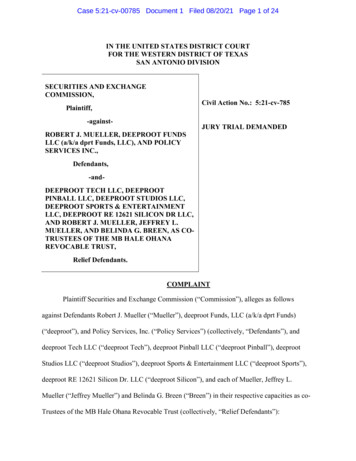

Transcription

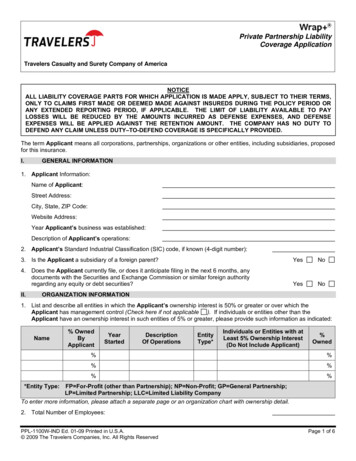

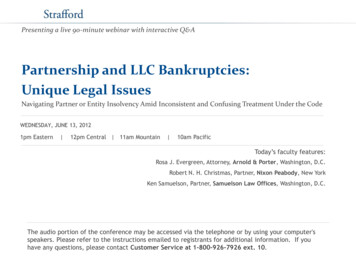

Presenting a live 90-minute webinar with interactive Q&APartnership and LLC Bankruptcies:Unique Legal IssuesNavigating Partner or Entity Insolvency Amid Inconsistent and Confusing Treatment Under the CodeWEDNESDAY, JUNE 13, 20121pm Eastern 12pm Central 11am Mountain 10am PacificToday’s faculty features:Rosa J. Evergreen, Attorney, Arnold & Porter, Washington, D.C.Robert N. H. Christmas, Partner, Nixon Peabody, New YorkKen Samuelson, Partner, Samuelson Law Offices, Washington, D.C.The audio portion of the conference may be accessed via the telephone or by using your computer'sspeakers. Please refer to the instructions emailed to registrants for additional information. If youhave any questions, please contact Customer Service at 1-800-926-7926 ext. 10.

If you have not printed the conference materials for this program, pleasecomplete the following steps: Click on the sign next to “Conference Materials” in the middle of the lefthand column on your screen. Click on the tab labeled “Handouts” that appears, and there you will see aPDF of the slides for today's program. Double click on the PDF and a separate page will open. Print the slides by clicking on the printer icon.

FOR LIVE EVENT ONLYFor CLE purposes, please let us know how many people are listening at yourlocation by completing each of the following steps: In the chat box, type (1) your company name and (2) the number ofattendees at your location Click the SEND button beside the box

Sound QualityIf you are listening via your computer speakers, please note that the quality ofyour sound will vary depending on the speed and quality of your internetconnection.If the sound quality is not satisfactory and you are listening via your computerspeakers, you may listen via the phone: dial 1-888-450-9970 and enter yourPIN -when prompted. Otherwise, please send us a chat or e-mailsound@straffordpub.com immediately so we can address the problem.If you dialed in and have any difficulties during the call, press *0 for assistance.Viewing QualityTo maximize your screen, press the F11 key on your keyboard. To exit full screen,press the F11 key again.

Partnership and LLC BankruptciesPlease download or print the PDF Reference Material document prepared by Mr. Samuelson as his presentation willfollow this document. You can also access corresponding pages from the PDF Reference Material during the program onthe webinar platform under the handouts tab in the Conference Material section.Ken SamulesonSamuelson Law Officesksamuelson@samuelson-law.com202.494.0848

The otherMembersdon’t careabout yourbad boyguaranty.File the LLC.6

More thanjust achargingorder. I gotit all.7

Junior“member”without muchpower: Yourtime willcome!8

If you do aworkoutinstead, I’vegot apresent foryou.9

Partnership and LLC BankruptciesUnique Legal IssuesStafford Publications CLE Teleconference – June 13, 2012Rosa J. EvergreenArnold & Porter LLP555 Twelfth Street, NWWashington, DC 20004 -1206Rosa.Evergreen@aporter.com202-942-5572

Characteristics of a Partnership Relationship governed by state law/agreement. Laws of agency: general partner is an agent for thepartnership. “Bundle of rights”:– Rights in specific property of the partnership– Rights in his or her “partnership interest”– Rights to participate in management of the partnership11

Partner/Member Bankruptcy Issues Generally NotSpecifically Addressed in the Bankruptcy Code Bankruptcy law is focused on business/company andindividual bankruptcy filings. The Bankruptcy Code generally does not specifically deal withthe issues raised when a partner or member files forbankruptcy. Partner/Member issues addressed mostly in case law.12

Unique Issues Raised by the Bankruptcy Filing ofPartner/Member Partner/Member bankruptcy filings raise unique legal issues,including:– What are “estate” interests– Whether the bankruptcy filing leads to the dissolution of thepartnership/LLC– Whether the partner/member can retain his or her management rightsafter the bankruptcy filing– Impact of section 365 on partnership and LLC agreements– Implication of ipso facto provisions– Impact of bankruptcy filing on right of first refusal provisions– Applicability of buy-out provisions in bankruptcy13

Section 541: Property of the Estate Upon the filing of a petition in bankruptcy, a bankruptcy“estate” is created pursuant to section 541 of the BankruptcyCode. The bankruptcy “estate” consists of all equitable and legalinterests the debtor has, including property and contractualrights.14

Management of the Estate The estate is managed by the debtor itself, as a “debtor inpossession” or by a trustee appointed by the court. “The statutory and decisional authority is clear that abankruptcy trustee is the successor to property of the debtor’sestate and is the legal representative of the estate. TheTrustee succeeds to the property of the debtor’s estate.” In reModanlo, 412 B.R. 715 (Bankr. D. Md. 2006). The debtor in possession’s/trustee’s duty is to serve theestate for the benefit of creditors.15

Management Rights When Partner/MemberFiles Bankruptcy? The status of the management rights is often a contestedissue when the partner/member files bankruptcy. The filing of bankruptcy by the partner/manager, if found toresult in dissolution or termination of partnership/LLC interest,may preclude trustee from assuming the contractual rights ofthe partner/manager, including management rights.16

Effect on Partnership or LLC WhenPartner/Member Files Bankruptcy? Possible dissolution of partnership or LLC. Under the Uniform Partner Partnership Act (UPA), thebankruptcy of a partner generally dissolves the generalpartnership. Applicable state laws frequently provide for dissolution of LLCif a member files bankruptcy. Dissolution provisions often conflict with federal bankruptcylaw principles. Disagreement among the courts on whether dissolutionprovisions should be given any effect in bankruptcy.17

Courts Do Not Agree on Whether DissolutionProvisions Should Apply In re Sawyer , 130 B.R. 384 (Bankr. E.D.N.Y. 1991): findingthat under New York law, the filing of a chapter 7 case by thegeneral partner resulted in dissolution of the partnership. In re Modanlo, 412 B.R. 715 (Bankr. D. Md. 2006): finding thatthe filing of bankruptcy by sole member of LLC dissolved theLLC by operation of law, but chapter 7 trustee “resuscitated”the LLC by filing amendment to operating agreement. In re Clinton Court, 160 B.R. 57 (Bankr. E.D. Pa. 1993):general partner’s prior filing of a bankruptcy petition did notdissolve general partnership and, therefore, did not bar nondebtor general partner from filing subsequent bankruptcypetition on behalf of the partnership.18

Transferability of Rights to the “Estate” Economic rights/benefits v. management rights:– In re Garrison–Ashburn, L. C., 253 B.R. 700 (Bankr. E.D. Va. 2000):“[t]here is no question that the economic rights, that is the membershipinterest, becomes property of the estate.” What becomes property of the estate when a member/partnerfiles bankruptcy depends on the facts and circumstances:– Applicable state law and/or the operating agreement of partnership orLLC may provide that any partner or manager who files for bankruptcywithdraws from the partnership or LLC.– Enforceability of such provisions subject to debate among the courts.19

Withdrawal Provisions Enforceable? Bargained for rights/personal nature of managementagreements. Skeen v. Harms, 10 B.R. 817 (Bankr. D. Colo. 1981):– “A general partner is in a fiduciary relationship with the limited partners.It is important that he have no conflict of interest. Moreover, anagreement among partners is unique in the law. It is not only a legalrelationship, but it is also a personal relation or status, somewhat asmarriage is a relation or status.”– “When the only general partner in a limited partnership becomes adebtor-in-possession, there is an inherent conflict of interest . . . [h]e isa different entity.”20

Withdrawal Provisions Enforceable? (cont’d) Withdrawal provisions conditioned on the bankruptcy filingmay be unenforceable:– Section 365(e)(1): ipso facto provisions prohibited.– Section 541(c)(1)(B) states in pertinent part that “an interest of thedebtor in property becomes property of the estate. . . notwithstandingany provision in an agreement . . . that is conditioned . . . on thecommencement of a case . . . .”21

Public Policy Reasons for WithdrawalAfter Bankruptcy Filing Partners and members have voluntarily associated in thebusiness. Partnership/LLC may be formed by unique and personalrelationships. Partnership/LLC often a closely held entity. Possibility of competing interests of management and thebankruptcy “estate.”22

Implication of Transfer of ManagementRights on Multi-Member LLC In re Albright, 291 B.R. 538 (Bankr. D. Colo. 2003): findingbecause there were no other members in the LLC, the trusteeobtained all of the debtor’s rights, including the right to controlthe management of the LLC. In re Milford Power Company v. PDC Milford Power, 866 A.2d738 (Del. Ch. 2004): finding clause that deprived debtorminority member of its ability to participate as a member in thegovernance of the LLC enforceable and discussing the policyjustifications for such clauses. In re Modanlo, 412 B.R. 715 (Bankr. D. Md. 2006): findingtrustee could continue to participate in management, butnoting the result may have been different if there were othermembers.23

Considerations Related to Transferabilityof Management Rights Transferability of debtor’s management rights depends on avariety of factors, including:– Nature of the operating agreement– Applicable state law– Whether or not other members can be compelled to accept performancefrom a third party– Case law precedent/jurisdiction– Unique aspects of specific partnership/LLC and/or partner/manager– Whether any party objects24

Ability to File Involuntary PetitionAgainst Partnership/Company Split of authority as to whether a partner/member who is adebtor him or herself in bankruptcy has the authority orstanding to file petition for the partnership/company. In re H & W Food Mart, LLC, 2011 WL 6989927 (Bankr. N.D.Ga.): a bankruptcy petition filed on behalf of a Georgia limitedliability company was not authorized as the operatingagreement specifically provided that the manager ceased tobe a manager on the occurrence of filing bankruptcy. In re A-Z Electronics, LLC, 350 B.R. 886 (Bankr. D. Idaho2006): debtor’s managing member, who had filed for chapter7 relief, lacked authority to file chapter 11 petition for thelimited liability company but the chapter 7 trustee hadstanding.25

Assumption/Rejection of Executory Contracts Section 365 of the Bankruptcy Code permits the debtor-inpossession/trustee to assume or reject executory contracts. Executory contracts are often defined as a contract wherematerial performance by both sides remains.– The term “executory contract” in the Bankruptcy Code refers to a contracton which performance remains due to some extent on both sides. In reMirant Corp., 440 F.3d 238 (5th Cir. 2006).– Countryman test: an executory contract is “a contract under which theobligation of both the bankrupt and the other party are so far unperformedthat the failure of either to complete performance would constitute a materialbreach excusing the performance of the other.” Executory contracts may include management agreements,leases, operating agreements, etc.26

Executory Nature of Partnership Agreements &LLC Agreements Courts have differing views of whether partnershipagreements and LLC agreements are executory contracts:– A number of courts have held that partnership agreements and LLCagreements are executory contracts.– Other courts have found that partnership agreements and LLCagreements are not executory contracts.27

Executory Nature of PartnershipAgreements & LLC Agreements (Cont’d) In re Ehmann, 319 B.R. 200 (Bankr. D. Ariz. 2005): noting that courts consider, in decidingwhether the agreement is executory, whether there is “some material obligation owing tothe company by the member.” In re Prebul, 2011 WL 2947045 (Bankr. E.D. Tenn. Jul. 19, 2011): commenting that“[w]here the operating agreement imposes no duties or only remote and hypotheticalduties, it is not an executory contract” and “where the operating agreement both requiresongoing capital contributions and imposes management duties, it has often been deemedexecutory.” In re Allentown Ambassadors, Inc., 361 B.R. 422 (Bankr .E.D. Pa. 2007): providing that“[i]n this inquiry, the four corners of the parties' agreement are examined to determinewhether both parties have material, unperformed obligations as of the commencement ofthe bankruptcy case.” In re Tsiaoushis, 383 B.R. 616 (Bankr. E.D. Va. 2007) aff’d 2007 WL 2156162 (E.D. Va.July 19, 2007): “[t]he analysis used to determine whether a particular limited liabilitycompany operating agreement is an executory contract under Bankruptcy Code §365(e)(1) is clear . . . [t]here is no per se rule . . . [e]ach operating agreement is separatelyanalyzed.”28

Section 365(c)(1) Section 365(c)(1) provides that a trustee is unable to assumeor assign an agreement if applicable nonbankruptcy lawexcuses the nondebtor party from accepting performancefrom an “entity other than the debtor or debtor in possession.” The classic example is “personal services” contracts, whichcontracts courts generally agree cannot be assigned. State law – i.e., applicable nonbankrupcty law - often prohibitsthe assignment of a member’s/partner’s managementagreement.29

Differing Tests Under Section 365(c)(1) “Hypothetical Test”: non-consensual assumption of anexecutory contract or unexpired lease barred whereapplicable nonbankruptcy law would prevent assignment to ahypothetical third party. “Actual test”: nonconsensual assumption of an executorycontract or unexpired lease prohibited only where applicablenonbankruptcy law precludes the assignment of suchagreement and the debtor actually intends to assign it.30

Differing Tests Under Section 365(c)(1)(Cont’d) Courts examine the “facts and circumstances,” with a focuson the type of partner/manager and partnership/LLC at issue. In re Antonelli, 148 B.R. 443 (D. Md. 1992): “[a]pplication ofthe rule, however, calls for a particularized, practical approach the question of whether or not management power in apartnership is assignable turns not upon the status which‘applicable law’ generally accords to partnership agreementsbut upon the materiality of the identity of the partners to theperformance of the obligations remaining to be performedunder the partnership in question” (emphasis added).31

Section 365(e)(1): Ipso Facto Provisions Provisions of contracts that modify rights and duties solely onaccount of a bankruptcy proceeding are generally unenforceable asipso facto provisions under section 365(e)(1) of the BankruptcyCode. Provisions that cause a partnership/LLC to dissolve or that triggerbuy-out options solely on account of a bankruptcy proceeding of thepartner may be unenforceable as ipso facto clauses. Exceptions exist to section 365(e)(1) in the Bankruptcy Code. 365(e)(2)(A)(i): “applicable law excuses a party, other than thedebtor, to such contract or lease from accepting performance fromor rendering performance to the trustee or to an assignee of suchcontract or lease, whether or not such contract or lease prohibits orrestricts assignment of rights or delegation of duties.”32

Ipso Facto Clauses in Partner/MemberBankruptcy Filings LaHood v. Covey, 437 B.R. 330 (Bankr. C.D. Ill. 2010):concluding that the provisions of the operating agreementpurporting to place limitations or restrictions on the member’sinterest as a result of his bankruptcy filing wereunenforceable. In re Dixie Management & Inv., Ltd. Partners, 2011 WL1753971 (Bankr. W.D. Ark. May 9, 2011): finding provision ofLLC statute specifying that dissociation results frombankruptcy filing conflicted with federal bankruptcy law andwas ineffective.33

Ipso Facto Clauses in Partner/MemberBankruptcy Filings (Cont’d) In re Tsiaoushis, 383 B.R. 616 (Bankr. E.D. Va. 2007) aff'd, 2007 WL2156162 (E.D. Va. July 19, 2007):– Chapter 11 trustee filed adversary complaint against LLC of which debtorwas a member and sought to enforce the provisions of LLC's operatingagreement that provided that the LLC would be dissolved upon thebankruptcy of a member and that, upon dissolution, members couldproceed to sell or liquidate LLC's property– LLC’s manager opposed the trustee’s request, asserting that the operatingagreement was an executory contract and that the provision for automaticdissolution was an unenforceable ipso facto clause– The court concluded that the operating agreement was not an executorycontract and that therefore section 365(e)(1) of the Bankruptcy Code wasnot applicable– The operating agreement was valid and enforceable34

Transfer of Economic Interests inPartnership/LLC The interest of a general partner/manager in the partnership/LLC(i.e., profits and surplus) is property of the estate under section 541of the Bankruptcy Code. The trustee generally will be authorized to transfer partner/membereconomic interests – e.g., interests in profits – although, the transfergenerally remains subject to the terms and conditions of theagreement and/or applicable non-bankruptcy law. Baldwin v. Wolff, 690 N.E. 2d 632 (1st Dist. 1998): findingbankruptcy trustee could assign limited partner's right todistributions. In re Dean, 174 B.R. 787 (Bankr. E.D. Ark. 1994): finding that therestrictions contained in agreement related to the transfer ofinterests were not invalidated by any provision of Bankruptcy Code.35

Right of First Refusal Rights of first refusal are generally enforceable unlesstriggered by the bankruptcy. In re Todd, 118 B.R. 432 (Bankr. D.S.C. 1989): partnerobjected to sale of partnership interest to third party;bankruptcy court held that partner’s right under applicablestate law to match price offered was valid and enforceable bybankruptcy court.36

Right of First Refusal: Ipso Facto Clause In re The IT Group, Inc., Co., 302 B.R. 483 (D. Del. 2003):– Applicable law did not excuse members from rendering economicperformance to an assignee, therefore, the court concluded that section365(e)(2)(A) did not apply and the default provision in the agreementwas an unenforceable ipso facto provision.– The court concluded, however, that the right of first refusal was not anipso facto clause; instead, the right of first refusal was triggered by anytransfer of interest and not by the member filing for bankruptcy.– Accordingly, assumption and assignment of the debtor’s economicinterest was subject to the other members’ right of first refusal.37

Buy-Out Provisions There is disagreement among the courts whether agreed buyout provisions may be non-enforceable ipso facto clauses. Courts generally have concluded buy-out provisions cannotbe abrogated in bankruptcy, unless agreement would operateto effect “a forfeiture, modification, or termination.” In re Catron, 158 B.R. 629 (E.D. Va. 1993), aff'd. mem. 25F.3d 1038 (4th Cir. 1994): holding that section 365(e)(1) didnot invalidate the provision in the partnership agreementpermitting the non-bankrupt partners to buy out the debtor’sinterest upon the debtor’s filing for bankruptcy.38

Buy-Out Provisions (Cont’d) Connally v. Nuthatch Hill Assocs. (In re Manning ), 831 F.2d205 (10th Cir. 1987):– Partners entitled under the partnership agreement to buy-out the debtorgeneral partner’s interest in the partnership for a “discount” – i.e., 75%of the value of the debtor’s capital account -- which was less thandebtor’s share of the value of partnership.– The Tenth Circuit remanded to the bankruptcy court to examine, amongother things, whether there were any ipso facto provisions in theagreement related to the buy-out.39

Buy-Out Provisions (Cont’d)– According to the Tenth Circuit, if “the partners, in fact, did intend to allowa severe penalty upon dissolution by bankruptcy,” ipso facto provisionswould likely be implicated.– Given the “discount,” the court found that the buy-out provision may alsobe prohibited under sections 363(1) and 541(c) as a “modification” ofestate property.– The Tenth Circuit noted that “valuing the bankrupt’s interest, not atappreciated fair market value, as is typically done upon the death orincompetency of a partner, but instead at book value produces not onlya modification but has the added effect of requiring [the debtor] tovirtually forfeit his interest .”40

The Buy-Out Price Buy-out price may be subject to higher and better offers. In re Cutler, 165 B.R. 275 (Bankr. D. Ariz. 1994): buyoutrestriction at predetermined price was unenforceable; trusteecould sell the estate’s interest to the highest bidder. In re Grablowsky, 180 B.R. 134 (Bankr. E.D. Va. 1995):“While the partnership agreements in the case sub judice are notpunitive in that they provide for the purchase of the debtor's interest atthe fair market value, they are limiting in derogation of the BankruptcyCode by purporting to preclude the sale of the interests by the Trusteeto third parties who may be willing to pay the estate more than the fairmarket value for the interests. The estate is entitled to any bonus thatmay arise from the freedom to sell such interests to any willingpurchaser; only in that way can the Trustee realize the greatest value ofthe assets for the estate.”41

Partnership and LLC BankruptciesUnique Legal IssuesRobert N. H. ChristmasNixon Peabody LLPrchristmas@nixonpeabody.com212-940-3103

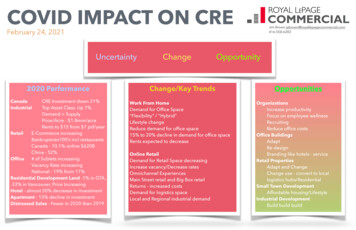

Recent increase in use of SPEs The past decade has seen a dramatic increase in the use of special-purpose entities(SPEs) in a variety of contexts, including throughout structured finance andsecuritization markets. SPEs, usually created in the form of LLCs or limitedpartnerships, are also sometimes referred to as "single-purpose entities" or"bankruptcy remote entities." Borrowers and their lenders have believed that using SPEs can provide more creditsecurity to the lender – resulting in lower interest rates to the borrower. By using an SPE, an organization seeks to separate cash-producing portions of itsbusiness from other, riskier portions of the larger business by transferring thefinancial assets to an SPE. The primary purpose of the isolation and transfer of financial assets to an SPE is toinsulate the lender or investors from the insolvency and bankruptcy risks of theoriginal borrower or originator that formed the SPE. How?43

Typical SPE organizational provisionsSPE organizational documents contain provisions intended to isolate SPEassets from risk associated with the assets, liabilities and performance of theparent or larger enterprise as a whole.Restrictions may include the ability of the SPE to:– Engage in any activity other than owning, operating and/or acquiring aspecified asset or collection of assets;– Enter into mergers, consolidations or dispositions of the asset(s);– Commingle assets, including cash flows and other revenue generated bythe asset(s);– Incur any debt or guaranty other than the subject loan or trade debt strictlyrelated to it;[continued]44

SPE org. documents restrict filing for bankruptcy protection without theconsent of independent directors.i. SPE organizational documents frequently require that the board ofdirectors include at least one independent director.ii. SPE organizational documents may also require that the independentdirector consider the interests of an SPE lender; however, such a provisionmay be limited “to the extent permitted by law.”iii. For example, directors of a Delaware corporation must be cognizant thatdirect fiduciary duties are owed to the company, not its creditors. See N.Am. Catholic Educ. Programming Found., Inc. v. Gheewalla, 930 A.2d 92(Del. 2007).Result: Reduction in the overall cost of borrowing for the originator, on thebasis that the use of an SPE (as generally assumed by lenders andinvestors) lowers the risk of insolvency and therefore lowers the credit risk.But is this true?45

GENERAL GROWTH PROPERTIESI. The business: General Growth, the second-largest U.S. mall owner, owned and managedmore than 200 U.S. malls. It filed for Chapter 11 bankruptcy protection inApril, 2009 with 27 billion in debt. the filing included 166 SPEs (each an individual mall owner) in thebankruptcy filing. independent directors who sat on the SPE boards were dismissed on theeve of the filing– at the mall/property level, the documents had the standard languagerequiring independent director approval of a bankruptcy filing.– the documents did not require notice of dismissal– the new directors voted in favor of the filing46

II. The first battle – the bad faith motion. Lenders to approximately 20 SPEsfiled motions seeking dismissal of their borrowers’ bankruptcy cases on thegrounds that the bankruptcy filings were in “bad faith”. The Lenders’principal arguments were: The cases were filed prematurely because the SPEs were not in anyimmediate financial distress The SPEs failed to negotiate with the lenders prior to filing for bankruptcy General Growth improperly replaced the independent managers of theSPEs with new managers on the eve of bankruptcy The SPE debtors cannot confirm a plan over the lenders’ objections47

The decision: In August, 2009, the bankruptcy court issued a decision denying themotions to dismiss. In re General Growth Properties Inc., 409 B.R. 43 (Bankr.S.D.N.Y. 2009) Judge Gropper rejected the “prematurity” argument on legal grounds (id. at 57),holding that SGL Carbon, 200 F.3d 154 (3d Cir. 1999), and other cases cited by thelenders are not relevant because they involve litigation claims and liability itself wasspeculative Judge Gropper also rejected the prematurity argument on factual grounds (id. at 58)– Although the SPEs were current on debt service and none of the loans had amaturity prior to March 2010, Judge Gropper found that the SPEs were in varyingdegrees of financial distress due to Cross defaults to other financings Guarantees of other financings High loan-to-value ratios Uncertainty as to the prospects for refinancing– declined to establish an “arbitrary rule” that a debtor cannot file a Chapter 11petition if the debt it is seeking to restructure is not due within one, two or threeyears48

On bad faith, the court applied a two-prong test which looks to (i) objectivefutility in pursuing a bankruptcy filing, and bad faith in filing the petition– Citing decisions in U.I.P Engineered Products, 831 F.2d 54 (4th Cir. 1987),and In re Mirant Corp., 2005 Bankr. LEXIS 1686, 2005 WL 2148362 (Bankr.N.D. Tex. Jan. 26, 2005), Judge Gropper applied a “family filing” standard “Whether to file a Chapter 11 petition can be based in good faith onconsiderations of the [corporate] group as well as the interests of the individualdebtor” 409 B.R. at 63. Making frequent reference to General Growth’s reliance on cash flow from theSPEs, Judge Gropper placed greater emphasis on the importance of thesubsidiaries to the health of the bankrupt parent than on the benefits flowing tothe subsidiaries from the relationship. Id., at 62-63. But what about the directors? Were they not required to look to theinterests of creditors – under applicable Delaware law on fiduciary duty ininsolvency?49

No -- these mall owners were solvent. So, the directors owed duties to theshareholders. Judge Gropper held that the directors and managers of the SPEs wereobligated to consider the interests of the shareholder, General Growth indetermining whether to authorize a bankruptcy filing. 409 B.R. at 64-65. Delaware corporate law provides that the directors of a solvent corporationhave fiduciary duties to shareholders, even in the “zone of insolvency”. Id.At 64 (citing N. Am. Catholic Educ. Programming Found., Inc. v.Gheewalla, 930 A.2d 92 (Del. 2007)). The decision discounts modifications to the fiduciary duties of directorsand managers contained in the SPEs’ operating agreements andauthorized by §18-1101 of the Delaware Limited Liability Co. Act. (Id.)50

What are the lessons from the General Growth bad faith motion? Better documentation– Creditors should receive advance notice when an independent director is replaced.– To reduce opportunities for director shopping – and to avoid relationships that mightsuggest a conflict of interest – independent directors should come from nationallyrecognized companies that provide such individuals to similar corporations– Require independent directors to have independent advisors– Spell out the fiduciary duties of independent directors– Given the court’s note of approval on GGP’s selection of replacement directors whowere familiar with restructuring, a parent/sponsor may be unable to justify removing analready well-qualified independent director with relevant experience and exposure toinsolvency. Review the context in which SPE operates– Financial health of parent– type of assets and whether they are central/have great importance to parent51

III. The second battle – cash collateral/adequate protection.The structure: GGP commingled SPE funds in its own account, then used this account topay all expenses of the SPEs, including those of cash-flow negative ones. Essentially it regularly made unsecured intercompany loans. No entityguaranteed the intercompany loans, and recipients could benefit from theliquidity without providing any collateral. However, many of the SPE loan documents for SPE debtors in GGPcontained “cash-trap” provisions providing that after an event of default, theSPE could no longer upstream some or all of its cash to GGP’s centralizedoperating account. Instead, the funds would be transferred directly from alockbox account according to a specific payment h

Partner/Member bankruptcy filings raise unique legal issues, including: -What are "estate" interests -Whether the bankruptcy filing leads to the dissolution of the partnership/LLC -Whether the partner/member can retain his or her management rights after the bankruptcy filing -Impact of section 365 on partnership and LLC agreements