Transcription

Celebrating 10 years.Ownership. Dedication. Success.10yearsOwnership. Dedication. Success.

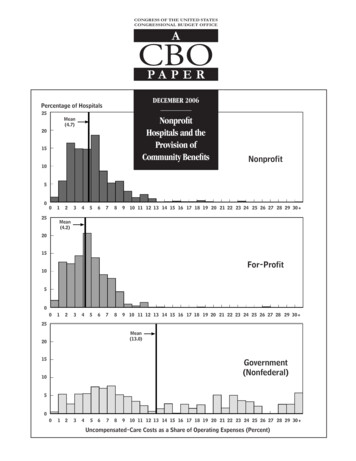

Looking Forward.Chip DentonChairman of the Board of DirectorsHPICHPIC currently insures 31 hospitals and systems with over 8.5 millionin annual written premium, over 40 million in surplus, and over 70million in assets as of year-end 2012. As you can see in the chartabove, HPIC has returned 11 million to its subscribers in the form ofequity returns.We believe these returns show the benefit of a member-owned,member-governed company. We appreciate your part in the company’ssuccess over the past 10 years and we look forward to your part in ourcontinued success in years to come.Sincerely,

Celebrating 10 Years of Ownership.20032003HPIC, sponsored by MHA, elected a board ofdirectors and began by raising over 8 million incharter capital from 23 charter members. HPICbecame licensed & commenced operation onJuly 1, 2003. The newly formed company had ayear-end loss of 876,000.2004The Subscriber Equity Allocation Plan (SEAP)was approved, and HPIC Committees wereestablished.20052006Director of Underwriting hired and new businesspartners selected and Madison became officialHPIC headquarters. Successfully completed itsfirst South Carolina Triennial audit.2008Recorded profits of 8.2 million. Board approvedfirst equity return of 1 million and a 5% ratereduction.2010Recorded profits of 8.9 million. Board approveda 5% rate reduction for hospitals and a 3 millionequity return. HPIC was ranked #4 RRG out of255 RRGs by Captive Review.2012Recorded profits of 5.2 million, surplus increasedto 40.6 million and assets increased to 70 million. Rates for hospitals reduced 5% and physician rates reduced by 10%. Board approved a 2million equity return bringing historical equityreturns to 11 million.2013HPIC recorded a profit of 3 million. Boardapproved insuring Class II Subscribers with pathway to Class I membership and developed planto consolidate operational headquarters inMadison.2007Recorded profits of 5.2 million. HPIC ranked#44 RRG (out of 255) by Captive Review.2009Recorded profits of 7.7 million. Surplusincreased to 31.1 million. Subscribers transferred 7.3 million to Surplus Capital Account.Board approved an equity return of 2 million.2011Recorded profits of 2.9 million. Surplusincreased to 37.3 million and assets increasedto 65.6 million. Board approved a 3 millionequity return and began writing non-sponsoredphysicians. Rates for hospitals and physicianswere reduced.

Celebrating 10 Years of Dedication.Healthcare Providers Insurance Company Board of Directors2012-2013Charles L. Denton, ChairmanChief Executive OfficerGrenada Lake Medical CenterTerry L. Varner, Vice ChairmanAdministratorYalobusha General HospitalGerald D. Wages, SecretaryExecutive Vice PresidentNorth Mississippi Health ServicesPaul A. Gardner, TreasurerAdministratorGeorge Regional Health SystemsSam W. Cameron (ex-officio)PresidentMississippi Hospital AssociationLee McCallAdministratorWinston Medical Center1st row (from left to right): Chip Denton, Gerald Wages; 2ndrow: Daryl Weaver, David Paris; 3rd rown: Lee McCall, PaulGardner; Back: Sam Cameron; Not pictured: Terry Varner,Chad Netterville, Jim Blackwood, Paul NewtonHPICO Board 2012-2013Paul Gardner, George Regional Health SystemTimothy H. Moore, North Mississippi HealthServicesSam W. Cameron, MHAJohn Dawson, Montfort Jones Memorial HospitalCharles L. Denton, Grenada Lake Medical CenterLarry C. Bourne, HPICEdward L. Foster, MHA SolutionsG. Douglas Higginbotham, South Central RegionalMedical CenterChad NettervilleChief Executive OfficerField Memorial Community HospitalJim BlackwoodCEO/AdministratorTallahatchie General HospitalDavid ParisChief Executive OfficerPerry County General HospitalDaryl WeaverChief Executive OfficerKing's Daughters HospitalPaul NewtonVice PresidentUSA Group of South Carolina

Healthcare Providers Insurance Company CommitteesExecutive CommitteeWhen the Board of Directors is not in session, the Executive Committee shall have the powers vested in the Board ofDirectors. The Committee will report all action taken at the next meeting of the Board of Directors.Chip Denton, ChairmanGrenada Lake Medical CenterSam CameronMississippi Hospital AssociationPaul GardnerGeorge Regional Health SystemGerald WagesNorth Mississippi Health ServicesLarry BourneHPICOHPIC Underwriting CommitteeThe Committee on Underwriting shall assure that standards and criteria established by the Committee on RiskManagement and Claims are adhered to by all Subscribers and submit reports and recommendations on memberinstitutions which fail to meet standards and criteria for insurance.Chip Denton, ChairmanGrenada Lake Medical CenterPaul GardnerGeorge Regional Health SystemTerry VarnerYalobusha General HospitalHPIC Risk Management and Claims CommitteeThe Committee on Risk Management and Claims shall consider matters of legal exposure to civil liability in themanagement and operation of the Subscribers of HPIC and develop procedures to improve patient safety and reducerisks. The Committee shall consider all policy matters concerning settlement and adjudication of claims and shall workin conjunction with the attorney-in-fact in making settlement of appropriate claims and establishing guidelines forlitigation of other claims.Lee McCall, ChairmanWinston Medical CenterMargie MajureScott Regional HospitalMolly BrownGrenada Lake Medical CenterChad NettervilleField Memorial HospitalJanice McClainTyler Holmes Memorial HospitalDaryl WeaverKing's Daughters HospitalHPIC Finance & Investment CommitteeThe Committee on Finance and Investment shall concern itself with the protection of the financial assets of HPIC,including the investments and securities of HPIC.Paul Gardner, ChairmanGeorge Regional Health SystemLee McCallWinston Medical CenterGerald WagesNorth Mississippi Health ServicesDarrell WildmanRush Health SystemsDavid ParisPerry County General HospitalHPIC Audit CommitteeThe Committee on Audit shall concern itself with required audits of the books of HPIC, with recommending to the Boardof Directors the selection and retention of auditors, and with procedures and accounting methods by which the variousparticipating subscribers’ accounts, both premium and equity, are maintained.Terry Varner, ChairmanYalobusha General HospitalKenneth PoseyJasper General HospitalChip DentonGrenada Lake Medical CenterJohn DawsonMontfort Jones Memorial Hospital

Celebrating 10 Years of Success.HPIC would not be celebrating 10 years of success today without the support andcommitment of our employees. Thank you!AdministrationLarry BournePresident & CEODee ManningExecutive Assistant to the CEOClaimsAllen Gill, JDClaims ManagerShea MoodySenior Claims ConsultantBrett Tucker, JDSenior Claims ConsultantKatherine MangumSenior Claims AssistantRisk ManagementLynda Plummer, MBA, RNDirector of Risk ManagementRobin WeltensDirector of Loss ControlLea Ann Mitchell, RN, RHIT, CPMSM, CPHQ, CPHRMSenior Risk Management ConsultantUnderwritingLauren CasciolaUnderwriterMarketingLisa Noble, CICDirector of MarketingBrady StewartMarketing Account ExecutiveKimber LowMarketing Account Customer Service RepresentativeHealthcare Employers Resources Exchange (HERE)Diann StogsdillSupervisor, Workers CompensationChris JoinerClaims Consultant

Looking Forward, Looking Back.Larry BournePresident/Chief Executive OfficerHPICIn 2003, Healthcare Providers Insurance Company (HPIC) wascreated by Mississippi hospitals for Mississippi hospitals out ofnecessity. Mississippi was in the depths of a medical liability crisis.There were few alternatives in obtaining professional liability insurance. It was determined that the best alternative would be the formation of a new company, sponsored by MHA, with the recognizedadvantages of being member-owned and member-governed.The primary goal was to create an actuarially sound program toprovide critically needed insurance products for MHA memberhospitals and sponsored physicians at competitive prices. HPIC wasdomiciled in South Carolina on July 1, 2003, and was registered andapproved to do business in Mississippi and Alabama.Today, HPIC insures 31 hospitals and systems with over 8.5 millionin annual written premium, over 40 million in surplus, and over 70million in assets as of year-end 2012. We have returned 11 million toour subscribers in the form of equity returns.Looking forward, we believe our member-owned, member-governedmodel is paramount to our continued strong capitalization and longterm financial stability. Thank you for helping us make the past 10years a success, and we look forward to shared success for manyyears to come.Sincerely,

Our Mission:To provide innovative and effectiveinsurance solutions to safeguard the assetsof our subscribers as theydeliver quality health care.Our Vision:To be the premiere insurance companyproviding innovative insurance solutions inpartnership with Mississippihealth care providers.Our Values:IntegrityOpen and honest communicationMutual respect and teamworkResourceful and responsiveExcellence/Service beyond expectationsAccountability to members and each other10yearsOwnership. Dedication. Success.www.hpico.com 1-800-234-8847

HPIC, sponsored by MHA, elected a board of directors and began by raising over 8 million in charter capital from 23 charter members. HPIC became licensed & commenced operation on July 1, 2003. The newly formed company had a year-end loss of 876,000. 2004 The Subscriber Equity Allocation Plan (SEAP) was approved, and HPIC Committees were .