Transcription

.DEPARTMENT OF COMMERCE & INSURANCE· . . .,,,. ,'.P,O. Box. 690, ;Jetferso".\ City! M9. 65102·0 90ORDERAfter full c,o sideration nd reyiew of the :report of the financial ex mination·.of s:at ty.Specialty. Insurance Companyfor.theperiod endedDecember 31, 2018,togetherwith any. ' ,.written submission s ot rebuttals and any i:elevant portions of he e xaminer's:workpapers, 1,Chlora Lindley-Myers, Director of the Missouri Department of Commerce and Insurancepursuant to section 374. 05.3(3 (a),, RSMo, adopt such e ami(!atioh r port. : fter myconsideration and review of such report, workpapers, and written submissions or rebuttals,I hereby incorporate }?y reference aqd deem tl)e following- parts of such. report to·. be myfindings·and conclusions to accompany this order pursuant to section 314.205.3(4), RSMo:summary of significant findings, company history, management and control, reinsµranc .accounts: and records, financial statements, analysis of examinatiori changes, comments onfinancial statement ,:subsequent events and summary of recommendations .Based on such findings and conclusions, I hereby, ORDER that the report of the financi lexamination of Safety Specialty Insurance Company. as of December: 31,. 2018 · be. and ;ishereby ADOPTED as. ,file and. for, Safety Specialty Insurance Company to take thefollpwing action or actions which l consider necessary to cure any violation of law,regulation or prior order of the Director revealedby such. report:( 1) accoui}tfor its financial. . .condition-and affaits in a manner consistent with t!1,e Director's findings and conclusio.ps·.?:l\ffiday of March, 2020. :Sp ordered, signe rn;l official seal affj ed this ;Chlora Lindley-Myers, DirectorQepartmenJ of Commerce, and lnsµrance.

REPORT OF THEFINANCIAL EXAMINATION OFSAFETY SPECIALTY INSURANCECOMPANYASOFDECEMBER 31, 2018STATE OF MISSOURIDEPARTMENT OF COMMERCE & INSURANCEJEFFERSON CITY, MISSOURI

TABLE OF CONTENTSSCOPE OF EXAMINATION . 1Period Covered . 1Procedures. 1SUMMARY OF SIGNIFICANT FINDINGS . 2COMPANY HISTORY .2General . 2Capital Stock and Paid-In Surplus . 3Dividends . 3Acquisitions, Mergers and Major Corporate Events . 3Surplus Debentures . 3MANAGEMENT AND CONTROL .3Board of Directors . 3Officers . 4Committees . 4Corporate Records .4Holding Company, Subsidiaries and Affiliates . 5Organization Chart. 5Affiliated Transactions . 6REINSURANCE . 7General . ?Assumed . 8Ceded . 8ACCOUNTS AND RECORDS . 8Independent Auditor . 8Independent Actuaries . 8ASSETS . 10LIABILITIES, SURPLUS AND OTHER FUNDS . 11STATEMENT OF INCOME . 12RECONCILIATION OF SURPLUS . 13ANALYSIS OF EXAMINATION CHANGES . 14COMMENTS ON FINANCIAL STATEMENTS . 14SUBSEQUENT EVENTS . 14SUMMARY OF RECOMMENDATIONS . 14ACKNOWLEDGEMENT . 15VERIFICATION . 15SUPERVISION . 16

January 2, 2020St. Louis, MOHonorable Chlora Lindley-Myers, DirectorMissouri Department of Commerce and Insurance301 West High Street, Room 530Jefferson City, MO 65101Director Lindley-Myers:In accordance with your financial examination warrant, a full-scope financial examination hasbeen made of the records, affairs and financial condition ofSafety Specialty Insurance Companyhereinafter referred to as "Safety Specialty," "SSIC" or the "Company." The Company's homeoffice is located at 1832 Schuetz Road, St. Louis, Missouri 63146, telephone number (314) 9955300. Examination fieldwork began on June 11, 2019, and concluded on the above date.SCOPE OF EXAMINATIONPeriod CoveredWe have performed a multi-state examination of Safety Specialty Insurance Company. The lastexamination was completed as of December 31, 2015. This examination covers the period fromJanuary l, 2016, through December 31, 2018, and also includes material transactions or eventsoccurring subsequent to December 31, 2018.ProceduresThis examination was conducted using guidelines set forth in the Financial Condition ExaminersHandbook (Handbook) of the National Association of Insurance Commissioners (NAIC), exceptwhere practices, procedures and applicable regulations of the Missouri Department of Commerceand Insurance (Department or DCI) or statutes of the state of Missouri prevailed. The Handbookrequires that we plan and perform the examination to evaluate the financial condition, assesscorporate governance, identify current and prospective risks of the company and evaluate systemcontrols and procedures used to mitigate those risks. An examination also includes identifyingand evaluating significant risks that could cause an insurer's surplus to be materially misstatedboth currently and prospectively.SSIC is a member of the Tokio Marine Holdings, Inc. group (NAIC #3098). The examination wasconducted concurrently with the examination of the Company's Missouri-domiciled affiliate,Safety National Casualty Corporation (SNCC).All accounts and activities of the Company were considered in accordance with the risk-focusedexamination process. This includes assessing significant estimates made by management andevaluating management's compliance with Statutory Accounting Principles. The examination1

SSIC-12/31/18 Examdoes not attest to the fair presentation of the financial statements included herein. If, during thecourse of the examination an adjustment is identified, the impact of such adjustment is documentedseparately following the Company's financial statements. The following key activities wereidentified during the examination: Affiliated Companies, Capital and Surplus, Claims Handling,Investments and Treasury, Premiums and Underwriting, Reserves, and Reinsurance.This examination report includes significant findings of fact and general information about theCompany and its financial condition. There may be other items identified during the examinationthat, due to their nature (e.g., subjective conclusions, proprietary information, etc.), are notincluded within the examination report but separately communicated to other regulators and/or theCompany.SUMMARY OF SIGNIFICANT FINDINGSThere were no material adverse findings, significant non-compliance issues or material changes tothe balance sheet or income statement identified during the examination.COMPANY HISTORYGeneralPrior to 2014, SSIC was known as SPARTA Specialty Insurance Company, a Connecticut domiciled insurer owned by SPARTA Insurance Company. In 2014, after incurring heavy losses,the Company was put in run-off status. Later in 2014, SPARTA Insurance Company was acquiredby Catalina Holdings Bermuda, Ltd., which became the ultimate controlling entity.In April of 2015, SPARTA Insurance Company entered into a Stock Purchase Agreement withSafety National Casualty Company for the sale of SPARTA Specialty Insurance Company. Thesale was completed in December 2015, at which time the Company became a wholly ownedsubsidiary of SNCC. In conjunction with the acquisition, the Company also redomiciled fromConnecticut to Missouri, changed its name to Safety Specialty Insurance Company and becamelicensed as a Domestic Surplus Lines Insurer under Chapter 384 RSMo (Surplus Lines InsuranceLaws).SSIC was a shell company at the time of acquisition with no existing operations, in-force policiesor outstanding claims. The transaction was accounted for as a Quasi-Reorganization in accordancewith SSAP No. 72 (Surplus and Quasi-Reorganizations), and SSIC's Unassigned Funds (Surplus)balance was reset to 0 upon completion of the purchase.Effective December 31, 2015, SNCC made a 30 million capital contribution to SSIC, consistingof approximately 28.7 million of investment grade bonds and 1.3 million cash. The purpose ofthe contribution was to enhance SSIC's surplus and further its ability to write surplus linesinsurance on a national basis.2

SSIC - 12/31/18 ExamCapital Stock and Paid-In SurplusSSIC has 6,000 shares of 1,000 par value common stock authorized, with 4,200 shares issued andoutstanding as of December 31, 2018, resulting in 4,200,000 capital stock. All outstanding sharesare owned by SNCC. The Company has no preferred stock authorized, issued or outstanding.Total paid-in surplus was 58,817,973 as of December 31, 2018. No capital contributions weremade during the examination period.DividendsThe Company did not issue any dividends during the exam period.Acquisitions, Mergers and Maior Corporate EventsAs detailed above, SSIC was acquired by SNCC in December 2015. There were no acquisitions,mergers or other major corporate events during the examination period.Surplus DebenturesThe Company issued a 1 million surplus note to Tokio Marine Kiln, Ltd (TMK) in exchange forcash on December 31, 2016. The interest rate for this note was 3%, and it had a maturity date ofJanuary 15, 2037. The Company paid 30,147.67 interest on this note during the examinationperiod and repaid the note in full in December 2017.The Company issued a 3.6 million surplus note to TMK in exchange for cash on December 31,20 l 7. The interest rate for this note was 3%, and it had a maturity date of January 15, 2038. TheCompany paid 113,100 interest on this note during the examination period and repaid the note infull in December 2018.The Company issued a 8.6 million surplus note to TMK in exchange for cash on December 31,2018. The interest rate for this note is 4%, and it has a maturity date of January 15, 2039.MANAGEMENT AND CONTROLBoard of DirectorsThe management of the Company is vested in a Board of Directors which, per the Articles ofIncorporation, will consist of not less than nine nor more than twenty-fl ve members. The Directorsserving as of December 31, 2018, were as follows:NameGus E. AivaliotisSt. Louis, MOPrincipal Occupation and Business AffiliationSenior Vice President-Large CasualtySafety National Casualty CorporationJohn P. CsikSt. Louis, MOExecutive Vice President, Chief Financial & Chief Risk OfficerSafety National Casualty CorporationSteven C. DivineSt. Louis, MOSenior Vice President-Finance and TreasurerSafety National Casualty Corporation3

SSIC - 12/31/18 ExamThomas V. GroveSt. Louis, MOSenior Vice President-Business DevelopmentSafety National Casualty CorporationDuane A. HerculesSt. Louis, MOPresidentSafety National Casualty CorporationNicholas A. KriegelSt. Louis, MOSenior Vice President and General CounselSafety National Casualty CorporationSteven F. LuebbertSt. Louis, MOChief Operating OfficerSafety National Casualty CorporationSeth A. SmithSt. Louis, MOExecutive Vice President-UnderwritingSafety National Casualty CorporationMark A. WilhelmSt. Louis, MOChief Executive OfficerSafety National Casualty CorporationOfficersOfficers serving as of December 31, 2018, were as follows:NameMark A. WilhelmDuane A. HerculesNicholas A. KriegelSteven C. DivineJohn P. CsikGus E. AivaliotisThomas V. GroveSteven F. LuebbertSeth A. SmithPositionChief Executive OfficerPresidentSecretaryTreasurerChief Financial OfficerChief Underwriting OfficerChief Business Development OfficerChief Operating OfficerExecutive Vice PresidentCommitteesSafety Specialty had an Audit Committee and an Executive and Investment Committee in place asof December 31, 2018.Corporate RecordsThe Articles of Incorporation and Bylaws of SSIC were reviewed. There were no changes to theArticles of Incorporation during the examination period. The Bylaws were amended in 2016 tomirror the Bylaws of SNCC and to change the name of the Company to Safety Specialty InsuranceCompany.The minutes of the meetings of the shareholder, board of directors and committees were reviewedfor the period under examination. The minutes appear to properly document and approve corporateevents and transactions.4

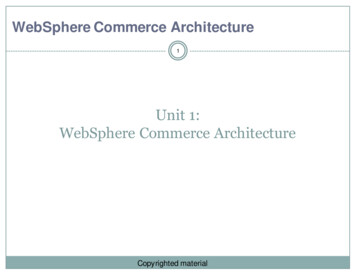

SSIC - 12/31/18 ExamHolding Company, Subsidiaries and AffiliatesSafety Specialty is a member of an insurance holding company system as defined by Chapter 382RSMo (Insurance Holding Companies). Affiliations are described in the Company History sectionabove. Tokio Marine Holdings, Inc. is the ultimate controlling entity within the holding companysystem.Organization ChartThe following is an abridged organization chart, which depicts the structure of companies relatingto Safety Specialty, as of December 31, 2018. All subsidiaries are wholly owned unless otherwisenoted.Tokio Marine Holdings,Inc.ITokio Marine & NichidoFire Insurance Co., ltd.IDelphi Financial Group,Inc.Reliance Standard lifeInsurance Company ofTexasNAIC #66575(TX}IISIG Holdings, Inc.Delphi CapitalManagement, Inc.ISafety NationalCasualty CorporationNAIC #15105(MO)Safety First InsuranceCompanyNAIC #11123(IL)IISafety National Re SPC(Cayman Islands)Safety SpecialtyInsurance CompanyNAIC#l3815(MO)5

SSIC -12/31/18 ExamAffiliated TransactionsThe Company was a party to the following affiliated agreements at December 31, 2018:Capital Support AgreementSSIC, SNCC, Safety First Insurance Company (SFIC) and Tokio Marine & NichidoAffiliates:Fire Insurance Co Ltd. (TMNF)May 21, 2013. Amended effective January l, 2016, to add SSIC.Effective:TMNF will provide SSIC, SNCC and/or SFIC an amount of statutory capital andTerms:surplus that is necessary to maintain a level at least equal to 300% of the amount oftheir authorized control level RBC.Tax Allocation AgreementDelphi Financial Group, Inc. and subsidiaries, including SSIC.Affiliates:January 1, 2001. Amended January 1, 2016 to add SSIC.Effective:Delphi Financial Group, Inc. files a consolidated federal income tax return annuallyTerms:on behalf of all participating members of the agreement. Each participant will payits share of the consolidated tax liability on the same basis as if it had filed its taxreturn on a separate and individual basis.Cost Sharing AgreementAffiliates:SSIC and Delphi Capital Management, Inc. (DCM)Effective:March 31, 20 I 6.DCM agrees to provide SSIC with all investment advisory and administrativeTerms:services necessary for the conduct of its business. SSIC pays DCM its share of thecosts of such services on an at-cost basis.Service AgreementAffiliates:SSIC and SNCCEffective:January 1, 2016SNCC provides services, staff and data processing functions to SSIC as necessaryTerms:for the conduct of SSIC's insurance operations. SSIC reimburses SNCC for itsallocable share of the costs of providing such services based on generally acceptedallocation methodologies.The following agreements were entered into as part of the commercial property fronting programwith Tokio Marine Kiln, Ltd. This program is described in the Territory and Plan of Operationsection below.Service AgreementAffiliates:SSIC and TMKJanuary 1, 2017Effective:TMK provides various services to SSIC under the commercial property programTerms:including claims services, legal services, administration, actuarial, financialservices and data processing. SSIC reimburses TMK for actual cost of servicesprovided6

SSIC - 12/31/18 Exam100% Quota Share Reinsurance AgreementAffiliates:SSIC and TMKJanuary 1, 2017Effective:Terms:SSIC cedes 100% of premiums and losses related to the commercial propertycoverage written by program administrators to TMK. SSIC retains a cedingcommission of between 1% and 5% based on the amount of gross net writtenpremiums ceded.Assumption AgreementAffiliates:SSIC and TMKJanuary 1, 2017Effective:TMK assumes, releases, discharges and indemnifies SSIC from any and allTerms:liabilities of SSIC arising from the commercial property insurance program.TERRITORY AND PLAN OF OPERATIONSSafety Specialty is licensed in Missouri under Chapter 384 RSMo (Surplus Lines Insurance) towrite surplus lines insurance in Missouri. The Company is eligible or approved to write surpluslines insurance in all 50 states and the District of Columbia, as well as all U.S. territories andCanada. The Company was acquired in 2015 to write various types of surplus lines coverage tocomplement the products offered by SNCC.Gross prem iums written increased dramatically during the examination period due to a programbegan i n 2017 with Tokio Marine Kiln, Ltd. under which SSIC writes commercial propertybusiness in the United States through various program administrators. The premiums are ceded toTMK through a 100% quota share reinsurance agreement. This program accounted for 71 % ofgross written premiums in 2018. The majority of SSIC's remaining business is ceded to SNCCunder a 90% quota share reinsurance agreement, resulting in a negligible amount of nel writtenpremiums.REINSURANCEGeneralPremiums written by the Company during the examination period were as follows:Direct WrittenAssumed from AffiliatesAssumed from Non-AffiliatesCeded to AffiliatesCeded to Non-AffiliatesNet Written Premiums 20162,043,070001,838,4220204,648201720,069,355 0 017,996,9241,506,321566,110 7 201866,485,7130025,116,94540,238,5521,130,216

SSIC - 12/31/18 ExamAssumedThe Company has not assumed any reinsurance since the acquisition by SNCC.CededA large portion of direct business is ceded to affiliated and unaffiliated reinsurers in an effort totransfer risk exposure. In general, approximately 90-98% of gross premiums were cededthroughout the examination period.Effective March 15, 2016, the Company entered into a 90% quota share reinsurance agreementwith Safety National Casualty Company. Under this agreement the Company cedes 90% ofpremiums and losses, less a ceding commission, on business classified as Public Officials Liability,Educators Legal Liability and Law Enforcement Liability insurance.Effective January 1, 20 I 7, the Company entered into a 100% quota share reinsurance agreementwith Tokio Marine Kiln, Ltd. Under this agreement the company writes commercial propertyinsurance through program administrators in the United States, and cedes all business to TMK lessa ceding commission. Effective January 1, 2018, the Company amended this agreement to cede75% to TMK and 25% to unaffiliated reinsurers.Effective June I, 2017, the Company entered into an 80% quota share reinsurance agreement withTokio Marine Kiln, Ltd. Under this agreement the Company cedes 80% of the first 25 millionon First and Third Cyber Liability policies.SSIC is contingently liable for all reinsurance losses ceded to others. This contingent liabilitywould become an actual liability in the event that an assuming reinsurer fails to perform itsobligations under the reinsurance agreement.ACCOUNTS AND RECORDSIndependent AuditorThe Company is audited annually by the accounting firm of PricewaterhouseCoopers LLP.Workpapers from the most recent audit were used during the course of the examination as deemedappropriate.Independent ActuariesReserves and related actuarial items reported in the financial statements were certified by theCompany's Chief Reserving and Appointed Actuary, TJ Clinch, FCAS.8

SSIC-12/31/18 ExamFINANCIAL STATEMENTSThe following financial statements are based on the statutory financial statements filed by theCompany and present the financial condition of the Company for the period ending December 31,2018. The accompanying comments on financial statements reflect any examination adjustmentsto the amounts reported in the annual statement and should be considered an integral part of thefinancial statements.There may have been additional differences found in the course of this examination that are notshown in the "Comments on Financial Statements." These differences were determined to beimmaterial in relation to the financial statements and therefore were only communicated to theCompany and noted in the workpapers for each key activity.9

SSIC - 12/31/18 ExamASSETSas of December 31, dsCash and short-term investmentsOther invested assetsInvestment income due and accruedUncollected premiumsDeferred premiumsOther amounts receivable under reins.Net deferred tax assetReceivables from affiliatesDeposits and other prepaid items TOTAL ASSETS 128,256,78710Non-AdmittedAssets0 000054,03600Net AdmittedAssets91,041,790 750,6541,271,46410,570,66854,036 00 128,202,751

SSIC - 12/31/18 ExamLIABILITIES, SURPLUS AND OTHER FUNDSas of December 31, 2018LossesLoss adjustment expensesOther expensesTaxes, licenses and feesCurrent federal income taxes payableUnearned premiumsCeded reinsurance premiums payableFunds held under reinsurance treatiesPayable to affiliatesPayable for securitiesOther amounts payable under reinsurance contractsTOTAL LIABILITIES Common capital stockSurplus notesGross paid in and contnbuted surplusUnassigned funds 14,200,0008,600,95659,817,97312,390,531SURPLUS AS REGARDS POLICYHOLDERS TOTAL LIABILITIES AND SURPLUS 128,202,7511185,009,460

SSIC - 12/31/18 ExamSTATEMENT OF INCOMEFor the Year Ended December 31, 2018Underwriting Income:Premiums earned Deductions:Losses incurredLoss adjustment expenses incurredOther underwriting expenses incurredTotal underwriting deductions 803,095316,07996,746(4,122,508)(3,709,683)Net Underwriting Gain (Loss)Investment Income:Net investment income earnedNet realized capital gains Net income before dividends and FIT 4,512,778 3,819,5233,897,397(77,874)Net Investment Gain (Loss)Other Income:Net loss from agents or premium balances charged offFinance and service chargesOther incomeTotal Other Income (1)00 (1) 8,332,300 1,669,11061663,1900Dividends to policyholdersFederal income taxes incurredNet income12

SSIC - 12/31/18 ExamRECONCILIATION OF SURPLUSChanges from December 31, 2015 to December 31, 2018Capital and surplus, end of prior yearNet incomeChange in net U/R capital gainsChange in net deferred income taxChange in nonadmitted assetsChange in surplus notesUnapproved interest on surplus notesChange in capital and surplusCapital and surplus, end of current year2016 054 67 ,631,356132017 (300)5,853,117 73,484,4722018 6(956)11,524,988 85,009,460

SSIC-12/31/18 ExamANALYSIS OF EXAMINATION CHANGESNo adjustments or reclassifications were made as a result of the examination.COMMENTS ON FINANCIAL STATEMENTSThere are no comments on the financial statements.SUBSEQUENT EVENTSThere were no significant subsequent events noted from December 3 l, 20 I 8, through the date ofthe report.SUMMARY OF RECOMMENDATIONSThere are no recommendations.14

SSIC - 12/31/18 ExamACKNOWLEDGEMENTThe assistance and cooperation extended by the officers and employees of Safety SpecialtyInsurance Company during the course of this examination is hereby acknowledged andappreciated. In addition to the undersigned, Andy Balas, AES, CFE, CPA, Doug Daniels, CFE,CPA, Richard Hayes, CFE. James Le, ARe, CFE, CPA, CPU, and Scott Reeves, CFE, CPA;examiners for the Missouri Department of Commerce and Insurance participated in thisexamination. Consulting actuary Kristine Fitzgerald, ACAS, MAAA, FCA, of Actuarial andTechnical Solutions, Inc. was retained by DCI to review the adequacy of the Company's reserves.VERIFICATION))County of St. Louis )State of MissouriI, on my oath swear that to the best of my knowledge and belief the above examination report istrue and accurate and is comprised of only facts appearing upon the books, records or otherdocuments of the Company, its agents or other persons examined or as ascertained from thetestimony of its officers or agents or other persons examined concerning its affairs and suchconclusions and recommendations as the examiners find reasonably warranted from the facts.ibc- Thomas Cunnin Examiner-in ChargeMissouri Department of Commerce andInsuranceExaminer-in-ChargeMissouri Department of Commerce andInsuranceSworn to and subscribed before me this \ 'Jay ofss;1: ;u : :CHRISTINA LAMBERTNOTARY PUBLIC-NOTARY SEALSTATE OF MISSOURIST. CHARLES COUNTYCOMMISSION #13507276MY COMMISSION EXPIRES JULY 24 2021":3o. nu0-.f\j I 2.D2.0c -Notary Public15

SSIC - 12/31/18 ExamSUPERVISIONThe examination process has been monitored and supervised by the undersigned. The examinationreport and supporting workpapers have been reviewed and approved. Compliance with NAICprocedures and guidelines as contained in the Financial Condition Examiners Handbook has beenconfirmed.Michael Shadowens, CFEAssistant Chief Financial ExaminerMissouri Department of Commerce and Insurance16

Fire Insurance Co., ltd. I Delphi Financial Group, Inc. I I Reliance Standard life Insurance Company of SIG Holdings, Inc. Delphi Capital Texas Management, Inc. NAIC #66575 (TX} I Safety National Casualty Corporation NAIC #15105 (MO) I I Safety First Insurance Safety National Re SPC Safety Specialty Company (Cayman Islands) Insurance Company