Transcription

OECD Economic SurveysEconomic AssessmentThailandOctober -snapshot/

This Overview is extracted from the Economic Assessment of Thailand. The Assessment ispublished under the responsibility of the Secretary-General of the OECD.This document and any map included herein are without prejudice to the status of or sovereigntyover any territory, to the delimitation of international frontiers and boundaries and to the nameof any territory, city or area.OECD Economic Surveys: Thailand OECD 2020You can copy, download or print OECD content for your own use, and you can include excerptsfrom OECD publications, databases and multimedia products in your own documents,presentations, blogs, websites and teaching materials, provided that suitable acknowledgment ofOECD as source and copyright owner is given. All requests for public or commercial use andtranslation rights should be submitted to rights@oecd.org. Requests for permission to photocopyportions of this material for public or commercial use shall be addressed directly to the CopyrightClearance Center (CCC) at info@copyright.com or the Centre français d’exploitation du droit decopie (CFC) at contact@cfcopies.com.

3Table of contentsExecutive summary71 Key policy insights13Re-boosting growth after the COVID-19 outbreakThe COVID-19 outbreak struck an already slowing economyMonetary policy should remain very accommodativeThe financial sector appears sound, but risks are risingFiscal management is sound, but could be more flexibleThe fiscal framework is transparentTax revenue can be increased and made more progressiveThe healthcare and social protection systems need to be put on a more sustainable footingThe pension system needs to be made more inclusiveReforms to boost productivity are required for future prosperityImproving the business environment is key to boosting productivityMore investment in public infrastructure is neededThe potential of SMEs is still untappedEnhanced public sector integrity will help improve the overall business climateMaking agriculture more sustainable and productiveAddressing informality would benefit growth and well-beingReducing informality would bring multiple benefits to the economyGender gaps still persist in some domains despite recent effortsThe COVID-19 crisis is an opportunity to make the economy 0616268TablesTable 1. Activity is projected to contract, before bouncing back in 2021Table 1.1. An overview of South-East Asia’s confinement measuresTable 1.2. Relief measures were promptly introducedTable 1.3. Macroeconomic indicators and projectionsTable 1.4. Length to restore the pre-crisis peak levelTable 1.5. Low-probability vulnerabilities could hit the economyTable 1.6. Bond purchasing measures in Asia’s emerging market economiesTable 1.7. Regulatory framework for Fintech in Thailand is in line with the regional best practicesTable 1.8. Selected fiscal rules under the Fiscal Responsibility ActTable 1.9. Thailand’s social protection is more comprehensive than other Asian countriesTable 1.10. Almost all Thai citizens are covered by healthcare programmesTable 1.11. Past OECD Recommendations on fiscal policyTable 1.12. Past OECD Recommendations on structural policyTable 1.13. Recommendations to macroeconomic stability, structural and social policiesOECD ECONOMIC SURVEYS: THAILAND 2020 OECD 2020821222326273032333839415966

4 FiguresFigure 1. The share of renewable energy supply is highFigure 2. The catch-up with advanced countries has slowed downFigure 3. PISA scores are lowFigure 4. Skills shortages are substantialFigure 5. Services sectors are importantFigure 1.1. Thailand’s economy was performing well until the COVID-19 crisisFigure 1.2. Inequality between regions is significantFigure 1.3. Recent economic developmentsFigure 1.4. Exports of goods by market and commodityFigure 1.5. Thailand benefited less from trade diversion than its peersFigure 1.6. The sharp drop of international tourists affects Thailand significantlyFigure 1.7. The COVID-19 outbreak intensity varies in the regionFigure 1.8. Economic activity hit by lockdown orders has shown a slight reboundFigure 1.9. Thailand has experienced three severe shocks since 1960Figure 1.10. Private investment has contracted with weakening imports of capital goodsFigure 1.11. Policy reaction has been prompt when inflation turned negativeFigure 1.12. Thai Baht appreciated more than other currencies in the regionFigure 1.13. Fintech companies in Thailand are mainly in corporate finance, lending & credit and paymentsystemFigure 1.14. The central government's fiscal deficit has narrowed, but is expected to rise sharplyFigure 1.15. Disbursements of public capital spending allocations have declinedFigure 1.16. Thailand's tax revenue collection is still low compared to OECD countriesFigure 1.17. The value added tax accounts for almost a quarter of total revenueFigure 1.18. The overall level of inequality has declined but the tax-and-transfer system still plays a ratherlimited role in redistributing incomesFigure 1.19. Public social protection expenditure has much room to expandFigure 1.20. Healthcare expenditure is rising fastFigure 1.21. Thailand's old-age dependency ratio is expected to increase rapidlyFigure 1.22. Public debt is on the rise, but still below the threshold set by the governmentFigure 1.23. Public debt scenariosFigure 1.24. Thailand's labour force has been decliningFigure 1.25. Productivity is weakening in some sectors, including manufacturingFigure 1.26. Investment in Thailand is low relative to regional peersFigure 1.27. Thailand has made progress in improving its business environmentFigure 1.28. Thailand’s protection of international property rights is comparable to regional peersFigure 1.29. Thailand is lagging in terms of rail infrastructureFigure 1.30. Internet use and mobile services could be further improvedFigure 1.31. SMEs are an important driver of economic activity and employmentFigure 1.32. Thailand needs to strengthen its anti-corruption frameworkFigure 1.33. Thailand has stepped up anti-money laundering measuresFigure 1.34. Land productivity of natural rubber has declinedFigure 1.35. Thailand's food processing industry could thrive moreFigure 1.36. Informality remains high and is concentrated in agriculture and servicesFigure 1.37. Despite overall progress, Thailand lags behind in political empowerment of womenFigure 1.38. Renewables are x 1.1. South-East Asia’s public health policy reactions to counter the COVID-19 outbreakBox 1.2. How did Thailand recover from the previous severe shocks?Box 1.3. The pandemic has expanded central bank’s toolkit in emerging market economiesBox 1.4. Fiscal reform can ensure fiscal sustainabilityBox 1.5. Seeking for a better practice in PPPs2025304251OECD ECONOMIC SURVEYS: THAILAND 2020 OECD 2020

5This Assessment is published on the responsibility of the Secretary-General of the OECD. The draft reportwas discussed at a meeting of the Economic and Development Review Committee on 10 July 2020, withparticipation of representatives of the Thai authorities.The 2020 OECD Economic Assessment of Thailand was prepared by Kosuke Suzuki, MariekeVandeweyer, Ricardo Espinoza, Miso Lee, Laura Reznikova, and Tan Kay Kiang, under the supervisionof Patrick Lenain. It benefitted from contributions at various stages by Alvaro Pereira, Isabell Koske, FrankVan Tongeren, Christine Arriola, Inese Rozensteine, Andrew Bell, Alessandro Goglio, Michele Cimino,Andrea Cornejo, Norihiko Yamano, Peter Horvát, Manasit Choomsai Na Ayudhaya, and Thanit Herabat.Isabelle Luong provided statistical assistance and Stephanie Henry provided editorial support. Supportfrom the governments of Japan, Thailand and Malaysia is gratefully acknowledged.This is the first Economic Assessment of Thailand.OECD ECONOMIC SURVEYS: THAILAND 2020 OECD 2020

6 BASIC STATISTICS OF THAILAND, 2019*(Numbers in parentheses refer to the OECD average)**LAND, PEOPLE AND ELECTORAL CYCLEPopulation (million)69.6Under 15 (%)16.8(17.9)Over 65 (%)12.4(17.1)International migrant stock (% of population, 2015)5.8(9.7)0.3(0.6)Latest 5-year average growth (%)Population density per km² (2018)135.9(38.0)Life expectancy at birth (years, 2018)76.9(80.1)Men (2018)73.2(77.5)Women (2018)80.7(82.8)Latest general electionMarch-2019ECONOMYGross domestic product (GDP)Value added shares (%)In current prices (billion USD)544.4Agriculture, forestry and fishing8.0(2.6)In current prices (billion THB)16 875.9Industry including )Latest 5-year average real growth (%)3.4(2.2)Per capita (000 USD PPP)19.2(48.3)GENERAL GOVERNMENTPer cent of GDPExpenditure (2018)21.6(40.4)Revenue (2018)21.4(37.5)Exchange rate (THB per USD)31.00Main exports (% of total merchandise exports)PPP exchange rate (USA 1, 2018)12.37Machinery and transport equipment40.7Food and live animals13.2Manufactured goods12.9Gross financial debt (2018, OECD: 2017)EXTERNAL ACCOUNTSIn per cent of GDPExports of goods and services59.8(54.2)Imports of goods and services50.6(50.5)Main imports (% of total merchandise imports)Current account balance7.0(0.3)Machinery and transport equipment35.0Net international investment position (2017)-7.1Manufactured goods17.3Mineral fuels, lubricants and related materials15.7LABOUR MARKET, SKILLS AND INNOVATIONEmployment rate (aged 15 and over, ion rate (aged 15 and over, %)67.0(61.1)Mean weekly hours worked42.3Unemployment rate, Labour Force Survey (aged 15 and over, %)0.7(5.4)Youth (aged 15-24, %)4.2(11.7)Long-term unemployed (1 year and over, %)0.05(1.4)19.1(38.0)1.0(2.6)( 8.6)Tertiary educational attainment (aged 25-64, %, 2016, OECD: 2019)***(37.6) Gross domestic expenditure on R&D (% of GDP, 2017, OECD: 2018)ENVIRONMENTTotal primary energy supply per capita (toe, 2017, OECD: 2018)2.0(4.0)CO2 emissions from fuel combustion per capita (tonnes, 2017, OECD: 2018)3.520.0(10.5)Renewable internal freshwater resources per capita (1 000 m³, 2014)3.3Exposure to air pollution (more than 10 μg/m³ of PM 2.5, % of population, 2017)99.7(58.7)Income inequality (Gini coefficient, 2018, OECD: latest available)0.364(0.332) Education outcomes (PISA score, 2018)Poverty gap at USD3.10 a day (2011 PPP, %, 2013)0.12Renewables (%, 2017, OECD: 2018)SOCIETYPublic and private spending (% of GDP)Health care (2017)3.7(12.5)Education (% of GNI, ence426(489)Share of women in parliament (%)16.2(30.7)Net official development assistance (% of GNI, 2017)0.03(0.4)* The year is indicated in parenthesis if it deviates from the year in the main title of this table.** Where the OECD aggregate is not provided in the source database, a simple OECD average of latest available data is calculated where data exist for at least 80% of member countries.*** For Thailand, data refers to aged 25 and over.Source: Calculations based on data extracted from databases of the following organisations: OECD, International Energy Agency, International Labour Organisation, International Monetary Fund, World Bank.OECD ECONOMIC SURVEYS: THAILAND 2020 OECD 2020

Executive summary

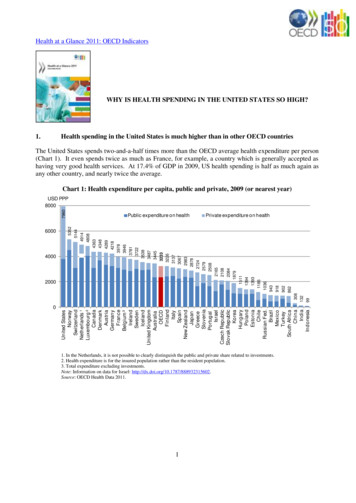

8 COVID-19 has abruptly interruptedThailand’s socioeconomic progressThailand made impressive economic andsocial progress over the past decades,thanks to its strong policy framework,friendly business climate, and attention tocitizens’ well-being. However, the COVID-19crisis has interrupted this progress, and a severerecession will occur in 2020, like in most othercountries. The economic recovery will be slow,and achieving high-income country status willrequire more policy reforms focused onproductivity growth and human capitalaccumulation. Together with environmentalprotection and inclusive growth, these goals areat the centre of the government’s “NationalStrategy 2018-2037”.Growth will contract sharply in 2020, beforebouncing back in 2021 (Table 1). Thegovernment has managed the COVID-19outbreak well and rapidly flattened the curve ofnew cases and deaths. Nevertheless, thelockdown measures to contain the outbreak haveseverely affected domestic demand. Tourism hasbeen hit particularly severely. Macroeconomicpolicies have been supportive, but risks arenonetheless tilted to the downside due to highuncertainties about the future course of theoutbreak. Investments to strengthen thehealthcare system and to prepare for a secondwave, with sufficient protective and testingcapacity, would help to bolster confidence.Table 1. Activity is projected to contract,before bouncing back in 2021Real GDPPrivate consumptionExportsImportsInflation (CPI)Federal governmentfiscal balance1Public debt, gross1Currentaccountbalance1Low oil prices risk undermining efforts tomitigate climate change during the postCOVID recovery. Instead, further investments inrenewables energy capacity could be key leversfor a sustainable economic recovery (Figure 1).The tourism industry also needs to becomegreener and more productive in the recoveryphase by adopting digital technology, especiallyin rural areas. In addition to preserving thecountry’s rich natural and cultural assets, a bettermanagement of local environments, includingwater and waste, would shore up the wholeattractiveness of the region.Figure 1. The share of renewable energysupply is highRenewable energy, % of primary energy 7.04.54.9Note: 1) % of GDP.Source: OECD calculations.Vulnerable workers are being hit hard. Evenbefore the outbreak, labour informality waswidespread despite the rapid eradication ofextreme poverty. Informal workers lack access tosufficient social protection, including trainingopportunities, weighing on overall productivity.Together with targeted formalisation measures,particularly for women, the emergency supportsneed to be gradually transformed into structuralmeasures to up- and re-skill vulnerable workers,thus making the post-outbreak economy moreinclusive and productive.20002004200820122016Source: IEA, IEA World Energy Statistics and Balances Database.Macroeconomic support is neededThanks to its sound macroeconomic policyframework, Thailand was well placed torespond rapidly to the sharp economicdownturn. Monetary policy has been quick toinject liquidity and support credit, while fiscalpolicy has cushioned the loss of income andhelped struggling companies.OECD ECONOMIC SURVEYS: THAILAND 2020 OECD 2020

9Inflation has dropped sharply, not only due tolow energy prices, but also to weak demand,raising concerns about deflation and fastdeteriorating economic prospects. The Bankof Thailand has reacted quickly, cutting its policyrate to a record low level. If downside risksmaterialise, the Bank could ease its monetarystance further. The use of additional policy toolsshould also be considered if space to lower itspolicy rate becomes insufficient.Fiscal policy has focused on providingfinancial relief to affected households andenterprises. The size of the fiscal measuresincluded in the various packages (14.8% of GDP)has been sizable. This has been made possibleby ample fiscal space, thanks to its pastprudence, and measures to contain the deficitand public debt prior to the crisis. After the exitfrom lockdown measures, fiscal resourcesshould be reallocated to boost public investmentand foster the long-term growth potential(Figure 2).Figure 2. The catch-up with advancedcountries has slowed downOECD 100120GDP per capita in 2017 USD PPPKoreaThailandViet Nam10080in general education in Thailand is high,particularly at the primary level, with access toprimary education nearly universal.The number of out-of-school children hasfallen since the turn of the century, thoughmany students from the poorest families still donot attend school, and the rates of exclusion arehigher in rural areas and among various ethnicand linguistic communities. Consequently,students of the age 15 achieve lower scores inreading, science and mathematics, on average,than OECD countries and Asian peers (Figure 3).The share of highly educated workers hasnonetheless increased significantly andmany young graduates hold degrees inengineering and manufacturing, socialsciences and ICT. Although the wage premiumfor university degrees remains strong, it hasdeclined relative to, for example, lowersecondary qualifications. The rapid expansion oftertiary education has not always been matchedwith job opportunities for graduates. High-qualitycareer guidance services, together with policiesstimulating the demand for higher-level skills inthe labour market, will be essential.Figure 3. PISA scores are lowMalaysiaChinaPISA mean ource: World Bank, World Development Indicators 18The tax and transfer system has little impacton the distribution of income. Revenuecollection remains low, and relies strongly onVAT, which is not progressive. In the long term,rapid population ageing will put pressure on fiscalsustainability. Higher tax revenue will be neededto strengthen social and healthcare expenditure.Source: OECD (2019), PISA 2018 Results (Volume I).Getting the right skills for prosperityThis situation makes it important to improvethe matching of demand and supply of skills.Thai employers could greatly benefit from a morethorough analysis of the type of skills that theyneed to hire, and should be involved moreThailand has made remarkable progress inexpanding access to education. ParticipationOECD ECONOMIC SURVEYS: THAILAND 2020 OECD 2020Because of skills mismatches, substantiallabour shortages prevail in a range ofoccupations and industries. The largestshortages are found in professional and officesupport occupations, but also in more technicaloccupations, like crafts and related trades,machine operators and assemblers (Figure 4).

10 actively in the formulation of vocational educationand training programmes. Efforts are being madeto provide high-quality career guidance, and thiscould be further expanded.Figure 4. Skills shortages are substantialShortage ( ) and surplus (-) intensity, 2018 or latestProfessionalsClerical support workerscoherent manner. Thailand has committed totrade integration, but can benefit more fromservice-oriented Preferential Trade Agreements(PTAs). PTAs that contain ambitious regulatoryreforms “behind the borders”, such as theRegional Comprehensive Economic Partnership(RCEP) and the Comprehensive and ProgressiveAgreement for Trans-Pacific Partnership (CPTPP), could provide the Thai manufacturers withbetter access to more efficient services providers.Craft & related trades workersFigure 5. Services sectors are importantPlant & machine operatorsElementary occupationsServices share of GDPServices & sales workers2019 or latest year available70Technicians & ass. professionalsThe services sectors have become important(Figure 5) and essential to international trade.Compared to its very large tourism sector, thesector of high-end services remains small. As theCOVID-19 pandemic has severely affectedinternational tourism, nurturing other servicesexports would make the Thai economy moreresilient. As IT and information, and professionalservices are traded indirectly through valuechains and are now crucial elements ofmanufacturing, strengthening these serviceswould benefit Thailand in reconfiguring itsparticipation in global value chains and enhancethe competitiveness of its manufacturers.The expansion of services sector is hinderedby tight regulations. Liberalising these sectorswould restore their competitiveness and boostproductivity not only in the services sectorsthemselves, but also in manufacturing sectorsthat rely on these services as input. Thegovernment recognises its importance, but thereare still a number of barriers, notably ininternational mobility of skilled workers and FDI.As goods and services trades are intertwined,barriers to both must be addressed in a2010SGPJPNOECDPHLAUSTHAKORMYS0CHNExpanding foreign trade in services30IDNSource: OECD, Skills for Jobs Database.40LAO0.6VNM0.4MMR0.2BRN050KHMSkilled agricultural workers-0.6 -0.4 -0.260OECDThailandManagersSource: World Bank, World Development Indicators Database.Foreign direct investment is essential toexpand exports of services. Restrictions oninward FDI have been eased in manufacturing,but not sufficiently in services. Eliminating FDIrestrictions would not only spur employment andexports, but also benefit consumers.As trade integration would entail jobdisplacement and wage adjustment, policieswill need to be put in place to mitigate theimpact on affected workers. In addition, sinceopening markets would stimulate demand of themanufacturing sector for more sophisticatedbusiness services, it would increase the demandfor highly skilled wokrers, exacerbating theexisting skills imbalances. To maximise thebenefits of services trade integration, Thailandneeds to step up policies to re- and up-skillworkers and make the labour market moreflexible. Particularly, given the significant regionaldisparities and a large share of agricultureemployment in Thailand, facilitating labour forceadjustment among different sectors andoccupations is crucial.OECD ECONOMIC SURVEYS: THAILAND 2020 OECD 2020

11MAIN FINDINGSKEY RECOMMENDATIONSMacroeconomic policy, fiscal sustainabilityThe COVID-19 outbreak has severely hit economic activities, and growth isexpected to be negative in 2020 and remain weak, while there is the high riskof a second wave of the pandemic.As high uncertainty about the future course of the outbreak and weakemployment prospects weigh on confidence of businesses and households,the recovery will be slow, which would have a scarring effect on long-termproductivity.Although the government’s fiscal position has been healthy, spending needswill increase further if the COVID-19 outbreak worsens.Extend the emergency support measures to vulnerable households andSMEs, if the situation worsens.Strengthen the capacity of public health system including testing.In the short run, maintain employment and stimulate demand.As the recovery becomes steady, boost the productive capacity of theeconomy by gradually shifting from income and employment supports tostructural measures including the up- and re-skilling of workers.In case further spending is required, use the available fiscal space within thefiscal constraints, and ensure cost-effectiveness and transparency.Inflation has dropped sharply and is expected to be negative in 2020 beforebouncing back to the lower bound of the target in 2021, with risks titled to thedownside.Keep monetary policy very accommodative, and if downside risksmaterialise, reduce the policy rate further.Consider additional monetary policy tools, if interest rate cuts furthernarrow policy space.Boosting productivity, tackling inequality and informality and narrowing gender gapsWhistle-blower protection is partially covered by separate laws.Consider developing a single dedicated law to protect whistle-blowers.Labour informality is high and female workers are concentrated in the informalsector, including as domestic workers.Lower the costs of formalisation by reviewing the stringent employmentprotection policies and preparing customised policy measures to thetargeted people with enhanced awareness among vulnerable people.Reach out to female informal workers and make formalisation measuresmore in line with their needs.Greening growthThe share of renewable energy production is growing, but still lower than inother regional peers.Mass tourism and narrow stakeholder involvement have caused degradationof tourism resources, while the overall productivity level of the tourism industryhas been low.To attain a sustainable high growth path, invest in green infrastructure,particularly strengthen the capacity of renewable energy production.Encourage further digitalisation of the tourism industry, especially in ruralareas and the reduction of its environmental footprint.Involve wider local communities to retain broader environmental resources,including the management of water and waste.Getting the right skills for future prosperitySkill needs in the Thai labour market are not assessed in a regular andsystematic way.Develop robust tools to regularly assess skill needs at the national, regionaland sectoral level.Student achievement is low by international standards and regionalinequalities are large.Consolidate the implementation of school curricula and improve educationinfrastructure in rural areas.Despite a slight decline in recent years, the wage benefit to university degreesis strong.Pair skills policies with policies that stimulate the demand for high-level skillsin the labour market by lowering barriers to entry for firms, intensifying effortsto boost technology adoption levels and actively promoting entrepreneurshipthrough professional and educational channels.Sufficiently use labour market information to develop relevant policies andpromote adult learning programmes.Promote targeted support (e.g. career guidance and trainings on skills in highdemand) for workers in jobs with high risk of significant changes.Data collection and analysis of participation of adults in training andemployers’ provision of training are lacking.Workers going though structural changes do not have sufficient labour marketinformation and access to necessary trainings.Making the best of international trade in servicesServices sector markets in Thailand are more strictly regulated than in otherAsian countries.Remove barriers in restricted sectors, particularly regarding the internationalmobility of skilled workers by expanding the coverage of Smart Visa.Restrictions of FDI tend to be stricter in the services sectors.Remove obstacles to FDI by relaxing the rules on capital thresholds andlisted sectors.Pursue PTAs that contain ambitious regulatory reforms beyond the currentcommitments under the General Agreement on Trade in Services (GATS).Thailand has concluded preferential trade agreements (PTAs), some of whichcontain services elements.OECD ECONOMIC SURVEYS: THAILAND 2020 OECD 2020

131 Key policy insightsDespite successful economic and social progress in the past decades, newchallenges are emerging, not least those that result from the COVID-19outbreak and its socioeconomic consequences. To achieve a high-incomestatus, returning to “business as usual” is no longer sufficient. Implementingsubstantial structural reforms, while maintaining macroeconomic stabilityand improving inclusiveness, is more than ever a prerequisite to re-boosteconomic growth. This chapter discusses policies to regain productivity andtackle social imbalances, both of which would further improve the wellbeingof Thailand’s population.OECD ECONOMIC SURVEYS: THAILAND 2020 OECD 2020

14 Re-boosting growth after the COVID-19 outbreakUntil the outbreak of the COVID-19 pandemic, Thailand had achieved successful economic and socialprogress. After the Asian Financial Crisis of the late 1990s, which severely hit the economy, a series ofstructural reforms restored growth at a pace robust enough to achieve resiliency when hit by the GlobalFinancial Crisis in 2008-09 and to become an upper-middle economy (Figure 1.1). The transformation froman agrarian economy to an export-oriented manufacturing regional centre in past decades has createdhigher-wage jobs and significantly reduced poverty. Progress was also made towards universal educationand social security, thus improving people’s welfare considerably.Figure 1.1. Thailand’s economy was performing well until the COVID-19 crisisGDP per capita relative to the OECD average, computed at 2017 USD PPPOECD 1001009080KoreaThailandIndonesiaViet NamOECD 008201020122014201620180Source: World Bank, World Development Indicators Database.Integration into the global economy brought economic prosperity. Thailand has benefited from beinglocated at the geographical centre of the Association of South East Asian Nations (ASEAN) and Asianregions, making it an attractive place to invest and trade. One of Thailand’s ports, Laem Chabang, is theworld’s 21st largest container port and the fourth largest in ASEAN, after Singapore and two Malaysianports. From the outset of its development in the 1960s, Thailand promoted openness and investment.Building on a friendly business environment, Thailand has been successful in attracting large inflows offoreign direct investment (FDI). Its manufacturing sectors, particularly in automobiles and electronics, aredeeply connected to global value chains (GVCs). Lessons have been learnt from natural disasters, suchas the floods that disrupted manufacturing production in 2011, thus making the value chains more resilient.However, progress towards higher economic and social levels has been suddenly interrupted by theCOVID-19 outbreak, despite the good management of the sanitary situation by the government. A severerecession is projected for 2020, with a sharp contraction of activity and employment, like in most othercountries, and the recovery will be slow. A second wave of the pandemic in Thailand or in other countrieswould further postpone the return to growth. The crisis will delay the achievement of high-income countrystatus and will require an adequate macroeconomic policy response and structural reforms focused onproductivity growth and human capital accumulation.Thailand was in a sound macroeconomic situation when it was hit by the crisis, with a strong fiscal positionand low inflation. However, trade tensions had already wea

Figure 1.1. Thailand's economy was performing well until the COVID-19 crisis 14 Figure 1.2. Inequality between regions is significant 15 Figure 1.3. Recent economic developments 17 Figure 1.4. Exports of goods by market and commodity 18 Figure 1.5. Thailand benefited less from trade diversion than its peers 18 Figure 1.6.