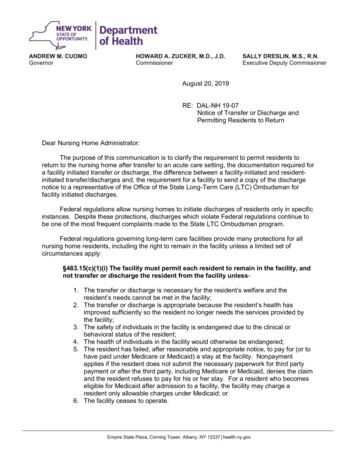

Transcription

annualreview2017/2018A

Thank you to everyone at theombudsman service who helpedcreate this annual review, includingthe people in our photos.The case studies in this annual review illustratethe themes and trends we’ve seen in 2017/2018– and they have some of the features of realproblems we’ve resolved. However, we needto keep people’s details confidential. So we’vechanged names and details – and the casestudies are illustrative, rather than being specificindividual complaints.b

contentschairman’s foreword5chief ombudsman &chief executive’s report7vulnerability: a fine line14living on credit15taking the long view – John Wightman16clocking up credit – Mark Hollands18staying aware20seeing the light – Sarah Holmes21helping people who need us23an early answer – Lauren Garrett26new ideas, new challenges27new ideas28new challenges30PPI: getting over the line – Charlie Sweeney32getting IT right – Lee Crawford35keeping pace36making progress – Pat Hurley37different perspectives38finding balance – Juliana Francis39loyalty and trust41loyalty42paying the price – Sean Hamilton43trust46making the right move – Phil Miller47getting somewhere – Jade Hulbert49building confidence50understanding what matters – Jim Hughes51data in more depth521

our year at a glancewe received 1,456,396 enquiries.equivalent to nearlythree enquiries everyminute of every day inthe year43%phoneenquiries57%written enquiriesincluding emailswe dealt with 339,967 new complaints and resolved400,658 complaints55%11%general insurancePPI400,658complaints31%banking & creditwe resolvedinvestments &pensions4%including32,780ombudsman decisions2

our year at a glance312146% home credit80883% credit references1,06073% hiring, leasing & renting1,58717,256199981,12964% payday loans53% investment trusts48% safe custody46% specialist insurancebiggest decreases41% point-of-sale loans3,61336,349251% corporate bonds% year-on-year change incomplaints received by product (2016/2017 - 2017/2018)40% consumer credit products & servicesbiggest increasessecured loans -32%% year-on-year change incomplaints received by product (2016/2017 - 2017/2018)781portfolio management -33%306unit-linked bonds -37%1,468building warranties -40%290packaged bank accounts -42%derivatives -44%pension mortgages -48%debt counselling -74%debt adjusting -76%interest-rate hedging products -84%11,6744022488135403

about usWe were set up by Parliament to resolveindividual complaints between financialbusinesses and their customers – fairly,reasonably, quickly and as informally aspossible. We can help with most types ofproblems – from payday loans to pensions, andfrom pet insurance to PPI.If a business and their customer can’t resolve aproblem themselves, we can step in to sort thingsout. Independent and unbiased, we’ll get to theheart of what’s happened – and reach a fair,pragmatic answer that helps both sides move on.If we decide the business has acted fairly – orthere’s just been a misunderstanding – we’llexplain how things stand. But if someone’s beentreated unfairly, we’ll use our powers to makesure the business puts things right. That couldinvolve anything from amending a credit file toreducing loan repayments, and from settling aninsurance claim to correcting a pension.Since we were set up, we’ve seen the impact offinancial concerns and complaints on people fromall sorts of backgrounds and livelihoods. We’recommitted to sharing our insight and experienceto encourage fairness and confidence in financialservices.4

chairman’s forewordThis annual review looks at what we havedone over the past year. But, as we approachour twentieth anniversary, it’s a good timeto cast our eyes further back, over the wholeperiod of our existence, and see what has andhasn’t changed.The list of what has changed could be endless.In 2000, much of the technology we now takefor granted would have been unheard of. Smartphones, tablets, digital currencies and so muchmore simply didn’t feature. And importantly,these aren’t just technological advances –they’ve changed the way we all think, live andinteract with each other.For the Financial Ombudsman Service, thathas meant rethinking how we work with ourcustomers, both consumers and financialproviders. The old paper-based model, oftenlasting weeks, just won’t work as the standardapproach now. That’s why we have movedto doing far more electronically or by phone,stepping in earlier and trying to sort things outbetween consumers and their financial providersbefore they unnecessarily crystallise into biggerproblems or harder-fought disputes.Sir Nicholas Montagu KCBchairmanWhat we deal with has changed too over the last20-year period. Who back in 2000 could haveforeseen the millions of payment protectioninsurance (PPI) policies sold and mis-sold, andwhat it would mean for both the buyers and thesellers? Our response to this unprecedenteddemand at the Ombudsman had to be quitedifferent from anything before or since. Lastyear’s figures show yet again the scale of PPI inour overall work, and, while focused on the taskbefore us, we share the general relief that anend is now in sight. I am proud of just how manycases we resolved last year, and the dedicationand professionalism of our people that madeit possible.5

Our people provide a good starting point forwhat has not changed. Our purpose and thevalues that underpin it remain as fundamentalto our organisation as they were when we werefounded, and we are lucky in having peoplewho reflect this in all their work. Fairness liesat the heart of what we do, and we need ourcustomers to have confidence in our unswervingcommitment to it. With public trust levels andcustomer satisfaction at an all-time high overthe year, we can take some reassurance thatwe are going in the right direction.But we can and must do more. We areconstantly seeking to improve the ways thatbusinesses and their customers interact, so asto strengthen confidence in financial services.Playing a key role in rebuilding that confidencehas been a major feature for us since thefinancial collapse of 2008, and I welcome theconstructive way in which banks and otherproviders have worked with us to help achieveour common purpose of customer satisfaction.Success in that shared endeavour meanslistening and recognising the particularcircumstances of our consumers. The ChiefOmbudsman in her introduction rightly laysemphasis on meeting the needs of vulnerablecustomers, for whom change and the growingcomplexity which it often brings can bechallenging. The idea of meeting people’s needsin this way is intrinsic to the idea of fairness.Change is challenging, too, for our own people,as they adapt to new ways of doing things, whilestill meeting the demands of our day-to-daycasework. That is why fairness to our own staff,as well as to our customers, lies at the heart ofthe constant values that I have mentioned. This,like our outward-facing work, is something wecan never let up on: we should celebrate ourachievements, but recognise that we still havea way to go. We are proud, but not complacent,and that is why my Board has commissioned awide-ranging review of our work by Richard Lloyd,who has significant expertise and experiencein the fields of dispute resolution and consumerprotection in which we operate. We think we’vedone well over the year, but we want to do better,and the review will point the way.So I end with thanks – to our staff, to theregulator and to the financial providers withwhom we have worked to increase customersatisfaction and trust. And to my Board, whosesupport and wisdom have, as ever, beenunfailing. Over the year we lost Maeve Sherlock,Pat Stafford and Gill Whitehead, all of whom hadmade terrific contributions: we were lucky to findthree outstanding replacements in Jenny Watson,Diana Warwick and Sienne Veit.Nick Montaguchairman30 May 20186

chief ombudsman &chief executive’s reportchief ombudsman &chief executive’s reportIt’s approaching 20 years ago nowthat discussions were underwayabout setting up a single ombudsmanfor financial services. This wouldreplace eight existing schemes –each covering individual industries,whose members didn’t always evenhave to sign up. Under these newarrangements, whatever the particularfinancial product or service involved,customers with complaints wouldhave access to a “one stop shop” –with statutory backing – to get aquick and fair answer.Caroline Waymanchief ombudsman& chief executiveIn 2018, the world looks very different towhen the Financial Ombudsman Servicewas first established. The complaintswe’ve seen over the last year give aninsight into how new technologies,together with economic and socialtrends, have changed the game in termsof how people live day-to-day – often inways that no-one anticipated back at theturn of the millennium.For us – like for the financial servicessector itself – standing still simply isn’tan option. That’s why, over the lastcouple of years, we’ve been through thebiggest transformation of our servicesince we were set up. While continuingto manage the fallout of mis-soldpayment protection insurance (PPI) –with complaints still reaching us in theirhundreds of thousands, accounting forover half of all those we receive – we’vebeen ensuring that we’re able to respondto the problems people are having today,and that we’re ready for the future too.7

chief ombudsman &chief executive’s reportThe feedback we’re getting from thepeople who rely on us suggests we’reincreasingly in step with what theyneed and expect. However, changehasn’t always been easy – and,as we look ahead, we know we’vegot to listen, learn and improve.We announced in April that our nonexecutive board has asked RichardLloyd to carry out an independentreview of our work, which will bepublished on our website in June.In reflecting on the year we’ve had –and taking stock of the hard workwe’ve still got to do – it’s importantto remember what we’re here for. In aworld that’s increasingly instant andinterconnected – and often, despitefirst impressions, confusing andcomplex – our guiding principlesof providing fair answers, quicklyand as informally as possible,are perhaps even more importanttoday than 20 years ago.vulnerability: a fine lineHowever, for some people, borrowingmay be a necessity, rather than a choice.And when people are living on credit,there can be a very fine line betweengetting by and going under.As we’ve highlighted in this review,we’re concerned that some lendersjust aren’t doing enough to ensurepeople’s borrowing is sustainable –or aren’t responding constructively totheir customers’ concerns. Looking inparticular at high-cost credit, paydayloans alone accounted for more than17,000 new complaints. And we foundin around six in ten cases that peoplehadn’t been treated fairly by their lender.It’s also remained clear that, as highprofile cybercrime hits the headlines,risks to people’s money may lie closer tohome. Over the last few months we’vehelped people who’ve found themselvesout of pocket after buying “self-funding”solar panels – and those who’ve facedselling their home because they can’tpay off their interest-only mortgage.Over recent years we’ve highlightedthe rising volumes of people telling usthey’ve had trouble after borrowingmoney. Complaints about consumercredit rose by a further 40% in2017/2018, following an 89% rise in theprevious year.On one hand, this reflects shiftingpreferences – mirroring official figures –in how people choose to pay for things.Today, for example, it’s the norm to geta new car on finance, rather than buyingit outright.8For us – like for thefinancial servicessector itself –standing still simplyisn’t an option

chief ombudsman &chief executive’s reportExamples like these reflect theimportance of being vigilant andengaged when it comes to money. Butit’s unrealistic – and unreasonable – toexpect everyone to be a savvy consumerall the time. And from what we’ve seen,we think some businesses could andshould do more – both in giving supportto their customers when things havegone wrong, and in preventing problemsarising in the first place.The challenges presented byvulnerability – which financialbusinesses have committed toaddressing – haven’t, and won’t,go away. Given the way vulnerabilitycan interact with people’s financialcircumstances, we think anunderstanding of these issues shouldcarry the same weight as any otheraspect of resolving complaints. So,with support from the Money AdviceTrust, we’ve taken steps this year toensure we’re doing all we can to helppeople in what may be extremelydifficult situations.Vulnerability – and the urgency it cancreate – also highlights the need foran ombudsman service that’s ableto help when it’s really needed. In2017/2018 we’ve continued to get betterat identifying and prioritising situationswhere our stepping in early on can makeall the difference. This means we’ve beenable to help significant numbersof people in days and sometimeshours – rather than weeks or monthsdown the line.Businesses’ willingness to engagewith us to do this reflects a recognitionthat our early involvement can havebenefits for both sides. Since 2015,following changes to the rules thatapply to how complaints are dealt with,we’ve been able to get involved incomplaints that businesses haven’t yetinvestigated themselves. A number ofbusinesses have now told us we can getinvolved whenever a customer wantsthis to happen – rather than giving uspermission on a case-by-case basis,which they’re technically able to do.This year we’ve continued to work withbusinesses to understand how we canmake greater use of this approach,reflecting our commitment to resolvecomplaints at the earliest possible stage.We were set up to give answers that arequick, as well as fair. And this level ofresponsiveness is something we couldnever have achieved under our previousstructure – where people could face await for our answer that in some caseswasn’t just frustrating, but unacceptable. we’re doing allwe can to helppeople in whatmay be extremelydifficult situations9

chief ombudsman &chief executive’s reportnew ideas, newchallengesResponsiveness isn’t only importantwhere people are vulnerable. As newtechnologies become part of daily life– increasing people’s expectations ofbusinesses and services they interactwith, but also affecting the nature of theproblems that can arise – we need toensure we keep pace.Other cases raise new, and perhapsmore complex questions of fairness– even though the products involvedmay be more familiar. Tens of millionsof people in the UK have car insurance.However, disputes we’ve seen this yearinvolving “black box” policies highlighthow, while greater use of data can bringbenefits, it doesn’t necessarily work outfor everyone.In the same way, new types of paymentservices may make things quicker andPart of this is about using technologyeasier on the face of it. The interfaceeffectively. This review illustratesbetween financial services andthe significant steps we’ve takenother types of service is increasinglyin 2017/2018 to transform our ITinvisible – which, in some ways,capabilities – in particular, developingbrings a level of convenience peopleour new case handling system and ourportals for financial businesses and their could hardly imagine even 20 yearscustomers. The investment we’ve made ago. But in the background, it may bemore complicated. And if somethingmeans our IT is working with – and notgoes wrong, unpicking exactly what’sagainst – our commitment to provide ahappened behind the scenes is unlikelypersonal, efficient and flexible service.to be as straightforward as making theWe’ve also continued to see new trends original transaction.reflected in the problems being referredto us – which have brought new insightsinto how people manage their money.For example, we’ve heard fromsmall numbers of people who lostout due to fluctuations in the valueof cryptocurrencies. While it’s onlyrelatively recently that these currencieshave received attention, these typesof concerns are similar to those we’vereceived over the years involvingrisky investments. our IT is working with– and not against – ourcommitment to providea personal, efficient andflexible service10

chief ombudsman &chief executive’s report we’ll be focused onmaking sure everyonewith concerns about PPIgets a fair answerThe challenges raised by the trade-offbetween personalisation and privacy –and between convenience and security– are issues that cut across differentfinancial products and services. They’relikely to become all the more pressing asthe General Data Protection Regulationcomes into force, and in light of widerconcerns about privacy in a socialmedia age.While keeping in step with thesedevelopments, we’ve also continuedto manage the long-term challenge ofpayment protection insurance – whichaccounted for 55% of all complaints wereceived in 2017/2018.This year, we got more clarity aboutsome of the uncertainties we’ve beenfacing in PPI. In March 2017, the FCAannounced its new rules and guidanceabout PPI complaints – addressingthe issue of undisclosed commission,following the case of Plevin v ParagonPersonal Finance Ltd – would come intoeffect on 29 August 2017. This meantthat, for a significant part of the year,we weren’t able to give our answer topeople waiting to hear from us aboutthe issues raised in Plevin.However, since the new rules came intoeffect, we’ve resolved over 100,000 ofthese complaints – and have resolvedover a quarter of a million complaintsabout PPI this year overall. And at theend of March 2018, we had fewer PPIcomplaints waiting for our answer thanwe’d had for the best part of the lastdecade. In the months ahead – eventhough we can’t say for sure how manycomplaints we’ll see and when – we’ll befocused on making sure everyone withconcerns about PPI gets a fair answer.loyalty and trustMass mis-selling clearly doesn’t putthe financial services sector in the bestlight – and takes a long time to put right.The FCA’s PPI complaints deadline is nowless than 18 months away. But peoplestill have a window to complain to usafter they’ve got an answer from thebusiness involved. So we’ll be dealingwith the fallout – involving policies oftensold in the 1990s and 2000s – well into2020/2021.While this disappointing saga maybe drawing to a close, this year we’vecontinued to hear from people whofeel particularly let down by a businessthey’d thought they could rely on.As we’ve highlighted in this review,during the year we received small butsteady numbers of complaints aboutinsurance premiums that had risen yearon-year – finally reaching levels thatcustomers, or their relatives, believedwere unacceptable. In some of thesecases, we agreed that people had paidthe price of loyalty – and during theyear, we had robust conversations withinsurers about the unfairness we’d seen.11

chief ombudsman &chief executive’s reportSimilarly, we heard from people who’dbeen counting on a business to do theright thing – but hadn’t received the careor support they needed. For example,while pension freedoms may offergreater flexibility, we’ve again seen how– at the point people are really relying onprofessional expertise – questionableadvice has instead put their retirementplans at risk.And when a travel firm went bust in2017, it became all too apparent that –rather than being able to trust financialbusinesses to help them sort thingsout – disappointed holidaymakersfelt they were just being passed frompillar to post.Encouragingly, we’ve also continuedto see examples of where businesseshave responded quickly and effectivelyto put in place plans to help theircustomers in the face of unexpectedevents. But, either way, situations likethese require a joined up, bigger-pictureapproach to put things right. And theyunderline just how significant, and justhow relevant, the idea of a “one stopshop” remains today.12We need to organise our service in away that means we can take that biggerpicture approach – rather than riskpeople feeling that we’re passing themfrom pillar to post as well. So this yearwe’ve continued to invest in our peopleand their knowledge – to help themresolve not just the increasing rangeof problems we’re seeing, but thoseproblems that don’t fit neatly into asingle area.Once again, feedback suggests thisapproach is well-received by the peoplewho use and rely on us. A majority offinancial businesses agreed the financialservices industry can have confidencein us, including the complaints handlerswho interact with us every day. Andoverall, 69% of people who used ourservice said they were satisfied –including half of those who didn’t get theanswer they had initially been hoping for.

chief ombudsman &chief executive’s reportdoing things betterTransforming our service over thelast few years has involved a numberof challenges – some of which weanticipated, and some which we’veneeded to take stock of and workthrough as they’ve arisen.But in 2018, at a time when the disputeresolution landscape continues tobe scrutinised, the idea that peopleshould have to navigate a fragmentedsystem – or face what’s likely to be theunaffordable cost of going to court –is a relic of the past in financial services.And there’s no doubt that financialbusinesses and their customers alikeare better off for that.In fact, this annual review is full ofthings we can be proud of. And I’mreally grateful to our people for all theircommitment and hard work – withoutwhich that wouldn’t be the case.In the year we published our firstreport on our equality, diversity andinclusion, it’s also a chance to reflecton, and celebrate again, the differentperspectives our people bring – andtheir commitment to supporting eachother, at the same time as helpingthose who use our service.We’ve always been committed to workingopenly – and together with this annualreview, we’re publishing the annualreport of our independent assessor,whose feedback each year helps us learnand improve the service we provide. Andwe welcome the opportunity for a furtherindependent perspective, in the formof Richard Lloyd’s review, on what andwhere we could do things better. We’ll bekeeping in touch with our stakeholdersabout that – and what it means – in themonths ahead.There’s always more we can do tomaintain and build people’s confidencein us. As we look ahead to the next20 years, staying true to our foundingprinciples – and always being ready tolisten and adapt – will stand us in goodstead to do that.Caroline Waymanchief ombudsman& chief executive30 May 2018 there’s always more wecan do to maintain andbuild people’s confidencein us13

vulnerability: a fine linevulnerability:a fine lineIn last year’s annual review, we highlighted howvulnerability isn’t only about long-term illness or oldage. Instead, events like divorce, bereavement or othersudden changes in circumstances can also leave peoplein a vulnerable position.The FCA’s Financial Lives survey, published in October2017, suggests half of UK adults have characteristics ofpotential vulnerability. This doesn’t necessarily meanpeople with these characteristics are, or will becomevulnerable. But the complaints we’ve seen this yearunderscore just how fine the line can be.14stories of the year living on credit staying aware helping peoplewho need us

vulnerability: a fine lineliving on creditFigures published by the Bank of England during theyear show household debt in the UK has reached itshighest levels since the 2008 financial crisis. Andpeople have continued to tell us they’ve had badexperiences with lenders – with complaints aboutconsumer credit products and services rising by 40%,following an 89% rise last year.In particular, we saw further significant increases incomplaints about high-cost credit, such as payday loansand instalment loans. The fact we’ve upheld six in tencomplaints about these types of borrowing – similarto last year – suggests lenders have some way to go inensuring they’re treating their customers fairly. Duringthe year we continued to share what we were seeing withthe FCA, to help inform its own ongoing work to addressregulatory concerns about the high-cost credit market.17,256we receivedcomplaints aboutpayday loans61%we upheldof complaints aboutpayday loans15% increasein complaints aboutcredit cards28%we upheldof complaints aboutcredit cards15

vulnerability: a fine linetaking the long viewJohn Wightman, ombudsman leaderOver the last couple of years, we’ve seen anincreasing number of complaints involvinginstalment loans. On the face of it, these mightseem more affordable than payday loans –the repayment periods are longer, and so themonthly payments may be lower. But extendingthe amount of time someone’s in debt meansthey’ll end up repaying more overall. So they’renot necessarily the right option for everyone.For example, this year we’ve heard from manypeople who’ve taken out high-cost instalmentloans as a way of refinancing unaffordablepayday loans. However, when people have beenstruggling to repay an existing payday loan, it’snot always appropriate for the lender to offermore expensive credit – even if the monthlyrepayment looks more manageable.In some situations we’ve seen, the lender hasgiven someone several instalment loans at thesame time. While these each might have beenaffordable on their own, the total monthly costeach month can be very high. And the borroweris then locked into this arrangement over alonger repayment period.16In cases like these – rather than helping peoplemanage – using instalment loans has led tomounting and ultimately unsustainable debt. Thelenders involved haven’t always got a handle onhow much their customers are paying out eachmonth – and have been offering loans peoplecould never have afforded.It’s not always the case that people could neverafford to borrow money in the first place. Butfrom what we’ve seen, lenders still have a wayto go in doing the right thing – both at the pointthey’re deciding to lend money, and at the pointtheir customers complain. And that’s particularlyso where the people involved may be vulnerable.Equally, if people are struggling, it’s essentialthey tell their lender as soon as possible – andcontact us if they feel they’re not getting the helpthey need.

vulnerability: a fine lineWhile lenders have a responsibility to spot signs theircustomers are in trouble, it’s possible too that someborrowers aren’t raising concerns. In the conversationswe’ve had this year with consumer organisations, we’veheard that some people are just focused on the immediatepriority of clearing or managing their debts. Making acomplaint isn’t the most pressing issue – even though alender’s actions might be causing difficulties, or makingthings worse.Once again this year, a significant proportion ofcomplaints from people using credit to buy everyday items– such as household appliances – have been about thequality of goods in question, or about administration oftheir account.However, the FCA’s research highlights the particularchallenges people may be facing – for example, thatpeople with catalogue credit accounts may have highlevels of arrears, and that people using rent-to-ownarrangements may be particularly likely to be vulnerable.It’s possible that, where credit is being used in this way,the risk of losing essential items may put some people offasking for help.of all non-PPI complaintsin 2017/2018were about consumercredit products andserviceswe receivedabout consumer creditnot up to scratchSarah phoned us after getting into a disputewith her car finance company.She explained she’d come to the end of her personalcontract purchase (PCP) agreement, and had tried togive the car back. But the business said there wasdamage to the wheels that was beyond normal levelsof wear and tear – and that she needed to pay 250.When we contacted the business, they told us – asthey’d told Sarah – that the charge was in line withindustry guidelines. We asked them to show us thereport they’d prepared, along with the guidance theywere referring to.The guidance said that minor scuffs and scratcheswere acceptable, but larger ones weren’t. However, thephotos the business sent us were very unclear – andthey certainly didn’t appear to show large amounts ofdamage. So we told the business it wasn’t fair for Sarahto be charged.17

vulnerability: a fine lineclocking up creditMark Hollands, ombudsman managerIn almost every ad break on the TV or radio,you’ll hear about deals for cars on finance.Given the low deposits and repayments beingoffered, it’s not surprising things like personalhire and personal contract purchases – “PCPs”– are so popular.But we’ve noticed too that some lenders aren’tbeing thorough enough with the affordabilitychecks they’re carrying out right at the start.And if they’d taken more care at this stage,their customer might not have ended up indifficulty at all.Unfortunately, we’ve continued to hear frompeople who haven’t got the great deal theywere expecting. Often, this is because they’vebeen hit with unexpected charges at the endof the contract – perhaps because the financecompany’s saying there’s damage to the car,or they’ve driven over the mileage limit intheir agreement. We’ll need to look into whathappened when the finance was taken out,to make sure all the important details weremade clear.For many people, losing your car isn’t just aminor inconvenience. It can set off a wholeseries of problems, including spiralling financialdifficulties – for example, if you can’t get to work.So it’s essential car finance providers get thesebasics right.Despite the low upfront cost of arrangementslike PCPs, we do hear from some people whoare struggling to keep up with their repayments.As in other areas of credit, car finance providersaren’t always responding as positively as theyshould when they know someone’s in trouble.18We’ll continue to engage with lenders to helpthem address customers’ concerns constructively– and more importantly, not sign people upfor “deals” they don’t understand

ombudsman service who helped create this annual review, including the people in our photos. The case studies in this annual review illustrate the themes and trends we've seen in 2017/2018 - and they have some of the features of real problems we've resolved. However, we need to keep people's details confidential. So we've