Transcription

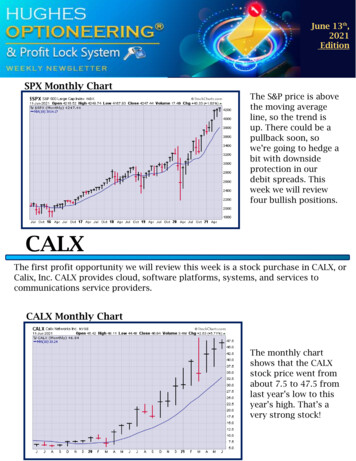

June 13th,2021EditionSPX Monthly ChartThe S&P price is abovethe moving averageline, so the trend isup. There could be apullback soon, sowe’re going to hedge abit with downsideprotection in ourdebit spreads. Thisweek we will reviewfour bullish positions.CALXThe first profit opportunity we will review this week is a stock purchase in CALX, orCalix, Inc. CALX provides cloud, software platforms, systems, and services tocommunications service providers.CALX Monthly ChartThe monthly chartshows that the CALXstock price went fromabout 7.5 to 47.5 fromlast year’s low to thisyear’s high. That’s avery strong stock!

The daily chart shows thatCALX hit its high for theyear in March. It’s beengoing sideways since then.Sideways trading in a bulltrend is usually followedby a further advance.CALX Daily ChartWe recommend buyingCALX stock at the currentprice level.AAPLThe next profit opportunity we will review today is a Call Option Purchase in AAPL,or Apple Inc. AAPL is engaged in designing, manufacturing, and marketing mobilecommunication and media devices, personal computers, and music players.AAPL Monthly ChartThe monthly chartshows that AAPL wentalmost straight upfrom this year’s lowuntil this year’s high.The current pause isexpected to befollowed by a furtheradvance.

The daily chart for AAPL shows a pullback to the March low followed by a rallyand a pullback to the May low. Now the bulls appear to be back in control. Thenext target is above the April high.AAPL Daily ChartWe will first look at selectinga call option strike forpurchasing an AAPL calloption. AAPL is currentlytrading at 127.35. Let’s lookat buying the August 20 110strike call. The August 20options expire in 68 days.We will analyze this optionusing the Optioneering CallOption Purchase Calculator.The Call Option Purchase calculator will calculate the profit potential for a call optionpurchase trade based on the price change in the underlying stock/ETF at optionexpiration in this example from a 12.5% increase in stock price to a flat stock price.We developed what we call the 1% Rule to help us select an option strike price. The 1%rule says to limit the time value portion of the option to less than 1% of the stockprice. If you limit the time value portion of an option to 1%, the stock price onlyhas to move down 1% for the put to breakeven and start profiting.The calculator will also calculate the time value portion of an option. With this optionpurchase, the time value is 0.95 points (boxed in red). The time value of 0.95 is lessthan 1% of the 127.35 stock price, so this strike price qualifies under the 1% Rule.The second row fromBuy to Open the AAPL August 20 110-Strike Call bottom of the calculatorlists the dollar profitpotential. The bottom rowlists the percent returnprofit potential. We can seethat if the AAPL stock priceincreases by 1% (boxed ingreen) at option expiration,a 1.8% profit will berealized. This confirms the1% Rule of profiting withonly a 1% increase in thestock price.

There is no limit on theprofit potential of calloption purchases if theunderlying stock continuesto increase in price. If theAAPL stock price increasesby 10% between now andoption expiration, the CallOption PurchaseCalculator shows that the110-Strike Call will realizea 64.4% or 1,179 profit(boxed in green).Buy to Open the AAPL August 20 110-StrikeCall\\On the other hand, if AAPL is flat at 127.35 on option expiration, the 110-Strike Callwill only lose -5.2% or - 95. If we bought an at the money or out of the money optionand the stock price was flat at option expiration it could result in a 100% loss.Remember, if you purchase an at the money or out of the money strike call option andthe underlying stock/ETF is flat or down at option expiration, it could result in a 100%loss for your option trade! Using the 1% Rule to select an option strike price willincrease your percentage of winning trades compared to trading at the money or out ofthe money strike calls. This higher accuracy can make you a more successful trader.We recommend buying the AAPL August 20 110-Strike Call at current prices.LOVEThe next profit opportunity we will consider this week is in LOVE, or The LovesacCompany. LOVE retails home furnishing products. The patented furniture model ofLovesac is known as the ‘Sactional’ which can be combined in different varieties withSeat or Side pieces.LOVE Monthly ChartThe monthly chart showsthat LOVE has been in astrong, steady bull trendsince April 2020. A furtheradvance is expected.

LOVE Daily ChartThe daily chart shows thatLOVE hit a new record highlast month. A new record highis a positive sign for the bulls.We are going to review a calldebit spread for LOVE.Traders who want a moreleveraged approach can buyLOVE calls.Buy to Open the LOVE July 16 75-Strike CallSell to Open the LOVE July 16 85-Strike CallWe can see from this calloption spread analysis thatif the LOVE stock pricedeclines by -5%, remainsflat, or increases in pricewhen the options expire,the spread will make a 55%or 355 profit. If LOVE isdown -7.5% at expiration,the profit will be 47.8% or 309.TQQQThe last profit opportunity we will review is in TQQQ, or the ProShares UltraProQQQ ETF. TQQQ seeks daily investment results, before fees and expenses, thatcorrespond to three times (3x) the daily performance of the NASDAQ-100 Index.

TQQQ Monthly ChartThe monthly chart showsthat the TQQQ ETF pricewent from about 15 at lastyear’s low to over 110 inMarch. That’s a strong ETF!TQQQ Daily ChartThe daily chart shows thatTQQQ hit a new record highlast month. A new recordhigh is a positive sign for thebulls.We are going to review a calldebit spread for TQQQ.Traders who want a moreleveraged approach can buyTQQQ calls.We can see from the CallOption Spread AnalysisCalculator that this trade willmake a 30.7% or 235 profit ifTQQQ declines by -2.5%,remains flat, or increases inprice when the options expire.If TQQQ is down -5% atexpiration, the profit will be27.6% or 211. If TQQQ is down-7.5% when the options expire,we will lose -8.1% or - 62.Buy to Open the TQQQ July 16 94-Strike CallSell to Open the TQQQ July 16 104-Strike Call

This week we recommended the following:Buy CALX StockBuy to Open the AAPL August 20 110-Strike CallBuy to Open the LOVE July 16 75-Strike CallSell to Open the LOVE July 16 85-Strike CallBuy to Open the TQQQ July 16 94-Strike CallSell to Open the TQQQ July 16 104-Strike CallNote: Profit performance displayed in this newsletter does not includecommission cost.Good Trading andwe’ll see you nextweek!

Sideways trading in a bull trend is usually followed by a further advance. LUV Daily Chart As we said above, we want to buy a call in LUV. We will first look at selecting a call option strike price for purchasing a LUV call Option. LUV is currently trading at 61.46. Let’s look at buying the LUV July 16 52.5-strike call. The July 16 options expire in 46 days. The Call Option Purchase .File Size: 854KBPage Count: 7