Transcription

NATIONAL INSURANCE RISESNATIONALINSURANCERISE SPELLSDOUBLE TROUBLEFOR UMBRELLACONTRACTORS Class 1 Employers’ NICs will increase from13.8% to 15.05% on earnings over 8,840. Class 1 Employees’ NICs above the 9,568threshold will increase from 12% to 13.25%(main rate), and from 2% to 3.25%(higher rate). Class 4 contributions (for the self-employed)above the 9,568 threshold will increasefrom 9% to 10.25% (main rate), and from2% to 3.25% (higher rate).It’s been on the cards for a while,and now it’s almost here. NationalInsurance is rising by 1.25% this April.The increase is expected to rake in anestimated 36bn over the next three years,the money being used to get the NHS backon its feet after the last couple of years, andto kick-start a national social care reform.Millions of UK workers could see an increaseto their National Insurance tax bill. But foragencies and contractors engaging withUmbrella companies the increases carry furthercomplication as well as expense.The Employee’s National Insurance increaseimpacts nearly all workers in the UK.The way Umbrellas are structured means thatcontractors (especially those on short termassignments) could be impacted by both the 1.25%Employer’s and Employee’s National Insurance rise.peoplegroupservices.com

NATIONAL INSURANCE RISESWHO FOOTS THE BILL FOR THEEXTRA 1.25% EMPLOYER’S NATIONALINSURANCE?This is heavily influenced by the assignmentduration because of the Agency WorkersRegulations of 2011 (AWR).WHY DOES AWR MATTER?Temporary workers on assignments of 12 weeksor over are entitled to pay and benefits equal to acomparable permanently employed worker.Permanently employed workers will see theadditional 1.25% Employee’s National Insurancedeductions on their payslip, but the employer paysthe additional 1.25% Employer’s National Insurance.This means that in order to remain compliant withcomparator pay rules under AWR, agencies shouldincrease Umbrella pay rates by 1.25%.Failing to do so on 12 week plus assignmentswould result in a breach of the AWR comparatorrules and leave the agency exposed.For agencies with contractors on assignments ofless than 12 weeks there’s a difficult choice.Consultants could set a future-proof AWRcompliant Umbrella pay rate using the comparatormethod - and get an additional 1.25% from theclient or absorb the 1.25% from the margin.Or agencies could keep the existing Umbrella rate- but be prepared for extra questions and unhappycontractors who’s net pay has reduced by 2.5%.Agencies, hirers and contractors have beenthrough a terrible couple of years. This latest hitcould be the last straw for some.But at People Group, we have a solution.peoplegroupservices.com

NATIONAL INSURANCE RISESGETTINGINTO THENUMBERSWHAT THIS MEANS FOR YOURCONTRACTORS AND UMBRELLAS.But what doesthe increase meanin real money?Let’s take an example:MEET LINDALinda is employedShe earns 30,000 a yearIn 2021-22 she would have paid 47.15 a weekfor Class 1 National Insurance.From 2022-23, however, this will rise to 52.05 a week to paybecause of the new 1.25% increase.That’s 4.90 more.The calculation on your left gives you an idea ofthe numbers. But there are wider implications.These days many of us are counting the pennies.This is another hit and could have a real impacton contractor satisfaction. Not what any agencyneeds in the middle of a skills shortage.We’re all aware of the dangers of Umbrellas thatsail too close to the wind and we also know thatthey don’t offer the benefits they used to.But this isn’t about good vs. bad Umbrellas. It hitsevery employer, including Umbrella companies.People Group’s Umbrella is about as compliantand clear as Umbrellas get, but every employeris legally obliged to deduct and pay NationalInsurance at the new rates.These changes make Agency payroll even moreexpensive to run, and presents uncomfortablequestions for the Umbrella model in the long term.And we all have to be clear-eyed about that.But here’s the kicker:If Linda was starting a new assignmentthrough an Umbrella company she couldsee additional deductions of 9.80 for thefirst 12 weeks.However, after 12 weeks when the AWRpay comparator rules come into effect, theUmbrella pay rate should increase by 1.25%.This means an increase to agency costs- unless the client charge rates can beincreased.peoplegroupservices.com

NATIONAL INSURANCE RISESWe asked over 600Umbrella contractors aboutApril’s National Insurance risesCONTRACTOR CONCERNS43% told us that they were not aware of theupcoming changes, and of those that are aware,89% of them have found out for themselvesthrough research or through the media.This is an opportunity for agencies tocommunicate more with their contractors.HOW CONCERNED ARE CONTRACTORS?Contractors are seriously worried about theeffect on their take-home veraged8 out of 10“I don’t earn that much so less take homeis an issue and the cost of living is goingway up so everything is costing me moreespecially energy bills and petrol.”“I took early pension at 60 and have towork 2 days a week to top it up and that isstill not quite enough to cover living costs.”“I am a single mum already strugglingfinancially. So, this is going to put even morestress and pressure on me.”We also learned that 65% of those contractorswho were aware of the increase didn’t knowexactly how their income would be affected. Thechances are they’ll only realise when they get theirfirst pay slip in the new tax year.The double rise also throws up questions aboutUmbrella contractors and their willingness to takeon new work, with a third saying it would certainlyaffect their work choices.One contractor told us:“I will be paying an increase in NI on theemployee and employer as I am paid viaUmbrella. It’s a good reason for getting rid ofUmbrella companies.”Another explained: “National Insurance is alreadya huge deduction from my pay and combinedwith PAYE tax, my take-home rate is alreadysignificantly lower than I ever expected it tobe. An increase in NI is very likely to cause mefinancial hardship.”“I feel my tax already takes up a largeproportion of my wage and I would be highlyconcerned if it was increased.”peoplegroupservices.com

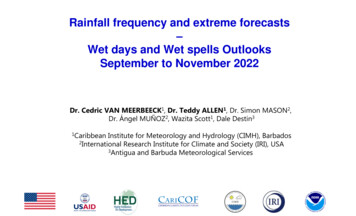

NATIONAL INSURANCE RISESa high proportion of contractorswould consider other options, such asalternative payroll solutions orstopping temporary work.which of the following would contractors reconsideras a result of the ni changes?end hirer12%Would youconsider derPROFESSION27%27%YES/maybe76%Would youconsiderstoppingtemporary/shift work?where i liveNO20%15%39%don’t knowYES/maybe60%how longi work for4%NO24%don’t know15%peoplegroupservices.com

NATIONAL INSURANCE RISESTHERE IS A WIN:WIN SCENARIOA PEO solution (Professional EmploymentOrganisation) could be the answer. The initial1.25% rise to Employee’s National Insurance stillapplies, that’s for everyone. All employmentcosts (Employer’s NI, Employer’s Pension,Apprenticeship Levy, and margin) are agreed andarranged between the agency and People Group.Therefore the contractor does not see any marginor employment costs on their payslip.Our research tells us thatthis could get a really positiveresponse from contractors with 76%stating they would happily consider analternative payroll solution.With this NI rise, now could be the time to makethat move. It’s a win:win scenario for everyone.WHY is peo different from other solutions?VATVAT applies to 1% ofinvoice value onlyAll inclusive rate (incl Holiday Pay)Contractor QuestionsHeadline Umbrella RateUmbrella MarginEmployers NationalInsuranceEmployers PensionContrubitionsApprenticeship LevyContractor Taxable Gross PayStraightforward PAYE rate(incl Holiday Pay)PEO MarginAdditional Employerscost provisionEmployers NationalInsuranceEmployers PensionContributionsApprenticeship LevyPAYEEmployees NationalInsuranceEmployees PensionContributionsPAYEEmployees NationalInsuranceEmployees PensionContributionsNet PayNet PayUmbrella CompanyContractor PayVisible to ContractorsTotal Agency OutgoingsContractor PayVisible to ContractorsNet PayContractor Net PayProfessional EmploymentOrganisation (PEO)peoplegroupservices.com

NATIONAL INSURANCE RISESPEOPLE PAY– SIMPLE, CLEAR AND HONESTAt People Group we’ve seen more and morepeople switching to People Pay, our PEO solution.It’s designed for the modern world, being simpleand transparent.The PAYE rate agreed between worker and agencyhas only employee tax deductions applied to it.We take care of all statutoryobligations, such as pension andholiday, plus contractors have accessto Anytime Wages and the manyMy Wallet benefits including tastecard and Medicash health plans.People PEO could be just what Umbrellacontractors are looking for. It’s clear, honest andcould save time and money. Which is great newsfor ‘Lindas’ everywhere.What your contractorsshould knowgiving your contractorsother choices Both Employer and Employee NationalInsurances are rising by 1.25% fromApril 2022 The rise will impact employees,employers and the self-employed Employees of Umbrella companiescould end up paying more There are alternatives toUmbrella companies Consider a move to PEO for moretransparency It can save money and hassleyourapril 2022checklistReview Umbrella rates to ensure compliance with paycomparator rules within AWR.Communicate changes internally to your team, externallyto your clients and contractors.Be prepared for more payslip and deduction questions,especially from Umbrella contractors, from 8th April.Consider a simple and transparent alternative likePeople PEO ready for unhappy contractors.Review the payroll options you offer and the suppliersproviding those services.FIND OUT MOREYou can also share our‘Simple guide to the NI changes in April 2022’with your contractorshello@peoplegroupservices.com0345 034 1530peoplegroupservices.com

The Employee's National Insurance increase impacts nearly all workers in the UK. The way Umbrellas are structured means that contractors (especially those on short term assignments) could be impacted by both the 1.25% Employer's and Employee's National Insurance rise. peoplegroupservices.com NATIONAL INSURANCE RISE SPELLS DOUBLE TROUBLE