Transcription

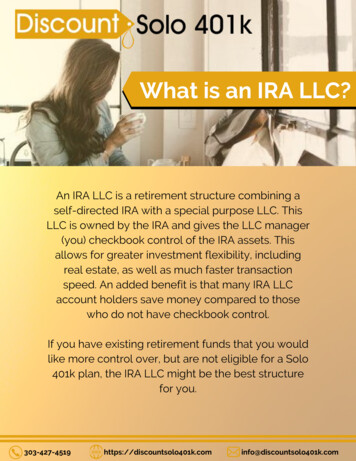

What is an IRA LLC?An IRA LLC is a retirement structure combining aself-directed IRA with a special purpose LLC. ThisLLC is owned by the IRA and gives the LLC manager(you) checkbook control of the IRA assets. Thisallows for greater investment flexibility, includingreal estate, as well as much faster transactionspeed. An added benefit is that many IRA LLCaccount holders save money compared to thosewho do not have checkbook control.If you have existing retirement funds that you wouldlike more control over, but are not eligible for a Solo401k plan, the IRA LLC might be the best structurefor iscountsolo401k.com

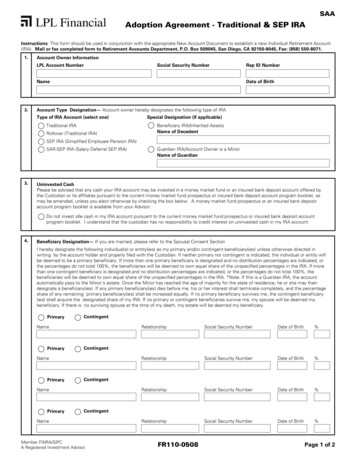

IRAIRA LLCLLCFeaturesFeaturesCheckbook ControlOur IRA LLC structure, sometimesreferred to as a "checkbook IRA"allows you to hold the checkbookto your retirement funds.Alternative AssetsInvest into real estate, privatecompanies, tax liens, notes,cryptocurrencies, traditionalassets such as stocks & mutualfunds, and more.Quicker Transaction SpeedYou’ll have the ability toimmediately write checks, processdebit card transactions, or sendwires for your IRA LLC. Yourinvestments won’t be sloweddown by custodial processingdelays.Low Cost & AdministrationGain more control andflexibility over your assets withno asset-based charges ortransaction fees. There is no annualfiling requirement for the singlemember iscountsolo401k.com

Let's get somequestionsanswered!WHAT CAN AN IRA LLCINVEST IN?HOW MUCH CAN I CONTRIBUTETO AN IRA LLC?Unlike most IRAs, an IRA LLC from DiscountSolo 401k can invest into anything allowedby law. We don’t place any additionalrestrictions on your activities. This leavesyou free to invest in real estate, privatebusinesses, mortgage notes, preciousmetals, tax deeds and more.The 2020 contribution limit for an IRA is 6,000, or 7,000 for those age 50 andolder.Traditional assets such as stocks, bonds,and mutual funds are also permitted. Themain restriction is on “self dealing” whichmeans you cannot direct your IRA LLC totransact with (or benefit) you or certainfamily members. Doing so would generallybe a prohibited transaction.IS A CUSTODIAN REQUIRED?Yes, IRAs always require a custodian. Thegood news, however, is that we include thecustodial fees in our pricing and with the LLCwe create for your IRA, you do not have togo through the custodian to executetransactions. You will have checkbookcontrol.303-427-4519CAN I TRANSFER EXISTINGRETIREMENT FUNDS INTO ANIRA LLC?Yes. You can transfer funds from mostretirement accounts into the IRA LLCwithout creating taxable distributions.There is no limit on transfer or rolloveramounts.WHAT STATE SHOULD THE IRALLC BE FORMED IN?While the IRA LLC can be formed in anystate, it usually makes sense to form theLLC in the state in which you live and/orthe state(s) in which you plan to lo401k.com

What arethe Fees?FEE SCHEDULE 1,000IRA LLC formation( filing fees) 300IRA LLC annual feeAsset fees 0Transaction fees 0*Contact us today for any available nfo@discountsolo401k.com

Why Choose DiscountSolo 401k?Many Investors consider our services for the low prices,but most choose us based on so much more:Over a decade of experience inNo asset-based feesself-directed investingNo transaction based feesWe never handle your funds;No hidden feeswe set you up to be in controlFree referral program - allowStreamlined bank accountus to show appreciation for anyopening for your IRA LLCreferrals you sendWe use state-of-the-art 256-We never raise rates onbit encryption to securelyexisting clients - everdeliver filesOpen weekends byFlat fee annual billing -appointmentdocument updates andCustodial fees are includedsupport are includedQuick response timesBBB accredited, with zeroWe create LLCs for all 50complaintsstatesBBB A @discountsolo401k.com

Discount Solo 401kis on BiggerPockets!KREIGHTON REEDBusiness Bankerfrom Denver, Colorado@Tony Gunter I work with Justin and his clients. (I openthe 401K checking accounts). He's been doing this for awhile (mid 2000's). I interface with his clients after theyare done opening their Solo 401K and they are very wellprepared with the ongoing forms they will need totransact business with their 401K and conduct the rolloverfrom their previous IRA/401K. The Gold Standard in thisbusiness is follow up and follow through and Justin is 24karat.JOHN WALLACEInvestorInvestorfromfrom ColoradoColorado Springs,Springs, ColoradoColoradoHi Tony, I opened an account with Justin lastyear and his service has been more thancomplete, courteous, and the most inexpensivevendor I could find. As a plus he is "local" for me(about 60 miles) but I never needed to visit inperson. He has answered questions bothignorant and complex and helped me find abank willing to hold thetrust account. It's all good!ANTHONY DIGGSWholesalerWholesalerfromfrom Odenton,Odenton, MarylandMarylandAs a current client of Justin, I too can attestthat the services he has provided areimmaculate. After contacting multiple Solo401k companies, I decided to go withDiscount Solo 401k because their serviceswere up to par and prices were reasonable.Other companies were charging twice theprice for the same service with no additionalbenefit. PM me if you have any 1k.cominfo@discountsolo401k.com

We are Better BusinessBureau accredited!Discount Solo 401kis PROUD todisplay ourAA RRaattiinnggwith theBetter Business Bureau303-427-4519info@discountsolo401k.com

TESTIMONIALSJustin at Discount Solo 401K did a great jobestablishing solo 401k plans for my businesspartner and myself. Justin customized theplan to suit our needs. He was highlyresponsive to any questions or issues we had.He was available to assist us through theestablishment of the 401k, the establishing ofbank accounts, the transferring of funds fromour IRAs and the signing of the loandocuments. If you want to establish a highquality plan at a reasonable price I highlyrecommend Justin at DiscountSolo401K.com.Rob N, RK Homes LLCI use Discount Solo 401k for my own 401kplan. I’m so relieved to have this team keepmy plan documents up to date. And each timeI have questions, they are incrediblyresponsive. They are a great resource forsmall business.Lisa Bushur, CPAJustin knew exactly what he was talkingabout and answered all our questions. Theprocess went very quick and within a coupleof days our trust was set up and registeredwith the IRS. Justin supported the processfrom start to finish and followed up until wehad our bank account opened. We highlyrecommend Discount Solo 401k.Fisher Weis LLC, Chicago303-427-4519info@discountsolo401k.com

TESTIMONIALSI signed up for Discount Solo 401k overa year ago. I have to be honest, thepricing is what first caught my eye.They offered the lowest price amongall the service providers. (Some feeswere over 2x what I paid)The setup process was smooth,seamless, and secure (I was provided aclear checklist, fast response time, asecure method of transferring files).But the service was above and beyondwhat I expected. I was opening achecking account at my bank underthe newly created 401k entity and thebank customer service reps wereclueless about Solo 401k and they keptreferring me to an IRA specialist or aninvestment broker (who also had noclue about Solo 401ks) . Justin, fromDiscount Solo 401k, hopped on aconference call with me and thebanking people to walk them throughthe particulars of the type of account Ineeded to setup. I finally was able tosetup my account.That service was above and beyondwhat I expected. Discount Solo 401koffers great value to its clients and Iwould and have referred them tofamily, friends, and colleagues.Thank you Discount Solo 401k formaking it easier to prepare for myretirement.Regards,Wil MorganCM Business SolutionsPhone: 303-427-4519

TESTIMONIALSDiscount Solo 401k are simply the mostefficient and responsive business people Ihave come across in all my over 10 yearsof being a business owner. They arethorough, professional and veryknowledgeable. They answered all myquestions promptly and make me feel theyreally care, so it's worth every penny. Youjust don't see companies like this anymore.I highly recommend Discount Solo401k.You will not regret signing up. Ask forJustin W.B.E. Halstead - PresidentHalstead Homes RealtyReal Estate BrokerI am writing to give my thoughts onforming a Solo401k with Justin Windham.From my initial query to final details,Justin gave careful and patient advice andinsight to the process. He gave the rightamount of emphasis and direction on theelements that mattered most andaddressed all my questions and fears withanswers in a way that I could understand. Iwas actually shocked that he wasavailable every time I called to answerquestions. I would whole heartedlyencourage others to use Justin atDiscountSolo401K.SincerelyWilli Sherer303-427-4519info@discountsolo401k.com

TESTIMONIALSAfter significant research I found littleor no difference between this plan andthe more expensive plans. After Ibought the plan I received mydocuments quickly. The instructionswere very clear. Followingthose instructions I had no difficultyopening bank and investmentaccounts. Discount Solo 401K was veryresponsive to the few questions I didhave. I reduced the administrative feesby over 2000 per year. Based on myexperience so far I am confident thiswas the right decision and I wouldgladly recommend Discount Solo 401Kto others.Ron M., NYJustin at Discount Solo401k answeredall my questions promptly aboutsetting up my Solo401k account withcheckbook control. He is indeed atrue professional and explained thesetup from start to finish. Thank youfor all the work you did in setting upmy account. I highly recommendDiscount Solo401K!!!Colin K, Houston Texas303-427-4519info@discountsolo401k.com

TESTIMONIALSJustin:The professional service you providethrough Discount Solo 401k has beentruly exceptional. Thank you.The qualified plan documents youprovided along with the accessibleand personal customer service youprovided along the way hastransformed and empowered me tobe an effective, efficient, and "fullyin-control" self-directed retirementinvestor.Thank you also for yourrecommendation of Solera NationalBank. The banking services providedby Solera have been similarlyexceptional.Kreighton Reed and Lena Barbalyukare knowledgeable, accessible, andresponsive. They understand andaddress the needs of self-directedIRA investors seeking bankingaccount services for qualifiedplan trusts. Prior to contactingSolera, I sought to establishaccounts with 7 different bankinginstitutions and inexplicably wasturned down each time. Within 24hours of initial contact, Soleraestablished accounts for 2 qualifiedplan trusts.Again, thank you Justin.Bill PPhone: 303-427-4519

TESTIMONIALSI highly recommend DiscountSolo401K and Justin Windham forestablishing a hassle-free, easy, solo401K account that is a great value.Justin has been extremely helpful inanswering our many questionsand is very accessible as well.His attention to detail and patiencewith his clients is unsurpassed andI encourage folks to go with DiscountSolo 401K.Rebecca andMichael JacobsenI recently researched severalcompanies for creating a Solo 401Kand Discount Solo 401K Inc. was mychoice. Justin was very knowledgeableabout the Solo 401K planrequirements, rules and regulations forestablishing the plan, very responsivewith my emails and voicemails and hisprice was perfect . His responsivenessfrom sending the application, creationof the plans and for us to open up achecking account with a bank waswithin four days! My wife and I wereable to access the documents, submitthem and now we have checkbookfreedom. Justin has been available toanswer all of our questions during theentire process! I recommend DiscountSolo 401K Inc. for all your needs withestablishing your Solo 401K plans.FIG Tree-LJF303-427-4519info@discountsolo401k.com

TESTIMONIALSDiscount Solo 401k was a pleasure to work with.They were fast, responsive, courteous andprofessional. All email correspondence wasquickly responded to. Reaching them on the phonewas no problem. They helped set up an account forme during the end of the year Holiday Season andmade sure it was done on time. Justin knew whathe was talking about and was able to answer all myquestions easily. My bank readily accepted theirpaperwork to set up the account. Theway the account is structured, other than the set-upfee going to Discount Solo 401k, all other accountfunding is handled directly by the consumer whichmakes it much more 1k.cominfo@discountsolo401k.com

An IRA LLC is a retirement structure combining a self-directed IRA with a special purpose LLC. This LLC is owned by the IRA and gives the LLC manager (you) checkbook control of the IRA assets. This allows for greater investment flexibility, including real estate, as well as much faster transaction speed. An added benefit is that many IRA LLC