Transcription

2019Medicare Part DProvider Resource

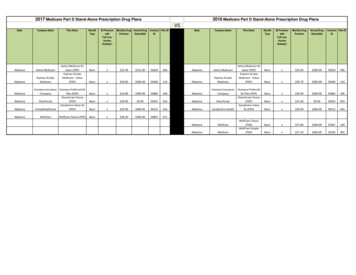

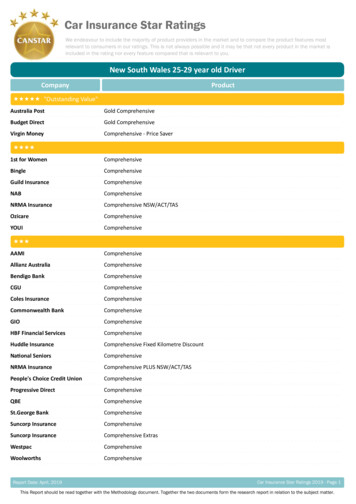

2019 Medicare Part D Stand-Alone Prescription Drug PlansData as of September 5, 2018. Includes 2019 approved contracts/plans. Employer sponsored plans (800 series) are excluded. Plans under sanction are not shown.Notes: Data are subject to change as contracts are finalized. For 2019, enhanced alternative plans may offer additional cost sharing reductions in the gap on a sub-set of the formulary drugs,beyond the standard Part D ntractPlan 45021367403013118155Company NamePlan NameAetna MedicareAetna MedicareAetna MedicareCigna-HealthSpring RxCigna-HealthSpring RxCigna-HealthSpring RxEnvisionRx PlusExpress Scripts MedicareExpress Scripts MedicareExpress Scripts MedicareHISC - Blue Cross Blue Shield of TexasHISC - Blue Cross Blue Shield of TexasHISC - Blue Cross Blue Shield of TexasHumanaHumanaHumanaMutual of Omaha RxMutual of Omaha reWellCareAetna Medicare Rx Saver (PDP)Aetna Medicare Rx Select (PDP)Aetna Medicare Rx Value Plus (PDP)Cigna-HealthSpring Rx Secure (PDP)Cigna-HealthSpring Rx Secure-Essential (PDP)Cigna-HealthSpring Rx Secure-Extra (PDP)EnvisionRxPlus (PDP)Express Scripts Medicare - Choice (PDP)Express Scripts Medicare - Saver (PDP)Express Scripts Medicare - Value (PDP)Blue Cross MedicareRx Basic (PDP)Blue Cross MedicareRx Plus (PDP)Blue Cross MedicareRx Value (PDP)Humana Enhanced (PDP)Humana Preferred Rx Plan (PDP)Humana Walmart Rx Plan (PDP)Mutual of Omaha Rx Plus (PDP)Mutual of Omaha Rx Value (PDP)SilverScript Allure (PDP)SilverScript Choice (PDP)SilverScript Plus (PDP)AARP MedicareRx Preferred (PDP)AARP MedicareRx Saver Plus (PDP)AARP MedicareRx Walgreens (PDP)WellCare Classic (PDP)WellCare Extra (PDP)WellCare Value Script (PDP) 0 Premium withBenefit Type Full ncedxxxxxMonthly DrugPremium 051.6075.3038.1028.0024.3067.0010.40Annual DrugDeductible 00415.00415.00415.00Additional DrugCoverage Offeredin the NoNoNoNoNoNo

2019 Medicare Part D Stand-Alone Prescription Drug PlansIncludes plans placed under sanction as of September 5, 2018. Information is provided for these plans, but they are not able to accept any new enrollees.Notes: Data are subject to change as contracts are finalized. For 2019, enhanced alternative plans may offer additional cost sharing reductions in the gap on a sub-set of the formulary drugs, beyond thestandard Part D benefit.StateCompany Name Plan NameBenefit Type 0 Premium withFull Low-IncomeSubsidy?Monthly DrugPremiumAnnual DrugDeductibleAdditional DrugCoverageOffered in theGapContract IDPlan IDBenefit TypeDetailSummary StarRating

2019 Medicare Part D Stand-Alone Prescription Drug Plans by Company Name2018 CMS Regional Benchmark for Texas 23.96KHC Provider 45No ContractNo tract ID Plan 021367403013118155KHC SPAP #SS005Company NamePlan NameAetna MedicareAetna MedicareAetna MedicareCigna-HealthSpring RxCigna-HealthSpring RxCigna-HealthSpring RxEnvisionRx PlusExpress Scripts MedicareExpress Scripts MedicareExpress Scripts MedicareHISC - Blue Cross Blue Shield of TexasHISC - Blue Cross Blue Shield of TexasHISC - Blue Cross Blue Shield of TexasHumanaHumanaHumanaMutual of Omaha RxMutual of Omaha reWellCareAetna Medicare Rx Saver (PDP)Aetna Medicare Rx Select (PDP)Aetna Medicare Rx Value Plus (PDP)Cigna-HealthSpring Rx Secure (PDP)Cigna-HealthSpring Rx Secure-Essential (PDP)Cigna-HealthSpring Rx Secure-Extra (PDP)EnvisionRxPlus (PDP)Express Scripts Medicare - Choice (PDP)Express Scripts Medicare - Saver (PDP)Express Scripts Medicare - Value (PDP)Blue Cross MedicareRx Basic (PDP)Blue Cross MedicareRx Plus (PDP)Blue Cross MedicareRx Value (PDP)Humana Enhanced (PDP)Humana Preferred Rx Plan (PDP)Humana Walmart Rx Plan (PDP)Mutual of Omaha Rx Plus (PDP)Mutual of Omaha Rx Value (PDP)SilverScript Allure (PDP)SilverScript Choice (PDP)SilverScript Plus (PDP)AARP MedicareRx Preferred (PDP)AARP MedicareRx Saver Plus (PDP)AARP MedicareRx Walgreens (PDP)WellCare Classic (PDP)WellCare Extra (PDP)WellCare Value Script (PDP) 0 PremiumAdditional DrugwithMonthly Drug Annual DrugCoverageBenefit Type Full LowPremiumDeductible Offered in hancedxxxxx 051.6075.3038.1028.0024.3067.0010.40 NoNoNoNoNoNoNoYesNoNoNoNoNoNo

2019 Kidney Health CarePrescription Drug Plan (PDP)Premium Payment FactsheetThe factsheets for the prescription drug plans (PDP) are in alphabetical order in thisdocument, and you can use the links to the S Plan numbers listed on this page.The Centers for Medicare and Medicaid Services (CMS) state benchmark is 23.96.The Subsidy amount (CMS Pays column) for providers who have chosen to useunrounded amounts are based on the 23.96 benchmark. Subsidy amounts for providerswho have chosen to use rounded amounts are based on a rounded 24.00 benchmark.Links sorted by NameLinks sorted by NumberAetna MedicareS5810S4802 WellCareCigna-HealthSpring RxS5617S5617 Cigna-HealthSpring RxAetna MedicareEnvisionRx PlusExpress Scripts MedicareHISC-Blue Cross Blue Shield of TXHumana Insurance CompanyMutual of OmahaSilverScriptUnited HealthcareUnited HealthcareWellCareS5768S7694S5660S5715S5884S5601 SilverScriptS5660 Express Scripts MedicareS5715 HISC-Blue Cross Blue Shield of TXS5768 Aetna MedicareS5810Aetna MedicareS7126S5820 United HealthcareS5820S5921 United HealthcareS5601S5921S4802S5884 Humana Insurance CompanyS7126 Mutual of OmahaS7694 EnvisionRx Plus

WellCareS4802State Benchmark 23.96Rounded Plan# 013PlanRx ClassicBasicBase Cost 24.30Subsidy %100%75%50%25%0%CMS Pays 24.30 18.00 12.00 6.00 0.00Member Pays 0.00 0.00 0.00 0.00 0.00Premium PriceKHC Pays 0.00 6.30 12.30 18.30 24.30 24.30PDP Premium 24.30 24.30 24.30 24.30 24.30Rounded Plan# 118PlanSubsidy %100%75%Rx Extra50%Enhanced25%0%Base Cost 43.40CMS PaysMember Pays 24.00 32.00 18.00 32.00 12.00 32.00 6.00 32.00 0.00 32.00Premium PriceKHC Pays 11.00 17.00 23.00 29.00 35.00 67.00PDP Premium 67.00 67.00 67.00 67.00 67.00Rounded Plan# 155PlanSubsidy %100%75%Rx Value Script50%25%0%Base Cost 9.80CMS PaysMember Pays 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00Premium PriceKHC Pays 10.40 10.40 10.40 10.40 10.40 10.40PDP Premium 10.40 10.40 10.40 10.40 10.40Late Enrollment Penalty (LEP) not covered by KHC.

SilverScriptS5601State Benchmark 23.96Rounded Plan# 044PlanChoiceBasicBase CostPlusEnhancedPremium Price 24.50Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 24.50 0.00 0.00 24.5075% 18.00 0.00 6.50 24.5050% 12.00 0.00 12.50 24.5025% 6.00 0.00 18.50 24.500% 0.00 0.00 24.50 24.50Rounded Plan# 045Plan 24.50Base Cost 34.40Premium Price 51.60Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 24.00 16.60 11.00 51.6075% 18.00 16.60 17.00 51.6050% 12.00 16.60 23.00 51.6025% 6.00 16.60 29.00 51.600% 0.00 16.60 35.00 51.60Rounded Plan# 164PlanSubsidy %100%75%Allure50%Enhanced25%0%Late Enrollment Penalty (LEP) not covered by KHC.Base CostCMS Pays 24.00 18.00 12.00 6.00 0.00 63.40Member Pays 45.00 45.00 45.00 45.00 45.00Premium PriceKHC Pays 11.00 17.00 23.00 29.00 35.00 80.00PDP Premium 80.00 80.00 80.00 80.00 80.00

Cigna-HealthSpring RxS5617State Benchmark 23.96Rounded Plan# 108PlanRx SecureBasicBase Cost 22.70Rx Secure-ExtraEnhancedCMS PaysMember PaysKHC PaysPDP Premium100% 22.70 0.00 0.00 22.7075% 17.00 0.00 5.70 22.7050% 11.40 0.00 11.30 22.7025% 5.70 0.00 17.00 22.700% 0.00 0.00 22.70 22.70Base Cost 51.30Rx Secure-EssentialEnchancedPremium Price 57.50Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 24.00 22.50 11.00 57.5075% 18.00 22.50 17.00 57.5050% 12.00 22.50 23.00 57.5025% 6.00 22.50 29.00 57.500% 0.00 22.50 35.00 57.50Rounded Plan# 301Plan 22.70Subsidy %Rounded Plan# 267PlanPremium PriceBase Cost 14.80Premium Price 21.80Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 14.80 0.00 7.00 21.8075% 11.10 0.00 10.70 21.8050% 7.40 0.00 14.40 21.8025% 3.70 0.00 18.10 21.800% 0.00 0.00 21.80 21.80Late Enrollment Penalty (LEP) not covered by KHC.

Express Scripts MedicareS5660State Benchmark 23.96Rounded Plan# 124PlanValueBasicBase CostChoiceEnhancedKHC Pays 44.60PDP PremiumSubsidy %CMS Pays100% 24.00 9.60 11.00 44.6075% 18.00 9.60 17.00 44.6050% 12.00 9.60 23.00 44.6025% 6.00 9.60 29.00 44.600% 0.00 9.60 35.00 44.60Premium PriceRounded Plan# 192PlanPremium Price 44.60Member PaysBase Cost 77.20Subsidy %CMS PaysMember PaysKHC Pays 99.90PDP Premium100% 24.00 64.90 11.00 99.9075% 18.00 64.90 17.00 99.9050% 12.00 64.90 23.00 99.9025% 6.00 64.90 29.00 99.900% 0.00 64.90 35.00 99.90Premium PriceKHC Pays 4.70 9.50 14.30 19.20 24.00 24.00PDP Premium 24.00 24.00 24.00 24.00 24.00Rounded Plan# 238PlanSubsidy %100%75%Saver50%Enhanced25%0%Late Enrollment Penalty (LEP) not covered by KHC.Base Cost 19.30CMS PaysMember Pays 19.30 0.00 14.50 0.00 9.70 0.00 4.80 0.00 0.00 0.00

HISC-Blue Cross Blue Shield of TexasS5715State Benchmark 23.96Rounded Plan# 005PlanRx ValueEnhancedBase CostRx PlusEnhancedRx Basic 82.10CMS PaysMember PaysKHC PaysPDP Premium100% 24.00 47.10 11.00 82.1075% 18.00 47.10 17.00 82.1050% 12.00 47.10 23.00 82.1025% 6.00 47.10 29.00 82.100% 0.00 47.10 35.00 82.10Base Cost 93.10Premium Price 140.10Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 24.00 105.10 11.00 140.1075% 18.00 105.10 17.00 140.1050% 12.00 105.10 23.00 140.1025% 6.00 105.10 29.00 140.100% 0.00 105.10 35.00 140.10Rounded Plan# 014PlanPremium PriceSubsidy %Rounded Plan# 006Plan 74.80Base Cost 30.70Premium Price 30.70Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 24.00 0.00 6.70 30.7075% 18.00 0.00 12.70 30.7050% 12.00 0.00 18.70 30.7025% 6.00 0.00 24.70 30.700% 0.00 0.00 30.70 30.70Late Enrollment Penalty (LEP) not covered by KHC.

Aetna MedicareS5768State Benchmark 23.96Rounded Plan# 145PlanRx Value PlusEnhancedBase Cost 46.20Premium Price 58.80Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 24.00 23.80 11.00 58.8075% 18.00 23.80 17.00 58.8050% 12.00 23.80 23.00 58.8025% 6.00 23.80 29.00 58.800% 0.00 23.80 35.00 58.80Late Enrollment Penalty (LEP) not covered by KHC.

Aetna MedicareS5810State Benchmark 23.96Rounded Plan# 056PlanRx SaverBasicBase Cost 21.30Subsidy %100%75%50%25%0%Rounded Plan# 293PlanSubsidy %100%75%Rx Select50%Enhanced25%0%Late Enrollment Penalty (LEP) not covered by KHC.CMS Pays 21.30 16.00 10.70 5.30 0.00Member Pays 0.00 0.00 0.00 0.00 0.00Base Cost 11.50CMS PaysMember Pays 11.50 0.00 8.60 0.00 5.80 0.00 2.90 0.00 0.00 0.00Premium PriceKHC Pays 0.00 5.30 10.60 16.00 21.30Premium PriceKHC Pays 4.60 7.50 10.30 13.20 16.10 21.30PDP Premium 21.30 21.30 21.30 21.30 21.30 16.10PDP Premium 16.10 16.10 16.10 16.10 16.10

United HealthcareS5820State Benchmark 23.96Rounded Plan #PlanRx PreferredEnhanced021Base Cost 58.50Premium Price 75.30Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 24.00 40.30 11.00 75.3075% 18.00 40.30 17.00 75.3050% 12.00 40.30 23.00 75.3025% 6.00 40.30 29.00 75.300% 0.00 40.30 35.00 75.30Late Enrollment Penalty (LEP) not covered by KHC.

HumanaS5884State Benchmark 23.96Rounded Plan# 020PlanEnhancedBase CostPreferred Rx PlanBasicWalmart Rx PlanEnhanced 76.00CMS PaysMember PaysKHC PaysPDP Premium100% 24.00 41.00 11.00 76.0075% 18.00 41.00 17.00 76.0050% 12.00 41.00 23.00 76.0025% 6.00 41.00 29.00 76.000% 0.00 41.00 35.00 76.00Base Cost 22.50Premium Price 22.50Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 22.50 0.00 0.00 22.5075% 16.90 0.00 5.60 22.5050% 11.30 0.00 11.20 22.5025% 5.60 0.00 16.90 22.500% 0.00 0.00 22.50 22.50Rounded Plan# 168PlanPremium PriceSubsidy %Rounded Plan# 143Plan 55.30Base Cost 21.20Premium Price 27.80Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 21.20 0.00 6.60 27.8075% 15.90 0.00 11.90 27.8050% 10.60 0.00 17.20 27.8025% 5.30 0.00 22.50 27.800% 0.00 0.00 27.80 27.80Late Enrollment Penalty (LEP) not covered by KHC.

United HealthcareS5921State Benchmark 23.96Rounded Plan# 367PlanSubsidy %100%75%Rx Saver50%Plus25%0%Base Cost 38.10CMS PaysMember Pays 24.00 3.10 18.00 3.10 12.00 3.10 6.00 3.10 0.00 3.10Premium PriceKHC Pays 11.00 17.00 23.00 29.00 35.00 38.10PDP Premium 38.10 38.10 38.10 38.10 38.10Rounded Plan# 403PlanSubsidy %100%75%Rx Walgreens50%Enhanced25%0%Base Cost 7.40CMS PaysMember Pays 7.40 0.00 5.60 0.00 3.70 0.00 1.90 0.00 0.00 0.00Premium PriceKHC Pays 20.60 22.40 24.30 26.10 28.00 28.00PDP Premium 28.00 28.00 28.00 28.00 28.00Late Enrollment Penalty (LEP) not covered by KHC.

Mutual of Omaha RxState Benchmark 23.96Rounded Plan# 021PlanRx PlusBasicBase CostRx ValueEnhanced 44.80Premium Price 44.80Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 24.00 9.80 11.00 44.8075% 18.00 9.80 17.00 44.8050% 12.00 9.80 23.00 44.8025% 6.00 9.80 29.00 44.800% 0.00 9.80 35.00 44.80Rounded Plan# 054PlanS7126Base Cost 23.70Premium Price 29.20Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 23.70 0.00 5.50 29.2075% 17.80 0.00 11.40 29.2050% 11.90 0.00 17.30 29.2025% 5.90 0.00 23.30 29.200% 0.00 0.00 29.20 29.20Late Enrollment Penalty (LEP) not covered by KHC.

Envision Rx PlusS7694State Benchmark 23.96Rounded Plan# 022PlanRxPlusBasicBase Cost 52.10Premium Price 52.10Subsidy %CMS PaysMember PaysKHC PaysPDP Premium100% 24.00 17.10 11.00 52.1075% 18.00 17.10 17.00 52.1050% 12.00 17.10 23.00 52.1025% 6.00 17.10 29.00 52.100% 0.00 17.10 35.00 52.10Late Enrollment Penalty (LEP) not covered by KHC.

Late Enrollment calculations for 8495051525354555657582018 LEP Amount 35.02Month 0.3561 0.7062 1.0563 1.4064 1.7565 2.1066 2.4567 2.8068 3.1569 3.5070 3.8571 4.2072 4.5573 4.9074 5.2575 5.6076 5.9577 6.3078 6.6579 7.0080 7.3581 7.7082 8.0583 8.4084 8.7685 9.1186 9.4687 9.8188 10.1689 10.5190 10.8691 11.2192 11.5693 11.9194 12.2695 12.6196 12.9697 13.3198 13.6699 14.01100 14.36101 14.71102 15.06103 15.41104 15.76105 16.11106 16.46107 16.81108 17.16109 17.51110 17.86111 18.21112 18.56113 18.91114 19.26115 19.61116 19.96117 20.31118 21.36 21.71 22.06 22.41 22.76 23.11 23.46 23.81 24.16 24.51 24.86 25.21 25.56 25.91 26.27 26.62 26.97 27.32 27.67 28.02 28.37 28.72 29.07 29.42 29.77 30.12 30.47 30.82 31.17 31.52 31.87 32.22 32.57 32.92 33.27 33.62 33.97 34.32 34.67 35.02 35.37 35.72 36.07 36.42 36.77 37.12 37.47 37.82 38.17 38.52 38.87 39.22 39.57 39.92 40.27 40.62 40.97 051525354555657582019 LEP Amount 33.49Month 0.3361 0.6762 1.0063 1.3464 1.6765 2.0166 2.3467 2.6668 2.9969 3.3270 3.6571 3.9872 4.3173 4.6574 4.9875 5.3176 5.6477 5.9778 6.3179 6.6480 6.9781 7.3082 7.6383 7.9784 8.3085 8.6386 8.9687 9.2988 9.6389 9.9690 10.2991 10.6292 10.9593 11.2894 11.6295 11.9596 12.2897 12.6198 12.9499 13.28100 13.61101 13.94102 14.27103 14.60104 14.94105 15.27106 15.60107 15.93108 16.26109 16.60110 16.93111 17.26112 17.59113 17.92114 18.25115 18.59116 18.92117 19.25118 20.25 20.58 20.91 21.24 21.57 21.91 22.24 22.57 22.90 23.23 23.56 23.90 24.23 24.56 24.89 25.22 25.56 25.89 26.22 26.55 26.88 27.22 27.55 27.88 28.21 28.54 28.88 29.21 29.54 29.87 30.20 30.53 30.87 31.20 31.53 31.86 32.19 32.53 32.86 33.19 33.52 33.85 34.19 34.52 34.85 35.18 35.51 35.85 36.18 36.51 36.84 37.17 37.50 37.84 38.17 38.50 38.83 39.16

5960 20.66 21.01119120 41.67 42.025960 19.58 19.91119120 39.50 39.83

How Medicaid Programs Pay MedicarePremiums and Out-of-Pocket CostsMQMB(Medicaid QualifiedMedicareBeneficiary) Pays Medicare Part B premium Pays deductibles andcopaymentQMB(Qualified MedicareBeneficiary) Pays Medicare Part B premium Pays Medicare Part A and PartB deductibles and copaymentsSLMB(Specified Low-IncomeMedicareBeneficiary and the QI -1Program) Pays Medicare Part B premiumNote: There are different Medicaid programs that pay for services not covered by Medicare. This table only illustrates thosethat pay Medicare out-of-pocket costs. In Texas, the Health and Human Services Commission administers Medicaid.

12018 - 2019 Standard Drug CostsStandard BenefitDeductibleInitial Coverage LimitOut-of-Pocket (OOP) Threshold (1)Total Covered Part D Spending at OOP Threshold forNon-Applicable Beneficiaries (2)Estimated Total Covered Part D Spending forApplicable Beneficiaries (3)Minimum Cost-Sharing in Catastrophic CoveragePortion of the BenefitGeneric/Preferred Multi-Source DrugOtherFull Subsidy-Full Benefit Dual Eligible (FBDE)IndividualsDeductibleCopayments for Institutionalized Beneficiaries[category code 3]Copayments for Beneficiaries Receiving Home andCommunity-Based Services [category code 3] (4)Maximum Copayments for Non-InstitutionalizedBeneficiariesUp to or at 100% Federal Poverty Level (FPL)[category code 2]Up to OOP ThresholdGeneric/Preferred Multi-Source Drug (5)Other (5)Above OOP ThresholdOver 100% FPL [category code 1]Up to OOP ThresholdGeneric/Preferred Multi-Source DrugOtherAbove OOP Threshold2018 405 3,750 5,0002019 415 3,820 5,100 7,508.75 7,653.75 8,417.60 8,139.54 3.35 8.35 3.40 8.5020182019 0.00 0.00 0.00 0.00 0.00 0.00 1.25 3.70 0.00 1.25 3.80 0.00 3.35 8.35 0.00 3.40 8.50 0.00

Full Subsidy-Non-FBDE Individuals (6)Applied or eligible for QMB/SLMB/QI or SSI, income at orbelow 135% FPL and resources 9,060 (individuals, 2018) or 14,340 (couples, 2018) [category code 1] (6)DeductibleMaximum Copayments up to OOP ThresholdGeneric/Preferred Multi-Source DrugOtherMaximum Copayments above OOP Threshold20182019 0.00 0.00 3.35 8.35 0.00 3.40 8.50 0.00Partial SubsidyApplied and income below 150% FPL and resources below 14,100 (individual, 2018) or 28,150 (couples, 2018)[category code 4] (6)Deductible (5)Coinsurance up to OOP ThresholdMaximum Copayments above OOP ThresholdGeneric/Preferred Multi-Source DrugOtherRetiree Drug Subsidy AmountsCost ThresholdCost Limit1.2.3.4.5.6.20182019 83.0015% 85.0015% 3.35 8.35 3.40 8.502018 405 8,3502019 415 8,500Pursuant to section 1860D-2(b)(4)(B)(i)(IV) of the Act, for each of years 2016 through 2019, the OOP threshold increaseis the lesser of the annual percentage increase or the July CPI plus two percentage points.For a beneficiary who is not considered an “applicable beneficiary,” as defined at section 1860D-14A(g)(1), and is noteligible for the coverage gap discount program, this is the amount of total drug spending required to reach the OOPthreshold in the defined standard benefit.For a beneficiary who is considered an “applicable beneficiary,” as defined at section 1860D-14A(g)(1), and is eligiblefor the coverage gap discount program, this is the estimated average amount of total drug spending required to reachthe OOP threshold in the defined standard benefit.Per section 1860D-14(a)(1)(D)(i) of the Act, full-benefit dual eligible beneficiaries qualify for zero cost-sharing if theywould be institutionalized individuals (or couple) if the individuals (couple) were not receiving home and communitybased services.The partial LIS deductible is increased from the unrounded 2018 value of 83.46, and the maximum copayments fornon-institutionalized FBDE individuals with incomes no greater than 100 percent of the FPL are increased from theunrounded 2018 values of 1.24 for generic/preferred multi-source drugs and 3.73 for all other drugs.These resource limit figures will be updated for contract year 2019. Additionally, these amounts include 1,500 perperson for burial expenses. See the HPMS memorandum titled, “2018 Resource and Cost-Sharing Limits for LowIncome Subsidy (LIS)” for additional details.Source: Announcement of Calendar Year (CY) 2019 Medicare Advantage Capitation Rates and Medicare Advantage and PartD Payment Policies and Final Call Letter. Table V-1. Updated Part D Benefit Parameters for Defined Standard Benefit, LowIncome Subsidy, and Retiree Drug Subsidy, see page 67 and 68[Type here]Page 2[Type here]Revised October 2018[Type here]

Revised October 2018Understanding MedicarePart C & Part D Enrollment PeriodsEnrollment in Medicare is limited to certain times. This publicationhas information about enrolling in Medicare Advantage Plans(Part C) and Medicare Prescription Drug Plans (Part D), includingwho can sign up, when to sign up, and how the timing, includingsigning up late, can affect your costs.Note: For information about signing up for Medicare Part A(Hospital Insurance) and Medicare Part B (Medical Insurance),visit Medicare.gov/publications to view the booklet “Enrolling inMedicare Part A & Part B.”

When can I sign up?There are specific times when you can sign up for a Medicare Advantage Plan(like an HMO or PPO) or Medicare prescription drug coverage, or make changesto coverage you already have: During your Initial Enrollment Period when you first become eligible forMedicare or when you turn 65. See page 3. During certain enrollment periods that happen each year. See page 5. Under certain circumstances that qualify you for a Special Enrollment Period(SEP), like: You move. You’re eligible for Medicaid. You qualify for Extra Help with Medicare prescription drug costs. You’re getting care in an institution, like a skilled nursing facility orlong‑term care hospital. You want to switch to a plan with a 5-star overall quality rating. Qualityratings are available on Medicare.gov.See the charts beginning on page 7 for a list of different SEPs, including rulesabout how to qualify.Note about joining a Medicare Advantage PlanYou must have Medicare Part A and Part B to join a Medicare Advantage Plan.In most cases, if you have End-Stage Renal Disease (ESRD), you can’t join aMedicare Advantage Plan.2

Initial Enrollment PeriodsIf this describes you.You can.At this time.You’re newly eligible forMedicare because you turn 65.Sign up for a MedicareAdvantage Plan (with orwithout prescription drugcoverage) or a MedicarePrescription Drug Plan.During the 7-month periodthat starts 3 months beforethe month you turn 65,includes the month you turn65, and ends 3 months afterthe month you turn 65.If you sign up for a MedicareAdvantage Plan during thistime, you can drop that planat any time during the next12 months and go back toOriginal Medicare.You’re newly eligible forMedicare because you have adisability and you’re under 65.Sign up for a MedicareAdvantage Plan (with orwithout prescription drugcoverage) or a MedicarePrescription Drug Plan.You’re already eligiblefor Medicare because of adisability, and you turn 65. Sign up for a MedicareAdvantage Plan (with orwithout prescription drugcoverage) or a MedicarePrescription Drug Plan. Switch from your currentMedicare Advantage orMedicare PrescriptionDrug Plan to another plan. Drop a MedicareAdvantage or MedicarePrescription Drug Plancompletely.During the 7-month periodthat starts 3 months beforethe month you turn 65,includes the month you turn65, and ends 3 months afterthe month you turn 65.You have Medicare Part Acoverage, and you get Part Bfor the first time by enrollingduring the Part B GeneralEnrollment Period(January 1–March 31).Sign up for a MedicareAdvantage Plan (with orwithout prescription drugcoverage).Between April 1–June 30.Starting 21 months afteryou get Social Security orRailroad Retirement Board(RRB) disability benefits.Your Medicare coveragebegins 24 months after youget Social Security or RRBbenefits. Your chance to signup lasts through the 28thmonth after you get SocialSecurity or RRB benefits.3

Part D late enrollment penaltyThe late enrollment penalty is an amount that’s added to your Part D premium.You may owe a late enrollment penalty if at any time after your Initial EnrollmentPeriod is over, there’s a period of 63 or more days in a row when you don’t havePart D or other creditable prescription drug coverage. Creditable prescription drugcoverage is coverage (for example, from an employer or union) that’s expected topay, on average, at least as much as Medicare’s standard prescription drug coverage.If you have a penalty, you may have to pay it each month for as long as you haveMedicare drug coverage. For more information about the late enrollment penalty,visit Medicare.gov, or call 1-800-MEDICARE (1-800-633-4227). TTY users can call1-877-486-2048.4

Enrollment periods that happen each yearEach year, you can make changes to your Medicare Advantage or Medicare prescriptiondrug coverage for the following year. There are 2 separate enrollment periods each year.See the chart below for specific dates.During this enrollmentperiod.October 15–December 7(Changes will take effect onJanuary 1.)January 1–March 31Medicare Advantage OpenEnrollment Period(You can only make onechange during this period.Changes will take effect thefirst of the month after theplan gets your request.)You can. Change from Original Medicare to a Medicare AdvantagePlan. Change from a Medicare Advantage Plan back to OriginalMedicare. Switch from one Medicare Advantage Plan to anotherMedicare Advantage Plan. Switch from a Medicare Advantage Plan that doesn’t offerdrug coverage to a Medicare Advantage Plan that offers drugcoverage. Switch from a Medicare Advantage Plan that offers drugcoverage to a Medicare Advantage Plan that doesn’t offer drugcoverage. Join a Medicare Prescription Drug Plan. Switch from one Medicare Prescription Drug Plan to anotherMedicare Prescription Drug Plan. Drop your Medicare prescription drug coverage completely. If you’re in a Medicare Advantage Plan (with or without drugcoverage), switch to another Medicare Advantage Plan (withor without drug coverage). Disenroll from your Medicare Advantage Plan and return toOriginal Medicare. If you choose to do so, you’ll be able tojoin a Medicare Prescription Drug Plan. If you enrolled in a Medicare Advantage Plan during yourInitial Enrollment Period, change to another MedicareAdvantage Plan (with or without drug coverage) or go back toOriginal Medicare (with or without drug coverage) within thefirst 3 months you have Medicare.You can’t. Switch from Original Medicare to a Medicare Advantage Plan. Join a Medicare Prescription Drug Plan if you’re in OriginalMedicare. Switch from one Medicare Prescription Drug Plan to anotherif you’re in Original Medicare.5

Special Enrollment PeriodsYou can make changes to your Medicare health and Medicare prescriptiondrug coverage when certain events happen in your life, like if you moveor you lose other insurance coverage. These chances to make changes arecalled Special Enrollment Periods (SEPs) and are in addition to the regularenrollment periods that happen each year. Rules about when you can makechanges and the type of changes you can make are different for each SEP.The SEPs listed on the next pages are examples. This list doesn’t includeevery situation. For more information about SEPs, call 1-800-MEDICARE(1-800-633-4227). TTY users can call 1-877-486-2048.6

Changes in where you liveIf this describes you You can At this time.You move to a new addressthat isn’t in your plan’sservice area.*Switch to a new MedicareAdvantage or MedicarePrescription Drug Plan.If you tell your planbefore you move, yourchance to switch plansbegins the month beforethe month you moveand continues for 2 fullmonths after you move.You move to a new addressthat’s still in your plan’sservice area, but you havenew plan options in your newlocation.* Note: If you’re in a MedicareAdvantage Plan and youmove outside your plan’sservice area, you can alsochoose to return to OriginalMedicare. If you don’t enrollin a new Medicare AdvantagePlan during this SEP, you’ll beenrolled in Original Medicarewhen you’re disenrolled fromyour old Medicare AdvantagePlan.If you tell your planafter you move, yourchance to switch plansbegins the month youtell your plan, plus 2more full months.You move back to the U.S.after living outside thecountry.Join a Medicare Advantage orMedicare Prescription DrugPlan.Your chance to join lastsfor 2 full months afterthe month you moveback to the U.S.You just moved into,currently live in, or justmoved out of an institution(like a skilled nursing facilityor long-term care hospital). Join a Medicare Advantageor Medicare PrescriptionDrug Plan. Switch from your currentplan to another Medi

Texas S5884 143 Humana Humana Preferred Rx Plan (PDP) Basic x 22.50 415.00 No Texas S5884 168 Humana Humana Walmart Rx Plan (PDP) Enhanced 27.80 415.00 No Texas S7126 021 Mutual of Omaha R