Transcription

601947 Citi Pricing Guide CTP Priority A4 EC1.ai13/8/2110:44 AMBanking fees at a glance.Your quick and easy guide toour schedule of charges.

601947 Citi Pricing Guide CTP Priority A4 EC1.ai23/8/2110:44 AMCitibank Global Consumer Banking SingaporeContentsDeposit Accounts2VISA, MasterCard and American Express 8Citibank ATM/Debit Card3Citibank Ready Credit11Account Service Fees4Mortgage12Cheque Charges5Citibank Brokerage12Foreign Currency Notes Services6Safe Deposit Box15Remittances6Coin Exchange Service15Standing Instructions and GIRO7Coin Deposit15Traveller’s Cheques7Other Services15

601947 Citi Pricing Guide CTP Priority A4 EC1.ai33/8/2110:44 AMDEPOSIT ACCOUNTSSavings AccountsSingapore Dollar Savings Account:Minimum initial deposit*Minimum balance to earn interestWaivedS 1Singapore Dollar Junior Savings Account:Minimum initial deposit*Minimum balance to earn interestWaivedS 1Singapore Dollar Money Market Savings Account:Minimum initial depositMinimum balance to earn interestWaivedS 1Checking AccountsSingapore Dollar Checking AccountMinimum initial deposit*WaivedUS Dollar Checking AccountMinimum initial deposit*WaivedSavings & Checking AccountsMaxiSave & MaxiSave Sweep Account (S ):Minimum initial deposit*Minimum balance to earn interestWaivedS 1InterestPlus Savings (S ) & Step-Up Interest Account (S ):Minimum initial deposit*Minimum balance to earn interestWaivedS 1Tap and Save Account (S ):Minimum initial deposit*Minimum balance to earn interestWaivedS 1CitiAccess (US ):Minimum initial deposit*WaivedCiti MaxiGain Account (S ):Minimum initial deposit*Minimum balance to earn base interestMinimum balance to earn bonus interestWaivedS 1S 1* Initial deposit must be funded within the 1st month of account opening.Citi Wealth First Account (S )Minimum initial deposit*Minimum balance to earn base interestMinimum balance to earn bonus interestWaivedS 1S 1Global Foreign Currency Account(US Dollar, EURO, Australian Dollar, New Zealand Dollar, Sterling Pound,Canadian Dollar, Swiss Franc, Japanese Yen, & Hong Kong Dollar)Minimum initial depositWaivedNote: There is no cheque book facility for these accounts except US Dollar denominated checking accounts.Time DepositSingapore Dollar Fixed Deposit:Minimum initial depositMinimum tenure*S 10,0001 weekSingapore Dollar Unfixed Deposit:Minimum initial depositMinimum tenure*S 10,0006 monthsForeign Currency Unfixed Deposit:Minimum initial depositSMinimum tenure* 10,000 or equivalent1 weekForeign Currency CashPlus Deposit:Minimum initial depositTenureS 10,000 or equivalentOvernight* An administrative fee or withdrawal charge may be imposed for termination of time deposits prior to maturity date.Note:The minimum initial deposit through Citibank Online is S 5,000 for Singapore Dollar Time Deposits. Likewise,S 5,000 or equivalent is required for Foreign Currency Time Deposits.2

601947 Citi Pricing Guide CTP Priority A4 EC1.ai43/8/2110:44 AMCITIBANK ATM / DEBIT CARDCash withdrawal and Debit Card spending limit:-Daily cash withdrawal limitDefault Daily Debit Point of Sales LimitMonthly Debit Point of Sales LimitS 5,000S 2,000S 30,000Cash withdrawals:Singapore-Citibank Singapore Limited ATMsNo Charge-Qualifying Full Bank (QFB) Shared ATMNetwork#No Charge#The Qualifying Full Bank (QFB) shared ATM network allows you to withdraw cash from Bank of China, HSBC, Maybank,Standard Chartered and State Bank of India at no transaction costs. ATM withdrawal limit is subject to the lower of thelimits set by Citibank Singapore Limited or the respective QFBs.Overseas-Citibank ATMsNo Processing Fee(No overseas cash withdrawalprocessing fee usingCitibank ATM/Debit card.Standard foreign exchangerates apply.)Transactions in foreign currencies(i) Card transactions effected in US dollars will be converted into Singapore dollars. Card transactions effected in foreigncurrencies other than US dollars will be converted to US dollars before being converted into Singapore dollars. Theconversion will take place on the date on which the transaction is received and recorded by us ("posting date"). Thecurrency conversion will be based on our prevailing foreign exchange rate or an exchange rate determined by MastercardInternational depending on whether the conversion is done by us or Mastercard International.(ii) In the event that the Card Transaction is done in a different currency from the account linked to the Debit card, theCard transaction will be subject to an administrative fee of up to 2.5% on the total converted amount, which includesa 1% fee by Mastercard International.(iii) In the event that the Card Transaction denominated in foreign currencies is converted into Singapore dollars viadynamic currency conversion (a service offered at certain overseas ATMs and merchants), it will be subject to anadministrative fee of up to 2.5% on the converted Singapore dollar amount, which includes a 1% fee by MastercardInternational.(iv) Where Citibank Global Wallet is turned on and we allow your Card to be tagged to a Foreign Currency Account andused for any and/or all foreign currency fund in the Foreign Currency Account, foreign currency transactions and CashWithdrawals will be directly authorized from the respective Foreign Currency Account in the foreign currency directlyprovided that that there are sufficient funds in the relevant foreign currency and you have activated your Card foroverseas use.Transactions in Singapore Dollars processed outside SingaporeAll Card Transactions in Singapore Dollars processed outside Singapore through an overseas intermediary or with an overseasmerchant will be subject to an administrative fee of up to 2.5% on the total amount of the transaction, which includes a 1%fee by Mastercard International. Please check with the relevant merchant whether such transaction is being processed outsideSingapore.3

601947 Citi Pricing Guide CTP Priority A4 EC1.ai53/8/2110:44 AMACCOUNT SERVICE FEESCiti Priority Account Service FeeS 15 per month Account Closure Fee(within 6 months from date of account opening)S 50 The monthly minimum Total Relationship Balance (TRB) to be maintained by a customer is S 15,000. Account Service Fee of S 15 per month will applyif your TRB is less than S 15,000 at the end of each month.The account service fee will apply based on the following sequence at the end of each month should your TRB fall below S 15,000:Charging SequenceAccount Type1SGD CHECKING2SGD MONEY MARKET ACCT3SGD MAXISAVE4SGD SAVINGS5SGD INTERESTPLUS SAVINGS6SGD STEP-UP INTEREST ACCOUNT7SGD TAP & SAVE ACCOUNT8SGD MAXIGAIN9SGD WEALTH FIRST ACCOUNT10USD CHECKING11USD CITIACCESS12USD SAVINGS ACCOUNT13AUD GLOBAL FCY AC14NZD GLOBAL FCY AC15EUR GLOBAL FCY AC16GBP GLOBAL FCY AC17CAD GLOBAL FCY AC18CHF GLOBAL FCY AC19JPY GLOBAL FCY AC20HKD GLOBAL FCY ACThe minimum TRB of S 15,000 and the account service fee of S 15 have been standardised across all of our bankingsegments, namely, Citibanking, Citi Priority, Citigold and Citigold Private Client.Your banking relationship may, from time to time, be realigned according to your Assets Under Management and thequalifying Assets Under Management for each segment.Assets Under Management refers to the combined balances held in a customer’s primary accounts including Citi checkingand savings accounts, time deposits and investments. Funds credited into cash management accounts will not counttowards Assets Under Management.Total Relationship Balance is the sum of:(i) the average daily balance of your checking, savings and deposit accounts,(ii) the average daily value of your investments, and(iii) all outstanding amount(s) payable on your secured loan accounts as of the date of your last statement.Citibank’s determination of TRB will be conclusive.4

601947 Citi Pricing Guide CTP Priority A4 EC1.ai63/8/2110:44 AMCHEQUE CHARGESCheque Book ReplenishmentDepositUS Dollar cheques drawn on local banks:Other foreign currency cheques drawnon local banks:Foreign Currency cheques drawn on bankslocated outside of Singapore:- Deposit- Cheques ReturnedS 15 per cheque bookNo ChargeS 15 per chequeS 15 per chequeS 15 per chequeForeign Cheques sent for overseas collection- Involving Foreign Exchange1/8% commission (min S 10,max S 100) postage/cable costs where applicable.1/8% commission (min S 10,max S 150) postage/cable costs where applicable.- Not Involving Foreign ExchangeNote:1. All charges reflected do not include charges by correspondent banks.2. Acceptance of foreign currency cheques, other banks’ cheques and traveller’s cheques is at the discretion of Citibank.3. All cheque books replenished will contain 30 leaves instead of 50 leaves from 24 July 2015. The charge for replenishment of30-leaves cheque books will take effect from 07 September 2015.Marked ChequesDirect Marking (S )(confirmation of status day)S 100 per chequeReturned ChequesS Waived for 1 cheque per Citi Priority account perday. Subsequent cheques at S 30 per cheque.US US 30 per chequeStop Payment- Singapore Dollar cheque- US Dollar chequeS 30 per chequeUS 30 per chequeCheque RetrievalS 50 per chequeTEMPORARY OVERDRAFT FEESTemporary Overdraft*Interest RatePrevailing prime lending rate 5%.EarmarkingThe customer’s funds in other account(s) with Citibank will be held as security and earmarked forthe repayment of the temporary overdraft. The customer will not be able to access or use the fundsearmarked so long as the temporary overdraft is outstanding.Repayment DateThe temporary overdraft (and any interest payable) must be repaid as soon as possible but in anyevent no later than 30 days from the date the temporary overdraft is granted or repayable on demand,whichever is earlier.Set-OffIf the temporary overdraft is not repaid by the Repayment Date, any outstanding owing (includinginterest) in respect of the temporary overdraft will be set off from the funds earmarked forrepayment/security without further reference to the customer.*Applicable for both cheques and GIROs.5

601947 Citi Pricing Guide CTP Priority A4 EC1.ai73/8/2110:44 AMFOREIGN CURRENCY NOTES SERVICESDepositForeign Currency Notes- Involving Foreign Exchange- Not Involving Foreign ExchangeNo ChargeA service fee of 0.5%(min S 10) appliesto all cash amounts.Withdrawal- Involving Foreign Exchange- Not Involving Foreign ExchangeNo ChargeA service fee for the respectiveforeign currencies applies:Note:Foreign Currency cash withdrawals are subject to the availability of currency. Where the requested foreigncurrency is not readily available, Citibank reserves the right to impose additional charges to offset any costincurred by Citibank in obtaining such foreign currency. Citibank deals with AUD, EUR, GBP, HKD, JPY &USD cash notes only. AUD – 2.5% HKD – 3.0% EUR – 1.5% JPY– 1.5% GBP – 1.5% USD – 1.5%ORmin S 10 whichever ishigher.REMITTANCESInward RemittancesHandling FeeNo ChargeWithdrawal by means ofForeign Currency NotesA service fee for therespective currenciesapplies. (Please referto the Foreign CurrencyNotes withdrawal feecharges above)Outward Remittances1) Local Transfer;a) Via branches and CitiPhone assistedb) Via Citibank Online and Citi Mobile App- MEPS (MAS Electronic Payment System)- GIRO (2 to 3 business days)- FAST (Fast and Secure Transfers)2) Overseas Transfer;a) Instant transfer to Citibank accountsoverseas via Citibank Global Transfer (CGT)b) Telegraphic Transfer (3 business days)- CommissionS 15 per transactionS 5 per transactionNo ChargeNo ChargeNo Charge1/8% commission(min S 20, max S 200)S 25- Cablec) Online Telegraphic Transfer toNon-Citibank accounts- All other overseas banks viaCitibank OnlineS 25 per transaction(cable charge) Instructions received before 5pm on a business day will be effected on the same day. Instructions after 5pm on a business day will be effected the nextbusiness day.Note:The commissions, fees and cable charges apply to all outward remittances regardless of whether the source account is a transactional account or a timedeposit account, and regardless whether the remittance is to yourself or to a third party. All charges reflected do not include charges by correspondentbanks.USD Cashier’s OrdersCharges1/8% commission (min S 20,max S 200) postagewhere applicableSGD Cashier’s OrdersChargesS 10 per cheque postage where applicableNote:No charges for Cashier’s Order Payable to 1st party for account closure and redemption against TD and FTD.6

601947 Citi Pricing Guide CTP Priority A4 EC1.ai83/8/2110:44 AMREMITTANCESPostage (Documents)ChargesS 2.24 per local registered mail actual postage or S 10 for overseas registered mail actual postage.Stop PaymentChargesS 20 per transaction plus cable cost where applicable.Tracers for InvestigationChargesS 30STANDING INSTRUCTIONS AND GIROStanding InstructionsWithdrawal from banking or time deposit account via:Cashier’s OrdersChargesBank DraftsChargesTelegraphic TransfersChargesGIRO(Only applicable to transfersfrom Singapore Dollarsbanking account)- Outward Remittances- Returned GIRO (for financialreasons)S 10 per transaction cost of Cashier’s Order of S 10 postage where applicable.S 10 per transaction 1/8% commission (min S 20, max S 200) postage S 30cable cost.S 10 per transaction 1/8% commission (min S 20, max S 200) postage S 30cable cost.No ChargeS 10 per transactionRejected Standing Instructions S 30 per transactionTRAVELLER’S CHEQUESFor Citicorp Traveller's Cheques only (only available at Capital Square Branch):EncashmentNo ChargeRemarks:Yen Denominated Traveller’s Cheques attracts additional 1% (min S 10) clearing fee imposed by clearing bankDepositS 20 per transaction7

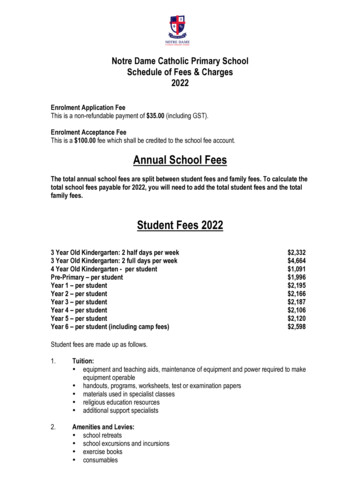

601947 Citi Pricing Guide CTP Priority A4 EC1.ai93/8/2110:44 AMVISA, MASTERCARD AND AMERICAN EXPRESS Annual Membership Fees (inclusive of GST)Citi Priority clients will enjoy perpetual fee waiver* on selected cards.Citibank CardBasicSupplementaryFee Waiver***Citi Cash Back CardS 192.60S 96.301 year annual feewaiver for basic and allsupplementary cardsCiti Clear CardS 29.96N.A.1 year annual fee waiverCiti ClearPlatinum CardS 160.50S 85.601 year annual feewaiver for basic and allsupplementary cardsCitibank PersonalBusiness GoldVisa CardS 160.50N.A.1 year annual fee waiverCiti PremierMilesS 267.50Free–S 192.60Free1 year annual feewaiver for basic andperpetual fee waiver forall supplementary cardsAmerican Express Card*Citi PremierMilesVisa CardCiti Prestige CardS 535.00FreeNo Fee Waiver*Citi Rewards CardS 192.60S 96.301 year annual feewaiver for basic and allsupplementary cardsCiti Cash Back PlatinumS 160.50S 80.25–Citi Clear Classic CardS 64.20Not Applicable–Citi Gold CardS 160.50S 85.60–Citi Platinum CardS 160.50S 85.60–Citi Silver CardS 64.20S 32.10–Citibank Partner CardBasicSupplementaryFee Waiver**Citi M1 PlatinumVisa CardS 192.60S 96.301 year annual feewaiver for basic and allsupplementary cards*Citi SMRT PlatinumVisa CardS 192.60S 96.302 year annual feewaiver for basic and allsupplementary cardsCiti M1 Blue CardS 64.20S 32.10–Citi M1 Gold CardS 160.50S 85.60–Citi Lazada CardS 192.60S 96.301 year annual feewaiver for basic and allsupplementary cards* Citi Priority clients need to maintain a Citi Priority relationship for at least 3 months with the minimum monthly average Assets Under Management ofS 70,000 in their Citi Priority account(s) with effect from 1st June 2017 and a minimum annual Retail Spend of S 18,000 per Credit Card. The fee waiveron the Citibank Credit Card annual subscription fee is applicable to only holders of the Citi PremierMiles Visa Card, Citi Cash Back Card, Citibank SMRTVisa Card and Citi Rewards Card. Offer is valid at an individual Credit Card level, which means that only individual cards that have accumulated a minimumannual Retail Spend of S 18,000 each will be eligible for the Citibank Credit Card annual subscription fee waiver. Annual Retail Spend will be calculatedusing the 12-month period prior to the relevant date on which the Citibank Credit Card annual subscription fee is payable, and annual Credit Card spendwill be calculated based on the preceding 12 monthly statements.Assets Under Management refers to the combined balances held in a customer’s primary accounts including Citi checking and savings accounts, timedeposits and investments. Funds credited into cash management accounts will not count towards Assets Under Management.** The fee waiver is applicable to only new credit card applications.8

601947 Citi Pricing Guide CTP Priority A4 EC1.ai103/8/2110:44 AMVISA, MASTERCARD AND AMERICAN EXPRESS Minimum Paymentand OverlimitAmount – exceptfor Citi Clear CardMinimum Payment AmountThe minimum payment amount is specified in your statement of account and is computed bytaking 1% of the current balance plus 1% of any outstanding unbilled instalment amounts plusinterest charges (including interest/service charges for any recurring/instalment payments) plusany late payment charge or S 50 (whichever is greater) plus any overdue amounts. If the currentbalance is less than S 50, the minimum payment amount shall be equivalent to the currentbalance.Overlimit AmountThe overlimit amount is specified in your statement of account and refers to the balance(includingany unbilled balances) in excess of your combined credit limit and must be paid immediately. Theoverlimit amount is in addition to the minimum payment amount.Minimum Paymentand OverlimitAmount – CitiClear CardMinimum Payment AmountThe minimum payment amount is specified in your statement of account and is computed bytaking 1% of the current balance plus 1% of any outstanding unbilled instalment amounts plusinterest charges (including interest/service charges for any recurring/instalment payments) pluslate payment charge or S 25 whichever is greater, plus any overdue amounts. If the currentbalance is less than S 25, the minimum payment amount shall be equivalent to the currentbalance.Overlimit AmountThe overlimit amount is specified in your statement of account and refers to the balance (includingany unbilled balances) in excess of your credit limit and must be paid immediately. The overlimitamount is in addition to the minimum payment amount.Cash AdvanceChargesS 15 or 6% of amount withdrawn, whichever is greater.Interest Charges forCard Transactions(including CashAdvance) - exceptfor Citi Clear CardThe effective interest rate applicable on your account will be:a. The prevailing retail interest rate of 26.9% per annum and cash interest rate** of 26.9% per annum;orb. A promotional retail interest rate of 20.9% per annum and cash interest rate** of 20.9%per annum which may be extended based on the good conduct of your account. This ratewill be effective after the next Statement billing date, following the payment due date.Notwithstanding the above, Citibank reserves the right to cancel/vary this promotionalrate at any time (including if your account becomes delinquent); orc. A retail interest rate of 29.9% per annum and cash interest rate** of 29.9% per annum in theevent your account is past due* in the current month. Citibank reserves the right to apply thisinterest rate. This rate will be effective after the next Statement billing date, following thepayment due date and your interest rate will revert to the prevailing product interest rate assoon as your account is no longer past due* in the current and last two months.If the interest accrued on the outstanding balance is less than S 3, a minimum of S 3 will be charged.* An account is considered past due if the minimum payment due is not received in full before the payment due date.** Cash Interest Rate refers to the interest rate applied on outstanding debit balances from Cash advance, Cash advance fee,Quasi-cash transactions, Outstanding Balances pursuant to the Balance Transfer Program after the expiry of the promotionalTenure, and interest charges resulting from such transactions. The retail interest rate refers to the interest rate applied onall other outstanding balances.If payment is not made in full by the payment due date, interest charges will be calculated on adaily basis on all transactions in both the current statement as well as next month's statementfrom the transaction date until the date full payment is received.Interest Charges forCard Transactions(including CashAdvance)- Citi Clear CardApplied rate – 2.34% per monthEffective interest rate – 28% per annumMinimum interest charge – S 3Late PaymentCharge - except forCiti Clear CardIf the Minimum Payment due is not received on or before the payment due date, a late paymentcharge of S 100 will be levied.Late PaymentCharge - except forCiti Clear CardIf the Minimum Payment due is not received on or before the payment due date, a late paymentcharge of S 100 will be levied.9

601947 Citi Pricing Guide CTP Priority A4 EC1.ai113/8/2110:44 AMVISA, MASTERCARD AND AMERICAN EXPRESS Transactions inForeign Currenciesand TransactionsProcessed OutsideSingaporea. Foreign currency transactions(i) Card transactions (including online and overseas transactions) effected in US dollars willbe converted into Singapore dollars. Card transactions effected in foreign currencies otherthan US dollars will be converted to US dollars before being converted into Singaporedollars, except for Australian dollars on Visa cards which will be converted into Singaporedollars directly. The conversion will take place on the date on which the transaction isreceived and recorded by us ("posting date"). The currency conversion will be based on ourprevailing foreign exchange rate or an exchange rate determined by VISA, MasterCardInternational, or American Express depending on whether the conversion is done by us,VISA, MasterCard International, or American Express.(ii) In addition, the card transaction will be subject to the following administrative fees onthe converted Singapore dollar amount:(A) an administrative fee of up to 3.25% if processed by Visa or MasterCard International;and(B) an administrative fee of up to 3.3% on the converted Singapore dollar amount, ofwhich 1.5% will be retained by American Express, or such other rate(s) as determinedby us and notified to you.b. Dynamic Currency Conversion(i) If your card transaction (including online and overseas transactions) is converted intoSingapore dollars via dynamic currency conversion (a service offered at certain ATMs andmerchants which allows a cardmember to convert a transaction denominated in a foreigncurrency to Singapore Dollars at the point of withdrawal/sale), you acknowledge that theprocess of conversion and the exchange rates applied will be determined by the relevantATM operator, merchant or dynamic currency conversion service provider, as the case maybe. You acknowledge that we do not determine whether a card transaction will beconverted into Singapore dollars via dynamic currency conversion and, where your cardtransaction is for a retail purchase, you may have to check with the relevant merchantwhether such conversion was done.(ii) In addition, the card transaction will be subject to an administrative fee of 1% levied byVISA/MasterCard International on the converted Singapore dollar amount if it is a VISA/MasterCard International transaction;c.Singapore Dollars transactions processed outside SingaporeIf the Singapore Dollars card transaction (including online transactions) is effected:i. with a local merchant whose payments are processed through an overseas intermediary; orii. with a merchant who is registered as an overseas merchant regardless of its actual location,such card transaction will be subject to an administrative fee of 1% on the transactionamount if the card transaction is processed by VISA/MasterCard International.This charge will be charged on card transactions including but not limited to any VISA or Mastercardretail card transaction presented in foreign currency that you choose to pay in Singapore Dollarsat point-of-sale via dynamic currency conversion or any online VISA or Mastercard retail cardtransaction in Singapore Dollars which was processed outside Singapore. You may have to checkwith the relevant merchant whether such transaction was processed outside Singapore.Liability forUnauthorisedTransactionsYou are reminded to keep your Citibank credit card in a safe and secure place and not to discloseyour PIN to any third party. If your credit card is lost, stolen or used by any third party or yourPIN is disclosed to any third party, you should immediately notify Citibank. Your liability forunauthorised transactions on each credit card account is capped at 100 provided that Citibankis satisfied that you have (i) not been negligent, (ii) not acted fraudulently and (iii) immediatelynotified Citibank about the loss/theft/disclosure.Repayment GracePeriod25 days from the date of the statement of account.Credit LimitThe credit limit shown is your combined credit limit effective across all the personal basic andsupplementary cards held by you including your personal business card if any.Overlimit FeeS 40 will be charged on the card with highest balance on the statement billing date, if the totaloutstanding balance (including unbilled balance) of all credit card(s) exceeds customer’s combinedcredit limit on any day within the statement period.Service Charge forInsufficient Funds(Inclusive of GST)Returned ChequeRejected Direct Debit Authorisation10S 25S 25

601947 Citi Pricing Guide CTP Priority A4 EC1.ai123/8/2110:44 AMVISA, MASTERCARD AND AMERICAN EXPRESS Retrieval Fee(Inclusive of GST)Requests for copies of sales drafts and statements are subject to the following charges:Charge per copySales Draft:- current to 2 monthsS 5- more than 2 months to 1 yearS 15Statement of Account:- current to 2 monthsFree- more than 2 months to 1 yearS 15- more than 1 year to 5 yearsS 30- more than 5 yearsS 100Payment HierarchyCiti shall be entitled in Citi’s reasonable discretion to apply and appropriate all payments receivedby Citi in such a manner or order of priority as Citi may deem fit, notwithstanding any specificappropriation of such sums by customer or any person making such payment.Branch Service FeeService fee of S 10.70 (inclusive of GST) is charged (on a per account basis) for each payment madeto Citi Credit Card account(s) over the counter at Citibank Branches.This pricing information guide is not intended to provide exhaustive information. You should refer to the applicableCardmember’s Agreement for the full terms and conditions.CITIBANK READY CREDITAnnual FeeInterest ChargeS 100Daily interest is calculated by multiplying the effective interest rate per annum by daily outstandingdebit balance over 365 days in a year. There is a minimum interest charge of 5 if you have anyoutstanding debit balance. The effective interest rate applicable on your account will be:a) the prevailing product interest rate of 20.95% per annum; orb) A promotional interest rate of 13.50% per annum which may be extended based on the goodconduct of your account. This rate will be effective after the next Statement billing date,following the payment due date.Notwithstanding the above, Citibank reserves the right to cancel/vary this promotional rateat any time (including if your account becomes delinquent); orc) An interest rate of 26.95% per annum will be applicable in the event your account is pastdue* in the current month. This rate will be effective after the next Statement billing date,following the payment due date and will revert to the prevailing product interest rate assoon as your account is no longer past due* in the current and last two months.*An account is considered past due if the minimum payment due is not received in full before thepayment due date.Minimum Paymentand OverlimitAmountMinimum PaymentIf the current balance on your Citi Ready Credit (“CRC”) account, including any Quick Cash (“QC”)minimum payment if you have a QC (“CRC Outstanding Balance”) is less than S 50, the minimumpayment amount shall be equivalent to the current CRC Outstanding Balance. If the CRC OutstandingBalance is more than or equal to S 50, the minimum payment shall be the higher of:(i) Sum of 1% of CRC outstanding balance, Quick Cash minimum payment, interest charges and latepayment charges; or(ii) S 50Any CRC Outstanding Balance due and unpaid in respect of earlier CRC statements shall be added tothe minimum payment due and payable under any current CRC statement.Overlimit AmountThe overlimit amount is specified in your statement of account and refers to the balance(including anyunbilled balances) in excess of your credit limit and must be paid immediately. The overlimit amount ispayable in addition to the minimum payment due on your CRC Outstanding Amount.Late PaymentChargeIf the Minimum Payment due is not received on or before the payment due date, a late paymentcharge of S 100 will be levied.Overlimit FeeIf the current balance on your account exceeds your credit limit, an overlimit fee of S 40 shallbe charged to your account.Returned ChequesS 30 per chequeStop PaymentS 30 per chequePayment HierarchyCiti shall be entitled in Citi’s reasonable discretion to apply and appropriate all payments receivedby Citi in such a manner or order of priority as Citi may deem fit, notwithstanding any specificappropriation of such sums by customer or any person making such payment.Branch Service FeeService fee of S 10.70 (inclusive of GST) is charged (on a per account basis) for each payment madeto Citi Ready Credit account over the counter at Citibank Branches.This pricing information guide is not intended to provide exhaustive information. You should refer to the applicableCardmember’s Agreement for the full terms and conditions.11

601947 Citi Pricing Guide CTP Priority A4 EC1.ai133/8/2110:44 AMMORTGAGEInterest RatesCitibank offers wide variety of interest rate packages, ranging from 1/3/6/12 months SIBORtenures to fixed rate packages. Please speak to us today at 6238 8838 for our latest interestrate packages.PrepaymentFee/Breakage FeeA prepayment fee/breakage fee may be applicable on partial

ACCOUNT SERVICE FEES Citi Priority Account Service Fee S 15 per month Account Closure Fee S 50 (within 6 months from date of account opening) The monthly minimum Total Relationship Balance (TRB) to be maintained by a customer is S 15,000. Account Service Fee of S 15 per month will apply if your TRB is less than S 15,000 at the end of each .