Transcription

Ch 9: Checking Accounts andOther Banking Services

Purpose of a Checking Account What is a Check? A Checking account is an account that allowsdepositors to write checks to make payments A check is a written order to a bank to pay thestated amount to the person or business named onthe check (payee) A checking account is also called a demand depositbecause money can be withdrawn at any time (ondemand)

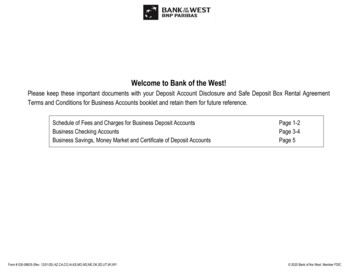

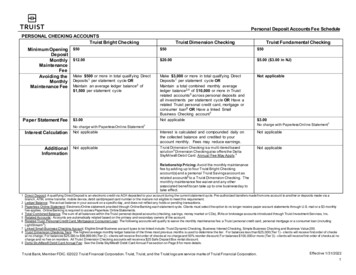

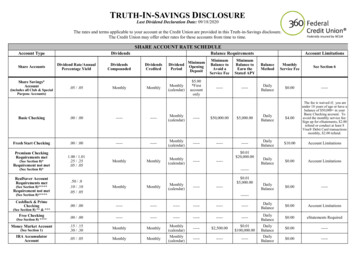

Checking Accounts Banks may require a minimum balance inyour checking account. Why? Fees may apply if you drop below theminimum balance Other fees may apply: Overdraft

Advantages of a CheckingAccount Convenience Safer than cash. It is harder to steal and get cash from a checkthan just stealing cash Built-in Record keeping system. You must keep records of the checks you writeand this helps you keep track of where yourmoney is going.

Opening a Checking Account You must sign a Signature AuthorizationForm Provides an Official Signature that the bankuses to compare to verify that your signaturewas not forged

Parts of a CheckA. Drawer’sInformation

Parts of a CheckB. ABA Number

Parts of a CheckC. Date

Parts of a CheckD. Check Number

Parts of a CheckE. Payee

Parts of a CheckF. Amount of Check

Parts of a CheckG. Written Amountof Check

Parts of a CheckH. Drawer’s BankInformation

Parts of a CheckI. Memo Line

Parts of a CheckJ. Drawer’s Signature

Parts of a CheckK. RoutingNumber

Parts of a CheckL. Account Number

Parts of a CheckM. Check Number(same as the other check number)

Completed Check ExampleSarah Smith314 Memphis VillasBrooklyn, Ohio 44144(216) 351-9577Billy JonesFifty five dollars andComputer Sarah Smith

Writing Checks Always use Pen Write Legibly, Start at the edge of each line, crossout any blank spaces Sign your name exactly as it appears on the check;No shortened names or nicknames If you make a mistake, Write VOID across thecheck and write a new check Make sure you have enough money in your accountto cover the check

Check Register Your Personal Record of Transactions Be sure to fill out the check register immediately whenwriting a check

Debit Cards Debit Cards work like electronicchecks; the money is deductedfrom your checking account. Debit cards may look like creditcards, but they are different. Debit cards use the money in yourchecking account.Credit cards are loans; you borrowthe money and pay it back plusinterest.

Deposit Slip# 2-74July 1,xx100 00350 00450 00--------450 00Deposit slips are used when you add money into youraccount.

Check Clearing What happens to a Check after you write it? Visit the following website and create a flowchart describing thepath a check takes to clear. Label each object in your g.htm

Check Clearing A check that has cleared is a check that Has been returned to your bank and the funds have been deductedfrom your account A Cancelled check is a check that Has cleared, has been stamped by your bank, and returned to you A truncated check is a check that Is cancelled, but the bank does not return to you. A check that is written for more money than is inthe checking account is called an Overdraft Floating a check means Writing a check for more than the amount you currently have inthe account; hoping your deposit clears before the check clears

Reconciling a Your Account When you receive your monthly statement,you will notice that the balance on thestatement does NOT match the balance inyour check Register. Why? Reconciling is the process of matching yourcheckbook register balance with thestatement balance This will account for outstanding fees,checks, and deposits

Bank ReconciliationCheck Book RegisterBalance824.00Plus OutstandingDeposits:0.00Minus OutstandingFees:0.00Reconciled Balance: 824.00

Finding Outstanding Deposits,Checks 36.1220.007/17/15220.50Find the Outstanding Checks &Deposits by going through thestatement and checking off thechecks that have cleared in yourCheck Register. The ones that youdid not check off are outstanding.

EndorsementsAn Endorsement is the signature of the Payee on the back of the check.Checks MUST be endorsed before they can be cashed.Blank Endorsementsare the most common type

Joint Accounts A Joint account is opened by two or morepeople Both people can draw on the account You can set it up so that both people must signthe checks or you can set it up where eitherperson can sign checks If one person dies, the other becomes the soleowner of the account

Other Methods of PaymentWhen you don't want to send cash, butyour check isn't acceptable, consider:1. Certified Check Your own check guaranteed by the bank.Your money is set aside to pay the check. A certified check will not bounce.2. Cashier's Check A check drawn by the bank on its own funds.You must pay cash for it, or have it taken from your checking or savings account. A cashier's check will not bounce.

Ch 9: Checking Accounts and Other Banking Services . Purpose of a Checking Account What is a Check? A Checking account is an account that allows depositors to write checks to make payments A check is a written order to a bank to pay the stated amount to the person or business named on