Transcription

Citibank Online Premium AccountCitibank Online Premium Account is a dual currency investment which offers youthe opportunity to earn potentially higher interest returns. It involves a currencyoption which gives the bank the right to repay your principal and interest earnedin either the Base Currency or the Alternate Currency.

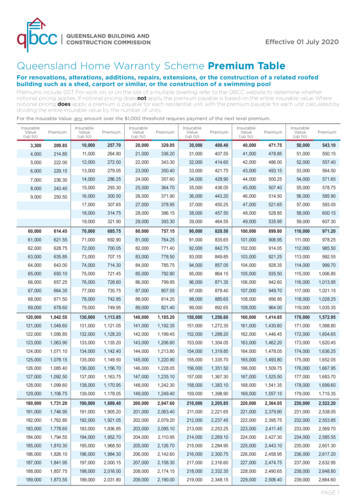

Citibank Online Premium AccountKey BenefitsPotentially Higher ReturnsReturns are higher than conventionalTime Deposits.Flexibility & ChoiceOf currency pairings, interest rates,tenure, buffer value & Strike RateShort Tenure of Investment1 week to 6 monthsLow start-up Investment amountUSD 5,000 or the equivalent amountin other currencies on Citibank Online.Target InvestorThis investment is ideal for you when:You are indifferent to the 2 currencieschosen - you are comfortable receivingyour money in either the base or thealternate currency.If you wish to hold on to a particularcurrency that is weakening – earn apotentially higher interest, and also havea chance of receiving your money back inthe same currency.Steps on Establishing a Premium AccountSTEP1Select Base Currency and Investment Amount.Select your Base Currency from the 10 currencies offered by Citibank.SGDEURUSDGBPAUDJPYCADNZDCHFHKDPlace your principal (minimum of USD 5,000 for online channel) in a base currency of your choice.STEP2STEP3STEP4Select Alternate Currency and Tenure of your investment.Select an Alternate Currency and decide on the Tenure of your investment, which can range from 1 week to 6months.Select your investment parameters.Depending on your investment strategy and market conditions, an exchange rate between the 2 currencies will bedetermined and agreed upon between you and the bank (Strike Rate). The interest rate will be determined byfactors (including but not limited to) such as the Currency Pairing, Tenure and Strike Rate.Upon maturity.The principal and interest earned in the Base or the Alternate Currency will be repaid in the weaker of the 2. Thiswill be determined by comparing the Strike Rate with the prevailing spot rate on the Expiry Date (2 businessdays before maturity). The Strike Rate will be applied if your Base Currency is converted to the AlternateCurrency.1

Citibank Online Premium AccountIllustrating how a Premium Account WorksThis example is based upon the assumption that you invest SGD100, 000 in a 1-month Citibank Premium Account with SGD asyour Base Currency and AUD as your Alternate Currency.On Transaction Date (09 September),Investment Amount(in Base Currency)Alternate CurrencyInvestment TenureSpot FX RateSGD 100,000AUD1 month1 AUD 1.2889 SGDAs part of your investment strategy, you could choose to maintain a buffer of 100 pips thus:Buffer ValueStrike RateInterest RateBuffer Value 100 pips1 AUD 1.2789 SGDInterest Rate 7.8346%2 business days later, on the Value Date (11 September), your Premium Account is effected and you start earning interest tothe maturity date of your Premium Account.Interest Computation:Interest Earned(in Base Currency) Investment Amount(in Base Currency)XInterest Rate%XInvestmentTenureInterest Earned(SGD) SGD 100,000X7.8346%X30/1 Year / 365* Interest amount(in Base Currency)SGD 643. 94*Number of days in a calendar year 365 days; except U.S calendar 360 days.2

Citibank Online Premium AccountOn the Expiry Date, (09 October), the currency (Base or Alternate) in which your investment is returned to you is determined bythe Spot FX rate as of that date. Accordingly, you are likely to face with one of the 3 following scenarios.Scenario 1: Spot Rate on Expiry Date Strike RateSpot Rate on Expiry Date: 1 AUD 1.2993 SGD Strike Rate: 1 AUD 1.2789 SGDInference: AUD has strengthened with respect to SGD from Transaction Date to Expiry Date. Your funds will bereturned to you in the weaker currency, i.e., SGD.Amount you will receive upon maturity SGD 100,000 SGD 643.94 SGD 100,643.94You would have gained SGD 643.94Scenario 2: Spot Rate on Expiry Date Strike RateSpot Rate on Expiry Date: 1 AUD 1.2789 SGD Strike Rate: 1 AUD 1.2789 SGDInference: AUD has neither strengthened nor weakened with respect to SGD from Transaction Date to Expiry Date. Inthis case, your funds will be returned to you in the Base currency, i.e., SGD.Amount you will receive upon maturity SGD 100,000 SGD 643.94 SGD 100,643.94You would have gained SGD 643.94Scenario 3: Spot Rate on Expiry Date Strike RateSpot Rate on Expiry Date: 1 AUD 1.2657 SGD Strike Rate: 1 AUD 1.2789 SGDInference: AUD has weakened with respect to SGD from Transaction Date to Expiry Date. Your funds will bereturned to you in the weaker currency, i.e., AUD.Amount you will receive upon maturity (SGD 100,000 SGD 643.94)/1.2789 AUD 78, 695.70If converted back to SGD, the amount is equivalent to SGD 99,605.15 (AUD 78, 695.70 x 1.2657) which is less than theprincipal amount of SGD 100,000.You would have lost SGD 394.852 business days after Expiry Date, is the Maturity Date (11 October), that marks the end of your Premium Account Investment.You earn interest for your Premium Account up to this date. The funds from your Premium Account are returned to you onMaturity date in the weaker currency that was determined on Expiry Date.Note: The hypothetical profit and loss shown in the above 3 scenarios are meant for illustrative purposes only. The scenariosshown above have no reference to historical data and are not actual or indicative of future performance.3

Citibank Online Premium AccountFlexibility and Convenience of Investing OnlineEnjoy instant access to market opportunities anytime, anywhere with Citibank Online Investments. Featuring a choice ofcurrencies and access to real-time rates, you can establish new Premium Accounts and track all your investments online atwww.citibank.com.sg.Start a Premium Account todaywith an easy minimum of USD 5,000 via our online platform.For more information, please contact ( 65) 6333 9000.Before You StartPlease contact your Relationship Manager or Personal Banker or visit any of our branches tocomplete the Investment Risk Profile and Premium Account Agreement.DisclaimerBy investing in a Citibank Premium Account, you are allowing the bank to repay you at a future date in an alternate currencythat is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid inthis currency at that time. A Premium Account is unlike a traditional bank account as it is an investment and returns may vary.A Premium Account is an investment in one or more foreign currencies. It is subject to foreign exchange rate fluctuations,which may provide both opportunities and risks. You may experience a loss when you convert any alternate currency into thebase currency. The higher rate of interest you may earn in the Premium Account as compared to a traditional time deposit maynot compensate you for the foreign exchange loss. A Premium Account is not a deposit and is not subject to the provisions ofthe Deposit Insurance and Policy Owners' Protection Schemes Act 2011 of Singapore ("Act"), nor eligible for deposit insurancecoverage under the Deposit Insurance Scheme. Exchange controls may apply from time to time to certain foreign currencies.Our Treasury Services Managers and Relationship Managers may assist you with information on any exchange controls that arerelevant to the currencies in which you invest. You should note that a Premium Account is an investment product that shouldbe held to maturity. Early withdrawal of a part of a Premium Account prior to the maturity date is not permitted. Earlywithdrawal of the whole of a Premium Account is permitted but strongly discouraged, because you will have to pay earlytermination charges and these charges will be deducted from the amount repaid under the Premium Account. As a result, theamount repaid to you may be less than the principal amount. If you wish to terminate your Premium Account prior to maturity,please contact the Bank. The Bank may, at any time at its discretion, terminate the Premium Account. This may happen, forexample, if restrictions on convertibility and transferability become applicable to any of the currency in your Premium Account.In such cases, payment to you may be made in the alternate currency or another currency chosen by the Bank. You may incura loss on the principal amount in such cases. You should obtain the advice of a licensed or an exempt financial advisor beforemaking a commitment to enter into a Premium Account transaction. In the event that you choose not to seek advice from afinancial adviser, you should carefully consider whether a Premium Account is suitable for you in light of your investmentobjectives, your financial means and your risk profile. For more information on a Premium Account, you should also carefullyread the terms and conditions of the Premium Account. Investment and Treasury products are not available to US persons.Citibank's full disclaimers, terms and conditions apply to individual products and banking services. 2012 Citibank. Citibank is a registered service mark of Citigroup Inc. Citibank Singapore Limited Co. Reg.No. 200309485K4

By investing in a Citibank Premium Account, you are allowing the bank to repay you at a future date in an alternate currency that is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid in this currency at that time. A Premium Account is unlike a traditional bank account as it is an .