Transcription

DEPARTMENT OF INSURANCE, FINANCIALINSTITUTIONS AN]) PROFESSIONAL REGISTRATIONP0. Box 690, Jefferson City, Mo. 65102-0690ORDERAfter full consideration and review of the report of the financial examination of MissouriValley Life and Health Insurance Company for the period ended December 31, 2017,together with any’ written submissions or rebuttals and any relevant portions of theexaminer’s workpapers, I, Chiora Lindley-Myers. Director of the Missouri Department ofInsurance. Financial Institutions and Professional Registration pursuant to section374.205.3(3)(a). RSMo, adopt such examination report. Alter my consideration and reviewof such report, workpapers, and written submissions or rebuttals. I hereby incorporate byreference and deem the following parts of such report to be my findings and conclusions toaccompany this order pursuant to section 374.205.3(4), RSMo: summary of significantfindings, subsequent events, company history, corporate records. territory and plan ofoperation. reinsurance, financial statements. financial statement changes resulting fromexamination, comments on financial statement items, and summary of recommendations.Based on such findings and conclusions, I hereby ORDER that the report of the tinancialexamination of Missouri Valley Life and Health Insurance Company as of December 31,2017 be and is hereby ADOPTED as filed and for Missouri Valley Life and HealthInsurance Company to take the following action or actions, which I consider necessary tocure any violation of law, regulation or prior order of the Director revealed by such report:(1) account for its financial condition and affairs in a manner consistent with the Director’sfindings and conclusions.So ordered, signed and official seal affixed thisday of June, 2019.Chlora Lindley-Myer-fectorDepartment of Insurance. Financial 1nstiitionsand Professional Registration

REPORT OF THEFINANCIAL EXAMINATION OFMissouri Valley Life and HealthInsurance CompanyASOFp’1DECEMBER 31, 201744’4’STATE OF MISSOURIDEPARTMENT OF INSURANCE, FINANCIAL INSTITUTIONS ANDPROFESSIONAL REGISTRATIONJEFFERSON CITY, MISSOURI

TABLE OF CONTENTSSCOPE OF EXAMINATIONPERIOo COVEREDIPROCEDURESIRELIANCI UPON QrIlI-Rs2SUMMARY OF SIGNIFICANT FINDINGS2SUBSEQUENT EVENTS2CORPORATE HISTORY2GENERAl2CAI’I At. CONTRIBUTIONS3DIVIDENDS3MERGERS AND Acvisi DONS3CORPORATE RECORDS3BOARD OF DIRECTORS3CONINIITTEES4Oil ICFRS4HoLDrco C0NIPANv. SUBSIDI \IES. AND AEEILIATES5OROANIZATIONAI. CIIART7INI ERCOMPANY TRANSACTIONS8TERRITORY AND PLAN OF OPERATIONREISURANCE910GENERAL10ASsLIEB10CEDED10

FINANCIAL STATEMENTS.11ASSETS12L:. \rnL:TIES. SLRPLLS AND OTHER FINDS12Su.: F\IE\T OF INCOMEL3CAPITAl. AND SERPIUS Accot:N13FINANCIAL STATEMENT CHANGES RESULTING FROM EXAMINATION14COMMENTS ON FINANCIAL STATEMENT ITEMS14SUMMARY OF UPERVISION1611

Kansas City, MOMay 16, 2019Honorable Chiora Lindley-Myers. DirectorMissouri Department of Insurance. FinancialInstitutions and Professional Registration301 West High Street. Room 530Jefferson City. Missouri 65102Director Lindley-Myers:In accordance with your financial examination warrant, a full scope financial associationexamination has been made of the records. aiThirs and financial condition ofMissouri Valley Life and Health Insurance Companyhereinafter referred to as Missouri Valley or as the Company. Its main administrative office islocated at 2301 Main Street, Kansas City, Missouri 64108. The fieldwork for this examinationbegan on June 25. 2018 and concluded on the above date.SCOPE OF EXAMINATIONPeriod CoveredThe Missouri Department of Insurance. Financial Institutions and Professional Registration(DIFP) has performed a full scope financial examination of Missouri Valley Life and HealthInsurance Company. The last examination covered the period January 1. 2008 through December31. 2012 and was also completed by examiners from the DIFP. This examination covers thepcriod of January 1.2013 through December 31. 2017.This examination was performed concurrently with the examination of the Companys parent. BlueCross and Blue Shield of Kansas City (BCBSKC). and its other affiliates: Good Health HMO. Inc.(Good Health). and Blue Advantage Plus of Kansas City, Inc. (BA ).The examination also includes the material transactions and/or events occurring subsequent toDecember 31. 2017. which are noted in this report.ProceduresWe conducted our examination in accordance with the National Association of InsuranceCommissioners (NAIC) Financial Condition Examiners Handbook (Handbook) except wherepractices. procedures and applicable regulations of the DIFP and statutes of the State of Missouriprevailed. The Handbook requires the planning and performance of the examination to evaluatethe Companys financial condition. assess corporate governance, identify current and prospectiverisks of the Company and evaluate system controls and procedures used to mitigate those risks.An examination also includes identifying and evaluating significant risks that could cause aninsurer’s surplus to be materially misstated both currently and prospectively.

Missouri Valley—12/31/17 ExamAll accounts and activities of the Company were considered in accordance with the risk-focusedexamination approach. This may include assessing significant estimates made by managementand evaluating management’s compliance with Statutory Accounting Principles. The examinationdoes not attest to the fair presentation of the financial statements included herein. If. during thecourse of the examination an adjustment is identified, the impact of such adjustment will hedocumented separately following the Company’s financial statements. The following keyactivities were identified during the examination: Investments. Related Party. Reserves/ClaimsHandling. Premiums/Underwriting, and Medicare Advantage.The examination report includes significant findings of fact and general information about theinsurer and its financiaL condition. There may be other items identified during the examinationthat, due to their nature, are not communicated within the examination report but separatelycommunicated to other regulators and/or the Company.Reliance Upon OthersThe examination relied upon information provided by the Company and its management. Wherethe examiners have deemed appropriate, this information has been tested or verified with externalsources. The examiners also relied upon information supplied by the Company’s independentauditor. Ernst & Young. LLP of Kansas City’. Missouri for its audit covering the period fromJanuary 1. 2017 through December 31. 2017 and BCBSKC’s Internal Audit Department.Information relied upon included, but was not limited to: fraud risk analysis. process narratives.control and substantive testing procedures for investments, premiums. claims, and taxes.SUMMARY OF SIGNIFICANT FINDINGSThere were no material adverse findings, significant non-compliance issues, or material changesto the financial statements noted during the examination.SUBSEQUENT EVENTSAs discussed below in the Territory and Plan of Operation section. Missouri Valley entered theMedicare Advantage marketplace in 2018.CORPORATE HISTORYGeneralMissouri Valley was incorporated on June 4. 1987 and commenced business on June 1, 1990 as alife insurer under the insurance Jaws of Chapter 376 Revised Statutes of Missouri (RSM0) (Life.Health, and Accident Insurance). The Company is also licensed to write insurance in the State ofKansas. hut has not written any premiums in Kansas since 1999. Missouri Valley was originallyestablished primarily to write individual and group health business outside of the service territoryof its ultimate parent. BCBSKC.2

Missouri Valley—12/3 1/17 ExamCapital ContributionsIn December 2017. the Company received a 3.000.000 capital contribution from its direct parent.BCBSKC. No other capital contributions were made to the Company during the examinationperiod.DividendsNo dividends were declared or paid during the examination period.Mergers and AcquisitionsThere were no mergers or acquisitions significant to Missouri Valley during the period underexamination.CORPORATE RECORDSThe Company’s Articles of Incorporation and its Bylaws were reviewed for the period underexamination. No changes to the Articles of Incorporation were made during the examinationperiod.The Companv’s Bylaws were amended and restated in August 2017 to reflect various updates andrevisions. The primary revision was to Article 5 relating to the liability and indemnification ofofficers and directors. Other revisions included changing the number of directors from nine to noless than nine, adding a requirement for meetings to he held when called, allowing for statementsof consent in lieu of meetings, limiting the compensation of directors and officers toreimbursement of expenses tied to meetings. and the addition ofan affiliation clause that does notallow contracts with companies or organizations affiliated with officers.The minutes for the Board of Directors and shareholders meetings were reviewed for properapproval of corporate transactions. In general. the minutes appear to properly reflect and approvethe Company’s major transactions and events for the period under examination.Board of DirectorsThe management of the Company is vested in a Board of Directors. The Company’s Articles ofConsolidation and Incorporation and its Bylaws specify that the number of directors shall be noless than nine. The Directors elected and serving, as of December 31, 2017, were as follows:NamePrincipal Occupation and Business AffiliationErin E. StuckyExecutive Vice President. Marketing Innovation and BusinessDevelopment. BCBCKCThomas E. NightingaleTreasurer and Actuary. Missouri Valley. Senior Vice President.Chief Financial Officer. and Treasurer. BCBSKC3

Missouri Valley—12/31/17 ExamKim G. WhiteVice President and Chief of StafC BCBSKCRichard J. efAdministrative Officer and Corporate Secretary, BCBSKCRon R. RoweSenior Vice President. Sales and Marketing. BCBSKCDanetle K. WilsonVice President. Missouri Valley, President and Chief ExecutiveOfficer. BCBSKCNancy M. Ct-easyPresident and Chief Executive Officer, Missouri Valley,Executive Vice President. Technology and Service Delivery,BCBSKCKaren S. JohnsonVice President. Healthcare Insights and Partnerships. BCBSKCGreg I. Sweal. MDVice Presideni and Chief Medical Officer, BCBSKCSubsequent to the examination date, Richard 3. Kastner, Ron R. Rowe, Danette K. Wilson andNancy M. Creasy resigned from the Board of Directors. Jenny L. Housley, Raelene Knolla, DO,Chad M. Moore and Mark A. Newcomer were appointed Directors, effective January 15, 2019.CommitteesThe Company does not have any committees and utilizes the committees of its parent, BCBSKCto manage its operations.OfficersThe Board of Directors annually elects various Company officers, as required by the Bylaws. ThePresident and Chief Executive Officer supervises the day to day operations of the Company asdirected by the Board of Directors. The senior officers elected and serving as of December 31.2017 were as follows:Nancy M. CreasyRichard J. KastnerThomas E. NightingaleGregory T. Sweat, MDDanette K- WilsonPresident and Chief Executive OfficerSecretaryTreasurer and ActuaryChief Medical OfficerBoard ChairSubsequent to the examination date. Nancy M, Creasy and Richard J. Kastner resigned as officersof the Company. Effective January 16, 2019, GregoryT. Sweat. MD was appointed President andChief Executive Officer, Raelene KnoI]a. DO was appointed Medical Director. Mark A.Newcomer was appointed Secretary, and Erin E. Stucky was appointed Board Chair.4

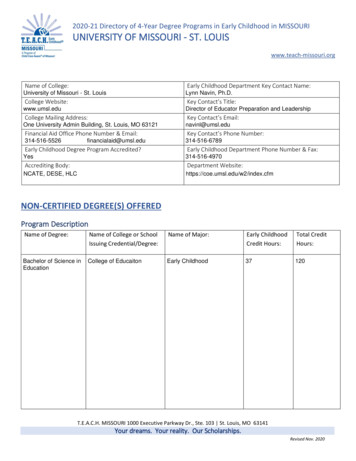

Missouri Valley—12/31/17 ExamHolding Company, Subsidiaries, and AffiliatesMissouri Valley is a member of an Insurance Holding Company System as defined by Section382.010. RSMo (Definitions). An Insurance Holding Company System Registration Statementwas filed by Missouri Valley’s parent. BCBSKC, on behalf of itself and its other subsidiaries foreach year of the examination period.Missouri Valley is I OO /o owned by BCBSKC. which is a not-for-profit, health care insurer that isdomiciled in the State of Missouri. BCBSKC has no stockholders or other ownership. MissouriValley is ultimately controlled by the Board of Directors of BCBSKC.BCBSKC has several subsidiaries that all have businesses involved in or related to the health careindustry. These subsidiaries are described as follows: Good Health lIMO. Inc. d/h/a Blue Care. Inc. Blue Advantage Plus of Kansas City. Inc.,and Missouri Valley Life and Health Insurance Company are Missouri domiciled insurers. Canopy. Inc. (Canopy) f/k/a Financial Associates Midwest. Inc. is a brokerage companyspecializing in group and individual health products. life, dental, disability, and retirementannuities. Missouri Valley Caring Program for Children. Inc. is a charitable organization providingdurable medical equipment to children for items not covercd by insurance. Spira Care. LLC (Spira Care) is in the business of providing services to health careproviders, and owning and operating health care clinics.Cobalt Ventures. LLC (Cobalt) is a holding company and directly holds BCBSKC’sinterest in its non—insurance subsidiaries. The entities held are NDBH Holding CompanyLLC; The EPOCh Group. LC; Prcferred Health Professionals LLC; CompAlliance, LEE’;MEDVAL, EEC and Cobalt Talon EEC. The EPOCH Group. LC (EPOCH) d/h/a Cobalt MedPlans serves as an outsoiircing partnerfor insurance claims processing. staff augmentation. backlog reduction. systemsconversions, and facility consolidation. Cobalt owns a 99% interest in EPOCH and GoodHealth owns the remaining I 04 interest. Preferred Health Professionals. LEC (PHP) provides network rental and medicalmanagement services for groups and third-party administrators. MEDVAL. EEC provides consultation services in the settlement of insurance claims. Itsprimary business involves preparing Medicare set-aside arrangements and integratingthese arrangements into workers’ compensation and personal injury settlements. II alsoprovides structured settlement services and administration. Cobalt Talon. EEC (Cobalt Talon) currently exists as a shell company since the sale of itsassets to Health Lumen in 2016. Prior to the asset sale, Coha]i Talon provided healthcaredata analytic services.)

Missouri Valley— 12131/17 Exam NDBH Holding C’ompanv. LLC (NDBH l-IoldCo) is a holding company that owns NewDirections Behavioral Health, LLC’. BCBSKC owns a 33.33% interest in NDBH HoidGo. New Directions Behavioral Health. LLC (NDBH) manages behavioral health benefits andoperates an employee assistance program. NDBI-1 HodCo owns a 99% interest and GoodHealth owns a 1% interest in NDBI-I. GompAlliance. LLC is a managed care sen-ice organization for workers compensationclaims: providing bill review. Preferred Provider Organization (PPO) and casemanagement services. CompAlliance. LLC owns Premier Workers (‘omp Networks,LLC. CompAlliance QRC. LLC, and CompResults. LLC. Premier Workers Comp Networks. LLC is a PPO network used exclusively for thetreatment of work—related injuries and illnesses. CompResults. LLC is a PPO network used exclusively to bring workers compensationcost containment solutions to employers and payers. CompAlliance QRC. LLC provides qualified workers compensation consultationservices.6

Missouri Valley—12/31/17 ExamOrganizational ChartThe following organizational chart depicts Missouri Valleys ownership and holding companysystem. as of December 31, 2017:blue Cross and Blue Shield of Kansas CiryNL souriThe MissouriValley CaringProgram forChildren. Inc.Spira Care.LLCCanopy. Inc.d/h/aFinancialAssociatesMidwest. Inc.CobaltVentures.LLCBlueAdvantagePlus ofKansas City.Inc.MissouriValley Lifeand HealthInsuraHueCornpanGood HealdiFIMO. Inc.(Missouri)lOOt/c(Missouri)lOW/c(Kansas)oar/cI )10W/ct.NDRHHoldingCompanLLCThe EPOCHGroup. LC-(Kansas)33.331/cNew DirectionsBehavioral Health,LLC(Kansas)99% NDI3HHoldCo1% Good Health( Kansas I99% CohatI c GoodHealthPrerenvdHealthProfessionals.LLC)Katisas )00%CompAfliance.LLCNIEDVAL.LLCCohat Talon.LLCMissouri:’00%( Kansas1(10%KansasI 00%(PremierConipResul ts.WorkCompManagement.LLCLLCCompAl Ii onceQRC. LLC(Kansas)looc,i( Kansas)100%Missouril007

Missouri Valley—12/31/17 ExamIntercompany TransactionsThe Company’s intercompany agreements in effect, as of December 31. 2017 are outlined below,1. Type:Affiliates:Effective:Terms:2. Type:Affiliate:Effective:Terms:3. Type:Affiliates:Effective:Terms:Third Amended and Restated Agreement for the Sharing of Federal Income Taxesand Filing of a Consolidated Tax ReturnBCBSKC. Good Health. BAt and CanopyDecember 31, 2014, amended January 22, 2016 to update the parties to theagreement and add a provision for addition and termination of parties to theagreement.BCBSKC will file a consolidated federal tax return for itself and its subsidiaries.The tax liability for each subsidiary shall be based upon each subsidiary’s taxableincome or loss as reflected in the consolidated financial statements. Eachsubsidiary will pay its federal income taxes to BCBSKC. BCBSKC will collectand remit an\ tax refunds to the subsidiaries.Administrative Services AgreementBCBSKCAugust 1. 2006BCBSKC agrees to provide the following administrative services: accotinting.budgeting. personnel. payroll. office space, utilities. maintenance, claimsprocessing. purchasing. legal. actuarial, underwriting, cash management.investment. marketing. data processing. and other services. Missouri Valley willpay BCBSKC the actual expenses incurred for the services provided.Agreement for the Management of Intercompany Payahles and ReceivablesBCBSKC. Good Health. Canopy. Spira Care and BA August 1.2006. restated effective March 1.2009 to remove an exclusion for theMissouri Valley direct enrollment PPO. change the duration and renewals terms.and include an exclusion for Medicaid payments. and amended November 1.2017 to add Spira Care and Canopy to the agreement.BCBSKC shall pay the payables and collect the receivables for its subsidiaries.Separate accounting records will be maintained for the transactions for eachsubsidiary. Transfers of funds to or from the subsidiaries will be made tominimize uninvested cash balances and to minimize the receivable or payablebalance with each subsidiary. BCBSKC shall settle all intercompany payable andreceivables within ninety days following receipt by BCBSKC.BCBSKC shall pool and retain the consolidated funds resulting from thesetransactions and invest the pooled funds. BCBSKC shall pay interest or receiveinterest each month from the subsidiaries based on the intercompany balance ofeach subsidiary.8

Missouri Valley4. Type:Affiliates:Effective:Terms:—12/31/17 ExamAncillary Provider AgreementBCI3SKC. NDBI-T. Good I lea]th and BA-fJanuary 1. 2006. amended June 1.2006. October 1. 2007, June 1.2008, January1, 2011, January 1. 2014, September 1, 2015. and April 7, 2016 to adjust ratesand include additional services to be provided by NDBH.NDBH agrees to manage and/or arrange for the provision of behavioral healthand substance abuse services for BCBSKC’s members and the members ofBCBSKCs subsidiaries. NDBFI will provide for the credentialing reviews of theproviders. BCBSKC will pay NDBH a capitation payment each month that isdetermined by the per member per month rates specified in the agreement. Therates vary between products sold by BCBSKC and its subsidiaries.5. Type:Affiliate:Effective:Terms:Guarantor AgreementBCBSKCMarch 1. 1991BCBSKC agrees to provide any contributions to the capital and surplus ofMissouri Valley necessary to maintain capitalization of 1.500.000.6. Type:Affiliates:Effective:Terms:Medicare Advantage and Part D Services AgreementBCBSKCJanuary 1, 2017BCBSKC provides Missouri Valley with certain administrative services inestablishing and maintaining a Medicare Advantage and/or Part 0 programincluding sales and marketing. provider network. compliance and audit functions.reporting. LI’ support. dedicated Medicare Advantage personnel qualitycommittees. financial services, legal and additional general corpoi-ate services asneccssary to stay compliant with the Center for Medicaid and Medicare Services.Missouri Valley shall reimburse BCBSKC the actual costs in providing theservices as allocated by BCBSKC’s cost allocation system. The cost allocationsystem allocates all administrative costs to lines of business based on statisticssuch as actual employee time reports, processed claims counts and membershipcounts.TERRITORY AND PLAN OF OPERATIONMissouri Valley is licensed by the DIFP under Chapter 376 RSMo (Life, Health and AccidentInsurance). The Company is also a licensed insurer in the State of Kansas; however, the Companyhas not written premiums in Kansas since 1999. As of December 31, 2017 the Company reported45,085 policies covering 103.4 19 lives on the stop-loss line of business.The Company was originall\ established primarily to write individual and group health insurancebusiness outside of the service territory of its ultimate parent. BCBSKC. Currently, the Companyprovides group term life insurance for BCBSKC’s individual health insurance policyholders andstop loss insurance to self-insured groups. The Company’s group life policy for BCBSKCprovides a 10,000 death benefit to BCBSKS individual health insurance contract holders in nonACA compliant individual health insurance products. BCBSKC allocates a portion of the9

Missouri Valley—12/31/17 Exampremium revenue for individual health contracts to Missouri Valley as premium for the lifeinsurance benefit. In 2015. the stop-loss business written to self-insured groups using the BlueCross network was transferred from BCBSKC to Missouri Valley.Beginning in 2018. Missouri Valley entered the Medicare Advantage (MA) marketplace with aPreferred Provider Organization (PPO) Blue Medicare Advantage Access product. offering an MAPPO individual product and a group product through Employer Group Waiver Plans.REINSURANCEGeneralthe Company’s premium activity on a direct written, assumed and ceded basis. for the periodunder examination, is detailed below:Direct BusinessReinsurance Ceded:AffiliatesNon-affiliatesNet Premiums Written20172016526.875.386 018201420135851.864Sl.074.645SI .274.75700000(235)S85L629S1.274.757AssumedThe Company does not assume any business.CededMissouri Valley. together with BA . Good Health, and BCBSKC. are reinsured by an excess ofloss agreement with BCS Insurance Company (BCS). BCS is domiciled in the State of Ohio andis licensed as a property and casualty company with an accident and health line in the State ofMissouri. The Company s specific retention is 2,500,000 per covered loss under the agreementfor fully insured medical.The Company is contingently liable for all reinsurance losses ceded to others. This contingentliability would become an actual liability in the event that an assuming reinsurer fails to performits obligations under the reinsurance agreement.10

Missouri Valley—12/31/17 ExaniFINANCIAL STATEMENTSThe following financial statements are based on the statutory financial statements filed by theCompany with the DIFP and present the financial condition of the Company for the period endingDecember 31, 2017.The accompanying comments on financial statements reflect anyexamination adjustments to the amounts reported in the annual statement and should be consideredan integral part of the financial statements.There may have been additional differences found in the course of this examination, which are notshown in the ‘Comments on Financial Statement Items”. These differences were determined tobe immaterial concerning their effect on the financial statements and therefore were onlycommunicated to the Company and noted in the workpapers for each individual activity.11

Nlissouri Valley—12/31/ 17 ExamAssetsBondsCash, cash equivalents and shortterm investmentsInvestment income due andaccruedUncollected premiums and agentsbalances in course ofcollectionCurrent federal and foreignincome (ax recoverable andinterest thereonAggregate write-ins for otherthan-invested assetsTOTAL ASSETSAssetsS 1,267111,267-20,20420,204-275,168275,168-32,001 18,139,048Net AdmittedAssetsS 15,701,78632,001S-32,001 18,107,047Liabilities, Surplus and Other FundsAggregate reserve for accident and healthContract claims LifeContract claims A&HPremiums and annuity considerationsInterest maintenance reservesGeneral expenses due and accruedTaxes. licenses and fees due or accruedAsset valuation reservesPayable to parents, subsidiaries and affiliatesAggregate write-ins 868426.195170.000TOTAL LIABILITIESCommon stockGross paid in and contributed surplusUnassigned fundsLess treasury stock, at costTOTAL COMMON STOCK AND )SS13,831,952—-TOTAL LIABILITIES AND SURPLUS1218,107,047

Missouri Valley—12/31/17 ExamStatement of IncomePremiums and annuity considerations for life and A&HNet investment incomeAmortization of interest maintenance reservesAggregate write-ins for miscellaneous income (loss)Total revenueDeath benefitDisability benefits and benefits under A&HIncrease in aggregate reserves for Life and A&HS26,083,561240,57138,3787 ns on premiums. annuity consideration and deposit-typecontract fundsGeneral insurance expensesInsurance taxes. licenses and feesTotal underwriting deductionsNet gain before taxesFederal and foreign income taxes incurredNET INCOME (LOSS) S 780)Reconciliation of Capital and SurplusChanges from January 1, 2013 to December 31, 2017( 000 Omitted)Capital and Surplus. Beginnin of YearNet incomeChange 92 10,943776690625--unrealized capital ga[ns (losses)67Change in net deferred income tax(15)Change in non-admitted assetsChange in asset valuation reserveSurphis adjustment, paid inChange in capital and surplus for the yearCapital and Surplus, End of Year-(5. [S4)I(2)(20)(I)-54I(3)25(32)(35)3629(11)3.000- 8473694 626S14.772515.466S16.09213(67)(35.l49j 2,889510.943SUJ32

Missouri Valley—12/31/17 ExamFINANCIAL STATEMENT CHANGES RESULTING FROM EXAMINATIONNoneCOMMENTS ON FINANCIAL STATEMENT ITEMSNoneSUMMARY OF RECOMMENDATIONSNone14

Missouri Valley—12/31/17 ExamACKNOWLEDGMENTThe assistance and cooperation extended by the officers and the ernplo\ees of Missouri ValleyLife and Health Insurance Company during the course of this examination is hereby acknowledgedand appreciated. In addition to the undersigned. Mark Nance. CPA. CFE. Emily Pennington. CFE.Lisa Li. CPA. CFE, Kimberly Dobbs. AES, CISA, CEE. Bradley Brunton. AFE. and DanielleSmith. AFE, examiners for the DIFP. participated in this examination. The firm of Lewis & Ellis,Inc. participated as consulting actuaries. The firm, Risk & Regulatory Consulting, LLC. alsoparticipated as an information technology systems consultant.VERIFICATIONState of MissouriCounty of JacksonI, Laura Church. CPA. CEE, on my oath swear that to the best of my knowledge and belief theabove examination report is true and accurate and is comprised of only facts appearing upon thebooks. records or other documents of Missouri Valley Life and Health Insurance Company. itsagents or other persons examined or as ascertained from the testimony of its officers or agents orother persons examined concerning its affairs and such conclusions and recommendations as theexaminers find reasonably warranted from the factsLura Church, CPA. CFEExaminer-In-ChargeMissouri Department of Insurance, FinancialInstitutions and Professional RegistrationSworn to and subscribed before me thisMy commission expires:yof,2019./EOONEY JACXSON PO1WOODMy ConwW ExplesApt8 2023comiis*nm*570615

Missouri Valley— 12/31/17 ExamSUPERVISIONThe examination process has been monitored and supervised by the undersigned. The examinationreport and supporting workpapers have been reviewed and approved. Compliance with NAICprocedures and guidelines as contained in the Financial Condition Examiners Handbook has beenconfirmed, except where practices, procedures and applica1-e regulations of the DIFP and statutesof the State of Missouri prevailed.7Levi N. Nwasdcia, CPA, CFEAudit ManagerMissouri Department of Insurance. FinancialInstitutions and Professional Registration16

Missouri Valley was incorporated on June 4. 1987 and commenced business on June 1, 1990 as a life insurer under the insurance Jaws of Chapter 376 Revised Statutes of Missouri (RSM0) (Life. Health, and Accident Insurance). The Company is also licensed to write insurance in the State of Kansas. hut has not written any premiums in Kansas since 1999.