Transcription

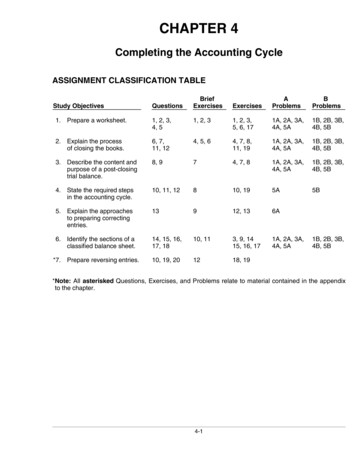

CHAPTER 4Completing the Accounting CycleASSIGNMENT CLASSIFICATION TABLEExercisesAProblemsBProblems1, 2, 31, 2, 3,5, 6, 171A, 2A, 3A,4A, 5A1B, 2B, 3B,4B, 5B6, 7,11, 124, 5, 64, 7, 8,11, 191A, 2A, 3A,4A, 5A1B, 2B, 3B,4B, 5B*3. Describe the content andpurpose of a post-closingtrial balance.8, 974, 7, 81A, 2A, 3A,4A, 5A1B, 2B, 3B,4B, 5B*4. State the required stepsin the accounting cycle.10, 11, 12810, 195A5B*5. Explain the approachesto preparing correctingentries.13912, 136A*6. Identify the sections of aclassified balance sheet.14, 15, 16,17, 1810, 113, 9, 1415, 16, 171A, 2A, 3A,4A, 5A*7. Prepare reversing entries.10, 19, 201218, 19Study ObjectivesQuestions*1. Prepare a worksheet.1, 2, 3,4, 5*2. Explain the processof closing the books.BriefExercises1B, 2B, 3B,4B, 5B*Note: All asterisked Questions, Exercises, and Problems relate to material contained in the appendix*to the chapter.4-1

ASSIGNMENT CHARACTERISTICS TABLEProblemNumberDescriptionDifficultyLevelTime Allotted(min.)Simple40–501APrepare worksheet, financial statements, and adjustingand closing entries.2AComplete worksheet; prepare financial statements,closing entries, and post-closing trial balance.Moderate50–603APrepare financial statements, closing entries, and postclosing trial balance.Moderate40–504AComplete worksheet; prepare classified balance sheet,entries, and post-closing trial balance.Moderate50–605AComplete all steps in accounting cycle.Complex70–906AAnalyze errors and prepare correcting entries and trialbalance.Moderate40–501BPrepare worksheet, financial statements, and adjustingand closing entries.Simple40–502BComplete worksheet; prepare financial statements,closing entries, and post-closing trial balance.Moderate50–603BPrepare financial statements, closing entries, and postclosing trial balance.Moderate40–504BComplete worksheet; prepare classified balance sheet,entries, and post-closing trial balance.Moderate50–605BComplete all steps in accounting cycle.Complex70–90Comprehensive Problem: Chapters 2 to 44-2

4-3Identify the sections ofa classified balance sheet.Prepare reversing entries.*6.*7.Broadening Your PerspectiveExplain the approaches topreparing correcting entries.*5.Describe the content andpurpose of a post-closing trialbalance.*3.State the required steps inthe accounting cycle.Explain the process of closingthe books.*2.*4.Prepare a worksheet.*1.Study -12BE4-1KnowledgeCommunicationExploring the WebQ4-10Q4-19E4-18E4-19Financial ReportingDecision MakingAcross theOrganizationComparative AnalysisQ4-20BE4-12E4-17 P4-1AP4-2A P4-4AP4-3A P4-5AP4-2B BP4-5BP4-3A P4-1AP4-2B P4-4AP4-3B P4-2B BE4-2P4-3B Q4-5BE4-3ComprehensionSynthesisAll About YouEthics CaseExploring theWebEvaluationCorrelation Chart between Bloom’s Taxonomy, Study Objectives and End-of-Chapter Exercises and ProblemsBLOOM’S TAXONOMY TABLE

ANSWERS TO QUESTIONS1.No. A worksheet is not a permanent accounting record. The use of a worksheet is an optionalstep in the accounting cycle.2.The worksheet is merely a device used to make it easier to prepare adjusting entries and thefinancial statements.3.The amount shown in the adjusted trial balance column for an account equals the accountbalance in the ledger after adjusting entries have been journalized and posted.4.The net income of 12,000 will appear in the income statement debit column and the balancesheet credit column. A net loss will appear in the income statement credit column and thebalance sheet debit column.5.Formal financial statements are needed because the columnar data are not properly arrangedand classified for statement purposes. For example, a drawing account is listed with assets.6.(1)(2)(3)(4)7.Income Summary is a temporary account that is used in the closing process. The account isdebited for expenses and credited for revenues. The difference, either net income or loss, is thenclosed to the owner’s capital account.8.The post-closing trial balance contains only balance sheet accounts. Its purpose is to prove theequality of the permanent account balances that are carried forward into the next accountingperiod.9.The accounts that will not appear in the post-closing trial balance are Depreciation Expense;Jennifer Shaeffer, Drawing; and Service Revenue.10.A reversing entry is the exact opposite, both in amount and in account titles, of an adjusting entryand is made at the beginning of the new accounting period. Reversing entries are an optionalstep in the accounting cycle.11.The steps that involve journalizing are: (1) journalize the transactions, (2) journalize the adjustingentries, and (3) journalize the closing entries.12.The three trial balances are the: (1) trial balance, (2) adjusted trial balance, and (3) post-closingtrial balance.13.Correcting entries differ from adjusting entries because they: (1) are not a required part of theaccounting cycle, (2) may be made at any time, and (3) may affect any combination of accounts.(Dr) Individual revenue accounts and (Cr) Income Summary.(Dr) Income Summary and (Cr) Individual expense accounts.(Dr) Income Summary and (Cr) Owner’s Capital (for net income).(Dr) Owner’s Capital and (Cr) Owner’s Drawing.4-4

Questions Chapter 4 (Continued)*14. The standard classifications in a balance sheet are:AssetsCurrent AssetsLong-term InvestmentsProperty, Plant, and EquipmentIntangible AssetsLiabilities and Owner’s EquityCurrent LiabilitiesLong-term LiabilitiesOwner’s Equity*15. A company’s operating cycle is the average time required to go from cash to cash in producingrevenues. The operating cycle of a company is the average time that it takes to purchaseinventory, sell it on account, and then collect cash from customers.*16. Current assets are assets that a company expects to convert to cash or use up in one year. Somecompanies use a period longer than one year to classify assets and liabilities as current because theyhave an operating cycle longer than one year. Companies usually list current assets in the orderin which they expect to convert them into cash.*17. Long-term investments are generally investments in stocks and bonds of other companies thatare normally held for many years. Property, plant, and equipment are assets with relatively longuseful lives that a company is currently using in operating the business.*18. (a)(b)The owner’s equity section for a corporation is called stockholders’ equity.The two accounts and the purpose of each are: (1) Capital stock is used to record investments of assets in the business by the owners (stockholders). (2) Retained earnings is usedto record net income retained in the business.**19. After reversing entries have been made, the balances will be Interest Payable, zero balance;Interest Expense, a credit balance.*20. (a) Jan. 10Salaries Expense .Cash.8,0008,000Because of the January 1 reversing entry that credited Salaries Expense for 3,500, SalariesExpense will have a debit balance of 4,500 which equals the expense for the current period.(b)Jan. 10Salaries Payable .Salaries Expense .Cash.Note that Salaries Expense will again have a debit balance of 4,500.4-53,5004,5008,000

SOLUTIONS TO BRIEF EXERCISESBRIEF EXERCISE 4-1The steps in using a worksheet are performed in the following sequence:(1) prepare a trial balance on the worksheet, (2) enter adjustment data,(3) enter adjusted balances, (4) extend adjusted balances to appropriatestatement columns and (5) total the statement columns, compute netincome (loss), and complete the worksheet. Filling in the blanks, theanswers are 1, 3, 4, 5, 2.The solution to BRIEF EXERCISE 4-2 is on page 4-7.BRIEF EXERCISE 4-3AccountAccumulated DepreciationDepreciation ExpenseN. Batan, CapitalN. Batan, DrawingService RevenueSuppliesAccounts PayableIncome StatementDr.Cr.Balance SheetDr.Cr.XXXXXXXBRIEF EXERCISE 4-4Dec. 31313131Service Revenue .Income Summary.50,000Income Summary.Salaries Expense .Supplies Expense.31,000Income Summary.D. Swann, Capital.19,000D. Swann, Capital .D. Swann, Drawing .2,0004-650,00027,0004,00019,0002,000

Prepaid InsuranceService RevenueSalaries ExpenseAccounts ReceivableSalaries PayableInsurance ExpenseAccount Titles4-725,0003,000Dr.58,000Cr.Trial Balance(a) 1,200(c)800(b) 1,100Dr.(c)800(a) 1,200(b) 1,100Cr.AdjustmentsLEY r.AdjustedTrial 1,800Dr.800Cr.BalanceSheetBRIEF EXERCISE 4-2

BRIEF EXERCISE 4-5Salaries Expense27,000 (2) 27,000Income Summary(2) 31,000 (1) 50,000(3) 19,00050,00050,000Service Revenue(1) 50,00050,000Supplies Expense4,000 (2) 4,000D. Swann, Capital(4)2,00030,000(3) 19,000Bal. 47,000D. Swann, Drawing2,000 (4) 2,000BRIEF EXERCISE 4-6July 3131Date7/317/31Date7/317/31Green Fee Revenue .Income Summary.13,600Income Summary .Salaries Expense .Maintenance Expense.10,700ExplanationBalanceClosing entryExplanationGreen Fee e13,6000CreditBalance8,2008,200013,600Salaries ExpenseRef.DebitBalanceClosing entry8,2004-8

BRIEF EXERCISE 4-6 (Continued)Date7/317/31ExplanationMaintenance ExpenseRef.DebitBalanceClosing entryCreditBalance2,5002,50002,500BRIEF EXERCISE 4-7The accounts that will appear in the post-closing trial balance are:Accumulated DepreciationN. Batan, CapitalSuppliesAccounts PayableBRIEF EXERCISE 4-8The proper sequencing of the required steps in the accounting cycle is asfollows:1.2.3.4.5.6.7.8.9.Analyze business transactions.Journalize the transactions.Post to ledger accounts.Prepare a trial balance.Journalize and post adjusting entries.Prepare an adjusted trial balance.Prepare financial statements.Journalize and post closing entries.Prepare a post-closing trial balance.Filling in the blanks, the answers are 4, 2, 8, 7, 5, 3, 9, 6, 1.4-9

BRIEF EXERCISE 4-91.2.Service Revenue.Accounts Receivable .780Accounts Payable ( 1,750 – 1,570) .Store Supplies.180780180BRIEF EXERCISE 4-10DIAZ COMPANYPartial Balance SheetCurrent assetsCash.Short-term investments .Accounts receivable.Supplies.Prepaid insurance.Total current assets. 15,4006,70012,5005,2003,600 43,400BRIEF EXERCISE 4-11CLCAPPEPPECAIAAccounts payableAccounts receivableAccumulated come tax payableInvestment in long-term bondsLandMerchandise inventoryPatentSupplies*BRIEF EXERCISE 4-12Nov. 1Salaries Payable .Salaries Expense .1,4001,400The balances after posting the reversing entry are Salaries Expense (Cr.) 1,400 and Salaries Payable 0.4-10

SOLUTIONS TO EXERCISESEXERCISE 4-1BRISCOE COMPANYWorksheetFor the Month Ended June 30, 2008Account TitlesTrial BalanceDr.CashCr.AdjustmentsDr.Adj. Trial BalanceCr.Dr.Cr.Income StatementDr.Cr.Balance eceivableSupplies1,880Accounts nearned240Revenue140Lenny Briscoe,Capital3,600Service RevenueSalaries 580MiscellaneousExpenseTotalsSupplies Expense1607,3607,3601,580Salaries 4040402,5802,5805,100Net LossTotals4-115,0605,1005,100

EXERCISE 4-2GOODE COMPANY(Partial) WorksheetFor the Month Ended April 30, 2008AdjustedTrial BalanceAccount TitlesCashAccounts ReceivablePrepaid RentEquipmentAccum. DepreciationNotes PayableAccounts PayableT. Goode, CapitalT. Goode, DrawingService RevenueSalaries ExpenseRent ExpenseDepreciation ExpenseInterest ExpenseInterest PayableTotalsNet ementDr.Cr.Balance ,26215

Comprehensive Problem: Chapters 2 to 4. BLOOM’S TAXONOMY TABLE 4-3 Correlation Chart between Bloom’s Taxonomy, Study Objectives and End-of-Chapter Exercises and Problems Study ObjectiveKnowledge Comprehension Application Analysis Synthesis Evaluation * 1. Prepare a worksheet. BE4-1 Q4-1 Q4-2 Q4-3 Q4-4 Q4-5 BE4-3 E4-1 E4-2 E4-3 E4-17 P4-2A P4-3A P4-2B P4-3B BE4-2 E4