Transcription

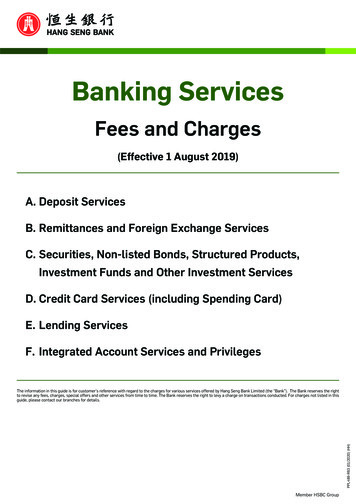

Banking ServicesFees and Charges(Effective 1 August 2019)A. Deposit ServicesB. Remittances and Foreign Exchange ServicesC. Securities, Non-listed Bonds, Structured Products,Investment Funds and Other Investment ServicesD. Credit Card Services (including Spending Card)E. Lending ServicesF. Integrated Account Services and PrivilegesPPL489-R63 (01/2020) (HH)The information in this guide is for customer’s reference with regard to the charges for various services offered by Hang Seng Bank Limited (the “Bank”). The Bank reserves the rightto revise any fees, charges, special offers and other services from time to time. The Bank reserves the right to levy a charge on transactions conducted. For charges not listed in thisguide, please contact our branches for details.

A. Deposit ServicesCurrent AccountsServiceChargeCheque Returned- due to insufficient funds- due to other reasons- due to cheque amount exceeding RMB80,000Paper Cheque / e-ChequeHK 150 per cheque (RMB 200) (1)HK 70 per cheque (RMB 50) (2)RMB 200 per cheque (3)RMB Cheque Handling Fee- autosweeping to cover insufficient funds- switching of deposit by customer to cover insufficient fundsPaper Cheque / e-Cheque1% of the total amount of transfer (min RMB: 200)1% of the deposit to cover the insufficient funds of current account (minRMB: 200)Stop Cheque Payment InstructionPaper Cheque: HK 100 per chequee-Cheque: WaivedCheque Mark Good- sent by customer- sent by BankHK 60 per chequeHK 200 per chequeCheque Book(s) delivery by Courier Service (4)HK 25 per itemUnauthorised OverdraftHK 120 per item plus interest on overdrawn balance (5)Savings Deposit AccountsServiceATM Savings Account Counter Service Fee- transfer / cash withdrawalWaivedHKD account transactions conducted through branches per customer percalendar month (6)WaivedTransaction ChargesThe Bank reserves the right to levy a charge on transactions conductedBelow Balance Service Fee- HKD Passbook / Statement Savings Account- ATM Passbook / ATM Statement Savings AccountNot subject to Below Balance Service FeeNot subject to Below Balance Service Fee-1-This page has been revised since 1 August 2019.PPL489-R63 (01/2020) (HH)Charge

A. Deposit Services (cont’d)Inactive Account Service Charges (7)ServiceCurrencyChargeSavings/Current Accountinactive for two years and balance belowPayable semi-annually(For over 2 000601,0002,000HK DollarRMBU.S. DollarPound Sterling/EuroCanadian Dollar/Swiss Franc/Australian Dollar/ New Zealand DollarSouth African RandThai BahtJapanese YenCashier’s Order / Demand Draft / Gift ChequeServiceChargeCashier’s Order- issuance (8)(9)/ re-purchased (10)- report lossHK 50 per chequeHK 60 per cheque(Plus: HK 300 payable to Clearing House of HKAB)Demand Draft- issuance (11) / re-purchased / amendment- HKD demand draft issuanceHK 100Plus: An additional 0.25% commission (maximum: HK 1,000; minimum:HK 120)HK 300 Cable charge HK 100(Plus: Foreign bank charges)- stop-paymentGift Cheque (12)HK 10 per chequeBulk Cheque / Cash / Coins DepositServiceBulk Cheque Deposit - Per customer per day- Up to 30 pieces- Over 30 piecesFreeHK 1 per additional cheque (13)Bulk Cash Deposit - Per customer per day (Applicable to all currencies)- Up to 200 pieces of notes- Over 200 pieces of notesFree0.25% on deposit amount (min. HK 50)Bulk Coins Deposit - Per customer per day- Up to 500 coins- Over 500 coinsFree2% on deposit amount (min. HK 50)Coin Changing Charges (14)HK 2 per sachet-2-This page has been revised since 1 August 2019.PPL489-R63 (01/2020) (HH)Charge

A. Deposit Services (cont’d)Savings Deposit RatesCurrencyAccount BalanceDeposit RateHK DollarHK 5,000 or above0.001%Below HK 5,0000%US 1,000 or above0.001%Below US 1,0000%RMB 5,000 or above0.25%Below RMB 5,0000%U.S. DollarRMBLow Balance Foreign Currency Savings Deposit RatesCurrencyWith Account Balance BelowDeposit Rate5,0001,0002005000%RMBU.S. DollarPound Sterling/EuroCanadian Dollar/Swiss FrancAustralian Dollar/New Zealand DollarSouth African RandThai BahtJapanese YenSingapore Dollar2,00010,00030,000400Account ClosureServiceChargeImproperly conducted account closed by the BankHK 150 annuallyWithin three months of the date of its opening- Savings Account- Current/Integrated AccountHK 50 per accountHK 200 per accountStanding Instruction / Direct Debit AuthorisationService- returned due to insufficient fundsSet Up Direct Debit Authorisation (17)- via Hang Seng Personal e-Banking / Hang Seng Business e-Banking /Hang Seng HSBCnet- via BranchAutopay Returned Due to Insufficient Funds-3-This page has been revised since 27 December 2019.ChargePer item Transfer to Hang Seng BankTransfer to other banksHK 150 per itemHK 70HK 100WaivedPer item Transfer to Hang Seng BankWaivedTransfer to other banksHK 30(Transfers to HKSAR Government, Public Utilities, Educational,Charitable Institutions and The Hong Kong Jockey Club areexempted)HK 150 per itemPPL489-R63 (01/2020) (HH)Standing Instruction- set up / amendment (15)(16)

A. Deposit Services (cont’d)Report Request / PhotocopyingServiceChargeCompany Search Fee- local company- overseas companyHK 150 per accountHK 10,000 per accountBank Confirmation for Audit PurposeHK 300 per account(Max.: HK 1,800; Min.: HK 600) - via electronic submission*HK 330 per account(Max.: HK 1,980; Min.: HK 660) - via paper-form submissionAdditional copies: HK 100 per copyAccount History Record of Savings or Time Deposit Accounts- For 1 Year- For 2 Years- For 3 Years- For more than 3 yearsHK 250 per accountHK 750 per accountHK 1,000 per accountHK 1,000 per year thereafterPhotocopying of- statement- cheque/voucher/transaction advice.HK 50 per cycle or per copy(No service charge for applying a copy of the consolidation statement listingthe unposted items of passbook account.)HK 50 per copyIssuance of Overdraft Interest StatementHK 300 per copy per cycleReference LetterHK 300 per letter(HK 20 for each additional letter if several letters are issued at one time)Certificate of Account BalanceHK 100 per certificate(HK 100 for each additional account)Certificate of Deposit Interest Earned- for 1/2/3 year(s)- for more than 3 yearsHK 250/HK 750/HK 1,000 per accountHK 1,000 per year thereafterBanker’s Endorsement on Customer’s SignatureHK 150 per itemPersonal data access requestCircumstantial (maximum HK 500 per request) (18)* For details submission (bank confirmation of information for audit purposes), please visit our public website at gitally/audit-confirmation/OthersServiceHK 50 per cardReport Loss ofPassbook (16)(19) / Chop (16)HK 100 per accountHandling Letter of Instruction for Fund TransferHK 150 per transferSpecial Mailing InstructionHK 1,000 per account per yearLate payment for safe deposit box rental fee (20)HK 50Paper StatementHK 20 per account (For every 12 months period from July to June of thefollowing year) (21)-4-This page has been revised since 1 August 2019.PPL489-R63 (01/2020) (HH)Replacement ofHang Seng Card (16)(19) / Integrated Account Card of Prestige Banking /Integrated Account Card of Preferred Banking / Integrated Account Card /M.I. Kid AssetBuilder Card / Green Banking Smart CardCharge

A. Deposit Services (cont’d)ATM ServicesInternational ATMSignagesHSBC ATM Network(22)Banking ServicesLocation- Asian countries / territories(Brunei, China [excluding Hong Kong SpecialAdministrative Region], Macau, Malaysia,Philippines, Thailand, Singapore, Indonesia,Sri Lanka, etc.) and Middle East- Canada- United States(New York)- United Kingdom(London, Wales, etc.)HK 20- Worldwidethe China Region (includes Hong Kong, Macauand Mainland China), Japan, Singapore, Korea,Thailand, Vietnam, the Philippines, UnitedStates, Germany, Spain, Luxembourg, Belgium,France, Turkey, Switzerland, Australia, Italy andRussia etc.HK 20Cash withdrawal, balanceenquiry, funds transfer(23)and statement / chequebook requestCash withdrawalCash withdrawal andbalance enquiryCash withdrawal andbalance enquiryCash withdrawal andbalance enquiry in mostcountries / regionsUnionPay / PLUS / CirrusATM Network-5-This page has been revised since 1 August 2019.PPL489-R63 (01/2020) (HH)Note: Cash withdrawals at overseas ATM will be paid in local currencies and subject to the maximum daily withdrawal limit of HK 30,000 for Prestige Banking and Preferred Banking,and HK 20,000 for other accounts. You must activate the overseas ATM daily cash withdrawal limit in advance for overseas ATM cash withdrawal. Due to the different dispensing limits of ATMs at different location, you may have to perform more than one transaction in order to obtain the amount of cash you require. For transactions effected via the Mastercard/Cirrus ATM network, the money withdrawn is first converted to US dollars, and then to Hong Kong dollars, at the daily exchange ratesset by Mastercard and Hang Seng respectively, plus a Foreign Currency Conversion Fee. For transactions effected via the Visa/Plus ATM network, the money withdrawn isconverted directly into Hong Kong dollars at the daily exchange rates set by Visa plus a Foreign Currency Conversion Fee. For transactions effected via other networks (includingHSBC overseas ATMs), the money withdrawn is converted directly into Hong Kong dollars at the daily exchange rate set by HSBC plus a Foreign Currency Conversion Fee. Fortransactions effected via the UnionPay network, the money debited is converted directly into Hong Kong dollars at the daily exchange rate set by UnionPay. Surcharges of overseaslocal bank may be levied (if applicable). If customer withdraws cash at ATM overseas, network provider will debit HKD equivalent amount from your HKD account at exchange rate provided by the ATM network on thedate of withdrawal. And a service charge of HK 20 will be debited for each ATM withdrawal. Please visit the web page of ATM network for the reference of exchange rate. Please note some overseas ATMs only allow cash withdrawal from the account shown on your card face, please ensure there is sufficient balance in that account before departure.

A. Deposit Services (cont’d)(1)Only applicable to RMB Current Account.Only applicable to RMB Current Account.(3) Only applicable to holders of Hong Kong Identity Card who conduct RMB cheque payment for the acquisition of customer goods and / or services within the Guangdong Province(including Shenzhen) in the Mainland China. Issuing RMB cheque for payment for the acquisition of consumer goods and / or services within the Guangdong Province (includingShenzhen) in the Mainland China is not applicable to personal customers who are a non-Hong Kong Identity Card holder.(4) Fee waiver is for the Integrated Account of Prestige Banking and is not applicable to other account(s) under the name of the same customer.(5) Interest is calculated daily and charged monthly at the Bank’s prevailing interest rate. For Integrated Account of Prestige Banking and Integrated Account of Preferred Banking,the Unauthorised Overdraft interest rate is Prime Rate 6% (p.a.). For Integrated Account of Green Banking, Integrated Account, all Current Accounts and Business IntegratedAccount, such interest rate is Prime Rate 8% (p.a.). This interest charge is applicable to all current accounts and saving accounts with unauthorised overdraft balance.(6) The total number of counter transactions includes all HKD account transactions made under the same customer name. Commercial customers will be notified individually of theirmonthly quota of free counter transactions by mail.(7) It is not applicable to personal customers. Excludes Integrated Account and FlexiForex / ProForex / FlexiGold / ProGold Trading Account and Hang Seng FX and Precious MetalMargin Trading Services / Hang Seng Advanced FX and Precious Metal Margin Trading Services Account. Applicable to all Foreign Currency Account. Service charges shall not beapplicable if deposit in any one of these currencies is above the stipulated deposit level of the respective currency under the multi-foreign Currency passbook Savings Account.(8) Prestige Banking Customers can enjoy a privileged service charge of HK 25, and fee waiver is for customers with Senior Citizen Cards or customers aged 65 or above. No privilegeor fee waiver will be given to the issuance of Cashier’s Order for the purpose of IPO subscription.(9) This service is not available to non-account holder.(10) Fee waiver is for the Prestige Banking Customers.(11) Prestige Banking Customers can enjoy a privileged service charge of HK 50.(12) Fee waiver is for customers with Senior Citizen Cards or customers aged 65 or above and the Prestige Banking Customers. Preferred Banking and Green Banking Customers canenjoy a privileged service charge of HK 5.(13) Waived if all cheques are deposited into the same account as one single transaction.(14) Prestige Banking Customers can enjoy a privileged service charge of HK 1 per sachet.(15) Standing Instruction set up and amendment fee waiver is for the Integrated Account of Prestige Banking, Preferred Banking and Green Banking and is not applicable to otheraccount(s) under the name of the same customer.(16) Fee waiver is for customers with Senior Citizen Cards or customers aged 65 or above.(17) Fee waiver is for Integrated Account of Prestige Banking, Preferred Banking, Green Banking and Integrated Account and is not applicable to other account(s) under the name of thesame customer. If there is no transaction recorded under this direct debit authorisation for more than two years, the Bank may cancel this direct debit authorisation without givingany notice.(18) This standard concessionary charge only applies to the first time and normal data access request. In other cases, the Bank reserves the right to charge the actual commercial costincurred without applying a cap to the charge. However, in any case, the Bank will inform the data requestor individually the actual handling charge and will only process therequest upon receiving the requestor’s acceptance.(19) Exemptions apply to customers aged below 18, recipients of Comprehensive Social Security Assistance (supporting documents required) and persons who present a proof ofdisability document (e.g. document of receiving government disability allowance).(20) Overdue handling fee of HK 50 will be levied if the customer pays the safe deposit box rental fee later than 2 months from the due date.(21) Applicable to personal accounts including Prestige Banking, Preferred Banking, Green Banking, Integrated Account, M.I. Kid AssetBuilder Account, HKD Current Account, HKDStatement Savings Account and ATM Statement Savings Account. A fee of HK 20 per account will be charged if customers receive more than 2 paper statements for every 12months from July to June of the following year. Exemptions apply to senior citizens (aged 65 or above), customers aged below 18, recipients of Comprehensive Social SecurityAssistance (supporting documents required) or persons who present a proof of disability document (e.g. document of receiving government disability allowance).(22) ATM Chip cards cannot be used at designated HSBC ATMs including Mexico, Argentina, Brazil, Panama, New Zealand, France, Malta, Greece and Turkey.(23) You can only transfer money between accounts on the same card at ATMs in Macau.-6-This page has been revised since 1 August 2019.PPL489-R63 (01/2020) (HH)(2)

B. Remittances and Foreign Exchange ServicesOutward RemittancesServiceChargeRemarksLocal Interbank Transfer Services- outward- via Faster Payment SystemFor Personal Customers: WaivedFor Commercial Customer:Payment AmountHK 100,000 equivalent or belowHK 100,000 above - HK 1,000,000CNY100,000 equivalent or belowCNY100,000 above - CNY1,000,000ChargesHK 5HK 10CNY5CNY10 The charges will be waived from the period of 30September 2018 to 31 December 2018.Waived- Via other channelsHK 190 per item (1)This page has been revised since 1 January 2019.Remittance CurrencyHKDCNYOther Currencies#Channels subscribed by customers: HK 25: HK 25: HK 55An extra charge of HK 100 will be levied forinstruction containing Chinese charactersPPL489-R63 (01/2020) (HH)-1-- via Clearing House Automated TransferSystem - CHATS- via Personal e-Banking- via Business e-Banking /- Hang Seng HSBCnet #

B. Remittances and Foreign Exchange Services (cont’d)Outward RemittancesServiceChargeRemarksTelegraphic Transfer- Remit to a beneficiary account with HangSeng in Mainland China / Macau- Remit to a beneficiary account with anotherbank in Hong Kong / Mainland China /Taiwan / Macau- Remit to a beneficiary account in othercountries / territories- other remittance services- Amendment / cancellation- Cable enquiry-2-This page has been revised since 1 January 2019.Hang SengPersonale-BankingBranch / OtherChannels (4)HK 65 (3)Hang SengHSBCnet /Businesse-BankingHK 85HK 65HK 115HK 220HK 65HK 115HK 220(HKD anddomicilecurrency)HK 260 (5)(Non-domicilecurrency)HK 190HK 200(Plus cable charges of HK 100 and foreign bankcharges (if any))Min. HK 250 per transaction(including cable charges of HK 100 and foreignbank charges (if any))An extra charge of HK 150 will be levied forinstruction containing Chinese(Exempted for HKD remittance to Macau)An extra charge of HK 40 will be levied oneach remittance instruction requestingsame day processing submitted via theBank’s branches after 12 noon fromMondays to Fridays(i.e. business days)Plus Correspondent Bank Charges(if applicable) (6)(a) If charge to beneficiary’s account:subject to correspondent bank charges(b) If charge to applicant’s account (6)(7):- For remittance to Australia, UK,Canada, USA in domicile currency:Min HK 160- For remittance in USD to countries /territories outside USA: US 35- For remittance in EUR to most of themajor European countries / territories: HK 200 if remit amountEUR 12,500; HK 250 if remit amount EUR 12,500;- For remittance in RMB to mainlandChina: HK 20 (8) or HK 100 (9) , asappropriate- For remittance in RMB to countries /territories outside mainland China:HK 250- For remittance in JPY to Japan HK 200 if remit to beneficiaryaccounts with JPY DesignatedBanks (10) and remit amount JPY2.5million Min HK 350 if remit to beneficiaryaccounts with other banks or remitamount JPY2.5 million- For others: subject to correspondentbank chargesPPL489-R63 (01/2020) (HH)- issuance (2)

B. Remittances and Foreign Exchange Services (cont’d)Inward RemittancesServiceChargeLocal Interbank Transfer Services- inward- via Faster Payment SystemWaived- via Clearing House Automated Transfer System - CHATSFor Personal Customers: WaivedFor Commercial Customer: HK 15 (1)- Addressing Services for Faster Payment System- Registration / Amendment / De-registrationWaivedTelegraphic TransferCredit to account with Hang Seng Bank (11)HK 65Onward transfer to other local banksHK 150-HK 300(12)Foreign Currency Notes ExchangeChargeServiceForeign Currency Notes- deposit into /withdraw from T/T accountCurrency-Waived for Prestige / Preferred / Green BankingCustomersFreeFreeHK 50 Per TransactionNo Fees up to the following amount limit (peraccount per day) If the single-day total deposits/withdrawals exceeds the below limit, handlingfee will apply as follows:Notes deposits/ withdrawals: 0.25% of the totalamount that dayPrestige CustomersOther 005001,000150,0002,00010,0001,500AUD / CADCHF/ ZAREUR/GBPJPYNZDTHBUSD-3-RemarksThis page has been revised since 30 September 2018.Handling fee waived for RMB notes deposit / withdrawalPPL489-R63 (01/2020) (HH)Foreign Currency Notes Purchase/SaleAccount Holder- RMB- Other Currencies HK 3,000 equivalentHK 3,000 equivalent(13)

B. Remittances and Foreign Exchange Services (cont’d)Foreign Currency Cheques ExchangeServiceLocal USD Clearing Cheques- deposit into HKD /USD T/T account- deposit into USD notes accountForeign Cheques- encashment (deposit into HKD/FCY T/T/USDnotes account)ChargeWaived0.25% of deposit amount(Min.: HK 60 per transaction)USD 0.25%Other currencies 0.375%(Min.: HK 60 per transaction)- collectionHK 200 per chequePlus: Postage for registered airmail & Foreignbank charges- returned unpaidHK 150 per chequePlus: Foreign bank charges and InterestCheque send to Guangdong and / or Shenzhenfor cheque clearing- HKD- USDHKD Macau Cheque EncashmentRemarksGDHK 50N.A. Additional Fee for purchasing of foreigncurrency cheques payable (Appendix) Additional Charges for Foreign Cheques ofNon-domicile currency (Appendix) Charges shall be collected irrespective ofnon-valid payment of the cheques Interest shall be calculated at the prevailingbills advance rate of the related currencyfrom the date of purchaseSZHK 50HK 100HK 60 per transaction plus0.25% on deposit amount(Min.: HK 160 per transaction)-4-This page has been revised since 1 July 2019.PPL489-R63 (01/2020) (HH)[Notes](1) Or its equivalent in the relevant currency. The exchange rate is determined by Hang Seng Bank Limited from time to time.(2) Remittance to the Mainland China or other places outside Hong Kong for non-Hong Kong Identity Card holder is subject to local rules and requirements of Mainland China or therelevant jurisdictions. Outward remittance may be rejected due to local regulatory requirements and rules and subject to charges applicable to returned remittance.(3) Prestige Banking customer enjoys fee waiver for a remittance via Integrated Account of Prestige Banking by Personal e-Banking to a beneficiary account with Hang Seng Bank(China) Limited or Macau Branch. Preferred Banking customer enjoys fee waiver for a remittance via Integrated Account of Preferred Banking by Personal e-Banking to aself-named account with Hang Seng Bank (China) Limited.(4) Other channels include Phone Banking and Remittance by Standing Instruction etc.(5) Prestige Banking customer enjoys a privileged charge HK 220 for the non-domicile currency remittance conducted via Integrated Account of Prestige Banking through HangSeng branch to an account with a bank in any location apart from Hong Kong / Mainland China / Taiwan / Macau.(6) Please note that the Bank is entitled to reimbursement from the customer for the expenses incurred by the Bank, its correspondents and agents. Additional overseas charges(including charges levied by the beneficiary bank and/or correspondent banks) may be imposed by some overseas banks. Please also note that some of the beneficiary banks orcorrespondent banks may deduct the Correspondent Bank Charges from the Remit Amount in which case, the Beneficiary may not be able to receive the Remit Amount in full,regardless of the payment instructions stated in the remittance application form.(7) If the charges (as specified in the table) debited by the Bank are not sufficient to cover all the Correspondent Bank Charges, the Bank reserves the right to debit the shortfallamount from the applicant’s account without prior notice.(8) Applicable to (a) RMB remittance processed via CIPS and with valid beneficiary bank’s SWIFT BIC code or (b) RMB remittance processed via CNAPS and with valid beneficiarybank’s CNAPS code provided.(9) Applicable to any other RMB remittance which does not meet the criteria in note (8) above.(10) “JPY Designated Banks” currently refers to Bank of Tokyo-Mitsubishi UFJ, Mizuho Bank Limited and Sumitomo Mitsui Banking Corporation. The Bank may update the list of JPYDesignated Banks from time to time at its sole discretion and without prior notice.(11) Fee waiver is for the Integrated Account of Prestige Banking and is not applicable to other account(s) under the name of the same customer.(12) The handling charge for onward transfer to other banks is dependent on the method for the onward transfer, and is exclusive of any charges levied or to be levied by anycorrespondence bank and/or beneficiary bank.(13) Fee waiver is for the Prestige Banking Customers, the Preferred Banking and the Green Banking Customers.

B. Remittances and Foreign Exchange Services (cont’d)AppendixAdditional Foreign Bank Charges for Foreign ChequeCurrencyChargesRemarksSingaporeSGD 5.00BelgiumNew ZealandAustriaSpainJapanEUR 10NZD 1.50EUR 100.5%, Min. EUR 5HSBC cheque JPY 2,000Sanwa Bank cheque JPY 2,100Other banks' cheque JPY 4,500Per cheque(only applicable to non-transferable cheque)Per chequePer transaction, despite of quantityPer transaction, despite of quantityBased on cheque's amountPer chequeAdditional Charges for Foreign Cheques of Non-domicile currencyCountries / TerritoriesPercentageMinimum ChargeFranceNetherland1.5%(1 % forUS 20,000.00equivalent or above)HK 650.00HK liaNew ZealandSwedenNorwayDenmarkFinland-5-This page has been revised since 1 January 2019.HK 550.001%(1)If there is difference between two charges,higher charge shall preveil(2) Waived for USD cheque paid in Canada(3) HKD Cheque paid in Macau 0.25%,Minimum HK 100.00(4) According to beneficiary bank whetheraccept non-domicile currency chequeprocessingHK 200.00PPL489-R63 (01/2020) (HH)JapanSingaporeMacauUSA / CanadaRemarks

C. Securities, Non-listed Bonds, Structured Products,Investment Funds and Other Investment ServicesLocal Securities (1)SEHK Listed SecuritiesItemsServices ChargesMinMaxHang Seng Personal e-Banking / Automated Securities Trading Hotline: 0.25% for any transaction amountHK 100---Manned Securities Trading Hotlines (3) / Branches: 0.3% for transaction amount below HK 200,000 0.25% for transaction amount equal to or above HK 200,000HK 100---Brokerage Fee for SEHKListed Notes / Bonds0.2% of transaction amountHK 100---Transaction Levy(collected by SFC)0.0027% of transaction amount------Trading Fee (collected by 0.005% of transaction amountHKEX)------Stamp Duty (collected byHKSAR Government)HK 1 for every HK 1,000 of transaction amount or part thereof------Deposit Charge forPurchase Orders (4)Prestige Banking customers: HK 2.5/lotOther customers: HK 5/lotCharge will be waived if securities are sold before settlementHK 30HK 188Italian FinancialBased on daily net increase of customer’s beneficial holding of the same share at accountTransaction Tax (“FTT”) (5) level on each settlement day x weighted average purchase price x 0.1%(collected by ItalianInland Revenue Office)------Trade - Related(2)Brokerage Fee forSEHK Listed Securities(1)Not applicable to The Stock Exchange of Hong Kong Limited (SEHK) listed overseas securities and Renminbi denominated securities. All charges are calculated on each securitieseach transaction basis, except for those items with other charge basis specified.(2) For details of services charges of the ETF settled in US currency - ABF PAN ASIA BOND INDEX FUND (Stock Code: 02821), please refer to services charges for Hong Kong listedsecurities / ETF settled in US currency.(3) Not applicable to the securities orders placed via Relationship Mangers of Corporate Wealth Management Services.(4) Not applicable to iBond.(5) Customers who trade shares issued by Italian resident companies which listed on The Stock Exchange of Hong Kong Limited via our Bank are required to pay for the Italian FTT.-1-This page has been revised since 1 January 2018.PPL489-R62 (11/2019) (LT)Customers may be required to pay the costs, fees and charges incurred or charged by third parties in relation to the provision of securities trading, custodian and/or nominee servicesby the Bank. Such third party costs, fees and charges are subject to change without prior notice and will be determined by the Bank. All fees and charges determined by TheGovernment of Hong Kong Special Administrative Region/HKEX/HKSCC/SFC/SSE/SZSE/CSRC/ChinaClear Shanghai/ChinaClear Shenzhen/SAT/SEC are subject to change withoutprior notice. Hang Seng Bank Limited reserves the right to revise any charges, special offers and other services from time to time.

C. Securities, Non-listed Bonds, Structured Products,Investment Funds and Other Investment Services (cont’d)Local Securities (1)SEHK Listed SecuritiesItemsServices ChargesMinMaxScrip Handling & Settlement-RelatedPhysical scrip deposit- Deposit FeeHK 30/securities/ transaction------- Transfer deedstamp duty(collected by HKSARGovernment)HK 5 for each transfer deed------HK 50---Physical Scrip Withdrawal- Withdrawal FeeHK 7.5/lot/securitiesThrough Central Clearing and Settlement System (CCASS)- Deposit FeeFree- Withdrawal FeeHK 7.5/lot/securities------HK 50---HK 30HK 2,000Nominee Services and Corporate Actions- Collection of Dividends/ 0.5% on amount collectedInterest (2)- Scrip Dividends- Cash Offer- Privatisation(Receipt of Cash)- Conversion of Warrants(Cash Settled)(1)(2)Not applicable to The Stock Exchange of Hong Kong Limited (SEHK) listed overseas securities and Renminbi denominated securities. All charges are calculated on each securitieseach transaction basis, except for those items with other charge basis specified.Not applicable to iBond.-2-This page has been revised since 1 June 2015.PPL489-R63 (01/2020) (HH)Customers may be required to pay the costs, fees and charges incurred or charged by third parties in relation to the provision of securities trading, custodian and/or nominee servicesby the Bank. Such third party costs, fees and charges are subject to change without prior notice and will be determined by the Bank. All fees and charges determined by TheGovernment of Hong Kong Special Administrative Region/HKEX/HKSCC/SFC/SSE/SZSE/CSRC/ChinaClear Shanghai/ChinaClear Shenzhen/SAT/SEC are subject to change withoutprior notice. Hang Seng Bank Limited reserves the right to revise any charges, special offers and other services from time to time.

C. Securities, Non-listed Bonds, Structured Products,Investment Funds and Other Investment Services (cont’d)Local Securities (1)SEHK Listed SecuritiesItemsServices ChargesMinMax---------HK 300a) Dividend 0.5% on amount collectedHK 30HK 2,000b) Bonus Issue: HK 50 per distribution------------Nominee Services and Corporate Actions- Receipt of Bonus Issues

set by Mastercard and Hang Seng respectively, plus a Foreign Currency Conversion Fee. For transactions effected via the Visa/Plus ATM network, the money withdrawn is converted directly into Hong Kong dollars at the daily exchange rates set by Visa plus a Foreign Currency Conversion Fee. For transactions effected via other networks (including