Transcription

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSNON-MONETARY BUSINESS TRANSACTIONSEFFECTIVE FISCAL YEAR 2019Prepared By:GENERAL LEDGER AND ADVISORY BRANCHFISCAL ACCOUNTINGBUREAU OF THE FISCAL SERVICEU.S. DEPARTMENT OF THE TREASURY

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Version NumberDateDescription of Change1.004/23/2019 Original VersionEffectiveEffectiveUSSGL TFM Date2019-1407/11/2019Page 2 of 61FY 2019

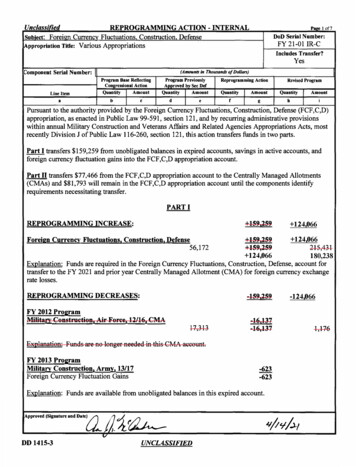

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019BackgroundThroughout the year, Federal Program Agencies (FPAs) incur gains and losses on non-monetary business transactions based on the fluctuationof foreign currency exchange rates. During the period of execution, gains and losses are incurred at the time of disbursement as these exchangerates move up/down.A gain is recognized when the exchange rate in the value of foreign currency decreases in relation to the equivalent value of the United Statesdollar (USD). A loss is recognized when the exchange rate in the value of foreign currency increases in relation to the USD equivalent value.For accounting purposes, applicable gains and losses are realized at the time of disbursement.Historically, USSGL guidance only addressed gains/losses from the revaluation of foreign currency at the end of accounting periods (whenforeign currency is revalued at the going exchange rate) for monetary assets, such as cash and cash equivalent investments. Specifically,USSGL Transaction Code D576 records a loss resulting from the revaluation of foreign currency in the Foreign Currency Account Symbol(X7000 series) at the end of an accounting period, while Transaction Code D578 records a corresponding gain. However, there has been notransaction-level guidance to standardize the accounting treatment of gains and losses related to non-monetary assets, such as unpaid obligations,in the normal course of business.Currently, FPAs utilize USSGL accounts 719000 and 729000 for recording these gains and losses. However, the only foreign currency gainsand losses recognized in the USSGL guidance are related to the revaluation of foreign currency investments (USSGL account 120000) in theForeign Currency Account Symbol (X7000 series). As currently written, the transactions associated with USSGL accounts 719000 and 729000do not provide a standard means for recording gains and losses incurred on non-monetary transactions in the normal course of business. Newstandardized Transaction Codes are needed to account for gains/losses on unpaid obligations from the revaluation of foreign currency if thereis a change in the foreign currency exchange rate between the time the funds are obligated, and the time the funds are disbursed. These TCswould be recorded immediately preceding the funds disbursement, rather than at the end of an accounting period.This scenario applies to FPAs with Treasury Accounts Symbols (TASs) that receive budgetary resources through appropriations, and mustabsorb any gains/losses from currency fluctuations within the TAS. FPAs with foreign currency fluctuation accounts that have legal authorityto Transfer and Merge funding are addressed in a separate example and are excluded from this scenario. Those excluded TASs are: Peace Corp (011X0101) American Battle Monuments Commission (074X0101) Department of Defense (097X0801) Department of Defense (097X0803)Page 3 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019New USSGL Transactions (Effective FY 2019)B450 To record a gain on current year unpaid obligations due to fluctuation of foreign currency exchange rates on a non-monetary transaction,where excess obligations due to the rate variance are deobligated at the time of disbursement.Comment: Also post, reverse to USSGL TC B134 for direct appropriations. Post this transaction immediately preceding disbursement(USSGL TC B110).Budgetary EntryDebit 490100 Delivered Orders – Obligations, UnpaidCredit 445000 Unapportioned AuthorityCredit 451000 ApportionmentsCredit 461000 Allotments – Realized ResourcesProprietary EntryDebit 211000 Accounts PayableCredit 719000 Other GainsJustification: This transaction code is necessary to standardize the accounting treatment for gains and losses related to foreign currency fluctuation of nonmonetary assets in the normal course of business. It should be recorded immediately preceding a fund disbursement, when the value of the foreign currencyexchange rate decreases in relation to the US Dollar between the time the funds are obligated and the time the funds are disbursed. Excess obligations needto be deobligated and a gain needs recognized.B452 To record a loss on current year unpaid obligations due to fluctuation of foreign currency exchange rates on non-monetary transaction,where additional US equivalent dollars are obligated to cover the rate variance at the time of disbursement.Comment: Also post USSGL TC B134 for direct appropriations. Post this transaction immediately preceding disbursement (USSGL TCB110).Budgetary EntryDebit 461000 Allotments – Realized ResourcesCredit 490100 Delivered Orders – Obligations, UnpaidProprietary EntryDebit 729000 Other LossesCredit 211000 Accounts PayableJustification: This transaction code is necessary to standardize the accounting treatment for gains and losses related to foreign currency fluctuation ofnon-monetary assets in the normal course of business. It should be recorded immediately preceding a fund disbursement, when the value of the foreigncurrency exchange rate increases in relation to the US Dollar between the time the funds are obligated and the time the funds are disbursed. AdditionalUS Dollar funds need to be obligated to cover differences, and a loss needs recorded.Page 4 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019D618 To record a gain on prior-year unpaid obligations due to fluctuation of foreign currency exchange rates on a non-monetary transaction,where excess obligations of a prior year are adjusted downward due to the rate variance at the time of disbursement.Comment: Prior-year adjustments are used only in Year 2 or later. Record USSGL account 465000 if the authority has expired. Also postreverse to USSGL TC B134 for direct appropriations. Post this transaction immediately preceding disbursement (USSGL TCB110).Budgetary EntryDebit 497100 Downward Adjustments of Prior-Year Unpaid Delivered Orders – Obligations, RecoveriesCredit 445000 Unapportioned AuthorityCredit 451000 ApportionmentsCredit 461000 Allotments – Realized ResourcesCredit 465000 Allotments – Expired AuthorityProprietary EntryDebit 211000 Accounts PayableCredit 719000 Other GainsJustification: This transaction code is necessary to standardize the accounting treatment for gains and losses related to foreign currency fluctuation ofnon-monetary assets in the normal course of business. It should be recorded immediately preceding a fund disbursement, when the value of the foreigncurrency exchange rate decreases in relation to the US Dollar between the time the funds are obligated and the time the funds are disbursed. Excessobligations need to be deobligated and a gain needs recognized.D626 To record a loss on prior-year unpaid obligations due to fluctuation of foreign currency exchange rates on a non-monetary transaction,where excess obligations of a prior year are adjusted upward due to the rate variance at the time of disbursement.Comment: Prior-year adjustments are used only in Year 2 or later. Record USSGL account 465000 if the authority has expired. Also postUSSGL TC B134 for direct appropriations. Post this transaction immediately preceding disbursement (USSGL TC B110).Budgetary EntryDebit 461000 Allotments – Realized ResourcesDebit 465000 Allotments – Expired AuthorityCredit 498100 Upward Adjustments of Prior-Year Delivered Orders – Obligations, UnpaidProprietary EntryDebit 729000 Other LossesCredit 211000 Accounts PayablePage 5 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Justification: This transaction code is necessary to standardize the accounting treatment for gains and losses related to foreign currency fluctuation ofnon-monetary assets in the normal course of business. It should be recorded immediately preceding a fund disbursement, when the value of the foreigncurrency exchange rate increases in relation to the US Dollar between the time the funds are obligated and the time the funds are disbursed. AdditionalUS Dollar funds need to be obligated to cover differences, and a loss needs recorded.Listing of USSGL Accounts Used in This ScenarioAccount 00Account TitleOther Appropriations RealizedTotal Actual Resources – CollectedUnapportioned AuthorityApportionmentsAllotments – Realized ResourcesAllotments – Expired AuthorityUndelivered Orders – Obligations, UnpaidDelivered Orders – Obligations, UnpaidDelivered Orders – Obligations, PaidDownward Adjustments of Prior-Year Unpaid Delivered Orders – Obligations, RecoveriesUpward Adjustments of Prior-Year Delivered Orders – Obligations, UnpaidFund Balance with TreasuryAccounts PayableUnexpended Appropriations – CumulativeUnexpended Appropriations – Appropriations ReceivedUnexpended Appropriations – UsedCumulative Results of OperationsExpended AppropriationsOperating Expenses/Program CostsOther GainsOther LossesPage 6 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Scenario AssumptionsThe following overall assumptions are applicable to both the gain and the loss scenarios reflected in the transactions below: In Year 1, the FPA entered into an agreement to purchase supplies for 900,000 Euros (EUR) from a foreign entity based on the foreignentity’s currency Euro exchange rate.Obligations are posted in the FPA’s accounting system at the value of the US Dollar (USD).At the time of agreement, the foreign currency exchange rate is 1 EUR 1.12 USD.In Year 1, the FPA obligated 1,008,000 in appropriated funds, with a foreign currency exchange rate of 1.12 USD (900,000 EUR x1.12).Unobligated funds remaining at the end of Year 1 expire as of September 30th.The FPA has Definite Budget Authority.Beginning Trial Balances are not applicable in these scenarios.Page 7 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Scenario 1 – Gain on Foreign Currency FluctuationPage 8 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Year 1Illustrative TransactionsIn the following transactions, a FPA creates current-year orders without an advance with a foreign vendor, who uses Euros as currency. TheFPA must convert the value of US Dollar to the Euro. When goods are delivered, the FPA records the delivery and accrues an accounts payable.Before the FPA can disburse a payment to the foreign vendor, it identifies that the foreign exchange rate has changed. After the goods wereobligated, the value of the US Dollar increases (and the exchange rate in the value of foreign currency decreases.) Thus, the value of the goodsat the time of obligation was higher than the value at the time of disbursement. Excess obligations will need to be deobligated and a gain willneed to be recognized. Because the gain is recognized at the time of disbursement, this gain is also posted immediately preceding thedisbursement.1-1To record the enactment of appropriations.DRBudgetary Entry411900 Other Appropriations Realized445000 Unapportioned AuthorityCRTC5,000,0005,000,000A104Proprietary Entry101000 Fund Balance with Treasury310100 Unexpended Appropriations – Appropriations Received1-25,000,0005,000,000To record budgetary authority apportioned by the Office of Management and Budget and available for allotment.DRBudgetary Entry445000 Unapportioned Authority451000 y EntryNonePage 9 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 20191-3To record the allotment of authority.DRBudgetary Entry451000 Apportionments461000 Allotments – Realized ResourcesCRTC5,000,0005,000,000A120Proprietary EntryNone1-4To record current-year undelivered orders without an advance.DRBudgetary Entry461000 Allotments – Realized Resources480100 Undelivered Orders – Obligations, UnpaidCRTC1,008,0001,008,000B306Proprietary EntryNone900,000 EUR order x 1.12 USD exchange rate 1,008,000 Undelivered OrderPage 10 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 20191-5 The agency receives delivery of goods and accrues a liability for 75% of the obligated balance on the agreement. It records thedelivery of goods and accrues an accounts payable.DRCRTCBudgetary Entry480100 Undelivered Orders – Obligations, Unpaid756,000490100 Delivered Orders – Obligations, Unpaid756,000B402Proprietary Entry610000 Operating Expenses/Program Costs756,000211000 Accounts Payable756,000310700 Unexpended Appropriations – Used570000 Expended Appropriations756,000756,000B134 1,008,000 Obligation x 75% delivery of obligation 756,000 accrual.Page 11 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 20191-6The FPA records a gain on current-year unpaid obligations due to the fluctuation of foreign currency exchange rates on a nonmonetary transaction, in which excess obligations due to the rate of variance are deobligated at the time of disbursement.DRBudgetary Entry490100 Delivered Orders – Obligations, Unpaid461000 Allotments – Realized Resources47,250Proprietary Entry211000 Accounts Payable719000 Other Gains47,250CR47,250TCB45047,250570000 Expended Appropriations310700 Unexpended Appropriations – Used47,250B134R47,250At the time of obligation, the foreign currency exchange rate was (1 EUR 1.12 USD).At the time of disbursement, the foreign currency exchange rate has changed to (1 EUR 1.05 USD).A Gain of 47,250 is recognized due to the increased USD value, and the decreased value of the EUR rate previously obligated, using the following formula:Gain Value of obligation (1 EUR 1.12 USD) – Value of obligation at time of disbursement (1 EUR 1.05 USD)Gain 756,000 Accrual at 1.12 USD – (900,000 EUR x 1.05 USD x 75% delivery of Obligation)Gain 756,000 - 708,750 47,2501-7The FPA records a confirmed disbursement previously accrued.DRBudgetary Entry490100 Delivered Orders – Obligations, Unpaid490200 Delivered Orders – Obligations, PaidCRTC708,750708,750B110Proprietary Entry211000 Accounts Payable101000 Fund Balance with Treasury708,750708,750Page 12 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 20191-8The FPA receives delivery on and accrues a liability for the 25% remaining outstanding balance on the obligated balance on theagreement. It records the delivery of goods and accrues an accounts payable. The disbursement of funds will take place in Year 2.DRBudgetary Entry480100 Undelivered Orders – Obligations, Unpaid490100 Delivered Orders – Obligations, UnpaidCRTC252,000252,000B402Proprietary Entry610000 Operating Expenses/Program Costs211000 Accounts Payable252,000252,000B134310700 Unexpended Appropriations – Used570000 Expended Appropriations252,000252,000The Obligation was originally recorded at 900,000 EUR with an exchange rate of 1.12 USD 1,008,000 Obligation.25% of the original obligation was not yet delivered until this point.Upon delivery of the remaining 25% of the 1,008,000 Obligation balance, the FPA accrues 252,000. 1,008,000 Obligation x 25% 252,000 accrual.Page 13 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Year 1 Pre-Closing Adjusted Trial BalanceUSSGL dgetaryOther Appropriations RealizedAllotments – Realized ResourcesUndelivered Orders – Obligations, UnpaidDelivered Orders – Obligations, UnpaidDelivered Orders – Obligations, 00719000ProprietaryFund Balance with TreasuryAccounts PayableUnexpended Appropriations – Appropriations ReceivedUnexpended Appropriations – UsedExpended AppropriationsOperating Expenses/Program CostsOther 05,000,000960,75047,2506,260,000Page 14 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Year 1 Closing Entries1-9To record the consolidation of actual net-funded resources.DRBudgetary Entry420100 Total Actual Resources Collected411900 Other Appropriations RealizedCRTC5,000,0005,000,000F302Proprietary EntryNone1-10To record the closing of unobligated balances to expiring authority.DRBudgetary Entry461000 Allotments – Realized Resources465000 Allotments – Expired AuthorityCRTC4,039,2504,039,250F312Proprietary EntryNone1-11To record the closing of paid delivered orders to total actual resources.DRBudgetary Entry490200 Delivered Orders – Obligations, Paid420100 Total Actual Resources – CollectedCRTC708,750708,750F314Proprietary EntryNonePage 15 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 20191-12To record the closing of fiscal-year activity to unexpended appropriations.DRCRTCBudgetary EntryNoneProprietary Entry310100 Unexpended Appropriations – Appropriations Received310000 Unexpended Appropriations – CumulativeF3425,000,0005,000,000960,750310000 Unexpended Appropriations- Cumulative310700 Unexpended Appropriations- Used960,7501-13To record the closing of operating expenses/program costs to cumulative results of operations.DRBudgetary EntryNoneProprietary Entry331000 Cumulative Results of Operations570000 Expended Appropriations331000 Cumulative Results of Operations610000 Operating Expenses/Program o record the closing of other gains to cumulative results of operationsDRCRTCBudgetary EntryNoneProprietary Entry719000 Other Gains331000 Cumulative Results of OperationsF33847,25047,250Page 16 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Year 1 Post-Closing Adjusted Trial BalanceUSSGL yTotal Actual Resources – CollectedAllotments – Expired AuthorityUndelivered Orders – Obligations, UnpaidDelivered Orders – Obligations, 505,000,000101000211000310000ProprietaryFund Balance with TreasuryAccounts PayableUnexpended Appropriations – ,291,250Page 17 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Financial Statements – Year 1BALANCE SHEET – YEAR 11.15.Assets:Fund Balance with Treasury (101000E)Total Assets (calc. 6 through 14)4,291,2504,291,25021.28.Liabilities:Accounts Payable (211000E)Total Liabilities (calc. 20 through 27)252,000252,00031.33.35.36.37.Net Position:Unexpended Appropriations – All Other Funds (310100E, 310700E)Cumulative Results of Operations (331000E)Total Net Position- All Other Funds (calc. 31 through 33)Total Net Position (calc. 34 35)Total Liabilities and Net Position (calc. 28 36)4,039,2504.039,2504,039,2504,291,250STATEMENT OF NET COST – YEAR 11.2.3.5.8.Gross Program Costs:Gross Costs (610000 E)Less: earned revenue (719000 E)Net Program Costs (calc.)Net Program Costs including Assumption Changes (calc.)Net Cost of Operations (calc.)1,008,000(47,250)960,750960,750960,750Page 18 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 20191.3.4.7.8.9.STATEMENT OF CHANGES IN NET POSITION – YEAR 1Unexpended AppropriationsBeginning Balance:Unexpended Appropriations – CumulativeBeginning Balance, as adjusted (calc.)Appropriations Received (310100 E)Appropriations Used (310700 E)Total Budgetary Financing Sources (calc.)Total Unexpended Appropriations (calc.)10.12.Cumulative Results of Operations:Beginning Balance:Cumulative Results of OperationsBeginning Balance, as adjusted14.23.24.25.26.27.Budgetary Financing Sources:Appropriations Used (570000E)Total Financing Sources (calc.)Net Cost of Operations ( /-)Net Change (calc.)Cumulative Results of Operations (calc.)Net Position 0960,750(960,750)4,039,250Page 19 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 201912901910STATEMENT OF BUDGETARY RESOURCES – YEAR 1Budgetary Resources:Appropriations (discretionary and mandatory) (411900E)Total Budgetary Resources (calc. SBR Lines 1051 1290 1490 1690 1890)2190Status of Budgetary Resources:New obligations and upward adjustments (total) (480100E, 490100E, 490200E)2204241224902500Unobligated balance, end of year:Apportioned, unexpired account (461000E)Unexpired unobligated balance, end of year (calc. SBR Lines 2204 2304 2404)Unobligated balance, end of year (total) (calc. SBR Lines 2204, 2304, 2404, & 2413)Total budgetary resources (calc. SBR Lines 2190 2490)41904210Outlays, Net:Outlays, net (total) (discretionary and mandatory) (490200E)Agency outlays, net (discretionary and 2504,039,2505,000,000708,750708,750Page 20 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019SF 133: Report on Budget Execution and Budgetary Resources &Budget Program and Financing Schedule (Schedule P) – YEAR 1SF 1330900BUDGETARY RESOURCESAll accounts:Total new obligations, unexpired accounts (480100E, 490100E, 490200E)Schedule P-960,75011001160Budget on (411900E)Appropriations, discretionary (total) (calc. Lines 19101930Budget authority (total)Total budgetary resourcesTotal budgetary resources Memorandum (non-add) entries:All accounts:Unobligated balance expiring (-) (465000E)-(4,039,250)2001200421702190STATUS OF BUDGETARY RESOURCESNew obligations and upward adjustments:Direct:Category A (by quarter) (480100E, 490100E, 490200E)Direct obligations (total) (calc. Lines 2001 - 2003)New obligations, unexpired accounts (480100E, 490100E, 490200E)New obligations and upward adjustments (total) (calc. Lines 2170 2180)960,750960,750960,750960,750-2201Unobligated balance:Apportioned, unexpired accounts:Available in the current period (461000E)4,039,250-Page 21 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 20194,039,250-2412Unexpired unobligated balance, end of year24902500Unobligated balance, end of year (total)Total budgetary resources (calc. Lines 2001 - 2403, and 2413)4,039,2505,000,000-30103020305031003200CHANGE IN OBLIGATED BALANCEUnpaid obligations:New obligations, unexpired accounts (480100E, 490100E, 490200E)Outlays (gross) (-) (490200E)Unpaid obligations, end of year (480100E, 490100E)Obligated balance, start of the year (calc. Lines 3000, 3001, 3060 and 3061)Obligated balance, end of year ( or 2,000252,00040004010402040704080BUDGET AUTHORITY AND OUTLAYS, NETDiscretionary:Gross budget authority and outlays:Budget authority, grossOutlays from new discretionary authority (490200E)Outlays, gross (total) (calc. 4010 4011)Budget authority, net (discretionary)Outlays, net 0Budget authority and outlays, net (total):Budget authority, net (total) (calc. Lines 4070 and 4160)Outlays, net (total) (calc. Lines 4080 and 4170)5,000,000708,7505,000,000708,750Page 22 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Year 2Illustrative TransactionsDuring Year 2, the FPA is ready to disburse funds to the foreign vendor for expenses incurred in Year 1.Before the FPA disburses the payment to the foreign vendor, it identifies that the foreign exchange rate has changed from the time of obligationin Year 1. After the goods were obligated with Year 1 Budgetary Authority, the value of the US Dollar increased (and the exchange rate in thevalue of foreign currency decreased.) Thus, the value of the goods at the time of obligation was higher than the value at the time of disbursement.Excess obligations will need to be deobligated, and a gain and downward adjustment will need to be recognized. Because the gain is recognizedat the time of disbursement, this gain and downward adjustment are posted immediately preceding the disbursement.2-1To record a gain on a prior-year unpaid obligation due to fluctuation of foreign currency exchange rates on a non-monetarytransaction, where excess obligations of a prior-year are adjusted downward due to the rate variance at the time of disbursement.DRBudgetary Entry497100 Downward Adjustments of Prior-Year Unpaid Delivered Orders –Obligations, Recoveries465000 Allotments – Expired AuthorityProprietary Entry211000 Accounts Payable719000 Other GainsCRTC4,500D6184,5004,5004,500B134R570000 Expended Appropriations310700 Unexpended Appropriations – Used4,5004,500At the time of obligation, the foreign currency exchange rate was (1 EUR 1.12 USD).At the time of disbursement in Year 2, the foreign currency exchange rate has changed to (1 EUR 1.10 USD).A 4,500 Gain and Downward Adjustment are recognized due to the increased value of the USD, and the decreased value of the EUR rate previously obligated,using the following formula:Gain Value of obligation (1 EUR 1.12 USD) – Value of obligation at time of disbursement (1 EUR 1.10 USD)Gain 252,000 Accrual at 1.12 USD – (900,000 EUR x 1.10 USD x 25% delivery of Obligation)Gain 252,000 - 247,500 4,500.Page 23 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 20192-2To record a confirmed disbursement schedule previously accrued.DRBudgetary Entry490100 Delivered Orders – Obligations, Unpaid490200 Delivered Orders – Obligations, PaidCRTC247,500247,500B110Proprietary Entry211000 Accounts Payable101000 Fund Balance with Treasury247,500247,500Page 24 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Year 2 Pre-Closing Adjusted Trial BalancesUSSGL 310000310700570000610000719000BudgetaryTotal Actual Resources – CollectedAllotments – Expired AuthorityUndelivered Orders – Obligations, UnpaidDelivered Orders – Obligations, UnpaidDelivered Orders – Obligations, PaidDownward Adjustments of Prior-Year Unpaid Delivered Orders – Obligations,RecoveriesTOTALProprietaryFund Balance with TreasuryUnexpended Appropriations – CumulativeUnexpended Appropriations – UsedExpended AppropriationsOperating Expenses/Program CostsOther 048,2504,039,2504,5004,5004,048,250Page 25 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Year 2 Closing Entries2-3To record the closing of paid delivered orders to total actual resources.DRBudgetary Entry490200 Delivered Orders – Obligations, Paid420100 Total Actual Resources – CollectedCRTC247,500247,500F314Proprietary EntryNone2-4To record the closing of downward adjustments to prior-year unpaid delivered orders - obligations, recoveries.DRBudgetary Entry490100 Delivered Orders – Obligations, Unpaid497100 Downward Adjustments of Prior-Year Unpaid Delivered Orders –Obligations, RecoveriesCRTC4,500F3254,500Proprietary EntryNone2-5To record the closing of fiscal-year activity to unexpended appropriations.DRCRTCBudgetary EntryNoneProprietary Entry310700 Unexpended Appropriations – Used310000 Unexpended Appropriations – Cumulative4,500F3424,500Page 26 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 20192-6To record the closing of expended appropriations to cumulative results of operations.DRBudgetary EntryNoneProprietary Entry331000 Cumulative Results of Operations570000 Expended Appropriations2-7CRTC4,500F3364,500To record the closing of other gains to cumulative results of operations.DRCRTCBudgetary EntryNoneProprietary Entry719000 Other Gains331000 Cumulative Results of Operations4,5004,500F338Year 2 Post-Closing Adjusted Trial BalancesUSSGL ryTotal Actual Resources – CollectedAllotments – Expired AuthorityUndelivered Orders – Obligations, UnpaidDelivered Orders – Obligations, 504,752,500101000310000ProprietaryFund Balance with TreasuryUnexpended Appropriations – 0Page 27 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 2019Financial Statements – Year 2BALANCE SHEET – YEAR 2Assets:1. Fund Balance with Treasury (101000E)15. Total Assets (calc. 6 through 14)4,043,7504,043,750Liabilities:28. Total Liabilities (calc. 20 through 27)-31.33.35.36.37.2.3.5.8.Net Position:Unexpended Appropriations – All Other Funds (310000E, 310700E)Cumulative Results of Operations- All Other Funds (331000E)Total Net Position – All Other Funds (calc.)Total Net Position (calc.)Total Liabilities and Net Position (calc.)STATEMENT OF NET COST – YEAR 2Gross Program Costs:Less: Other Gains (719000E)Net Program Costs (calc.)Net Program Costs including Assumption Changes (calc.)Net Cost of Operations (4,500)(4,500)(4,500)Page 28 of 61FY 2019

GAINS AND LOSSES ON FOREIGN CURRENCY RATE FLUCTUATIONSEffective Fiscal 20191.3.7.8.9.STATEMENT OF CHANGES IN NET POSITION – YEAR 2Unexpen

Currently, FPAs utilize USSGL accounts 719000 and 729000 for recording these gains and losses. However, the only foreign currency gains and losses recognized in the USSGL guidance are related to the revaluation of foreign currency investments (USSGL account 120000) in the Foreign Currency Account Symbol (X7000 series).