Transcription

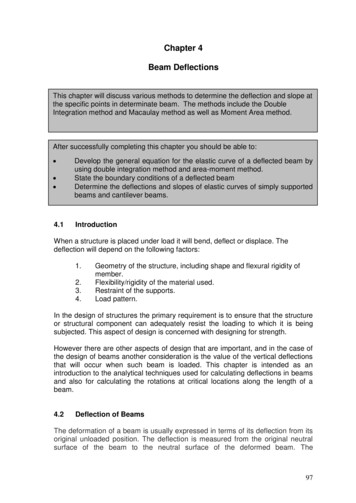

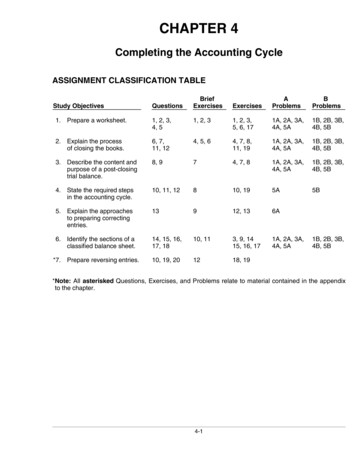

CHAPTER 3Adjusting the AccountsASSIGNMENT CLASSIFICATION TABLEBriefExercisesAProblemsBProblems5, 6, 7, 8,9, 10, 11,12, 13, 151A, 2A, 3A,4A, 5A, 6A1B, 2B, 3B,4B, 5B75, 6, 7, 8,9, 10, 11,12, 13, 151A, 2A, 3A,4A, 5A, 6A1B, 2B, 3B,4B, 5B219, 1010, 11, 12,13, 141A, 2A, 3A,5A, 6A1B, 2B, 3B,5B221116, 176AStudy ObjectivesQuestionsExercises*1. Explain the time periodassumption.11*2. Explain the accrual basisof accounting.2, 3, 4, 52, 3, 10*3. Explain the reasons foradjusting entries.6, 71*4. Identify the major typesof adjusting entries.8, 182, 84, 6, 11*5. Prepare adjusting entriesfor deferrals.8, 9, 10,11, 12, 13,18, 19, 203, 4, 5, 6*6. Prepare adjusting entriesfor accruals.8, 14, 15,16, 17, 18,19, 20*7. Describe the nature andpurpose of an adjustedtrial balance.*8. Prepare adjustingentries for the alternativetreatment of deferrals.*Note: All asterisked Questions, Exercises, and Problems relate to material contained in the appendixto the chapter.3-1

ASSIGNMENT CHARACTERISTICS lotted (min.)1APrepare adjusting entries, post to ledger accounts,and prepare an adjusted trial balance.Simple40–502APrepare adjusting entries, post, and prepare adjustedtrial balance and financial statements.Simple50–603APrepare adjusting entries and financial statements.Moderate40–504APrepare adjusting entries.Moderate30–405AJournalize transactions and follow through accountingcycle to preparation of financial statements.Moderate60–70Prepare adjusting entries, adjusted trial balance,and financial statements using appendix.Moderate40–50*6A*1BPrepare adjusting entries, post to ledger accounts,and prepare an adjusted trial balance.Simple40–502BPrepare adjusting entries, post, and prepare adjustedtrial balance and financial statements.Simple50–603BPrepare adjusting entries and financial statements.Moderate40–504BPrepare adjusting entries.Moderate30–405BJournalize transactions and follow through accountingcycle to preparation of financial statements.Moderate60–703-2

3-3Broadening Your PerspectivePrepare adjusting entries for the alternativetreatment of deferrals.*8.Prepare adjusting entries for deferrals.*5.Describe the nature and purpose of anadjusted trial balance.Identify the major types of adjusting entries.*4.*7.Explain the reasons for adjusting entries.*3.Prepare adjusting entries for accruals.Explain the accrual basis of accounting.*2.*6.Explain the time period assumption.*1.Study ObjectiveKnowledgeSynthesisP3-4A E3-15P3-5AP3-6AP3-1BP3-2BP3-3BP3-4BP3-5BP3-4A P3-2A P3-2BP3-3A P3-3BP3-5A E3-8 E3-6E3-4E3-11AnalysisE3-2EvaluationDecision Making All About YouFinancial ReportingEthics CaseComparative Analysis Across theOrganizationExploring the E3-8Q3-18BE3-2E3-10Q3-17BE3-1Q3-4 2Q3-3Q3-1ComprehensionCorrelation Chart between Bloom’s Taxonomy, Study Objectives and End-of-Chapter Exercises and ProblemsBLOOM’S TAXONOMY TABLE

ANSWERS TO QUESTIONS1.(a) Under the time period assumption, an accountant is required to determine the relevance ofeach business transaction to specific accounting periods.(b) An accounting time period of one year in length is referred to as a fiscal year. A fiscal yearthat extends from January 1 to December 31 is referred to as a calendar year. Accountingperiods of less than one year are called interim periods.2.The two generally accepted accounting principles that relate to adjusting the accounts are:The revenue recognition principle, which states that revenue should be recognized in the accountingperiod in which it is earned.The matching principle, which states that efforts (expenses) be matched with accomplishments(revenues).3.The law firm should recognize the revenue in April. The revenue recognition principle states thatrevenue should be recognized in the accounting period in which it is earned.4.Information presented on an accrual basis is more useful than on a cash basis because it revealsrelationships that are likely to be important in predicting future results. To illustrate, under accrualaccounting, revenues are recognized when earned so they can be related to the economicenvironment in which they occur. Trends in revenues are thus more meaningful.5.Expenses of 4,500 should be deducted from the revenues in April. Under the matching principleefforts (expenses) should be matched with accomplishments (revenues).6.No, adjusting entries are required by the revenue recognition and matching principles.7.A trial balance may not contain up-to-date information for financial statements because:(1) Some events are not journalized daily because it is not efficient to do so.(2) The expiration of some costs occurs with the passage of time rather than as a result of dailytransactions.(3) Some items may be unrecorded because the transaction data are not known.8.The two categories of adjusting entries are deferrals and accruals. Deferrals consist of prepaidexpenses and unearned revenues. Accruals consist of accrued revenues and accrued expenses.9.In the adjusting entry for a prepaid expense, an expense is debited and an asset is credited.10.No. Depreciation is the process of allocating the cost of an asset to expense over its useful life ina rational and systematic manner. Depreciation results in the presentation of the book value ofthe asset, not its market value.11.Depreciation expense is an expense account whose normal balance is a debit. This accountshows the cost that has expired during the current accounting period. Accumulated depreciationis a contra asset account whose normal balance is a credit. The balance in this account is thedepreciation that has been recognized from the date of acquisition to the balance sheet date.12.Equipment .Less: Accumulated Depreciation.3-4 18,0006,000 12,000

Questions Chapter 3 (Continued)*13.In the adjusting entry for an unearned revenue, a liability is debited and a revenue is credited.*14.Asset and revenue. An asset would be debited and a revenue would be credited.*15.An expense is debited and a liability is credited.*16.Net income was understated 200 because prior to adjustment, revenues are understated by 900 and expenses are understated by 700. The difference in this case is 200 ( 900 – 700).*17.The entry is:Jan. 9Salaries Payable .Salaries Expense.Cash .2,0003,0005,000*18.(a)(b)(c)Accrued revenues.Unearned revenues.Accrued expenses.(d)(e)(f)Accrued expenses or prepaid expenses.Prepaid expenses.Accrued revenues or unearned revenues.*19.(a)(b)(c)Salaries Payable.Accumulated Depreciation.Interest Expense.(d)(e)(f)Supplies Expense.Service Revenue.Service Revenue.*20.Disagree. An adjusting entry affects only one balance sheet account and one income statementaccount.*21.Financial statements can be prepared from an adjusted trial balance because the balances of allaccounts have been adjusted to show the effects of all financial events that have occurredduring the accounting period.*22.For Supplies Expense (prepaid expense): expenses are overstated and assets are understated.The adjusting entry is:Assets (Supplies).XXExpenses (Supplies Expense).XXFor Rent Revenue (unearned revenues): revenues are overstated and liabilities are understated.The adjusting entry is:Revenues (Rent Revenue) .XXLiabilities (Unearned Rent Revenue) .XX3-5

SOLUTIONS TO BRIEF EXERCISESBRIEF EXERCISE 3-1(a) Prepaid Insurance—to recognize insurance expired during the period.(b) Depreciation Expense—to account for the depreciation that has occurredon the asset during the period.(c) Unearned Revenue—to record revenue earned for services provided.(d) Interest Payable—to recognize interest accrued but unpaid on notespayable.BRIEF EXERCISE 3-2(a)Type of Adjustment(b)Account Balances before Adjustment1.Prepaid ExpensesAssets OverstatedExpenses Understated2.Accrued RevenuesAssets UnderstatedRevenues Understated3.Accrued ExpensesExpenses UnderstatedLiabilities Understated4.Unearned RevenuesLiabilities OverstatedRevenues UnderstatedItemBRIEF EXERCISE 3-3Dec. 31Advertising Supplies Expense.Advertising Supplies ( 6,700 – 2,700) .Advertising Supplies6,700 12/314,00012/31 Bal. 2,7004,0004,000Advertising Supplies Expense12/314,0003-6

BRIEF EXERCISE 3-4Dec. 31Depreciation Expense—Equipment.Accumulated Depreciation—Equipment.Depr. Expense—Equipment12/315,0005,0005,000Accum. Depreciation—Equipment12/315,000Balance Sheet:Equipment.Less: Accumulated Depreciation. 30,0005,000 25,000BRIEF EXERCISE 3-5July 1Dec. 31Prepaid Insurance.Cash.18,000Insurance Expense [( 18,000 3) X 1/2] .Prepaid Insurance.3,000Prepaid Insurance7/118,000 12/3112/31 Bal. 15,0003,00012/3118,0003,000Insurance Expense3,000BRIEF EXERCISE 3-6July 1Dec. 31Cash .Unearned Insurance Revenue .18,000Unearned Insurance Revenue .Insurance Revenue.3,000Unearned Insurance Revenue12/313,000 7/118,00012/31 Bal. 15,00018,000Insurance Revenue12/313-73,0003,000

BRIEF EXERCISE 3-71.2.3.Dec. 313131Interest Expense.Interest Payable .400Accounts Receivable .Service Revenue .1,500Salaries Expense .Salaries Payable .9004001,500900BRIEF EXERCISE 3-8Account(a)Type of Adjustment(b)Related AccountAccounts ReceivablePrepaid InsuranceAccum. Depr.—EquipmentInterest PayableUnearned Service RevenueAccrued RevenuesPrepaid ExpensesPrepaid ExpensesAccrued ExpensesUnearned RevenuesService RevenueInsurance ExpenseDepreciation ExpenseInterest ExpenseService RevenueBRIEF EXERCISE 3-9HARMONY COMPANYIncome StatementFor the Year Ended December 31, 2008RevenuesService revenue.ExpensesSalaries expense .Rent expense.Insurance expense .Supplies expense.Depreciation expense.Total expenses.Net income .3-8 35,400 16,0004,0002,0001,5001,30024,800 10,600

BRIEF EXERCISE 3-10HARMONY COMPANYOwner’s Equity StatementFor the Year Ended December 31, 2008Capital, January 1.Add: Net income.Less: Drawings .Capital, December 31 . 15,60010,60026,2006,000 20,200*BRIEF EXERCISE 3-11(a) Apr. 30(b)30Supplies.Supplies Expense.1,000Service Revenue.Unearned Service Revenue.3,0003-91,0003,000

SOLUTIONS TO EXERCISESEXERCISE 3-11.True.2.True.3.False. Many business transactions affect more than one of these artificialtime periods. For example, the purchase of a building affects expensesfor many years.4.True.5.False. A time period that lasts less than one year, such as monthly orquarterly periods, is called an interim period.6.False. All calendar years are fiscal years, but not all fiscal years arecalendar years. An accounting time period that is one year in length isreferred to as a fiscal year. A fiscal year that starts on January 1 andends on December 31 is a calendar year.EXERCISE 3-2(a) Accrual-basis accounting records the transactions that change acompany’s financial statements in the periods in which the eventsoccur rather than in the periods in which the company receives or payscash. Information presented on an accrual basis is useful because itreveals relationships that are likely to be important in predicting futureresults. Conversely, under cash-basis accounting, revenue is recordedonly when cash is received, and an expe

3-10 SOLUTIONS TO EXERCISES EXERCISE 3-1 1. True. 2. True. 3. False. Many business transactions affect more than one of these artificial time periods. For example, the purchase of a building affects expenses for many years. 4. True. 5. False. A time period that lasts less than one year, such as monthly or quarterly periods, is called an interim .