Transcription

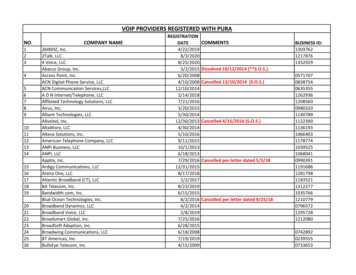

ALJ/DAP/smtPROPOSED DECISIONAgenda ID #19758RatesettingDecisionBEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIAIn the Matter of the Joint Application ofCBTS TECHNOLOGY SOLUTIONS LLC(U-5393-C), and CINCINNATI BELLINC., and RED FIBER PARENT LLC, ForApproval to Acquire Indirect Control ofCBTS Technology Solutions LLCPursuant to California Public UtilitiesCode Section 854(a).Application 20-07-010DECISION AUTHORIZING TRANSFER OF INDIRECT CONTROLOF CBTS TECHNOLOGY SOLUTIONS, LLC. ANDCINCINNATI BELL, INC. TO RED FIBERPARENT, LLC.397322638-1-

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONTABLE OF CONTENTSTitlePageDECISION AUTHORIZING TRANSFER OF INDIRECT CONTROL OF CBTSTECHNOLOGY SOLUTIONS, LLC. AND CINCINNATI BELL, INC. TORED FIBER PARENT, LLC. .1Summary .21. Background .21.1. Parties to the Proposed Transaction .21.2. Proposed Transaction .51.3. Procedural Background .62. Jurisdiction .103. Issues Before the Commission .104. Standard of Review .115. Requirements for a CPCN.135.1. Financial Statements and Ability to Finance .135.2. Technical and Managerial Competence .145.2.1. Affidavits.155.3. Tariffs .206. Impact of the Proposed Transaction on the Environmental and Social JusticeCommunity .217. Environmental and Safety Considerations .228. Conclusion .239. Comments on Proposed Decision .2310. Assignment of Proceeding .23Findings of Fact .23Conclusions of Law .25ORDER .26Appendix A – Diagrams of the Pre- and Post-Transaction Corporate OwnershipStructuresAppendix B – Diagram of the Corporate Ownership Structure of the PrivateEquity Group of Ares Management Corporation-1-

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONDECISION AUTHORIZING TRANSFER OF INDIRECT CONTROLOF CBTS TECHNOLOGY SOLUTIONS, LLC. ANDCINCINNATI BELL, INC. TO RED FIBERPARENT, LLC.SummaryThis decision grants the unopposed joint application of CTBS TechnologySolutions, LLC. (U5393C), Cincinnati Bell, Inc., and Red Fiber Parent, LLC., filedon July 10, 2020, for approval of the indirect transfer of control of CTBSTechnology Solutions, LLC. to Transferee Red Fiber Parent, LLC., pursuant toCalifornia Public Utilities (Pub. Util.) Code Section 854(a).This proceeding is closed.1. BackgroundPursuant to California Public Utilities (Pub. Util.) Code §854(a), CTBSTechnology Solutions, LLC. (U5393C) (CBTS), Cincinnati Bell, Inc. (CincinnatiBell), and Red Fiber Parent, LLC. (RFP) (collectively as Applicants), filed thisapplication on July 10, 2020 (Application) and request authorization to transferownership of CTBS to RFP, through the acquisition of Cincinnati Bell and itsvarious subsidiaries (Proposed Transaction).1.1.Parties to the Proposed TransactionCincinnati Bell is a publicly traded corporation organized under the lawsof Ohio (NYSE: CBB) and the holding company and ultimate parent of CBTSand its affiliates. Cincinnati Bell is headquartered at 221 East Fourth Street,Cincinnati, Ohio, 45202. Cincinnati Bell is authorized in California to transactintrastate business and in good standing with the California Secretary of State(entity number C2361901). Cincinnati Bell, through its various subsidiaries,provides high-speed data, video and voice solutions to consumers andbusinesses over fiber and legacy copper network. Cincinnati Bell’s operatingsubsidiaries are authorized to provide competitive local exchange, competitive-2-

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONaccess and/or interexchange services in the District of Columbia and every stateexcept Alaska, and by the Federal Communications Commission (FCC) toprovide interstate and international services.CBTS is a limited liability company organized under the laws of Delawareand authorized to transact intrastate business in California and in good standingwith the Secretary of State (entity number 201728510123). CBTS is headquarteredat 221 East Fourth Street, Cincinnati, Ohio, 45202. CBTS is an indirect, whollyowned subsidiary of Cincinnati Bell and a direct, wholly owned subsidiary ofCBTS, LLC. In California, CBTS resells competitive local exchange servicespursuant to a Certificate of Public Convenience and Necessity (CPCN) granted inCommission Decision1 (D.) 10-04-049 and interLATA and intraLATA resoldinterexchange carrier services pursuant to a CPCN granted in D.96-12-045, in theservice territories of AT&T, Verizon/XO, CenturyLink and Sprint/T-Mobile. InCalifornia, CBTS provides voice long distance service and data connectivityservices including Internet Protocol Virtual Private Network, Dedicated InternetAccess, and private lines to 56 enterprise customers and is authorized to provideinterstate telecommunications services by the FCC.2RFP is a limited liability company organized under the laws of Delawareand a holding company created as an acquisition vehicle for the ProposedTransaction. RFP does not provide telecommunications services on its own andis not authorized to transact intrastate business in California. RFP’s principalplace of business is located at 125 West 55th Street, New York, New York 10019.At closing of the purchase, RFP will be owned 61.5 percent by MIP V (FCC) AIV,1Commission Decisions can be found on the Commission website.2Joint Prehearing Conference Statement, filed September 28, 2020 (Joint PHC Statement), at 4-5.-3-

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONL.P. (MIP V);3 21.2 percent by Private Equity Group of Ares ManagementCorporation (Ares Management);4 and 17.3 percent by Retail EmployeesSuperannuation Trust (REST).5MIP V is a Delaware limited partnership and a fund managed by amember of Macquarie Infrastructure and Real Assets (MIRA). MIRA is a globalalternative asset manager with investments in the communications infrastructureindustry. MIRA partners with investors, governments, and communities tomanage, develop, and enhance assets relied on by more than100 million people each day.6 Through its predecessor funds, MIRA holdsinvestments in various communications infrastructure and utilities companies.7Ares Management is a global alternative investment manager operatingthree integrated businesses across Credit, Private Equity, and Real Estate withMIP V is part of the North American infrastructure funds of MGL managed by a member ofMIRA with parallel funds and alternate investment vehicles, raising approximately 4 billion ofcommitted capital from a wide array of institutional investors ( 4 Billion Commitment). As ofMarch 31, 2020, MIRA managed 107.9 billion in infrastructure assets. MIRA’s ultimate parentis MGL, a publicly traded company incorporated in Australia.3Ares Management holds RFP interests through a number of alternative investment vehiclescontrolled by ASSF Management IV, L.P., a Delaware limited partnership, as the generalpartner and ASOF Management, L.P., a Delaware limited partnership, as the general partner.4REST is an Australian superannuation fund. The Rest Immediate Entity is a special purposeinvestment vehicle whose sole beneficiary is REST Nominees No. 1 Pty Ltd as trustee for RESTInternational Infrastructure Investments Holding Trust (Rest Intermediate Entity). The solebeneficiary of the Rest Intermediate Entity is REST, which is managed by the Rest Trustee, in itscapacity as the trustee of REST. REST’s indirect interest in Red Fiber Parent will be held by RestNominees No. 2 Pty Ltd as trustee for the REST US Infrastructure No. 2 Trust (Rest ImmediateEntity).56Application at 6.7Id. at 15.-4-

A.20-07-010 ALJ/DAP/smtPROPOSED DECISION 149 billion of assets under management, as of March 31, 2020, and employsapproximately 1,200 employees in over 20 offices in more than 10 countries.8REST is an Australian public offer pension fund, managing over AUD 52 billion (USD 36 billion) on behalf of approximately 1.7 million members.The assets of the trust are managed by the trustee for the benefit of the membersof the trust, and the trust is only able to act through the trustee.9 The RESTTrustee acted as the sole trustee for REST since the inception of the trust.10RFP will be indirectly owned by MIP V, Ares Management and RESTthrough their respective interests in Red Fiber Holdings, LLC (RF Holdings) andRF Topco, LLC (RF TopCo), the sole owner of RFP.111.2.Proposed TransactionThe Proposed Transaction will be accomplished through a series oftransactions to be finalized following the satisfaction of various closingconditions as described in the Application. In addition, Exhibit E to theApplication, entitled "Pre- and Post-Transaction Corporate OwnershipStructures", has been included as Appendix A to this Proposed Decision toprovide a visual diagram of the details surrounding the Proposed Transaction.Upon consummation of the Proposed Transaction, RFP will be theultimate owners of CTBS through a transfer of equity interests in CBTS' parent,Cincinnati Bell. However, CBTS will continue to be 100-percent indirectlyowned and controlled by Cincinnati Bell and the officers of MIP V.8Id. at 7.Response to Administrative Law Judge Ruling, filed February 26, 2021 (February 26, 2021Response), at. 4.910Ibid.Application at 6. See also Exhibit E of the Application, Diagrams of the Pre- and Post-TransactionCorporate Ownership Structures.11-5-

A.20-07-010 ALJ/DAP/smt1.3.PROPOSED DECISIONProcedural BackgroundOn July 10, 2020, Applicants applied for approval of the indirect transfer ofcontrol of CTBS, through the acquisition of Cincinnati Bell by RFP, pursuant toPub. Util. Code § 854(a), and in accordance with Rule 3.6 of the Commission’sRules.12 No party filed a response or protested the Application.On September 21, 2020, assigned Administrative Law Judge (ALJ)Daphne Lee issued an Email Ruling setting the prehearing conference (PHC) onOctober 14, 2020, and ordering the parties to meet, confer, and submit a JointPHC Statement prior to the PHC. The parties timely filed a Joint PHC Statement.A PHC was held on October 14, 2020, to address the issues of law and fact,determine the need for hearing, set the schedule for resolving the matter, andaddress other matters as necessary. During the PHC, the parties were instructedto file comments on additional issues set forth during the PHC.The assigned Commissioner issued a Scoping Memorandum and Rulingon November 9, 2020.From October 14, 2020, through June 11, 2021, the ALJ issued multiplerulings for information from the Applicants:1. On October 14, 2021, the ALJ issued an email rulingdirecting the Applicants to respond to ALJ inquiry byOctober 21, 2020, including affidavits to meet requirementsunder Decision 95-12-056, Appendix C andDecision 13-05-035 and disclosure of all liens forApplicants, affiliates, officers, directors, partners, agents, orowners (directly or indirectly) of more than 10% of RFP.On October 21, 2020, the Applicants’ Response provided anexplanation of the affidavits attached to the Applicationand did not disclose any liens against Ares Management,12All references to Rules are to the Commission’s Rules of Practice and Procedure.-6-

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONLP., Ares Capital Corporation and Ares Commercial RealEstate Corporation, the subsidiaries of Ares Management;132. On November 6, 2020, the ALJ issued a ruling requestingexplanation of all judgement liens against AresManagement, LP., Ares Capital Corporation and AresCommercial Real Estate Corporation. RFP responded, onNovember 12, 2020, and disclosed two tax liens, issued bythe State of California, against Ares Management LP in2017 and 2014, respectively, and a lien against Ares CapitalManagement LLC. in 2014 recorded in California. RFPprovided the status of the liens without explanation of thecause of the liens.143. On November 13, 2020, the ALJ issued a ruling requestingexplanation of all judgement liens in any state other thanCalifornia against Ares Management, LP., Ares CapitalCorporation and Ares Commercial Real EstateCorporation. RFP responded, on November 20, 2020, thatno judgement liens were discovered after a search ofTransUnion’s TLO platform, Dun and Bradstreet, Inc.’sDNBi Risk Management tool, and the LexisNexis Accurintsearch service.154. On November 17, 2020, the ALJ issued a ruling requestingidentification of information seeking confidentialtreatment which were available in public records. OnNovember 24, 2020, Cincinnati Bell filed an AmendedMotion for Leave to File Confidential Materials Under Seal.5. On December 16, 2020, the ALJ directed the RFP to provideclarification on specific liens identified against Ares CapitalCorporation and Ares Commercial Real EstateCorporation. On December 28, 2020, RFP responded thatResponse to Administrative Law Judge Inquiry, filed on October 21, 2020 (October 21, 2020Response), at 7-9.13Response to Administrative Law Judge Inquiry, filed November 12, 2020 (November 12, 2020Response), at 1.14Response to Administrative Law Judge Inquiry, filed November 20, 2020 (November 20, 2020Response), at 1-2.15-7-

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONits prior responses to the ALJ inquiry were amisunderstanding regarding judgment liens rather thantax liens and provided the status and cause of the liensidentified in the ruling.166. On January 19, 2021, the ALJ directed the Applicants toprovide clarification of documents that Applicants soughtto file under seal. On January 22, 2021, Applicantswithdrew their respective motions to file confidentialunder seal documents in response to prior rulings.7. On January 27, 2021, the ALJ granted the Applicants’Motion to Withdraw Motions to File Confidential MaterialsUnder Seal and directed Applicants to file unredacteddocuments. On January 29, 2021, Applicants timely filedrespective unredacted documents. On February 2, 2021,the ALJ closed the record.8. On February 17, 2021, upon further review of the record,the ALJ reopened the record and requested RFP to providefurther information, including affidavits from MIP V, AresManagement and REST that met the requirements underD.95-12-056, Appendix C and D.13-05-035. OnFebruary 26, 2021, RFP provided the affidavit of AntonFeingold of Ares Management as detailed in Section 5.2below.179. On March 15, 2021, the ALJ directed the Applicantsprovide additional information including:a) Sworn affidavits, including items a through f,referenced in the from Red Fiber Parent, MIP V, AresManagement or REST, RF TopCo, RF Holdings, theirimmediate officers, directors, partners, agents, orowners (directly or indirectly) of more than 10% of RFP,including MIP V, Ares Management or REST, MIRA, RFTopCo and RF Holdings, that meet the requirements ofResponse to Administrative Law Judge Inquiry, filed December 28, 2020 (December 28, 2020Response), at 1-3.1617February 26, 2021 Response, Exhibit A.-8-

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIOND.95-12-056, Appendix C and D.13-05-035 withoutlimitation of time or title of officers, andb) An explanation for each item a through f, which wasexcluded from the affidavit.The ruling further identified 30 individuals whom the Applicants previousidentified as officers, partners or managers of either RFP, MIP V, AresManagement or REST to provide affidavits meeting the requirements ofD.95-12-056, Appendix C and D.13-05-035. In its response, RFP provide anaffidavits from Anton Moldan on March 22, 2021,18 and onMay 3, 2021,19 as detailed in Section 5.2 below.10. On May 5, 2021, the ALJ requested clarification of actionstaken by Ares Management in response to the Securitiesand Exchange Commission Cease and Desist Order, issuedon May 26, 2020 (SEC Order). On May 12, 2021, RFPclarified that Ares Management, LLC., a subsidiary of AresManagement, which received the SEC Order, was neitheran affiliate nor a 10 percent owner of RFP and was notincluded in the affidavit from Anton Moldan submitted inthe May 3, 2021 Response (May 3, 2021 Affidavit).20 RFPfurther identified steps taken by Ares Management, LLC.after receipt of the SEC Order.2111. On June 11, 2021, RFP submitted a chart of the corporatestructure of Ares Management in response to the rulingResponse to Administrative Law Judge Ruling, filed March 22, 2021 (March 22, 2021 Response),Verification of Anton Moldan.18Supplement to March 22, 2021 Response to March 15, 2021 ALJ Ruling, filed May 3, 2021(May 3, 2021 Response), Revised Verification.19Response to Administrative Law Judge Ruling, filed May 12, 2021 (May 12, 2021 Response), at 2,fn. 1.2021Id. at 2-3.-9-

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONissued by the ALJ on June 9, 2021.22 A copy of the chartwill be attached as Appendix B.Upon the determination that no further information or evidence is neededto adequately inform and evaluate the issues in this proceeding, the record wasclosed and submitted on June 23, 2021.2. JurisdictionCalifornia Pub. Util. Code § 851 et seq. provides broad Commissionauthority to approve transfers of control which involve public utilities operatingwithin California, as is requested in this proceeding. Pub. Util. Code § 854(a),which is applicable here,23 states:No person or corporation, whether or not organized underthe laws of this state, shall merge, acquire, or control eitherdirectly or indirectly any public utility organized and doingbusiness in this state without first securing authorization to doso from this Commission. The Commission may establish byorder or rule the definitions of what constitute merger,acquisition, or control activities that are subject to this sectionof the statute. (Pub. Util. Code §854(a).)After the transfer of control is completed, the Commission will retain thesame regulatory authority over the CPCN holder that it currently possesses.3. Issues Before the CommissionThe issues to be determined or otherwise considered are:1. Whether the Applicants meet all Commission requirementsunder Pub. Util. Code §854 for the acquisition of CincinnatiBell and indirectly CBTS by RFP thereby transferringcontrol of CBTS and the Certificate of Public Convenienceand Necessity (CPCN) issued to CBTS to provideResponse to ALJ Inquiry of Ares Management Corporation, filed June 11, 2021 (June 11, 2021Response), Attachment A.22Pub. Util. Code §§ 854 (b) and (c) are not applicable to this proceeding because none of theApplicants have gross annual California revenues in excess of 500 million.23- 10 -

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONcompetitive local exchange telecommunications services,interLATA and intraLATA exchange services in the serviceareas of AT&T, Verizon/XO, CenturyLink, Sprint/T-Mobile and interexchange services on a statewide basis;2. Whether the RFP’s acquisition of Cincinnati Bell willadversely affect the public interest; and3. Whether the RFP’s acquisition of Cincinnati Bell andindirectly the CPCN issued to CBTS impact environmentaland social justice communities, including any impacts onthe nine goals of the Commission’s Environmental andSocial Justice (ESJ) Action Plan.4. Standard of ReviewPub. Util. Code §854(a) requires Commission authorization before a publicutility company may “merge, acquire, or control either directly or indirectly anypublic utility organized and doing business in this state .” The purpose of thisand related code sections is to enable the Commission, before any transfer ofpublic utility authority is consummated, to review the proposal and to take suchaction, as a condition of transfer, as the public interest may require.24The Commission has broad discretion under Section 854(a) to approve orreject a proposed transaction. If necessary and appropriate, the Commissionmay attach conditions to approval of a transaction to protect and promote thepublic interest. The primary question in a transfer of control proceeding underSection § 854(a) is whether the transaction will be in the public interest.Pub. Util. Code §§854(b) and (c) do not apply to this Application because theApplicants do not have gross California revenue in excess of 500 million.2524See San Jose Water Co. (1916) 10 CRC 56.25See Pub. Util. Code §§854(b) and (c).- 11 -

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONThe Commission factors the past conduct of the acquiring company in thenet benefit of the Proposed Transaction. In this proceeding, the acquiringcompany, RFP, was created for the purpose of the Proposed Transaction. Assuch, the Commission assesses the past conduct of the ultimate parentcompanies. Among the three parent companies of RFP,26 subsidiaries of AresManagement, a 21.2 percent indirect owner of RFP, received multiple tax liensissued from various State and local agencies in the past 10 years (AresManagement Liens) and the SEC Order in May 2020.27 In addition, RFP’s failureto fully disclose the Ares Management Liens and to provide an affidavit, meetingall requirements under D.95-12-056, Appendix C and D.13-05-035, caused furtherconcerns of Ares Management’s and, ultimately, RFP’s fitness to acquire a CPCNholder.28Yet, the Commission has previously determined that the publicconvenience and necessity require that competition be allowed in the provisionof competitive local exchange service. By its issuance of D.95-07-054,D.95-12-056 and D.96-02-072, the Commission recognized the benefits ofcompetition for local exchange and intraLATA services. These benefits includetechnological innovation in telecommunications, the deployment of advancedtelecommunications services, lower rates and improved services forRFP is managed solely by RF TopCo and does not have any directors. Apart frompass-through special purpose vehicles created solely for purposes of the Proposed Transaction,RFP has only three indirect owners of more than 10%: (i) MIP V, (ii) REST, assets of which aremanaged by its trustee, Retail Employees Superannuation Pty Ltd, and (iii) Ares InvestmentsHoldings LLC, a subsidiary of Ares Management. March 22, 2021 Response at 1-2.26See Exhibit B to February 26, 2021 Response; see also November 12, 2020 Response;December 28, 2020 Response and June 11, 2021 Response.27See October 21, 2020 Response at 9; November 12, 2020 Response; November 20, 2020Response; December 28, 2020 Response and June 11, 2021 Response.28- 12 -

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONtelecommunications service users, investment in new infrastructure and thecreation of new jobs in the State.Although Ares Management’s past conduct raised concerns of their abilityto comply with statutes and regulations, the officers of MIP V, the 61.5 percentindirect majority owner, will have primary control of RFP and, indirectly,CTBS.29 Thus, granting this Application will serve the public interest incontinuing market competition and expanding the availability of technologicallyadvanced telecommunications services within the State.5. Requirements for a CPCNWhen the acquiring individual or company which does not have a CPCNseeks to acquire control of a company that possesses a CPCN, the Commissionwill apply the same requirements to the acquiring company as would be appliedto an initial applicant seeking the type of CPCN held by the company beingacquired. The two major criteria are financial resources and managerial andtechnical expertise. We address these CPCN requirements in detail below.5.1.Financial Statements and Ability to FinanceThe Applicant must clearly demonstrate that it is financially capable ofrendering its proposed service. To be granted a CPCN, an applicant forauthority to provide full facilities-based competitive local exchange servicesmust demonstrate that it has a minimum of 100,000 cash or cash equivalent,reasonably liquid and readily available to meet the firm’s start-up expenses. Anapplicant must also demonstrate that it has sufficient additional resources tocover all deposits required by local exchange carriers (LECs) and/or29March 22, 2021 Response at 5.- 13 -

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONinterexchange carriers (IECs) in order to provide the proposed service.30Acceptable forms of financial documentation include an audited balance sheetand income statements demonstrating sufficient cash flow or, in the alternative,one of several other cash equivalent financial instruments.31Applicants met this requirements by providing the audited consolidatedfinancial statements of Cincinnati Bell, including its balance sheet and incomestatement provided in its SEC Form 10-K filing for the fiscal year endingDecember 31, 2018, and December 31, 2019.32 Applicants further satisfy thisrequirement with the funding shown in Exhibit F of this application, whichincludes an irrevocable guarantee, issued by MIP V, for a period oftwelve (12) months from the authorization of the Proposed Transaction by theCommission.335.2.Technical and Managerial CompetenceThe Applicants seeking authority to provide local exchange and/orinterexchange service must demonstrate that it has the technical and managerialThe requirement for Competitive Local Carrier applicants to demonstrate that they haveadditional financial resources to meet any deposits required by underlying LECs and/or IECs isset forth in D.95-12-056, Appendix C. For NDIECs, the requirement is found in D.93-05-010.30See D.95-12-056, Appendix C (applicable to CLEC applications) and D.91-10-041, Appendix A(applicable to NDIEC applications) as modified by D.13-05-035.31Exhibit G of the Application and Exhibit 1 of the Joint Applicants’ PHC Statement, filedSeptember 28, 2020 (PHC Statement).32MIP V has raised approximately 4 billion of committed capital from a wide array ofinstitutional investors (the “ 4 Billion Commitments”). MIP V closed its initial and severalsubsequent investment rounds in 2020. MIP V (FCC) AIV has the unilateral right to draw uponthe 4 Billion Commitments to make investments and to otherwise honor its contractualobligations, including under the referenced 100,000 guarantee. MIP V is the signatory to the 1.065 billion equity commitment letter by MIP V in favor of Cincinnati Bell, which underpinsthe Proposed Transaction. Additionally, the general partner of MIP V, and the other investmentvehicles that comprise MIP V, MIP V GP LLC, is wholly owned subsidiary of MGL, whichtrades on the Australian Stock Exchange and has a market capitalization of 49.73 billion.October 21, 2020 Response at 6-7. See also Application at 10-11.33- 14 -

A.20-07-010 ALJ/DAP/smtPROPOSED DECISIONqualifications necessary to provide the proposed services in its service territory.The Applicants should provide the following information, including, but notlimited to: the Applicants’ key management and technical personnel, resumesand biographies of the key management and technical person that reflects thatthe applicant possesses significant technical and managerial expertise foroperating a telecommunications company, consistent with the Commission’srequirements.Applicants provided the biographies of key personnel after thetransaction.34 Additionally, the indirect transfer of control of CBTS to RFP willresult in a change in the ultimate ownership of CBTS, but Cincinnati Bell andCBTS will continue to be managed and operated by the same officers and keypersonnel, supplemented by the managerial capabilities of RFP.355.2.1. AffidavitsUnder D.95-12-056, Appendix C and D.13-05-035, the Applicants mustprovide sworn affidavits stating the following:Neither applicant, any of its affiliates, officers, directors,partners, agents, or owners (directly or indirectly) of morethan 10% of applicant, or anyone acting in a managementcapacity for applicant: (a) held one of these positions with acompany that filed for bankruptcy; (b) been personally foundliable, or held one of these positions with a company that hasbeen found liable, for fraud, dishonesty, failure to disclose, ormisrepresentations to consumers or others; (c) been convictedof a felony; (d) been (to his/her knowledge) the subject of acriminal referral by judge or public agency; (e) had atelecommunications license or operating authority denied,suspended, revoked, or limited in any jurisdiction;34Exhibit H of the Application and Exhibit C of the October 21, 2020 Response.Application at 10 and Exhibit H of the Application. S

A.20-07-010 ALJ/DAP/smt PROPOSED DECISION - 4 - L.P. (MIP V);3 21.2 percent by Private Equity Group of Ares Management Corporation (AresandManagement);4 and 17.3 percent by Retail Employees Superannuation Trust (REST).5 MIP V