Transcription

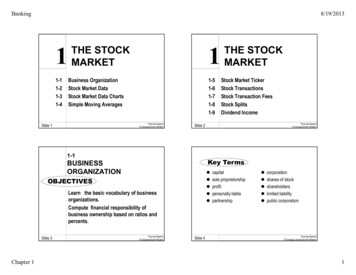

Banking8/19/201311-11-21-31-4THE STOCKMARKET1Business OrganizationStock Market DataStock Market Data ChartsSimple Moving Averages1-51-61-71-81-9Financial Algebra Cengage/South-WesternSlide 1THE STOCKMARKETStock Market TickerStock TransactionsStock Transaction FeesStock SplitsDividend IncomeFinancial Algebra Cengage/South-WesternSlide 21-1Key TermsBUSINESSORGANIZATION OBJECTIVESLearn the basic vocabulary of businessorganizations.Compute financial responsibility ofbusiness ownership based on ratios andpercents.Slide 3Chapter 1Financial Algebra Cengage/South-WesternSlide 4capitalsole proprietorshipprofitpersonally liablepartnership corporationshares of stockshareholderslimited liabilitypublic corporationFinancial Algebra Cengage Learning/South-Western1

Banking8/19/2013How do businesses start? What are common everyday products that you thinksell millions each year? In which type of business do you think an owner’spersonal possessions may potentially be taken in theevent of a lawsuit or a financial crisis? If you owned shares of stock in a public corporation,what would that mean to you in terms of profit andpersonal liability?Financial Algebra Cengage Learning/South-WesternSlide 5CHECK YOUR UNDERSTANDINGKyle invests 20,000 in a partnership that has fiveother partners. The total investment of the partners is 160,000. What percent of the business is owned bythe five other partners?Slide 7Chapter 1Financial Algebra Cengage Learning/South-WesternExample 1Michelle invests 15,000 in a partnership that has fourother partners. The total investment of all partners is 240,000. What percent of the business does Michelleown?Slide 6Financial Algebra Cengage Learning/South-WesternExample 2The total number of shares of stock in the BullsCorporation is 650,000. Mike owns 12% of the shares.How many shares of Bulls Corporation stock does heown?Slide 8Financial Algebra Cengage Learning/South-Western2

Banking8/19/2013CHECK YOUR UNDERSTANDINGJillian owns 60% of the stock in a private cateringcorporation. There are 1,200 shares in the entirecorporation. How many shares does Jillian own?Financial Algebra Cengage Learning/South-WesternSlide 9Financial Algebra Cengage Learning/South-WesternSlide 10CHECK YOUR UNDERSTANDINGEXTEND YOUR UNDERSTANDINGTwo partners are starting a wedding planningbusiness. The total investment is 45,000. Theirinvestments are in the ratio 4:5. How much doeseach investor contribute?Two partners each invest 35% in a startup business.They need to find another investor for the rest of themoney. What percent of the business will that personown? Write a ratio to represent the investments in thebusiness.Slide 11Chapter 1EXAMPLE 3Three partners are investing a total of 900,000 to opena garden and landscaping store. Their investments arein the ratio 2:3:5. How much does the partner thatinvested the least contribute?Financial Algebra Cengage Learning/South-WesternSlide 12Financial Algebra Cengage Learning/South-Western3

Banking8/19/20131-2Key TermsSTOCK MARKET DATA OBJECTIVESUse stock data to follow the dailyprogress of a corporate stock.Write spreadsheet formulas.Slide 13Financial Algebra Cengage/South-WesternWhat stock market data is availableon a daily basis?Chapter 1 volumeSales in 100s52-week high52-week lownet changeafter-hours tradingspreadsheetcellFinancial Algebra Cengage Learning/South-WesternSlide 14Example 1What was the difference between the high andthe low prices on May 5? Where have you heard the word trend used before? How might trends be important when following thestock market? What makes an Internet site credible? Name credible Internet sources for financialinformation. What is a stock trade? Why is net change an important stock statistic?Slide 15stock markettradesNYSENASDAQlastclosehighlowFinancial Algebra Cengage Learning/South-WesternSlide 16Financial Algebra Cengage Learning/South-Western4

Banking8/19/2013CHECK YOUR UNDERSTANDINGWhat was the difference between the high and lowprices on May 12?Financial Algebra Cengage Learning/South-WesternSlide 17CHECK YOUR UNDERSTANDINGOn May 5, what was the actual volume of XYZshares posted? Write the volume in thousands.Slide 19Chapter 1Financial Algebra Cengage Learning/South-WesternExample 2On May 12, what was the actual volume of XYZshares posted? Write the volume in thousands.Slide 18Financial Algebra Cengage Learning/South-WesternEXAMPLE 3At what price did XYZ Corporation close on May 4?Slide 20Financial Algebra Cengage Learning/South-Western5

Banking8/19/2013EXAMPLE 4CHECK YOUR UNDERSTANDINGUse the May 4 closing price from Example 3and the May 5 opening price to find thedifference in prices as a percent increase.Round to the nearest hundredth percent.At what price did XYZ Corporation close on May 11?Financial Algebra Cengage Learning/South-WesternSlide 21CHECK YOUR UNDERSTANDINGUse the May 11 closing price from the previous CheckYour Understanding and the May 12 opening price torepresent the difference as a percent decrease. Roundto the nearest hundred percent.Slide 23Chapter 1Financial Algebra Cengage Learning/South-WesternSlide 22Financial Algebra Cengage Learning/South-WesternEXAMPLE 5On May 6, the XYZ Corporation announced a decreasein earnings. This news caused the price of their stock todrop. It closed at 44.37. Express the net change fromMay 5 to May 6 as a percent.Slide 24Financial Algebra Cengage Learning/South-Western6

Banking8/19/2013CHECK YOUR UNDERSTANDINGOn May 13, the XYZ Corporation announced anotherdecrease in earnings. The price of their stock droppedto close at 45.72. Express the net change from May12 to May 13 as a percent, to the nearest tenth.Spreadsheets D5--D4 D5Financial Algebra Cengage Learning/South-WesternSlide 25EXAMPLE 6CHECK YOUR UNDERSTANDINGWrite a formula for cell F6 to calculate thepercent net change for May 6.Slide 27Chapter 1Financial Algebra Cengage Learning/South-WesternSlide 26Write formulas for cells E6 and F5 in the spreadsheetabove.Financial Algebra Cengage Learning/South-WesternSlide 28Financial Algebra Cengage Learning/South-Western7

Banking8/19/20131-3STOCK MARKET DATACHARTSOBJECTIVESKey Terms stock chart stock bar chart candlestick chartInterpret a stock bar chart.Create a stock bar chart.Interpret a stock candlestick chart.Create a stock candlestick chart.Slide 29Financial Algebra Cengage/South-WesternEXAMPLE 1How can stock data be displayed?Which day had the greatest high price? Whichday had the least low price? What types of data displays have you studied? Are any of these data displays a good fit for the stockmarket data? Why might an investor be interested in historicalinformation about the trading prices and volumes of aparticular stock?Slide 31Chapter 1Financial Algebra Cengage Learning/South-WesternSlide 30Financial Algebra Cengage Learning/South-WesternSlide 32Financial Algebra Cengage Learning/South-Western8

Banking8/19/2013CHECK YOUR UNDERSTANDINGBetween which two days did afterhours trading appearto have the biggest impact on the difference betweenthe closing price and the following day’s opening price?Financial Algebra Cengage Learning/South-WesternSlide 33CHECK YOUR UNDERSTANDINGUse the stock bar chart to write a brief financial storyof the trading action that occurred for Ford MotorCompany on April 28 and April 29. Begin your storywith “On April 28, one share of Ford Motor Companyopened at 8.15. During the day . . . ”Slide 35Chapter 1Financial Algebra Cengage Learning/South-WesternExample 2Approximately how many shares of Ford MotorCompany were traded over the five-day period?Slide 34Financial Algebra Cengage Learning/South-WesternEXAMPLE 3Use the information below to construct a one-day stockbar chart.Open: 40.10Close: 39.79High: 40.65Low: 39.39Volume: 44,500,000Slide 36Financial Algebra Cengage Learning/South-Western9

Banking8/19/2013CHECK YOUR UNDERSTANDINGSuppose that trading was suspended for one entireday for a corporation. What might the stock bar chartlook like?Financial Algebra Cengage Learning/South-WesternSlide 37EXAMPLE 4Candlestick chartsCHECK YOUR UNDERSTANDINGInterpret a green candlestick that is shown as only arectangle with no lines at the top or bottom.Explain the difference between the market action onSeptember 8 compared to September 9 shown in thecandlestick chart for Sept. 7–11.Slide 39Chapter 1Financial Algebra Cengage Learning/South-WesternSlide 38Financial Algebra Cengage Learning/South-WesternSlide 40Financial Algebra Cengage Learning/South-Western10

Banking8/19/2013EXAMPLE 5What was the approximate difference between thehighest price and the lowest price for the week shown inthe candlestick chart for Sept. 7–11?Financial Algebra Cengage Learning/South-WesternSlide 41CHECK YOUR UNDERSTANDINGThe lengths of the candlesticks for September 8and 11 are approximately the same. What doesthis mean about the trading prices on both of thosedays?Financial Algebra Cengage Learning/South-WesternSlide 421-4Key TermsSIMPLE MOVINGAVERAGESOBJECTIVESUnderstand how data is smoothed.Calculate simple moving averages using the arithmeticaverage formula.Calculate simple moving averages using thesubtraction and addition method.Graph simple moving averages using a spreadsheet.Slide 43Chapter 1Financial Algebra Cengage/South-Western Slide 44smoothing techniquessimple moving average (SMA)arithmetic average (mean)lagging indicatorsfast moving averageslow moving averagecrossoverFinancial Algebra Cengage Learning/South-Western11

Banking8/19/2013Example 1How can stock data be smoothed? What factors might contribute to the fluctuation ofstock market prices?Financial Algebra Cengage Learning/South-WesternSlide 45CHECK YOUR UNDERSTANDINGClosing prices for 10 consecutive trading days were 55, 60, 62, 48, 40, 42, 45, 46, 43, and 49.Calculate the 5-day SMA. Plot both the closing pricesand the averages on a graph.Slide 47Chapter 1Financial Algebra Cengage Learning/South-WesternThe closing prices for 10 consecutive trading days for aparticular stock are shown. Calculate the 5-day SMAand plot both the closing prices and the averages on agraph.Slide 46Financial Algebra Cengage Learning/South-WesternExample 2Use the subtraction and addition method to determinethe 4-day SMA for the following closing prices. 121, 122, 120, 119, 124, 128, 126Slide 48Financial Algebra Cengage Learning/South-Western12

Banking8/19/2013CHECK YOUR UNDERSTANDINGEXTEND YOUR UNDERSTANDINGUse the subtraction and addition method to determinethe 3-day SMA for the closing prices 28, 31, 37, 38, and 35.In Example 2, what would the eighth trading day’sclosing price have to be so that the next movingaverage remains the same at 124.25?Slide 49Financial Algebra Cengage Learning/South-WesternGraph simple moving averages using a spreadsheetFinancial Algebra Cengage Learning/South-WesternSlide 50EXAMPLE 3Use a spreadsheet to calculate the 5-day SMA of theclosing prices for 10 consecutive trading days.Slide 51Chapter 1Financial Algebra Cengage Learning/South-WesternSlide 52Financial Algebra Cengage Learning/South-Western13

Banking8/19/2013EXAMPLE 4CHECK YOUR UNDERSTANDINGAdd column D to the spreadsheet to calculate the 3day SMA. In what cell do you start? What formula doyou use?Financial Algebra Cengage Learning/South-WesternSlide 53The graph shows the closing prices for 30 consecutivetrading days. It also charts the 7-day and 21-day simplemoving averages. What signal might the graphs give aninvestor?Financial Algebra Cengage Learning/South-WesternSlide 54CHECK YOUR UNDERSTANDING1-5Suppose that on the 35th trading day, the 21-daySMA graph rises above the 7-day graph. What mightthat indicate?STOCK MARKETTICKEROBJECTIVESUnderstand stock market tickerinformation.Determine the total value of a tradefrom ticker information.Determine trade volumes from tickerinformation.Slide 55Chapter 1Financial Algebra Cengage Learning/South-WesternSlide 56Financial Algebra Cengage/South-Western14

Banking8/19/2013How is stock market datatransmitted to the investor?Key Terms Dow Jones IndustrialAverage (DIJA) ticker stock symbol ticker symbol trading volume trading price directional arrowSlide 57 total value of a trade uptick downtick money flow positive money flow negative money flow daily money flow net money flowFinancial Algebra Cengage Learning/South-WesternExample 1Marcy is following the stock market ticker scrollingacross the bottom of her TV screen on cablebusiness station. She had purchased some sharesof Visa, Inc. last week and is interested in seeing ifthere are any current trades. She knows that Visa,Inc. has the ticker symbol V. She saw the followinginformation: V 12K@87.37 0.12. What can Marcylearn from this line of symbols?Slide 59Chapter 1 Why might an investor be interested in a ticker?Financial Algebra Cengage Learning/South-WesternFinancial Algebra Cengage Learning/South-WesternSlide 58CHECK YOUR UNDERSTANDINGKevin knows that General Electric has the tickersymbol GE. What can Kevin learn from the followingline of symbols: GE 12K@73.72 0.55?Slide 60Financial Algebra Cengage Learning/South-Western15

Banking8/19/2013EXTEND YOUR UNDERSTANDINGHad the trading price of this transaction been at 87.35, what number would have appeared after thedirectional arrow? Explain your answer.Financial Algebra Cengage Learning/South-WesternSlide 61CHECK YOUR UNDERSTANDINGWhat would be the previous day’s close for a share ofCoca-Cola if the ticker had read KO 3K@57 0.25?Slide 63Chapter 1Financial Algebra Cengage Learning/South-WesternExample 2Tom needed money for graduate school tuition. Hecalled his broker and asked her to sell all 3,000 of hisCoca-Cola (KO) shares on Wednesday as soon as thetrading price hit 57 per share. Tom knew that CocaCola closed at 57.25 on Tuesday. How will his tradeappear on the ticker?Slide 62Financial Algebra Cengage Learning/South-WesternEXAMPLE 3Toni purchased 15,000 shares of stock of TargetCorporation at 54.88 per share. Her trade appeared onthe stock ticker as TGT 15K@54.88 0.17. What wasthe total value of her trade?Slide 64Financial Algebra Cengage Learning/South-Western16

Banking8/19/2013CHECK YOUR UNDERSTANDINGSuppose Toni made her purchase at the previousday’s closing price. What would have been thedifference between the values of the trades?Financial Algebra Cengage Learning/South-WesternSlide 65CHECK YOUR UNDERSTANDINGExpress 0.15M shares traded using the K symbol.Slide 67Chapter 1Financial Algebra Cengage Learning/South-WesternEXAMPLE 4Grandpa Rich left his three grandchildren: Nicole, Jeff,and Kristen, 8,750 shares of Apple Inc (AAPL) in hiswill. The grandchildren sold all of the shares at a priceof 190.30 on Friday. The closing price of Apple onThursday was 187.83. How did this trade appear onthe stock ticker?Slide 66Financial Algebra Cengage Learning/South-WesternEXAMPLE 5Laura is interested in trades of Microsoft (MSFT). Shehas been following the upticks and downticks for thepast two days. She knows that MSFT closed onTuesday at 20.68, with a high at 21.25 and a low at 20.50. There were 11,902,000 shares traded on thatday. She found that Monday’s closing price was 21.23.The high was 21.30 and the low was 19.95. Thevolume for Monday was 16,537,000 shares. Was thenet money flow from Monday to Tuesday positive ornegative?Slide 68Financial Algebra Cengage Learning/South-Western17

Banking8/19/2013CHECK YOUR UNDERSTANDING1-6Let H represent a day’s High, L represent a day’sLow, C represent a day’s close, and V represent theday’s volume. Write a formula that can be used todetermine the day’s money flow.STOCKTRANSACTIONSOBJECTIVESLearn the basic vocabulary of buyingand selling shares of stock.Compute gains and losses from stocktrades.Financial Algebra Cengage Learning/South-WesternSlide 69What is a stock portfolio?Key Terms Slide 71Chapter 1Financial Algebra Cengage/South-WesternSlide 70portfolioround lotodd lottradegross capital gaingross capital loss What does the term “portfolio” mean For an artist? For a student preparing for college? For the financial world?Financial Algebra Cengage Learning/South-WesternSlide 72Financial Algebra Cengage Learning/South-Western18

Banking8/19/2013Example 1Several years ago, Marlene purchased stock for 7,241.Last week she sold the stock for 9,219. What was hergross capital gain?Slide 73Financial Algebra Cengage Learning/South-WesternExample 2Five years ago, Jessica bought 300 shares of acosmetics company’s stock for 34.87 per share.Yesterday she sold all of the shares for 41 pershare. What was her capital gain?Slide 75Chapter 1Financial Algebra Cengage Learning/South-WesternCHECK YOUR UNDERSTANDINGBrett used money he received as a gift for high schoolgraduation to purchase 4,000 worth of shares ofstock. After he graduated from college, he neededmoney to buy a car, so he sold the stock for 2,433.What was his capital gain or loss?Financial Algebra Cengage Learning/South-WesternSlide 74CHECK YOUR UNDERSTANDINGKelvin bought 125 shares of stock for 68.24 pershare. He sold them nine months later for 85.89 pershare. What was his capital gain?Slide 76Financial Algebra Cengage Learning/South-Western19

Banking8/19/2013EXAMPLE 3EXTEND YOUR UNDERSTANDINGRandy paid 3,450 for shares of a corporationthat manufactured cell phones. He sold it for 6,100. Express his capital gain as a percent ofthe original purchase price. Round to the nearesttenth of a percent.Three years ago, Maxine bought 450 shares ofstock for x dollars per share. She sold them lastweek for y dollars per share. Express her capitalgain algebraically in terms of x and y.Financial Algebra Cengage Learning/South-WesternSlide 77CHECK YOUR UNDERSTANDINGAllison bought shares in Citigroup Corporation in early2007 for 55 per share. She sold them later that yearfor 35 per share. Express her loss as a percent ofthe purchase price. Round to the nearest percent.Slide 79Chapter 1Financial Algebra Cengage Learning/South-WesternSlide 78Financial Algebra Cengage Learning/South-WesternEXAMPLE 4Andy paid w dollars for shares of a corporation thatmanufactured cell phones. He sold it for y dollars.Express his capital gain as a percent of the originalpurchase price. Round to the nearest tenth of a percent.Slide 80Financial Algebra Cengage Learning/South-Western20

Banking8/19/2013CHECK YOUR UNDERSTANDING1-7Linda bought 800 of stock in a garden equipmentcorporation. The selling price is x dollars. Express thepercent increase of Linda’s potential capital gainalgebraically.STOCK TRANSACTIONFEESOBJECTIVESCompute the fees involved in buyingand selling stocks.Become familiar with the basicvocabulary of stock trading.Financial Algebra Cengage Learning/South-WesternSlide 81Slide 83Chapter 1Financial Algebra Cengage/South-WesternHow do you buy and sell stock?Key Terms Slide 82stockbrokerbroker feecommissiondiscount brokerat the marketlimit ordernet proceeds How has the Internet changed the way stock istraded?Financial Algebra Cengage Learning/South-WesternSlide 84Financial Algebra Cengage Learning/South-Western21

Banking8/19/2013Example 1Lee made two trades through his online discountbroker, We-Trade. We-Trade charges a fee of 12 pertrade. Lee’s first purchase was for 3,456 and hissecond purchase, later in the day, was for 2,000. Howmuch did he spend on the day’s purchases, includingbroker fees?Financial Algebra Cengage Learning/South-WesternSlide 85Example 2CHECK YOUR UNDERSTANDINGGarret made two trades in one day with his discountbroker that charges 7 per trade. Garret’s firstpurchase was for 1,790 and his second purchasewas for 8,456. How much did he spend includingbroker fees?CHECK YOUR UNDERSTANDINGJared has a portfolio worth 500,000. He made 10telephone trades during the past year, buying andselling 50,000 worth of stock. What was his totalbroker fee for the year? Express his total broker feealgebraically if Jared had made b automatedtelephone trades.Adriana purchased 7,000 worth of stock from abroker at Tenser Brokerage. The current value ofAdriana’s portfolio is 11,567. What broker feemust she pay?Slide 87Chapter 1Financial Algebra Cengage Learning/South-WesternSlide 86Financial Algebra Cengage Learning/South-WesternSlide 88Financial Algebra Cengage Learning/South-Western22

Banking8/19/2013EXAMPLE 3Erin purchased 23,510 worth of stock and paid herbroker a 1% broker fee. She sold when the stock priceincreased to 27,300, and used a discount broker whocharged 21 per trade. Compute her net proceeds.Slide 89Financial Algebra Cengage Learning/South-WesternEXAMPLE 4Johan purchased stock six years ago for x dollars andpaid a 2% broker fee. He sold that stock yesterday fory dollars and paid a discount broker 35 for the sale.Express his net proceeds algebraically.Slide 91Chapter 1Financial Algebra Cengage Learning/South-WesternCHECK YOUR UNDERSTANDINGYolanda purchased stock for 7,000 and paid a 1.5%broker fee. She sold it for 6,325 and paid a 0.5%broker fee. Compute her net proceeds.Financial Algebra Cengage Learning/South-WesternSlide 90CHECK YOUR UNDERSTANDINGRob purchased stock for p dollars and paid a flat 40broker fee. Rob needed money for a homeimprovement so he sold it at a loss, for h dollars, plusa 1% broker fee. Express his net proceedsalgebraically.Slide 92Financial Algebra Cengage Learning/South-Western23

Banking8/19/20131-8Key TermsSTOCK SPLITS OBJECTIVESCalculate the post-split outstanding sharesand share price for a traditional split.Calculate the post-split outstanding sharesand share price for a reverse split.Calculate the fractional value amount that ashareholder receives after a split.Slide 93Financial Algebra Cengage/South-WesternWhy do corporations split stocks? What are some reasons a stock might split? How do you think the perception of changemight lead to an increase in sales and marketprices?Slide 95Chapter 1Financial Algebra Cengage Learning/South-WesternSlide 94stock splitoutstanding sharesmarket capitalization or market captraditional stock splitreverse stock splitpenny stockfractional part of a shareFinancial Algebra Cengage Learning/South-WesternExample 1On December 4, John Deere Corporation (DE)instituted a 2-for-1 stock split. Before the split, themarket share price was 87.68 per share and thecorporation had 1.2 billion shares outstanding. Whatwas the presplit market cap for John Deere?Slide 96Financial Algebra Cengage Learning/South-Western24

Banking8/19/2013CHECK YOUR UNDERSTANDINGA corporation has a market capitalization of 24,000,000,000 with 250M outstanding shares.Calculate the price per share.Financial Algebra Cengage Learning/South-WesternSlide 97CHECK YOUR UNDERSTANDINGQualComm, Inc. instituted a 4-for-1 split in November.After the split, Elena owned 12,800 shares. How manyshares had she owned before the split?Slide 99Chapter 1Financial Algebra Cengage Learning/South-WesternExample 2What was the post-split number of shares outstandingfor John Deere?Slide 98Financial Algebra Cengage Learning/South-WesternEXAMPLE 3What was the post-split market price per share forJohn Deere in Example 1? How many shares areoutstanding? Did the market cap change after thesplit?Slide 100Financial Algebra Cengage Learning/South-Western25

Banking8/19/2013CHECK YOUR UNDERSTANDINGIn October, Johnson Controls, Inc instituted a 3-for-1split. After the split, the price of one share was 39.24. What was the pre-split price per share?Slide 101Financial Algebra Cengage Learning/South-WesternCHECK YOUR UNDERSTANDINGA major drugstore chain whose stocks are tradedon the New York Stock Exchange was consideringa 2-for-5 reverse split. If the pre-split market capwas 1.71B, what would the post-split market capbe?Slide 103Chapter 1Financial Algebra Cengage Learning/South-WesternEXAMPLE 4On October 15, Palm, Inc. instituted a 1-for-20 reversestock split. Before the split, the market share price was 0.64 and there were 580,000,000 shares. What wasthe post-split share price and number of shares?Slide 102Financial Algebra Cengage Learning/South-WesternEXTEND YOUR UNDERSTANDINGSuppose that before a stock split, a share was sellingfor 2.35. After the stock split, the price was 7.05 pershare. What was the stock-split ratio?Slide 104Financial Algebra Cengage Learning/South-Western26

Banking8/19/2013EXAMPLE 5Steve owned 942 shares of Graham Corporation. OnJanuary 3, a 5-for-4 split was announced. The stockwas selling at 56 per share before the split. How wasSteve financially affected by the split?Financial Algebra Cengage Learning/South-WesternSlide 105Financial Algebra Cengage Learning/South-WesternSlide 106Key TermsDIVIDEND INCOME Understand the concept of shareownerssplitting the profit of the corporation theyown.Compute dividend income.Compute the yield for a given stock.Compute the interest earned on corporatebonds.Chapter 1Gabriella owned 1,045 shares of Hollow Corporationat a price of 62.79. The stock split 3-for-2. How wasGabriella financially affected by the split?1-9OBJECTIVESSlide 107CHECK YOUR UNDERSTANDINGFinancial Algebra Cengage/South-WesternSlide 108dividenddividend incomeincome stockyieldgrowth stock preferred stockcommon stockcorporate bondface valuematuresFinancial Algebra Cengage Learning/South-Western27

Banking8/19/2013If shareholders own a corporation, are theyentitled to some of the profits? Corporations reinvest part of their profits intonew products and services. Do you think this is agood business strategy?Slide 109Financial Algebra Cengage Learning/South-WesternCHECK YOUR UNDERSTANDINGJacques purchased x shares of a corporation thatpays a y dollar annual dividend. What is his annualdividend income, expressed algebraically?Slide 111Chapter 1Financial Algebra Cengage Learning/South-WesternExample 1Roberta is considering purchasing a common stockthat pays an annual dividend of 2.13 per share. Ifshe purchases 700 shares for 45.16 per share, whatwould her annual income be from dividends?Slide 110Financial Algebra Cengage Learning/South-WesternExample 2Elyse owns 2,000 shares of a corporation that pays aquarterly dividend of 0.51 per share. How much shouldshe expect to receive in a year?Slide 112Financial Algebra Cengage Learning/South-Western28

Banking8/19/2013CHECK YOUR UNDERSTANDINGMonique owns x shares of stock. The quarterlydividend per share is y dollars. Express Monique’sannual dividend amount algebraically.Slide 113Financial Algebra Cengage Learning/South-WesternCHECK YOUR UNDERSTANDINGYou bought x shares of a stock for y per share. Theannual dividend per share is d. Express the percentyield algebraically.Slide 115Chapter 1Financial Algebra Cengage Learning/South-WesternEXAMPLE 3Kristen owns common stock in Max’s Toy Den. Theannual dividend is 1.40. The current price is 57.40per share. What is the yield of the stock to the nearesttenth of a percent?Slide 114Financial Algebra Cengage Learning/South-WesternEXAMPLE 4One share of BeepCo preferred stock pays an annualdividend of 1.20. Today BeepCo closed at 34.50 witha net change of 0.50. What was the stock’s yield atyesterday’s closing price?Slide 116Financial Algebra Cengage Learning/South-Western29

Banking8/19/2013CHECK YOUR UNDERSTANDINGOne share of Skroy Corporation stock pays an annualdividend of 1.55. Today Skroy closed at x dollars witha net change of 0.40. Express the yield at yesterday’sclose algebraically.Slide 117Financial Algebra Cengage Learning/South-WesternCHECK YOUR UNDERSTANDINGA corporation was paying a 2.10 annual dividend.The stock underwent a 3-for-2 split. What is the newannual dividend per share?Slide 119Chapter 1Financial Algebra Cengage Learning/South-WesternEXAMPLE 5A stock paid an annual dividend of 2.14. The stocksplit 2-for-1. What is the annual dividend after the split?Slide 118Financial Algebra Cengage Learning/South-WesternEXAMPLE 6Adam bought a 1,000 corporate bond in the LabateCorporation. The bond pays 5.7% interest per year.How much does Adam receive in interest each yearfrom this bond?Slide 120Financial Algebra Cengage Learning/South-Western30

Banking8/19/2013CHECK YOUR UNDERSTANDINGIf Adam holds the bond from Example 6 for 11 years,how much will he receive in total interest?Slide 121Chapter 1Financial Algebra Cengage Learning/South-Western31

STOCK MARKET TICKER Understand stock market ticker information. Banking