Transcription

20144 marks yeear of achievements for PT ValleJakarta, February 26, 2015 – PT ValeV Indoneesia Tbk (“PTT Vale” or the “Company”, IDXTicker: INCO) today announced itsi audited results for 2014 (FY144). Earningss for theyear were US 172.3Ummillion– moore than fouur times higgher than eaarnings recoorded in2013.aprooduction voolume in itts history in 2014,PT Vale reecorded thee highest annualsuccessfullyy executingg its strategyy to lower unit cost off revenue and benefiting froman improveed realized pricepover 2013.22was ann importantt one for PTT Vale on manymfronts,,” said Nicoo Kanter,“The year 2014CEO and Prresident Dirrector of the Companyy. “In 2014 wew successffully concluuded ourContract of Work rennegotiation with the GovernmenGnt of Indonesia, we immprovedefficienciess and effecttively restruuctured our productioon costs to the point that weare now are less susceeptible to gllobal oil prices. Each of these alonne, and certtainly allogether, havve enhanceed our competitive position as we look to grow theof these tobusiness gooing forward.”nin matte production increased by 4%% in 2014 overoproduuction inPT Vale’s nickel2013, attributable inn large paart to highher averagge electric power froom ourhydroelectric generating facilities and imprroved operaation of thee electric fuurnaces.On a quarteer over quaarter basis, nickel in maatte producction increase 7% in the fourthquarter 20114 (4Q14) overo3Q14.Sales volumme in 2014 increased by 3% commpared to 20132and byb 4% quartter overquarter (4QQ14 vs 3Q 14).1 The Commpany also realized a 9%9 higher average selling pricein 2014 oveer 2013, ressulting in 133% higher reevenues forr the year.o revenue for the CompanyCdeclined 6%% in 2014 over 2013,, drivenThe cost ofpredominantly by loower fuel, lubricant and emplloyment coosts. This reflectsa operating productivity at PT ValeV andcontinuouss improvement in cost discipline andhighlights the success of the Company’s cost redduction strrategy – a majorn phase 1 projectp(CCPP1), which replacesrcomponentt of which is the coal conversionhigh sulphuur fuel oil (HHSFO) with coalc in the oreo dryers.[1]PT Vale Indonesia Tbkndd. Sudirman Kaav. 54-55, Jakartta 12190, IndonnesiaPlaza Bapindo, Citibank Tower 22 fl, Jl. JendTel: 62-21 52449000 Fax.: 622-21 5249010

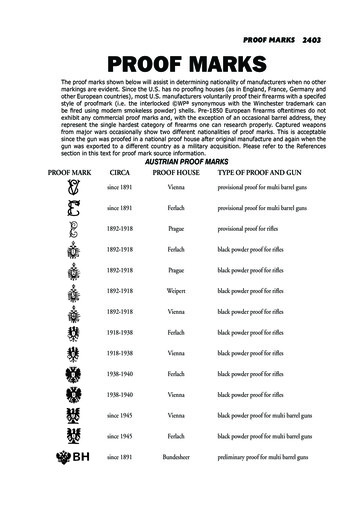

PT Vale’s HSFOHand diesel fuel consumptiion in 4Q144, 3Q14, 20142and 2013 arecaptured inn the table below:b4Q144412,418US 94.0116,189US 0.87UHSFO volumme (barrels))HSFO averaage price peer barrelDiesel volume (kilo litrres)Diesel averrage price per litreU3Q14393,,669US 1000.2215,,302US 00.9220141,6644,260USS 98.4563,344UUS 0.8920132,331,063UUS 100.7959,224US 0.87sa trend of decreeasing fuel consumptioon achievedd through thhe CCP1The table showsproject, and through improved fuuel‐efficienccy in the redduction kilnns, a direct resultrofovement program.the Company’s operattional improa cash eqquivalent as of Decemmber 31, 20014 and SepptemberThe Compaany’s cash and30, 2014 werewUS 3022.3 million and US 372.4 million respectivelly. During the year,the Company disburseed approximmately US 776.8 million in capital expenditureees.mize its capaacity and producepappproximatelyy 80,000In 2015, PTT Vale plans to maximmetric tonss (t) of nickkel in mattee. At the saame time, thet Companny will maintain itsfocus on improving costs to sustainscommpetitiveneess in the long run withoutmpany’s foremost valuue: Life Maatters Most. The Comppany willcompromissing the Comalso continue to leveraage its enhaanced smeltting capacitty and proceess optimizaation.PT Vale’s managemenmnt team firmmly believess the Comppany is on tracktto exeecute itsstrategy too ensure loong‐term profitable grrowth by improving efficiencyeaandcostcompetitiveeness, and maximizingg productioon through operationaal excellencce. Theamendmennt of the Coontract of WorkWin Occtober provvides greateer certaintyy for theCompany’s long‐termm future, and pavess the way for the developmeent andadvancemeent of our growth proggrams.Readers aree encouraged to revieww the Comppany’s results. Operatiional achievvementsand auditedd financial results are summarized on the foollowing pagges – all figures arein US exceept for nickeel in matte production and deliveries which area in metric tons.For furtheer informatiion, please contact:Feebriany, Chief Financiaal Officerptvvi.investorrelations@vvale.comor visit our weebsite atwww.vvale.com/inndonesiaH[2]PT Vale Indonesia TbkndPlaza Bapindo, Citibank Tower 22 fl, Jl. Jendd. Sudirman Kaav. 54-55, Jakartta 12190, IndonnesiaTel: 62-21 52449000 Fax.: 622-21 5249010

PTT Vale Indoonesia TbkProductiion and Finaancial Highlights4Q143Q142014120131Nickel in mattemproduuction220,58619,31378,726675,802Nickel matte deliveriees220,61119,83079,477777,198Average reealized pricce permetric 962.4172.3338.70.00420.00630.017330.0039p share3Earnings per1audited figuresmetric tonn (t)3US 4US millioon2[3]PT Vale Indonesia TbkndPlaza Bapindo, Citibank Tower 22 fl, Jl. Jendd. Sudirman Kaav. 54-55, Jakartta 12190, IndonnesiaTel: 62-21 52449000 Fax.: 622-21 5249010

PTT Vale Indonnesia TbkStatementts of Comprrehensive Inncome(In thouusands of US U except basic earnings per 3432295913455OOperating expenses(3,211)(4,1178)(114,464)(13,041)OOther ng prrofit60,78290,44542449,44570,137FFinance costss(3,392)(2,4431)(112,514)(14,678)PProfit beforee income 62)62,3361(664,660)1772,271(16,807)38,652Actuarial (looss)/gain from definedcontributionn plan and posst‐retirement medicalmbeneffits, net(1,125)‐((1,125)4,260TTotal compreehensive income forthe 7300.0039CCost of revennueGGross profitOOther incomeeInncome tax exxpensePProfit for thee periodOOther comprrehensive inccomeEEarnings per share‐ Basic (in US Dollars)[4]PT Vale Inddonesia TbkndPlaza Bappindo, Citibank TowerT22 fl, Jl. Jend. Sudirmaan Kav. 54-55, JakartaJ12190, IndonesiaITel: 62-221 5249000 Faxx.: 62-21 52490010

PTT Vale Indonnesia TbkStatements of Finaancial Posittionn thousands of US )(InDecember 31,32014(Audited))AssetsCash and cash equivalenntsRestricted cashTrade receivables ‐ Relatted partiesInventoriess, netPrepaid taxxes ‐ Corporatte income tax‐ Other taxxesnts and advancesPrepaymenOther curreent financial assetsaTotal currennt assetsUSeptember 300,2014(Unaudited))Deecember 1,714,266Total liabilities and equity2,3344,1902,375,6692,281,119Prepaid taxxes ‐ Corporatte income tax‐ Other taaxesNon‐trade receivables ‐ Related partieesFixed assetts, netOther non‐‐current financial assetsTotal non‐cuurrent assetsTotal assettsLiabilities aand EquityTrade payaables ‐ Relatedd parties‐ Third partiesAccrualsm employee beenefit liabilitieesShort‐termTaxes payaableCurrent portion of long‐tterm bankborrowingsCurrent portion of post‐employment benefitliabilitiesShare‐baseed payment liaabilitiesOther curreent financial liabilitiesTotal currennt liabilitiesUULong‐term bank borrowiingsLong‐term post‐employmment benefitliabilitiesDeferred taax liabilities, netnProvision foor asset retireementTotal non‐cuurrent liabilitiesTotal liabilities[5]PT Vale Inddonesia TbkndPlaza Bappindo, Citibank TowerT22 fl, Jl. Jend. Sudirmaan Kav. 54-55, JakartaJ12190, IndonesiaITel: 62-221 5249000 Faxx.: 62-21 52490010

PT Vaale Indonesia TbkStatemments of Cassh Flows(In thhousands off US 882655,892Cash flowss from investting activitieesPayments forf acquisitioon of fixed asssetsNet cash flows used foor investing ,8466)(76,8466)(1400,487)(1400,487)Cash flowss from financcing activitieesPayments oof dividendsPlacement of restrictedd cashUsage of reestricted cashPayments oof long‐term borrowingsPayments oof finance coostsNet cash flows used foor financing 5662000,020Cash flowss from operaating activitieesReceipts froom customeersPayments tto suppliers(Payments))/refunds of corporate inncome tax(Payments))/refunds of taxesPayments tto employeeesOther receiptsmentsOther paymNet cash flows provideed from operratingactivitiessNet(decreaase)/increasee in cash andd cashequivalenntsCash and cash equivaleents at the beginningberiodof the peEffect of exxchange ratee changes onn cash andcash equivalentsCash and cash equivaleents at the ende of theperiod2014(Audited)20113(Audiited)4Q114[6]PT Vale Inddonesia TbkndPlaza Bappindo, Citibank TowerT22 fl, Jl. Jend. Sudirmaan Kav. 54-55, JakartaJ12190, IndonesiaITel: 62-221 5249000 Faxx.: 62-21 52490010

advanceme Readers are and audited in US exce a Tbk Citibank Towe 9000 Fax.: 62 SFO and the table b e (barrels) ge price pe me (kilo litr age price p hows a tre d through i ny's operat ny's cash a ere US 302 ny disburse Vale plan (t) of nick improving ing the Com ue to levera anagemen ensure lo ness, and