Transcription

HFMA Presentation:Value Driven Care UpdateJanuary 15, 2018Melinda HancockChief Financial OfficerVCU HealthJeffery Gruen, MD, MBAChief Innovation Officer and Chief Medical OfficerInnosight1

Jeffery Gruen, MD, MBAChief Innovation Officer and Chief Medical OfficerInnosight2

POLITICSTrump Officials, After Rejecting Obama Medicare Model,Adopt One Like ItJan 10, 2018“The current administration would like to reverse everythingassociated with the Affordable Care Act and theObama administration,” Dr. Fisher said.“But this week’s announcement shows that thereis a bipartisan consensus on the need to change the waywe deliver and pay for health care.”- Dr. Elliot Fisher, Dartmouth3

Provider Profit Margins FallingSource: Congressional Budget Office, Sept. 2016

Disruption AcceleratingThe newflexibledeliveryplatform?The newasset lighthealthsystem?Ubiquitoushealthservices ondemand?The newhealth plan/provider?

Inpatient Model Being DisruptedInpatient0%Outpatient 23%

Inpatient Disruption Will Accelerate Over Next 10 Years

CMS Increasing Value PaymentsMACRA legislation allowed for slower transitional shift to value in 2017 and 2018—in 2019, implementation accelerates significantlyMedicare value-based reimbursement trends will continue to drive increased adoption on the commercial side

Commercial Payors Also Increasing Value Payments45% spend tiedto value in2016; goal of75% by 202045% spend tiedto value43% spend tied toshared savings;goal of 50% by20189

Provider MIPS CMS Payment Dollar Risk Increasing 5% 7% 9% 9% 9% 9%2022202320242025 -9%-9%-9%-9% 4%201920202021-4%-5%-7%Those remaining largely in Medicare fee-for-service will see increasingMedicare reimbursement swings based on quality and costIncreasingly incentivized to participate in “Alternative PaymentModels” across all payers, all bearing a more-than-nominal amount ofdownside risk in a variety of arrangements

MEDICARE ACO PARTICIPATION IN WESTERN REGION Less than 20% of MSSPACOs are located in theWestern Region About 30% of NextGeneration ACOs arelocated in the WesternRegionSource: Centers for Medicare and Medicaid Services

WESTERN REGION MEDICARE ACO RESULTS Based on the most recent available results, the highest performingMedicare ACO (MSSP) earned more than 7.4M, with the lowestperforming ACO (Next Generation) losing 5.2M2015 MSSP ResultsCommonwealth Primary Care ACORevere HealthScottsdale Health Partners, LLCJohn Muir Health Medicare ACONational ACORainier Health NetworkSilver State ACO LLCPremier Choice ACO, IncArizona Connected Care, LLCAdvanced Premier Physicians ACOCopeland - Beajow Medical Institute, ChtdDBA Internal Medicine AssociatesAntelope Valley ACO 7,404,173 6,300,913 4,568,301 3,305,157 3,069,100 2,981,335 2,686,857 2,676,462 2,239,894 1,849,7612016 Results Western NG ACOProspectMemorialCare 1,580,006 1,398,168Source: Centers for Medicare and Medicaid Services 938,839( 5,240,146)

Legislative and Regulatory Changes Adding PressureTax Law Individual mandate repeal 13 million fewer insured by2026 Overall higher deficit jeopardizes Medicare spendDec 21 Short-Term Spending Bill Extends CHIP only through March Does not address delaying DSH cuts2018 Hospital Outpatient Prospective Payment System Update Payments for 340B drugs cut by 20 % More procedures removed from inpatient-only list

Trump’s CMS Not Backing Away From “Value”Design differences aside, the push towards value is bipartisan

New CMS Bundles: January 9, 2018Inpatient Episodes Disorders of the liver excluding malignancy,cirrhosis, alcoholic hepatitisAcute myocardial infarctionBack & neck except spinal fusionCardiac arrhythmiaCardiac defibrillatorCardiac valveCellulitisCervical spinal fusionCOPD, bronchitis, asthmaCombined anterior posterior spinal fusionCongestive heart failureCoronary artery bypass graftDouble joint replacement of the lower extremityFractures of the femur and hip or pelvisGastrointestinal hemorrhageGastrointestinal obstruction Hip & femur procedures except major jointLower extremity/humerus procedure except hip,foot, femurMajor bowel procedureMajor joint replacement of the lower extremityMajor joint replacement of the upper extremityPacemakerPercutaneous coronary interventionRenal failureSepsisSimple pneumonia and respiratory infectionsSpinal fusion (non-cervical)StrokeUrinary tract infectionOutpatient Episodes Percutaneous Coronary Intervention (PCI) Cardiac Defibrillator Back & Neck except Spinal Fusion

CMS Incentivizing Outpatient CareProcedures Removed from inpatient-only list for 2018:1. Total knee arthroplasty2. Laparoscopy, surgical, repair of paraesophageal hernia with implantation of mesh3. Laparoscopy, surgical, gastric restrictive procedure; removal of adjustable gastricrestrictive device component only4. Laparoscopy, surgical, gastric restrictive procedure; removal and replacement ofadjustable gastric restrictive device component only5. Laparoscopy, surgical, gastric restrictive procedure; removal of adjustable gastricrestrictive device and subcutaneous port components6. Laparoscopy, surgical prostatectomy, retropubic radical, including nerve sparing,includes robotic assistance, when performed

Providers are beginning to realize severity of situationOur client surveys and interactions indicate that healthcare executives believeindustry is already in or are fast approaching the Red Alert stageSafeEarly Warning SignRed Alert!Stable or IncreasingSlow declineRapid declineVenture CapitalInvestmentLittle or noneSubstantial seed and earlystage activitySubstantial growth stageactivityIndustry EntrantActivityLittle or noneGrowth at the low-end orfringe of the marketEntering or present inmainstreamHabits are stableChange at the fringesChange in the mainstreamEntrants are me-too copycatsEntrants exploring new modelsEntrants succeeding with newmodelsStable or increasing due totop-line growthSlow decline or increasingdue to cost managementRapid declineCustomer LoyaltyCustomer Habit ShiftBusiness ModelInnovationProfit MarginsBut don’t feel they are prepared to change.80%Source:Recognize theneed to transformin response tochanging markets31%“Are Business Leaders Caught in a Confidence Bubble,” Innosight Survey, s-leaders-caught-in-a-confidence-bubble/Are very confidentthattheir company isprepared to change

MANY ORGANIZATIONS TAKING MORE STRATEGICAPPROACH TO VALUE DRIVEN CARE DESIGNFUTURE-BACK STRATEGYTRANSFORMATION ATRANSFORMATION BCore Growth & Repositioning Reposition core as neededon key Jobs to be Done Complementary and adjacencygrowth Cost transformation,as needed M&A and partnershipsNew GrowthCAPABILITIESLINK Jobs to be doneShared resourcesand capabilities,while managingthe interfacebetween A & B inthe right way System / value network Business model innovationdevelopment Test and learn plansand implementation M&A and partnershipsCOMPETING ON HEALTH INNOVATION PLATFORM(Health Innovation Model, Assets and Capabilities Repository)

The New Approach to Building Value Driven CareProgramsInnovation AssessmentCare Model AssessmentStrategic Opportunity Areas (SOA)Growth gapDetermine the scope, scale and timing oftransformative innovation required andits contribution to future growth gap /organization objectivesCustomercentered SOAsStructure and define SOAs to focusinnovation activities and drive action bytying them to consumer needs, emergingbusiness models, and techBusiness ModelCanvas for SoAsCreate business model framework for eachSoA to help teams innovate beyond tech orproduct and consider breadth of innovationlevers to drive success

What might ’Compete on Health’ look like?World-classacademic researchIntegrated caredeliveryPersonalgenomicsSocial servicesand eHealthy lifestyleadvicemanagementCustomized behavioralsupport

A & B SUCCESS FACTORSAAReposition TodayTRANSFORMATION1. Zero in on the post-disruption jobto be done2. Innovate your business model todeliver against the job3. Determine and monitor newmetrics4. Implement aggressivelyBBCreate TomorrowTRANSFORMATION1. Identify constrained markets2. Iteratively develop a businessmodel to serve that market3. Use partnerships, acquisitions, andnew hires to succeed against anew competitive set

Melinda HancockChief Financial OfficerVCU Health22

Our Academic Health Center 23

The VCU Health System is an urban, comprehensive academicmedical center in central Virginia established to preserve andrestore health for all people, to seek the cause and cure ofdiseases through innovative research, and to educate thosewho serve humanity.24

VCU Health System by The Numbers VCU Medical Center 805 licensed acute care beds37,938 inpatient discharges714,669 clinic visits23% share of the Richmond metroinpatient market93,354 emergency department visits,and is the region's only Level ITrauma CenterVCU Community MemorialHospital MCV Physicians 830-physician,faculty group practiceMost comprehensivescope of clinicalservices in theCommonwealthProvides all teachingand training formedical students andresidents99 licensed acute care beds Virginia Premier2,682 inpatient dischargesHealth Plan23,005 emergency department visits 209,000 members161 licensed long-term care bedsMedicaid HealthMaintenance Children’s Hospital of RichmondOrganization Pediatric specialty hospital 60 licensed long-term care beds25200 ClinicalSpecialties830 Physicians12,500Team Members5,000 Students & Residents

Value Based Care and VCU Health Transition to Value Based Care Mandatory ProgramsVoluntary ProgramsGovernmental/Commercial/InternalComplex Care Clinic/Care for Advanced Health Management Access to Care Ambulatory presence Parking, parking, parking Geographic reach Partnerships Department of Human Resource Management Little Clinics Open to new definitions of partnerships26

Mandatory Payment Reform is EverywhereVBPPQRS/VMSNF VBPRRPMUHH VBPHACMIPS/APMCJR27

Cost Spend Medicare cost is from the perspective of Medicare Attributed to the hospital by discharge and to the physician by plurality ofservices For example, Medicare Spend per Beneficiary 3 days prior to admission The admission Any claim initiated within 30 days of discharge Part A and B28

Fundamental Formula29

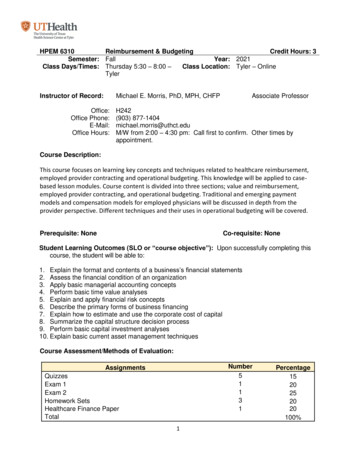

CMS Merit-CMSCMS HospitalInternally CMS ValueBasedReadmission AcquiredBasedIncentiveIdentifiedReduction ConditionPaymentOpportunity Purchasing* Program* Program*AnthemQHIP *VizientQ&ARankingXXXXXXXXXReference% lefton tableAlignment ofQuality, Safety,Service PrioritiesProgram*Hospital Acquired InfectionsXXMortalityXXReadmissionsXPt Experience/STAR XXXSafety: PSIsXXAccess to CareXHigh Reliability CultureXXXXXXXQuality, Safety, Service Measures: Relative WeightsDollars Left on Table, FFY18,across programs, MCVH 3,500,000HAIs 3,000,000Mortality Total 2,879,589 2,500,000Readmission/Care CoordinationTotalPatient Experience Total 2,000,000 1,086,554 1,500,000 755,709 878,822 795,709 1,000,000Efficiency/Spend/MSPB 500,000X0LOS/Throughput 310,000 -0%5%10%15%20%% Weighting in Vizient Q&A Rankings25%30%Patient Safety for SelectedIndicators (PSI)30

Acute: VBP/RRP/HACBase of 100,000,000 of Medicare Part A Revenue 7,000,000 6,000,000 6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 1,000,000 4 0( 1,000,000)ReadmissionHospital Acquired ConditionValue Based Purchasing( 1,000,000)( 2,000,000)( 2,000,000)( 3,000,000)( 3,000,000)( 4,000,000)CurrentTotal Incentive31

Decision Tree for QPPAm I in an APM?NoNoNeitherYesYesIs it an AdvancedAPM?Do I meetminimumcriteria?NoYesDo I meet thevolume orrevenue criteria?No (Option of Partial Qualifying, if not, then MIPS Path)Yes32

MIPS OptimizationPractice with 25M in Medicare fee schedule paymentsIncentive 2,500,000Penalty10% Bonus 2,500,000 2,500,000 2,500,000 2,250,000 1,750,000 1,250,000 1,000,00020192020- 1,000,00020212022- 1,250,000- 1,750,000- 2,250,000Does not include the adjustment factor of up to 3X per year33

AnthemCurrently 30% of Anthem providers are valuebasedWebsite lists 3 methods:1) ACOs: currently 118 ACOS2) P4P3) BundlesSource: uisitions-target-medicaid-medicare/34

Aetna Currently at 30% value based with a goal of 75% by the end of thedecade Specifically calls out:––––– ACOs (currently in 62 ACOs)BundlesP4P: 7 efficiency metrics and up to 20 quality metricsMedical Homes (currently 1 million members)High Performance Networks (760k members)Source: tions/pfpsummit10/curran 1.pdf35

Documentation, Documentation, Documentation36

Hips: With Fractures37

Post Acute Networks Formalizing preferred providers by post acute provider type Hold preferred providers accountable based on qualitymetrics/outcomes Share data on routine basis Partner on streamlined protocols Gain share or put dollars at risk38

SNF Criteria Grids Criteria includes: Skills and Service Availability, Coverage, Capacity, Safety & Quality39

Appendix

Voluntary Bundles in VirginiaBundles (BPCI Model 2 and 3)Source: tml#model 41

Bundle Data: CABG42

All Innovation Models in VirginiaSource: tml#model 43

HEALTH SYSTEM 2017 APM PARTICIPATIONIn which Alternative Payment Models (APMs) are your system currentlyparticipating (2017 performance year)? (Please check all that apply.)Medicare Shared Savings Program Accountable Care Organization 50%Comprehensive Primary Care Plus (CPC )31%Comprehensive Care for Joint Replacement (CJR)27%Commercial/other payer risk-based payment contracts27%Bundled Payment for Care Improvement (BPCI)19%Next Generation Accountable Care Organization15%Oncology Care Model (OCM)12%Comprehensive End-Stage Renal Disease Care Model4%Medicare Shared Savings Program Accountable Care Organization Medicare Shared Savings Program Accountable Care Organization I don’t know4%4%4%0%10%Source: Huron & Health ManagementAcademy20%30%40%50%60%

HEALTH SYSTEM PLANNED PARTICIPATIONIs your system currently considering participating in any of thefollowing models for the first time, to begin in 2018?New commercial/other payer risk-based contracts31%Medicare Shared Savings Program Accountable CareOrganization Track 119%Comprehensive Primary Care Plus (CPC )15%Medicare Shared Savings Program Accountable CareOrganization Track 1 12%Medicare-Medicaid Accountable Care Organization8%Next Generation Accountable Care Organization8%Medicare Shared Savings Program Accountable CareOrganization Track 3Medicare Shared Savings Program Accountable CareOrganization Track 28%4%I don’t know4%0%5%10%15%Source: Huron & Health ManagementAcademy20%25%30%35%

VCU Medical Center 805 licensed acute care beds 37,938 inpatient discharges 714,669 clinic visits 23% share of the Richmond metro inpatient market 93,354 emergency department visits, and is the region's only Level I Trauma Center VCU Community Memorial Hospital 99 licensed acute care beds 2,682 inpatient discharges