Transcription

Completing Partial Implied Vol Surfaces withVariational Autoencoders

Previously faculty member at theUniversity of ChicagoMaxime BergeronDirector R&D, RiskfuelResearch on the topology of highdimensional parameter spaces and itsimplications in machine learning

Three pillars of deep learning at Riskfuel1. Fast models (pricing of exotic derivatives)2. Unsupervised learning (variational autoencoders)3. Reinforcement learning (deep hedging, the next steps)

Riskfuel's 1st ProblemDeeply Learning DerivativesRyan Ferguson and Andrew Green, 2018Given: A family of partial differential equations problems A method (slow and noisy) to compute individual solutions (calibration and inference)Can we:Build a fast and accurate mesh-free representation of the solutions operator O ?Yes:Leveraging the slow solver to generate training data for deep neural networks!Results in lightning-fast inference and (when they exist) sensitivities

Real-time PricingBlack-ScholesBermudan Swaptions 157 dimensionshic sunt draconesSwapsFX Barriers 81 dimensionsAutocallables 400 dimensions

FX Double Knock-Out Partial Barrier Option 81 input dimensions Full volatility surface Interest rate curves Trade specificsTrained over wide range of synthetic valuesto accommodate extreme scenariosHandled Covid Crisiswithout a ogy-innovation-of-the-year-scotiabank

Bermudan Swaption Demo 157 input dimensions! Volatility surface Interest rate curve Trade specifics (strike, NC, term,.)pricer.riskfuel.com

Three pillars of deep learning at Riskfuel1. Fast models (pricing of exotic derivatives) 2. Unsupervised learning (variational autoencoders)3. Reinforcement learning (deep hedging, the next steps)Fast pricers need fast good data

Volatility surfaces maintain their mystique All models have flaws Backward looking, good until they break (W) Have bad understanding of what vol surfaces really looks likeHands off: let the data speak for itself!

What we want from a good volatility modelWant the ability to robustly: Complete Compress ExploreWant the model to be: Fast Realistic Interpretable

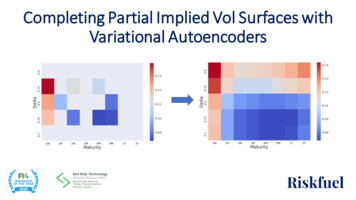

Complete& Interpolate Complete data in real timefrom partial information Monitor data for outliersand trading opportunities

Complete& Interpolate Complete data in real timefrom partial information Monitor data for outliersand trading opportunities

ExploreWant to understand geometry ofthe space of volatility surfaces Realistic stress testing:surfaces don't move in parallel shifts! Generate synthetic training datafor fast AI models

CompressHow many parameters do weneed to represent anentire surface? Parsimony vs accuracy ofrepresentation Monitor data for outliers andtrading opportunities

Variational Autoencoders: not your grandpa's PCAMonitorCompressCompletePCA (linear) AutoEncoders (AE) better Variational AutoEncoders (VAE) robust robustEmbrace the freedom of non-linearity!SampleExplore

Manifold Learning VAE is trained on real volatility surfaces to encode their distribution in its latent variables Gives a continuous structure to latent variables: they are not just compressions!

Manifold LearningPCA & AE Learn shape of volatility surface VAE Learn shape of the space of volatility surfaces

Trained VAE: 3 things for the price of 11. Encoder 2. Latent Space 3. Decoder

Decoder (Generator)Feed latent variables through decoder half of previously trained VAEAccurate and fast matching of market dataZ1Z2

EncoderFeed full surfaces through encoder half of previously trained VAEGreat for detecting outliers and trade opportunitiesZ1Z2

Explore latent spaceLatent variable values can be perturbed or sampled arbitrarily Resulting surfaces produced by previously trained decoder Can generate "good bad vol surfaces" for stress testing!Z1'Z2'

Case study: FX market data OTC data from 2012-2020 for five currency pairs Each surface 40-point grid of 8 maturities x 5 deltas Data split chronologically: set aside March – December 2020 for validation Train VAE's with 2, 3 and 4 dimensional latent encodings24

Test ability to complete volatility surfaces Observe subset of points on a surface (tight deltas, short maturities) Find latent encodings that generate best fit surface at these locations

Test ability to complete volatility surfaces Observe subset of points on a surface (tight deltas, short maturities) Find latent encodings that generate best fit surface at these locations

A typicalday in March VAE has seen days like this before Nails the fit using only a handfulof observed points in the first fewmaturities Mean Absolute Error in bps

Error distribution in bps across the AUD/USD validation setusing a VAE with four latent variables to complete partially observed surfaces.meanbid-askspreadHow bad do things get?March 24th, 2020

A wild day inMarch The VAE (trained on data from2012 to January 2020) was neverexposed to true crisis conditions! Mean Absolute Error in bps.

What's happening under the hood? Focus on 3 dimensional VAE for full visualization of latent space This means three numbers parametrize an entire surface What did the VAE do with these three numbers?

Skew and Wings

Term Structure

Volatility level

A knot in latent space

What's next? Equity indexes Single equities Time filtrations

Three pillars of deep learning at Riskfuel 1. Fast models (pricing of exotic derivatives) 2. Unsupervised learning (variational autoencoders) 3. Reinforcement learning (deep hedging, the next steps)