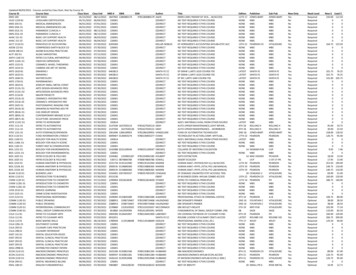

Transcription

DEPARTMENT OF HUMAN RESOURCES2022 RetireeBenefits Bookrefresh · restart · renew

Receive benefits information right on your phone! Text the word Gwinnett to 833.437.0978 ORscan the QR code to the left. Then reply GC Retiree

TABLE OF CONTENTS62022 Benefit Changes7Health Plan Eligibility Information102022 Benefit Changes Plans12Kaiser HMO15Aetna Traditional PPO19Aetna Bronze, Silver, and Gold Max Choice HSA23Humana Medicare Advantage25Dental Plan27Vision Plan28GC Retiree Website29My GCHub (Formerly ESS) Instructions34Important Information for Gwinnett County Retirees35Gwinnett County Human Resources Contact Information36Vendor Contact Information2022 Retiree Benefit Plans 3

Gwinnett CountyBoard of Commissioners2022 Retiree Benefits PlansWelcome to the Retiree Benefits program. Gwinnett County provides a broad range of benefits designed to support all aspects of retireehealth and wellbeing and to provide financial protection. This book provides details about the benefits options available to you and youreligible dependents. Also find important eligibility and enrollment information. Both the retiree and the County contribute to the cost ofbenefits. Premiums are included in each section.Find additional resources on GC Retiree, including the Annual Enrollment video and presentation and the Annual Enrollment guide.The GC Retiree website also has Summary Plan Descriptions (SPDs) and details, as defined by the Funding and Eligibility Policy for OtherPost-Employment Benefits (OPEB) Policy.2022 Retiree Benefit Plans 4

Benefits PlansThe Gwinnett County Board of Commissioners reserves the right to revise benefits offered atany time and the right to charge appropriate premiums for these benefits.The benefits and premiums listed in this book are effective as of January 1, 2022, and are notguaranteed to remain the same in future years.Please note: Fraudulent statements on benefits application forms or website (My GCHub, formerly known as ESS)enrollment will invalidate any payment of claims for services and will be grounds for canceling the retiree’s benefit coverage.2022 Retiree Benefit Plans 5

2022 UpdatesPre-Medicare Medical Plans There are no changes to deductibles, coinsurance, or out-of-pocket maximums. Medical plan costs are trending higher, and many retiree plans have reached the County’s maximum contributionamount as outlined in the Other Post Employment Benefits (OPEB) policy. While the County will continue tocontribute toward the cost of retiree health care, premiums will increase for 2022. Please review the many planoptions available to determine the right plan and costs for you.Two new, free programs are coming for Aetna members in 2022: Aetna Back and Joint, powered by Hinge Health, is an app-based, digital physical therapy program to help manageback, knee, shoulder, neck, and hip pain. Aetna Second Opinion, partnered with 2nd.MD, provides access to elite specialists for questions about new orexisting conditions, surgery or procedures, medications, and treatment plans.New Humana Medicare Advantage Plan – Same Benefits, Lower PremiumsHumana will replace Aetna as the Medicare Advantage Plan’s insurance carrier with no changes to the benefits, lowerpremiums, and minimal prescription formulary changes. If you are currently enrolled in the Aetna Medicare AdvantagePlan and make no changes during Annual Enrollment, your enrollment will automatically transfer to the new HumanaMedicare Advantage Plan. If you have questions, call 866.396.8810 to speak to a Humana representative.CignaThere are no changes to plan designs and premiums decreased.VSPThere are no changes to plan designs or premiums.2022 Retiree Benefit Plans 6

HEALTH PLANELIGIBILITY INFORMATIONMedical Levels of Coverage Retiree only: No dependent coverageRetiree spouse: No dependent childrenRetiree child(ren): Employee one or more children, no spouseFamily: Retiree, spouse, and child(ren)Coverage for the retireeThis document describes the benefits an eligible retiree may receive through health plans (medical, dental, vision, and EAP) offered by Gwinnett County.Employees approved for a medical disability while employed by Gwinnett County are eligible to continue health, dental, and/or vision benefits at retireerates for a maximum of two years. Benefits can continue past two years if the disability is total and permanent, as defined by the Social SecurityAdministration, and if the employee is receiving approved disability benefits provided by Gwinnett County. Refer to CA OPEB Policy for additional detailsconcerning continued benefit eligibility.Coverage for the retiree’s dependentsIf the retiree is covered by Gwinnett County health plans, eligible dependents of the retiree may also enroll. Only dependents who were eligible for benefitson the participant’s retirement date can be covered by any of the Gwinnett County benefits plans.If the retiree is covered, eligible dependents can enroll in any plan that offers dependent coverage. Eligible dependents are: Legal spouse Eligible children, who include: Natural children Stepchildren Legally adopted children (or children proposed for adoption) Foster children Appointed legal guardianship of a childRetirees adding dependents during Annual Enrollment, or adding dependents as a result of a qualified life status change, will be required to prove theeligibility of all dependents being enrolled in Gwinnett County medical, dental, and/or vision benefits. Gwinnett County’s eligibility requirements areincluded in this book. If documentation for a dependent(s) is not received and validated by the date specified, the level of coverage for elected benefitswill be “retiree only” as of their0 effective date.The Gwinnett County Department of Human Resources will verify all retiree and dependent eligibility. For a list of documentation required for eachpotentially benefit-eligible dependent (spouse, child, or stepchild) please refer to the Gwinnett County Summary Plan Document located on the GC2022 Retiree Benefit Plans 7

Retiree website.Important information about eligibility for Medicare:retirees and covered dependentsImportant Notice: Retirees are required to contact the GwinnettCounty Benefits Division 60 days prior to the date they or theircovered dependent(s) become Medicare-eligible. As soon as theretiree becomes Medicare-eligible they must immediately enroll inMedicare Part A and Part B to continue participation in GwinnettCounty health plans.The Gwinnett County health plan option for retirees and eligibledependent(s) who are Medicare-eligible is the Humana MedicareAdvantage Plan.Consider thisIf there is a non-Medicare participant and a Medicare eligible participant on the same coverage, the non-Medicareparticipant will be linked to a non-Medicare plan of choiceas provided by Gwinnett County. If there is a non-Medicareeligible retiree/dependent, coverage for the dependent willbe linked to a non-Medicare plan of your choice as provided by Gwinnett County.Retiree procedures for submission of documentationUpon final completion of the website enrollment process, print and review a confirmation statement to ensure accuracy of the enrollment. Supportingdocumentation must be received by the Department of Human Resources, Benefits Division, by the date specified. Clear photocopies of the documentswill be adequate. The documents submitted will not be returned.Enrollment must be completed within 30 days of retirement. Documents must be received in the Department of Human Resources within 30 calendardays of retirement or life status change for the benefits to become effective for the retiree and any eligible dependents.Document review proceduresDocuments will be reviewed by the Department of Human Resources staff. If the documentation is found to be adequate, no further action will be necessary.If documentation is deemed inadequate, a Department of Human Resources staff member will request additional documentation or clarification fromthe retiree. If the documentation does not support dependent eligibility for benefits, enrollment of the dependent will be denied. Medical, dental, and/orvision coverage for dependents ruled ineligible will be rescinded unless an appeal of this decisionis processed and approved.Immediately upon denial of a dependent’s eligibility, the employeewill be contacted by Human Resources.2020 Retiree Benefit Plans 8

Life status changeAt any time other than the annual enrollment period, retirees are unable to add or delete coverage for themselves ortheir dependents unless the retiree experiences a life status change, as defined by the IRS.For details of life status change, refer to the Gwinnett County Summary Plan Document located on the GC Retireewebsite.Important information: If a retiree experiences a qualified life status change that results in a request to add a dependentto any of his/her benefits plans, the request will be considered only if the dependent was eligible for benefits at the timeof retirement. Only dependents who were eligible for benefits on the retiree’s retirement date can be covered by any ofthe Gwinnett County benefits plans at that time or in the future. (See CA OPEB policy)The Department of Human Resources must be notified – in writing, with required documentation – within 30 calendardays of a qualified life status change if the retiree wants to apply for a change in coverage as a result of the change instatus. If approved, the requested change will be effective on the date of the qualifying event.

Qualified EventRequired Documentation of Proof Marriage CertificateQualified financial document (ie. tax filing, bank statement, rental agreement etc.)Completed Life Status Change FormDivorce or legal separation Divorce Decree or Legal Separation AgreementCompleted Life Status Change FormFailure to notify Human Resources in writing within 30 days of a divorce or legalseparation can result in reimbursement to Gwinnett County for any employer-paidpremiums for any ineligible dependents left on the planBirth and/or adoption Birth CertificateCompleted Life Status Change FormDeath of a spouse Death CertificateCompleted Life Status Change FormMarriage You, your spouse, or your eligible dependent has a loss of qualified coverage Other Proof of coverage lostMarriage Certificate and financial documentation if covering spouseBirth Certificate for eligible dependentsCompleted Life Status Change FormThis is not an exclusive list. Please contact Human Resources if you think you may have aqualified life status changeOpting out of benefits offered by Gwinnett CountyRetirees are given the opportunity to elect to continue receiving group health benefits at the time of retirement. If the optionto continue group health benefits is not elected within 30 days of retirement, and the retiree does not have comparable

2022 Benefits Plans Kaiser Permanente Gold and Silver HMO Plans Cigna Dental Plans Aetna Traditional PPO Plan VSP Vision Plans Aetna Maximum Choice HSAGold, Silver, and Bronze Plans Employee AssistanceProgram (EAP) Aetna Medicare Advantage Plan2022 Retiree Benefit Plans 11

Pre-Medicare Medical PlansYou can choose between Aetna and Kaiser.KaiserChoose from two Health Maintenance Organizations (HMOs). You must use an in-network provider—thereis no out-of-network coverage except in an emergency.AetnaChoose from three high deductible health plans. After you meet your deductible, the plan will pay a portionof covered services. You also have a traditional PPO option. Aetna is an open network, which means youcan pick and choose your medical providers.2022 Retiree Benefit Plans 12

Kaiser HMOCost to YouWhat’s CoveredSilver HMOIn-NetworkGold HMOIn-Network 2,150 per person 4,300 per family 1,200 per person 2,400 per family 6,100 per person 12,200 per family 3,700 per person 7,400 per family 65 copay 35 copayNo costVaries, based on typeand place of serviceNo costVaries, based on typeand place of serviceSpecialty Care Office Visit 85 copay 55 copayEmergency CareUrgent Care FacilityAmbulanceHospital Emergency Room 70 copay 100 copay per trip30% coinsurance after deductible 50 copay 100 copay per trip20% coinsurance after deductibleAnnual DeductibleOut-of-Pocket MaximumDeductible, coinsurance, and copay accumulate toward the Out-ofPocket MaximumPrimary Care Office VisitPreventive CareAffordable Care Act GuidelinesNon-ACA ServicesInpatient HospitalIncluding Mental Health and Chemical Dependency30% coinsurance after deductible20% coinsurance after deductibleInpatient/Outpatient Surgery30% coinsurance after deductible20% coinsurance after deductibleLab and ImagingInpatient and OutpatientLab, Diagnostic Clinic, or FacilityOutpatient VisitMental Health and Chemical DependencyNo cost with office visit;30% coinsurance outpatientNo cost with office visit;20% coinsurance outpatient 65 copay 30 copay2022 Retiree Benefit Plans 13

Kaiser HMOCost to YouWhat’s CoveredSilver HMOIn-NetworkGold HMOIn-Network30% coinsurance after deductible20% coinsurance after deductible 85 copay 50 copayMaternity ServicesSpecialty Office VisitPre and Post Maternity CareDelivery and Hospital Care 85 copay30% coinsurance after deductible 50 copay20% coinsurance after deductibleFamily PlanningSpecialty Office VisitDiagnostic Infertility Services (to diagnose condition)(Artificial Insemination and In-Vitro Fertilization are not covered) 85 copay30% coinsurance after deductible 85 copay20% coinsurance after deductibleSkilled Nursing Facility(60-day limit per calendar year)30% coinsurance after deductible20% coinsurance after deductibleHome Health Care(120-day limit per calendar year)30% coinsurance after deductible20% coinsurance after deductible0% coinsurance, no deductible0% coinsurance, no deductible 85 copay 55 copay 1,000 maximum benefit 1,000 maximum benefitRehabilitationPhysical TherapyOccupational Therapy(PT and OT: combined 20 visit limit per calendar year)Speech Therapy(20 visit limit per calendar year)Chiropractic Visit(30 visit limit per calendar year)Hospice CareVision Exam(no optical hardware benefit)Hearing Aids(every 3 years)2022 Retiree Benefit Plans 14

Kaiser HMOCost to YouWhat’s CoveredDurable Medical EquipmentSilver HMOIn-NetworkGold HMOIn-Network30% coinsurance after deductible20% coinsurance after deductibleNoneNone 30 copay 70 copay 10 copay 40 copay 60 copay 140 copay 20 copay 80 copayPrescription Drugs – Kaiser NetworkPharmacy DeductibleRetail (up to 30 days)GenericBrandMail Order (up to 90 days)GenericBrandDrug must be on Kaiser formulary to be covered unless medicalexception is approved. View Kaiser formulary at www.kp.org.Kaiser SilverHMO PlanKaiser GoldHMO PlanRetiree 233.03 409.09Ret Spouse 519.06 902.14Ret Child(ren) 486.98 865.52Ret Family 697.47 1,111.39Kaiser SilverHMO PlanKaiser GoldHMO PlanRetiree Spouse (1 Medicare) 381.77 575.94Ret Child(ren) (1 Medicare) 301.37 468.23Ret Family (2 Medicare) 273.56 283.29Ret Family (1 Medicare) 409.89 609.72Monthly Pre-Medicare Retiree PremiumMonthly Blended Retiree Premium(Pre-Medicare and Medicare Retiree)2022 Retiree Benefit Plans 15

Aetna Traditional PPOWhat’s CoveredTraditional PPOAetna Network: (Aetna Choice POS II)(Open Access)In-NetworkOut-of-NetworkAnnual Deductible 1,600 per person 3,200 per family 3,200 per person 6,400 per familyOut-of-Pocket MaximumDeductible, coinsurance, and copay accumulate toward the Out-ofPocket Maximum 4,200 per person 8,400 per family 8,400 per person 16,800 per family 50 copay50% coinsurance after deductibleNo costVaries based on type/place of service50% coinsurance after deductible 75 copay50% coinsurance after deductible 75 copay50% coinsurance after deductibleAmbulance30% coinsurance after deductible50% coinsurance after deductibleHospital Emergency Room30% coinsurance after deductible30% coinsurance after deductibleInpatient HospitalIncluding Mental Health and Chemical Dependency30% coinsurance after deductible50% coinsurance after deductibleInpatient/Outpatient Surgery30% coinsurance after deductible50% coinsurance after deductibleLab and ImagingInpatient and OutpatientLab, Diagnostic Clinic, or Facility30% coinsurance after deductible50% coinsurance after deductible 75 copay50% coinsurance after deductiblePrimary Care Office VisitPreventive CareAffordable Care Act GuidelinesNon-ACA ServicesSpecialty Care Office VisitEmergency CareUrgent Care FacilityOutpatient VisitMental Health and Chemical Dependency2022 Retiree Benefit Plans 16

Aetna Traditional PPOTraditional PPOAetna Network: (Aetna Choice POS II)(Open Access)What’s CoveredIn-NetworkOut-of-Network 75 co-pay60-visit combined maximumper year for speech, physical,occupational, and chiropractic visits50% after deductible; 60-visitcombined per year maximum forspeech, physical, occupational, andchiropractic visitsInpatient (Facility fee)30% coinsurance after deductible50% coinsurance after deductibleInpatient (Physician fee)30% coinsurance after deductible50% coinsurance after deductibleInpatient Substance Abuse Detoxification (Facility fee)30% coinsurance after deductible50% coinsurance after deductibleInpatient Substance Abuse Detoxification (Physician fee)30% coinsurance after deductible50% coinsurance after deductibleTherapy Services(Calendar year maximums are combined between in-network and out-of-network)Speech Therapy, Physical Therapy,Occupational TherapyChiropractic ServicesBehavioral Health Services(Services must be authorized by calling 1.800.292.2879)Other Services(Calendar year maximums are combined between in-network and out-of-network)Urgent Care Center 75 copayment50% coinsurance after deductibleSkilled Nursing FacilityAnnual Maximum: 30 days(Maximum combined in-network and out-of-network days)30% coinsurance after deductible60-day calendar year maximum50% coinsurance after deductible60-day calendar year maximumHome Health CareAnnual Maximum: 120 days (combined in-network and out-ofnetwork)30% coinsurance after deductible60-visits per calendar year50% coinsurance after deductible60-visit calendar year30% coinsurance(not subject to deductible)50% coinsurance(not subject to deductible)30% coinsurance50% coinsuranceHospice CareAmbulance (Covered only when medically necessary)2022 Retiree Benefit Plans 17

Aetna Traditional PPOWhat’s CoveredDurable Medical Equipment (DME)Prescription Drug CoverageTraditional PPOAetna Network: (Aetna Choice POS II)(Open Access)In-NetworkOut-of-Network30% coinsurance after deductible50% coinsurance after deductiblePrescription drug coverage is provided by CVS/Caremark. See the CVS/Caremark summary on page 12 for details.RehabilitationPhysical TherapyOccupational TherapySpeech Therapy(PT, OT, and ST - includes Autism and Cerebral Palsy: combined 60visit limit per calendar year) 75 copay50% coinsurance after deductibleChiropractic Visit/Spinal Manipulation 75 copay50% coinsurance after deductibleMaternity ServicesSpecialty Office VisitPre and Post Maternity CareDelivery and Hospital Care 75 copay30% coinsurance after deductible50% coinsurance after deductibleFamily PlanningSpecialty Office VisitDiagnostic Infertility Services (to diagnose condition)(Artificial Insemination and In-Vitro Fertilization are not covered) 75 copay30% coinsurance after deductible50% coinsurance after deductibleSkilled Nursing Facility(Annual Maximum: 60 days combined in or out-of-network)30% coinsurance after deductible50% coinsurance after deductibleHome Health Care(Annual Maximum: 60 days combined in or out-of-network)30% coinsurance after deductible50% coinsurance after deductibleHospice Care30% coinsurance after deductible50% coinsurance after deductible 75 copay50% coinsurance after deductible30% coinsurance after deductible50% coinsurance after deductibleVision Exam(no optical hardware benefit)Hearing Aids(one per ear, every 3 years)2022 Retiree Benefit Plans 18

Aetna Traditional PPOWhat’s CoveredDurable Medical EquipmentTraditional PPOAetna Network: (Aetna Choice POS II)(Open Access)In-NetworkOut-of-Network30% coinsurance after deductible50% coinsurance after deductiblePharmacy DeductibleNoneRetail (up to 30 days)GenericPreferred BrandNon-Preferred Brand 20 copay 50 copay 75 copayMail Order (up to 90 days)GenericPreferred BrandNon-Preferred Brand 40 copay 100 copay 150 copayDrug must be on Aetna formulary to be covered unless medical exception is approved. View Aetna formulary at www.aetna.com.Monthly Pre-Medicare Retiree PremiumRetireeAetnaTraditional PPO Plan 585.13Ret Spouse 1,403.87Ret Child(ren) 1,368.21Ret Family 1,423.08Monthly Blended Retiree Premium(Pre-Medicare and Medicare Retiree)AetnaTraditional PPO PlanRetiree Spouse (1 Medicare) 897.10Ret Child(ren) (1 Medicare) 593.25Ret Family (2 Medicare) 281.26Ret Family (1 Medicare) 939.622022 Retiree Benefit Plans 19

Aetna Maximum Choice HSA Gold, Silver, and Bronze PlansWhat’s CoveredAetna Bronze Max Choice HSAAetna Network: Aetna Choice POS II(Open Access)Aetna Silver Max Choice HSAAetna Network: Aetna Choice POS II(Open Access)Aetna Gold Max Choice HSAAetna Network: Aetna Choice POS II(Open tworkIn-NetworkOut-of-NetworkAnnual Deductible 3,900/individual 7,800/family 7,800/individual 15,600/family 2,350/individual 4,700/family 4,700/individual 9,400/family 1,550/individual 3,100/family 3,100/individual 6,200/familyOut-of-Pocket MaximumDeductible, coinsuranceand copay accumulatetoward the Out-of-PocketMaximum 6,900/individual 13,800/family 13,800/individual 27,600/family 4,900/individual 9,800/family 9,800/individual 19,600/family 2,800/individual 5,600/family 5,600/individual 11,200/familyPrimary Care Office Visit30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductiblePreventive CareAffordable Care Act GuidelinesNon-ACA ServicesNo cost50% coinsuranceafter deductibleNo cost50% coinsuranceafter deductibleNo cost50% coinsuranceafter deductibleSpecialty Care Office Visit30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductiblePrimary Care Office Visit30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleHospital EmergencyRoomUrgent Care FacilityAmbulance30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible30% coinsuranceafter deductible15% coinsuranceafter deductible15% coinsuranceafter deductibleInpatient HospitalIncluding MentalHealth and ChemicalDependency30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleEmergency Care2022 Retiree Benefit Plans 20

Aetna Maximum Choice HSA Gold, Silver, and Bronze PlansWhat’s CoveredAetna Bronze Max Choice HSAAetna Network: Aetna Choice POS II(Open Access)Aetna Silver Max Choice HSAAetna Network: Aetna Choice POS II(Open Access)Aetna Gold Max Choice HSAAetna Network: Aetna Choice POS II(Open urgery30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleLab and ImagingInpatient and OutpatientLab, Diagnostic Clinic, orFacility30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleOutpatient VisitMental Health andChemical Dependency30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleRehabilitationPhysical TherapyOccupational TherapySpeech Therapy(PT, OT, and ST –includes Autism andCerebral Palsy: combined60 visit limit per calendaryear)30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleChiropractic Visit/SpinalManipulation(30 per calendar year)30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleMaternity ServicesSpecialty Office VisitPre and Post MaternityCareDelivery and Hospital Care30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductible2022 Retiree Benefit Plans 21

Aetna Maximum Choice HSA Gold, Silver, and Bronze PlansWhat’s CoveredAetna Bronze Max Choice HSAAetna Network: Aetna Choice POS II(Open Access)Aetna Silver Max Choice HSAAetna Network: Aetna Choice POS II(Open Access)Aetna Gold Max Choice HSAAetna Network: Aetna Choice POS II(Open tworkIn-NetworkOut-of-Network30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleSkilled Nursing Facility30%(Annual Maximum: 60 dayscoinsurancecombined in or out-ofafter deductiblenetwork)50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleHome Health Care30%(Annual Maximum: 60 dayscoinsurancecombined in or out-ofafter deductiblenetwork)50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleHospice Care30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleVision Exam(no optical hardwarebenefit)30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleHearing Aids(one per ear, every 3 years)30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleDurable Medical Equipment30%coinsuranceafter deductible50% coinsuranceafter deductible30% coinsuranceafter deductible50% coinsuranceafter deductible15% coinsuranceafter deductible50% coinsuranceafter deductibleFamily PlanningSpecialty Office VisitDiagnostic InfertilityServices (to diagnosecondition) (ArtificialInsemination and InVitro Fertilization are notcovered)2022 Retiree Benefit Plans 22

Aetna Maximum Choice HSA Gold, Silver, and Bronze PlansWhat’s CoveredAetna Bronze Max Choice HSAAetna Network: Aetna Choice POS II(Open Access)In-NetworkOut-of-NetworkAetna Silver Max Choice HSAAetna Network: Aetna Choice POS II(Open Access)In-NetworkOut-of-NetworkAetna Gold Max Choice HSAAetna Network: Aetna Choice POS II(Open Access)In-NetworkOut-of-NetworkPrescription DrugsPharmacy DeductibleNoneRetail (up to 30 days)GenericPreferred BrandNon-Preferred Brand30%coinsuranceafter deductible30% coinsuranceafter deductible15% coinsuranceafter deductibleMail Order (up to 90 days)GenericPreferred BrandNon-Preferred Brand30%coinsuranceafter deductible30% coinsuranceafter deductible15% coinsuranceafter deductibleDrug must be on Aetna formulary to be covered unless medical exception is approved. View Aetna formulary at www.aetna.com.Aetna BronzeHSA PlanAetna SilverHSA PlanAetna GoldHSA PlanRetiree 166.50 279.70 462.52Ret Spouse 315.25 559.42 925.06Ret Child(ren) 301.26 527.62 853.12Ret Family 413.28 807.32 1236.94Aetna BronzeHSA PlanAetna SilverHSA PlanAetna GoldHSA PlanRetiree Spouse (1 Medicare) 246.46 350.14 755.63Ret Child(ren) (1 Medicare) 175.22 274.27 623.82Ret Family (2 Medicare) 168.89 276.23 286.08Ret Family (1 Medicare) 278.43 410.29 794.44Monthly Pre-Medicare Retiree PremiumMonthly Blended Retiree Premium(Pre-Medicare and Medicare Retiree)2022 Retiree Benefit Plans 23

Humana Medicare Advantage PlanThere is one Medicare Advantage Plan available for Medicare-eligible retirees and their Medicare-eligible dependents.Humana Medicare Advantage PlanWhat’s CoveredAnnual DeductibleCost To YouIn-NetworkOut-of-Network 150This is the amount you have to pay out of pocket before the plan will pay its share for your coveredMedicare Part A and B services.Out-of-Pocket Maximum per year 3,400The maximum out-of-pocket limit applies to all covered Medicare Part A and Bbenefits including deductible.Primary Care Physician SelectionOptionalThere is no requirement for member pre-certification. Your provider will do this on your behalf.Referral RequirementNone.Primary Care Office Visit 15 CopayIncludes services of an internist, general physician, family practitioner for routine care as well asdiagnosis and treatment of an illness or injury and in-office surgery.Specialty Care Office Visit 30 CopayAmbulance Services 75 CopayEmergency Room 50 CopayUrgent Care 30 CopayPreventive Care 0Screenings/Immunizations 0Inpatient HospitalSkilled Nursing 500 copay per stay 20 copay per day, day(s) 1 – 5; 0 copay per day, day(s) 6 –100.Limited to 100 days per Medicare Benefit Period2022 Retiree Benefit Plans 24

Humana Medicare Advantage PlanRetail Prescription DrugsGeneric 10 copayPreferred Brand 30 copayNon-Preferred Brand 60 copay 100 CopayLimited to One-Month SupplySpecialtyWhat’s CoveredCost To YouIn-Net

Pre-Medicare Medical Plans You can choose between Aetna and Kaiser. Kaiser Choose from two Health Maintenance Organizations (HMOs). You must use an in-network provider—there is no out-of-network coverage except in an emergency. Aetna Choose from three high deductible health plans. After you meet your deductible, the plan will pay a portion