Transcription

Healthcare in AfricaSouth Africa: Working towards aworld-class life sciences industry

Brochure / report title goes here Section title goes here ContentMaking the case for economic diversification in South Africa03The role of life sciences in diversification04Keys to success06Conclusion10Contact details 1102

Healthcare in Africa / South Africa: Working towards a world-class life sciences industryMaking the case foreconomic diversificationin South AfricaThe tough economic conditions are due to a combinationof global and domestic factors and have had a particularlynegative effect on the country’s well established industriessuch as energy and resources.In line with the experiences of other openmiddle income economies South Africahas experienced subdued growth in recentyears averaging approximately 2.1% yearon-year GDP growth from 2011 to 2015.The reliance of industries such as miningand resources on exports has addedsignificant pressure to the trade deficit andcurrent account as global resource priceshave dropped.Despite the challenges South Africa isranked as Africa’s second largest economywith a GDP of USD318 billion (USD5951 per capita) recorded in 2015 and isconsidered to be Africa’s most diverseeconomy in terms of economic activity(i.e. manufacturing, resource extraction,services and value-added exports).Government has acknowledged the needfor further diversification, and policies suchas the National Development Plan (NDP),the Industrial Policy Action Plan (IPAP) andthe Bio-economy Strategy (BES) have beenpublished as guidelines for how additionaldiversification can be achieved.Working towards the goals stated inthese documents is considered to be ofparamount importance to the long-termsuccess of the economy. It is clear thatthe reliance on low value-added mineralexports must be reduced and the economymust supply a higher proportion of valueadded products to domestic, regional andglobal markets.03

Healthcare in Africa / South Africa: Working towards a world-class life sciences industryThe role of life sciencesin diversificationOne industry identified as being critical to the economicdiversification is the life sciences industry.South Africa has thelargest life sciencesmarket on the Africancontinent.This industry can be considered tobe made up of two interlinked subsectors, namely: biotechnology andpharmaceuticals.South Africa has the largest life sciencesmarket on the African continent, atapproximately USD3.2 billion. This feedsinto what is the continent’s largesthealthcare market valued at approximatelyUSD28.1 billion. Further to this, the SouthAfrican prescription drug, generic drugand over the counter drug markets are allprojected to show considerable growthup to 2023.04As outlined above there is considerabledemand for life sciences products inSouth Africa. However, much of the localdemand for the products (particularlyvalue-added innovative products) issupplied from other markets in theglobal economy. This had resulted in apharmaceuticals trade deficit of USD1.6billion in 2015.A deficit this large may be considered tobe a barrier to economic diversificationand growth of the local industry asenvisioned in the NDP, IPAP and BES.Fortunately, despite the challenges,South Africa nonetheless has theeconomic fundamentals to develop acompetitive advantage and significantlyimprove its share of the global lifesciences market in the long term. Thispotential competitive advantage lies in anumber of factors contained in what canbe termed ‘keys to success’.

05

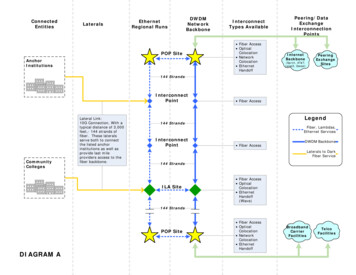

Healthcare in Africa / South Africa: Working towards a world-class life sciences industryKeys to successSouth Africa has adiversified manufacturingindustry that includespharmaceuticals andbiotechnology.The Department of Science andTechnology’s BES has noted that SouthAfrica needs to develop its healthinnovation system using a ‘quadruple helix’model that brings together government,academia, industry and civil society – inwhich each of these stakeholders havedistinct but complementary roles.Deloitte is in agreement with this view; andof the opinion that the keys to success forworking towards the realisation of a worldclass industry can be found in the followingdomestic market factors: (1) ManufacturingCapability; (2) Research and Academia and(3) Regulatory Environment; as illustrated bythe ‘Triangle of success’ – see Figure 1. Theexisting competitive advantage in theseareas is outlined below.Manufacturing capabilitySouth Africa has a diversifiedmanufacturing industry that includespharmaceuticals and biotechnology.Global generics companies, such asAspen Pharmacare and Adcock Ingram,have also emerged from the country.This is indicative of an establishedmarket with the requisite skills base andfundamentals for additional investmentto yield significant results – if done in astrategically sound manner.The Department of Trade and Industry(the dti) has put into place a number ofgrants and incentives aimed at supportinggrowth of value-adding economicactivities – including those of life sciencesmanufacturers. These incentives cover arange of activities including but not limited06to: Research and Development (e.g. S11DIncentive); Infrastructure Development(e.g. Critical Infrastructure Programme);and Manufacturing Competitiveness(e.g. MCEP Incentive). The existence ofsuch incentives is important for supportingthe life sciences industry but more workcan be done to better promote them andincrease ease of access.Research and AcademiaSouth Africa has a well-establishedresearch and academic fraternity in lifesciences that has provided a steady outputof research and development (R&D).A robust regulatoryenvironment is criticalfor any country aimingto develop world-classindustries. Goodperformance in thisarea increases economiccompetitiveness andbusiness confidence.Research by the African Society forLaboratory Medicine has foundthat while Africa has less than 500internationally accredited laboratories,90% of these are based in South Africa.This strengthens South Africa’s positionas the most suitable African country forinvestment into life sciences knowledgegeneration and production.In order to fully leverage and build on thefundamentals outlined above, greatereffort and resources are required toincrease the number of researcherscurrently in the market and upgradetheir collective skill set. This will requirea number of private and public sectorinterventions including but not limited to:*Department of Science and Technology: Bioeconomy Strategy Finding ways to encourage collaborationbetween leading global researchers andlocal industry. This could potentially bedone by leveraging on South Africa’s levelof development in ICT infrastructureto explore the potential for remotecollaboration Reform of immigration laws to attractmore skilled researchers and academicsin life sciences.Regulatory EnvironmentA robust regulatory environment is criticalfor any country aiming to develop worldclass industries. Good performance in thisarea increases economic competitivenessand business confidence. As a result, itis important for South Africa to take thenecessary steps in continuing to developits institutional capacity in this regard.At present South Africa ranks 49th outof 140 countries in the World EconomicForum’s (WEF) Global CompetitivenessReport for 2015–2016. This is the secondhighest ranking amongst African countrieswith only Mauritius ranked higher at 46thplace. The WEF notes the following as thereason for the ranking:South Africa climbs seven places to reach49th, reversing its four-year downward trendthanks largely to increased uptake of ICTs– specially higher Internet bandwidth andimprovements in innovation (up by five placesto 38th), which establishes the economy as theregion’s most innovative.South Africa also hosts the continent’s mostefficient financial market (12th) and benefitsfrom a sound goods market (38th), which isdriven by strong domestic competition (28th)and an efficient transport infrastructure(29th). It further benefits from stronginstitutions (38th), particularly property rights(24th) and a robust and independent legalframework.These are favourable rankings and SouthAfrica’s performance suggests a generallystable and low-risk business environmentfor industries such as life sciences.

Healthcare in Africa / South Africa: Working towards a world-class life sciences industryFigure 1. Triangle of success: requirements for a world-classpharmaceuticals industryMANUFACTURING CAPABILITYFor a national competitiveadvantage to bedeveloped, industrialpolicy needs to beeffectively implementedand effective co-operationbetween the public andprivate sectors is required.WORLD-CLASSINDUSTRYREGULATORY ENVIRONMENTTwo additional drivers also give SouthAfrica a critical advantage in workingtowards a world-class life sciences industry.These are as follows:1. Genetic diversityDue to historical and present daysocioeconomic reasons, South Africahas a population with a high geneticdiversity. This makes it a particularlyadvantageous location for life sciencesresearch and application in the longterm. The importance of this factorlies in the growing role of populationgenetics in the future of life sciences andhealthcare. Large diverse populationsin close geographic proximity can helpreduce research costs and make itmore likely to be able to carry out moregenetically representative research.Fundamentals for the way forwardIt is important to note that while thefactors above are advantageous and signalsignificant potential for transformationand growth of the South African lifesciences industry, their existence aloneis not enough. For a national competitiveadvantage to be developed, industrialpolicy needs to be effectively implementedand effective co-operation between thepublic and private sectors is required.2. The African growth story andhealthcare demandGrowing economies, higher disposableincomes and a high disease burdenacross Africa means that there will likelybe continually increasing demand forlife sciences based products on thecontinent. This growth story providesSouth Africa with a fast-growing regionalmarket to tap into.1. Life sciences productmanufacturers:Life sciences manufacturers shouldrecognise and act on the currentattractiveness and continuing growthpotential of the South African market. Key strategic areas of growth shouldbe identified and the appropriatedelivery partners with whom firms caneffectively collaborate and co-investinto new ventures should be selected.Private sector call to actionThe private sector is best placed to bethe driver in growth of the life sciencesindustry in South Africa. Private sectorstakeholders can pioneer a new era ofgrowth in South Africa’s life sciences bypursuing the following:RESEARCH AND ACADEMIA2. Clinical trial/research institutes:Companies involved in South Africa’s lifesciences R&D industry should developbusiness strategies to leverage on SouthAfrica’s competitive advantage in termsof manufacturing, research, robustinstitutions and population diversity. A long-term strategic area of growth isin the digitisation of clinical researchactivities.Particularly in terms of remote monitoringof trial participants. The internet is betterenabling long-distance collaboration ofresearchers and extending the geographicreach of trials. South African firms shouldendeavour to place themselves at the heartof this global trend.07

Healthcare in Africa / South Africa: Working towards a world-class life sciences industryThe public sector should look at waysin which it can improve the services itprovides to better enable the privatesector and encourage local manufacturingand R&D.Public sector call to actionThe public sector should look at waysin which it can improve the services itprovides to better enable the private sectorand encourage local manufacturing andR&D. This could be achieved by working toachieve the following:1. Procurement designation:Establishing ways in which a designationpolicy could be implemented for publichealthcare procurement should beconsidered. Designating funds from the publicpurse to procure products from lifescience companies with manufacturingfacilities in South Africa may provecritical in sustaining a fledgling industryin the short to medium term.2. Improvement of existing incentives:Better promotion and effectiveimplementation of existingmanufacturing incentives in life sciencesR&D and manufacturing. Better promotion and administrationof existing government incentiveswould better enable government tosupport growth of the industry.3. Collaboration with private sector:Initiating strategic private sectorpartnerships for initiatives such asKetlaphela (which intends to create astate owned pharmaceutical company)would enable the public sector to play adirect and meaningful role in developingdomestic manufacturing capacity.4. Special Economic Zones:Creation of a Special Economic Zone(SEZ) for life sciences companies,with favourable tax incentives formanufacturing and R&D, may provecritical in increasing domestic andinternational investment into theindustry. Creating a SEZ specificallyfor life science companies may alsobe critical in aiding the formation ofa specialised geographic cluster inwhich skills and resources can be moreefficiently shared.The public sector should look atways in which it can improve theservices it provides to better enablethe private sector and encouragelocal manufacturing and R&D.08

Brochure / report title goes here Section title goes here 09

Healthcare in Africa / South Africa: Working towards a world-class life sciences industryConclusionIn conclusion it can be said that there are a numberof critical areas and factors related to the life sciencesindustry in which South Africa performs well, particularlyin terms of institutional strengths, human capital, andexisting infrastructure and population demographics.However, more effective collaboration betweenstakeholders across and between the public and privatesectors is required in order to leverage on these factorsand more effectively grow the industry.10

Healthcare in Africa / South Africa: Working towards a world-class life sciences industryContact detailsValter AdaoHealthcare: Industry LeadEmail: vadao@deloitte.co.zaJudy VarndellHealthcare: Senior ManagerEmail: jvarndell@deloitte.co.zaNjabulo SkhosanaHealthcare: Senior ManagerEmail: nskhosana@deloitte.co.za11

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UKprivate company limited by guarantee (“DTTL”), its network of member firms,and their related entities. DTTL and each of its member firms are legallyseparate and independent entities. DTTL (also referred to as “Deloitte Global”)does not provide services to clients. Please see www.deloitte.com/about tolearn more about our global network of member firms.Deloitte provides audit, consulting, financial advisory, risk advisory, tax andrelated services to public and private clients spanning multiple industries.Deloitte serves four out of five Fortune Global 500 companies through aglobally connected network of member firms in more than 150 countries andterritories bringing world-class capabilities, insights, and high-quality serviceto address clients’ most complex business challenges. To learn more abouthow Deloitte’s approximately 245 000 professionals make an impact thatmatters, please connect with us on Facebook, LinkedIn, or Twitter.This communication contains general information only, and none of DeloitteTouche Tohmatsu Limited, its member firms, or their related entities(collectively, the “Deloitte network”) is, by means of this communication,rendering professional advice or services. Before making any decision ortaking any action that may affect your finances or your business, you shouldconsult a qualified professional adviser. No entity in the Deloitte networkshall be responsible for any loss whatsoever sustained by any person whorelies on this communication. 2017. For information, contact Deloitte Touche Tohmatsu Limited(40AprCS/jar)

Healthcare in Africa / South Africa: Working towards a world-class life sciences industry In line with the experiences of other open middle income economies South Africa has experienced subdued growth in recent years averaging approximately 2.1% year-on-year GDP growth from 2011 to 2015. The reliance of industries such as mining