Transcription

United States Government Accountability OfficeMarch 2017HIGHLIGHTS OF AFORUMDATA ANALYTICS TOADDRESS FRAUDAND IMPROPERPAYMENTSConvened by the Comptroler General of the U.S.Accessible VersionGAO-17-339SP

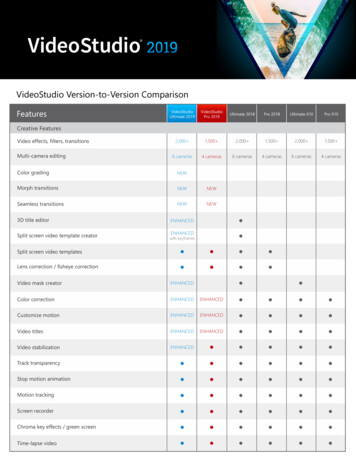

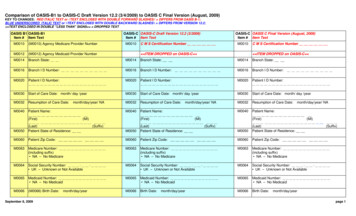

January 2016Data Analytics to Address Fraud and ImproperPaymentsHIGHLIGHTS OF A FORUMConvened by the ComptrollerGeneral of the United StatesWhy GAO Convened ThisForumIn fiscal year 2016, federal agenciesestimated making over 144 billion inimproper payments, a number that hasincreased considerably in recent years.Improper payments, including thoseresulting from fraud, are a significantand pervasive government-wide issueand have presented a continuingchallenge to the federal government.Reducing improper payments is criticalto safeguarding federal funds, andcould help achieve cost savings andhelp improve the government’s fiscalposition.What the Participants SaidOpportunities for CollaborationCollaboration between the government, private sector, public–privatepartnerships, and academia may allow entities to share analytics-relatedresources and knowledge to address the challenge of improper payments, asshown in the figure below. To foster collaboration, entities in a prospectivecollaboration should identify the defined objectives and desired outcomes of theirpartnership, according to panelists. Further, entities should work to build trustwith each other and demonstrate a willingness to collaborate. Panelists statedthat many commonly cited barriers to collaboration, including potential legal anddata-sharing barriers, may be overcome through communication and research.Examples of Partnerships and Resources Provided by the PanelistsGAO’s previous work has shown thatimplementing preventive and detectivecontrols, including data-analytics toolsand techniques, is one strategy toaddress improper payments, includingfraud.On September 21, 2016, GAOconvened a group of data-analysisexperts to discuss: (1) opportunities forcollaboration, (2) considerations forestablishing a data-analytics program,and (3) considerations for refining adata-analytics program. GAO selected12 forum panelists from thegovernment, private sector, public–private partnerships, and academiabased on their demonstrated ability toprovide examples of their work anddiscuss topics related to using dataanalytics to address improperpayments, including fraud. This reportsummarizes the discussion by forumpanelists. Comments expressed in thereport do not necessarily represent theviews of all participants, theirorganizations, or GAO. Panelistsreviewed a draft of this report, andGAO incorporated their comments, asappropriate.View GAO-17-339SP. For more information,contact Vijay D'Souza at (202) 512-2700 ordsouzav@gao.gov, or Seto Bagdoyan at (202)512-6722 or bagdoyans@gao.gov.Considerations for Establishing Analytics ProgramsForum panelists identified several considerations for entities in the early stagesof developing an analytics program to address improper payments, including (1)identifying specific objectives and aligning analytics programs with thoseobjectives; (2) conducting an inventory of existing technology, techniques, data,and staff, and identifying new opportunities to leverage existing capabilities; and(3) demonstrating the value of analytics to obtain entity-wide support.Considerations for Refining Analytics ProgramsPanelists highlighted the importance of continuously improving analyticsprograms by revisiting and reassessing analytics tools, techniques, and availabledata sets. Additionally, panelists stated that entities should identify staff withknowledge of both analytics and the business of the entity to further the entity’smission and meet objectives.United States Government Accountability Office

ContentsLetter1Considerations for Establishing Analytics ProgramsConsiderations for Refining Analytics ProgramsOpportunities for Collaboration61517Appendix I: Objectives, Scope, and Methodology22Appendix II: Forum Panelists26Appendix III: Forum Agenda28Appendix IV: Forum Issue Brief29Appendix V: GAO Contacts and Staff Acknowledgments30GAO ContactsStaff Acknowledgments3030Related GAO Products31FiguresFigure 1: Examples of Analytic TechniquesFigure 2: Examples of Data Sources Used to Detect ImproperInsurance PaymentsFigure 3: Visualization of Federal Housing Administration (FHA)Mortgage Insurance ClaimsFigure 4: Hurricane Sandy Storm Surge and Department ofHousing and Urban Development (HUD) Public-HousingAssets around Atlantic City, New JerseyFigure 5: Examples of Partnerships and Resources Provided bythe PanelistsPage i79121421GAO-17-339SP Forum on Data Analytics

AbbreviationsCDACConsolidated Data Analysis CenterCIACentral Intelligence AgencyCMSCenters for Medicare & Medicaid ServicesCPICenter for Program IntegrityDODDepartment of DefenseFEMAFederal Emergency Management AgencyFHAFederal Housing AdministrationFNSFood and Nutrition ServiceHFPPHealthcare Fraud Prevention PartnershipHHSDepartment of Health and Human ServicesHUDDepartment of Housing and Urban DevelopmentIDRIntegrated Data RepositoryOIGOffice of Inspector GeneralOMBOffice of Management and BudgetSNAPSupplemental Nutrition Assistance ProgramUSDAUnited States Department of AgricultureUSPSUnited States Postal ServiceThis is a work of the U.S. government and is not subject to copyright protection in theUnited States. The published product may be reproduced and distributed in its entiretywithout further permission from GAO. However, because this work may containcopyrighted images or other material, permission from the copyright holder may benecessary if you wish to reproduce this material separately.Page iiGAO-17-339SP Forum on Data Analytics

441 G St. N.W.Washington, DC 20548LetterMarch 31, 2017Congressional AddresseesIn fiscal year 2016, federal agencies estimated making over 144 billionin improper payments, which includes payments that should not havebeen made or that were made in an incorrect amount. Such payments area significant and pervasive government-wide issue and present acontinuing challenge to the federal government. Since fiscal year 2003—when certain agencies were required by statute to begin reportingimproper payments—cumulative improper payment estimates havetotaled over 1.2 trillion. 1 Reducing improper payments, including thosethat are the result of fraud, is critical to safeguarding federal funds, andcould help achieve cost savings and help improve the government’s fiscalposition.0FAs stewards of taxpayer dollars, federal managers have the ultimateresponsibility for overseeing how government funds are spent. We havepreviously reported on ways they might do so more effectively. 2 Our priorwork highlights a set of leading practices that may serve as a guide forprogram managers to use when developing or enhancing efforts tocombat fraud in a strategic, risk-based manner. 3 Laws, including theFraud Reduction and Data Analytics Act of 2015, and guidance by theOffice of Management and Budget (OMB), including the revised OMBCircular A-123, have increasingly focused on the need for program1F2F1GAO has found that recent laws and guidance have focused attention on improperpayments, but incomplete or understated estimates and noncompliance with criteria listedin federal law hinder the government’s ability to assess the full extent of improperpayments and implement strategies to reduce them. See GAO, Fiscal Outlook:Addressing Improper Payments and the Tax Gap Would Improve the Government’s FiscalPosition, GAO-16-92T (Washington, D.C.: Oct. 1, 2015).2For example, see GAO, Improper Payments: CFO Act Agencies Need to Improve Effortsto Address Compliance Issues, GAO-16-554 (Washington, D.C.: June 30, 2016), andGAO-16-92T, among others.3See GAO, A Framework for Managing Fraud Risks in Federal Programs, GAO-15-593SP(Washington, D.C.: July 2015).Page 1GAO-17-339SP Forum on Data Analytics

Lettermanagers to take a strategic approach to managing improper paymentsand risks that include fraud. 43FOne element of a strategic approach is implementing preventive anddetective controls, including data analytics. Data analytics involves avariety of techniques to analyze and interpret data to facilitate decisionmaking and may be used to identify patterns or trends, determine whetherproblems are widespread and systemic in nature, and evaluate programperformance and outcomes.On September 21, 2016, we convened a forum to advance theintergovernmental dialogue on implementing data analytics to preventand detect improper payments, including fraud. 5 We selected 12panelists, including individuals from across government, the privatesector, public–private partnerships, and academia, based on theirdemonstrated ability to discuss and provide examples of using dataanalytics to address improper payments. 6 In addition to these panelists,we invited guests, primarily from the federal government, to observe theforum and learn from the panel discussions.4F5FForum panelists highlighted the following three topics for discussion:·Establishing an analytics program to address improper payments.·Refining an analytics program to address improper payments.·Identifying opportunities for collaboration among analytics programs.This report summarizes the discussion by forum panelists and guests,highlighting key ideas that emerged during the discussion sessions. It isnot intended to represent an exhaustive list of all ideas and themes that4The Fraud Reduction and Data Analytics Act of 2015 requires OMB to establishguidelines for federal agencies to establish financial and administrative controls to identifyand assess fraud risks and design and implement control activities in order to prevent,detect, and respond to fraud, including improper payments. Additionally, the law statesthat these guidelines shall incorporate the leading practices identified in GAO’sFramework for Managing Fraud Risks in Federal Programs. Pub. L. No. 114-186 (June30, 2016); 31 U.S.C. § 3321 note.5For purposes of this report, when we use the term “improper payments,” we are referringto all improper payments, including those considered fraud.6Although we originally selected 13 panelists for the forum, 1 panelist was unable toattend at the last minute. A total of 12 panelists spoke at the forum.Page 2GAO-17-339SP Forum on Data Analytics

Letteremerged during the forum. Further, the information presented in thisreport does not necessarily represent the views of all participants or theviews of their organizations, including GAO. We structured the forum sothat all panelists could openly comment on issues, although not allpanelists commented on all topics. Throughout the report, we refer to“panelists” in order to indicate views expressed by more than onepanelist. After the forum, we conducted several follow-up interviews withselected panelists in order to obtain further clarification on statementsmade during the forum, and provided an opportunity for the panelists tocomment on a draft of this report.Appendix I provides more details on the scope and methodology used toplan and conduct the forum and prepare this report. Appendix II providesa list of forum panelists and their affiliations, and appendix III provides theforum agenda. Appendix IV provides the issue brief sent to panelists priorto the forum.We conducted our work from December 2015 to March 2017 as part ofour ongoing body of work on improper payments, including fraud, and inaccordance with all sections of GAO’s Quality Assurance Framework thatare relevant to our objectives. The framework requires that we plan andperform the engagement to obtain sufficient, appropriate evidence tomeet our stated objectives and discuss any limitations in our work. Webelieve that the information and data obtained, and the analysisconducted, provide a reasonable basis for this product.This report is available at no charge on the GAO website athttp://www.gao.gov.If you or your staff have any questions about this report, please contactVijay D’Souza at (202) 512-2700 or dsouzav@gao.gov or Seto Bagdoyanat (202) 512-6722 or bagdoyans@gao.gov. Contact points for our Officesof Congressional Relations and Public Affairs may be found on the lastpage of this report. GAO staff who made key contributions to this reportare listed in appendix V.Page 3GAO-17-339SP Forum on Data Analytics

LetterI wish to thank all of the forum participants for their time and thoughtfulcontributions to the forum discussion. The discussion enhanced ourunderstanding of issues related to the use of data analytics to addressimproper payments, and we will all benefit from these insights as we carryout our work on this issue.Gene L. DodaroComptroller General of the United StatesPage 4GAO-17-339SP Forum on Data Analytics

LetterList of AddresseesThe Honorable Greg WaldenChairmanThe Honorable Frank PalloneRanking MemberCommittee on Energy and CommerceHouse of RepresentativesThe Honorable Lamar SmithChairmanCommittee on Science, Space, and TechnologyHouse of RepresentativesThe Honorable Jeff FlakeChairmanThe Honorable Al FrankenRanking MemberSubcommittee on Privacy, Technology, and the LawCommittee on the JudiciaryUnited States SenateThe Honorable Barbara ComstockChairwomanSubcommittee on Research and TechnologyCommittee on Science, Space, and TechnologyHouse of RepresentativesThe Honorable Christopher CoonsUnited States SenateThe Honorable Mark TakanoHouse of RepresentativesPage 5GAO-17-339SP Forum on Data Analytics

LetterConsiderations for Establishing AnalyticsProgramsForum panelists identified several considerations for entities 7 establishinganalytics programs to address improper payments including (1) identifyingspecific objectives and aligning analytics programs with those objectives;(2) conducting an inventory of existing technology, techniques, data, andstaff and identifying new opportunities to leverage existing capabilities;and (3) demonstrating the value of analytics to obtain entity-wide support.6FIdentify Objectives and Align Analytics Programs

Data analytics involves a variety of techniques to analyze and interpret data to facilitate decision making and may be used to identify patterns or trends, determine whether problems are widespread and systemic in nature, and evaluate program performance and outcomes.