Transcription

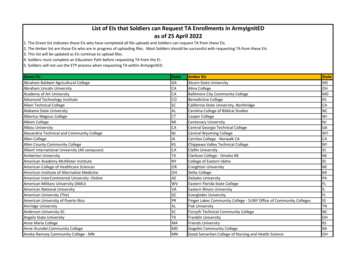

Revised 10/2016UNITED STATES BANKRUPTCY COURTEASTERN DISTRICT OF TENNESSEEINSTRUCTIONS FOR SUBMISSION OF AN APPLICATIONFOR PAYMENT OF UNCLAIMED FUNDSFor all applicants:1. Submit a completed application directly to the court. The application must contain a valid casenumber which includes the assigned judge's initials. Have your signature notarized. Seeattachment (1). Mailing instructions are listed below.2. Attach to the application a certificate of service evidencing that a copy of the application hasbeen mailed to the proper office of the United States Attorney for the Eastern Districtof Tennessee (as determined by the case number) pursuant to 28 U.S.C. § 2042. Noticeto the United States Attorney is required in ALL instances. See attachment (2).3. Attach a proposed order. See attachment (3). The order must contain a valid case numberwhich includes the assigned judge's initials. If the application is being filed by anattorney for the applicant, the proposed order should be approved for entry by theattorney.4. If the applicant is not the owner of record, additional information must be submitted with theapplication. Click here for complete requirements.5. Mail a copy of the entire application packet to the United States Attorney’s Office for thedivision indicated by the case number.6. File a form AO 213, Vendor Information/TIN Certification form. See attachment (4).A form is required for all applications submitted and must be filed separately.Click here for the form. Forms are also available on the court’swebsite, http://www.tneb.uscourts.gov/forms-local. Applications filed electronicallymust use the restricted access event, Form 213 Vendor Information/Certification, perLocal Rule 3011-1(c). For conventional filings (over the counter or mailed), this formwill be docketed separately using the restricted access event.For claimants in multiple cases, a separate application must be prepared for each case with all theabove requirements attached to each application.All indications of fraud will be promptly forwarded to the United States Attorney for review.Privacy Note: Because documents filed with the Court are available through the Internet, the Court iscommitted to the protection of personal identification information. It is also recommended that all butthe last four digits of a Social Security number be blackened, for the same privacy reasons.

Mailing Application and Order forms:For all cases in the Southern division (case numbers beginning with 1).Example: 1:15-bk-11234-SDR or 1:15-bk-11235-NWW.Please note that cases in the Southern division are assigned to eitherThe Honorable Shelley D. Rucker ("SDR") or The Honorable Nicholas W. Whittenburg("NWW").Please query the case in PACER to determine the assigned judge.United States Bankruptcy CourtHistoric United States Courthouse31 East 11th StreetChattanooga, TN 37402-2722For all cases in the Northeastern division (case numbers beginning with 2).Example: 2:15-bk-51234-MPP.United States Bankruptcy CourtJames H. Quillen United States Courthouse220 West Depot Street, Suite 218Greeneville, TN 37743-4924For all cases in the Northern division (case numbers beginning with 3).Example: 3:15-bk-31234-SHB.United States Bankruptcy CourtHoward H. Baker Jr. United States Courthouse800 Market Street, Suite 330Knoxville, TN 37902-2343For all cases in the Winchester division (case numbers beginning with 4).Example: 4:15-bk-11234-SDR.United States Bankruptcy CourtHistoric United States Courthouse31 East 11th StreetChattanooga, TN 37402-2722

Revised 05/27/2014UNITED STATES BANKUPTCY COURTEASTERN DISTRICT OF TENNESSEEAttachment (1)IN RE:DebtorBankruptcy Case NumberAPPLICATION FOR PAYMENT OF UNCLAIMED FUNDSThe Claimant identified below applies for an Order authorizing payment of unclaimed funds now on deposit in theTreasury of the United States for the benefit of Claimant. Claimant was a creditor/debtor in the above captionedbankruptcy case and has not received payment of these funds which remain due and owing to the Claimant.Claimant furtlıer states that Claimant is:NAME OF CLAIMANT:PHONE NUMBER: LAST FOUR DIGITS OF SOCIAL SECURITY NO:MAILING ADDRESS:CITY: STATE: ZIP:Amount of Unclaimed Funds Requested: Claimant certifies that all statements made by Claimant on this Application and any attachments required for thisApplication are, to the best of Claimant's knowledge, true and correct. Accordingly, Claimant requests the Court toenter an Order authorizing payment of the unclaimed funds currently being held for the benefit of the Claimant.Date:Claimant’s SignatureCo-claimant’s Signature (if any)State ofCounty ofSubscribed and sworn to before me this day of , 20 .Notary PublicMy commission expires:

Attachment (2)CERTIFICATE OF SERVICEIn accordance with 28 U.S.C. § 2042, the undersigned hereby certifies that on the datedesignated below a true copy of this application with all required attachments was mailed to[check one as applicable]:For all cases in Chattanooga & Winchester divisions (five-digit case number beginningwith 1):Office of the United States AttorneyEastern District of Tennessee1110 Market Street, Suite 301Chattanooga, TN 37402For all cases in the Greeneville or Knoxville division (five-digit case number beginningwith 2 ,3 or 5):Office of the United States AttorneyEastern District of Tennessee800 Market Street, Suite 211Knoxville, TN 37902Date:Claimant’s Signature

Revised 05/27/2014Attachment (3)UNITED STATES BANRUPTCY COURTEASTERN DISTRICT OF TENNESSEEIN RE:DebtorBankruptcy Case NumberORDER GRANTING APPLICATION FOR PAYMENTOF UNCLAIMED FUNDSThe Court having considered the Application for Payment of Unclaimed Funds filed by:NAME OF CLAIMANT:MAILING ADDRESS:STATE: ZIP:CITY:("Claimant") for payment of unclaimed funds in the amount of ,and it appearing to the Court that the Claimant is entitled to receive payment, and these funds are now ondeposit in the Treasury of the United States, and that proper notice of the Application was given to the UnitedStates Attorney for the Eastern District of Tennessee pursuant to 28 U.S.C. § 2042,IT IS THEREFORE ORDERED that the Clerk of the United States Bankruptcy Court direct the issuanceof a draft upon the Treasury of the United States in the amount stated above and payable to the Claimant.###

AO 213P (9/19)REQUEST FOR PAYEE INFORMATION AND TIN CERTIFICATIONRefer to the instructions page for further information on completing this form.Vendors providing goods and services must use the AO 213 form.Part 1Line 1.Line 2.Part 2Payee InformationPayee Name:Additional payee information: (if applicable)Business Name (if different from above)Enter your TIN in the appropriate box.EIN:The TIN provided must match the name given in Part 1, Line 1.Enter only an EIN or SSN - NOT BOTH.SSN:Part 4 Select the appropriate box below for U.S. tax classification for person or entity listed in Part 1, Line 1.” Corporation (Payments related to attorneys’ fees or gross proceeds paid to attorneys)” Individual or single member LLC” LLC (Except single member)” Partnership(Select one:) ” C Corp ” S Corp ” Partnership ” Trust/Estate” Other:Part 5 Mailing AddressStreet address:City:State:Zip code:Name:Point of Contact (if different from Part 1, Line 1 above)Phone #:Email Address:Part 6 Electronic Funds Transfer (EFT) Information (OPTIONAL)Owner(s) name as it appears on bank account:Bank Name:Routing #: (Must contain 9 digits)Payee must select an account type: (Select one)” Checking ” SavingsAccount Number: (do not include check number)Part 7 CertificationUnder penalties of perjury, I certify that:1.The number shown on this form is my correct taxpayer identification number; and2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have notbeen notified by the IRS that I am subject to backup withholding as a result of a failure to report all interest anddividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and3.I am a U.S. citizen or other U.S. person (defined in the instructions).Part 3The IRS does not require your consent to any provision of this document other than the certifications required to avoidbackup withholding.Signature:Date:Select those boxes that apply:” Addition” ActiveFor Judiciary Use Only” ChangeVendor Code:” InactiveVendor Type:(Trustee or Vendor)Vendor Administrators: Attach this form to the JIFMS MANL document. This form can also be submitted, subject to separation of dutiesrequirements, via HEAT at: https://nsms.ao.dcn. The service request can be found under Financial Management Services JIFMS Vendor Additionsor Updates. For FAS4T users (CCAM only), send this form to the local court vendor administrator. For questions regarding JIFMS and courtFAS4T, please contact the National Support Desk at (210) 536-5000. This form should be completed including the vendor's signature and submittedby Judiciary staff only.Sensitive information must be securely maintained and only visible to designated staff.PrintSave As.Reset

General InstructionsPurpose of the AO 213PThe Judiciary utilizes the AO 213P to collect information necessary tofacilitate payment by EFT or U.S. Treasury check.For many payments, the Judiciary is required to file an information return(e.g., 1099-MISC; 1099-INT) with the IRS and, therefore, must obtainpayees’ correct names and associated TINs to do so. If a TIN is notprovided, a payee may be subject to backup withholding –situations where the judiciary must withhold a certain percentage to ensurethe IRS receives any tax due on the payment.Payments disbursed by the U.S. Treasury on the judiciary’s behalf mustcollect payee TINs to comply with the U.S. Treasury’s TIN Policy.Payee TINs, obtained through this form, may be used by thegovernment to collect and report on any delinquent amounts arising out ofthe payee’s relationship with the government.Part 1, Line 1Do not leave this line blank. Enter only one name for you or yourentity. The name should match the name on your or your entity’s U.S.tax return.Individual. Generally, enter the name shown on your U.S. tax return. If youhave changed your last name without informing the Social SecurityAdministration of the name change, enter your first name, the last nameas shown on your social security card, and your new last name.Note:For Individual Taxpayer Identification Number (ITIN)applicants, enter your name as it was entered on your IRS Form W-7application, line 1a.Sole Proprietor or Single-Member LLC. Enter your name as shown onyour IRS 1040/1040A/1040EZ in Part 1. You may enter your businessname or “doing business as” (DBA) name in Part 2.Partnership, LLC (Except Single-Member LLCs), or Corporations.Enter the entity’s name as shown on the entity’s U.S. tax return in Part 1and any business name or DBA name in Part 2.Other entities. Enter your name as shown on required U.S. taxdocuments in Part 1. This name should match the name shown on thecharter or other legal document creating the entity. You may enter anybusiness name or DBA name in Part 2.Part 1, Line 2If this form is being completed so that a U.S. Treasury check may beissued payable to more than one person or entity, or if an EFT paymentwill be issued to an account owned jointly, enter in Part 1, Line 1 thename of the person or entity whose TIN you entered in Part 3.Additional names for joint accounts or for other payees (“and,” “or,”or “care of”) must be entered in Part 1, Line 2.If payment is to be made by EFT to Payee 1 AND Payee 2,co-owners of a joint accountU.S. Treasury check madepayable to Payee 1, Payee 2,AND Payee 3.Then, enter the following Payee 1’s name in Part 1,Line 1;Payee 2’s name in Part 1,Line 2;Payee 1’s TIN in Part 3.Payee 1’s name in Part 1,Line 1;Payee 2’s name AND Payee3’s name in Part 1, Line 2;Payee 1’s TIN in Part 3.U.S. Treasury check madepayable to Payee 1, Payee 2,OR Payee 3.U.S. Treasury check madepayable to Payee 1, CARE OF (c/o) Power of AttorneyPayee 1’s name in Part 1,Line 1;Payee 2’s name OR Payee3’s name in Part 1, Line 2;Payee 1’s TIN in Part 3.Payee 1’s name in Part 1,Line 1;C/O Power of Attorney namein Part 1, Line 2;Payee 1’s TIN in Part 3.Part 2If you have a business or DBA name, you may enter it in Part 2.Part 3Enter your or your entity’s TIN in the appropriate box. The TIN must bethe TIN associated with the one person or one entity listed in Part 1,Line 1.If you are a resident alien and you do not have – and are not eligible to get– an SSN, your TIN is your ITIN. Enter it in the social security numberbox.If you are a sole proprietor and you have an EIN, you may enter eitheryour SSN or EIN.If the LLC is classified as a corporation or partnership, enter theentity’s EIN.Part 4Check the appropriate box in Part 4 for the U.S. tax classification of theperson or entity’s whose name is entered in Part 1. Check only one box inPart 4.Part 5Enter your address (number, street, and apartment or suitenumber). This is where your paper U.S. Treasury check and anyinformation returns (e.g., 1099-MISC; 1099-INT), if applicable, will bemailed.Enter a point-of-contact name, email, and phone number. A point ofcontact is necessary if an entity is listed in Part 1, Line 1 or a point-ofcontact is different than an individual listed in Part 1, Line 1.Part 6The Routing Number must be nine digits. If you are unsure of yourRouting or Account Numbers, consult your financial institution.You must identify your account as either checking or savings toensure our payment is accepted by your financial institution. Theaccount must be associated with the one person or one entity listed inPart 1, Line 1.Part 7You must cross out item 2 if you have been notified by the IRS that youare currently subject to backup withholding because you have failed toreport all interest and dividends on your tax return.For item 3, you are considered a U.S. person, for federal taxpurposes, if you are: An individual who is a U.S. citizen or U.S. resident alien; A partnership, corporation, company, or association created ororganized in, or under the laws of, the United States; An estate (other than a foreign estate); or A domestic trust (as defined in Regulations section 301.7701-7).For a joint account, only the person whose TIN is shown in Part 3should sign.

requirements, via HEAT at: https://nsms.ao.dcn. The service request can be found under Financial Management Services JIFMS Vendor Additions or Updates. For FAS4T users (CCAM only), send this form to the local court vendor administrator. For questions regarding JIFMS and court FAS4T, please contact the National Support Desk at (210) 536-5000.