Transcription

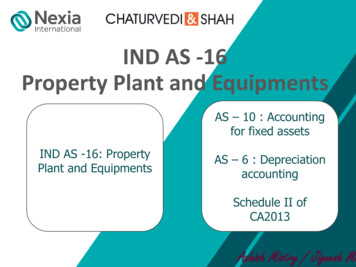

IND AS -16Property Plant and EquipmentsAS – 10 : Accountingfor fixed assetsIND AS -16: PropertyPlant and EquipmentsAS – 6 : DepreciationaccountingSchedule II ofCA2013Ashish Mistry / Jignesh Me

ScopeDefinitionRecognition and MeasurementSubsequent MeasurementDepreciationComponent AccountingDe-recognition & ImpairmentCertain other differences - IND AS & Existing ASDisclosure RequirementsFirst time adoptionKey Differences IND AS & ICDS

Scope Accounting for all property, plant and equipment unlessanother Standard requires or permits a different accountingtreatment. Does not Apply to: Property Plant & Equipment classified as held for sale (IND AS 105) Biological Assets related to Agricultural activity (IND AS 41) Exploration and evaluation assets (IND AS 106) Mineral rights and mineral reserves Also applies to Investment Property – Cost Model (IND AS 40)Existing AS 10 provides for other specific exclusions like- Live stock- Expenditure on Real Estate Developments

DEFINATIONS

DefinitionProperty, Plant and Equipment (‘PPE’)spare parts, stand-by equipment are recognised as PPE when they meetthe above definition of PPE

RECOGNITION ANDMEASUREMENT

Recognition and MeasurementProperty, Plant &Equipment shall berecognized as an assetwhen:Criteria apply to all costswhen incurred, includingFuture economicbenefits areprobableInitial acquisitionor constructioncostsCost can bemeasured reliablySubsequent CostsProperty, PlantEquipment ismeasured initiallyat cost.Existing AS 10 – allows to capitalise the subsequent cost when it increasesthe future benefits beyond its previously assessed standard of performance.

Elements of CostAll costs involved in bringing the asset to the present locationand condition necessary for it to be capable of operating inthe manner intended by management.Cost ElementsPurchase CostsDirectly attributable CostsOther Costs Purchase Costs Import Duties/NonRefundableTaxes Deduct tradediscounts/rebates Cost of Employee benefits Cost of Site Preparation Initial delivery and handling Costs Transport handling Charges Installation and assembly costs Cost of testing Professional Fees Initial estimates ofdismantling costs. Initial estimates ofsite restoration costs Major inspectioncosts Cost ofReplacements

Elements of CostCost Element - Exclusion Costs of Opening a new facility Costs of introducing a new product or service orconducting business in a new location; Administrative and other general overheadsExisting AS 10 – Admin & Gen Ohds are usually excluded, however in somecircumstances such expenses are specifically attributable to construction /acquisition of asset then can be capitalized.

Elements of Cost Initial operating losses charged to P&L Abnormal losses and profits in case of self constructed asset charged toP&L Incidental operations during construction period charged to P&L payment is deferred beyond normal credit terms, the differencebetween the cash price equivalent and the total payment is recognisedas interestKey impacts Trial run Interest income during construction period Expenses incurred by new company promoted to set up new plant.

Elements of CostSpare parts, stand-by equipment & Servicing Equipment These are recognized in accordance with this IND AS when theymeet the definition of PPE Otherwise such items are classified as InventoryExisting AS 10 – Spares which can be used only in connection with a fixedassets and whose use is expected to be irregular, can be capitalized- Standby assets and Servicing Equipment are generally capitalized.

Exchange of AssetsMeasure costs at Fair value,unless:If PPE is acquired inexchange for other nonmonetary asset or for acombination of monetaryasset- The exchange transaction hasno commercial substances,or- Fair value of neither the assetreceived nor given up can bereliably measuredIf the acquired item is not measured at fair value, its cost is measuredat the carrying amount of the asset given up.

SUBSEQUENT COST ANDMEASUREMENT

Subsequent Measurement Can choose Cost Model or Revaluation Model as its accountingpolicy Adopted option as accounting policy will apply to entire class ofPPE Revaluation shall be done with sufficient regularity to ensure thatthere is no significant gap between FV and Carrying Value Under revaluation model, carrying amount restated withreference to available observable market dataExisting AS 10 – Revaluation approach adopted therein is ad hoc in nature, asadoption does not require as a part of accounting policy and independentasset can be revalued. Also frequency of revaluation not specified.

Revaluation ModelRevaluationUpwardRecognized directly in OtherComprehensive Income &accumulated under Equity inrevaluation surplusDownwardDebit revaluation Surplus to theextent recognized previouslyand balance, if any, Charge toProfit or Loss A/c.The revaluation surplus may be transferred to retained earnings whenthe assets is derecognized or as it is used by the entity (not throughProfit & Loss)Existing GN on Treatment of Reserve created on revaluation state if anyadditional depreciation on revalued amount charged to P&L then accumulatedadditional depreciation on revalued amount can be moved from RevaluationReserve to P&L / Gen Res as the case may be

Subsequent Cost - Part Replacement Day to day servicing cost are charged to P&L Some items involve a series of linked parts which require regularreplacement at different intervals and have different useful lives. Recognize the cost of replacing a part in the carrying amount, ifrecognition criteria are met. The carrying amount of replaced parts is derecognized For Example, a furnace may require relining after a specifiednumber of hours of use, or aircraft interiors such as seats andgalleys may require replacement several times during the life ofthe airframe.

Subsequent Cost – Major inspection/ Overhaul Costs Performing regular major inspections for faults, regardless ofparts being replaced or not, may be a condition of continuing tooperate an item of Property Plant and Equipment. Cost of each major inspection performed is recognized in carryingamount, as a replacement, if the recognition criteria are met. Any remaining carrying amount of the cost of the previousinspection is derecognized.

DEPRECIATION

Depreciation Depreciation begins when the asset is available for use (ie when itis in the location and condition necessary for it to be capable ofoperating in the manner intended by management) & continuesuntil the asset is derecognized or classifies as held for sale. The Residual value –Amount can be obtained from disposal (–) costs of disposal The residual value & the useful life of an asset shall be reviewed atleast at each financial year end, and if expectations differs fromprevious estimates, the change shall be accounted for as a changein accounting estimates.Depreciable Amount Cost - Residual Value

Useful Life of Asset- Key FactorsAll the following factors are considered in the determining the usefullife of an asset:Expectedusage of theasset.Expectedphysicalwear andteardependingonoperationalfactorsTechnical orcommercialobsolescencearising from : Changes orimprovementin production; Change inMarketdemand forproductionLegal orsimilar limitson the use(E.g. Expirydates ofrelated leases)AssetManagementpolicy mayinvolvedisposal ofasset after aspecified timeTherefore,useful life maybe shorterthaneconomic lifeRepairs andMaintenancepolicies mayalso affectuseful life.

Depreciation MethodDiminishingbalanceMethodUnits ofProductionMethodStraightline MethodDepreciationMethodsMethod selected should closely reflects the pattern ofconsumption of economic benefits expected to be consumed byentity

Depreciation Method Depreciation method shall be reviewed at least at eachfinancial year-end. If there is a significant change in expected pattern of consumingfuture economic benefits Methods shall be changed to reflect new pattern Change shall be treated as change in an accounting estimate andaccounted for as per IND AS 8 and hence will have Prospective effect.Existing AS – 6: changes in method can be made if required by AccountingStandard or required by statue or for better preparation / presentation offinancial statement.Change in method treated as Change in Accounting Policy & hence will haveretrospective effect.

Component AccountingKey ConsiderationsUseful life aulEach major part of an item of PPE with cost being significant in relationto total cost of the item – should be depreciated separately, eventhough it may not have different useful life, but may be grouped fordetermining depreciation charge.

De-recognition andImpairment

De-recognition Derecognize the carrying amount: On disposal; or When no future benefits are expected from its use. Any gain or loss arising from the De-recognition to be included inprofit or loss. Gains (or proceeds) are not classified as revenue.Impairment Compensation from third party for item of PPE that is impaired /Lost / Given up shall be included in P&L when compensationbecomes receivable. Impairment of Assets including PPE dealt by IND AS 36

DISCLOSURES

Disclosures Measurement basis for determining gross carrying value Depreciation methods used Useful lives or depreciation rates used Gross carrying amount and accumulated depreciation at thebeginning and end of the period Reconciliation of the carrying amount at the beginning and endof the period ( Addition, Deletion, Assets classified as held forsale, Business Combination, Revaluation, impairment, exchangedifference & Other charges) Comparative information required Existence and amounts of restrictions on title to assets Property Plant and equipments pledged as security for liabilities

Disclosures Amount of expenditures recognized in the course of construction Contractual commitments for acquisition of Property Plant andEquipment Amount of compensation from third parties for items of propertyplant and equipments (if not disclosed separately in P&L)

Disclosure for Revalued Assets Effective date of Revaluation Whether an independent valuer was involved Methods and significant assumptions applied in estimating fairvalues. Extent to which fair value were determined based onobservable prices or other valuation techniques Carrying amount of each class of revalued Property Plant andEquipment if the cost model had been applied Revaluation surplus, including movement and any restrictionson distribution of balance to shareholders

Other DifferencesIND AS & Existing AS

Other Differences - IND AS & Existing ASExisting AS 10 Specifically deals with following situation (not dealtin IND AS 16) Fixed Assets owned by the entity jointly with others Several Assets purchased for a consolidated priceIND AS 16 Specifically deals with certain situation (not covered inExisting AS 10) Self constructed assets – cost of abnormal amounts (wastedmaterial, labour or other resources) incurred in the construction is notincluded Payment for acquiring is deferred beyond normal credit period, thendifference between cash price equivalent and actual total payment isrecognized as interest.

AppendixA. Changes in Existing Decommissioning,Restoration and Similar LiabilitiesB. Stripping Costs in the Production Phaseof a Surface Mine

Appendix A Subsequent re-measurement of decommissioning or similarliability recognised as cost of asset changes due to: Change in estimate of outflow of resources Change in market base discount rate Increase that reflect passage of time – unwinding discount ischarged to P&L

Appendix ACost modelChange inliability add orreduce thecost of relatedassetAmountdeducted shallnot exceedcarrying costand shall berecognised inP&LAmount addedthen considerindication ofimpairment asper INDAS 36

Appendix ARevalued modelDecrease inliability –credited to fromOCI/Revaluation surplus,except whererevaluationdeficit wasrecognised onthat asset inP&LIncrease inliability –reducedOCI/Revaluation surplus to theextent availableand balance toP&LDecrease inliability cannotexceed theamount thatwould havebeen carriedunder costmodel

Appendix B Recognition of Production stripping cost as asset Initial measurement of stripping activity asset Subsequent measurement of stripping activity asset

First time adoption

First time adoptionFor first time translation entity has four options:1. Measure PPE at fair value and use that fair value as deemedcost.2. Previous GAAP revaluation at deemed cost if comparable to fairvalue or depreciated cost adjusted for change in price index3. If there is no change in functionalcurrency, book value as per previousGAAP can be continued as deemed costadjusted for decommissioning liabilityCarve out in Ind AS –IFRS does not have thisoption

KEY DIFFERENCESInd AS and ICDS

IssueExchangefluctuationIND AS 16Charged to Profit & Loss, except Capitalised as per ICDS VI – Effecttreated as part of borrowingof changes in Foreign exchangecostrates i.e. as per section 43A of ITActWhen assets is ready for theused intended by managementStartup commissioning,experimental test run cost to becapitalised. Expenditure incurredafter commercial production forintended sale or captiveconsumption to be charged torevenueAbonormal cost to be chargedto P&LNo guidanceCessation of cost tobe capitalisedSelf constructedassetICDS

IssueIND AS 16Cost of replacement capitalisedif meets definition of PPEImprovement andrepairsICDSExpenditure that increases thefuture benefits from the existingasset beyond its previouslyassessed standard of performanceis added to the actual cost.No guidance on inspection costWhen assets is ready for theused intended by managementStartup commissioning,experimental test run cost to becapitalised. Expenditure incurredafter commercial production forintended sale or captiveconsumption to be charged torevenueAbonormal cost to be chargedto P&LNo guidanceCessation of cost tobe capitalisedSelf constructedasset

THANK YOUFOR YOUR ATTETION

Repairs and Maintenance policies may also affect useful life. Depreciation Method Depreciation Methods Straight line Method Diminishing balance Method Units of Production Method Method selected should closely reflects the pattern of consumption o