Transcription

ANNUALPlanningCOMPLIMENTARYMAKES A DIFFERENCEGift Planning, Queen’s UniversityGeorge and Maureen Ewanare adding theArt to the Sciencein Research Successinside this issueAdding the Art to the Science in Research Success . 2Introducing the Spend-Down Fund Giving Option . 6The Value of Asking the Right Questions. 8

Adding theArt to the Sciencein Research Successdr. and Mrs. ewan attending the snO exhibit titled “new eyes on the universe”“A master of the art of collaborationwho convinced talented physicistsand national and internationalagencies that a multi-million dollarscience project two kilometersunder the earth in a Sudbury mineshaft would make it possible tosolve The Solar Neutrino Problem.”These are the words used to describe theremarkable academic accomplishments ofGeorge Ewan, DSc’05, when he receivedhis honorary degree from Queen’s University. They also describe the important rolethat Dr. Ewan’s powerful communicationskills played in helping him achieve his research goals.2Now an emeritus professor in the Department of Physics, Engineering Physics andAstronomy, Dr. Ewan focused on nuclearphysics and sub-atomic research, particularly the solar neutrino problem – too fewneutrinos recorded reaching the Earthfrom the centre of the Sun.Dr. Ewan, along with Dr. Herb Chen ofUniversity of California, Irvine and otherfellow physicists from Canada, the US andthe UK, founded the Sudbury NeutrinoObservatory (SNO), a subterranean neutrino observation facility located in a Sudbury nickel mine. Only after considerablemeetings with politicians, industry leaders,and academic administrators from acrossNorth America, as well as plenty of mediainterviews, were Dr. Ewan and his collaborators able to acquire the funding, requeensu.ca/alumni/giftplanning

general public.” His wife, Maureen, agreessources and support they needed to purwith him, saying “his work is so remotesue their remarkable research.from what most people would find comIn 2015, the years of research at theprehensible.” E ective communicationSudbury Neutrino Observatory (SNO)skills are vital to successful research. As heresulted in a Nobel Prize for Dr. Arthurputs it, scientists have soMcDonald and his“It’simportantforstudentsmuch of value to sharecollaborators, includingwith the world. “As aDr. Ewan, in recognition to spend time with theseof their ground- breaking scientists talking about science rule, scientists don’t inform the educated pubexperiments whichinwaysthateveryonecanlic, but there are peopledemonstrated thatneutrinos changeunderstand,” Dr. Ewan says. who work on excitingidentities.“That way when someone asks experiments who couldgive very good talks. MyWhen Dr. McDonaldastudentwhatthey’redream is to have themaccepted the Nobel Prizeon behalf of the SNOstudying, they can answer in come to Queen’s to givelectures on the state ofteam in 2015, Dr. Ewana way that will get peopletheir experiments andwas in Stockholm withexcitedabouttheirwork.”especially about their rehim.sults, and to do it in a way that peopleWith his work recognized at the highestwithout PhDs can understand.”level, the 90-year-old Dr. Ewan nowThis is why Dr. Ewan and his wife havepushes ahead with a goal of influencingdecided to donate 100,000 to Queen’s tothe next generation of scientists here atcreate The George and Maureen EwanQueen’s, remarking that “it is vital that weLecture Series, which will support seminarscientists make our work accessible to thein January, members of the original snO Collaboration got together for coffee in the graduate lounge in stirling hall.From left to right: Barry Robertson, hugh evans, George ewan, hamish Leslie, hay Boon Mak and Peter skensved.queensu.ca/alumni/giftplanning3

dr. George ewan and some of his snO collaborators at the nobel Prize ceremony in stockholm in 2015, where dr. Art Mcdonald received anobel Prize in Physics for the research that took place at the sudbury neutrino Observatory.Back row: doug hallman (Laurentian and Queen’s universities), davis earle (snO), Aksel hallin (university of Alberta). Front row: Art Mcdonald(Queen’s), George ewan (Queen’s), david sinclair (Carleton university).Dr. Ewan’s gift, which will use Queen’sand lecture programs designed to increasenew spend-down option (see page 6 forscientific discourse and culture within themore information on this new fund opParticle Astrophysics community attion), will give the deQueen’s University.“Georgewantstoratchetuppartment access toDr. Tony Noble, a for 10,000 a year until themer SNOLAB directorthe level of discourse atfund is depleted. As Dr.and the current directorQueen’sandenticetopNoble explains, aof the Canadian Particlescientists from around the 10,000 annual budgetAstrophysics ResearchCentre, shares Dr.world to come here and share will make it possible forthe department to lookEwan’s dream and seestheirideasandresults.farther afield for guestgreat benefit in it – esToexposeourstudentstolecturers and host thempecially for Queen’s stufor a longer stay. “Thedents. “George wants to this kind of thinking wouldidea is to have the guestratchet up the level ofbeinspirationalforthem.lecturers stay for a whilediscourse at Queen’sand spend some qualityand entice top scientists It will open them up to newtime with the students,from around the world possibilities.”interacting with themto come here and shareand working with them in the labs,” hetheir ideas and results,” he says. “To exsays.pose our students to this kind of thinking“It’s important for students to spend timewould be inspirational for them. It willwith these scientists talking about scienceopen them up to new possibilities.”4queensu.ca/alumni/giftplanning

in ways that everyone can understand,” Dr.Ewan says. “That way when someone asksa student what they’re studying, they cananswer in a way that will get people excited about their work.”The lecture series is only the latest wayin which the Ewans have chosen to supportQueen’s. In 2014, the couple created twofunds in support of the Ban Righ Centre,where Mrs. Ewan worked from 1976 to1992. Maureen’s Room, a cozy study spacein the Ban Righ Centre is named after Mrs.Ewan and can be found in what was onceher o ce. In honour of the great workdone by the centre, the couple establishedthe Maureen Ewan Ban Righ Bursary aswell as the Maureen Ewan Ban Righ Endowment Fund, which is used to provideongoing support for the programs and services overseen by the Ban Righ Foundation. Both of these funds will ensure thatwomen who have experienced an interruption in their formal education can return totheir studies in order to achieve their personal academic goals.The Ewans have made their gift commitments a reflection of their lives at Queen’s.If you are considering making your gift toQueen’s a meaningful reflection of yourown life, please get in touch with our GiftPlanning team. We can help you createyour legacy.To learn more about the SNO (now SNOLAB)facility and the research being done there, go -breakthroughqueensu.ca/alumni/giftplanningBan Righ ribbon cutting in 1974. Maureen ewan is second from the right.Putting the Queen’sEndowment to Workfor Your Legacythe ewans chose to make their gift using a spenddown fund because it enables them to make asignificant impact over a relatively long time frame.Queen’s newest fund option, the spend-down modelis invested in the Queen’s endowment, so it generatesinvestment returns in addition to the original gift’sface value. the fund pays out 10 per cent of the gift’sface value each year until it spends down, which ishow the ewans’ gift is able to generate 10,000 a year.the payments, which include the investment returns,typically last about 10 to 20 years, although they couldlast longer (or shorter) depending on the market’sperformance.One of the reasons spend-down funds can pay out somuch is that, unlike endowed funds, they’re notdesigned to last in perpetuity. that suits the ewansperfectly. “i don’t want the gift to serve for infinity,”dr. ewan says, “but i do want 10,000 available eachyear because this way we can create a specialexperience for our students with the lecturers insteadof just flying them in and flying them out.”5

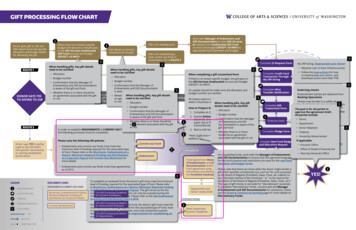

Spend-DownFund Giving OptionQueen’s has traditionally o ered twofunding options to donors – expendablefunds and endowed funds. Expendablefunds enable you to make a significantimpact immediately. Endowed funds enableyou to make an impact in perpetuity. Butwhat if you want to have a big impact overa longer period of time, but not inperpetuity? That’s where a spend-downfund could be the right fit for you.A spend-down fund enables you to makea big impact over a longer time frame,typically over 10 to 20 years.Where endowed funds are designed tolast forever and expendable funds typicallyare designed to provide an immediateimpact, spend-down funds typically last 10to 20 years. The spend-down fund doesn’tgenerate as much investment return as anendowed fund, but it has the potential togenerate more than an expendable fund.How does it work?We invest your gift with the Queen’sEndowment Fund. The annual payout ofyour fund will be 10% of the gift’s originalface value. So for a gift of 150,000, thepayout will be 15,000 per year.Because the investment portfolio isinfluenced by the overall marketperformance, we can’t guarantee how longthe money will last. We expect that mostspend-down gifts will last between 10 and6Income generated by giftIntroducing theendowedspenddownexpendableLife of gift20 years.Because the capital of the spend-downfund is invested, the return rate and thelifespan will depend on the investmentperformance. That means the lifetimepayout could be lower than the originalgift. It also means that the gift might spenddown to zero before 10 years have elapsed.Spend-Down Invested in Queen’s Endowment Annual distribution is 10% of thegift's initial face value Distributions consist of principal investment returns Time frame of distributionsdetermined by investmentperformance Payouts continue until balance is 0If you are interested in learning more about spenddown funds, please contact our Gift Planning team atgift.planning@queensu.ca or our Gift Services teamat gifts@queensu.ca.queensu.ca/alumni/giftplanning

Over the years, people just like you have chosento make Queen’s a part of their legacy, assuring thewell-being of the university and its studentsfor years to come.What will your legacyplanninglook like?makes a differenceInterested in remembering Queen’s in your estate plans?Let us help.Contact Linda Pearson, Executive Director, Gift Planningat 1-800-267-7837 or at gift.planning@queensu.ca.We look forward to hearing from you.queensu.ca/alumni/giftplanning7

The Valueof Askingthe RightQuestionsSusan Moore, Com’90, Wealth Specialist forthe Menard-Kinkaid Team at RBC DominionSecurities and a member of the Queen’s GiftPlanning Advisory Committee. Susan is notonly an alumna, but as of this Fall, she is alsoa proud Queen’s parent. Here, Susan o ersguidance and insight into the questions youmay ask your financial advisor to help youachieve your philanthropic and personalgoals while o ering income tax advantages.Many of us make charitable donations.We do it on a regular basis to institutionslike Queen’s that are close to our hearts. Asour level of giving increases, the donationstend to become more strategic. The key tostrategic donations is planning. You shouldbe working with your financial advisor todevelop a long-term plan for your givingthat aligns with your personal circumstances and philanthropic goals and with aview to maximizing tax e ectiveness.Timing is EverythingWherever possible, it is a good idea toconsider the potential tax benefits that youcan realize by timing your charitable donations appropriately, both to ensure the8donation tax credits will not expire, and toensure the donation will reduce as muchtax as possible. A tax credit on donationsmay be claimed up to a limit of 75% of netincome. If you exceed the 75% net incomelimit, you can carry the excess donationsforward for up to five years, but any creditsnot used in the five-year period will expire. The federal donation tax credit ratefor donations over 200 is 33% to the extent that an individual has taxable incometaxed at 33%. However, where the donation tax credit is carried forward to beclaimed in a subsequent year, the taxcredit will not be eligible for this high 33%rate, so timing your donations can make adi erence.For example, making a charitable gift atthe time that you sell property or yourbusiness, or when you exercise stock options, may help reduce your tax liability.If you choose to donate the proceeds, or aportion of the proceeds from the sale of abusiness, you may receive a tax credit forthe value of your donation which couldresult in significant tax savings for the taxyear in which you made the gift. A com-queensu.ca/alumni/giftplanning

prehensive financial plan can help to ensure that tax credits or deductions will beused most e ciently.Donations as Part of YourEstate PlanningMaking charitable bequests as part ofyour estate plan can also be tax-e ective.Depending on your situation, your executors may have the flexibility of allocatingthis donation to the tax year of the estatein which the donation is made, to a previous tax year of the estate, or to your last ornext-to-last taxation year. The income limitation increases to 100% of your incomefor gifts claimed in the year of your deathand for the preceding year.Donate to EliminateIf you wish to provide significant estaterelated gifts to Queen’s and want to maximize your tax benefits, you shouldconsider a “donate to eliminate” strategyduring your lifetime – that is, donating intwo or more parts: an outright gift whilealive, and a gift through your estate. Thismay eliminate the conundrum of havingunused charitable donation credits. Aswith any plan, it is important to reviewyour personal situation in detail with yourfinancial advisors.Consider the example of an alumnus whois considering starting an endowment atQueen’s while alive and enhancing the endowment with a bequest. The minimumthreshold for creating an endowment atQueen’s is currently 50,000, which canbe paid over a five-year period, or 10,000per year for five years. In this case, thealumnus has the opportunity to maximizethe credit to income tax at the high rate,while minimizing the risk that donationqueensu.ca/alumni/giftplanningcredits will expire. In addition, the alumnus could gift publicly traded securitieswith the highest accrued gain, therebybenefitting from both the tax credit as wellas the elimination of the inherent tax liability associated with the shares, thanks toa special tax rule that eliminates the capital gains tax that would otherwise apply tosuch donations.What Questions ShouldYou Ask?Here are some questions to help sparkfurther conversation with your financialadvisor and help you better plan yourcharitable giving strategies:1. Is my financial plan sustainable? Doesmy charitable gifting strategy meshwith my current financial plan?2. Which of my assets are creating thelargest tax liabilities for me?3. What is the most tax-e ective way forme to make a gift to charity during mylife? How large of a tax credit can I usethis year? Can income tax projectionsbe prepared to help spot opportunities?4. Are there estate-related directdesignation gift opportunities that Ishould consider, e.g. insurance orregistered retirement funds? Do myinsurance policies representopportunities to gift?5. What is my expected tax liability at mydeath? What opportunities are there tomitigate this tax liability?6. When would tax credits be mostuseful/tax e ective? Should I make mydonations annually, through my estate,or both? Are there tax smart ways forme to combine gifts in life with myestate related gifts?7. Do the directions in my will reflect mycurrent financial plan?9

Conclusion:Planning Makes a DifferenceCanada has one of the most generous taxsystems for charitable giving, and with somany ways to give, it is wise to seek professional advice. Speak with your financialadvisor about the tax benefits of giving aspart of your tax and estate planning. Understanding the rules for donating assetscan make a big di erence when it comesto capital gains tax. Moreover, it providesyou with a chance to make a real di erence to a charity by planning the way youchoose to give.The timing, amount, and type of yourcharitable gift will depend on your uniquesituation, as will the associated income taxand estate planning implications. It allstarts with a good plan. Queen’s stronglyrecommends that donors seek independent legal and financial advice.To learn how you can make a difference, simplycontact the Gift Planning office at 1-800-267-7837 orby email at gift.planning@queensu.ca. The Queen’sGift Planning team is always available to partnerwith you and your financial planning team to helpyou achieve your philanthropic goals.“We believe that education canbe a game changer,” saysCatherine. “It can break thecycle of poverty, not just forstudents, but for their familiesas well. Our kids were in goodshape, so we thought we couldhelp someone else’s children.We had an opportunity todo something special Life is short and thisis important.”Catherine Purcell, Artsci’78,Ed’85, MEd’98& Michael Purcell, Sc’75Queen’s University alumniand insurance donorsplanningmakes u.ca/alumni/giftplanning

“I see my bequest as a way to bring new ideas tothe Queen’s community, to look forward, becreative, be courageous, envision betterthings, and enhance the futureexperience of education.”The Honorable Hugh F. Landerkin, QC LLB’67Queen’s University alumnus,Retired Judge, Provincial Court of Albertaand Bequest donorplanningmakes adifferencequeensu.ca/alumni/giftplanningThe Queen’s Financial Planner is provided as a special service for the alumni and friends of Queen’s University by the O ce of Gift Planning.Readers are cautioned to consult their own professional advisors to determine the applicability of information and opinions in this newsletterin any particular circumstances. This newsletter is copyright; its reproduction in whole or in part by any means without the written permissionof the copyright owner is forbidden.Queen’s University respects the privacy of its alumni, donors, and friendsand the sensitivity and security of personal information. The personalinformation collected by the O ce of Advancement is collected under theauthority of the Royal Charter of 1841, as amended, and the Freedom ofInformation and Protection of Privacy Act and is used for the purpose ofadvancing cooperative relationships between alumni, friends and students,and the University, and to increase the philanthropic resources of theinstitution. If you have any questions or concerns about the informationcollected or how it will be used, please contact the O ce of Advancement,Queen’s University Kingston, ON K7L 3N6, or by telephone at 613.533.2060,or 1.800.267.7837.queensu.ca/alumni/giftplanningSave Paper!If you would like to receive future issues ofthis newsletter by email, please contact us atgift.planning@queensu.ca11

Royal LegacySocietythe Royal Legacy society recognizesthose alumni and friends who havethoughtfully remembered Queen’suniversity through a bequest oranother future gift commitment.if you have already rememberedQueen’s with a future gift, please letus know so that we can honour yourintention.For more information on theRoyal Legacy Society,please visit our website atqueensu.ca/alumni/rlsOFFICE OFGIFT PLANNINGQueen’s UniversityKingston, on k7l 3n6Tel1.800.267.7837613.533.2060Fax 613.533.6762Email ning17-0056 Queen’s University Marketing – Fall 2017 Financial PlannerWe look forward to welcoming you.

Back row: doug hallman (Laurentian and Queen's universities), davis earle (snO), Aksel hallin (university of Alberta). Front row: Art Mcdonald (Queen's), George ewan (Queen's), david sinclair (Carleton university). and lecture programs designed to increase scientic discourse and culture within the Particle Astrophysics community at