Transcription

CMYKPMS ?PMS ?PMS ?PMS ?Non-printingColoursCOLOURCOLOURJOB LOCATION:PRINERGY 3Your introduction tochargebacks and retrievalspayment acceptanceBCD111605BROB1.indd 116/10/2013 10:20

1strength through knowledgeretWe know that chargebackscan be a real problem for yourbusiness, and costly too. If atransaction is charged back youcould lose both the payment andthe goods or services thatyou’ve provided – plus any timespent on administration, sellingor delivering the ‘sale’.What iThis guide will help you betterunderstand both chargebacksand retrieval requests. It alsotells you how you can help usdefend chargebacks on yourbehalf – with the right evidenceand information, we may beable to stop you from losing outon the payment.A retrievalinformatioabout a trcompany.transactiodon’t recoto help jogfraudulentUnder theto the cardinformationeed youtransactiocan sharecontentsA retrievalaccount wcan nd ouRetrieval requests2Chargebacks5– Reason codes– Defences811Dedicated support17Need further help?17Glossary18BCD111605BROB1.indd 216/10/2013 10:20

ut2retrieval requestsWhat is a retrieval request?How will I be contacted?A retrieval request, sometimes called a request forinformation (RFI), is simply us asking you for informationabout a transaction at the request of a card issuingcompany. This happens when a cardholder queries atransaction with the card issuing company because theydon’t recognise it and would like further informationto help jog their memory and identify if it is genuine orfraudulent.When we have a retrieval request for a transactionyou’ve processed, we’ll send you a retrieval letterdetailing the transactions that have been queried.You’ll receive this either in the post or by fax.Under the Card Scheme regulations we must respondto the card issuing company’s retrieval request withinformation about the transaction. This means we’llneed you to provide detailed information about thetransaction for us to send back to them so that theycan share it with their cardholder.A retrieval request itself is not a chargeback and youraccount will not be debited the disputed amount – youcan nd out more about chargebacks on page 5.BCD111605BROB1.indd 316/10/2013 10:20

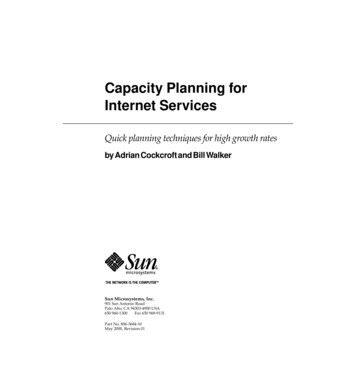

3Example of a retrieval letterHow loretrievYour docucalendar dthe retrievPLEASE FAX BACK TO 0300 020 0171REF CASE ID 1234- 01MAY13/ LDTA 30-MAY-13WhereplyRETRIEVALPAYMENT ACCEPTANCEDEPT FX, 1234 Pavilion DriveNorthampton NN4 7SGFAX: 0300 020 0171THE MANAGERCOMPANYCONTACT NAMEADDRESSADDRESSADDRESSFax you0044 (0Fax you(POTENTIAL FRAUDULENT TRANSACTION)PLEASE FAX YOUR REPLY TO 0300 020 0171 OR POST TO THE ABOVE ADDRESSCARD NUMBER: 1111222233334444CARD NUMBEREXPIRY DATERETAILER REFTERMINAL NUMBERSEQUENCE NUMBERTERMINAL TYPETRAN AMOUNTKEYING INDICATOR: 1111222233334444: 10-OCT-13: 1234ABCD: 1234567: 000000000111: PDQ: 100.00: SWIPEDTRANS DATE: 03-APR-13OUTLET: 1234567STORE REF: 1234567Dear name PLEASE SUPPLY A CLEAR AND LEGIBLE COPY OF THE SIGNED VOUCHER/DETAILS RELATING TO THE ABOVETRANSACTION BY 15 MAY 2013.PLEASE BE ASSURED WE WILL DO EVERYTHING WE CAN TO PREVENT A CHARGEBACK TO YOUR ACCOUNT.HOWEVER, THE CARD ISSUER MAY STILL PROCESS A DEBIT FOR A LATE REPLY OR OTHER REASON AT ALATER DATE. TO ENSURE WE ACTION YOUR REPLY AS SOON AS POSSIBLE PLEASE FAX YOUR REPLYTO 0300 020 0171CUSTOMER SERVICE – PLACE YOUR VOUCHER/DETAILS HERETO FIND OUT MORE INFORMATION ON HOW TO REDUCE THE RISK OF CHARGEBACKS AND RETRIEVALS INTHE FUTURE, PLEASE REFER TO YOUR PROCEDURE GUIDE OR mers/chargebacksBarclaycard is a trading name of Barclays Bank PLC. Barclays Bank PLC is authorised by the Prudential Regulation Authority and regulatedby the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register Number: 122702) and adhere to theLending Code which is monitored and enforced by the Lending Standards Board. Registered in England No: 1026167.Registered O ce: 1 Churchill Place, London E14 5HP.BCD111605BROB1.indd 416/10/2013 10:20

4How long do I have to reply to aretrieval request?What happens if I don’t respondto the retrieval request in time?Your documentation must be received by us within 14calendar days from the date that we rst noti ed you ofthe retrieval request.Failure to respond to a retrieval request within the settime frame could result in a chargeback being raisedthat we won’t be able to defend on your behalf. Andthat means it’s highly likely that your account would bedebited for the disputed amount. So it’s in your intereststo make sure we receive your documentation within14 days.Where should I fax my retrievalreply to?Fax your multicurrency (or international) retrievals to0044 (0) 300 020 0175.Fax your sterling retrievals to 0300 020 0171.If I respond to the retrievalrequest, can a chargeback stillbe raised?A retrieval request can be closely followed by achargeback if the Card Issuing Company doesn’t receivesu cient information about the transaction. That s whyit’s important you send as much information as possiblein your reply to the retrieval request.Unfortunately, some retrieval requests can still lead to achargeback even when all the correct information on thetransaction has been supplied. Once the Card IssuingCompany has raised a chargeback case, you’re at riskof being debited for the disputed amount. Please referto the chargebacks section for further information.BCD111605BROB1.indd 517/10/2013 08:43

5EchargebacksWhat is a chargeback?A chargeback is a transaction where you may haveinitially received payment but the transaction issubsequently rejected by the cardholder or the CardIssuing Company and your account is debited with thedisputed amount.We don’t raise chargebacks – the Card Issuing Companydoes, usually on behalf of their cardholder. Please beassured that we’ll do everything possible to defend thechargeback on your behalf. However, the nature of thedispute and the type of chargeback will greatly a ectwhat actions we’re able to take under the Card Schemerules as well as the outcome of the defence claims.How will I know that I have beencharged back?What reasons are given for adisputed transaction?The most common reasons include: transaction not recognised not responding in time to a request for a copyof a transaction (a retrieval request) the transaction is duplicated – so the cardholderwas charged more than once the transaction wasn’t authorised the goods or services haven’t been received.Full lists of the chargeback codes and reasons, asset by the Card Scheme Regulators, are providedin the ‘reason codes’ section starting on page 8.If you’ve received a chargeback, we’ll let you know bynoti cation letter (see example opposite), fax or schedule,telling you why. In some cases, depending on the natureof the chargeback, this communication will advise youthat we’re ‘pending’ or putting the chargeback debiton hold for 14 days, while we wait for the requestedresponse (or in other words, a reply to a retrievalrequest) from you.BCD111605BROB1.indd 616/10/2013 10:20

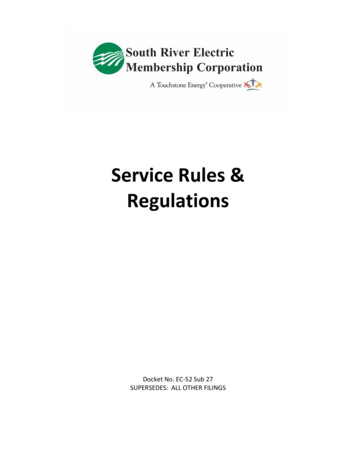

BCD111605BROB1 02/03/2015 15:54 Page 76Example of a chargeback notification letteraopy ofholdered.s, asidede 8.payment acceptanceJanuary 29 2009TEL: 0844 755 0094REF: CASE ID 1187-26JAN09/DOYLA/M63YOUR REF: PRIOR CASE ID: 1234-28DEC08THE MANAGERCOMPANYCONTACT NAMEADDRESSADDRESSADDRESSFINANCIAL EXCEPTIONSPAYMENT ACCEPTANCE1234 Pavilion DriveNorthampton NN4 7SGPLEASE FAX YOUR REPLY TO 0300 020 0170 OR POST TO THE ABOVE ADDRESSOUTLET/MERCHANT: 1234567RETAILER REF : 2222 333333CARDHOLDER : NAME NOT GIVEN BY CARD ISSUERCARD NUMBER : 1111222233334444TRANS DATE : 03-JAN-09TAPE SERIAL : AABBCCTRAN AMOUNT : 178.16DISPUTED AMOUNT: 178.16KEY IND: CONTINUOUS AUTHTERMINAL TYPE : POSReason Code ofchargeback caseExact amount disputedby the CardholderDear Sir/Madam,CARDHOLDER DOES NOT RECOGNISE TRANSACTIONWe regret to inform you that the Card Issuing Company has advised us their cardholder does not recognise theabove transaction.As part of our commitment to provide excellent customer service, Barclaycard will endeavour to assist you inresolving this matter. To enable us to pursue this case on your behalf and to give the cardholder everyopportunity to recognise the transaction, we require the following information:FOR CARD PRESENT TRANSACTIONS A full description of the Goods or Services provided A delivery address if applicable A legible signed/swiped (not keyed) Sales receipt A legible signed and imprinted verification voucher.If you are unable to reply to us by 12.00pm noon on the 12 February 2009, arrangements will be made to debityou. Should you accept this Chargeback, there is no need to contact us. To ensure that we action your reply assoon as possible, please fax your reply quoting case ID 1187-26JAN09 to 0300 020 0170.Barclaycard is a trading name of Barclays Bank PLC. Barclays Bank PLC is authorised by the Prudential Regulation Authority andregulated by the Financial Conduct Authority and the Prudential Regulation Authority and adhere to the Lending Code which is monitoredand enforced by the Lending Standards Board. Registered in England No: 1026167. Registered Office: 1 Churchill Place, London E14 5HP.

7ReasHow long do I have to respond toa chargeback noti cation letter?Chargeback rules and time restrictions are set by theCard Scheme Regulators and are very stringent. It’stherefore absolutely essential that if you’re able toprovide compelling evidence to help us to defend yourchargeback, you reply within 14 days from the date ofour chargeback noti cation letter.Why do I need to reply?Because in certain circumstances and with the necessarydefending evidence, we may be able to defend thechargeback for you, even if your chargeback noti cationadvises that you’ve already been debited.BCD111605BROB1.indd 8Visa, Mchargeband eacWhere should I send myreply to?Your chargeback noti cation letter will advise youof the correct postal address that should be usedto send your response back to us. Or you can faxyour reply to us.Fax your multicurrency (or international) chargebackreplies to 0044 (0) 300 020 0173.CodeNV30SthsV41CV53Should I refund my customer forthe disputed transaction?NcrewV57No. It’s important that you don’t refund the cardholderbecause this could result in your account being debitedtwice. If a refund has already been processed to thecardholder’s account, please provide us with full detailsso we can defend the case on your thV75TcoFax your sterling chargeback replies to0044 (0) 300 020 0170.17/10/2013 08:45

BCD111605BROB1 11/03/2015 10:18 Page 98Reason codesVisa, MasterCard and Maestro each have their own set of reason codes forchargeback cases. These denote the reason why the transaction is disputedand each reason code has its own regulations set by the relevant card scheme.e youusedn faxrgebackCodeName and descriptionCodeName and descriptionV30Services not provided or merchandise not received –the cardholder is stating that they did not receive theservices or goods that they paid for.V75Transaction not recognised – the cardholder isclaiming that they do not recognise the transactionon their statement.V41Cancelled recurring or Instalment Transaction.V76V53Not as described or defective merchandise - thecardholder is stating that the service/goods that theyreceived were either defective, counterfeit or not whatwas originally described to them by the merchant orthe Cardholder is disputing the quality of themerchandise or the Cardholder claims that the termsof sale were misrepresented by the merchant.Incorrect currency or transaction code – the CardIssuing Company is stating that the transactionwas not processed in the correct currency, or thecardholder has been charged a conversion differencewhen an incorrect charge has been requested.V77Non-matching or invalid account number – the CardIssuing Company is stating that an incorrect cardnumber was charged for the transaction.V78Service code violation – the Card Issuing Company isstating that an authorisation code was not obtained.V80Illegible fulfilment (of retrieval case) – the Card IssuingCompany received the merchant’s transactioninformation from the retrieval case but the documentsare illegible/incorrect.Incorrect transaction amount or account number – thecardholder is stating that the amount of thetransaction is higher than the amount that they agreedto be charged for or were quoted for.V81Counterfeit transaction – the cardholder deniesauthorising or participating in the disputed transaction.A counterfeit card may have been used.Fraud – ‘card present’ environment – the cardholderdenies participating in or authorising the transactionthat was undertaken in a ‘card present’ environment.V82Duplicate processing – the cardholder is stating thatthe same transaction was processed more than onceto their account.V83Fraud – ‘card absent’ environment – the cardholderdenies participating in or authorising the transactionthat was undertaken in a ‘card absent’ environment.r fordholderdebitedthedetailsV57V60V62Fraudulent multiple transactions – the cardholderacknowledges participation in one transaction with themerchant. However, they deny authorisation of anyfurther charges.V70Card recovery bulletin or exception file.V71Declined authorisation – the Card Issuing Companyis stating that the merchant processed thetransaction despite having obtained a Declineauthorisation response.V72No authorisation – the Card Issuing Company isstating that an authorisation code was required forthe transaction but that it was not obtained.V85Credit not processed – the cardholder is stating thatthe refund due to them has not been processed.V86V73Expired card – the Card Issuing Company is statingthat the transaction was processed with anexpired card.Paid by other means – the cardholder is stating thatthe transaction was paid for by other means and hasprovided evidence to support the alternative payment.V90Non-receipt of cash or load transaction value at ATMor load device.V93Risk identification service.V74Late presentment – the Card Issuing Company isstating that the transaction was not processed withinthe required time frame for settlement.

BCD111605BROB1 11/03/2015 10:11 Page 109CodeName and descriptionCodeName and descriptionM02Requested transaction receipt illegible – the CardIssuing Company received the transaction informationfrom the retrieval case but the documents are illegibleor missing.M59Addendum, no-show or ATM dispute. Various specificreasons within this reason code – these are the mostfrequently used:02NDRS3 ATM Ccw80LisapM07Card recovery bulletin.M08Transaction not authorised – the Card Issuing Companyis stating that an authorisation code was required forthe transaction but that it was not obtained.M12Non-matching account number – the Card IssuingCompany is stating that an incorrect card numberwas charged for the transaction.M31M34Transaction amount differs – the cardholder is stating thatthe amount of the transaction is higher than the amountthat they agreed to be charged for or were quoted foror that they paid for the transactions by other means.Transaction duplication – the cardholder is stating thatthe same transaction was processed more than onceto their account.M37Fraudulent transaction – the cardholder deniesparticipating in or authorising the card present/cardnot present transaction.M40Fraudulent processing of transactions – the cardholderacknowledges participation in one transaction with themerchant. However, they deny authorisation of anyfurther charges with the same merchant.M41Cancelled recurring or Instalment Transaction or DigitalGoods Transaction or Cardholder disputes the feesrelating to payday loans.M42Late presentment – the Card Issuing Company isstating that the transaction was not processed withinthe required time frame for settlement.M46Correct transaction currency not provided – the CardIssuing Company is stating that the transaction wasnot processed in the correct currency.M49Questionable merchant activity.M53Not as described – the cardholder is stating that theservice/goods that they received were either defectiveor not what was originally described to them bythe merchant.M55Goods or services not provided – the cardholder isstating that they did not receive the services or goodsthat they paid for.RS5 Guaranteed Reservation Service – thecardholder cancelled the reservation, or themerchant did not meet the terms of thebooking as agreed to at the time of booking(see MasterCard regulations for full list).RS7 Addendum dispute – the cardholder is statingthat they did not authorise an addendumcharge to their original transaction.M60M63M70M71Credit not posted – the cardholder is stating that therefund due to them has not been processed.Cardholder does not recognise transactionon their statement.Chip liability shift – the cardholder denies authorisingor participating in the disputed transaction; acounterfeit card may have been used at a nonChip-capable terminal.CodeNMChip/PIN liability shift.

s speci ce mostthe10CodeName and DescriptionMaestro Intra European0208Non Ful lment of Request: Illegible copy SameDescription as MasterCard.CodeCodeEurope Members Members OutsideUse Reason Code Europe use thisReason Code0278Incorrect Transaction Amount – Same Descriptionas MasterCard.34Duplicate Processing of Transaction – SameDescription as MasterCard.34373171that the46Currency Errors – Same Description as MasterCard.41Cancelled Recurring Transaction – Same Descriptionas MasterCard.55Goods or Services Not Received – Same Descriptionas MasterCard.59ATM Dispute – The cardholder did not receive,or received only in part, funds charged to hisor her account as a result of an automatedcash disbursement.horisingn-60Credit Not Received – Same Description as MasterCard.70Chip Liability Shift – The cardholder denies participatingin or authorising the disputed transaction. ACounterfeit card may have been used at a non chipcapable terminal or a lost, stolen or never received cardwas conducted at a mag stripe reading only terminal.80Late Presentment – An intra-European transactionis presented more than seven calendar daysafter the transaction date and the account ispermanently closed.Disputed Amount – SameDescription as MasterCard.kingNo Cardholder Authorisation – Same Descriptionas MasterCard.Non Ful lment of Request:as MasterCard.3137Maestro InterregionalSame DescriptionTransaction Not Authorised – Same Descriptionas MasterCard.tatingmName and Description73Duplicate Transaction – SameDescription as MasterCard.74Missing or Illegible Signatureor No Cardholder Authorisation– Same Descriptionas MasterCard.5579Goods or Services NotReceived – Same Descriptionas MasterCard.5917Cardholder Dispute – Thecardholder did not receive, orreceived only in part, fundscharged to his or her accountas a result of an automatedcash disbursement.6075Credit Not Received – Sameas MasterCard.7070Chip Liability Shift –The cardholder deniesparticipating in or authorisingthe disputed transaction whichresulted from a Counterfeitcard.8080Chip Transaction LatePresentment – A transactionis processed after 7 calendardays and the Cardholder’saccount is closed or containsinsu cient funds.BCD111605BROB1.indd 1116/10/2013 10:21

11DefencesCardChargeback defences vary by reason code. Chargeback reason codescan be divided into six main dispute groups:Why wchargeCardholder doesnot recogniseFraudAuthorisationProcessing errorCancelled/returnedNon-receipt ofgoods/servicesThis typebecause thon their sttransactioThe next few pages will give you an idea of what you can provide in defence when you receive a chargebackfalling into one of these groups.BCD111605BROB1.indd 1216/10/2013 10:21

des12Cardholder does not recogniseWhy would this type ofchargeback be raised?This type of chargeback would typically be raisedbecause the cardholder doesn’t recognise a transactionon their statement, or can’t recall the value of thetransaction processed.What can you provide indefence?The minimum requirement in accordance with theCard Scheme rules to defend these reason codesis additional information about the transaction thatmay not appear on the cardholder’s statement.We’d simply ask you to provide all the detailsand information that you have on record for thetransaction, including a full description of themerchandise or services provided/purchased. We’dalso advise you to respond to all chargebacksreceived under these reason codes because, aslong as you respond within the set deadlines,there’s a very good chance we’ll be able torepresent the case for you.sBCD111605BROB1.indd 1317/10/2013 08:47

13FraudProcWhy would these types ofchargebacks be raised?Why wchargeTypically, a fraud chargeback will be raised because thecardholder claims that they neither participated in norauthorised a transaction that has been processed totheir account.For these reason codes the cardholder must sign adisclaimer con rming that they didn t authorise thedisputed transactions.To defend fraudulent chargebacks you must provethat the genuine cardholder of the account chargedparticipated in or authorised the disputed transaction(s).What can you provide indefence?Fully completed and signed veri cation voucher. Signed delivery receipt at the cardholder’saddress. Compelling evidence to prove that the genuinecardholder participated in the transaction. Any documentation that you may have whichproves the transaction was undertaken by thegenuine cardholder.The defence mechanisms available to you will depend onyour industry type and the sales method used to acceptthe transaction.AuthorisationWhy would these types ofchargebacks be raised?What can you provide indefence?Typically, an authorisation chargeback is raisedbecause the Card Issuing Company is stating thatan approval code and valid authorisation codewas needed but not obtained for a transaction.Sometimes the cardholder’s account is out of orderor closed.If we granted authorisation we’ll defend this type ofchargeback using our information from our internalsystems or Visa/MasterCard online logs – so we’llonly contact you if further information is needed.BCD111605BROB1.indd 14If authorisation is received via a third party, acopy of the authorisation log proving that the fullamount of the transaction was approved and anauthorisation code was obtained will be needed todefend the case.16/10/2013 10:21Usually ththe cardhobeen procprocessingDi erent rdi erent inWe’ll explanoti catio

oucher.snuinehichy the14Processing errorWhy would these types ofchargebacks be raised?Usually these types of chargebacks are raised whenthe cardholder believes that an incorrect charge hasbeen processed by the merchant or there’s been aprocessing error.Di erent reason codes in this dispute group will needdi erent information from you to defend the chargeback.We’ll explain the reason for the chargeback in thenoti cation letter we send you.What can you provide indefence? Evidence to show that the transaction wasprocessed within the time frames stipulated bythe Card Schemes should be provided – such asa transaction receipt or screen shot showing thedate that the transaction took place. Proof that the transaction was properlyprocessed with the correct currency code whichwas quoted to the cardholder at the time ofthe transaction. A copy of a legible transaction receipt or bookingrecord showing the card number quoted by thecardholder. This proves that the transaction wasprocessed to the correct card number. Proof that, if the amount of the transactionprocessed was altered from the original quote,the amendment is in accordance with yourterms and conditions and that the cardholderagreed to the altered amount. Evidence that all transactions processed tothe cardholder’s account are valid transactionsand that no duplication has occurred. Forexample, you could provide copies of invoices,tickets, transaction receipts or screen printsof bookings. Documentation to show that you didn’t receivepayment by other means such as cash, chequeor an alternative credit card.type ofnternalwe’llded. Documentation to show that the transactionwas a valid debit and that no credits are due tothe cardholder.e fulld anded toBCD111605BROB1.indd 1516/10/2013 10:21

15Cancelled/returnedNon-Why would these types ofchargebacks be raised?Why wchargeChargebacks can be raised under these reason codesbecause: the cardholder has stated that they returned thegoods to you but haven’t yet received a refund the cardholder has stated that they cancelleda booking or reservation but haven’t receiveda refund a recurring transaction can no longer be processedto a cardholder’s accountWhat can you provide indefence?You should provide any information ordocumentation that would help to prove that thecardholder is not due a refund in accordance withyour terms and conditions. If goods were receivedby the cardholder or the services rendered wereused by the cardholder, proof of this should beprovided (see ‘Non-receipt of goods/services’ forfurther guidance). the cardpurchasa six m you made or the sor goods or services were defective or not as described.If a cancellation was made, they would also have toprovide their cancellation reference.BCD111605BROB1.indd 16Typically acodes whethe goods16/10/2013 10:21

t thewithceivedwerebes’ for16Non-receipt goods/servicesWhy would these types ofchargebacks be raised?Typically a chargeback will be raised under these reasoncodes when a cardholder believes that they didn’t receivethe goods or services that they purchased. Often: the cardholder may have misunderstood theirpurchase e.g. the cardholder believes they purchaseda six month service when it is actually only for three you may have failed to deliver goods, or only partlydelivered goods or the services may have been only partly rendered,or not at all.What can you provide indefence?If goods were delivered, you should provideevidence that they were received at thecardholder’s address, such as: a signed delivery receipt by the genuinecardholder or tracking documentation fromthe courier any additional information or evidence you haveto show that the cardholder received the goods,such as emails received from the cardholder.If services were provided, you need to haveevidence that the cardholder received them.This could be one of the following examples: a signed car rental agreement at the pick-up ofthe vehicle a signed transaction receipt proving that thecardholder was present to receive the services signed check-in documentation for a hotel stayor evidence that the cardholder used other hotelservices such as the mini-bar, restaurant etc a copy of the invoice for the services providedproof that the services were o ered/accessiblebut the cardholder chose not to use them.BCD111605BROB1.indd 1716/10/2013 10:21

BCD111605BROB1 02/03/2015 16:15 Page 1817dedicated supportgloWe hope you’ve found this introduction useful, but itreally is just the start of how we can help you. Becausewe recognise that chargebacks are an ongoing concern,we have a dedicated Portfolio Manager for each businesssector to help reduce your exposure to chargebacks –and challenge them on your behalf whenever we can.Listedhear oFor more information on the type of support yourbusiness can expect to receive, please contact a memberof the chargeback team on 0844 755 0094* or by email ukAcquirThe financservices toCardhneed further help?This guide is just one in the series we’ve developed tohelp you better understand what chargebacks are, whythey occur and what you can do to reduce their impacton your business. More detailed guides are available.Other guides available include: “don’t lose out” – A guide to preventing chargebackson Cardholder present transactions “be prepared”– A guide to preventing chargebackson card not present transactions A series of sector-specific guides on best practice foravoiding chargebacks, codes and defences including:- Airline- Car rental- Hotel- Internet gaming.Together we can help your business buildstronger defences.The owneCard IsThe financcard to theCard SA networkthat acts aissuer for

memberemail toard.co.uk18glossaryListed below is a summary of the terminology which you mayhear or see quoted in documentation.AcquirerCard Scheme Rules/RegulationsThe nancial institution that provides card processingservices to the merchant.Rules set by the Card Schemes, that all card issuers andacquirers must adhere to.CardholderMerchantThe owner of the card used to make a purchase.The business accepting credit or debit card paymentsfor products or services sold to the cardholder.Card Issuing Company/IssuerThe nancial institution that issued the credit or debitcard to the cardholder.Card SchemeRepresentmentThe process used by the acquirer to return thechargeback to the card issuer with information todefend the dispute.A network such as Visa, MasterCard, Amex, Maestro etcthat acts as a gateway between the acquirer and cardissuer for authorising and funding transactions.BCD111605BROB1.indd 1916/10/2013 10:21

BCD111605BROB1 02/03/2015 16:16 Page 20This document is available in large print, Braille and audioby calling 0844 811 6666.**Calls may be monitored and/or recorded to maintain high levels of security and quality of service. For BT business customerscalls to 0844 numbers will cost no more than 5.5p per minute, minimum call charge 6p (current at May 2013). The price onnon-BT phone lines may be different. Calls may be recorded and/or customers/chargebacksBarclaycard is a trading name of Barclays Bank PLC. Barclays Bank PLC is authorised by the Prudential Regulation Authorityand regulated by the Financial Conduct Authority and the

Reason codes Visa, MasterCard and Maestro each have their own set of reason codes for chargeback cases. These denote the reason why the transaction is disputed and each reason code has its own regulations set by the relevant card scheme. 7 Should I refund my customer for WKHGLVSXWHGWUDQVDFWLRQ" No. It s important that you don t refund the .