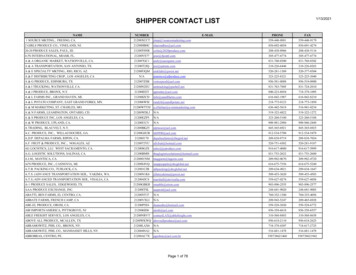

Transcription

HOW TO COMPLETE THE SHIPPER’S LETTER OF INSTRUCTION (SLI)(Companion Document to SLI Portrait v.1.2 042214)Box#1.DescriptionUSPPI NameRegulatory Citations and AdditionalInformationInstructionsEnter full USPPI name. This should not be oneentity in care of another entity. It must bethe same company whose EIN is being used.FTR 15 CFR 30.3: The USPPI is the person in the USAthat receives the primary benefit, monetary orotherwise, of the export transaction. Generally, thatperson is the U.S. Seller, manufacturer, or orderparty. In general, the Freight Forwarder cannot bethe USPPI.When a foreign entity is in the United States at thetime the items are purchased or obtained for export,the foreign entity is the USPPI for filing purposes.2.USPPI AddressIncluding ZipCode:Enter USPPI address for documentationand/or billing purposes. If this is also theaddress to be used for AES reporting, a P.O.Box is not allowed.Enter USPPI address to be used for documentationand/or billing. If this address is also being used forAES reporting, a P.O. Box is not allowed.If the cargo begins its journey to the port of exportfrom a different address, please report that addressin box number 4.3.Freight LocationCompanyName:If different from the USPPI name, entercompany name where cargo begins itsjourney to the port of export.If the USPPI does not own or lease the facility fromwhich the cargo is beginning its journey to the portof export, please provide the company name of thefacility.4.Freight LocationAddress (ifdifferent frombox #2)Enter the street address (no PO Box allowed)where the cargo begins its journey to the portof export. This may not be the same addressas the USPPI address. Please include valid USPostal (Zip) code.Enter the address where the cargo begins its journeyto the port of export (if different that the USPPIaddress in box #2).-1-Per FTR 15 CFR 30.6(a)(1)(ii): In all EEI filings, theUSPPI shall report the address or location (no postoffice box number) from which the goods actuallybegin the journey to the port of export even if theUSPPI does not own/lease the facility. For example,the EEI covering goods laden aboard a truck at awarehouse in Georgia for transport to Florida forloading onto a vessel for export to a foreign countryshall show the address of the warehouse in Georgia.For shipments with multiple origins, report theaddress from which the commodity with the greatestvalue begins its export journey. If such information is

How to Complete the SLIBox#Descriptionwww.ncbfaa.org2014Regulatory Citations and AdditionalInformationInstructionsnot known, report the address in the state where thecommodities are consolidated for export.5.ForwardingAgent:If you are not using a freight forwarder’s“Shipper’s Letter of Instruction” form,complete the name and address of theforwarding agent that you are authorizing (orthat you buyer/FPPI has authorized) totransmit Electronic Export Information (EEI).FTR 15 CFR 30.6(b)(1) (ii) and (iii): Report the nameand address of the authorized agent. The authorizedagent is that person or entity in the United Statesthat is authorized by the USPPI or the FPPI to prepareand file the EEI or the person or entity, if any, namedon the export license. (See § 30.3 for details on thespecific reporting responsibilities of authorizedagents and Subpart B of this part for export controllicensing requirements for authorized agents.)6.USPPI EIN (IRS)No:Report your 9 digit (numeric) company EIN.This must be the EIN of the party reported asthe USPPI. If your company utilizes a 2character suffice (alpha-numeric) that youwant reported, please include thosecharacters. (Example 951234567AB).FTR 15 CFR 30.6(a)(1)(iii): USPPI identificationnumber: The USPPI shall report its own IRS EIN. If theUSPPI has only one EIN, report that EIN. If the USPPIhas more than one EIN, report the EIN that the USPPIuses to report employee wages and withholdings,and not the EIN that is used to report only companyearnings or receipts. If the USPPI does not have anEIN, the USPPI must obtain an EIN for reporting tothe AES. Use of another company's or individual's EINor other identification number is prohibited.When a foreign entity is in the United Statesat the time the items are purchased orobtained for export, the foreign entity is theUSPPI for filing purposes. In such situations,the foreign entity shall report a DUNS, bordercrossing number, passport number, or anynumber assigned by CBP.7.Related PartyIndicator:Check “related” if you own 10% of theultimate consignee or if they own 10% of yourcompany. Otherwise check “Non-Related”.Check “Related” if you as the USPPI or the ultimateconsignee owns directly or indirectly 10 percent ormore of the other party as stated in FTR 15 CFR30.6(a)(10).Otherwise check "Non-Related".8.USPPIReference#:Enter your shipment internal control /reference number – the number that youwant the forwarder to refer to if they haveany questions. . This is for forwarder/shipper identification purposes only. (It isnot the same as the Shipment ReferenceNumber which will be assigned by the filerand transmitted as required by 15 CFR30.6(a)(19).)Enter your shipment internal control / referencenumber – the number that you want the forwarderto refer to if they have any questions.9.Routed ExportTransaction:If the movement of the cargo out of the U.S.is controlled by the USPPI or their forwarder,check “No”. If the movement of the cargo outof the U.S. is controlled by the foreign buyer’sforwarder, check “Yes”.Check “No” if the USPPI or their forwarder iscontrolling the movement of the cargo out of theU.S. Check “Yes” if the foreign buyer’s forwarder iscontrolling the movement of the cargo out of theU.S.-2-

How to Complete the SLIBox#Descriptionwww.ncbfaa.org2014Regulatory Citations and AdditionalInformationInstructionsFTR 15 CFR 30.6(a)(24) The routed export transactionindicator: An indicator that identifies that theshipment is a routed export transaction as defined in§ 30.3.FTR 15 CFR 30.3(e) : The Census Bureau recognizes“routed export transactions” as a subset of exporttransactions. A routed export transaction is atransaction in which the FPPI authorizes a U.S. agentto facilitate the export of items from the UnitedStates and to prepare and file EEI. See also theExport Administration Regulations (EAR) 15 CFR758.3(b).10.UltimateConsigneename andaddress:Enter the name and address (includingcountry) of the party who will be receiving theexport shipment at destination. This partymight be the FPPI and/or the end user, but itwill not be the party at destination (likelyforwarding agent) who is acting as agent hiredto deliver the items to the ultimate consignee(see Intermediate Consignee).For items subject to licensing under the ITAR,enter the name and address of the ForeignEnd User.11.UltimateConsigneeType:This is a NEW mandatory field effective April5, 2014. Select one from the list. Please donot select “Other/Unknown” unless theultimate consignee truly does not fit into anyof the other categories.-3-FTR 15 CFR 30.6(a)(3): The ultimate consignee is theperson, party, or designee that is located abroad andactually receives the export shipment. The ultimateconsignee as known at the time of export shall bereported. For shipments requiring an export license,the ultimate consignee shall be the person sodesignated on the export license or authorized to bethe ultimate consignee under the applicable licenseexemption in conformance with the EAR or ITAR, asapplicable.For items subject to licensing under the ITAR, enterthe name and address of the Foreign End User.FTR 15 CFR 30.6(a)(28): Provide the businessfunction of the ultimate consignee that most oftenapplies. If more than one type applies to theultimate consignee, report the type that applies mostoften. Direct Consumer - a non-government institution,enterprise, or company that will consume or usethe exported good as a consumable, for its owninternal processes, as an input to the productionof another good or as machinery or equipmentthat is part of a manufacturing process or aprovision of services and will not resell ordistribute the good. Government Entity - A government-owned orgovernment-controlled agency, institution,enterprise or company. Reseller - A non-government reseller, retailer,wholesaler, distributor, distribution center ortrading company. Other/Unknown - An entity that is not a DirectConsumer, Government Entity or Reseller, as

How to Complete the SLIBox#Descriptionwww.ncbfaa.org2014Regulatory Citations and AdditionalInformationInstructionsdefined above, or whose ultimate consigneetype is not known at the time of export.12.IntermediateConsigneename andaddress:Enter the Intermediate consignee name andaddress (if there is one), including country.FTR 15 CFR 30.6(b)(2): The name and address of theintermediate consignee (if any) shall be reported.The intermediate consignee acts in a foreign countryas an agent for the principal party in interest or theultimate consignee for the purpose of effectingdelivery of the export shipment to the ultimateconsignee. The intermediate consignee is the personnamed as such on the export license or authorized toact as such under the applicable general license andin conformity with the EAR.13.State of Origin:Enter the State from which the cargo beganits journey to the port of export.FTR 15 CFR 30.6(a)(4): The U.S. state of origin is the2-character postal code for the state in which thegoods begin their journey to the port of export. Forexample, a shipment covering goods laden aboard atruck at a warehouse in Georgia for transport toFlorida for loading onto a vessel for export to aforeign country shall show Georgia as the state oforigin. The U.S. state of origin may be different fromthe U.S. state where the goods were produced,mined, or grown. For shipments of multi-state origin,reported as a single shipment, report the U.S. stateof the commodity with the greatest value. If suchinformation is not known, report the state in whichthe commodities are consolidated for export.14.Country ofUltimateDestination:Report the country in which the goods aregoing to be consumed, further processed,stored or manufactured.FTR 15 CFR 30.6(a)(5): The country of ultimatedestination is the country in which goods are to beconsumed, further processed, stored, ormanufactured, as known to the USPPI at the time ofexport. In the case of a Department of State license,the country of ultimate destination is the countryspecified with respect to the end user.15.HazardousMaterial:Check “Yes” if the shipment containshazardous cargo. Otherwise Check “No”.Select Yes or No. FTR 15 CFR 30.6(a)(21): Thehazardous material indicator identifies whether theshipment is hazardous as defined by the Departmentof Transportation.16.In-Bond Code:If your cargo is moving in bond, advise thebond type code here. Otherwise indicate :“70” -Not In Bond.Per 15 CFR 30.6(a)(22): The code indicating whether[or not] the shipment is being transported underbond.One of the following in-bond numbers will bereported. If your cargo is moving in bond, advise thetype here.-4-

How to Complete the SLIBox#Descriptionwww.ncbfaa.org2014Regulatory Citations and AdditionalInformationInstructions70 not in bond;or select one of the following “in-bond” codes:36 warehouse withdrawal for immediate export("IE");37 warehouse withdrawal for transportation andexportation ("T&E");67 IE from a Foreign Trade Zone (FTZ); Please alsoprovide FTZ identifier in box #18.68 T&E from a Foreign Trade Zone (FTZ). Pleasealso provide the FTZ Identifier in box #18.Note: The Entry Number (Box 17) is required for “inbonds”.FTR 15 CFR 30.6(b)(13): The entry number must bereported for goods that are entered in lieu of beingtransported under bond for which the importer ofrecord is a foreign entity or, for re-exports of goodswithdrawn from a FTZ for which a NAFTA deferredduty claim (entry type 08) could have been made,but that the importer elected to enter forconsumption under CBP entry type 06. For goodsimported into the United States for export to a thirdcountry of ultimate destination, where the importerof record on the entry is a foreign entity, the USPPIwill be the authorized agent designated by theforeign importer for service of process. The USPPI, inthis circumstance, is required to report the importentry number.17.Entry Number:Enter “Entry Number” if required.18.FTZ Identifier:Enter the 7 character Foreign Trade Zoneidentifier.Per FTR 15 CFR 30.6(b)(3): If goods are removed fromthe FTZ and not entered for consumption, report the[7 Character] FTZ identifier. This is the uniqueidentifier assigned by the Foreign Trade Zone Boardthat identifies the FTZ, subzone or site from whichgoods are withdrawn for export. First 3 positions: General Purpose Zone(3 numeric)Next 2 positions: Sub-Zone (2 alpha numeric)Last 2 positions: Site (2 alpha numeric)If the General purpose zone only has two digits,precede it with a zero.If there is no sub-zone or site, use zeroes.If the Sub-Zone or Site is only one letter or number,precede it with a zero.(Example: If the general purpose zone 9, subzone A and site 5, you should report 0090A05 as the FTZidentifier.)-5-

How to Complete the SLIBox#19.DescriptionTIB / Carnet?www.ncbfaa.org2014Regulatory Citations and AdditionalInformationInstructionsCheck Yes or No.Check Yes or No.Note: The reporting exemptions for temporaryexport and imports (including Carnets) formerlyallowed under 15 CFR 30.37(q) and(r) have beenremoved as of 4/5/14. Filing is required fortransactions over 2500.00 by Schedule B / HTS andfor licensed transactions.20.Domestic orForeign(D/F)Report Domestic and Foreign origin goodsseparately. In other words, If you have asingle Schedule B and part of the value isdomestic, part foreign, you must report theSchedule B twice, once with the domesticvalue and once with the foreign value.FTR 15 CFR 30.6(a)(11): The domestic or foreignindicator indicates if the goods exported are ofdomestic or foreign origin. Re

HOW TO COMPLETE THE SHIPPER’S LETTER OF INSTRUCTION (SLI) (Companion Document to SLI Portrait v.1.2_042214) Box # Description Instructions Regulatory Citations and Additional Information . 1. USPPI Name Enter full USPPI name. This should not be one entity in care of another entity. It must be the same company whose EIN is being used.