Transcription

Jump Start Loan ProgramFinancial Development CorporationPolicy ManualLatest Revision August 2020CalCAP Small Business Program Lender Manual0

Version August 2020TABLE OF CONTENTSI.At-a-Glance . 1II.Jump Start Participation Requirements . 2III. Making a Jump Start Loan . 3IV. Documentation, Disbursements, & Retention . 8A. Documentation . 8B. Disbursements . 8C. Retention Period . 8V. Default & Liquidation on a Jump Start Loan . 9A. Overview . 9VI. Reporting Requirements . 10B.C.D.E.Monthly Remittance of Loan Payments . 10Monthly Reporting. 12Annual Reporting . 14Change in FDC Points of Contact . 15VII. Low-Wealth Criteria . 16A. Average Annual Per Capita Income by County (including State Average) . 16B. Unemployment Rate by County (including State Average) . 18C. Unemployment Rate by City and County. 19VIII. Directives and Requirements . 41A. IBank Jump Start Loan Program Directives and Requirements . 41B. Corporations Code . 52C. California Small Business Financial Assistance Act of 2013 . 58IBank Jump Start Program FDC Policy Manual

I. AT-A-GLANCEThis Jump Start Loan Program (Jump Start) Financial Development Corporation (FDC) PolicyManual provides instructions, examples, directives and requirements for initiating loans andmanaging defaults in the Jump Start program that is managed by FDCs that are approved byIBank to participate in the Jump Start Program (Jump Start FDC).Jump Start FDCs are to use this manual as procedures for the Jump Start program, and tofrequently visit IBank’s Small Business Finance Center (SBFC) website enter/ for the most current version of themanual, updated forms, and latest directives and requirements. Jump Start FDCs should alsoensure IBank is kept informed of changes to the Jump Start FDC’s primary Jump Start FDCcontact information.Jump Start Loan ProgramLoan TypeTerm Loans from 500- 10,000EligibilitySmall Businesses in Low-Wealth CommunitiesInterest & FeesPayable by Borrower:Interest Rate: Prime 5%FDC Fee: 3% of Loan Principal AmountReportingMonthly:Jump Start Monthly ReportVia Email: SBFC@ibank.ca.govContactSmall Business Finance Center(916) 341-6600 – .ftmIBank Jump Start Program FDC Policy Manual1

II. JUMP START PARTICIPATION REQUIREMENTSJump Start is a loan and financial literacy/technical assistance program targeted for smallbusinesses in low-wealth communities. By targeting only low-wealth communities, the goal isto enable more small businesses to start, grow, and sustain their businesses, and make minimicro-loans (Loans) available to low-wealth entrepreneurs, including low-wealth businessesowned by women, minorities, veterans, persons with disabilities, and persons previouslyincarcerated. Must be a small business, or individual(s) becoming a smallbusiness, licensed in California. Located in a low-wealth community:oBusiness RequirementsJump Start is available only in a community located inboth:o a county within California with a per capita personalincome equal to or less than 115% of statewideaverage per capita incomeo a city or unincorporated area within such countywith an unemployment rate equal to or greater thanthe statewide average unemployment rate Low-wealth individual is defined as: businesses owner(s) withannual income equal to or less than the statewide average percapita income Loan proceeds must be used in the State of California 10,000 maximum loan(s) amount per business 500 minimum loan amount per business Term of up to 5-years, fully amortized Eligible use of loan proceeds may include:Authorized Loan Typesor UsesoStart-Up and Ongoing CostsoAcquisition or leasing of; real property, buildings,machinery, equipment and inventoryoConstruction or repair of: buildings, machinery andequipment, tenant ImprovementsoJump Start FeesoWorking capital, debt refinance Ineligible use of loan proceeds may include: Interest Rate & Fees Interest Rate: Prime 5%oPrime Rate is determined by the rate listed in theWall Street Journal on the date of the Jump StartLoan commitmentJump Start Fee: 3% of Loan Principal AmountIBank will not accept an individual as the borrower, unless the proceeds of the JumpStart Loan are used to establish a business by that individual. It is permissible for anindividual to be a guarantor on a Jump Start Loan.IBank Jump Start Program FDC Policy Manual2

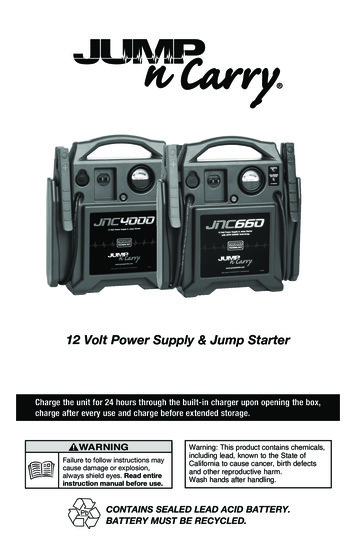

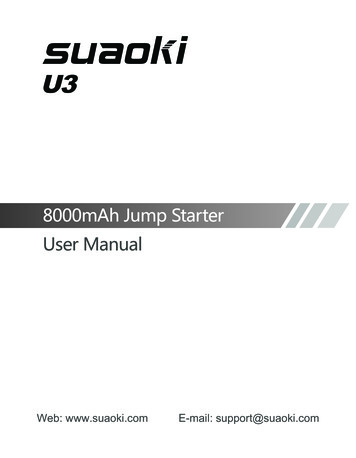

III.MAKING A JUMP START LOANJump Start FDC’s will contract with IBank and adhere to standardized credit underwriting,and provide loan disbursement, servicing, financial literacy training and technical assistanceto Jump Start Borrowers. Borrower must score 8 points based on the point system displayedbelow:1 PointCreditChallenged or NoHistory2 PointsChallenged History AdequateJustification3 PointsPositive HistoryCollateralNone to 49% ofloan amount50%- 99% of loanamount100% of loanamountCash flow1.0 DSCR1.2 DSCR1.3 DSCRTechnicalAssistance2 - 4 hours4.5 - 7 hours7.5 hoursIndustryExperience0 - 2 yearsover 2 - 4 yearsover 4 yearsTotal PointsCredit: No minimum credit score is required. However, the borrower’s credit report mustreflect a responsible payment history. Exceptions can be made with adequate justification.Credit that does not reflect responsible payment history and does not have adequatejustification shall be declined.Collateral: UCC -1 filing on all business assets including a first lien position on any purchasedequipment and inventory funded with the Loan. Personal property may also be held ascollateral, if appropriate. Personal guarantees are required from all individuals with a 20% orgreater ownership share of the business.IBank Jump Start Program FDC Policy Manual3

Cash Flow: The borrower must be able to demonstrate the ability to service the proposeddebt with business and/or personal revenue. Standardized cash flow and debt servicecalculations are as follows:Revenue- ExpensesNet Profit Interest Expense Depreciation/Amortization Non-Recurring Expenses- Living ExpensesAvailable to Service DebtExisting Debt ServiceProposed Debt ServiceTotal Debt ServiceDebt Service Coverage RatioDocuments required from borrowers and guarantors: One year of tax returns Signed 4506T IRS Personal financial statement (Self-prepared accepted)Technical Assistance: The borrower must complete a minimum of 2 hours of technicalassistance within 6 months of receiving the Jump Start Loan. Eligible technical assistancemay be provided by the Jump Start FDC or other entity deemed qualified by the Jump StartFDC. Prior to the loan, borrowers are required to capture, in writing, their business conceptincluding descriptions of their management team, a marketing plan, and the business financialprojections. These concepts may include: identifying potential customers; strategies toengage customers; business goals and objectives; management organization with identifiedkey decision makers; resumes of key managers; and planned pricing of product or service.Industry Experience: Points are awarded based on the years of experience possessed bythe borrower in the industry of the business.IBank Jump Start Program FDC Policy Manual4

Completing the Jump Start Program Credit Memo:In addition to the information listed in the Sample Credit Memo, the following issues are to beclearly identified and fully explained in the narrative portion of the Credit Memo: Business Overview including but not limited to:o Borrower contact informationo Guarantor contact information (if applicable)o Loan Terms (amount requested, term in months, interest rate, maturity date)o Fees/Payment Schedule (individual and total fees, repayment terms,amortization, monthly and annual payments)o Employment data (Jobs created and retained as a result of the Loan)o Loan purpose (use of requested funds)o Management & experience Narrative components of the underwriting matrixo Credito Collateralo Cash Flowo Technical Assistanceo Industry Experience Recommendation President/CEO approval, signature and dateIBank Jump Start Program FDC Policy Manual5

Sample Credit MemoIBank Jump Start Program FDC Policy Manual6

IBank Jump Start Program FDC Policy Manual7

IV.DOCUMENTATION, DISBURSEMENTS, & RETENTIONA. DocumentationPrior to disbursement of Jump Start funds: the Jump Start Loan must be reviewed andapproved by the FDC’s Board of Directors or by the Jump Start FDC’s loan committee, FDCPresident, Executive Director or Chief Credit Officer approved by the FDC’s Board ofDirectors; and the loan documents must be executed by the Jump Start FDC and theborrower(s). Jump Start FDCs must submit to IBank the following fully completed, signed,and dated required Loan documentation with each Jump Start Loan.Jump Start Loan documents must be received at IBank within 7 business days ofthe disbursement of funds to the borrower. Documents shall be sent to the SBFC’semail at the following address: SBFC@IBank.CA.GovJump Start Loan documents are generated through D&H LaserPRO and may include:1.2.3.4.5.6.7.8.9.Promissory NoteBusiness Loan AgreementCommercial Security AgreementUCC Financing StatementAgreement to Provide InsuranceNotice of Insurance RequirementsDisbursement Request and AuthorizationNotice of Final AgreementAmortization ScheduleB. DisbursementsRequests for disbursement must be sent to SBFC@IBank.CA.GOV and include the following: Borrower Name Disbursement Amount (must be same as loan amount) Instructions for Disbursement as outlined in the Disbursement AuthorizationC. Retention PeriodJump Start FDC must retain all financial records and supporting documents for at least fouryears from the date the Jump Start Loan is paid in full or, if the Jump Start Loan is in defaultof payment, for at least seven years after the payment default or last recovery paymentreceived.IBank Jump Start Program FDC Policy Manual8

V.DEFAULT & LIQUIDATION ON A JUMP START LOANA. OverviewJump Start FDC’s are to manage defaults pursuant to IBank’s Jump Start Loan DefaultProcedures as outlined in Section § 5026 and Jump Start Loan Liquidation as displayed inSection § 5027 of IBank’s Jump Start Directives and Requirements: The Jump Start FDC will provide IBank with written notice that a paymentdefault has occurred within 14 days. Jump Start FDC’s are to followdefault procedures. The FDC will arrange a meeting with the Jump Start Borrower upon apayment default occurrence to resolve the default. Actions taken by theFDC’s may include with the written approval of IBank, but are not limitedto, the following:oDeferment of principal payment(s)oRe-amortization of or rescheduling the payment(s) on the loanoReorganizationoAdditional collateraloChanges in the interest rateDEFAULTIf the Jump Start FDC is unable to resolve the payment default as approved by IBankwithin 30 days of the default notice received by IBank, then the FDC may beginliquidation procedures. LIQUIDATION The Jump Start FDC must create a liquidation plan and submit it to IBankfor approval.The Jump Start FDC must take the steps specified by the liquidation planfor the liquidation of the Jump Start Loan. Unless the Jump Start FDCreceives objections from IBank to the liquidation plan within 14 days ofsubmitting it to IBank, the plan will be deemed approved by IBank withoutany further action by the Jump Start FDC.If the Jump Start FDC receives objection to the plan from IBank within the14 days, IBank and the Jump Start FDC will negotiate a liquidation planwhere there is mutual acceptance. Liquidation recoveries received for theJump Start Loan will be applied in the following order of priority: ooo Pay liquidation costs approved by IBankPay principalPay interestThe Jump Start FDC will not initiate any legal action without the priorwritten approval of IBankIBank Jump Start Program FDC Policy Manual9

VI.REPORTING REQUIREMENTSA. OverviewJump Start FDCs are contractually required to regularly report to IBank on the status of JumpStart Loans made under the Jump Start Program. Each Jump Start FDC participating in theJump Start Program will be required to provide monthly reports on their activities in theprogram and will be examined annually by IBank for purposes of determining compliance withthe requirements of the Jump Start Program.The reports are required to be submitted as follows:ReportsReporting FrequencyMonthlyAnnualArticles of Incorporation & Bylaws from Prior Fiscal Year Audited Financial Statements Board Approved FDC Budget for Current Fiscal Year FDC Strategic Plan or Plan of Operation Full FDC Staff RosterProjected Fiscal Year Summary of Authorized ProgramActivities Methodology for Expense Reimbursement Monthly Report of Loan ActivityMonthly Report of Technical AssistanceMonthly Report of Administrative ExpendituresMonthly Remittance of Loan Payments B. Monthly Remittance of Loan PaymentsLoan payments collected from Jump Start borrowers are to be remitted to the Trustee Bankon a monthly basis.These payments shall include: 100% of the principal payment made by the borrower in the previous month 60% of the interest payment made by the borrower in the previous monthA detailed itemization of the payments being remitted shall be sent to the Trustee Bankwith remittance and a copy sent electronically to IBank.IBank Jump Start Program FDC Policy Manual10

Monthly Remittance of Loan Payments are due to the Trustee Bank with anelectronic copy to IBank by the 15th of the following month.Sample Remittance LetterIBank Jump Start Program FDC Policy Manual11

C. Monthly Reporting.Initial ReportInitial ReportMonthly ReportThe Jump Start Monthly Report is due electronically to IBank by the 15th of thefollowing month.Field:Information Needed: Loan Number Unique Jump Start loan number associated with the borrower’s loan Borrower Name Name of business requesting the loan Loan Date Date loan is executed Loan Amount List the full amount of the term loan Scheduled MonthlyPayment Monthly dollar amount due to IBank based on amortization schedule Interest Payment fromBorrower Amount applied to interest payment determined by the interest rate onthe loan Principal Payment fromBorrower Amount applied to the principal owed on the loan Total Payment fromBorrower Payment consisting of principal and interest amounts Interest Payment toSBFC 60% of interest payment paid by the borrower, to be remitted to SBFC Principal Payment toSBFC 100% of principal payment paid by the borrower, to be remitted toSBFC Total Payment to SBFC Total amount remitted to IBank’s SBFC Outstanding Balance Amount of unpaid principal balance of the loan Payment is Current All payments are paid in full for the billing cycle Secured Loan where the borrower pledges an asset Default Failure to fulfill the loan obligation Number of days indefault Days elapsed since last full payment Default Amount (A) Amount of principal owed at time of defaultIBank Jump Start Program FDC Policy Manual12

Default RecoveryAmount (B) Amount of default recovery Loan Loss ( A – B) Amount of principal funds outstanding on loan Training Hours PostLoan Training hours after loan was established Notes Space to add pertinent information about the loan that month, ifapplicable. Training Hours Pre-Loan Training hours before loan was established Interest Rate Enter the interest rate for the loan Maturity Date Due date on which the installment loan will be paid in full Use ofProceeds/Purpose Use of the dollar amount for the business Full Time Equivalents(FTEs) Number of full time equivalent (FTE) employees of the business—rounded to the nearest whole number. Must be a minimum of 1 andcannot exceed 750. Refer to the FDC Tools & Tips on IBank website for instructions onhow to report the number of FTEs. Jobs Created Number of jobs created for the business as a result of the Loan. Count each person, full or part time. If jobs are not created as a result of the loan, use “0”. Jobs Retained Number of jobs retained for the business as a result of the Loan. Count each person, full or part time. If jobs are not retained as a result of the Loan, use “0”. If enrolling multiple Loan for a business, only enter information forfirst enrolled loan, unless the jobs retained increases as a result ofadditional Jump Start Loans. NAICS Code Six digit number used by the North American Industry ClassificationSystem (NAICS) to categorize business types. http://www.census.gov/eos/www/naics/ Ethnicity Select from drop down menu on report Gender Select from drop down menu on report Veteran A person who has served in the United States Armed Services Disabled Previously Incarcerated Previously incarcerated/jailed Business Age Age of business (in months) since inception (0 for new business) Business Legal Structure Sole proprietorship, partnership, corporation Annual BusinessRevenue List the borrower’s annual business revenues for the last fiscal year—rounded to the nearest whole dollar amount.Any person who has a physical or mental impairment thatsubstantially limits one or more major life activities; has a record ofsuch impairment; or is regarded as having such an impairment If the business is a start-up, use the current income or 0.IBank Jump Start Program FDC Policy Manual13

Personal Income List the borrower’s income that qualifies them as a low-wealth individual Credit Score Borrower credit score Business Type Industry type by name i.e. hair salon Business Address Location where business is located and loan funds are used City City where business is located County County where business is located Zip Code Zip Code where business is located Census Tract # 11-digit number (no decimal point) used to identify the specificlocation of a business to provide more reporting consistency anduniformity. http://www.ffiec.gov/Geocode/default.aspx Senate District Territorial district of location of business where a senator is elected Assembly District Territorial district of location of business where the assembly is electedD. Annual ReportingCalifornia Government Code Chapter 6 - Small Business Financial Assistance Act of 2013,Article 11 Section 63089.97 specifies reporting requirements for each FDC. Pursuant to theGovernment Code (GC), FDCs must submit their Articles of Incorporations & Bylaws,Audited Financial Statements, Board Approved Budget, Strategic Plan or Plan ofOperation, and Projected Fiscal Year Summary of Authorized Program Activities toIBank on an annual basis. These reports can be in any format. IBank does not supplytemplates or have specific substance requirements other than what is listed in the GC. Refer to Chapter VIII for the full text of GC 63089.97.In addition, FDCs are required to submit a Full Staff Roster to IBank. The staff roster shouldlist names, titles, email address and phone number of all employees, loan committeemembers, and Board of Director members.All annual reports must be submitted to IBank by July 31 of each year, except forthe Audited Financial Statements which are due by October 31 for the prior fiscalyear.IBank Jump Start Program FDC Policy Manual14

E. Change in FDC Points of ContactTo ensure the Jump Start FDC is aware of all current IBank Directives & Requirements aswell as changes to program policies or practices, FDCs are required to inform IBank within 5days about all changes to key FDC contacts by sending a brief memo to IBank with the newor updated name, address, phone or email contact information. Specifically, FDCs shouldinform IBank of changes to: Main Contact – FDC’s primary contact. Public Contact – FDC contact for public inquiries (name and address will bepublished on IBank’s website). Financial Contact – FDC contact authorized to discuss Loan documents, reports,default claims, etc. with IBank. General Emailing List – on occasion, IBank sends out email announcements for newprocesses, new forms, FDC roundtable meetings, etc. FDCs should provide the emailaddresses for those wishing to receive such correspondence.Updates should be submitted to IBank’s SBFC email at: SBFC@ibank.ca.gov.Use “Change in FDC Contact” reference in the email subject line.IBank Jump Start Program FDC Policy Manual15

VII. LOW-WEALTH CRITERIAJump Start is available in low-wealth communities based on average annual per capital income andunemployment rates to low wealth individuals determined by annual per capital income. Low-wealthcriteria will be based on date published in this manual. Data is from Employment DevelopmentDepartment and updated from time to time.A. Average Annual Per Capita Income by County (including StateAverage)YearGeographyData Point2015Kings County2015Del tyRiversideCountyPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEA20152015Trinity County2015TehamaCounty2015ModocCounty2015Tulare County2015Kern CountyAmountIBank Jump Start Program FDC Policy ManualYearGeographyData Point 33,1262015Yuba County 33,1292015Lake County 33,5842015FresnoCounty 34,6302015Sierra County 35,1652015San JoaquinCounty 35,1652015Glenn County 35,4312015SiskiyouCounty 35,5892015StanislausCounty 35,6272015Butte County 35,8502015Sutter County 36,1852015ShastaCounty 36,5512015Mono County 37,3552015HumboldtCountyPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAAmount 37,535 37,807 38,323 38,722 38,769 39,375 39,381 39,445 39,971 40,514 40,882 40,926 41,52516

YearGeographyData ounty2015San ty2015MontereyCounty2015PlumasCounty2015Yolo County2015Napa County2015San LuisObispoCountyPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAAmountIBank Jump Start Program FDC Policy ManualYearGeographyData Point 41,7702015Inyo County 41,8072015San DiegoCounty 43,2372015SonomaCounty 43,6432015Los AngelesCounty 43,8452015California 44,5042015VenturaCounty 46,0692015 46,2892015SantaBarbaraCountyOrangeCounty 46,5392015Santa CruzCounty 46,7062015Placer County 47,6152015El DoradoCounty 49,0632015NevadaCounty 49,8362015AlamedaCountyPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAPer CapitaPersonalIncome – BEAAmount 52,668 53,298 53,520 53,521 53,741 54,155 54,428 55,325 57,257 57,696 59,145 61,483 61,879 49,87317

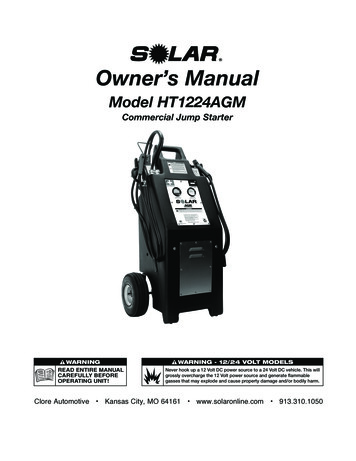

B. Unemployment Rate by County (including State Average)IBank Jump Start Program FDC Policy Manual18

C. Unemployment Rate by City and CountyLaborEmploy-UnemploymentArea NameForcementAlameda County845,200808,20037,000Alameda city42,10040,500Albany city10,100Ashland CDP11,200Berkeley city63,100Castro Valley meryville city8,0007,7002002.8%0.0095830.006021Fairview CDP5,8005,5003004.7%0.0068190.007347Fremont city119,300115,3004,1003.4%0.1426110.110285Hayward city80,00075,1004,9006.1%0.0929130.132616Livermore d CDPDublin cityNumberRateCensus RatiosNewark city24,10023,2009003.7%0.0286890.024319Oakland ,5001002.4%0.0067960.003711Pleasanton city40,20038,9001,4003.4%0.0481120.036806San Leandro city48,00045,7002,3004.7%0.0565940.061281San Lorenzo .0006370.000428Union City city37,50036,0001,5003.9%0.0445430.039995Amador County14,97014,1708005.3%1.0000001.000000Piedmont citySunol CDPAmador City city13012002.4%0.0085830.003970Ione city1,4701,410604.0%0.0997830.073500Jackson ,40096,9006,6006.3%1.0000001.000000Plymouth citySutter Creek cityButte CountyBiggs city70060010013.6%0.0065560.015201Chico city48,40045,8002,6005.3%0.4728510.389571Concow CDP20020006.0%0.0016220.001549Durham CDP3,0002,9001003.2%0.0295150.014677Gridley city2,8002,50030010.0%0.0256170.041990Magalia CDP4,2003,80040010.6%0.0387200.067922Oroville city6,5006,0005007.3%0.0622450.072529Oroville East CDP3,4003,1002006.8%0.0324790.034736Palermo CDP2,1001,90020011.1%0.0191700.035388IBank Jump Start Program FDC Policy Manual19

Area NameParadise sus outh Oroville CDP2,0001,8002008.2%0.0190800.025277Thermalito ,1005.2%1.0000001.000000Angels city1,8001,770301.8%0.0877300.029240Arnold 0.0%0.0028930.000000Forest Meadows CDP780740304.0%0.0369280.027840Mokelumne Hill CDP3703304010.0%0.0165560.033230Mountain Ranch CDP570530407.5%0.0263420.039070Calaveras CountyAvery CDPCopperopolis CDPDorrington CDPMurphys CDP890840505.3%0.0419130.042660Rancho Calaveras CDP2,9202,7202107.0%0.1349090.185900San Andreas CDP1,3201,280503.7%0.0632690.044450Valley Springs 0103400.011230Colusa le CDP1,7201,54018010.3%0.1523100.155430Colusa city3,1602,8603009.4%0.2831000.262600Williams city2,9002,53037012.7%0.2503400.323550Del Norte County9,6408,9806706.9%1.0000001.000000West Point CDPBertsch Oceanview 86,0004,3004.8%1.0000001.000000Cameron Park CDP9,6009,1005004.8%0.1062860.107910Diamond Springs 03.5%0.2377340.173400Crescent City cityKlamath CDPEl Dorado CountyEl Dorado Hills CDPGeorgetown CDP9008001006.5%0.0095010.013200Placerville city4,7004,4003006.5%0.0510690.070634Pollock Pines CDP3,1003,0001003.6%0.0347250.025790Shingle Springs CDP2,4002,3001003.9%0.0268200.021660South Lake Tahoe city11,70011,1006005.3%0.1292740.144026IBank Jump Start Program FDC Policy Manual20

LaborEmploy-Area NameForcementFresno County448,600410,200Auberry CDPUnemploymentNumber38,400RateCensus .0023250.000438Biola CDP40030010017.4%0.0007850.001785Calwa CDP6005001009.0%0.0012820.001348Cantua Creek 7Coalinga city7,0006,7003005.0%0.0162200.009050Del Rey CDP50050007.8%0.0011610.001050Easton CDP1,0001,0001007.9%0.0023440.002135Firebaugh city3,7003,4003008.7%0.0082030.008362Fowler city3,0002,8002007.0%0.0068310.005502Fresno city239,500217,20022,3009.3%0.5294980.580193Friant CDP100100032.0%0.0001260.000613Huron city2,6002,4002007.0%0.0057920.004689Kerman city7,0006,5005007.1%0.0157380.012864Kingsburg city5,8005,3005008.7%0.0129940.013270Lanare

Aug 10, 2020 · Manual provides instructions, examples, directives and requirements for initiating loans and managing defaults in the Jump Start program that is managed by FDCs that are approved by IBank to participate in the Jump Start Program (Jump Start FDC). Jump Start FDCs are to use this manual as proce