Transcription

Public Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure Authorized99506 v2Volume 2:Guidelines for Economic Analysis of Power Sector ProjectsTECHNICAL NOTESSeptember 2015

ACKNOWLEDGEMENTSThe Economic Analysis Guidance Note and this Annex Volume of Technical Notes wereprepared under the Direction of Vivien Foster (Practice Manager, PMSO) and GabrielaElizondo Azuela (Task Team Leader, PMSO), and guided by an Advisory Committeethat included Jamie Fergusson, Brian Casabianca (CNGSF), Kseniya Lvovsky (GENDR),Wendy Hughes, Todd Johnson, Fanny Missfeldt-Ringius, Demetrios Papathanasiou(GEEDR), and Grzegorz Peszko (GCCPT). The peer reviewers were Morgan Bazilian,Richard Spencer, Ashish Khanna (GEEDR) and Efstratios Tavoulereas (IFC). Importantcontributions and suggestions were made by Marianne Fay (GCCPT), Michael Toman(DECEE), Gevorg Sargsyan, Deb Chattopadhyay, Natsuko Toba (GEEDR), LauraBonzanigo, Julie Rozenberg, and Adrien Vogt-Schilb (GCCPT).The report was prepared by Peter Meier (Consultant).September 2015i

CONTENTSPart I:C1C2C3C4C5C6C7C8Basic Concepts . 1Costs . 1Benefits .17Externalities .19Decision-making approaches . 24Risk Assessment . 34Distributional Analysis . 39Energy Security . 44The discount Rate . 52Part II: Technology Related Issues. 53T1Variable renewable energy. 54T2Incremental Transmission Costs for Renewables . 66T3Learning Curve Benefits for Renewable Energy . 69T4Renewable Energy Counterfactuals . 74T5Macroeconomic Impacts . 80Part III: Methodologies & Techniques . 84M1CBA Best Practice . 85M2Estimating Demand Curves . 93M3Supply Curves . 99M4Local damage costs of Fossil Generation . 106M5Carbon Accounting . 117M6Multi-attribute Decision Analysis. 126M7Monte Carlo Simulation . 131M8Mean-variance portfolio Analysis . 136M9Scenario Discovery . 139Part IV Annexures . 142A1Bibliography . 143A2Index . 150A3Glossary . 154A4Sample Economic Analysis Tables: Indonesian Wind Farm . 156September 2015ii

BEST PRACTICE RECOMMENDATIONSCosts .16Risk assessment .38Distributional analysis .43Energy Security.51Variable renewable energy(VRE) . 65Transmission connections for renewables .68Learning curve benefits for renewables .73Macroeconomic spillovers .81Employment impacts of renewable energy projects . 83Numeraire & standard correction factors .87Variables to be included in the switching values analysis .90Demand curve estimation .98Local air pollution damage costs . 116GHG accounting .125September 2015iii

FCVDMUDPCDPLDSCRDSMEMPEOCKEPRIERAVERREUEU WGSCCLCALCOELHVLNGMACMADAMASENMATAmbdAsian Development BankBritish Thermal UnitCapital investment expenditureCost/benefit analysisCombined cycle gas turbinecarbon capture and storageCeylon Electricity Board (SriLanka)computable general equilibrium(model)China Renewable Energy Scale-upProgramConcentrated solar powerClean Technology FundCompensating variationDecision-making under uncertaintyDevelopment Policy CreditDevelopment Policy LoanDebt service cover ratioDemand side managementEnvironmental Management Planeconomic opportunity cost ofcapitalElectric Power Research Institute(US)Electricity Regulatory Authority ofVietnamEconomic rate of returnEuropean UnionEuropean Union Emissions TradingSystemFlue gas desulphurisationFinancial internal rate of returnfeed-in tarifffeasibility studygross domestic productGreenhouse gasgigawatt-hourHigher heating value (see Glossary)high speed dieselHigh voltage direct current(transmission)International Energy AgencyIndependent Evaluation Group (ofthe World Bank)International Financial InstitutionIndependent power producerInternational StandardsOrganisationInteragency Working Group on theSocial Cost of Carbon (US)Life cycle assessmentLevelised cost of electricityLower heating value (see Glossary)Liquefied natural gasMarginal abatement costMulti-attribute decision analysisMoroccan Agency for Solar EnergyMulti-attribute trade-off analysismillion barrels per daySeptember WTPMiddle East and North Africa(Region), World Bankmarine fuel oilMassachusetts Institute ofTechnologymillion British Thermal Unitsmillion tons per yearManufacture Unit Value (index)Nepal Electricity AuthorityNet present valueNational Renewable EnergyLaboratory (US)Opportunity cost of capitalMorocco State Power CompanyOperating cost expenditureOperations Policy and QualityDepartment (World Bank)Project Appraisal Document(World Bank)Project affected personProject Concept NoteIndonesian Electricity CompanyProject Management UnitPower purchase agreementPublic-Private-PartnershipPoverty and Social ImpactAssessmentPhotovoltaicRobust decision-makingRenewable energyStandard correction factorShadow exchange ratesocial mitigation planStrategic Petroleum Reserve (ofthe US)special purpose vehicleSocial value of carbonSocial rate of time preference (seeGlossary)transmission and distributionTask Team Leader (World Bank)Upper Arun Hydro Project(Nepal)United StatesUnited States Agency forInternational DevelopmentUnited States EnergyInformation AdministrationVietnamese DongValue of lost loadvariable renewable energyValue of statistical lifeWorld Development Indicators(World Bank database)weighted average cost of capitalWorld Energy Outlook (IEA)willingness-to-payiv

PART I: BASIC CONCEPTSSeptember 20151

C1 COSTSC1COSTS1.All power sector project appraisal economic analyses require as the mostfundamental inputs: Estimates of the investment and O&M costs of the projects being proposed (and ofthe costs of alternatives stipulated in the counter-factuals). Estimates of the future costs of fossil fuels. True even for renewable energy projectssince for these projects, the avoided costs of fossil fuels constitute one of the mainbenefits. Transmission and distribution projects need estimates of fossil fuel costs tocalculate the economic cost of losses. Off-grid renewables and rural electrificationrequire cost estimates of fuels used for lighting (kerosene) and self-generation(diesel).The reliability of these estimates will determine the reliability of the CBA.INTERNATIONAL FUEL PRICE FORECASTS2.In the absence of an official client government forecast, either the latest IEAWorld Energy Outlook (WEO) forecasts or the Bank’s commodity price forecast may beused as the starting point for assumptions about future fossil fuel prices. Those in thelatest 2014 WEO are shown in Table C1.1. For the past few years the three forecastsillustrated in Table C1.1 have been provided. For example, the “new policy” forecastcould be used as a baseline, with “current policies” and “450 scenario” as alternatives inthe sensitivity analysis and risk assessment.Table C1.1: The 2014 IEA fuel price forecastsUnitReal terms (2012 prices)IEA crude oil importsNatural gasUnited StatesEurope importsJapan importsOECD steam coal importsNominal termsIEA crude oil importsNatural gasUnited StatesEurope importsJapan importsOECD steam coal importsSource:New policies scenario20122020202520302035Current policies scenario2020202520302035450 scenario2020202520302035 /bbl109113116121128120127136145110107104100 /mmBTU /mmBTU /mmBTU 710.212.2865.99.511.775 /bbl109136156183216144171205245132144157169 /mmBTU /mmBTU /mmBTU 17.21288.615.418.4129101619.7127IEA, World Energy Outlook, 2014.3.Comparison of this latest IEA WEO forecast with that issued in 2008 (Table C1.2)is instructive.The 2014 current policies forecast for OECD coal imports in 2020 is 134/ton; that issued for the same year in 2008 was 157/ton. For oil imports, the 2014estimate for 2020 is 120/bbl, that issued in 2008 was 148/bbl – in other words, IEA hasrevised downwards its long term price forecasts.Table C1.2: The 2008 IEA fuel price forecasts, 2008UnitNominal termsIEA crude oil importsNatural gasUS importsEuropean importsJapan LNGOECD steam coal imports /barrel /mmBTU /mmBTU /mmBTU 6157.223.1820.3123.08171.127.282427.16186.1Source IEA, World Energy Outlook, 2008.4.The latest World Bank commodity price forecasts are shown in Table C1.3. Eventhat of November 2014 is substantially lower than the IEA forecast: that issued in JulySeptember 20151

C1 COSTS1025 is lower still. . The IEA 2020 forecast suggests a range of 132-144/bbl (nominal,Table C1.1), the World Bank forecast for the same year is 102/bbl (Table C1.3).Table C1.3: Latest (October 2014) World Bank price forecasts (nominal)UnitNovember 2014Crude oil(1)Natural gasUSEuropeanJapan LNGCoal, AustraliaJuly 2015Crude oil(1)Natural gasUSEuropeanJapan LNGCoal, 97.498.3100.2105.7 /mmBTU /mmBTU /mmBTU 2.5100.0 0 /barrel /mmBTU /mmBTU /mmBTU /tonneSource: World Bank Commodity Price Forecast, October 2014, and July 2015.(1) Average of Brent, WTI and Dubai spot pricesFigure C1.1: Comparison of IBRD and IEA world oil price forecasts (nominal)120250IEA new policyIEA 450ppm150World Bank, October 2014100US /bbl (nominal)US /bbl, nominalW orld Bank O ctober 2014 forecastIEA current policy2008060100W orld Bank July 2015 ATION OF DOMESTICALLY PRODUCED FOSSIL FUELS5.In countries that produce their own fossil fuels, many governments have longkept domestic prices at prices much below international prices, justified on a variety ofarguments (shield domestic consumers from “unreasonable” or “volatile” internationalprices, share the country’s resource endowment with consumers, why should domesticconsumers pay more than the cost of local production, etc.) One of the mainconsequences of keeping domestic prices low is that they provide inadequate incentiveto invest in new supply – particularly in the case of gas, many countries are in difficultybecause low prices have discouraged investment in exploration and resourcedevelopment (such as Egypt, Vietnam, Indonesia).6.Indeed, Indonesia is a good illustration of problematic domestic fuel pricingpolicy, though in recent years some significant improvements have been made (in 2012,the price of coal for power generation was raised to international price levels). TableC1.4 shows the wide range of prices that PLN pays for gas on Java - ranging from 2.84/mmBTU to 11.26/ mmBTU. PLN’s LNG price is set by the international price (ataround 16/mmBTU in mid-2014, prior to the more recent price collapse). Among manyother problems, the economic valuation of domestic gas is an issue for calculating theeconomic benefits of the Government’s proposed renewable tariffs.September 20152

C1 COSTSTable C1.4: Gas prices for power generation in arakarangTambakloGrati2Gresik34MkrngGresik23Gresik 1GratiSource: PLN /mmBTU /mmBTU /mmBTU /mmBTU /mmBTU /mmBTU /mmBTU /mmBTU /mmBTU /mmBTU /mmBTU /mmBTU 12.846.6910.307.957.847.847.847.These prices are claimed to reflect the economic costs of production. However,most of these fields are at various stages of approaching depletion, and the Governmentis now in the process of establishing a national gas pricing policy to encourage thedevelopment of additional supplies. At the very least, for evaluating the benefits ofrenewable energy in this context, the very low financial prices should be adjusted by adepletion premium to reflect the scarcity of the gas resource.The Depletion Premium8.The depletion premium is the amount equivalent to the opportunity cost ofextracting the resource at some time in the future, above its economic price today, andshould be added to the economic cost of production today. It is defined as follows 1:DPt ( PS T CS t )(1 r )(1 r )TwheretTPST CStR tyearyear to complete exhaustionprice of the substitute (internationally traded coal) at the time ofcomplete exhaustion.price of the domestic resource in year tdiscount rate9.The main problem in calculating the value of the premium is the uncertaintyabout when the resource is exhausted—because the economically exploitable size of aresource is a function of its market value and the cost (and technology) of its extraction.Assessment of reserves can change very rapidly—as illustrated by the dramatic recentdevelopments in gas and oil extraction technology in the US (fracking).10.Table C1.5 sets out the necessary assumptions for a sample calculation for a gasfield with a remaining time of 15 years to exhaustion, and for which the substitute fuel istaken as LNG.1See, e.g., ADB Guidelines for Economic Analysis of Projects, Economics and Development ResourceCenter, 1997, Annex 6, Depletion Premium.September 20153

C1 COSTSTable C1.5: Assumptions for depletion premium calculationunitsBCFBCF/yearyears /mmBTURemaining resourceExtraction ratetime to exhaustionPresent extraction costSubstitute fuelSubstitute price at exhaustion /mmBTUDiscount rate[ ]Base yearDepletion year [last year of Applying the above formula results in the economic valuation shown in TableC1.6. The economic value increases as the time to exhaustion approaches, ultimatelyreaching the value of the substitute fuel (LNG). The depletion premium calculation iseasily adjusted where the substitute fuel is assumed to increase (or decrease) over time(as in the case of the IEA forecasts for LNG shown in Table C1.1).Table C1.6: Depletion premium and the economic value of 62027202820292030Depletionpremium 7.638.549.5710.7112.00Economicvalue 3.614.716.0Import parity price12.For domestically produced fuels that are also traded, calculations of theeconomic value of a domestic thermal resource where financial prices for domestic fuelsare subsidized require an estimate of the so-called import parity price. This is calculatedfrom the identifyPrice of imported coal freight from port to domestic consumer price of domestic coal (at import parity) freight from mine to domesticconsumer incremental quality adjustment13.When these prices are expressed in currency per ton, freight costs must beadjusted for any difference in calorific value (often domestic coal is of lesser quality thanimported coal). This is sometimes taken simply as the ratio of calorific values. 2 In2However, this relationship is not necessarily linear, and is true only of high calorific valuecoals. Low calorific value coal trades on international markets at a value that is lowerthan mere adjustment by calorific value would suggest: this is because low value coalmay require blending with high value coals, increasing fuel stock management costs.September 20154

C1 COSTSaddition, where there are large differences in ash or sulfur contents, domestic coal mayincur additional ash and waste handling costs. Thus the import parity price calculates asIPEF1F2SCFPAG1G2 Import parity price of coal at mine gate in local currency/tonExchange rateFreight/Ton (financial prices) from port to consumer (market) in local currencyFreight/Ton (financial prices) from mine to consumer in local currencyStandard correction factor (which adjusts for the tax component of domestic costs)Cif import price, in USCoal quality penaltyGross calorific value of imported coal (kcal/kg)Gross calorific value of domestic coal (kcal/kg)Freight costs14.When building up a border price forecast for a particular location, freight costscan be important particularly for coal.3 These can be as volatile as the coal price itself,but are generally correlated with the underlying coal price: when the coal prices aredeclining (as in Spring 2015), freight costs will be low; when coal prices is are increasing,freight costs will (generally) be high (though there are some circumstances when thisdoes not apply). Table C1.7 shows selected freight rates in October 2014 compared withthose of February 2015.Table C1.7: Coal freight, /metric toneAustralia NSW, fobSouth Africa, Richards Bay, fobAustralia-ChinaRichards olivar-Rotterdam /ton (2) /ton (2)Capesize (1)Panamax pesizePanamaxOctober 201463.965.711.510.5017.2010.4511.75February ce: Coal Trader International (McGraw-Hill) [Available at the World Bank Library](1) see glossary.(2) World Bank “Pink Sheets” (available on line).CAPITAL INVESTMENT15.In a CBA, often the biggest problem in estimating capital costs is not for theproject being appraised (for which a detailed feasibility study prepared by engineeringconsultants is often available), but for specifying the capital costs for the counter-factual which is just as important in assuring the reliability of the CBA calculations as those ofthe project itself.3Because coal has a much lower value per unit of weight and volume than LNG or oil,freight can make up a much larger fraction of the price delivered at the point of import.September 20155

C1 COSTS16. Several problems are encountered in establishing the costs for a CBA:How to find reliable data on technology costs and performance.How to adjust past capital cost estimates to the price level of the CBA.How to adjust technology costs for local conditions.How to deal with volatile exchange rates.Reliable data on costs and technology performance17.In North America, the gold standard for a database on power technology costand performance was the Technical Assessment Guide maintained by the Electric PowerResearch Institute (EPRI). Unfortunately, despite having access to a large numbers ofpower projects all over the world, World Bank has not managed to maintain somethingcomparable. There is not even a simple database of capital costs of all World Bankenergy sector projects (as estimated in PADs, and as may have been adjusted inImplementation Completion Reports). From time to time the Bank has commissioneduseful studies from experienced international consultants (see Table C1.7), but thesehave not proven to be very useful for estimating costs in typical World Bank clientcountries.Table C1.7 Data sourcesSourceDescriptionCommentsAll technologiesNRELWorld Bank,ESMAPWorld EnergyCouncilWorld BankUS EnergyInformationAdministrationBlack&Veatch, 2012. Costand Performance Data forPower GenerationTechnologies, Report to NRELPaucschert, D. Study ofequipment prices in the powersector, ESMAP, TechnicalPaper 122/2009.Cost of Energy Technologies,2013Chubu Electric PowerCompany & ECA, 2012.Model for ElectricityTechnology AssessmentsUpdated Capital Cost Estimatesfor Utility Scale ElectricityGenerating Plants, April 2013Covers a wide range of fossil and renewableenergy technologies.Analyses costs in great detail, but for just threecountries (USA, India and Romania).Includes estimates for all technologies,including renewables. For some technologies,highlights the large differences between OECDcounties and China (e.g. coal CAPEX: China 660/kW, Australia,UK,USA 2,510-3,100/kW)!Authoritative source, useful for thermalgenerating projects. (See Table C1.8)Renewable energyRETSCREENSuite of financial models toevaluate renewable energyprojects.HOMERIRENAModel for operation of minigrids suitable for evaluatingwind/PV-diesel hybridsVarious reports,e.g.:Renewable Power generationCosts in 2012: An Overview;and Concentrated Solar PowerNRELwww.nrel.govSeptember 2015Sample spreadsheets are protected, so cannoteasily be used as a basis for more detailedmodel. No distinction between economic andfinancial costs (the model is for financialanalysis).Widely used for the design of small systems,especially diesel-wind and diesel-PV hybrids.A visit to the IRENA website should be one ofthe first sources to consult for a renewableenergy project (www.irena.org).The NREL website should also be one of the firstsources to consult for technology cost andperformance data and the latest studies onrenewable energy economics & planning.6

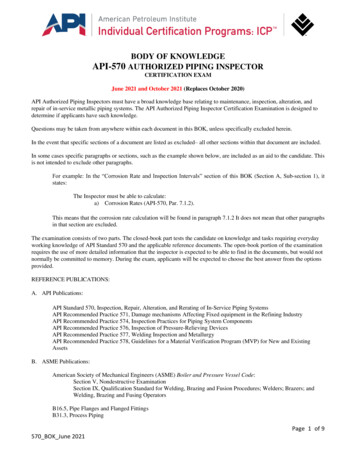

C1 COSTSTable C1.8: US construction costs, thermal generationSource: US Energy Information Administration Updated Capital Cost Estimates for Utility Scale ElectricityGenerating Plants, April 2013Adjusting past capital cost estimates18.Ideally, a detailed feasibility study would be available as a basis for estimatingconstruction costs of major energy projects, at price levels corresponding to the year ofappraisal. But that ideal is not always available. , If earlier costs estimates are just a yearor two old, the default for bringing these to the cost level used in project appraisal wouldbe application of the Manufactured Unit Index (MUV), published in the Bank’s website(Table C1.9).4Table C1.9: MUV Index 202320242025Manufactures Unit Value (MUV) Indexexpressed in U.S. dollar termsRelease date: July 7, 2014History 1960-2013; projections 2014-2025email: gcm@worldbank.orgMUV IndexU.S. GDP deflatorIndex 2010 100ch%Index 2010 urce: EXCEL file downloaded from the World Bank website4The MUV-index is the weighted average of export prices of manufactured goods for theG-5 economies (the United States, Japan, Germany, France, and the United Kingdom),with local currency based prices converted into current U.S. dollars using marketexchange rates.September 20157

C1 COSTSAdjusting technology costs for local conditions19.The net output of a new CCCT is generally quoted under so called ISOconditions (International Standards Organisation), meaning at an ambient temperatureof 15oC, and at sea level. At the higher ambient temperatures encountered in tropicalcountries, output reduces considerably: as shown in Table C1.10, a nominal 800 MW atISO project will have a net output of only 718.8 MW under actual ambient conditions –making for a 10% reduction in output.Table C1.10: Derivation of net CCCT output (for Vietnam)deduction100% at generator, ISO conditionsStep-up transformerOther auxiliary equipmentAmbient temperature adjustmentCooling water temperatureNet, 0.20%Source:. KEMA, LRMC of CCGT Generation in Singapore for Technical Parameters used for Setting the Vesting Pricefor the Period 1 January 2009 to 31 December 2010, Report to the Singapore Energy Market Authority, 22 June2009.20.Local variations in cost estimates can also be considerable, as illustrated in TableC1.11 for the case of Vietnam. The overnight costs (ISO) range from 646 to 911/kW - at2010 prices. But when converted to net /kW (including IDC), costs are much higher.Moreover, the difficulty for a project economist working in Vietnam is that the WorldBank’s ESMAP META database shows an overnight capital cost for an 800 MW CCGT at 552/kW – when actual costs – even gross at ISO – are in the range of 848-948 /kW.Table C1.11: CCGT cost estimates for Vietnam.MWPB consultants, Vietnam estimatePB consultants, Vietnam estimateKEMA, SingaporeNon Trach I (2)Non Trach II (2)World Bank, IndiaEVN 6th PDP(1)(ISO)720400800VNDbillionVND US/ US million19,122 16,9707,494 16,9701,126.8441.6729.0overnight /kW(ISO,gross)911848948646including IDC /kW 921,1041,1091,2341,1401,268756842Source: Electricity Regulatory Authority of Vietnam (ERAV), Review of the Avoided Cost Tariff for Small Gridconnected Renewable Energy Generation Projects, Hanoi, September 2011Notes:(1) PDP Power Development Plan(2) Actual costsExchange rates and market conditions21.A critical issue is exchange rates. Much renewable energy equipment ismanufactured in Europe, and hence costs are quoted in Euros: for a US denominatedeconomic analysis, foreign exchange rate volatility can therefore cause problems. Forexample, suppose a detailed cost analysis by a German research institute in mid-2012provided CSP costs at 3,000 Euro/kW. At the time the exchange rate was 1.26 per Euro,so 3,780/kW. In early 2015 the exchange rate is 1.13 per Euro, or 3,390 /kW. Therelevant point is that exchange rate volatility is an important component of capital cost5This is for new plant. As documented in the KEMA report, even with regularmaintenance and plant overhauls, a further 3-4% deterioration for ageing will generallyarise.September 20158

C1 COSTSuncertainty, which needs to be reflected in the sensitivity analysis. Moreover, for manycomponents of capital goods, market conditions can easily result in variations of 20%.622.A 1996 study examined the construction costs and schedules of 125 thermal andhydropower projects financed by the World Bank between 1965 and 1994. Constructioncosts were underestimated by an average of 17% (standard deviation 34%), constructions

Volume 2: Guidelines for Economic Analysis of Power Sector Projects TECHNICAL NOTES September 2015 Public Disclosure Authorized 99506 v2 Public Disclosure Authorized . Source: World Bank Commodity Price Forecast, October 2014, and July 2015. (1) Average of Brent, WTI and Dubai spot prices .