Transcription

2022Benefits Guide

Benefit Administrators: Contact InformationPlanProviderContact informationMedical BenefitExcellus BlueCross BlueShield (BCBS)800.493.0318 (TTY: 800.662.1220)ExcellusBCBS.com/syreduPrescription DrugBenefitOptumRx866.854.2945 (TTY: 711)optumrx.comFlexible (TTY: 866.353.8058 / International TTY: 602.267.3826)wageworks.comDental BenefitDelta Dental800.932.0783 (TTY: 711)deltadentalins.comVision BenefitVSP Vision800.877.7195 (TTY: 800.428.4833)vsp.comDental/Vision and DisabilityPlan for SEIU MembersService Employees Benefit Fund (SEBF)855.835.9720sebf.orgLife InsuranceMetLife (HR Shared Services isrecord keeper)315.443.4042 or hrservice@syr.eduHR Shared ServicesAuto and HomeInsuranceFarmers Insurance GroupLocal Representative: Tom Swanson315.656.2982 or toll-free 800.438.6388Long Term DisabilityInsuranceThe acuseRetirement Benefit PlanTIAA855.842.2873 (TTY: 800.842.2755)tiaa.org/syrDependent and RemittedTuitionSyracuse University315.443.4042 or hrservice@syr.eduHR Shared ServicesFaculty and Staff AssistanceProgram (FSAP)Carebridge800.437.0911 (TTY: 711)Care@WorkCare.com855.781.1303 or Care.comHelpful University Contact InformationSyracuse University Office of Human Resources – hr.syr.eduHR Shared Services315.443.4042 or hrservice@syr.eduOther Syracuse University DepartmentsBarnes Center at The Arch RecreationCollege of Professional StudiesEqual Opportunity, Inclusion and Resolution ServicesHazard Communication TrainingI.D. Card ServicesInformation Technology ServicesLesbian, Gay, Bisexual, Transgender and Queer (LGBTQ) Resource CenterParking and Transportation ServicesPayrollPublic Safety (Communications 652315.443.4042315.443.2224

Welcome to Syracuse UniversityWe are pleased to have you join our team of talented faculty and staff who work to deliver the bestexperience possible for our students—on campus, across the country and around the world.This booklet provides an overview of the comprehensive benefits program that provides flexibility andchoice to meet the unique needs of our employees. Beyond the basics found in this guide, you’ll want toreview the details found on the Human Resources website, hr.syr.edu, which is continually updated withthe most current benefit information.Our HR Shared Services team is here to help with any questions you may have about your employment.We can be contacted by phone at 315.443.4042 or via email at hrservice@syr.edu.We hope you find this information to be a valuable resource as you begin your University career, andwe wish you much success in your new role.Sincerely,Office of Human ResourcesSYRACUSE UNIVERSITY1

Table of ContentsNew Employee Checklist.3Benefits Quick Guide.5Retirement Planning.6Health Benefits (Medical and Prescription Drug).8Dental and Vision Benefits.13Flexible Spending Accounts (FSAs).16Wellness and WorkLife Resources.16Life Insurance.17Disability Benefits.18Workers’ Compensation.18Voluntary Long Term Disability Insurance.18Remitted Tuition Benefits.19Dependent Tuition Benefits.20Paid Time Off for Staff.21Leaves of Absence.21Caregiving Resources.21Identity Protection Services.21Auto and Home Insurance.21Travel Resources.21Guaranteed Mortgage Program.21Identification Cards.21Adoption Assistance.21Lesbian, Gay, Bisexual, Transgender and Queer (LGBTQ) Resource Center.22Information Technology Services.22Notice of Special Enrollment Rights.23Continuation of Health Coverage/COBRA.24Notice of Privacy Practices.27Notice Regarding the Women’s Health and Cancer Rights Act of 1998.30Summary of Benefits and Coverage (SBC).302BENEFITS GUIDE

New Employee ChecklistOn or Before Your First Day:nnComplete your Employment Eligibility Verification (I-9) form at Human Resources (HR). Bring your required documentation.Activate your NetID at netid.syr.edu, so that you have access to online resources and services such as: Email Electronic documents MySlice, the University web portal where you access the University’s benefits enrollment site and other employee servicesn O btain an identification card from the Office of Housing, Meal Plan and I.D. Card Services. Submit your photo by emailingidcard@syr.edu and follow the guidelines for photo submission by viewing When your new card is ready, you will receive an email directing you when and where to pick up the card.n Complete your Pay Notice Acknowledgment in the Payroll section of MySlice.n S ubmit your COVID-19 vaccination or exemption documentation. Follow the instructions for submitting COVID documentation athr.syr.edu/coviddoc.nComplete a retirement plan waiting period waiver form, if applicable.First Week:n S ign up for direct deposit of your pay and update your federal and/or state tax withholding status and allowances in the Payroll sectionof MySlice.nnnReview the Orange Alert information and provide your preferred contact information in the Personal Profile section of MySlice.Schedule your Hazard Communication Training online at ehss.syr.edu/about/training.If your duties will include accounting and payroll tasks, visit fab.syr.edu to register for applicable training. For additional trainingregarding the General Ledger Financial Reports, please contact General Accounting at 315.443.2522 or genacctg@syr.edu.First Month:nReview benefits information and enroll as soon as possible.IMPORTANT: You must enroll within the first 31 days of employment to commence benefits as of your hire date.n A ttend New Employee Orientation. New Employee Orientation sessions are regularly held, and you should receive anemail from Human Resources with details about the next session.SYRACUSE UNIVERSITY3

4BENEFITS GUIDE

Benefits Quick GuideEligibilityFaculty and Staff Assistance ProgramRetirementDisability and Life InsuranceYou are eligible for benefits the day you begin your benefitseligible position. Refer to the University’s benefits eligibility policy(hr.syr.edu/eligibility) to determine which dependents are eligiblefor coverage.You may contribute to the University's retirement plan immediatelyupon hire by electing pre-tax Traditional 403(b) and/or after-tax Roth403(b) contributions. Upon reaching your one-year anniversary, theUniversity will contribute 10% of your eligible pay, subject to annualIRS maximums. The one-year waiting period may be waived for thosewho qualify.Health InsuranceThree comprehensive medical options are available throughExcellus BCBS (hr.syr.edu/medical), with prescription drug coveragethrough OptumRx (hr.syr.edu/rx).Dental and VisionPreventive and comprehensive coverage is available through DeltaDental. You can add vision coverage to your dental coverage throughVSP (hr.syr.edu/dental).Flexible Spending AccountsWithhold salary on a pre-tax basis for reimbursement of eligible outof-pocket health care expenses and dependent care expenses. Themaximum withholding is 2,850 for medical expenses and 5,000per household for dependent care (hr.syr.edu/fsa).WellnessThe Syracuse University Wellness Initiative provides learningopportunities, activities, programs and other resources to empowerand encourage you to make decisions that lead to a balancedand healthy lifestyle. Learn about upcoming programs atwellness.syr.edu.Counselors are available for confidential consultation, assessment,referrals and counseling through Carebridge. Licensed, credentialedcounselors are available 24 hours a day, seven days a week, 365 daysa year by calling 800.437.0911 (TTY: 711).Income replacement benefits are available for short and long termdisabilities. The University also provides basic life and accidentaldeath & dismemberment (AD&D) protection, with the option topurchase additional coverage for you and your dependents(hr.syr.edu/life).TuitionDependent tuition is available after you complete the equivalentof three full-time years of service for eligible dependent childrenattending Syracuse University or other participating institutions.In addition, remitted tuition benefits for you and your eligiblespouse/same-sex domestic partner may be used toward graduateand undergraduate coursework. Visit hr.syr.edu/tuition for moreinformation.Paid Time OffThe University provides you with time to enjoy away from work, aswell as to protect you and your loved ones in times of sickness. Be sureto review and understand the time off that you are eligible for throughyour University benefits (hr.syr.edu/timeoff).Caregiving ResourcesThe University provides a variety of support to assist with child anddependent care needs, including access to a free premium membershipto the caregiving website Care@Work by Care.com, a dependentcare subsidy program, flexible work arrangements and more.Additional BenefitsAuto and home insurance, recreational facilities, identity protectionservices, travel assistance, career development, will preparationservices, adoption assistance and a guaranteed mortgage programare also available as part of the University’s comprehensive benefitsprogram.SYRACUSE UNIVERSITY5

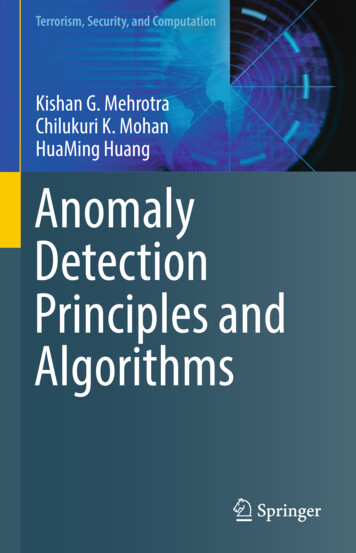

Retirement PlanningThe University offers you the opportunity to save in tax-deferred and tax-advantaged accounts and will contribute to those accounts if youare eligible. The accounts are administered by TIAA and you can select from a variety of investment options. You can change your contributionamount and investment elections at any time. For assistance with changing your contributions contact HR Shared Services at 315.443.4042or hrservice@syr.edu. For assistance with changing your investment elections visit tiaa.org/syr or contact TIAA at 855.842.CUSE(2873)/TTY: 800.842.2755.Retirement Plan Investment OptionsOne-step investing is easy when you select a single lifecycle fund. Select the T. Rowe Price Target Date Fund for the year closest to youranticipated retirement date. The fund invests more aggressively the longer you have until retirement and will adjust its mix of assets (stocks,bonds and cash) to become more conservative as retirement approaches.Want to design your own investment mix? Choose from actively managed or passive funds, including fixed and variable annuities, mutual funds,inflation-protected securities and real estate funds.If you do not select your investments when you first enroll, contributions will automatically go into the T. Rowe Price Target Date Fund for theyear closest to the year you will reach age 65.Categories to the left have potentially more inflation riskand less investment riskGuaranteedTIAATraditional*MoneyMarketCREF MoneyMarketAccount*TIAA StableValue**Fixed Income/ Hybrid and TargetBond FundsDate FundsCategories to the right have potentially less inflation riskand more investment riskDomestic EquityValueBlendGrowthReal EstateInternational/Global EquityBlackRockHigh YieldBond FundCREF SocialChoiceAccount*DelawareSmall-CapValueCREF StockAccount*AllianceBernsteinDiscoveryGrowthTIAA EFInflationLinked BondAccount*T. Rowe PriceTarget DateFundsJP MorganEquityIncomeTIAA-CREFSmall-CapEquityT. Rowe PriceBlue ChipGrowthTIAA RealEstateSecuritiesFund* VanguardTotalInternationalStock IndexVictoryEstablishedValueVanguardExtendedMarket IndexPIMCOTotal ReturnVanguardTotal BondMarket IndexVanguardInstitutionalIndexSyracuse University's retirement plan investment options are subject to change. For more information and a complete list of investment options available, please visit tiaa.org/syr.*Any guarantees under annuities issued by Teachers Insurance Annuity Association of America ("TIAA") are subject to its claims-paying ability. TIAA Traditional is a guaranteedinsurance contract and not an investment for federal securities law purposes. Payments under CREF and the TIAA Real Estate Account are variable and will rise or fall basedon investment performance. The TIAA Real Estate Account is a portfolio that has a direct investment exposure to commercial real estate. Returns are derived from propertiesappreciating in value and rental income and will generally be more fixed income-like.**The TIAA Stable fund is only available for University contributions to the Syracuse University Noncontributory Retirement Plan (101201).* The TIAA-CREF Real Estate Securities Fund is a mutual fund which invests primarily in real estate investment trusts (REITs). The volatility of this fund is equity-like and thereforesignificantly higher than the TIAA Real Estate Account.Your Retirement Plan ContributionsUpon employment, you are immediately eligible to contribute tothe University’s retirement plan. You can contribute either a flatdollar amount or a percentage of your pay each pay period, up to themaximum amount permitted by law, which is adjusted each year. Thisyear’s limits can be found by visiting hr.syr.edu/retirement-planning.6BENEFITS GUIDEIf you made contributions to a previous employer’s plan during thecalendar year, the combination of all of your contributions cannotexceed the annual maximum.To enroll, complete your new hire enrollment through MySliceor return the 403(b) Salary Reduction Form to HR, which can befound at hr.syr.edu/forms. You may elect pre-tax Traditional 403(b)and/or after-tax Roth 403(b) contributions.

University Retirement Plan ContributionsUpon completion of your first year of employment, the University willcontribute 10% of your eligible pay, subject to annual IRS maximumsand the terms of the Syracuse University Noncontributory RetirementPlan.Making Changes to Your InvestmentsIf you do not make an investment election, the University’scontribution will automatically be invested in a T. Rowe Price TargetDate Fund for the year closest to the year you reach age 65. Youcan make changes to this investment and the investments of yourown contributions online at tiaa.org/syr or by contacting TIAA at855.842.CUSE(2873)/TTY: 800.842.2755.Waiving the One-Year Waiting PeriodIn general, the one-year waiting period to receive the Universitycontribution may be waived for faculty and staff joining theUniversity from another accredited four-year institution that confersa baccalaureate degree, certain affiliates or research organization. Inorder to waive the University’s one-year waiting period, you must meetthe criteria provided on the waiver form. The waiver form, which mustbe completed by you and your previous employer, can be found athr.syr.edu/forms. Once the waiver form has been completed by yourprevious employer, you should review it for accuracy, sign and dateit, and return it to HR Shared Services either by fax (315.443.1063)or email (hrservice@syr.edu). This waiver will go into effect andthe University’s contributions will begin after the completed formis approved and processed by HR Shared Services. Please keep inmind that there is no retroactive contribution of the University’scontribution, so you are encouraged to complete the waiver form assoon as possible to maximize the amount you are eligible to receivefrom the University.Financial Counseling at No Additional CostTIAA offers personalized advice and education services to helpyou reach your retirement goals at no additional cost. To schedulea meeting with one of the University’s dedicated TIAA financialconsultants, or for assistance with your account, contact TIAA at855.842.CUSE (2873)/TTY: 800.842.2755, or sign up onlineat tiaa.org/syr. In addition, the University provides a variety ofresources to help you plan for a successful retirement. Be sure to checkout hr.syr.edu/financial-wellness to see the many tools available tosupport your personal financial goals.Designate a BeneficiaryA beneficiary is the person or organization who will receive the moneyin your accounts if you pass away. You can name primary beneficiaries,who receive the money if they are alive when you pass away, andcontingent beneficiaries, who receive the money if your primarybeneficiaries pass away before you. You can update your beneficiarydesignations at any time.In general, if you’re married, your spouse must consent in writing if youchoose to name someone else as your primary beneficiary. If you don’tname a beneficiary, the plan rules will determine who receives youraccount. Naming a beneficiary ensures that your wishes are followed.SYRACUSE UNIVERSITY7

Health BenefitsSyracuse University is committed to providing comprehensivehealth plan options for our faculty and staff. Three health insuranceoptions are available: SUBlue, SUOrange and SUPro. All threeoptions include medical coverage administered by Excellus BCBS andprescription drug coverage administered by OptumRx. In general, thesame services are covered under all three plans, but with a differentdeductible and copay/coinsurance structure.Benefits EligibilityYou are eligible to enroll as of your date of hire. Generally, youmay cover your legal spouse or eligible domestic partner, and yourchildren up to age 26 under your health coverage. Please refer to theUniversity’s Benefits Eligibility Policy online at hr.syr.edu/eligibilityto determine if your dependents are eligible for coverage. You mustshow documentation of your dependent’s relationship to you beforeyour dependent will be approved for coverage.Medical BenefitsSUBlue and SUPro allow members to receive services from anyprovider, subject to certain plan restrictions. When you receive healthcare, your coverage will be determined by whether the providerparticipates in the network, as described below. In-Network: Services must be performed by a providerthat participates with the local Excellus BCBS network orthe national BlueCard network, regardless of their location.Coordination with your Primary Care Physician (PCP) is notrequired. Out-of-Network: Services are performed by a provider thatdoes not participate in the Excellus BCBS network.SUOrange restricts coverage to only those providers that participatewith Excellus BCBS or the national BlueCard network.Coverage for International Travel: When traveling outside theUnited States, you have access to in-network providers in over200 countries worldwide. If you receive health care services froma participating BCBS Global Core provider, generally you canpresent your ID card and pay the applicable deductible and copay/coinsurance under SUBlue, SUOrange or SUPro.If you see an international provider who doesn’t participate in theBCBS Global Core network, you will need to pay for those servicesat the time they are rendered. If you’re enrolled in SUBlue or SUPro,you can submit those claims to Excellus BCBS for reimbursement asthough the providers were participating; however, there is no coveragefor non-participating providers in the SUOrange plan.Online Tools and Resources for Medical Benefits: Set up an accountthrough the excellusBCBS.com/syredu secure member website fora full suite of online tools. You can view your benefits, eligibility andclaims and search for participating providers and facilities. You canalso download the Excellus BCBS mobile app for instant access toyour member ID card and claims information. Excellus BCBS alsooffers member assistance through their dedicated customer serviceunit at 800.493.0318 (TTY: 800.662.1220).8BENEFITS GUIDEPrescription Drug BenefitsOptumRx is the pharmacy benefit manager for Syracuse University.The benefit provides many convenient ways to obtain yourprescriptions. Visit hr.syr.edu/rx for coverage details.Generic DrugsTo encourage the appropriate use of generic medications, if a genericequivalent is available and you choose to have the brand name drug, oryour doctor writes “Dispense As Written” (DAW) on your prescriptionto ensure that you get the brand name drug, generally you will berequired to pay the generic, tier one copay plus the difference in costbetween the brand name drug and the generic drug.Biotech/Specialty DrugsPrescription drugs in the biotech/specialty class are required to befilled through mail order by Optum Specialty Pharmacy and may belimited to a 30-day supply per refill. Your cost will follow the mailorder schedule for your medical plan option, but for a 30-day supply.Contact Optum Specialty Pharmacy at 844.265.1761 (TTY: 711) tolearn more about specialty medications.Home DeliveryIf you take certain prescription medications on an ongoing basis,you can fill your prescriptions using home delivery, which offersconvenient mail order service with free standard shipping. Enroll inhome delivery online at optumrx.com.Have your doctor write your prescription for up to a 90-day supplywith three refills. Your doctor can call, fax or electronically prescribeyour medication for home delivery. Some medications, includingpre-packaged medications and controlled substances, may not beavailable in a supply greater than 30 days per order. Home deliveryorders are generally received within 14 days, but you will benotified if there will be a delay with your shipment. Call OptumRx at866.854.2945 (TTY: 711) for assistance with home delivery.When you use mail order, the plan’s mail order cost sharing applies,which is different than the cost sharing at a retail pharmacy. This mayresult in significant savings in your out-of-pocket costs, but savingsvary for each medication and savings are not guaranteed.Retail 90-Day NetworkYou may fill a 90-day supply at a local participating pharmacy, insteadof using the mail order option, and pay the retail cost share for yourplan option.Online Tools and Resources for Prescription Drug BenefitsSet up your account at optumrx.com, the secure member website forprescription drug benefits. Then you can view your claim history, view/print your member ID card, find participating pharmacies, estimate thecost of prescriptions and much more. The OptumRx mobile app givesyou access from anywhere.

2022 Health Plan: Monthly Employee ContributionsSUBlueSUOrangeSUProSchedule ASchedule BSchedule ASchedule BSchedule ASchedule BEmployee 147.88 129.54 143.58 125.77 134.87 118.14Employee Spouse/Domestic Partner 360.79 284.99 350.43 276.70 331.09 259.91Employee Child(ren) 314.38 250.02 305.34 242.74 288.32 228.01Employee Spouse/Domestic Partner Child(ren) 520.51 405.47 505.60 393.67 478.23 369.78Contributions listed here are based on the 12-month calendar year. The actual deduction from your paycheck depends on your deduction cycle.Reduced Medical Contributions: Schedule BEmployees will pay the Schedule A contribution rates for health plan coverage unless they qualify, apply and are approved for reduced ScheduleB contributions. Applications must be received within 31 days of your date of hire and resubmitted each year during Open Enrollment. Eligibilityfor Schedule B contributions is based on household income and household size according to the chart below (subject to change each year).For 2022, the eligibility guidelines are:Household SizeHousehold Income1Less than 39,0002Less than 52,0003Less than 66,0004 and upLess than 80,000Household size is the number of individuals declared on your most recent federal income tax return and the return for your spouse or domesticpartner, if filed separately. Included in household size are your children who are not declared on your tax return, but are either under age 19 andliving with you, or age 19 or older and enrolled on your medical plan. Household income is the combined adjusted gross income reported on your(combined) federal income tax returns.Additional information about Schedule B contributions, including the application form, is available online at hr.syr.edu/scheduleb.SYRACUSE UNIVERSITY9

2022 Health Plan: Schedule of BenefitsThe following chart shows your cost sharing for some commonly used health care services. The complete benefit summary and coverage featuresof each plan option can be found in the Medical Booklet, posted online in kIn-NetworkOut-of-NetworkAnnualDeductible1 150 per individualwith a maximum of 300 per family 300 per individual witha maximum of 1,000per family 200 per individualwith a maximum of 400 per family 300 per individual witha maximum of 1,000per familyCoinsuranceGenerally, nocoinsurance. Certainexceptions apply. Seethe Medical Bookletfor information.30% allowable amountplus the differencebetween provider’scharge and the allowableamount. Certainexceptions apply.See the Medical Bookletfor information.5% of allowable amount forinpatient hospitalization- or 20% of allowable amountfor other services, exceptas otherwise noted in theMedical Booklet5% of allowable amount forinpatient hospitalization- or 30% of allowable amountfor other services, exceptas otherwise noted in theMedical Booklet- plus Difference betweenprovider's charge and theallowable amountAnnual Out-of-PocketMaximum2 2,000 per individualwith a maximum of 4,000 for a family 6,000 per individualwith a maximum of 12,000 for a family 1,500 per individual witha maximum of 3,000 fora family 6,000 per individualwith a maximum of 12,000 for a familyRoutine PreventiveScreeningsNo deductible orcopay; paid in fullDeductible pluscoinsuranceNo deductible orcoinsurance; paid in fullDeductible pluscoinsuranceRoutine Preventive Screenings include, but are not limited to, the following (certain restrictions apply, contact Excellus BCBSwith any questions): Breast Cancer Screenings (one per calendar year for ages 35 and older, with exceptions if high risk; both preventive and diagnosticscreenings are covered in full through an in-network provider) Prostate Cancer (one per calendar year for ages 50 and older, with exceptions if high risk) Cervical Cancer (one per calendar year for ages 18 and older) ColonoscopyThis list is subject to change based on guidelines issued by the United States Preventive Services Task Force and the Advisory Comm

Dependent and Remitted Tuition Syracuse University315.443.4042or hrservice@syr.edu HR Shared Services Faculty and Staff Assistance Program (FSAP) Carebridge800.437.0911 (TTY: 711) Care@Work Care.com855.781.1303or Care.com Helpful University Contact Information Syracuse University Office of Human Resources - hr.syr.edu