Transcription

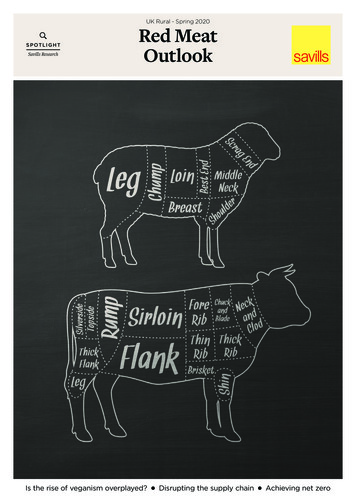

UK Rural - Spring 2020S P OT L I G H TSavills ResearchRed MeatOutlookIs the rise of veganism overplayed?Disrupting the supply chainAchieving net zero

Foreword80%16% 4.25bnOf UK beef and sheep meatis consumed domesticallyOf UK beef and sheep meatis exported to the EUOutput value of UK sheep andbeef markets at the farm gateNecessity to changebreeds innovationWe investigate beef and sheep meat markets witha view to the future of production and consumptionThe red meat sector has been the focus ofunprecedented media attention and now unprecedenteddisruption. While it has not been possible to takeaccount of the full impact of coronavirus in this report,the sector was facing substantial pressure before it hit,and it is not unreasonable to expect that many of thechallenges in ethics, climate and land use will persistonce the crisis has calmed.Last year, UK producers were faced with deepuncertainty as our trading relationships with the EUand other significant beef producing nations enterednegotiations. The coronavirus crisis has showed us againthat it’s not just trade arrangements that could disruptexisting supply chain patterns. Longer term, if otherclimate-impacting sectors of the economy suffer deepand perhaps lasting reductions in demand, particularlyto personal and international travel, agriculture’sclimate impact will be of more significance, not less.Equally, media hype around meat-free diets seems tohave disappeared as people rush to secure food, and foodproducers have been flipped from villain to hero. But thepossible role of animal protein consumption in creatingthe crisis means that a great deal of introspection islikely to follow.It’s impossible to say if the current revaluationof food by society will produce lasting change, butaccountability and scrutiny are likely to remain pressingconcerns and, globally, demand from developing areasof the world is predicted to keep rising, as consumptionof protein correlates with higher living standards. Theseare strong demand fundamentals.2020 will be a year of great change, and necessitywill breed innovative solutions. Producers looking toprepare their businesses for 2021 and beyond need tocarefully consider fundamental policy drivers, as wellas their target markets and value-add proposition toensure lasting benefit. This report provides an updateon the beef and sheep meat markets at what could be acritical turning point in our food system, together witha wider look at the pre-existing consumer trends andbehaviours, and thoughts about the future sustainabilityof the red meat sector. 11.3bnImplied retail valueof beef and sheepmeat suppliesincluding neteffect of importsand exports1,1004,0008253,0005502,0002751,0000 millionThousand tonnes (cwt)Value of production Beef and sheep meat production and farm gate value019941996Beef production199820002002Sheep meat production20042006Value (Beef)200820102012201420162018Value (Sheep meat)Source Defrasavills.com/research2

ConsumptionNine percent more beef is currentlyconsumed in the UK than a decade agoBest description of yourusual eating habits Meat eater 81% Vegetarian 3% Vegan 1% Don’t know 3% Flexitarian 14% Pescatarian 3% Other 3%Source YouGov 2019Most important reasonfor becoming veganTHE UK CONSUMES MOREBEEF THAN A DECADE AGO Animal ethics/welfare 32% To improve personal health 23% Environmental impactof meat production 16%Source AHDB/YouGov Consumer TrackerIs the rise of veganismin the UK overplayed?Due to population growth, 9% more beef is consumedin the UK than a decade ago. Furthermore, per capitaconsumption remains relatively flat with any reductionyet to show in annual per capita figures. With the UKpopulation set to continue growth of almost 5% by2030, the forecast is for beef markets to match thiswith a 4% expansion over the same period.Sheep meat (mostly lamb) consumption has seen agradual decline in the UK for some time. This is likely dueto limited cooking versatility and a perceived higher pricepoint. Although consumption has trended down 10% inthe last decade, it is still much higher in the UK on a percapita basis than in many other developed nations, alegacy of the historic importance of the wool trade withinBritain’s economy. Today consumers benefit from a highquality product being readily available locally.Overall meat consumption per head has increased as,on average, Britons consume over 61kg of animal proteinannually, up from 56kg a decade ago. Productivity gainsin the pork and poultry sectors have reduced their costsof production making them more affordable sources ofmeat protein, leading to an increase in overall meatconsumption and displacement of some beef and lambwithin consumers’ baskets.UK consumption per capitaA look beyond the marketing headlines30found 14% of the population describedthemselves as flexitarians.For many years consumers have beenencouraged to limit their consumptionof red meat and eat more fruit andvegetables by government healthyeating guidelines. The impact of thisadvice has been poor: fruit and vegetableconsumption remains well belowrecommended levels, but flexitarianshave taken the message on board. Laterthis year healthy diets will receiverenewed focus once Henry Dimbleby’sNational Food Strategy is published.For the red meat sector, flexitariansare the more important consumersector as they account for a biggershare of the market and crucially theyremain consumers of some meat.Flexitarians, with their underpinningmotivations, will logically favourquality over quantity, which meansthere are opportunities for producersand processors to capture a greatershare of value in the food chain byaiming branded products at thisgroup, which demonstrate high animalwelfare and product quality with alow environmental impact. AligningUK production with a ‘less and better’mantra may be the best strategy.32528.3222.8220Consumption (kg)There is no doubt a growing portionof consumers in the UK are activelyreducing their meat intake. Veganism’smedia profile has climbed rapidly,fuelled by social media, high-profileinfluencers and well-funded marketingcampaigns. However, as a dietarychoice it remains niche. Accordingto YouGov, in 2019 just 1% of thepopulation identified themselves asvegan. However, as a concept it hashad a more significant influence onconsumers, as over half the populationsay that they adopt some vegan buyingbehaviours (Opinion Matters poll).Alignment with broader climate changeadvice and the ethical debate aroundhuman interaction with animal speciesinfluences additional consumers toreduce their meat consumption.Those who have cut their meatconsumption are often classed as‘flexitarians’ although the qualificationcriteria vary. In some cases havingone or more meat-free meals a week(like ‘meat-free Monday’) is classedas ‘flexitarianism’, while in their2019 dietary study YouGov definedflexitarians as those who mainly followa vegetarian diet but occasionally eatmeat. Against this stricter definition it1511.6711.41104.924.12502009Sheep meat2019BeefPoultrySource OECDThe alternative protein sector (plant based meatsubstitutes) is less than 1% of the 1.4 trillionglobal meat market. Although this sector has seensignificant investor attention over the past five years, itwill be some time before it gains a significant market share.Source: Rabobank

ProductionOpportunities to increase exports to nonEU countries are progressing, with Chinalifting a 20-year ban on UK beef importsBeef farm gate vs retail pricesRetail volume sold (million kg)Average retail price ( /kg)16GB prime cattle price (Jan 313.313.313.313.31Total beefPrimarybeefMinceProcessedbeefBurgersand eatsMarinadesSousvideReadyto cook0Unit price ( /kg)Retail volume sold (million kg)7000Source AHDB, KantarSheep meat farm gate vs retail pricesRetail volume sold (million kg)Average retail price ( /kg)12.437510.31502516GB new season lamb (Jan 574.57Total sand grillsDiced/cubedMarinadesReadyto cook04Unit price ( /kg)Retail volume sold (million kg)1000Source AHDB, KantarUK meat productionGrowth in export markets is key to achieving higher pricesBEEFDomestically, the UK beef market hasstruggled for the past two years. Reducedslaughter volatility numbers and a recentlevelling of the GB R4L average deadweightprice suggest that the market is close toequilibrium, but lacklustre consumer demandevident at both retail and food service level ispushing prices lower. The disruption to foodservice caused by the coronavirus outbreakhas yet to be factored into markets, but islikely to result in a major shift to cooking athome and hence meat purchases from farms,butchers and supermarkets.Exports are likely to play an increasinglyimportant role in balancing the supply anddemand situation and setting domesticprices. Market access negotiations to non EUcountries are now taking place and recentsavills.com/researchannouncements of China and the US lifting20 year UK beef import bans are promisingsigns of progress. These markets alone presentan almost 300 million opportunity to sellhigh quality, hormone-free product into keygrowth markets.SHEEP MEATThe UK sheep meat market has traded in linewith five year average prices, having retreatedfrom above average prices over the pasttwo years. Brexit uncertainty has reducedbreeding flock numbers 4% year on year, thelargest change for a decade. The reductionhas followed the longer term trend of year onyear declines in domestic consumption rates.Imports and exports remain largely in balanceby volume with the two largest classes; UKwhole carcass exports into the EU offset by4NZ lamb leg imports. This trade accountsfor seasonal fluctuations in production andconsumer demand prior to the Easter spike.UK sheep meat producers face considerableuncertainty over the coming months whiletransition period trade negotiations playout. Estimated impacts of a ‘no-deal’ Brexitcould result in tariff rates as high as 45%-50%of carcass value on EU27 exports effectivelyforcing close to 33% of domestic lambproduction into other markets. The scope fordisplacing imported product with this extrasupply is limited due to the highly seasonalnature of the production and consumptioncycles, the manufacturing capacity availablein the UK and carcass balance issues becauseUK imports are skewed towards leg cuts,while the majority of exports are wholecarcasses.

Supply chains260%50%70%Estimated mark up betweenfarm gate and retail valueOf prime beef doesn’t meet idealtarget market specificationsAverage percentage of UK meatprocessor workforce with EU nationalityDisrupting the supply chainProposed policy changes are likely to target the entire supply chain to achieveoptimal outcomes. Opportunities will arise for those looking to work collaborativelyConsumers are becoming morealert to the provenance of theirfood and the impact of theirconsumption choices. They havebecome more willing to buy addedvalue products that tap into theirvalues, communicate quality,or offer other benefits such asconvenience. In response, thesupply chain is developing morebranded products and selling astory to capture additional value.Retaining and buildingconsumer trust is essential tothe long term viability of thesector. Investment in loweringenvironmental impact, highethical standards and premiumproduct quality may increasecosts in the short term but arelikely to become costs of marketentry. Increasing collaborationand transparency across thesupply chain will help accountfor this fairly and go some wayto realigning consumer priceexpectations. However, allstakeholders can spread theload by driving extra value.PRODUCERSSignificant value is added tored meat beyond the farm gate.According to the AHDB, UKfarmers sell their red meat fora total of 4.25 billion and itis then processed to achieve awholesale value of 11.3 billion(including a net 0.9 billioncontribution from import/exportbalance). This 260% mark-upshows there is potential forproducers to capture additionalvalue. Lobbying for the basisof pricing to be switched fromsubjective carcass assessments toobjective quality measurementswould help close the gap and passvalue back to those producinga product meeting consumers’desires. Producers can also addvalue by diversifying into directretail, or seize an opportunitythat the Agriculture Bill is due toprovide in England, to build theirmarket power and potentiallydevelop branded produce bycollaborating with other farmersto form a Producer Organisation(PO). The PO designationallows exemptions from certaincompetition laws, but hashistorically been restricted to thefresh fruit and vegetable sector. Itis credited with the rapid growthof UK soft fruit production overthe last 20 years.PROCESSORSEfficient, profitable processorsare an essential part of thesupply chain and the longevityof the sector. Their future lookschallenging, with lower throughput increasing marginal costs aswell as the increasing difficultyof accessing affordable skilledand unskilled labour. Accordingto the British Meat ProcessorsAssociation, on average 70% ofa processor’s workforce are EUworkers. The UK’s points basedimmigration system will favourskilled workers, roles with asalary over 25,600 and rolesthat are listed on the ‘shortageoccupations list’. The proposedlist does not include any meat5processing roles, where 60% of theworkforce are classed as unskilled.However, these roles have beenacknowledged as key roles underthe new coronavirus measures.Cooperative partnering withprocessors or cost plus marginprocessing agreements mayoffer opportunities to leveragea branded product and ensureprocessor supply is maintained.Investment in data, innovationand technology disruptors areessential in managing businessesand boosting profitability.RETAILERSRetailers hold enormous powerin the supply chain and are largelyresponsible for balancing salesvolume with the best possibleprice point per cut. While greaterprice transparency can alwaysbe demanded from premiumproduct lines, the cheaper end ofthe market is perhaps of greatersignificance as the product oftencomes at greater cost than what isseen on the label. There is a shiftto supply chains working withproducers who can prove theirenvironmental credentials, butwithout necessarily paying themany more to do so. Understandingthe value of on-farm sustainabilitymetrics in gaining higher marginmarket access is increasinglyimportant, particularly as net zeroand shareholder activism driveschange in corporate behaviours.FOOD SERVICEFood service offers plenty ofopportunity to drive innovationand value by showcasing thepotential of red meat. However,it must first overcome themajor disruption related tocoronavirus. Widespread closuresof restaurants and large franchisechains force significant volumesof beef and sheep meat back ontothe open market. McDonald’salone source on average 4,100tonnes of British and Irish beefmonthly and any extended closurecould prove troublesome forproducers unless retail demandresponds accordingly. Realigninga disjointed supply chain needsstakeholder collaboration to finda profitable solution for all.

The environment65%45.6m9%Of UK farmland is onlysuitable for growing grassTonnes total GHG emissionsfrom UK agricultureOf total UK emissions are attributedto the UK agricultural sectorAchieving net zeroThe livestock sector in the UK is uniquely positionedto make use of otherwise unproductive landWith the UK committed to achieve net zerogreenhouse gas emissions by 2050 and landuse uniquely offering the potential to sequestercarbon, agriculture’s future is being shaped by thisambition. Emissions accountability is coming to allsectors and farmers should be actively looking atways they can contribute.The 2050 commitment is based upon therecommendations of the Committee on ClimateChange. In 2020 the Committee released anupdated land use policies report that recommendedsignificant land use change to achieve the necessarylevels of climate change mitigation and adaptation.Under its plan 4.6 million hectares of UK landneeds to be released and repurposed. This majorstructural change would involve reducing thearable area by 30% and the area of grasslandby 11%. It is suggested that the released areacould be used for more trees, environmentaladaptation (peatland bogs, rewilding) and energycrops to achieve net zero on a national scale.Despite this scale of land use change, foodproduction from the UK is expected to be maintained,and globally it needs to increase. The UK remainsone of the most sustainable places in the world foragricultural production, livestock included. Richsoils, favourable climatic conditions and topographylead to efficient and reliable agricultural productioneven under a variety of future climate-relatedenvironmental changes. Furthermore, around 65%of UK farmland is only suitable for growing pasture.Utilising these large areas of upland and hillsideland for productive livestock grazing limits thespread of aggressive and undesirable vegetationthat otherwise possess limited or no alternativevalue or benefits to biodiversity. Proposedpolicy changes and the repackaging of subsidy tofocus more on environmental benefits suggestsadopting sustainable livestock and environmentalmanagement practices will pay dividends.COMPARING CARBONFOOTPRINTSRed meat often shoulders a largeportion of the human inducedcarbon footprint. But is thatjustified when compared toother common activities?Figures shown in kilograms CO 2equivalent emitted, the metricused to standardise differentemission types522UK average meatconsumption per year(18.2kg beef, 4.9kg lamb)450Return flightLondon to Rome760Annual emissions from a petrolcar driving 50 miles per week(operation only)5,400UK average per capitaemissions 2018Source Climate and Capitalism,Carbon Footprint, Carbon Briefsavills.com/research6

The environmentUK producers are well positioned to adopt a lower input, moreextensive approach to rearing and finishing ruminant animals,which encourages regenerative agricultural practicesLifecycle assessment of the GHG intensity of beef production300Beef herdDairy herdKgCO 2 e per kg retail itzerlandIrelandencFraSwedDenmUarKk0Source Committee on Climate Change: Land use: Policies for a Net Zero UKDecreasing the carbon hoof-printPractical steps to reducing greenhouse gas emissions of ruminant herds1Low-input, high-outputproduction unitsIncreasing reproductive rates andsurvivability together with highercarcass weights achieves greateroutput per breeder unit while reducingenergy intensive (and expensive) inputs.A ewe rearing twin lambs doubles outputand for virtually the same environmentalfootprint.2Methane inhibitionEarly trials with seaweed addedinto rations indicate a methaneemissions reduction of up to85% in sheep and 50% in dairycattle. A Swiss company expects to releasea methane inhibitor feed additive withinthe next five years. Genetics could also playa role as the level of methane an animalemits is in part an inherited trait. Throughselective breeding techniques loweremitting animals could be bred withina few generations.3FertiliserConsider nutrient cycling thatmirrors a circular farming modelas a substitute for energy intenseartificial fertilisers. Adding sulphuricacid to slurry reduces the GHG emissionsand increases nutrient value of the substrate.For those requiring artificial inputs, a shift totargeted fertiliser application with controlledrelease capabilities may be the way forward.45Grazing managementMaintaining ground cover isessential for pasture health andlongevity. It maximises carbonsequestration potential andensures a rapid growth response followingcell and rotational grazing patterns.Data informed management‘You can’t manage, what you don’tmeasure.’ A baseline measurementnow will inform what effectivechange looks like. There is unlikelyto be an industry standard carbon tool, sowork with supply chains on their requirementsor use a consistent methodology for selfevaluation. Natural capital assessments andnitrate loadings are other examples of whereto start.UK producers are well positioned to adopta lower input, more extensive approach torearing and finishing ruminant animals, whichencourages regenerative agricultural practices.Balancing a productive business unit with amantra of regenerative agriculture is of mutualbenefit to sustainable food production andincreasing diversity of plant, animal, insectand tree species. Livestock production playsan essential part in providing balance to thewhole ecosystem.A diverse combination of land use changestogether with appropriately managed andgrazed grasslands and a carefully consideredreduction in herd size can reach a domesticnet zero target and still provide a valuable,nutritious food source.Irish farmers are set to be paid to capture carbon in their permanent pasture as part of the country’s plan to achieve net zeroby 2050. The carbon sequestration potential of well managed pastures is estimated between 0.3t CO 2 /ha and 0.9t CO 2 /haper annum depending on management practices, and with carbon prices expected to reach 80/t in Ireland by 2030, the schemecould be worth anywhere between 100 million and 300 million across some 4.1 million hectares of grassland.7

The futureThere is no denying livestock emit greenhouse gassesthat contribute to global warming, but are they actuallyincreasing the global warming effect?A fair measure?New research suggests methane is unfairly accountedfor its warming effect under current metricsThere is no denying livestock emit greenhousegases that contribute to global warming,but are they actually increasing the globalwarming effect?New research argues that the currentmetrics used to assess the warmingcontribution of greenhouse gases incorrectlyaccount for methane, inflating greenhousegas emissions from ruminants andconsequently their significance within thenational picture. Methane is a short-livedgreenhouse gas that typically breaks downin the atmosphere within a decade, whilecarbon dioxide and nitrous oxides arelong-lived and continue to have a globalwarming impact in the atmosphere formany generations.To take this into account, researchers atthe University of Oxford have proposed that anew metric known as GWP* should be adoptedin place of the established metric GWP100(global warming potential over 100 years).savills.com/researchUsing GWP* reduces the global warmingimpact of ruminant livestock because itaccounts for the breakdown of methanerather than assuming it continues toaccumulate. This effectively means thatthe methane emissions from a steady ordeclining population of ruminants is notcausing additional global warming, as therate of methane production is cancelledout by the rate at which historic methaneemissions decay.Currently, all policy and reporting onclimate metrics use the GWP100 metric,however the IPCC has signalledits intention to report GWP* metrics inits forthcoming report.Using GWP* total UK agriculturalemissions in 2016 were 9.5 million tonnesCO2 equivalent (Mt CO2e), compared to45.6 Mt CO2e if the GWP100 calculation isused, a 79% difference in relative impact.Addressing this misrepresentation is8particularly important for the industry in therebalancing of policy to focus on heavy carbonemitting sectors such as construction, energy,manufacturing and transport.GWP* is not a licence to continue asnormal for the livestock sector. Limiting theeffects of anthropogenic global warming andslowing global temperature rises, requires aworldwide reduction in methane emissions.New methane inhibiting innovations showthe potential for progress, as do increases inoutput per breeder unit and genetic selectionagainst methane producing microbes. Socialpressures on the industry should encourageproducers to implement change at a farmlevel, which in combination with fair andeffective policy measures can position thesector well for a long, sustainable future.For more information on GWP* refer to OxfordMartin School – Climate metric for ruminantlivestock report.

The future83%45.6Mt9.5MtOf red meat consumption growthis expected from developing nationsCO2e is total UK agriculturalemissions under GWP100 metricCO2e is total UK agriculturalemissions under the new GWP* metricThe outlookWith a growing population, changing consumers anda precious environment to consider, challenges are aplentyThe red meat industry facesan unprecedented array ofchallenges. Turbulent markets,trade agreement uncertainty andworldwide consumption patterndisruption from coronavirus(effects unknown at the time ofwriting) make for a particularlyunpredictable businessenvironment.It is clear that as populationscontinue to grow, the weight ofdemand is negating changes inconsumption behaviour of thedeveloped world. Competitionfrom poultry and aquaculture,which are often cheaper and morereadily available alternative sourcesof protein will continue.Before coronavirus, consumptionin many developed countrieswas trending downward asenvironmental and health concernsweigh on consumers’ minds. Manytraditional strongholds of redmeat consumption were graduallyeating less, but a shift to homeconsumption could present atemporary or long-term change inconsumer behaviour. Producersshould be aware that short-termchanges may not last if consumersmove back to convenience and outof-home eating again. Flexitarianswill continue to demand highquality and value cuts of red meatalbeit less frequently.The UK is well placed toplay on its strengths to accessthese high value markets, butit remains unclear whether ornot this will be a factor in tradenegotiations, which are likely tofocus on financial services withagricultural concessions ratherthan opportunities. Investmentin data and traceability will bejustified to meet changing supplychain expectations around climateand environmental impacts.Competition for market sharefrom often cheaper white proteinsubstitutes and an increasingshare of plant based food canstill be expected. Wholesalers,manufacturers and retailers needto continue to invest in quality andpass value back down the supplychain to incentivise the higherstandards that consumers aredemanding from producers.We are moving from an erawhere business and consumptionwas financially focused andsocial or environmental impactsnot recognised. Consumers areplacing more weight on the socialand environmental credentials ofproducts they buy. Rapid change isinevitable as the UK acts to achievenet zero greenhouse gas emissionsby 2050 and while challenging forthe industry it could be beneficialtoo. Production processes that emitless carbon often use less energy, sowhile improving the environmentalimpact costs can be cut too.History shows those who areproactive in planning and adoptinginnovations will hold a competitiveadvantage.Today’s consumers andindeed the consumersof tomorrow will placemore weight on thesocial or environmentalcredentials of productswhen deciding whatto buyBeef and sheep meatconsumption forecastto 2020-20255.6%2.7%4,825k t39k tUKGlobalSource OECD9

UK Rural - January 2020S P OT L I G H TSavills ResearchUK Rural - January 2020Natural CapitalCarbon Offset MarketBiodiversity Net GainNitrate NeutralityS P OT L I G H TSavills ResearchRewilding1 Savills Spotlight NatCapital 10.indd 2Farmland forecastSavills ResearchBuyer and seller profilesSecurity and control of ownership15/01/2020 14:56UK Rural - November 2019S P OT L I G H TThe FarmlandMarketUK Rural - Spring 2020FarmDiversificationAre you making the most of your farm?Rural Vibrancy IndexS P OT L I G H TSavills ResearchCase studiesMarket evolutionHemp Cultivationin the UKGrowing costsMultiple end usesInvestment opportunitiesSavills ResearchWe’re a dedicated team with an unrivalled reputation for producing well-informed andaccurate analysis, research and commentary across all sectors of the UK property market.To view copies of our previous Spotlight publications, go to www.savills.co.uk/insight-and-opinion/Emily NortonHead of Rural Research020 7016 3786emily.norton@savills.comAngus LockeAssociate Rural Research020 7075 2871angus.locke@savills.comAndrew MacdonaldHead of Food and Farming Scotland01738 477 516andrew.macdonald@savills.comSavills plc: Savills plc is a global real estate services provider listed on the London Stock Exchange. We have an international network of more than 600 offices and associates throughout the Americas, the UK,continental Europe, Asia Pacific, Africa and the Middle East, offering a broad range of specialist advisory, management and transactional services to clients all over the world. This report is for general informativepurposes only. It may not be published, reproduced or quoted in part or in whole, nor may it be used as a basis for any contract, prospectus, agreement or other document without prior consent. While every effort hasbeen made to ensure its accuracy, Savills accepts no liability whatsoever for any direct or consequential loss arising from its use. The content is strictly copyright and reproduction of the whole or part of it in any formis prohibited without written permission from Savills Research.

for becoming vegan. BEEF. Domestically, the UK beef market has struggled for the past two years. Reduced . slaughter volatility numbers and a recent levelling of the GB R4L average deadweight price suggest that the marke