Transcription

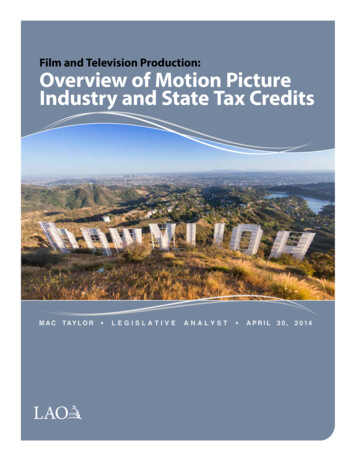

Film and Television Production:Overview of Motion PictureIndustry and State Tax CreditsMACT AY L O R LEGISLATIVEANALYST APRIL30,2 0 14

AN LAO REPORT2Legislative Analyst’s Office www.lao.ca.gov

AN LAO REPORTEXECUTIVE SUMMARYCalifornia has annually provided 100 million in tax credits to eligible film and televisionproductions since 2009. California lawmakers recently have been discussing legislation thatwould revise key provisions of the tax credit. We have prepared this report to provide backgroundinformation on the motion picture industry and offer preliminary observations regarding taxcredits. This report does not make recommendations regarding the tax credit or the proposedlegislation. (Our office will release a more wide ranging report on the program, as required bystatute, by January 2016.)The Motion Picture Industry While we caution against drawing strong conclusions from the data, growth in theU.S. motion picture industry may have slowed over the last decade. Nationwide, almost half of this industry’s jobs are located in Los Angeles County. Over the last several years, fewer large-budget films have been made in California.States’ Film and Television Subsidies Most states and many countries offer tax credits and grants to lure film and televisionproduction away from California. These efforts appear to have had some success. Nationwide, states are providing more than 1.4 billion annually to this industry.Key Takeaways for Legislature Ideally, states would not compete on the basis of subsidies. Some factors might lead the Legislature reasonably to consider extending or expandingthe state’s film tax credit. Given that other states and countries offer subsidies, it might bedifficult for California not to provide subsidies and still maintain its leadership position inthis industry. If the Legislature wishes to continue or expand the film tax credit, we suggest that it doso cautiously. We highlight several factors to consider. Specifically (1) responding to otherjurisdictions’ subsidies could be very expensive and (2) for state government, the film taxcredit does not “pay for itself.”www.lao.ca.gov Legislative Analyst’s Office3

AN LAO REPORT4Legislative Analyst’s Office www.lao.ca.gov

AN LAO REPORTINTRODUCTIONThe California Film and Television ProductionTax Credit (film tax credit) program providesup to 100 million annually to qualifying filmand television productions. Since 2009, whenthe program was adopted, the state has allocatedfilm tax credits using a lottery system because theprogram has had more eligible applicants thanavailable tax credits. Under current law, the filmtax credit program will sunset on July 1, 2017.California lawmakers recently have introducedlegislation that would revise key provisions of theprogram.Chapter 841, Statutes of 2012 (AB 2026,Fuentes), requires the Legislative Analyst’s Office(LAO) to report on the economic effects andadministration of the film tax credit program byJanuary 2016. Given the level of interest in thisprogram among the public and legislators, weprepared this initial report to provide backgroundinformation on the motion picture industry andto offer preliminary observations regarding thetax credits. In the preparation of this report, weconducted over two dozen interviews with industryexperts and reviewed the available research onthe economic effects of state subsidies for film andtelevision production. This early report does notmake recommendations regarding the film taxcredit program or the proposed legislation.Our next report on the program will review theproject-level data that state officials are collectingabout film tax credit recipients. We expect torelease the report required by Chapter 841 in late2015.THE MOTION PICTURE INDUSTRYProduction ProcessThe motion picture industry creates films,television programs, and other motion pictureproducts (such as commercials and music videos)for distribution through various channels—including movie theatres, television broadcasters,and retailers. While every motion pictureproduction is a different undertaking, each usuallyfollows the same process: (1) pre-production,(2) principal photography, and (3) post-production.Some understanding of these phases helps to betterunderstand the industry and certain provisions ofthe film tax credit.Hiring Ramps Up During Pre-ProductionPhase. Pre-production is the process of planningand preparing all of the details of the production.Industry experts advise us that the pre-productionphase typically begins with a small staff of aboutten individuals. During pre-production, the initialproduction staff prepare a detailed schedule andbudget, finalize the script, determine the filminglocation (or locations), and negotiate contracts withvendors and suppliers. During pre-production,the initial production staff also hires the coreproduction staff, crew, and cast. The coreproduction staff may exceed 200 people for largebudget films and television programs, althoughthis number varies depending on the needsof the individual production. (Smaller-budgetproductions typically have a smaller staff.) Thecore staff generally begins work—designing andbuilding sets and property (props), for example—well in advance of principal photography.Principal Photography Phase UsuallyIs Short, but Offers Many Jobs. The castperformances are filmed during the principalwww.lao.ca.gov Legislative Analyst’s Office5

AN LAO REPORTphotography phase. Employment may increasedramatically for short periods during principalphotography depending on the number ofadditional cast or crew required for individualscenes or episodes. Production spending is highestduring principal photography, although budgetsand durations of principal photography can varygreatly. While principal photography for a majorfeature film might continue for several months, amovie made for a basic cable television networktypically will be shot over 30-35 days and a singleepisode for a one-hour television drama typicallywill be shot over 7-9 days. Many televisioncommercials are filmed in a single day, but somemay require a longer period.Timeline and Employment DuringPost-Production Phase Are Highly Variable.Post-production is the process of editing andassembling all of the elements of the film, televisionprogram, or other production into the finishedproduct. Post-production often begins whileprincipal photography is still in progress. Thespecific requirements of post-production dependon the project. In addition to editing, the processtypically includes sound editing, adding soundeffects, adding a musical score, adding visualeffects, color correction, and other technical tasks.Following the completion of principal photography,post-production may take a week or many monthsdepending on the length of the project and, morecritically, the number and complexity of the addedvisual effects. Employment levels during this stageare highly variable and significantly depend on theneeds of the individual production.Production Phases Can Overlap or OccurSimultaneously. While the phases of theproduction processes overlap somewhat for a filmor one-time television program, it is more or lessa linear process. Episodic television programs,on the other hand, are more complex withwriting, planning and preparation, filming, and6Legislative Analyst’s Office www.lao.ca.govpost-production all occurring on different episodesat the same time.Workforce and Economic StatisticsAbout the Data. Much of our description ofthe film and television production industry belowrelies on employment, wage, and economic outputdata reported by state and federal agencies. Thesestatistics have certain limitations that may causethem to be somewhat overstated or understated.We provide more detail in the nearby box. Thesedata limitations are not unique to this report. Everyanalysis of this industry makes choices about how toaddress them. Comparisons across various studiesand reports are difficult because there is somevariation in how they address these data limitations.U.S. Motion Picture Industry Appears to BeGrowing More Slowly Than Overall Economy.To understand whether the U.S. motion pictureindustry is making more or fewer productsover time, we examined national data on the“gross output” of the “motion picture and videoindustries.” Gross output represents the totalmarket value of an industry’s production. Thegross output of the U.S. motion picture industrywas 120 billion in 2012. (This estimate, whilereasonable, reflects the data limitations describedabove. Gross output data is aggregated and, inaddition to film and television production andpost-production, it includes motion picturedistribution and movie theatres.) At 120 billion,the U.S. motion picture industry is larger than,for example, automotive repair and maintenance( 112 billion) and natural gas distribution( 82 billion).Figure 1 (see page 8) compares inflation-adjustedgrowth in the gross output of the motion pictureindustry since 1997 with growth in real grossdomestic product. We see that the U.S. motionpicture industry generally kept pace with the nation’seconomy between 1997 and 2004—with gross output

AN LAO REPORTgrowing by about 3.5 percent annually. Motionpicture industry gross output has since leveledoff. In real terms, it has declined by an average of0.2 percent annually between 2004 and 2012. Overthe 1997 to 2012 period, the motion picture industrygrew at an average annual rate of 1.5 percent, whilethe overall economy grew at an average annual rateof 2.3 percent.Another Look at Growth in the Motion PictureIndustry. Given the data limitations, we looked forother measures of film and television productionoutput—such as the number of movies or televisionepisodes filmed each year. Unfortunately, theproduction statistics that we are aware of arelimited and often self-reported by producers,distributors, or broadcasters. In the case ofWorkforce and Economic Data Have Some LimitationsMuch of our description of the film and television production industry relies on employment,wage, and economic output data reported by state and federal agencies. In some cases, the availabledata include businesses that do not produce films or television programs. For example, filmlibraries may be grouped with film and television post-production companies. Still in other cases,the available data do not include information regarding certain film and television productioncompanies because (1) their primary business activity is in another industry, such as televisionbroadcasting, or (2) they contract with a payroll services company, which serves as the employerof record for the production staff, cast, and crew. Additionally, the wages and output of actors,screenwriters, and directors working on a freelance basis (as opposed to being employees of amotion picture studio) typically are reported under a different industry group that also includesindependent artists and writers in other fields, such as novelists and professional speakers.State agencies derive employment and wage statistics from quarterly reports filed by mostemployers. In reviewing this data, it is important to note that various factors may cause employmentlevels and wages to be overstated or understated. Specifically, most of the employment informationrefers to jobs, not annual full-time equivalent positions. While this likely overstates employment forall industries, the effect is greater for industries with a lot of temporary and part-time employment—such as film and television production. Conversely, as described previously, film and televisionproduction jobs are understated because the statistics may not include freelance performers andcrew directly employed by payroll services companies.Wages are summarized in the available data as total annual wages (which may includebonuses, reimbursements, and some other benefits) for each establishment. To arrive at an averageannual wage for an industry, total annual wages are divided by total jobs. Annual wages may varywith employee skill levels, hourly wages, and the number of hours worked. For example, filmand television production workers may work a lot of overtime in some locations while, in otherlocations, similar workers may only work part-time. The available data does not provide sufficientinformation to help us understand whether changes in wages over years and across locations are dueto differences in employee skill levels, hourly pay, number of hours worked, or some combinationof these factors. However, the wage data clearly provides information on the total amount of wageincome earned by the employees working in that industry.www.lao.ca.gov Legislative Analyst’s Office7

DeputyAN LAO REPORTto the MPAA for rating (G,PG, PG-13, R, or NC-17) is aU.S. Motion Picture Industry Not Keeping Pace With Economygood, but imperfect measureReal Percentage Growth in Motion Picture Industry Gross Output andof annual film production.Gross Domestic Product (GDP) Since 1997(It excludes unrated films45%and double-counts some40films that were resubmittedGDP35or that have more than one30version.) By this metric,film production appears25to have peaked in 200320with 949 films rated by the15aMPAA. For comparison,U.S. Motion Picture Industry10the MPAA annually rated5between 700 and 800 filmsover each of the past five19971999200120032005200720092011years. While we cautiona Includes motion picture and video industries.against drawing strongconclusions from these data,the trends indicate thattelevision production, we were not able to identifyARTWORK#140164growth in the motion picture industry output maya consistently reliable source of output data. In thehave slowed over the last decade.case of film production,however, we found twoTemplate LAOReport mid.aitmetrics that were of sufficientFigure 2quality to illustrate trends inDeclines in Ticket Sales and Movies Rated Over Last Decadefilm output over time: (1) theFigure 1annual number of movietickets sold in the U.S. andCanada, and (2) the annualnumber of films rated by theMotion Picture Associationof America (MPAA)—anindustry advocacy group. Wepresent this information inFigure 2. Annual movie ticketsales peaked in 2002 with1.58 billion movie tickets soldin the U.S. and Canada. In2013, 1.34 billion tickets weresold, a decrease of 16 percentfrom the peak. The numberof films annually submitted81,800Millions of Movie Tickets Sold in the U.S. and Canada1,6001,4001,2001,000800Movies Rated by the MPAA6004002001997199920012003200520072009MPAA Motion Picture Association of America.Legislative Analyst’s Office www.lao.ca.govARTWORK #140164Template LAOReport mid.ait2011Graphic SSecretaryAnalystMPADeputy

AN LAO REPORTMotion Picture Production EmploymentGrowing. Employment statistics provideinformation on hiring trends in an industry. Thefederal Bureau of Labor Statistics reports thatin 2012, there were 205,000 film and televisionproduction jobs and 16,000 film and televisionpost-production jobs in the nation. Film andtelevision production employment has increasedsince 2001—when the industry supported 173,000jobs—at an average annual rate of 1.6 percent. Filmand television post-production employment has notsignificantly changed since 2001. Overall, film andtelevision production industry employment since2001 grew somewhat faster than U.S. employment.Wage Incomes for Motion Picture IndustryJobs Are High Relative to Other Industries. Wageincomes vary considerably across industries.The relatively high incomes earned by filmand television production and post-productionemployees frequently are cited as a reason forsupporting efforts to attract and develop thisindustry. In 2012, the national average annualwage income in the film and television productionindustry was 89,000 and was 106,000 in thepost-production industry. This compares to averageannual wage income of about 49,000 for all privatesector jobs in the U.S. in 2012. The average annualwage income in the film and television productionindustry has increased from 70,000 in 2001—anincrease of about 2.2 percent per year on average.This is slower than the 2.8 percent annual averageincrease in wage incomes for all private industries.Average annual wage income in the post-productionindustry increased faster than average, with arate of about 4 percent per year. There appearsto be significant variation in the average annualwage incomes for film and television productionemployees (and post-production employees) acrossstates. This may reflect differences in employee skilllevels, hourly pay, number of hours worked, or somecombination of these factors.Pressures Confronting the IndustryAccording to industry experts, the U.S.motion picture industry is facing challengesfrom intellectual property theft, competitionfrom other media, and competition from foreignproduction locations. The industry is also evolvingin significant ways due to globalization andtechnological change. These pressures and changesmay play some role in the industry’s slowinggrowth in output (discussed above) and the changesin production locations that we discuss later in thisreport.Intellectual Property Theft and CompetitionFrom Other Media. The MPAA has identifiedintellectual property theft as a major problemfacing the industry. This problem seems to havebecome more pervasive with widespread accessto unauthorized copies of films and televisionprograms on the Internet. In addition, there seemsto be an increase in competition for consumers’attention and disposable income as new types ofconsumer electronic entertainment devices becomeavailable. As the data in Figure 2 show, annual percapita movie ticket sales declined from 5 ticketsin 2002 to 3.8 tickets in 2013. It is unclear whetherthis decline is being offset by an increase in theviewing of films in other ways, such as DVDs,on-demand cable television, and Internet streamingor downloading (legal or illegal). However, onesurvey reports that Americans are watching moretelevision; in 2012 Americans spent an average of2.8 hours per day watching television—a 10 percentincrease from 2003.Government Subsidies to Attract Productions.Throughout the history of cinema, films have beenmade in foreign locations for creative reasons(for example, a film is shot in Paris because thestory takes place in that city). Beginning around1997, however, some productions began to filmin Canada because favorable currency exchangerates and labor costs reduced production costs.www.lao.ca.gov Legislative Analyst’s Office9

AN LAO REPORTAs economic conditions began to normalize,a particularly rich history with the motion pictureprovincial governments began to offer filmmakersindustry. Former Governor Leland Stanfordsubsidies to enhance the financial incentive tofunded the photographic experiments of Eadweardfilm in Canada instead of the U.S. Now, otherMuybridge that led in 1878 to what some historiansgovernments around the world are offering similarconsider to be the very first motion picture.subsidies to attract film and television production.Thomas Edison and his employees advanced theThe relocation of production due to subsidies,early commercial development of the U.S. motioninstead of for creative reasons, is what the industrypicture industry in New York and New Jersey. Sooncalls “runaway production.”afterwards, however, many pioneering filmmakersTechnological Change and Globalization.began to relocate to Southern California in order toIndustry experts advise us that technologicaltake advantage of the better filming conditions and,changes have transformed the way films andperhaps, to avoid paying the fees to license Edison’stelevision programs are made. Digital film editing,patents. The community of Hollywood—whichdigital cameras, three-dimensional projection,merged with the City of Los Angeles in 1910—was aextensive digital animation in live action films, andkey location for filmmakers. The entire Los Angeleshigh-definition television have led to significantarea—often broadly called “Hollywood”—became,changes in the industry. Some of these changes haveand remains to this day, the center of film andreduced production costs, while other technologicaltelevision production in the U.S.changes have increased the complexity and costsCalifornia Has a Large, but Declining Share ofof production. In addition, other technologicalU.S. Motion Picture Employment. California hadadvancements—such as e-mail, smartphones, and107,400 film and television production jobs in 2012.video teleconferencing—reduce production costsThis is more than half—52 percent—of the 205,000and allow management to better oversee film andindustry jobs in the nation. As shown in Figure 3,television development overgreat distances. IndustryFigure 3experts have noted, forMore Than Half of U.S. Motion PictureProduction Employment Is in Californiaexample, that the combined2012forces of technologicalchange and globalizationNew Yorknow allow digital animatorsand post-production staffLos Angeles Countyin multiple locations tocollaborate in real timeon production and visualOther Stateseffects.Concentration inSouthern CaliforniaHistorical Homeof the Motion PictureIndustry. California hasFloridaPennsylvaniaLouisianaNew JerseyGeorgiaTexas10 Legislative Analyst’s Office www.lao.ca.govRest of California

AN LAO REPORTNew York is the only other state with a significantnumber of film and television production jobs.Florida, Pennsylvania, Louisiana, New Jersey,Georgia, and Texas each account for about2 percent of U.S. jobs in the industry. Californiaalso had 9,600 film and television post-productionjobs in 2012, 61 percent of the U.S. total. WhileCalifornia has more than half of the nation’sfilm and television production jobs, its share ofnational employment has steadily declined since2004—when California had about 65 percent of thenational film and television production jobs.Most California Motion Picture IndustryJobs Are in Los Angeles. Film and televisionproduction employment is heavily concentratedin Los Angeles County. Of the 107,400 filmand television production jobs in California,100,500—94 percent—are located in Los AngelesCounty. In addition, about 8,100 film and televisionpost-production jobs are located in Los AngelesCounty—about 84 percent of the post-productionjobs in California. This means that half of all filmand television production and post-production jobsin the U.S. are located in a single county.The motion picture industry is a significantemployer in Los Angeles County. The 108,600combined film and television production andpost-production jobs account for nearly 3 percent ofall jobs in the county. By employment, the industryis about the same size as the construction sectoror about a third as large as the manufacturingsector, which, in Los Angeles County, includes asignificant number of jobs related to manufacturingtransportation equipment, apparel, fabricated metalproducts, and computer and electronic products.Industry Wages in Los Angeles Are HigherThan Elsewhere. As mentioned above, jobs in themotion picture and video industries have relativelyhigh wages. Average annual wage incomes forthese industries are higher in Los Angeles Countythan in New York or the rest of the U.S. It is notclear to us whether this difference in annual wageincomes across the states reflects differences inemployee skill levels, hourly pay, number of hoursworked, or some combination of these factors.The average annual wage income for a film andtelevision production job in Los Angeles Countywas 101,000 in 2012—5 percent higher than inNew York and 82 percent higher than the rest ofthe nation. The discrepancy is more pronounced forpost-production incomes. The average annual wageincome for a post-production job in Los AngelesCounty was 127,000 in 2012—29 percent higherthan in New York and more than twice as much asthe average in the rest of the nation.Additional Jobs in Related Industries. Themany businesses that provide the motion pictureindustry with specialized equipment and servicesemploy many thousands of California residents—mostly in the Los Angeles area. Within Hollywoodis an aggregation of thousands of specializedbusinesses that support the motion picture industryin various ways. Vendors and suppliers of specialty motionpicture, video, sound, and lightingequipment. Vendors and suppliers of specialtyproduction items, such as animal handlers,property (prop) craftsmen, and companiesrenting trailers. Specialty insurance, legal, informationtechnology, and other business servicesproviders.As this is a somewhat unusual industry, thesetypes of individual suppliers have specialized tomeet the industry’s needs. Growth or decline inmotion picture production in California will alsohave an economic effect on these other businesses.Industry experts estimate that one motion pictureindustry job supports about 2.7 other jobs in thewww.lao.ca.gov Legislative Analyst’s Office 11

AN LAO REPORTarea—suggesting that the industrysupports between 250,000 and300,000 additional jobs in California.The Thirty-Mile Zone(TMZ). Many film and televisionproduction workers are unionized.Historically, collective bargainingagreements have stipulated morefavorable work rules and other laborprovisions for production work thatis located within a 30-mile radiusof the intersection of West BeverlyBoulevard and North La CienegaBoulevard in Los Angeles. This is onereason that the industry became soheavily concentrated in Los Angeles.Figure 4 shows that most of the TMZis located in Los Angeles Countywith some parts of Orange andVentura counties included.Figure 4Motion Picture Industry IsConcentrated in the Thirty-Mile ZoneVentura CountyLos Angeles CountySanta Clarita5BurbankSimi s Angeles4055AnaheimLong BeachOrange CountyLOS ANGELES AND RUNAWAY PRODUCTIONSome film and television productions located inother countries and other states might have locatedin California were it not for the subsidies offeredby those jurisdictions. (We discuss these subsidyprograms in more detail later in the report.) Therelocation of motion picture production due tothese subsidies—runaway production—has beena major topic in legislative discussions of film taxcredits. However, there has been considerabledebate about the extent to which this is a problem.As we discuss further below, official wage andemployment statistics suggest that California—andLos Angeles County in particular—has a largeshare of employment and wages in the motionpicture and video industries, but that California’sshare has declined somewhat.12 Legislative Analyst’s Office www.lao.ca.govSome Types of Production Appear to HaveIncreased, While Others Decreased. Los AngelesCounty and several cities in the Los Angelesmetropolitan area contract with a nonprofitcompany—Film L.A.—to coordinate and processpermits for on-location motion picture filming.Film L.A. tracks permitted production days fordifferent types of motion picture productionincluding feature films, television programs, andcommercials. Their data, replicated in Figure 5,shows that overall permitted production dayshave increased by about 90 percent since 1993, buttotal permitted production days in 2013 remainsomewhat below 2005-2007 levels. While notshown in Figure 5, Film L.A.’s data also show thatthe share of permitted production days for filmshas declined relative to the share for television

AN LAO REPORTand commercials (productions that typicallyFigure 6 (see next page), they found that thehave lower levels of spending and employmentnumber of the top 25 films for which Californiathan films). In reviewing the Film L.A. data, it iswas the location of principal photography hasimportant to note certain limitations. First, somedeclined from 16 in 1997 to 2 in 2013. While 1997of the changes could be affected due to growth inmay have been an anomalous year—the averagethe number of jurisdictions that contract with Filmnumber of top 25 films made in California fromL.A. to coordinate permitting. In addition, some1998 to 2004 was 10—the recent negative trend forfilm and television production in the Los Angeleslarge-budget films is clear. The LAEDC researchedarea is excluded because Film L.A. data do notthe locations of principal photography for theinclude unpermitted filming and most filming on41 live action feature-length films released betweensoundstages (large, sound-proofed buildings forJuly 2012 and June 2013 that had an estimatedmotion picture production).production budget of more than 75 million. OfStudies Report Fewer Major Films andthese, only 2 were made entirely in California andTelevision Drama Programs Made in California.9 used California as a secondary location. For 30 of Graphic SigFilm L.A. staff and other industry experts assertthese films—or 73 percent—principal photographySecretarythat there has been a shift in the composition ofoccurred entirely outside of California.Analystproduction from larger budget films and televisionSince 2008, Film L.A. has captured moreprograms—with more spending and hiring perdetailed data on the types of television programs MPADeputyproduction day—to smaller budget productionsfilming on-location in the Los Angeles regionthat employ fewer people. Film L.A. observesthan it did previously. Figure 7 (see next page)that, in terms of budget size, the films made inshows that television dramas—which typicallyLos Angeles in 1993 were larger than those beinghave larger budgets than other types of televisionmade in 2013. While FilmL.A. does not track data onFigure 5production budget or crewOn-Location Motion Picture Production in Los Angeles Areasize, there have been someTotal Annual Permitted Production Daysaattempts to measure these45,000changes. In 2014, Film L.A.40,000and the Los Angeles County35,000Economic DevelopmentCorporation (LAEDC) each30,000issued reports measuring the25,000decline in the production of20,000large-budget, feature-length15,000films in California.

2015. The California Film and Television Production Tax Credit (film tax credit) program provides up to 100 million annually to qualifying film and television productions. Since 2009, when the program was adopted, the state has allocated film tax credits using a lottery system because the program has had more eligible applicants than