Transcription

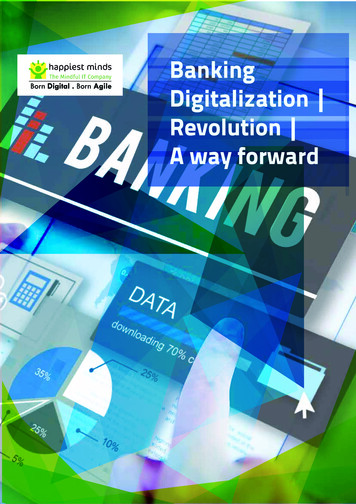

BankingDigitalization Revolution A way forward

------------------------------ 3Digital --------------- ----------------------- 5Digitalize Customer Experience ------------------------------------------ 6Digitalize Products & -- 7Digitalize ------------- 7Digitalize ------------- 7Banking Industry Perceived ---------------------------------------------- 8Digital Delivery ------- 8Digital Banking Enterprise --------------------------------------------- 9Challenge to ------------ 10Case ----------------- 11About ---------------- 122 Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

Introduction“Digital” is the new buzz word in the banking sector, with banks all around the globe shifting towards digitalization. Banks of allsizes and across all regions are making huge investments in digital initiatives in order to maintain a competitive edge and deliverthe maximum to its customers.Additionally, digitalization leads to robust data analytics and intelligence, which helps banks get closer to customers and close inon competition.what does “digital” actually mean?More Americans are embracing digital banking technology each year (2014 vs 2015)33% increase in those using mobile banking apps 35% increase in those using a bank’swebsite or online banking portalSource: IT Research conducted by Brian ResearchBanking digitalization3 Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

Digital bankingCombines the benefits of two worlds: a new customer experience on the outside and an efficient, effectiveoper-ating model on the inside—both enabled by digitalization and the underlying technologies,processes, and structures.The primary steps on the digital banking journey have been largely focused on adding to the existing offeringusing new, technology-enabled services to increase the accessibility and value for customers. The most noticeable examples are mobile apps, e-wallet solutions, APIs, and personal finance management (PFM) tools.The current business priorities for banks in the digital world is to use the new establishment for increasing profitability and revenue. In this innovative business model, it is crucial to ensure regulatory compliance for smoothand long-term execution. The key challenge in the digital era is to ensure all customers are safeguarded fromcybercrimes, and the most advanced cyber securities are employed. The shift to digitalization and the continuance of it should cater to reduced cost for the industry, as this will reduce manpower and make the system automated.79% of global bank directors say theirgreatest technology concern is havinga strong technology infrastructure toprotect from cyber attacks.(Source: Research done by CDW Financial Services)Customer convenience is the number one advantage of online banking. Like the traditional bank’s ATM, onlinebanking is available 24 hours a day, 365 days a year. However, you can do your banking from the comfort of yourown home and this improves the time taken to process all the requests.61% global banks noted digitalization ashigh priority for 2016; however, 88% seeit as a challenge as identifying the rightdigital partner would be the key.(Source: Research done by CDW Financial Services)Online banking is accessible everywhere and increases the customer base, online banking is compatible withmoney management programs and delivers end-to-end value to customers. Digitalization not only helps ingetting more customers but also delivering top-notch services, as efficiency counts as well.To facilitate the digitalization of banking industry, the enablers can be grouped mainly into: DigitalizeCustomer Experience, Digitalize Products & Services, Digitalize Organization and Digitalize Operations.4 Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

EnablersCustomerExperienceOrganisationPdts &ServicesOperationDeveloping SeamlessOmni-Channel Digital ServicesSimplify Core Products, Businessand Operating Models360 View of Customer InsightDevelop Customer CentricBusiness ModelInnovative Disruptive Technology PushDynamic Partner EcosystemAdd Value Added Services (VAS)in Value Chain5 Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

Digitalize Products & ServicesTraditionally, banking practice has focused on “product push” (i.e. increasing sales targets) rather thanunderstanding how best to delight its customers. Inrecent times, banks are keen to become morecustomer-centric.Digitalize Customer ExperienceDigitalization impacts everything, and this impact istransformative. Digitalization is about taking fullcontrol of your customer-experience and managingall the needs, existing and new, for your customersand developing a business model accordingly.Customers drive this trend of digitalization, as theyare aware of their needs and look for businessesthat cater to and fulfill their end-to-end requirements. Customers have readily and effortlesslyadapted to the digital world. Customers expect aseamless multichannel experience and a consistent,global service. They judge their experience on threelevels: how well companies understand their needs;the simplicity of doing business, and; how delightfulit is. There must be an obsession with customerexperience and develop ways to steadily improvethe experience and learn from every interaction.6Digital infrastructure provides billions of customerswith affordable broadband and low-cost devices.Banks need to develop new products and servicesthat are meeting the changing needs of customers,maintain competitive edge and match with thelatest technology trends.Barclays was one of the first banks toshift to internet and digital banking,revealing that its customers now visittheir branch on average twice amonth, while using the bank’s mobileservices 18 times in the same period.Moreover, there is a movement by several banks toacquire innovative payment companies as a way tobring innovation internally and leverage new evolving technology. Banks also need to build productsbased on customer segments while maintain highfocus on mobile penetration. Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

Digitalize OrganizationWhile all banks recognize the importance of multichannel integration with a unified flow of information, they have not structured their internal organizations and governance policies accordingly. Besidesgovernance, traditional approaches to channels,products, and customer segments will need to bemodernized and existing silos need to be dismantled. While most of the efforts are focused on thecustomer, digitalization's severe impact on the backend often gets neglected.A complete review of existing structures will berequired to support the new digital banking journey.Back-office staff will need to develop highly efficientskills while at the same time be able to understandnew demands of the customers.The push to use big data to improvecustomer relationship management (CRM)capabilities is putting pressure on data qualityand governance and dramatically increasingsystem performance, and yet only about one infour banks have immediate plans for big-dataprojects.Digitalize OperationsBanks will become more digital! As customers, competitors, and even regulatory agencies push in thisdirection, the promise of anytime, anywhere bankingwith transparency and convenience will ultimatelybring together all the elements of banking in thedigital world.In an article in the Financial Times,McKinsey London’s Tunde Olanrewaju,wrote that “Retail bank customersdon’t experience the same level ofdigital choice, freedom and empowerment as in other industries” such astravel, to quote just one.7Banks need to identify opportunities by looking at theoverall customer life cycle, focus on improving experiences and enable better customer services. Bankingdoes not guarantee customer loyalty due to customerbehavior. A fluctuation of loyalty has been noticed inthe industry, furthermore loyalty is not thekey answer, but it is experiences. Customerexperience and customer service needs to beenhanced in a coherent way: from cross channeland multichannel to omnichannel. The practice ofdigital marketing and customer service strategiesneed to be engaged to acquire, retain and delightcustomers. Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

Banking Industry Perceived Threats New banking models with paramount digitized services Online Payment Providers- PayTM, Mobikwik,PayPal, Mobile wallets-Telcos P2P Players turning to Asset- Backed Securities (ABS) marketCrowd funding, cryptocurrencies, mobile inclusion- ProvidingP2P payments, P2P insurance, P2P finance Social Media Network Retail inclusion BUY CLICK Happiest Minds Technologies Pvt. Ltd. All Rights ReservedSelenium (Java or Python) /ROBOT(Python)8 Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

Digital Banking Enterprise RoadmapPdt Marketing & SalesNew Business AcquisitionDigital ServicesSales Force AutomationDigitalize On- Boarding ProcessProduct Bundling & Self-ServiceSocial Consumer EngagementCustomer Data & InsightsMobile Banking EcosystemCustomer 360 ViewPersonalized Customer RelationshipOmni- Channel ServiceCustomerAnalyticsMobileEnablementSeamless CrossChannel Integration& Banking BusinessData ManagementDashboarding& Reporting869 Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

Challenge to DigitalizationLegacy ofexistingmodels &practices21High cost ofimplementation53Lack oftechnologyexpertise,skilledwork forceComplyingwithlegislation& regulation4Dealingwith humangous,pervasive data7Connectingdifferentdata pools6Lack of clearstrategy& vision8610 Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

Rapid adoption of smart phones andtablets require an effective responseby global wealth managers.Advisors as well as clients will behungry for the capabilities these newconsumer devices provide inmanaging investments — GartnerCase StudyTablet based Private WealthManagement Advisory AppThe Tablet based Private Wealth Management advisory application of Happiest Minds Technologies makes themost of the iPad's hands-on interactive features. The application design features off-the shelf methodology combined with designcustomization that helps to blend perfectly well with the underlying Wealth Management solution of the bank.Usage of tablets by advisors, enable their clients to have a better intuitive and richer digital interaction leading tobetter customer experience. The tablet based application enables to create easier navigation leading to improvedbrowsing experience unlike the legacy desktop application. The advisory app solution also features Peer to Peer(P2P) communication that can enhance the customer experience.Tablets are increasingly being viewed as productivity tools. The tablet can be an agent driving automation in themiddle and back offices of a bank. It can play a huge role in straight through processing (STP) of transactions withminimal manual interventions. Usage of tablets by wealth management firms in advisory services enables advisorsto respond faster to client's needs by processing trade requests even when they are away from office.The Tablet based advisory application assigns a portfolio from a list of model portfolios based on the riskprofile of the investor.The portfolio consists of variousasset classes that areallotted different weightagesbased on the risk-averse natureof the investor and the riskinessof the financial instrument.11 Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

The risk versus return scenariofor a portfolio can be viewedusing risk charts that are populated along with each portfolio.The advisor can use similargraphical images to provide anenriching experience to theinvestor before the investordecides upon an asset class.Benchmark Index ReturnsPortfolio ReturnsThe Advisory Application can be augmented to include features like clientconfirmations on the spot using theelectronic signature capabilities of tablets. Other mechanisms that couldimprove efficiencies of the advisory services include payment capture usingcard scans, cheque captures and document scans that reduce paper work.Client experience can be enhanced by avariety of innovative features like pushing alerts and client dashboard/ KeyPerformance Indicators (KPI); providingadvisors with client items that requirehigh priority attention.8612 Happiest Minds Technologies Pvt. Ltd. All Rights Reserved

About the AuthorRicha is a Business Analysis/ Functional Consultant with 5 years of experience in varied domains.Her experience lies in Healthcare, Retail Banking and Governance, Risks & Compliance Products/Services. She believes in exploiting and embracing digital technologies to keep abreast of competitivemarket landscape. Her work involves defining, analyzing, managing and el

The primary steps on the digital banking journey have been largely focused on adding to the existing offering using new, technology-enabled services to increase the accessibility and value for customers. The most notice- able examples are mobile apps, e-wallet solutions, APIs, and personal finance management (PFM) tools. The current business priorities for banks in the digital world is to use .