Transcription

Offer Period: 3rd Dec - 9th Dec 2021

What do you expect from your investments?Higher SafetyRelatively Stable ReturnsLower Taxby Edelweiss Mutual FundNo Lock-in

What do you expect from your investments?by Edelweiss Mutual FundBHARAT Bond ETF brings in the best features of – Bonds, Mutual Funds & ETFsBondsPredictable ReturnsFixed Maturity DateLower Interest Rate Risk,if held till maturityMutual FundsDiversified PortfolioProfessionally ManagedTax EfficiencyETFsHigh LiquidityLow Cost*Transparency*The fund will be managed at a very low cost -. Up to 10,000 crore -0.0005% p.a. ; Next 10,001 crore to 20,000- 0.0005% : Over 20,001 crores – 0.0001% p.a.

Invest in Public Sector Company BondsWith BHARAT Bond ETFInvest in Bonds of Public Sector Companies with just Rs.1000/The mentioned companies are part of Nifty BHARAT Bond Index – April 2032 as on 2nd November 2021by Edelweiss Mutual Fund

BHARAT Bond ETF – A Bond of TrustPublic Sector CompaniesAn Exchange Traded Fund which will invest your moneyin Public Sector Companies.Defined Maturity*The Fund will have a defined maturity date and at maturity you will get backyour investment proceeds along with returns.Exchange TradedYou can buy or sell units of this fund on exchange anytime during thetenure of the fund.* Please note that the Scheme (s) is neither a Capital Protected nor a Guaranteed Return Product.by Edelweiss Mutual Fund

Investment StrategyBHARAT Bond ETF – April 2032 will have a fixed maturity periodhaving a diversified portfolio of Public Sector Company BondsIt will seek to track investment results of the Nifty BHARAT BondIndex – April 2032It will invest in AAA rated Public Sector bonds maturing on or beforethe maturity date of the respective fundIt will endeavor to hold bonds till their maturity with an aim toprovide stable and predictable returnsby Edelweiss Mutual Fund

How it works?by Edelweiss Mutual FundBHARAT Bond ETFInvestorPublic Sector Company BondsBuy/Sell units of BHARATBond ETF which islisted/traded on the exchangeBHARAT Bond ETF invests in PublicSector Company bonds maturingon or before scheme maturityUpon maturity of the Fund, you will get back your moneyinvested along with the returns**Please note that the Scheme (s) is neither a Capital Protected nor a Guaranteed Return Product.

Nifty BHARAT Bond Index Methodologyby Edelweiss Mutual FundBHARAT Bond ETF will invest in Public Sector Company bonds that meet the eligibility criteria of the IndexBHARAT Bond ETF will have similar maturity as that of the IndexIndex will select bonds in a transparent manner through a 3-step processSelectionAAA rated bonds issued by publicsector companiesBonds maturing within 12 monthsprior to the maturity of IndexWeight AssignmentWeight based on totaloutstanding amount i.e.higher the outstanding– higher the weightageExposure to singlecompany capped at 15%RebalancingQuarterly Rebalancing ofIndex constituents

Investment options for you – ETF and FOFby Edelweiss Mutual FundInvestors holding Demat account can invest in BHARAT Bond ETF – April 2032.Investors who do not have a demat account have an alternative medium to invest via BHARAT Bond ETF FoF – April 2032BHARAT Bond ETF - April 2032BHARAT Bond ETF FOF - April 2032Invests inBHARAT Bond ETF- April 2032Underlying IndexYield10 years6.87%*10 years6.87%*Units of BHARAT Bond ETF- April 2032Underlying IndexYield*The Scheme will track the constituents of the underlying index i.e., NIFTY BHARAT Bond Index – April 2032. The indicative yield provided is that of the Index and not that of the Scheme. The Scheme (s) areneither a Capital Protected nor a guaranteed return Product and may or may not generate returns in line with Index. Indicative Yield of the Index is as on 2nd November 2021.

Why should you invest?by Edelweiss Mutual FundWhy Should You Invest?Stability & PredictabilityHigh SafetyTransparencyA bond like structure withfixed maturity providespredictable and stablereturns at maturityInvestment inPublic Sector BondsDaily disclosure ofportfolio constituentsand live NAV Periodicallythrough the day#No Lock-inLower TaxLow CostBuy/Sell onexchangeany time or throughAMC in specificbasket size#Tax efficient compared totraditional investmentavenues. Taxed at only 20%post indexation*The Fund will be managed ata very low cost – 0.0005%#*Additional surcharge and cess applicable #This is applicable only for BHARAT Bond ETF – April 2032.

Features Comparisonby Edelweiss Mutual FundWhy Should You Invest?FeaturesTargetMaturity IndexFunds/ETFsOpen-endedDebt MutualFundsVisibility* of Returns Liquidity Defined Maturity Tax Efficiency Indexation Ease of Access asan Investment ToolDiversificationTerm Deposits IndividualBondsTax FreeBondsSmall SavingsScheme *Please note that the Scheme (s) is neither a Capital Protected nor a Guaranteed Return Product.

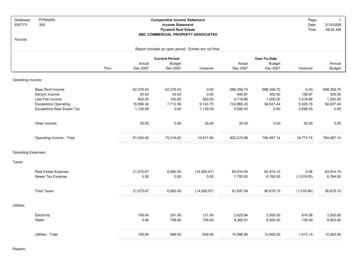

Indexation Exampleby Edelweiss Mutual FundWhy Should You Invest?BHARAT Bond ETF April 2032Traditional Investment100,000100,0006.87%5.40%11NAValue on Maturity198,847172,302Indexed Cost153,945100,000Taxable Amount44,90272,302Applicable Tax*9,34022,558Post Tax Value189,508149,7446.37%3.98%Investment AmountAssumed Rate of ReturnIndexation**Net Post Tax ReturnAssumed Tenure for Traditional Investment and Bond ETF (11 Indexation ) – 10.3 Years**Assumed Rate of Inflation is 4%.* Traditional Investment Taxed at 30% 4% Cess and BHARAT Bond ETF – April 2032 at 20% 4% Cess post indexation,Above is only for illustration purposes. Please consult you TAX Advisor before making any investmentIndexation is an efficient way to lower taxon your returns by adjusting it forinflation.Indexation allows you to adjust purchaseprice of your investment with inflation.It is applied to long term returns on yourinvestmentsHigher inflation means higher purchaseprice, which means lower taxLong term capital gain is taxed at 20%post Indexation

Nifty BHARAT Bond Index – April 2032 (Key Features)by Edelweiss Mutual FundWhy Should YouInvest?NIFTY Bharat Bond Index – April 2032 constituentsSr. no.IssuerRatingsWeights1INDIAN RAILWAY FINANCE CORPORATION LIMITEDAAA15.00%2POWER FINANCE CORPORATION LIMITEDAAA15.00%3POWER GRID CORPORATION OF INDIA LIMITEDAAA15.00%4NTPC LIMITEDAAA15.00%5NATIONAL BANK FOR AGRICULTURE AND RURAL DEVELOPMENTAAA14.98%6EXPORT-IMPORT BANK OF INDIAAAA12.15%7NHPC LIMITEDAAA8.72%8NUCLEAR POWER CORPORATION OF INDIA LIMITEDAAA4.15%Grand Total100%Key Index Quantitative Indicators (As of November 2, 2021)YTM6.87%Mod DurationMaturity DatePortfolioIndexation6.84 years15th April2032100% AAA11*The indicative yield provided is that of NIFTY BHARAT Bond Index – April 2032 and not that of the Scheme. The Scheme (s) are neither a Capital Protected nor a guaranteed Return Product and may or may notgenerate returns in lines with Index. Indicative Yield of the Index is as on 2nd November 2021

Scheme Features – ETF and FOFby Edelweiss Mutual FundWhy Should You Invest?SchemeInvestment ObjectiveNSE SymbolBHARAT Bond ETF – April 2032To track the Nifty BHARAT Bond Index – April 2032by investing in bonds of AAA-rated CPSEs/CPSUs/CPFIs and other Government organizations, subjectto tracking errors.Minimum InvestmentAmount (NFO Period)To generate returns by investing in units of BHARAT Bond ETF –April 2032.EBBETF0432NFO PeriodUnderlying IndexBHARAT Bond ETF FOF – April 2032NA3rd December - 9th December, 2021Nifty BHARAT Bond Index – April 2032Nifty BHARAT Bond Index – April 2032Rs. 1,000/- and in multiples of Re. 1/- thereafter, perapplication (Retail investors)Rs. 1,000/- and in multiples of Re. 1/- thereafter, per applicationRs. 2,00,001/- and in multiples of Re. 1/- thereafter,per application (Retirement Funds, QIBs and Noninstitutional investors) Exit LoadFund ManagerNIL If redeemed or switched out on or before 30 days from the dateof allotment – 0.10%;If redeemed or switched out after completion of 30 days fromthe date of allotment – NILMr. Dhawal Dalal (Fund Manager) and Mr. Rahul Dedhia (Co-Fund Manager)

Riskometer & Disclaimerby Edelweiss Mutual FundDisclaimer:The information provided above is for information purpose only and do not construe to be any investment, legal or taxation advice or solicitation of business in schemes of Edelweiss Mutual Fund. Please notethat Edelweiss Asset Management Limited (Investment Manager of Edelweiss Mutual Fund) / Edelweiss Trusteeship Company Limited (Trustee Company) / Edelweiss Financial Services Limited (Sponsor ofEdelweiss Mutual Fund) or any of its Associate Company will not be liable in any manner for the consequence of any action taken by you on the information contained herein. Please note that the proposedSchemes and their features are awaiting SEBI approval and may undergo changes accordingly. Please consult your Financial / Investment Adviser before making any investment decision. Neither Sponsor /AMC/ Trustee Company and its associates nor Edelweiss Mutual Fund or any person connected with it, accepts any liability arising from the use of this information. Utmost care has been exercised whilepreparing the document, and Sponsor /AMC /Trustee Company and its associates or Edelweiss Mutual Fund does not warrant the completeness or accuracy of the information and disclaims all liabilities,losses and damages arising out of the use of this information.MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

by Edelweiss Mutual FundThank you

The Fund will have a defined maturity date and at maturity you will get back . is neither a Capital Protected nor a Guaranteed Return Product. BHARAT Bond ETF -A Bond of Trust. by Edelweiss Mutual Fund It will seek to track investment results of the Nifty BHARAT Bond . Value on Maturity 198,847 172,302 Indexed Cost 153,945 100,000