Transcription

Bermuda ReportingRequirementsAn overview of statutory andsolvency reporting deliverablesfor general insurersMay 2021

ContentsOverview of reporting landscape4Statutory Financial Statements7Economic Balance Sheet9Bermuda Solvency Capital Requirement13Governance and disclosure19 2021 DCB Holding Ltd. and its affiliates.Bermuda Reporting Requirements2

Commonly used acronyms in the Bermuda reporting regimeBELBest Estimate LiabilityFCRFinancial Condition ReportALMAsset Liability MatchingGSSAGroup Solvency Self-AssessmentBMABermuda Monetary AuthorityLRSLoss Reserve SpecialistBSCRBermuda Solvency Capital RequirementLRSOLoss Reserve Specialist OpinionCISSACommercial Insurer’s Solvency Self-AssessmentMSMMinimum Solvency MarginCIRACommercial Insurer Risk AssessmentPMLProbable Maximum LossCSRCapital and Solvency ReturnRMRisk MarginEBSEconomic Balance SheetSFSStatutory Financial StatementsECREnhanced Capital RequirementTPTechnical Provisions 2021 DCB Holding Ltd. and its affiliates.Bermuda Reporting Requirements3

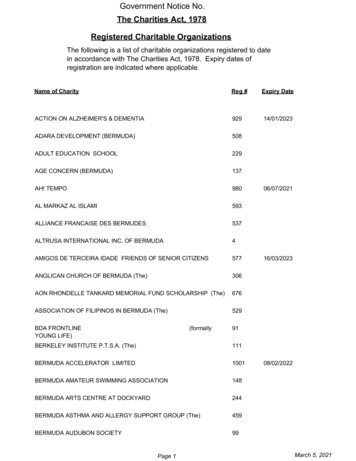

Overview of reporting landscape 2021 DCB Holding Ltd. and its affiliates.Bermuda Reporting Requirements4

Statutory reporting regimeTo ensure that Bermuda continues to adhere to international standards and best practices for insurance regulation andsupervision, in 2015 the BMA instituted a series of enhancements to its statutory and prudential reporting requirementsfor commercial insurers.Statutory ReportingThe BMA recognizes that insurers having varying risk profiles arising from the nature, scale and complexity of their business. As a result, commercial insurers haveadditional reporting requirements, such as: Every commercial insurer shall, in addition prepare GAAP financial statements in respect of its insurance business for each financial year. A company canchoose to report under US GAAP, Canadian GAAP or another framework (such as IFRS) as their ongoing reporting requirements.What’s audited?Prudential FiltersConsolidated GAAP FinancialsConsolidated StatutoryFinancial Statements – Newrequirement from 2016Unconsolidated StatutoryFinancial Statements 2021 DCB Holding Ltd. and its affiliates.When is it filed?Must file within 4 months of theyear-end unless an extension isobtained, which is usually issued 1month at a time, provided that thecompany is in compliance and thereis a valid reason for the request.Actuarial OpinionCommercial classes require aloss reserve specialistopinion on the TechnicalProvisions on the EBS.The principal representative isresponsible for obtaining theextension.Bermuda Reporting Requirements5

Solvency reporting and capital assessmentAs a Solvency II equivalent jurisdiction, Bermuda adopts a Three Pillar approach to risk-based supervision. Insurers file aCapital and Solvency Return (CSR) within four months of the financial year end.Solvency ReportingAn overarching objective of Bermuda’s solvency regime over the past decade is to achieve and maintain Solvency II equivalence, which effectively enablesBermuda domiciled insurers to conduct business in the EU on a level playing field as EU domiciled insurers. The BMA is keen to sustain and continue to developits risk-based regulatory approach that both (a) meets or exceeds international standards and (b) appropriately reflects the nature of the Bermuda market.To this end, numerous legislation and guidance have been recently issued, that broadly mirror the Three Pillar approach of Solvency II.Pillar 1Quantitative RequirementsRequired capital based onEconomic Balance Sheet(EBS).Bermuda Solvency CapitalRequirement (BSCR)computed using standardformula or approvedinternal model.Calibrated to approach butnot exceed Solvency II. 2021 DCB Holding Ltd. and its affiliates.Pillar 2Risk GovernancePillar 3Risk DisclosurePrepare CommercialInsurer’s Solvency SelfAssessment (CISSA),assessing risk governanceand capital adequacy undernormal and stressedconditions.Beginning with 2016-yearend, prepare FinancialCondition Report (FCR).Integrate at Group levelwhere multiple legalentities exist.To be made publiclyavailable on insurer’swebsite.Outline performance, riskprofile, and organizationalgovernance.Bermuda Reporting Requirements6

Statutory Financial Statements (SFS) 2021 DCB Holding Ltd. and its affiliates.Bermuda Reporting Requirements7

Statutory financials and scope of auditIn order to streamline the process and minimize duplication of effort, the BMA amended statutory accounting valuationstandards to be consistent with GAAP valuation, subject to certain prudential filters.Scope of the AuditGAAP Financial Statements and Prudential Filters are required to beaudited.The auditor’s opinion is whether the statutory balance sheet, statutoryincome statement, and statutory capital and surplus have beenprepared in accordance with the Act and these Rules.Audited- Forms 1SFS, 2SFS and 8SFSAuditedSome key prudential filters include:GoodwillValued at zero.Other intangiblesValue of future economic benefitsflowing to insurer, only if separable andevidence of similar exchangetransactions; zero otherwise.Prepaids and deferredexpensesValued at zero.Deferred acquisitioncosts (DAC)Valued consistently with GAAP.Contingent liabilitiesDeferred taxassets/liabilitiesAuditedExpected present value of future cashflows.Valued consistently with GAAP. 2021 DCB Holding Ltd. and its affiliates.Source: Bermuda Monetary AuthorityBermuda Reporting Requirements8

Economic Balance Sheet (EBS) 2021 DCB Holding Ltd. and its affiliates.Bermuda Reporting Requirements9

The Economic Balance Sheet frameworkBeginning with financial year 2016, the EBS framework forms the basis used to determine capital requirements forBermuda commercial insurers. The Loss Reserve Specialist is also required to render an opinion on the reasonablenessof EBS technical provisions.AssetsPrinciples of EBSAssets and liabilities are assessed and included onthe EBS at fair value in line with GAAP principles, or,if GAAP does not require an economic valuation,following the EBS fair value hierarchy.Free surplusRequired capital overMSMSpecifically, a Technical Provision is required forinsurance liabilities. It is calculated as follows:Minimum SolvencyMargin (MSM) Best estimate cashflows Discounted for time value of money andilliquidityMarket value of assets 2021 DCB Holding Ltd. and its affiliates.Assets backing TechnicalProvisionWhen applying the EBS framework, the principle ofsubstance over form is applied, for example whenselecting actuarial methodologies.Enhanced CapitalRequirement (ECR)Risk margin Plus, a risk margin for uncertainty inherent in thecashflowsBecause EBS is designed to evaluate a company’slevel of economic surplus, non-economicassumptions are zeroed.LiabilitiesEBS Technical ProvisionBest estimate liabilityBermuda Reporting Requirements10

Unpacking the Technical ProvisionThe Technical Provision represents the amount required to meet insurance obligations as they fall due, and compensatecapital providers for assuming the risk inherent in these obligations.1. Liability cash flowsare projectedaccording to theactuary’s bestestimate assumptionsfor the relevant riskdrivers.2. Cash flows arediscounted to reflecttime value of moneyand illiquidity. TheBMA providescalibrated discountcurves for widely usedcurrencies.Best estimate cashflows 2021 DCB Holding Ltd. and its affiliates.Discounted for timevalue of money andilliquidity3. A risk margin isadded to reflect theinherent uncertaintyin the best estimatecash flows. Thisreflects the amountof compensationrequired by capitalproviders for bearingthis uncertainty. Risk margin4. The EBS TechnicalProvision is the totalliability valuerecorded forinsurance obligations.The Loss ReserveSpecialist renders anopinion on thereasonableness ofoverall TPs. EBS TechnicalProvisionBermuda Reporting Requirements11

Other EBS considerationsThere are several other new concepts in the EBS framework that build on the statutory basis toward a moreeconomically consistent technical provision. Notably, insurers need to calculate a risk margin, adjust reinsurancerecoverable for default costs, and render an actuarial opinion on the overall reasonableness of the TPs.Risk marginCounterparty defaultA risk margin is added to the BEL to arrive at the total EBStechnical provision. Although the BEL by definition reflects theexpected value of insurance benefits payable, there isinherent uncertainty in the underlying cash flows.Under the EBS framework, reinsurance recoverables must be adjusted for expected losses due tocounterparty default. The preferred methodology mirrors widely used expected credit lossapproaches.Conceptually, the risk margin represents the compensationrequired by the insurer to bear this uncertainty. The preferredmethodology is the Cost of Capital approach, but certainapproximations are permissible. Under this approach, theinsurer calculates the cost of holding its required capital overthe lifetime of its insurance obligations, as follows:Bound But Not Incepted (“BBNI”) Business𝑅𝑅𝑅𝑅 𝐶𝐶𝐶𝐶𝐶𝐶 𝐸𝐸𝐸𝐸𝐸𝐸𝑡𝑡1 𝑟𝑟𝑡𝑡 1𝑡𝑡 1 𝐸𝐸𝐸𝐸𝐸𝐸𝑡𝑡 is the insurers required capital at time t, per thestandard formula or its own internal model. 𝑟𝑟𝑡𝑡 is the risk-free discount rate 𝐶𝐶𝐶𝐶𝐶𝐶 is the cost of capital – currently 6%Provisions must also be set aside for business to which the insurer is bound to as at the valuationdate, even though the underlying contracts may not yet have incepted.Actuarial opinionUnder the new reporting regime, an actuarial opinion is required on the reasonableness of EBSTPs.The Loss Reserve Specialist should specifically discuss the following: Commentary on data underlying the EBS TPs Discussion of how Events Not In Data (ENIDs) are incorporated into their actuarial estimates Discussion of how the Loss Reserve Specialist arrived at their actuarial estimates of theinsurer’s aggregate TPs Commentary on the methodology used to arrive at the adjustment included in the bestestimate of reinsurance recoveries that was made to reflect expected losses due tocounterparty default 2021 DCB Holding Ltd. and its affiliates.Bermuda Reporting Requirements12

Bermuda Solvency Capital Requirement (BSCR) 2021 DCB Holding Ltd. and its affiliates.Bermuda Reporting Requirements13

Capital requirementsInsurers are required to demonstrate capital adequacy with respect to the Bermuda Solvency Capital Requirement(BSCR), which is computed per the BMA’s standard capital model or an approved internal capital model.Risk categoriesGeneral insurers must calculate capital requirements with respect to the categories to theright. Most capital calculations are determined by multiplying the prescribed capital factorby some defined exposure amount. Some key factors include:Diversified BSCROperational RiskCapitaladjustments Premium: ranges from 15-55% of diversified net written premium with concentrationadjustment Reserve: ranges from 12-52% of diversified EBS BEL with concentration adjustment Catastrophe: Net PML less CAT premium less credit risk charge on reinsurancerecoverable Investments: generally, market value x factor ranging by riskiness of assetMarket RiskAggregationInsurance RiskFixed receivableReserve Interest: duration or shock-based methodology on net assets Market: generally, market value x factor ranging by riskiness of assetCredit RiskInterest/LiquidityCatastropheCapital requirements are aggregated in a straightforward manner, applying a very simpledependency structure as follows: Half the credit risk charge is perfectly correlated with reserve riskConcentration All other pairs are independent of each other Operational risk and capital adjustments are added on post diversification 2021 DCB Holding Ltd. and its affiliates.CurrencyBermuda Reporting Requirements14

BSCR Individual ChargesBelow we explain in more detail the risk charges associated with Bermuda’s BSCR framework for general insurersSummary of BSCR Risk ChargesRisk ModuleBermuda BSCRFixed Income Investment RiskApplies to all fixed income investments, and charges vary by asset class (corporate bonds, mortgages, etc.) and BSCR rating.Equity Investment RiskApplies to all equity investments and varies by various factors. Includes common equity, preferred equity, and real estate.Credit RiskApplies to reinsurance exposure balances, as well as accounts receivables.Interest Rate RiskApplies to net assets, either via a duration-based approximation or using a interest rate shock methodology on asset and liability cash flows.Concentration RiskApplies to top 10 asset exposures. Effectively, the insurer must hold double the asset risk charge on these 10 exposures; however, theadditional charge is diversified with other risk modules.Currency RiskApplies to net foreign currency exposures, and charges vary by currency.Premium RiskApplies by BMA Line of Business. Written premium applicable for each line is used to arrive at a premium risk charge by multiplying therelevant premium by an associated pre-defined risk factorReserve RiskApplies by BMA Line of Business. Takes the claims provision component of the TPs by Line of Business, and arrives at a reserve risk chargeby multiplying the claims provision by an associated pre-defined risk factorCatastrophe RiskCatastrophe risk exposures by peril / region are multiplied by risk factors and aggregated in order to arrive at an overall catastrophe riskchargeDiversification CreditApplied using a straightforward covariance approach prescribed by the BMA.Operational RiskApplies as a surcharge to diversified BSCR, based on the insurer’s self assessment of their risk controls and governance.TaxesN/A 2021 DCB Holding Ltd. and its affiliates.Bermuda Reporting Requirements15

Solvency ratios and eligible capitalFinancial instruments may qualify into one of three tiers according to their permanence and subordination. The BMAfurther enforces constraints on the quality of capital supporting the MSM and ECR.MSM and ECRThe Minimum Solvency Margin (MSM) is a prescribed regulatory capital floor as a function of business volume. The Enhanced Capital Requirement (ECR) is themaximum of the MSM and BSCR requirements. The BMA imposes a target ECR coverage ratio of 120%. BSCR will almost always be greater than the MSM and willhence drive the ECR.The minimum capital requirements are intended to reflect a 0.5% probability of insolvency, generally considered commensurate to a BBB-rated company.Companies targeting higher credit ratings would target higher coverage ratios as defined in their risk appetite.Eligible capitalThe general criteria for an instrument toqualify into one of the three capital tiers areoutlined in the table to the right.In the case where certain assets areencumbered due to the nature of a particularreinsurance structure, any excessencumbrances are classified as either Tier 1 orTier 2. 2021 DCB Holding Ltd. and its affiliates.TierConstraintsGeneral criteria for eligibilityTier 1At least 80% of MSMAt least 50% of ECRPerpetual, unencumbered, non-redeemable, noncallable and the highest level of subordination.Tier 2At most 25% of MSMAt most 50% of ECRRelaxes some Tier 1 criteria to allow callable hybridsand some other non-perpetual instruments availableunder a going concern, and certain approved lettersof credit/guarantees.Tier 3Ineligible for MSMAt most 15% of ECRFurther relaxes criteria to allow more non-perpetualinstruments, and certain approved letters ofcredit/guarantees.Bermuda Reporting Requirements16

Transition to new regimeIn its continued effort to maintain Solvency II equivalence, the BMA planned several refinements to the BSCR standardmodel which were recently field-tested prior to implementation. The changes came into effect 1/1/2019 and phased-inover a three-year period for general insurers.AreaEquity riskChanges in new regimeIn the current regime, equity risk charges range from 5% to 55% by type of holding. The new regime introduces various changes to these charges, notably increasing the charge on commonstocks from 14.4% to 35%. Additionally, strategic or duration-based holdings are now charged 20%. Short positions used for hedging purposes may be netted.Additionally, equity holdings are classified into three buckets, which are assumed to be 75% pairwise correlated, as opposed to perfect correlation in the current framework.Risk aggregationIn the current regime, risks are generally considered to be independent, with a few exceptions, leading to generous diversification benefits. The new regime uses multiple layers of correlationmatrices, consistent with the Solvency II approach.Operational riskIn the current regime, the operational risk surcharge ranges from 1% to 10% according to the insurer’s score on the CIRA. The scoring process is unchanged; however, the new regime changesthe associated range of surcharges to 1% to 20% and steepening the scale such that insurers are further incentivized to implement comprehensive operational risk frameworks.Deferred taxesThe BMA recognizes that certain Bermuda-licensed insurers pay taxes in a foreign jurisdiction, and consequently any loss absorbing capacity resulting from such should be deducted from theinsurer’s capital requirements. The new regime sets adjustment limits based on a combination of carried-back losses, current net DTL position, and anticipated carried-forward losses.Premium riskIn the current regime, premium risk exposure only considers net written premiums for the current reporting year. To better align with Solvency II, the scope for premium risk charge is expanded to include potentialgrowth in earned premium over the following year, as well as future earned premiums on multi-year contracts.Risk mitigationThe BMA recognizes that risk mitigation techniques are central to many insurers’ business strategies and will allow adjustments to capital requirements subject to certain criteria on the permanence and legalenforceability of such mitigation.Look throughIn the current regime, risk charges for investments in collective investment vehicles or funds are evaluated on a total basis. The new regime requires “looking through” to the underlying assets within the fund anddetermining risk charges on an individual basis.If individual asset information cannot be reliably obtained, risk charges may be calculated based on a target allocation provided that the underlying assets are strictly managed to these targets, or based oninvestment limits, representing the riskiest allocation that is at any time permissible within the investment strategy.Phase-inProposed changes are being linearly graded in over three reporting years beginning with the 2019 year-end filings. 2021 DCB Holding Ltd. and its affiliates.Bermuda Reporting Requirements17

Capital requirements for Insurance GroupsA comparison of the BSCR risk changes under the Old Regime and New Regime is presented belowSummary of BSCR Risk ChargesOld RegimeNew RegimeFixed IncomeInvestment RiskVarying factors by asset class and BSCR rating applied to value offixed income investmentsSimilar, includes a risk charge for credit spreads based on prescribedshocksEquity InvestmentRiskVarying factors equity type and BSCR rating applied to value ofequity investments (includes common/preferred equity, and realestate)Varying shocks applied to 4 categories of equities, taking intoaccount equities qualified for risk-mitigating purposesInterest andLiquidity Risk2% factor applied to value of asset and net duration gapVarying shocks applied to interest rate based on c

Statutory Financial Statements. 7. Economic Balance Sheet. 9. Bermuda Solvency Capital Requirement. 13. Governance and disclosure. 19 . the BMA amended statutory accounting valuation standards to be consistent with GAAP valuation, subject to certain prudential filters. Statutory financials and scope of audit