5 years (for 5 yearlimited pay policies) or 10 years (for other policies). For Mid TermAdd to existing policies, the minimum policy term is 6 years.10 Premium rates (non guaranteed) will differ for standalone plansand will vary based on different occupational class, gender, ageat entry and smoker status.11 Premium per day is based on annual premium divided by 365 daysand rounded up to the nearest ten cents. Male non smoker, age 30 at next birthday is 203.00 per annum, fora coverage term of 40 years Female non-smoker, age 30 at next birthday is 239.50 per annum,for a coverage term of 40 years Male non smoker, age 40 at next birthday is 356.50 per annum , fora coverage term of 30 years Female non-smoker, age 40 at next birthday is 446.50 per annum,for a coverage term of 30 years

Note:Buying life insurance is a long-term commitment. An early terminationof the policy usually involves high costs and the surrender valuepayable may be less than the total premiums paid.Buying health insurance that is not suitable for you may impact yourability to finance your future healthcare needs. You should seek advicefrom a qualified Prudential Financial Consultant if in doubt.Premiums are not guaranteed and may be adjusted based on futureclaims experience. The company reserves the right to vary thepremiums at any time by giving 30 days’ notice to the policyownerbefore doing so.This brochure is for reference only and is not a contract of insurance.Please refer to the exact terms and conditions, specific details andexclusions applicable to this insurance in the policy document thatcan be obtained from a Prudential Financial Consultant.This brochure is for distribution in Singapore only and shall not beconstrued as an offer to sell or solicitation to buy or provision of anyinsurance product outside Singapore. In case of discrepancy betweenthe English and Mandarin versions of this brochure, the Englishversion shall prevail.Information correct as at 27 May 2016.

PROTECTPROTECTPrudential Assurance Company Singapore (Pte) Limited.(Reg. No. 199002477Z)30 Cecil Street #30-01 Prudential TowerSingapore 049712Tel: 1800 333 0 333 Fax: 6734 6953Part of Prudential plc

Early Stage Disability. offers early assistance that allows you to focus on recovery. The policy may help you: supplement potential loss of income and extra expenses incurred to adapt to partial and temporary disability and . cope with the change in lifestyle fset some ongoing treatment and nursing expenses of brought on by the disability