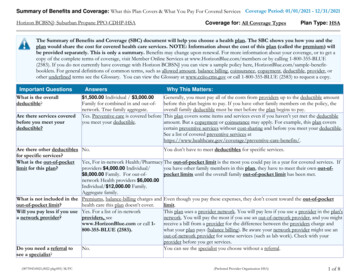

Transcription

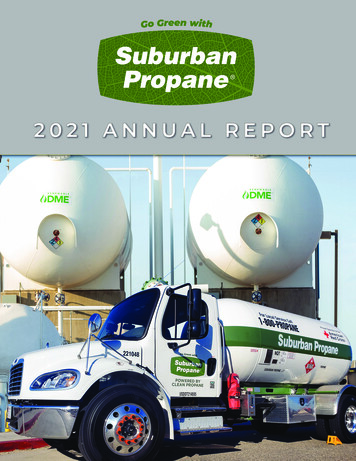

Suburban Propane Partners, L.P.Investor PresentationMay 6, 2021

Forward-Looking StatementsThe following information contains “forward-looking statements,” relating to our future businessexpectations and predictions and financial conditions and results of the operations. Some of thesestatements can be identified by the use of forward-looking terminology such as “prospects,” “estimates,”“intends,” “may,” “will,” “should,” “contemplates,” “expects” or “plans” or the negative or other variation ofthese or similar words, or by discussion of trends and conditions, strategies or risks and uncertainties.These forward-looking statements involve certain risks and uncertainties that could cause actual results todiffer materially from those discussed or implied in such forward-looking statements. The forward-lookingstatements are subject to a number of factors and uncertainties that could cause actual results to differmaterially from those described in the forward-looking statements. A full discussion of our operations andfinancial condition, including factors that may affect our business and future prospects is contained indocuments we have filed with the SEC and will be contained in subsequent filings with the SEC. You shouldalso refer to the factors included under the captions “Risk Factors” and “Disclosure Regarding ForwardLooking Statements” in our Annual Report on Form 10-K for the fiscal year ended September 26, 2020 andQuarterly Report on Form 10-Q for the quarterly period ended March 27, 2021. While we believe that ourassumptions are reasonable, it is very difficult to predict the impact of known factors on, and it is impossibleto anticipate all factors that could affect, our actual results. We undertake no obligation to publicly update orrevise any forward-looking statement as a result of new information, future events or otherwise, except asotherwise required by law.2

Suburban PropanePartners Update3

Overview of Suburban PropaneSuburban engages in the retail marketing anddistribution of propane, renewable propane,fuel oil and refined fuels, as well as themarketing of natural gas and electricity in theUnited States Continuously engaged in retail propane businesssince 1928 Investor in low carbon fuel alternatives since 2020Proudly Serving Since 19283rd largest propane gas marketer in the UnitedStates with a 5% market share Diverse business operations with approximately700 locations in 41 states Concentrated on U.S. coasts, the most attractivepropane markets nationally Serving approximately 1.0 million residential,commercial, industrial and agriculturalcustomers Employees: 3,170 2.1 billion Enterprise Value (1)4(1)Based on closing Unit price as of May 5, 2021 and outstanding debt of 1,181 million as of March 2021.Gross Margin by Segment (FY 2020)

Overview of the Propane Industry Propane is a clean burning, versatile energysource Alternative to natural gas due to ease ofportability Generally less expensive than electricity as aheating sourceConsistent 5% share of U.S. householdenergy market over past several decadesMature, unregulated and highlyfragmented industry Majors still only 26% market share – despitesignificant acquisition activity Over 5,000 independent propane retailersU.S. Propane Market Share (2)5,000 IndependentRetailersOverall forecasted propane demand growthof roughly 17% in the U.S. between 2017 and2025(3) 5Household Energy Sources (1)Propane is a basic necessity to manycustomers for heating, cooking andagricultural purposesGrowth in demand is forecasted across all keysectors with the largest driver coming from theengine fuel markets(1)(2)(3)US Census Bureau American Community Survey - 2019.Feb 2021 LP Gas Magazine and Dec 2020 PERC Annual RetailPropane Sales Report.Source: ICF International.

Expansive SPH Operating FootprintOperations spread throughout approximately 700 locations in 41 states with concentrationin most attractive East Coast and West Coast regions Organized and managed through 180 Customer Service Centers in 11 RegionsLegendCorporate Headquarters –Whippany, NJBlueRed6Customer Service CenterSatellite location

Streamlined Organizational Structure andConservative Balance Sheet Management Streamlined capital structure enhances cost ofcapitalSPH is controlled by unitholders through anelected Board of Supervisors -- six of the sevenBoard members are independentGeneral Partner has no economic interest in SPHIncentive Distribution Rights (IDRs) eliminatedthrough GP conversion in October 2006Leverage now under 4.0x, with target leverage inthe mid 3x Total Debt / Adj. EBITDA range( in millions)As ofMaturityCash and Cash EquivalentsRevolver ( 500.0)3/5/2025Rate(1)3/27/2021 6.7L 20056.2Total Secured Debt 56.25.500% Senior Notes due 20246/1 /20245.500%525.05.750% Senior Notes due 20253/1 /20255.750%250.05.875% Senior Notes due 20273/1 /20275.875%350.0Total DebtSuburban Energy Services LLC(the “General Partner”)0.0% Interest0.0% InterestSuburban Propane Partners, L.P.(NYSE: SPH)62.5 Million Common Units 1 ,1 81 .2Market Value of Equity (5/5/2021 )91 1 .1Total Capitalization 2,092.3LTM 3/27/21 Adj. EBITDA(3) 299.1Total Debt / Adj. EBITDA3.95xWeighted Average Maturity4.1 Years100.0% InterestSuburban Propane,L.P.(the “OLP”)(2) 444 56 525 350 2502021202220235.500% Senior Notes due 2024Revolver Undrawn202420255.750% Senior Notes due 20255.875% Senior Notes due 2027202620272028Revolver Drawn ( 500)100.0% Interest7OperatingSubsidiaries(1)Revolver shall have a springing maturity to 91 days ahead of the 2024 Senior Notes.(2) Excludes Letters of Credit outstanding.(3) Pursuant to the Credit Agreement, EBITDA for purposes of debt covenant metrics excludes unit-based,non-cash compensation expense. See Reconciliation of Non-GAAP Measures on Slide 21.

Key InvestmentHighlights8

Key Investment Highlights1Stable Margins andFree Cash Flow2 History of DisciplinedAcquisitions 3 Unique OperatingPhilosophy andAdvanced SystemsPlatform4Strong Commitmentto ESG InitiativesConservative BalanceSheet Management69Experienced andProven ManagementTeamInergy Propane acquisition (August 2012) for 1.8 billion increased Suburban’s size,scale and financial resources, while reducing overall business risk profileAgway Energy acquisition (December 2003) for 205 million significantly increasedpresence in attractive Northeast market and transformed into distributor of multiplefuelsAcquired 39% equity stake in Oberon Fuels as first step toward renewable energyplatformProven track record of successful integration and achievement of targeted synergies Proven track record of managing cost structure and driving operating efficienciesCentralized/regionalized approach for majority of back office activitiesStreamlined management structure to facilitate decision-making and accountabilitySignificant investments in people and technology to enhance customer–oriented focusAdvanced, scalable systems infrastructure Go Green with Suburban Propane pillar focuses on advocacy for the versatile, clean- 5Flexible cost model and low maintenance capex needsSubstantially insulated from commodity price fluctuationsDiverse geography and customer base enhances cash flow stability burning attributes of propane and investing in innovative renewable energy solutionsSuburbanCares pillar highlights our devotion to our dedicated employees and ourphilanthropic initiatives to support the local communities we serve; inclusive ofnational partnership with the American Red CrossSimple, investor friendly organizational structure and governanceTarget leverage in the mid 3x Total Debt / Adj. EBITDA rangeStrong distribution coverage permitted significant deleveragingStrong banking relationships (recently extended 5-year Revolver through 2025)Management team has a reputation as “best in class” operators in well-establishedindustryHighly tenured operational management team with deep industry knowledgeSenior leadership team has over 300 years of combined service

1Stable Margins and Free Cash Flow Flexible cost structure mitigates weathersensitivityVolume by Region (FY 2020) Diversity of geography and customer mix Geographic diversity provides a naturalhedge to weather fluctuations Well-balanced customer mix reducesvolatility of cash flows Commodity price changes are typically passedon to end-users Substantially insulated from commodityprice volatility Supply and risk management activitiesensure the availability of product whilelimiting price risk exposure, especially intimes of volatility 90% of annual volumes are sold underfloating price arrangements allowing passthrough of fluctuations in commodity prices Low maintenance capex requirements Significant tank ownership percentage ( 85%)and focus on customer service drives strongretention10Volume by Customer Type (FY 2020)

1Historical Weather and Margin TrendsHeating Degree Day (“HDD”) % of Normal in Suburban’s Operating Area10-Year Average HDD% -- 92% (1)Record Warm% -- 83%Average HDD% for the last ten years (2011 – 2020) was 92% of Normal(1) Record warm or near-record warm temperatures 3 out of last 10 years Adapted demand outlook and manpower planning to reflect 10-year average HDD%“Normal” represents the thirty-year average heating degree days as measured and provided by National Oceanic and Atmospheric AdministrationUnit Margin and Commodity Price TrendsPre-Inergy Acquisition Consistent longterm historicaltrack record ofeffective marginmanagement,regardless ofcommodity priceenvironment11Inergy Acquisition (2012) and Integration

2Focused Business Strategy To deliver increasing value to investors through initiatives, both internal andexternal, that are geared toward achieving sustainable, profitable growth Driving operational efficiencies Streamlining/right-sizing cost structureInternal Enhancing the customer mixGrowth Maximizing customer base growth andretention New market penetration Selective and disciplined approach towardacquisitions Focus on propane distributors instrategically attractive markets Successfully integrated 11 acquisitions overthe last ten years -- investing 125 millionExternalGrowth Strategic diversification through the build-outof a renewable energy platform 12Acquired 39% equity stake in Oberon Fuelsin October 2020Select Notable Acquisitions

2Oberon Fuels: Multiple Pathways to theCommercialization of Dimethyl Ether (“DME”)13

3Unique Operating Philosophy and AdvancedSystems Platform“Our Business isCustomerSatisfaction”“Close the BackDoor”“ExceedingCustomerExpectations”14 Streamlined operating platform creates an infrastructure to better serve customers 24/7/365 emergency service and automatic delivery Budget payment plan and other billing options User-friendly customer portal for online account management Full service energy provider New technology in the hands of drivers and service technicians to enhance customerexperience and drive efficiencies With steady rate of new customer activity,customer retention is key to growth Investing in understanding and trackingthe reasons for customer losses Real-time tracking system used to trackcustomer complaints and follow upresolution High-performance customer servicetraining and coaching programcustomized for Suburban to enhancecustomer interface and communications Ongoing reinforcement of telephone skillsand techniques to better serve customers

4Three Pillars of the Suburban Propane ExperienceEnvironmental, Social and Governance (ESG)We launched the ‘Three Pillars of the Suburban Propane Experience’ in June 2019 to emphasize our commitment to excellencefor the comfort and safety of our customers, our devotion to our dedicated employees to provide for their safety and careerdevelopment, our philanthropic efforts to give back to the communities we serve, our work to advocate for the inherentenvironmental benefits of using propane as a clean energy solution and our strategic vision to invest in and develop innovativesolutions to help pave the way to lowering greenhouse gas esSuburbanCommitment Recognized for its low environmental impact bythe Clean Air Act Amendments, propane canoffer immediate opportunities to reduce carbonemissions over traditional fossil fuels Propane is non-toxic, does not produce sulfurdioxide, and emits 60-70% fewer smogproducing hydrocarbons than gasoline anddiesel Sold more than 2.7 million gallons of propaneannually to the over-the-road vehicle market,which helped reduce carbon emissionsannually by approximately 19 million pounds,or 55%, compared to diesel Contracted for the supply of approximately 1.0million gallons of renewable propane,produced from waste fats and oils, to meetcustomer demand for renewable energy source Acquired a 39% equity stake in Oberon Fuels,Inc., a development-stage producer of a lowcarbon transportation fuel called dimethyl ether,or DME, which can be produced from renewablesources such as timber waste from the paperand pulp industry or dairy biogas Dedication to philanthropic endeavors throughour national partnership with the AmericanRed Cross and countless local communitysponsorships and events, as well as manyemployee-focused initiatives that differentiateSuburban as a great place to work Delivering excellence locally, backed by ourstrong national presenceGo Green withSuburban Propane15 Supported frontline activities associated withCOVID-19 by providing vital temporary heatand power generation for makeshift testingtents, hospital sites, shelters and fooddistribution centers Recognized as a S&P Global Platts finalist intheir 2020 Corporate Social Responsibilitycategory In further support of our commitment tobuilding a diverse and inclusive culture atSuburban, we have developed manyemployee-focused initiatives to supportemployee career development and hiring, suchas our “Steer Your Career” program, our “HeroesHired Here” program and our “ApprenticeProgram” 90 year legacy of unwavering commitmentto excellence for benefit of all stakeholders SPH was one of first publicly-traded MLP’s toeliminate the “incentive distribution rights” ofits GP (completed in 2006) The GP does not have any economic interestin SPH or our Operating Partnership.Therefore, unlike many publicly-tradedpartnerships, SPH is controlled by ourUnitholders through the independentlyelected Board Six of the seven members of the Board ofSupervisors are independent (March 2021) We consider all aspects of a candidate’squalifications and skills with a view tocreating a Board with a diversity of experienceand perspectives; including diversity withrespect to race, gender, age, background andareas of expertise

5Conservative Balance Sheet Management Strong free cash flow, after distributions, provides funding for investing in growth and maintaining balancesheet strength Maintain balanced approach to investing in strategic growth and balance sheet management. Use offree cash flows over the last three plus fiscal years:2018Acquisition consideration(*)Debt reductionTotal 16.819.035.82019 22.830.152.92020 23.418.942.3Mar 2021YTD 7.738.446.1Total 70.7106.4 177.1(*) Includes non-compete consideration paid over the non-compete period. Target leverage profile in the mid 3x Total Debt/ Adjusted EBITDA range Consolidated leverage ratio as of March 2021 was 3.95x Maintenance of strong distribution coverage Distribution coverage at the current annualized distribution rate of 1.20 is 2.77x for TTM March 2021 Strong liquidity position Unused borrowing capacity of 390 million as of March 2021 under the Revolving Credit Agreement Staggered and long-dated debt maturities with no funded maturities until 2024Historical Leverage Trends16

6Experienced and Proven Management TeamMichaelStivalaMichaelKuglinA. DavinD’AmbrosioPresidentand ChiefExecutiveOfficerChiefFinancialOfficerand ChiefAccountingOfficerVicePresidentandTreasurerHas served as President, Chief ExecutiveOfficer and Supervisor since 2014Has served as Chief Financial Officer andChief Accounting Officer since 2014Has served as Treasurer since 2002 and VicePresident since 200720 years of industry experience13 years of industry experience25 years of industry experience35 years of industry experienceDouglasBrinkworthSenior Vice President, Product Supply,Purchasing and LogisticsNeilScanlonSenior Vice President, Information Services23 years of industry experienceDanielBloomsteinVice President and Controller6 years of industry experienceFrancescaCleffiVice President, Human ResourcesM. DouglasDaganVice President Strategic Initiatives –Renewable EnergyBryon L.KoepkeVice President, General Counsel & SecretaryKeithOnderdonkVice President, Operating SupportMichael A.SchuelerVice President, Product SupplySteven C.BoydChief Operating OfficerGreg BoydArt Tate1728 years of industry experience2 year of industry experience15 years of industry experienceVice President, Area Operations31 years of industry experienceVice President, Area Operations35 years of industry experienceDan BoydTom Ross23 years of industry experience1 year of industry experience20 years of industry experienceVice President, Area Operations29 years of industry experienceVice President, Area Operations23 years of industry experience

Financial Update18

Operational and Financial PerformanceRetail Propane Gallons Sold (MM)Adjusted EBITDA ( MM)600125% 300125% 290 283120%120% 275500415421440115%427403 275115%417 254110%400105%300 250110% 243105%100%93%94%90%20092%95%100% 225 22393%94%90%92%90%83%90%85%85%10095% 20083%85%85%80%80%075%2016201720182019Propane Gallons2020 175TTM Mar '2175%2016HDD%5.28x20182019Adjusted EBITDALeverage5.50x20172020TTM Mar '21HDD%Distribution 201820192020TTM Mar '2120162017TTM Mar '21Notes:i. Adjusted EBITDA, Leverage and Distribution Coverage are non-GAAP terms. See Reconciliation of Non-GAAP Measures on Slide 21. Adjusted EBITDA used for debt covenant metrics utilized for theLeverage chart.ii. Distribution coverage reflects actual distributions paid of 3.55, 3.55, 2.69, 2.40, 2.10 and 1.50 per unit for fiscal 2016, 2017, 2018, 2019, 2020 and TTM March 2021, respectively. The annualized distributionrate based on the quarterly distribution declared in respect of the second quarter of fiscal 2021 was 1.20 per unit. Pro forma distribution coverage at the current annualized rate for TTM March 2021 was2.77x.

Appendix20

Reconciliation of Non-GAAP Measures in millions, except per unit information2016Net incomeAdd:Provision for (benefit from) income taxesInterest expense, netDepreciation and amortizationEBITDAUnrealized (non-cash) (gains) losses on changesin fair value of derivativesEquity in earnings of unconsolidated affiliateMulti-employer pension plan withdrawal chargeProduct liability settlementPension settlement chargeLoss on debt extinguishment(Gain) loss on sale of businessAdjusted EBITDA 14.4 0.675.1129.6219.7 1.26.63.02.00.3(9.8)223.0Less:Maintenance capital expendituresCash interest expenseProvision for income taxes - currentDistributable cash flow2017 38.0 0.575.3127.9241.7 (6.3)6.11.6243.016.674.30.6 131.6Free cash flow DistributionsDPUUnits Outstanding Growth capital expenditures 76.5 (0.6)77.4125.2278.5 (0.3)4.8283.011.373.00.5 158.3109.8 215.53.5560.8 21.8Distribution Coverage Ratio:Maintenance capital expenditures onlyTotal capital expendituresFiscal Year Ended September2018201968.6 0.976.7120.9267.0 8.0275.013.273.60.5 195.7141.4 216.63.5461.1 16.90.61 x0.51 x 60.8 (0.1)74.7116.8252.1 0.41.10.1253.713.973.00.9 187.3176.0 147.22.4061.4 19.70.73 x0.65 x2020 37.4 0.175.8118.7232.0 2.60.1234.713.471.20.3 168.8166.2 147.92.4061.7 21.11.33 x1.20 xTrailing Twelve Months EndedMarch 2020March 2021108.4 1.072.7113.6295.7 (8.0)0.41.6289.714.372.10.6 147.6149.7 130.22.1062.1 19.11.27 x1.12 x 12.169.20.9 207.5123.1 193.3148.32.3962.1 93.31.4962.524.61.30 x1.15 x14.21.00 x0.83 x2.22 x2.07 xTotal Debt 1,221.2 1,287.6 1,268.6 1,238.5 1,219.6 1,270.1 1,181.2Adjusted EBITDA, per aboveUnit-based, non-cash compensation expenseAdjusted EBITDA, for debt covenant calculations 223.08.3231.3 243.07.3250.3 283.08.2291.2 275.010.5285.6 253.79.2262.9 234.78.8243.5 289.79.4299.1Debt/EBITDA21(1) 5.28 x 5.14 x 4.36 x 4.34 xPursuant to the Credi t Agreement, EBITDA for purposes of debt covenant metri cs excl udes uni t-based, non-cash compensati on expense. 4.64 x 5.22 x 3.95 x

9 Key Investment Highlights History of Disciplined Acquisitions Inergy Propane acquisition (August 2012) for 1.8 billion increased Suburban's size, scale and financial resources, while reducing overall business risk profile Agway Energy acquisition (December 2003) for 205 million significantly increased presence in attractive Northeast market and transformed into distributor of multiple