Transcription

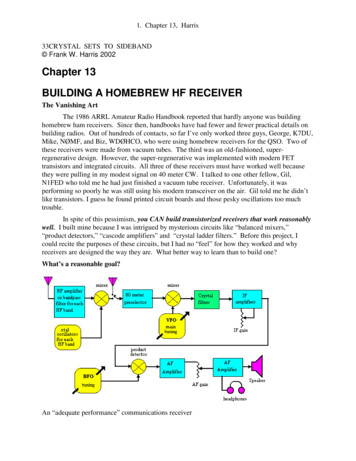

What Can You Do When Your Hedge Fund Investment Goes Bad?A Presentation and Discussion Hosted by IIEFNew York City, Wednesday, October 10, 2012Keynote Speaker: Simon Lack, Author of The Hedge Fund MirageDiscussion Moderator: Allan BellChair of the Trusts and Estates Practice Group at Sills Cummis & Gross P.C.Keynote Presentation: Simon Lack(click here to view the slides from Mr. Lack’s presentation.)Simon Lack’s book, The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to be True,created quite a stir when it was published in January 2012. He was accused by some of bias and faultymath, and lauded by others for revealing that the emperor was wearing no clothes. In his book, and in hiskeynote address at this IIEF Roundtable, he made the case for why, “If all the money that’s ever beeninvested in hedge funds had been put in Treasury Bills instead, the results would have been twice asgood.” Lack’s analysis of hedge fund returns between 1998 and 2011 revealed that, while hedge funds didvery well relative to the market in the late 1990s, they did significantly worse than a traditional 60%equities/40% bond portfolio after 2003. And in 2008, hedge fund losses wiped out all of their historicalprofits. Meanwhile, the fees earned by hedge fund managers grew substantially in proportion to realinvestor profits.To explain the downward trajectory, Lack asserts that hedge funds were better when they were smaller. Inthe early hedge fund days, they tended to be nimble and run by creative, intensely focused managers. Thetime to get into hedge funds was back when few people were doing it. After early big gains, everyonerushed into hedge funds, and performance plummeted.Lack focused on four main reasons why hedge funds are no longer a good bet:Fees: Hedge fund managers are doubly paid, earning both a standard fund management fee andperformance fees that can be extremely high. These fees have eaten away real investor profits. One ofLack’s slides shows that, between 1998 and 2011, real investor profits were down 80 billion; in the sametime period, hedge fund managers earned 413 billion in fees.-More10/10/2012 Hedge Funds Roundtableiief.orgPage 1

Simon Lack Keynote Address —ContinuedLack of Transparency: Hedge funds are subject to less transparency than other major investment vehicles,including public equities and debt, private equity and real estate. Traditional assets are largely handledthrough separately managed accounts. Clients retain complete ownership of their capital as well as theability to observe precisely how it’s invested. The co-mingled, open-ended fund structure so common inhedge funds limits transparency.Size: Lack asserts that hedge funds are over-capitalized. And big hedge fund managers today are not asnimble or as talented as smaller managers who launched the hedge fund concept in the 1990s.Lack of Investor Protections: Most U.S. hedge funds are incorporated as limited partnerships in Delaware.As pointed out in one of the Roundtable workbook articles written by Jay Eisenhofer, under Delaware law,general partners are legally permitted to void the fiduciary duties they owe to investors. They can alsodisclaim all liability when they take action in reliance on the opinion of an investment banker.Mr. Lack stopped short of arguing that investors should avoid hedge funds altogether. He urged investorsto look for smaller, more nimble managers and demand transparency. And he cautioned against expectingmagical returns. He notes that many of today’s investors are betting on a record year for hedge funds everyyear, despite the fact that they fail to deliver on that promise. Investor expectations of a 7% return haveonly been realized once – in 2009. 2002 was the last year that hedge funds outperformed returns on atraditional 60/40 portfolio.The lack of consistent performance among hedge fund managers is another concern. High-performing managers rarely stay that way; of funds in the top 40% of performers in any one year, only 7% are able to stayon top every year. The other 93% spend some time in the bottom 60%. This absence of return persistencemakes manager selection especially challenging. He argued against “diversified” hedge funds and in favorof narrowly focused strategies. “A hedge fund is not trying to match the market. Manager selection iseverything.”Lack asserts that the hedge fund industry offers a bad combination: investors who are helplessly momentum driven, and a set of investments that is utterly mean reverting. “This is never going to end well.Investors are always going to be going in at the wrong time because no one wants to invest in out-of-favorhedge funds.”Mr. Lack’s introductory remarks were followed by aQ&A discussion with the participants (Page 3)and a Roundtable Discussion (Page 7).10/10/2012 Hedge Funds Roundtableiief.orgPage 2

“Let me posit a provocative idea here – that a diversified portfolio of hedgefunds is the dumbest idea in finance.”- Simon LackQ&A with Simon LackFund Counsel: There’s not necessarily a correlation betweeninvestors’ rights and managers’ rights; side letters arebecoming less in favor than in the past. Corporategovernance is in the process of changing; we’re working onnew models to enhance corporate governance and creategreater parity between investors and managers.Simon Lack: Let me posit a provocative idea here – that adiversified portfolio of hedge funds is the dumbest idea infinance. The whole point of the Capital Asset Pricing Model isthat idiosyncratic risk doesn't get rewarded, and that's whythe efficient frontier generally has you investing in a diversebasket of securities. Diversification is designed tosystematically get you the market return. But if you're ahedge fund investor, you want to get as far away from themarket return as you can. If you are truly skilled at selectingmanagers, the intelligent way to invest is to have a verysmall number of hedge funds in your portfolio and a total of2-3% invested in hedge funds. I know that doesn't solve theproblem for the pension fund with a 7 or 8% return target.Simon Lack: People say to me that mutual funds are bad aswell. That's not an argument for hedge funds; it just says weall suck. I think with hedge funds it's a bigger sin, becausemutual fund managers have to stay fully invested. If youwere a tech manager in the late 90s, assets flowed in andthen you got clobbered. Your IRR may have been really lowbecause you had maximum assets and the market was falling– but your job was to stay fully invested. The hedge fundindustry grew up as a way to generate absolute returns – tomake you money, not every day or every month, but over acycle. So that's why I thought it was fair to ask if they’veactually done that. The answer is clearly “no.”Investment Industry Regulatory Advocate: Every kid whocomes through our program has visions of becoming a hedgefund manager and driving a Ferrari in two years. Largeinstitutions are still pouring money into alternatives – a lot ofit into the hedge fund space in pursuit of returns. Assetsunder management are up to pre-crisis levels, and fundformation seems to be on the upswing again. I'm not quitesure where the disconnect is here – why people keeppursuing this.“The whole infrastructure of the investmentindustry is designed to channel assetsinto hedge funds.“Chief Investment Officer: Simon, some of the examples andillustrations you cite could be improved upon if youconsidered leverage as part of the adjustments you make forsize and return.Simon Lack: I think you're right; I just don't know how to getthe data in a way that would make sense across the wholeindustry. It's hard to get data on leverage; you have to get tothe individual fund level to get that information. Andleverage is only one measure of risk, particularly as thederivatives industry has grown. You can have no apparentleverage and lots of economic leverage, depending on whatderivatives you're using.Chief Investment Officer: Your point is well taken withregard to fees versus total returns. The market was slack fora decade, and only a very few managers beat the marketover that same period.10/10/2012 Hedge Funds RoundtableSimon Lack: I think the most likely outcome is that assetswill continue to flow in and returns will continue to be reallybad – very low single digits – at great expense. The wholeindustry is designed to move assets into hedge funds, and allthe people in the industry are pro hedge funds, includingconsultants recommending allocations, capital introductionpeople at the prime brokerages, fund of funds analysts andhedge fund specialists at big institutions. The career costs ofswitching direction are very high. If you're a hedge fundanalyst at a big institution, it’s not so easy to become aprivate equity guy; it takes years to develop the expertiseand the contacts. There’s just enough of a positive story thatit still looks compelling, but eventually, enough years of poorreturns will force a change.iief.orgPage 3

“For the past 10 years, a traditional 60/40 portfolio did better than the hedgefunds; looking at that, it’s questionable whether hedge funds have anyplace in the portfolio.” - Simon LackQ&A with Simon Lack Continued:Simon Lack: Chris Vogt, formerly with Allstate Insurance,was one of the first to invest in hedge funds. In an interviewrecently with Reuters, he said that this is a make or breakyear for hedge funds, because the past five years have allbeen bad. When you put the five year returns into the meanvariance optimizer, hedge funds will start to look a lot lessattractive. Institutional investors are patient but I would betthat they'll be disappointed. The math is not going to work.Fund Counsel: There's a lot of conjecture behind the scenesthat there will be a compression of manager fees, so I'msuggesting that we're in a dynamic marketplace. Certainmanagers are closing down because they can't handle thevolatility of the markets, and many people blamegovernment interference in the markets. There’s no relyingon fundamental analysis.Simon Lack: There are a lot of really intelligent peoplerunning hedge funds. My book was not written for hedgefund managers; it’s investors who need help. The smartestpeople will probably always run hedge funds because that’swhere you can make the most money, and they will evolveand adapt. I certainly don’t expect the industry will go away,but in its present structure, I believe we’ll continue to getdisappointing results.“Is there not value in having hedge funds as adiversifying asset in a portfolio?”Alternative Investments Manager: You mentioned returncorrelation, but you didn’t talk about the downsideprotection hedge funds offer in portfolio construction. If youlook at that negative period of 2008 and 2009, where theyoutperformed, is there not value in having hedge funds as adiversifying asset in a portfolio?Simon Lack: In our interviews with people before 2008, oneof our common questions included: “What will a bad runlook like? How much can you afford to lose?10/10/2012 Hedge Funds Roundtable“Prior to 2008, any hedge fund money managerwould have said that to be down 12 -15% would bean absolute worst-case.“And so I was surprised after 2008 that hedge fund investorswere not even more upset, because I believe being down23% is a disaster for strategies that are supposed to hedge.But hedge funds blew up as well and investors justified their23% hedge fund losses by saying that their stock portfolioswere down 35%. So why didn’t hedge funds do what theywere designed to do? I believe it’s because the hedge fundindustry is six times the size it used to be; they don't providethat much uggestconcentrating on a very small number of hedge fundmanagers, but that's totally counterintuitive to most of us. Ifyou have just 2 or 3 managers, when one blows up it defeatsthe purpose of having them in the first place.Simon Lack: I'm not suggesting that you should have 20% inhedge funds. If you're only going to have two or threemanagers, be sure to have only 1-2% invested in hedgefunds. Go elsewhere; in fact, you can do a lot with stocksand bonds.For the past 10 years, a traditional 60/40 portfolio did betterthan the hedge funds; looking at that, it’s questionablewhether hedge funds have any place in the portfolio. I'mtaking the Capital Asset Pricing Model and applying it tohedge funds, recognizing that the hedge fund risk premiumis negative.When you put that into the CAPM, it produces a total totallydifferent result than if you assume that hedge funds have apositive risk premium. For institutional investors with longlife liabilities, hedge funds are not going to do it for them.The math just won't work. There’s a big concern about all ofthe public pension money going into the hedge funds. Thehedge fund industry can’t make money with 2 trillion; whywill it make money with 2.5 or 3 trillion?iief.orgPage 4

“If we assume that the bonds in a 60/40 portfolio are municipal bonds, and weassume a very inefficient tax structure for most hedge funds, am I correct thatthe numbers would be even worse?” - Wealth AdvisorQ&A with Simon Lack Continued:Wealth Advisor: As someone who was in the hedge fundbusiness for a long time, I completely agree with you, butnow I work with high net worth clients. I'm curious to knowif you’ve tax-effected your numbers. If we assume that thebonds in a 60/40 portfolio are municipal bonds, and weassume a very inefficient tax structure for most hedge funds,am I correct that the numbers would be even worse?Simon Lack: Yes, they would be much worse. And hedgefunds do a lousy job in generating ordinary income. Clearlyfor taxable investors, hedge funds are highly tax inefficient. Iwas once a taxable investor in an incubator fund andrecognized how bad that was; the only mitigating featurewas that I didn't have to pay the fees that we charged otherclients, because I ran the fund.Restructuring Counsel: Across the life of funds, fromperformance reporting to the redemption process tolitigation, we see issues around valuation. I wonder if youhave an industry-wide prescription for those valuationproblems, things that investors should be looking at tosafeguard their interests.“I think the open-ended fund structure that'sprevalent in the hedge fund industry isdis-advantageous to many investors.”Simon Lack: The fact is that there's no mid-market; there’s abid and an offer. You have fund documents that assume aNet Asset Value based on mid-market value - and it's ahypothetical concept. In reality, any portfolio has a highNAV if you need to buy securities, and a bit lower NAV if youneed to sell securities for money coming out.I’ll give you an example. We invested 25 million of seedcapital in an equity market-neutral fund in San Francisco thatruns 3 to 1 leverage in a quantitative strategy. I had dailytransparency as a non-negotiable requirement.10/10/2012 Hedge Funds RoundtableOn the first day, the P&L was down 35 basis points and I wastold that was due to market impact costs. The month goesby and the fund is up a little bit. Another month goes by andanother 25 million comes in from another investor. We’redown 17 basis points on the first day, because the second 25 million is now invested with the same market impactcosts, but the costs are spread across twice the money.In fact, as money comes into a fund that is growing, thereare market impact costs incurred to employ new capital.Hedge fund managers totally understand this, but mostinvestors don't; hedge fund managers have no reason toexplain this to clients. It's the same thing in reverse whenmoney comes out. If you're in a hedge fund where assetsare declining and monies are coming out, you also pay partof the fees and expenses of the assets being sold to pay outcash to the departing investor.“There’s an inequitable allocation of costs.”So I suggested we should change this and charge an entryand exit fee for new money, and that fee should be ourestimate of the market impact costs of money coming in. Isuggested that the fee should go to the fund, not themanager, and be used to defray the cost of new moneycoming in and going out. This doesn't change the economicsoverall; it just makes sure that the costs are equitablyallocated. The company did a second fund with this entryand exit fee and they had a hell of a time convincinginvestors that it wasn't just another fee.The open-ended fund structure really should only exist forstrategies that are in liquid securities such as governmentbonds and large cap U.S. equities, where the market impactcosts of money coming in and going out are minimal. Everyhedge fund, in my opinion, should actually be a closed-endfund where investors get in and out based on whatever theprevailing discount is. The problem with that is thatclosed-end funds generally trade at a discount, and it's avery small, inefficient market in the U.S. They trade at adiscount for a reason, because of the value of that liquidity.iief.orgPage 5

“Investors will claim that they read the small print and the LPA,but you really pay attention to it only when things go wrong.”- Simon LackQ&A with Simon Lack Continued:Simon Lack: Here’s another example. We invested in aconvertible arbitrage fund called Acuity. We had the right totake money out intra-month, based on what the NAV was. Ibenefited from daily transparency. We had our own internalrisk management rule; if we were down more than 10%, wehad to take some of the money out. We saw the dailyresults go down the gutter and wanted to take half ourmoney out. All of a sudden, Acuity’s results accelerateddown. Knowing that they were going to be giving us backour money, they valued the portfolio using the mid-marketof convertible bonds - thereby depressing the NAV. This isall legal; it’s all within the discretion of the manager. I wasreally angry and said, “You guys are ripping me off; youshould be consistent.”There's no real consensus on this issue. Some people wouldsay that if they have to sell bonds to give you your money, ofcourse they should value the portfolio on the bid sidebecause that's where they have to sell the bonds. If money’scoming in, they should use the offer side because they haveto buy bonds to invest that new money. In our case, Acuityalready had cash, so they really did rip us off. They just gaveus the cash they already had, didn't sell any bonds andvalued our portfolio on the bid side – so all the remaininginvestors benefited from getting someone out at a bad price.“Hedge fund investors shoulddemand transparency.”I would never have known this if I didn't have completetransparency. I sat with a trader on the convertible bonddesk at J.P. Morgan to figure it out. Most investors don'thave this level of insight, which is one of the reasons whyhedge fund investors should demand transparency. There isa lot wrong with the current open-ended fund structure. Anopen-ended fund is great for the manager, because you setup one fund and create the illusion of a discrete NAV whereeverything can get done with no friction.10/10/2012 Hedge Funds Roundtable“Investors delude themselves into thinking thatthey really have 30-day liquidity.”If they understood more, they would ask for transparency.But they don't even know to ask for it, because if you haven'tactually traded and incurred market transaction costs, it’snot a normal thing to think about.Insolvency Administrator: Beyond transparency, did youdraw some conclusions about corporate governance?“I think investors have very weak rights, and it'svery hard for investors to act in concert – or evenget a list of other clients from the manager.“Simon Lack: Investors will claim that they read the smallprint and the LPA, but you really pay attention to it onlywhen things go wrong. I think investors have very weakrights, and it's very hard for investors to act in concert – oreven get a list of other clients from the manager. In a publiccompany, you can have a proxy fight where everyone has allthe same information. But in a hedge fund, you can’t requirethe manager to communicate information that you'd like toshare with other investors in the fund.Prior to ‘08, few people really thought that governancerights would be that important. But in recent years, I’vebeen quite shocked. One manager we had took a portfoliothat had been suspended for two years and sold it to aprivate equity group at a third off the NAV that he hadpresented to us. The investors never had the opportunity tosay, “Before you sell that portfolio, can we at least considerfiring you and finding someone else to manage theportfolio?” This illustrated for me how much control themanagers have.The program continued with aRoundtable Discussion (Beginning on Page 7)iief.orgPage 6

“The differences between a corporate structure and the typical operations of ahedge fund have a significant impact on the rights of investors and managers.”- Investors’ CounselRoundtable Discussion:Moderator Allan Bell announced that Chatham House ruleswould be followed to encourage frank and open dialogue.Only the keynote speaker’s and moderator’s comments areattributed by name in this discussion summary.Roundtable topics: Fiduciary Standards Governing Hedge FundsHow To Get Out Of A Zombie Hedge FundClawbacks: The Law Post–MadoffInsider Trading And Hedge FundsValuation Issues: Can You Trust Your NAVFiduciary Standards Governing Hedge FundsInvestors’ Counsel: This issue has gotten a lot of attentionrecently, both in the Delaware courts and in some offshorejurisdictions – including the Cayman Islands and the BVIs.Hedge funds, as everyone knows, are a completely differententity than traditional equities; they’re either governed by aforeign law, or by Delaware LLP or LLC law.The differences between a corporate structure and thetypical operations of a hedge fund have a significant impacton the rights of investors and managers. Delaware's LLCprogram essentially allows all the rights to be contractbased, whereas the corporate structure imposes fiduciaryduties. The default rule under Delaware law is that a hedgefund manager has all the fiduciary duties that a director of acorporation has, but Delaware law allows you to eliminate orrestrict those fiduciary duties by contract.As the industry has grown, managers and the people whocreate hedge funds have become increasingly adept atdrafting clauses and restrictions on shareholders’ rights toeliminate their fiduciary duties. Let’s take Simon’s exampleabout a manager who sold the portfolio at a dramaticdiscount without consulting the investors.10/10/2012 Hedge Funds RoundtableUnder typical fiduciary duty law, there would be significantrecourse, depending on how the sale was done. But if theLLC agreement was drafted in favor of the manager, theinvestors are stuck. With offshore funds, investors’ rightsare essentially limited to seeking a wind-up or liquidation ofthe fund under Cayman or BVI law, and it's often harder todo that in the BVIs than in the Cayman Islands.How much do hedge fund investors actually pay attention tothe LLC agreement and the underlying laws? Do they fullyunderstand the limitations on their liability and responsibility– and the differences between the remedies and rightsavailable in an equity investment versus the rights availablein a hedge fund context? Investors could positively impacttheir investments by choosing more responsible LLCorganizations - rather than ones that essentially create ablack box with no remedies.“After the convulsion of 2008,I thought we'd see a big shift in LLP termsprotecting investors, but that hasn't occurred.”Family Office Advisor: I do strategy work with families andwealth management firms, am chairman of a majorAmerican not-for-profit and I served in a state legislature.After the convulsion of 2008, I thought we'd see a big shift inLLP terms protecting investors, but that hasn't occurred. Ieven thought there would be a populist movement in thelegislatures, but that hasn’t happened either. Hedge fundsstill seem to control the game.Investors’ Counsel: I think that’s because the person writingthe documents wants maximum flexibility. It's a race to thebottom, just as it was in corporate law back in the 80s and90s.Family Office Advisor:But Simon was able to gettransparency with the San Francisco fund in which heinvested 25 million.iief.orgPage 7

“An important shift has occurred in the last five years:over 90% of the assets in the alternative space are going to managers with 5 billion or greater in assets. ” - Fund CounselSimon Lack: That's because we were a seed investor andtransparency was non-negotiable. I think the reason whyLPs haven’t gotten better terms is that looking at thedocuments is the last thing investors do – and hedge fundsare not easily substitutable. Once you've selected a hedgefund and done all the investment analysis and research, thenyou review the offering documents and terms. It would beunlikely for an investor to say, “We like everything aboutyou, but we don't like the liquidity terms. If you won't give usthose terms, we’ll go with another hedge fund.” Maybeinvestors should start out by saying, “Here are the basicterms on which we invest; if you don't like them, we won'tdo any due diligence on you.” Investors are not doing that.Fund Counsel: At the SEC, I used to prosecute moneymanagers. I started a law firm and we represent over 800funds as well as investors. An important shift has occurred inthe last five years: over 90% of the assets in the alternativespace are going to managers with 5 billion or greater inassets.Last December, I worked on a 500 million allocation from astate government going into one manager. There are alimited number of managers large enough to take aninvestment of that size, so the big investors will investregardless of what the terms are. There's a large swath ofmanagers with whom they probably could negotiate muchmore friendly terms, but they’re not suitable investments byvirtue of their size. On the other hand, smaller investorswith 15-25 million are too small to have negotiating power.Family Office Advisor: You’re on to a big theme in my worldof family offices. While large families with 1 billion to investmight take a unit and invest it into an LP, it’s still a smallamount to some of these funds. There are no standards fordue diligence at the family office level. In fact, in contrast towhat you would think would be a movement towardstandardization, there is no real community emergence ofstandards in the family office world. There is actually amovement in the opposite direction.10/10/2012 Hedge Funds Roundtable“Investors may pay the fees buthedge funds are the real clients.”Simon Lack: Here's a true story. A very large hedge fundwas meeting with a big U.S. pension fund. The chief riskofficer of the hedge fund was presenting and the investorsaid, “We've been invested with you for two years, haveplaced 500 million with you, and I don't think you know myname.” The chief risk officer paused, left the room, cameback in and said, “I've been in this business 30 years, and noone's ever talked to me like that. You're going to apologizeto me right now.” The pension fund is still a client!That's why I went into the seeding business. In the 90s, Iinvested in big hedge funds as part of a proprietary portfolio.You have to put your kneepads on to become a client and Ididn't want that. I wanted to invest where I had a stronghand to negotiate. Don’t invest in a market where you havesuch a weak negotiating position; there’s a lot better thingsto do with your life.“When you buy a TV set, you don’t read the fineprint and say, ‘I don't like the way Panasonic limitsits legal liability, so I won’t buy a Panasonic.’ ”Institutional Investors’ Counsel: Unfortunately, it seemsthat investors deal with their hedge fund investments in thesame way. And that's why we need the protection oflegislative rules, because investors are not going to do it forthemselves. There need to be limits on how far funds can gointo abridging these rights.Fund Counsel: But isn’t that a slippery slope? Weunfortunately live in a world where people don't takeresponsibility for their own decisions, and sadly Dodd-Frankis going to make that worse. Investors expect registrationwill be a cure-all for fraud, and it's not. You need to knowwhat you're getting into and be willing to walk away fromthe deal.iief.orgPage 8

“Fairness should be a basic ground rule. But under the statutes now, you areallowed to eliminate even the most basic requirements for fairness.”- Investors’ CounselInstitutional Investors’ Counsel: Experience has shown thatinvestors are not going to adequately protect themselves.You have to have a default rule; the question is whether itwill be more protective or less protective of investors.Fund Counsel: There are rules in place; there are anti-fraudprovisions.Fund Counsel: I’d rather the government get involved ineducating investors. In the alternative space, accreditedinvestors make up just 8% of the entire population.Given that we’re in an environment where governmentseems to be growing, not shrinking, it’s a concern for me tohave government intervene further.Investors’ Counsel: There are some basic ground rules thatapply in normal business organizations that don’t have toapply in the LLP context.For example, I had a case several years ago in which the fundmanager transferred assets to the general partner. Underthe LLC agreement, they waived the manager’s fiduciaryduties and they argued that they also waived fiduciary dutiesto the general partner. And as a result, they argued, theasset transfer didn't have to be on fair terms to the fund orto the investors. We were able to argue that the agreementwasn't carefully drafted enough, and they wound up settling.Fairness should be a basic ground rule. But under thestatutes now, you are allowed to eliminate even the mostbasic requirements for fairness.Fund Counsel: One of the very basics of Delaware Law is toa

was one of the first to invest in hedge funds. In an interview recently with Reuters, he said that this is a make or break year for hedge funds, because the past five years have all been bad. When you put the five year returns into the mean variance optimizer, hedge funds will start to look a lot less attractive.