Transcription

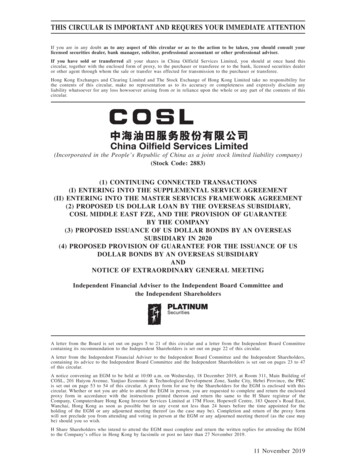

THIS CIRCULAR IS IMPORTANT AND REQURES YOUR IMMEDIATE ATTENTIONIf you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult yourlicensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser.If you have sold or transferred all your shares in China Oilfield Services Limited, you should at once hand thiscircular, together with the enclosed form of proxy, to the purchaser or transferee or to the bank, licensed securities dealeror other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee.Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility forthe contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim anyliability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of thiscircular.(Incorporated in the People’s Republic of China as a joint stock limited liability company)(Stock Code: 2883)(1) CONTINUING CONNECTED TRANSACTIONS(I) ENTERING INTO THE SUPPLEMENTAL SERVICE AGREEMENT(II) ENTERING INTO THE MASTER SERVICES FRAMEWORK AGREEMENT(2) PROPOSED US DOLLAR LOAN BY THE OVERSEAS SUBSIDIARY,COSL MIDDLE EAST FZE, AND THE PROVISION OF GUARANTEEBY THE COMPANY(3) PROPOSED ISSUANCE OF US DOLLAR BONDS BY AN OVERSEASSUBSIDIARY IN 2020(4) PROPOSED PROVISION OF GUARANTEE FOR THE ISSUANCE OF USDOLLAR BONDS BY AN OVERSEAS SUBSIDIARYANDNOTICE OF EXTRAORDINARY GENERAL MEETINGIndependent Financial Adviser to the Independent Board Committee andthe Independent ShareholdersA letter from the Board is set out on pages 5 to 21 of this circular and a letter from the Independent Board Committeecontaining its recommendation to the Independent Shareholders is set out on page 22 of this circular.A letter from the Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders,containing its advice to the Independent Board Committee and the Independent Shareholders is set out on pages 23 to 47of this circular.A notice convening an EGM to be held at 10:00 a.m. on Wednesday, 18 December 2019, at Room 311, Main Building ofCOSL, 201 Haiyou Avenue, Yanjiao Economic & Technological Development Zone, Sanhe City, Hebei Province, the PRCis set out on page 53 to 54 of this circular. A proxy form for use by the Shareholders for the EGM is enclosed with thiscircular. Whether or not you are able to attend the EGM in person, you are requested to complete and return the enclosedproxy form in accordance with the instructions printed thereon and return the same to the H Share registrar of theCompany, Computershare Hong Kong Investor Services Limited at 17M Floor, Hopewell Centre, 183 Queen’s Road East,Wanchai, Hong Kong as soon as possible but in any event not less than 24 hours before the time appointed for theholding of the EGM or any adjourned meeting thereof (as the case may be). Completion and return of the proxy formwill not preclude you from attending and voting in person at the EGM or any adjourned meeting thereof (as the case maybe) should you so wish.H Share Shareholders who intend to attend the EGM must complete and return the written replies for attending the EGMto the Company’s office in Hong Kong by facsimile or post no later than 27 November 2019.11 November 2019

CONTENTPageDefinitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1Letter from the Board . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5Letter from the Independent Board Committee . . . . . . . . . . . . . . . . . . . . . . . . . . . .22Letter from the Independent Financial Adviser . . . . . . . . . . . . . . . . . . . . . . . . . . . .23Appendix I – General Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .48Notice of EGM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .53–i–

DEFINITIONSIn this circular, the following expressions shall have the meanings set out below unlessthe context requires otherwise:“Articles of Association”the articles of association of the Company as amendedfrom time to time;“A Share(s)”RMB denominated domestic Share(s) of nominal valueof RMB1.00 each in the ordinary share capital of theCompany which are listed on the Shanghai StockExchange;“associates”has the same meaning as given to it under the HongKong Listing Rules;“bbl”a barrel, which is equivalent to approximately 158.988liters or 0.134 tons of oil (at a API gravity of 33degrees);“Board”the board of Directors;“Company”China Oilfield Services Limited, a joint stock companyincorporated in the PRC with limited liability, the AShares of which are listed on the Shanghai StockExchange and the H Shares of which are listed on mainboard of the Stock Exchange;“CNOOC”China National Offshore Oil Corporation, a state-ownedenterprise incorporated under the laws of the PRC, thecontrolling shareholder of the Company, as well as thecontrolling shareholder of two companies listed inHong Kong, namely, CNOOC Limited (HKSE:0883.HK) and China BlueChemical Limited (HKSE:3983.HK), and three companies listed in PRC;“CNOOC Group”CNOOC and its subsidiaries, excluding the Group;“Continuing ConnectedTransactions”the continuing connected transactions under the MasterAgreement, including the provision of the OilfieldServices by the Group to CNOOC Group, the provisionof the Machinery Leasing, Equipment, Material andUtilities Services by CNOOC Group to the Group, andthe provision of the Property Services by CNOOCGroup to the Group;“Current Master Agreement”the Master Services Framework Agreement entered intobetween the Company and CNOOC on 4 November2016, which will expire on 31 December 2019;–1–

DEFINITIONS“Director(s)”the director(s) of the Company;“EGM”the extraordinary general meeting of the Company tobe held at 10:00 a.m. on Wednesday, 18 December2019 at Room 311, Main Building of COSL, 201Haiyou Avenue, Yanjiao Economic & TechnologicalDevelopment Zone, Sanhe City, Hebei Province, thePRC or any adjournment thereof;“Group”the Company and its subsidiaries;“H Share(s)”overseas listed foreign Shares of nominal value ofRMB1.00 each in the share capital of the Companywhich are listed on the main board of the StockExchange and subscribed in Hong Kong dollars;“Hong Kong”the Hong Kong Special Administrative Region of thePRC;“Hong Kong Listing Rules”the Rules Governing the Listing of Securities on theStock Exchange;“Independent Board Committee”an independent committee of the Board, comprising theindependent non-executive Directors, which has beenappointed by the Board to advise the IndependentShareholders on the Supplemental Service Agreementand the Master Agreement and the relevant annual capsin relation to the continuing connected transactions tobe contemplated thereunder;“Independent Financial Adviser”Platinum Securities Company Limited, a licensedcorporation under the SFO licensed to carry out Type 1(dealing in securities) and Type 6 (advising oncorporate finance) regulated activities under the SFO,and the independent financial adviser to advise theIndependent Board Committee and the IndependentShareholders on the Supplemental Service Agreementand the Master Agreement and the relevant annual capsin relation to the continuing connected transactions tobe contemplated thereunder;“Independent Shareholders”the Shareholders of the Company other than CNOOCand its associates;“Latest Practicable Date”30 October 2019, being the latest practicable date priorto the printing of this circular for the purpose ofascertaining certain information for inclusion in thiscircular;–2–

DEFINITIONS“Machinery Leasing, Equipment,Material and Utilities Services”the supply of machineries for leasing, the supply ofequipment, material, labour, utilities and other ancillaryservices by the CNOOC Group to the Group;“Master Agreement”the Master Services Framework Agreement entered intobetween the Company and CNOOC on 30 October2019;“NDRC”the National Development and Reform Commission;“Oilfield Services”the provision of offshore oilfield services by the Groupto the CNOOC Group, including drilling services, wellservices, marine support services and geophysical andsurveying services;“PRC”the People’s Republic of China;“Property Services”the leasing of certain properties in relation to theGroup’s operations from the CNOOC Group;“Proposed Annual Caps”the proposed maximum annual aggregate value(s) foreach type of the Continuing Connected Transactionsunder the Master Agreement for each of the three yearsending 31 December 2020, 2021 and 2022;“Proposed Revised Cap”the proposed revised annual cap on the provision of theOilfield Services by the Group to the CNOOC Groupfor the year ending 31 December 2019 under theCurrent Master Agreement;“RMB”Renminbi, the lawful currency of the PRC;“SFO”the Securities and Futures Ordinance (Chapter 571 ofthe Laws of Hong Kong);“Shares”the ordinary shares issued by the Company, with aRMB denominated par value of RMB1.00 each, the HShares are listed on the Stock Exchange and the AShares are listed on the Shanghai Stock Exchange;“Shareholder(s)”holder(s) of the Shares;“Stock Exchange”The Stock Exchange of Hong Kong Limited;–3–

DEFINITIONS“Supplemental ServiceAgreement”the Supplemental Agreement to the Current MasterAgreement entered into between the Company andCNOOC on 30 October 2019, pursuant to which theexisting annual cap for the continuing connectedtransactions of the Oilfield Services for the year ending31 December 2019 as set out in the Current MasterAgreement will be adjusted to RMB25,917 million;“US dollar” or “USD”United States dollars, the lawful currency of the UnitedStates.–4–

LETTER FROM THE BOARD(Incorporated in the People’s Republic of China as a joint stock limited liability company)(Stock Code: 2883)Board of Directors:Qi Meisheng (Chairman)Cao ShujieMeng Jun*Zhang Wukui*Law Hong Ping, Lawrence**Fong Chung, Mark**Wong Kwai Huen, Albert**Legal address in the PRC:No.1581, Haichuan Road,Tanggu Ocean Hi-tech Zone,Binhai Hi-techDevelopment District, TianjinThe PRCRegistered Office in Hong Kong:65/F, Bank of China Tower1 Garden RoadHong Kong* Non-executive Director** Independent non-executive DirectorTo the Shareholders11 November 2019Dear Sir/Madam,(1) CONTINUING CONNECTED TRANSACTIONS(I) ENTERING INTO THE SUPPLEMENTAL SERVICE AGREEMENT(II) ENTERING INTO THE MASTER SERVICES FRAMEWORK AGREEMENT(2) PROPOSED US DOLLAR LOAN BY THE OVERSEAS SUBSIDIARY,COSL MIDDLE EAST FZE, AND THE PROVISION OF GUARANTEEBY THE COMPANY(3) PROPOSED ISSUANCE OF US DOLLAR BONDS BY AN OVERSEASSUBSIDIARY IN 2020(4) PROPOSED PROVISION OF GUARANTEE FOR THE ISSUANCE OF USDOLLAR BONDS BY AN OVERSEAS SUBSIDIARYANDNOTICE OF EXTRAORDINARY GENERAL MEETINGINTRODUCTIONReference is made to the announcement made by the Company on 30 October 2019 inrelation to (i) entering into the Supplemental Service Agreement; and (ii) entering into theMaster Agreement.The purpose of this circular is to provide you with, among other things, furtherinformation in relation to (i) the Supplemental Service Agreement; (ii) the MasterAgreement; (iii) proposed US dollar loan by the overseas subsidiary, COSL Middle EastFZE, and the provision of guarantee by the Company; (iv) proposed issuance of US dollarbonds by an overseas subsidiary in 2020; (v) proposed provision of guarantee for the–5–

LETTER FROM THE BOARDissuance of US dollar bonds by an overseas subsidiary; (vi) the recommendation from theIndependent Board Committee and the recommendation from the Independent FinancialAdviser to the Independent Board Committee and the Independent Shareholders on thecontinuing connected transactions; and (vii) a notice of the EGM.(1)CONTINUING CONNECTED TRANSACTIONS(I)ENTERING INTO THE SUPPLEMENTAL SERVICE AGREEMENTBackgroundReferences are made to the announcement of the Company dated 6 November 2016 andthe circular of the Company dated 9 November 2016, in relation to, among others, thecontinuing connected transactions under the Current Master Agreement entered into betweenthe Company and the CNOOC.On 4 November 2016, the Company entered into the Current Master Agreement,pursuant to which, the Group has agreed to provide the Oilfield Services to the CNOOCGroup, and the CNOOC Group has agreed to provide the Machinery Leasing, Equipment,Material and Utilities Services as well as the Property Services to the Group for the threeyears ended/ending 31 December 2017, 2018 and 2019, and maximum annual caps havebeen set for each type of the above-mentioned continuing connected transactions.Supplemental Service AgreementThe Company has been monitoring the historical transaction amounts of the continuingconnected transactions under the Current Master Agreement. Due to increased transactionvolume brought by favorable domestic and overseas market condition accompanied by thereviving oil price during 2018 and 2019, it is expected that the annual cap on the provisionof the Oilfield Services by the Group to the CNOOC Group for the year ending 31December 2019, being RMB23,095 million, may be exceeded. In order to ensure productionand operation and protect the interests of the Company and its shareholders, the Companyand CNOOC entered into the Supplemental Service Agreement, proposing to increase theexisting annual cap of the Oilfield Services for the year ending 31 December 2019 toRMB25,917 million. In addition, as to the prices of the Oilfield Services provided by theGroup to the CNOOC Group, the parties agreed that, the prices will be adjusted according tothe average international market price on the basis of the pricing basis of the Current MasterAgreement. All existing principal terms and conditions under the Current Master Agreementwill remain unchanged.The Company confirmed that, as of Latest Practicable Date, the actual historicaltransaction amounts of continuing connected transactions under the Current MasterAgreement have not exceeded the existing annual caps.Details of the Supplemental Service Agreement are set out as follows.–6–

LETTER FROM THE BOARDDate30 October 2019PartiesThe Company and CNOOCRevision of Annual CapBased on the actual historical transaction amounts of the parties as of 30 June 2019and the forecast of the future market trends, and subject to approval by the IndependentShareholders at the EGM, the parties propose to increase the annual cap on the OilfieldServices provided by the Group to CNOOC Group for the year ending 31 December 2019under the Current Master Agreement to RMB25,917 million from RMB23,095 million.The other existing annual caps on the continuing connected transactions under theCurrent Master Agreement for the year ending 31 December 2019 will remain unchanged.Pricing BasisAs to the prices of the Oilfield Services provided by the Group to the CNOOC Group,the parties agreed that, the prices will be adjusted according to the average internationalmarket price on the basis of the pricing basis of the Current Master Agreement.Term and terminationSubject to the approval by the Independent Shareholders on the EGM on 18 December2019, the Supplemental Service Agreement will take effect and will expire on 31 December2019.OtherThe Supplemental Service Agreement, which is a supplement to the Current MasterAgreement, and the Current Master Agreement together constitute a complete agreement andhas equal legal effect as the Current Master Agreement.Historical Transaction Amounts and Existing Annual CapsThe existing annual caps for the years ended/ending 31 December 2017, 2018 and 2019and the historical transaction amounts under the Current Master Agreement for the yearsended 31 December 2017 and 2018 and for the six months ended 30 June 2019 are asfollows:–7–

LETTER FROM THE BOARDFor theyear ended31 December2017(RMB million)For theyear ended31 December2018(RMB million)For theyear ending31 December2019(RMB For theyear ended31 December2017(RMB million)For theyear ended31 December2018(RMB million)For thesix monthsended30 June2019(RMB sting annual caps– Provision by the Group of the OilfieldServices to the CNOOC Group– Provision by the CNOOC Group of theMachinery Leasing, Equipment, Materialand Utilities Services to the Group– Provision by the CNOOC Group of theProperty Services to the GroupHistorical transaction amounts– Provision by the Group of the OilfieldServices to the CNOOC Group– Provision by the CNOOC Group of theMachinery Leasing, Equipment, Materialand Utilities Services to the Group(Note 1)– Provision by the CNOOC Group of theProperty Services to the Group (Note 1)Note:1.The difference between the actual historical transaction amounts and the approved annual caps for thethree years ended/ending 31 December 2017, 2018 and 2019 was mainly due to the Company’sstrategy to control its costs in consideration of the globally oil price in recovery during 2017-2019following the significant drop since 2014.Basis for the Proposed Revised Cap under the Supplemental Service AgreementThe Proposed Revised Cap for the Supplemental Service Agreement is determined withreference to (i) the historical transaction amount of Oilfield Services for the six monthsended 30 June 2019; (ii) the historical transaction amount of Oilfield Services for the sixmonths ended 31 December 2018; (iii) the estimated 33% increase in transaction amount ofOilfield Services for the six months ending 31 December 2019 as compared with the sameperiod in 2018; and (iv) 20% buffer.–8–

LETTER FROM THE BOARDThe calculation of the estimated transaction amount of Oilfield Services in 2019 is setout below:2018(RMB million)2019(RMB million)Historical/Estimated Transaction AmountsFor the six months ended 30 JuneFor the six months ended/ending 31 December6,08710,878For the year ended/ending 31 December16,96511,02514,421(Note 1)25,446(Note 2)Notes:1.The number is calculated based on an estimated increase rate of 33% from the historical transactionamount of Oilfield Services for the six months ended 31 December 2018.2.The number is calculated based on the historical transaction amount of Oilfield Services for the sixmonths ended 30 June 2019 and the estimated transaction amount of Oilfield Services for the sixmonths ending 31 December 2019.In view of the above, the estimated transaction amount of the continuing connectedtransactions in relation to the Oilfield Services for the year ending 31 December 2019 willincrease by RMB2,351 million as compared to the existing annual cap RMB23,095 million,while the Proposed Revised Cap is set to RMB25,917 million after adding a 20% buffer tothe estimated increase.The Directors (including the independent non-executive Directors) are of the opinionthat the Proposed Revised Cap is fair and reasonable and that the transactions contemplatedunder the Supplemental Service Agreement are entered into on normal commercial terms andin the ordinary and usual course of business of the Group, and the terms of the agreementare fair and reasonable and in the interest of the Shareholders as a whole.Reasons for and Benefits of the Supplemental Service AgreementThanks to favorable national policy and market condition, the Group’s transactionvolume has increased significantly, and revenue from the continuing connected transactionshas been on the rise. Pursuant to the estimation of the Company, the estimated transactionamount from the continuing connected transactions in relation to the Oilfield Services by theGroup to CNOOC Group for the year ending 31 December 2019 might exceed the existingannual cap under the Current Master Agreement. Therefore, the Company considers that it isin the interest of the Company to enter into the Supplemental Service Agreement withCNOOC to adjust the existing annual cap.–9–

LETTER FROM THE BOARD(II) ENTERING INTO THE MASTER SERVICES FRAMEWORK AGREEMENTBackgroundThe Company is one of the leading integrated oilfield services providers in the world.Its services cover each phase of oil and gas exploration, development and production.CNOOC is the largest offshore oil producer in the PRC. CNOOC is the controllingshareholder of the Company. As at the date hereof, CNOOC holds 50.53% interest in theCompany.As disclosed in the announcement dated 6 November 2016 and the circular dated 9November 2016, the Company has entered into the Current Master Agreement with CNOOCon 4 November 2016, the term of which will expire on 31 December 2019.The Company has entered into a new Master Agreement with CNOOC on 30 October2019. Pursuant to the Master Agreement, the Group has agreed to continue to provide theOilfield Services to the CNOOC Group, and the CNOOC Group has agreed to continue toprovide the Machinery Leasing, Equipment, Material and Utilities Services as well as theProperty Services to the Group for the three years ending 31 December 2020, 2021 and2022. Upon approval at the EGM, the Master Agreement will be effective from 1 January2020.Master Services Framework AgreementDetails of the Master Agreement are set out as follows.Date30 October 2019PartiesThe Company and CNOOCDetails of the transactionThe terms of the Master Agreement have been reached after arm’s-length negotiationbetween the Company and CNOOC.Pursuant to the Master Agreement, the Company and the CNOOC Group have agreedto the provision of the following services between the parties:– 10 –

LETTER FROM THE BOARD(a)Provision by the Group of the Oilfield Services to the CNOOC GroupThe Group, and its predecessors, has been providing such offshore oilfieldservices to the CNOOC Group since 1982. Pursuant to the Master Agreement, theGroup will continue to provide the Oilfield Services to the CNOOC Group in relationto its offshore oil and gas exploration, development and production activities.(b)Provision by the CNOOC Group of the Machinery Leasing, Equipment, Materialand Utilities Services to the GroupIn the past, the CNOOC Group has provided the Group with various equipment,communication, warehousing, stevedoring, construction, medical, materials, utilities,labour and other ancillary services. Pursuant to the Master Agreement, the CNOOCGroup will continue to provide the Group with such services, and the CNOOC Groupwill also continue to provide the Group with machinery leasing services.(c)Provision by the CNOOC Group of the Property Services to the GroupThe Group has leased certain properties from the CNOOC Group for warehousing,office, production and living quarters’ uses. Pursuant to the Master Agreement, theCNOOC Group will continue to lease the properties to the Group and provide theGroup with property administration services.Historical Transaction Amounts and Proposed Annual CapsThe existing annual caps for the three years ended/ ending 31 December 2017, 2018and 2019 and historical transactional amounts of the continuing connected transactions forthe two years ended 31 December 2017 and 2018 and the six months ended 30 June 2019under the Current Master Agreement, and the Proposed Annual Caps of the ContinuingConnected Transactions for each of the years ending 31 December 2020, 2021 and 2022 areset out as below:– 11 –

LETTER FROM THE BOARDFor the year For the year For the yearended 31ended 31ending million)million)million)– Provision by the Groupof the Oilfield Servicesto the CNOOC GroupProposed Annual CapsHistorical TransactionAmounts– Provision by theCNOOC Group of theMachinery Leasing,Equipment, Materialand Utilities Servicesto the GroupProposed Annual CapsHistorical TransactionAmounts (Note 1)– Provision by theCNOOC Group of theProperty Services tothe GroupProposed Annual CapsHistorical TransactionAmounts (Note 60130175For the six For the year For the year For the yearmonthsending 31ending 31ending 31ended 30DecemberDecemberDecemberJune 5346007971,05911,0253,91864663849Note:1.The difference between the actual historical transaction amounts and the approved annual caps for thethree years ended/ending 31 December 2017, 2018 and 2019 was mainly due to the Company’sstrategy to control its costs in consideration of the globally oil price in recovery during 2017-2019following the significant drop since 2014.Basis for the Proposed Annual CapsThe Proposed Annual Caps were determined with reference to the historicaltransactional amounts between the CNOOC Group and the Group for the two years ended 31December 2017 and 2018 and the six months ended 30 June 2019, and the anticipatedbusiness volume between the CNOOC Group and the Group for the three years ending 31December 2020, 2021 and 2022.The anticipated business volume between the CNOOC Group and the Group for thethree years ending 31 December 2020, 2021 and 2022 are based on (1) revenue forecasts forthe next three years ending 31 December 2020, 2021 and 2022 for the existing servicesoffered by the Group to the CNOOC Group; (2) applying the historical percentage ofrevenue being generated from the CNOOC Group; and (3) 20% buffer.The transaction amounts of continuing connected transactions are closely linked to oilprices and capital expenditure of the CNOOC Group in exploration and production activitiesin offshore China. During the years 2018 and 2019, the international oil price droppedsharply by 35% in the fourth quarter of 2018, followed by an increase of 27% in the firstquarter of 2019 and a 2.70% drop in the second quarter of 2019. According to the estimation– 12 –

LETTER FROM THE BOARDin EIA’s short term energy forecast dated 5 September 2019, the Brent oil price will beUSD 63.39/bbl for the year 2019 and USD 62.00/bbl for the year 2020, featuring a slow butsteady increase in the oil price as a whole. Following the rising oil prices, the capitalexpenditure in upstream oil exploration and production will also increase.According to IHS Markit’s data, the global expenditure in offshore exploration hasincreased significantly and is expected to remain a 10% annual increase for the followingyears. Along with the rising global capital expenditure in the international market, theCNOOC Group will continue to increase their overseas investment in the future. Inconsideration of the “Seven-year Action Plan” of the CNOOC Group and CNOOC’soperation arrangement to “increase reserve and promote production”, the Company expectthat the domestic and overseas operation volume of the Company from the CNOOC Groupwill continue to increase in the next three years. Therefore, the market anticipates that oilprices will increase during the next three years, and capital expenditure of the CNOOCGroup in exploration and production activities in offshore China will also increase. TheCompany has compared the Company’s past performance with the performance of theCompany’s peers and the industry reports published by IHS Markit, and the Company is ofthe view that the Company has been prepared for the continuous increase of the businessvolume. Therefore, the historical transaction amounts for the two years ended 31 December2017 and 2018 and six months ended 30 June 2019 as a whole are valuable indicators forfuture transaction amounts during the next three years, and the anticipated business volumebetween the Group and the CNOOC Group for the three years ending 31 December 2020,2021 and 2022 will also increase which is in line with the capital expenditure of theCNOOC Group. The year on year growth rate of Proposed Annual Caps for the three yearsending 31 December 2020, 2021 and 2022 is also consistent with the expected trend of oilprices and the capital expenditure of the CNOOC Group.Additionally, the Company estimates that its revenues from other customers will alsoincrease during the next three years. The provision by the Group of the Oilfield Services tothe CNOOC Group during the two years ended 31 December 2017 and 2018 representedapproximately 78% of the total revenue of the Group. Since the Oilfield Services have beenthe main contributor to the Group’s revenue, as such, the proposed annual caps and theactual historical transaction amounts being at a similar percentage against the total revenueof the respective period is an appropriate basis to assess the fairness and reasonableness ofthe proposed annual caps. Hence, the Company has used the same percentage to estimateproposed annual caps. Considering the future capital expenditure plan of the CNOOC Group,it is estimated that the percentage of revenue from the Continuing Connected Transactionsduring the three years 2020 to 2022 will be slightly higher than that of the year 2019.Therefore, 83%, increased on the basis of 81% contribution by the Continuing ConnectedTransactions in the total revenue in the first half of 2019, will be used for the estimation ofthe percentage contribution of the proposed annual caps.As for the cost of the Continuing Connected Transactions, considering that theCompany’s operation model will not face significant change and that the cost from theMachinery Leasing, Equipment, Material and Utilities Services and the Property Servicesprovided by the CNOOC Group to the Group will remain relatively stable, the Companyexpects that the percentage of costs from the Continuing Connected Transactions in the totalcost of the Group will not encounter any major changes. Therefore, the Company made the– 13 –

LETTER FROM THE BOARDestimation of the amount of cost from the Continuing Connected Transactions for the nextthree years based on an estimated 8.0% contribution of the cost from the ContinuingConnected Transactions in the total cost of the Group (the average contribution durin

COSL, 201 Haiyou Avenue, Yanjiao Economic & Technological Development Zone, Sanhe City, Hebei Province, the PRC is set out on page 53 to 54 of this circular. A proxy form for use by the Shareholders for the EGM is enclosed with this circular. Whether or not you are able to attend the EGM in person, you are requested to complete and return the .