Transcription

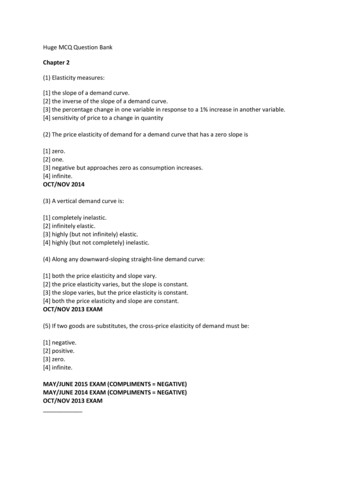

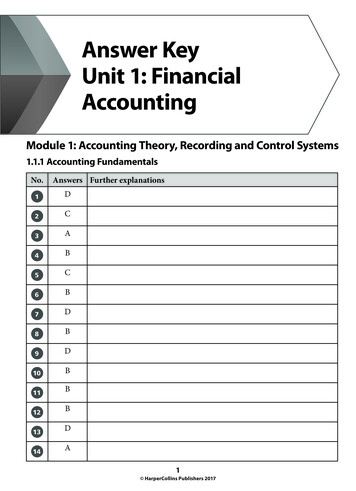

Answer KeyUnit 1: FinancialAccountingModule 1: Accounting Theory, Recording and Control Systems1.1.1 Accounting FundamentalsNo.Answers Further explanations1D2C3A4B5C6B7D8B9D10B11B12B13D14A1 HarperCollins Publishers 2017

No.15Answers Further 8D29D1.1.2 Recording Financial InformationNo.Answers Further explanations1B2BExplanationThe body of the question says, “an equivalent value of ordinary shares”and makes no mention of the value of the shares. The possible answeris that ordinary shares (common stock) issued is equal to the fair valuephysical assets. The acquisition of assets is always at fair value not atbook value.2 HarperCollins Publishers 2017

No.3Answers Further explanationsAWorkingFair Value of the individual asset Fair Value of the total assets Theacquisition cost Recorded value of the individual assets 50 000 250 000 200 000 40 0004CWorkingFair Value of the asset Fair Value of the total asset The acquisitioncost Recorded value of the individual assets 80 000 250 000 200 000 64 0005B6C7D8C9C10BWorkingGoodwill The purchase price of the business – the fair value of thebusiness 13 000 000 – 12 000 000 1 000 00011D12B13D14C15C16D17A3 HarperCollins Publishers 2017

No.18Answers Further explanationsCWorkingReducing balance method for calculating depreciationFormula: Depreciation for the year *Net Book Value (NBV) givenpercentage *120 000 15% 18 000*Net Book Value Property, Plant and Equipment at cost – AccumulatedDepreciationThe journal is Dr: Income Summary; Cr: Allowance for Depreciation19D20D21D22C23D24D25BExplanationBAny issue of common stock (ordinary shares) to current shareholders ata discounted price from market price is called a rights issue.Working26The issue of shares was a rights issue. The current ordinaryshareholders were issued the shares at 12.00 which is 2.00 above par( 12.00 – 10.00 2.00). The market price does not matter in a rightsissue as the shares are usually issued lower than market price, that is, adiscounted price for current shareholders. As a result:Dr: Cash: Cash Collected 12.00 20 000 ordinary shares 240 000Cr: Ordinary Shares: Ordinary Shares value 10.00 20 000 ordinaryshares 200 000Cr: Paid-in Capital in Excess of Par: Capital in Excess of Par 2.00 20 000 ordinary shares 40 00027D4 HarperCollins Publishers 2017

No.2829Answers Further explanationsCB1.1.3 Internal ControlsNo.Answers Further Although most students see the answer as ‘establishment ofresponsibility’ or ‘segregation of duties’, the issue here is the lack ofsupervision or checking of the money by someone other than thecashier to verify that the sum collected is equal to the day’s recordedreceipts up to the point that the deposit slip is prepared and depositedinto the night deposit facility.13B5 HarperCollins Publishers 2017

No.Answers Further explanations14D15A16D17C18D19B20AModule 2: Preparation of Financial Statements1.2.1 Forms of Business OrganisationsNo.Answers Further explanations1B2A3B4A5D6B7A8A9D10A6 HarperCollins Publishers 2017

1.2.2 Preparation and Presentation of Statement of Comprehensive IncomeNo.Answers Further explanations1D2B3BWorkingTotal number of units in stock 900Number of units of stock remaining in stock Total number of units –Stock issued 900 – 600 300Value of stock using FIFO (200 14) (100 15) 43004AWorkingValue of stock using weighted average Total value of units in hand /Total number of units in hand 12 200/900 13.55300 13.55 40655A6C7B8D9AWorking(Opening capital Additional capital) – (Closing capital drawings) ( 30 000 30 000) – ( 60 000 10 000) 10 00010B11D12D13D14A15D7 HarperCollins Publishers 2017

1.2.3 Preparation and Presentation of Statements of Retained Earningand Financial PositionNo.1Answers Further explanationsBWorkingRetained Earnings 1 January 2014 90 000Prior year adjustment understatement depreciation( 20 000)Adjusted Retained Earnings January 2014 70 000Profit for the year 80 000 150 0002C3D4C5BDividends declared (20 000)Balance of retained earnings for 2014 130 000WorkingCost of Equipment – Allowance for depreciation 10% ( 100 000 – 25 000) 10% 75006BWorkingAllowance for depreciation annual depreciation ( 25 000 7500) 32 5007CWorkingCost of depreciation – accumulated depreciation ( 100 000 – 32 500) 67 5008D9A10C8 HarperCollins Publishers 2017

No.Answers Further explanations11B12D13C14BWorkingDMonthly salary 12 20 000 12 240 000Working15Total salaries paid for the year – salaries for the period 320 000 – 240 000 80 00016A17B18B19C20A21A22AWorkingClosing capital –400 300 70 40 15 – 3 2223DWorkingNet loss Opening capital – minus closing capital 200 – 22 178 loss1.2.4 Preparation of Financial Statement for other businessesNo.Answers Further explanations1D2CWorking15-year mortgage value 10% 200 000 10% 20 0009 HarperCollins Publishers 2017

No.3Answers Further explanationsCWorking Sales2 000 000Purchases(800 000)1 200 000Honoraria(30 000)Insurance(5000)General(10 000)Salaries and wages(30 000)Loan interest(20 000)Net profit4C1 105 000Working300 members 150 monthly subscriptions 45 0005A6D7A8D9D10A11A12C13D14D15BWorkingACommon stock 10 000 2 bonus shares 20 000Working16Common stock bonus shares rights issues 20 000 10 000 5 6 00010 HarperCollins Publishers 2017

No.17Answers Further explanationsAWorkingCommon Stock 10 000 20 000 6 000 36 000The bonus shares total of 20 000 will deducted from the additionalcapital first and the remainder from retained earnings18BTherefore Additional Capital 19 000 – 19 000 0 and RetainedEarnings 71 000 – 1 000 70 000 Sales revenues 150 000Cost of goods sold(80 000)Gross profit70 000Other revenues20 00090 000Selling expenses(10 000)Administrative expenses(20 000)Other expenses(15 000)Finance costs1920(8000)AProfit before taxWorking37 000AProfit before tax 37 000 20% 7 400WorkingProfit before tax 37 000 – Corporation tax 7400 29 6001.2.5 Accounting for PartnershipsNo.Answers Further explanations1A2AWorkingTotal Fair market value of assets – Total capital ( 400 000 100 000 150 000 40 000) – 900 000 210 0003D4A11 HarperCollins Publishers 2017

No.5Answers Further explanationsAWorkingValue of shares ( 100 000 5) – old capital added to new investment( 150 000 2 100 000) 100 0006D7B8DWorkingOld partners’ capital new partner capital ( 80 000 75 000 300 000) 455 0009CWorkingTotal investment 1/5 interest 455 000 5 91 00010CWorkingWood’s investment – Wood’s interest 300 000 – 91 000 209 00011A12D13BWorkingNet profit 26 000 – Salary 6 000 remaining profits to be shared 20 0003/5 share of profit 20 000 12 0002/5 share of profit 20 000 800014B15BWorkingTotal income to be shared Income 50 000 less share of interest ofcapital ( 100 000 10% 10 000) ( 50 000 10% 5 000) 35 000.16BAmount of income to be shared between partners 35 000 2 17 500 eachWorkingOld partners’ capitals New partner capital 48 000 42 000 50 000 140 000New partner 1/5 share of capital is 140 000 5 28 00012 HarperCollins Publishers 2017

No.17Answers Further explanationsA18A19C20A21B22DWorkingTotal loss to be shared equally 39 000 3 13 000Module 3: Financial Reporting and Interpretation1.3.1 Preparation of Cashflow Statement (Indirect Method Only)No.Answers Further explanations1C2DExplanationIt is important to remember that not only are cash items and itemsthat can be easily converted to cash considered to be cash and cashequivalents, but a bank overdraft, because of its nature of being ademand payment, significantly affects the cash balance and should beincluded in this total.3C4B5D6A7C8A9C13 HarperCollins Publishers 2017

No.10Answers Further explanationsDExplanation and workingUnder IAS 7, operating activities start with the profit before interest andtax. Adjustment must also be made for any Investment income, such asdividend income or interest income for the period.Profit before interest and tax Net Income Tax for the year Interestexpense for the year – Interest income or Investment income for theyear 29 000 4000 1500 – ( 1200 6000) 27 30011AExplanation and workingNet cash flow from operating activities is calculated as follows:Profit before interest and tax *Net non-cashflow adjustments *Netchanges to working capital – Tax paid – Interest paid*(this figure can be positive or negative)In this question it is calculated as follows:Profit before interest and taxes as calculated inthe previous question 27 300Adjustments (noncash flow items)Depreciation 1750Gain on sale of equipment( 900) 28 150Changes in working capital12DNet increase in current assets except cash( 6000)Net increase in current liabilities 4500( 1500)Interest paid( 1200)Tax paid( 3200)Net cashflow from operating activities 22 250ExplanationSince the land was exchanged for ordinary shares there is no exchange ofcash in the transaction. However, because of its significance to the financialstatements and as a result the users of these statements, IAS 7 requires thatthere must be separate disclosure of this transaction in the notes.14 HarperCollins Publishers 2017

No.13Answers Further explanationsDExplanation and workingNet cashflow from investing activities Proceeds from sale or disposalof non-current assets – Purchase of non-current assets InvestmentincomeIn this question the following items are investing activity items:14A15DPurchase of motor van( 15 000)Proceeds from sale of equipment 6000Dividend Income 6000Interest income received 1200Net cash flow from investing activities( 1800)1.3.2 Financial Statements Analysis: RatiosNo.Answers Further explanations1B2D3DWorkingClosing inventory Opening inventory 110% 35 000 110% 38 5004BWorkingAverage inventory (Opening Inventory Closing Inventory) 2 ( 35 000 ( 35 000 110%)) 2 36 7505BWorkingStock Turnover Cost of Sales Average Inventory * 112 000 36 750 3.05 times*Cost of sales 80% of sales 80% 140 000 112 00015 HarperCollins Publishers 2017

No.6Answers Further explanationsCWorkingAccounts receivable days ratio Average Accounts Receivables CreditSales Number of business days * 20 000 120 000 340 57 days*Average receivable (Opening Receivables Closing Receivables) 2 ( 25 000 15 000) 2 20 0007DWorkingAccounts payable days ratio Average Accounts Payables Cost ofSales Number of business days * 15 000 80 000 340 64 days*Average Payables (Opening Payables Closing Payables) 2 ( 25 000 15 000) 2 20 0008D9B10CWorkingCurrent Ratio Current Assets Current Liabilities ( 14 000 8000 30 000 15 000) ( 6000 16 000 15 000) 67 000 37 000 1.81:111BWorkingAcid Test/Quick Ratio (Current Assets – Inventory) CurrentLiabilities ( 14 000 8000 30 000) ( 6000 16 000 15 000) 52 000 37 000 1.41:112D13A14DWorkingGross Profit Percentage *Gross Profit Net Sales 100 80 000 152 000 100 52.63%Gross Profit *Net Sales – Cost of Sales 152 000 – 72 000 80 000Net Sales Sales – Sales returns and Allowances 156 000 – 4000 152 00015A16 HarperCollins Publishers 2017

No.16Answers Further explanationsBWorkingNet profit margin *Net Profit Net Sales 100 38 250 152 000 100 25.16%*Net Profit Profit before tax – corporation tax 45 000 – ( 45 000 15%) 38 250Profit before tax Net Sales other revenues – Cost of Sales –operating and other expenses 152 000 7000 – 72 000 – 30 000 – 12 000 45 0001718192021BNet Sales Sales – Sales returns and Allowances 156 000 – 4000 152 000WorkingCIncome attributable to ordinary shareholders Net Income – PreferenceDividend 62 000 – 6000 56 000WorkingDEarnings per share Income attributable to ordinary shareholdersdivided by average number of ordinary shares in issue ( 75 000 – 6000) ((26000 shares 20000 shares) 2) 3.00 per ordinary shareWorkingBMV per share / EPS 25 / 3 8.33WorkingB(TCL TNCL) / TA (115 185) / 750 40%Working(TCL TNCL) / TSE (75 175) / 250 122A23A1.3.3 Disclosures and ReceivershipNo.Answers Further explanations1C2D17 HarperCollins Publishers 2017

No.Answers Further explanations3B4A5C6A7D8BWorkingTotal sales @ 90% (10 4 7 9) 90% 279C10C11C12B13A14B15D16C17D18C19B20C21B22A23D18 HarperCollins Publishers 2017

No.24Answers Further explanationsC25B26C27A28B29A30C19 HarperCollins Publishers 2017

Unit 2: Cost andManagementAccountingModule 1: Costing Principles2.1.1 Introduction to Cost and Management AccountingNo.Answers Further explanations1D2D3C4C5D2.1.2 Manufacturing Accounts PreparationNo.Answers Further explanations1B2D3C4D20 HarperCollins Publishers 2017

No.5Answers Further explanationsBWorkingBeginning finished goods inventory 100 000Add cost of goods manufactured 800 000 900 000Less ending finished goods inventory 300 000Cost of goods sold 600 0002.1.3 Cost Classification and CurvesNo.Answers Further explanations1D2D3A4C5B2.1.4 Elements of Cost: MaterialsNo.Answers Further explanations1B2D3C4D5D6C7A21 HarperCollins Publishers 2017

No.8Answers Further explanationsAWorkingCost of goods sold is calculated as follows. 3000 8 24 000 5000 8.40 42 000 6000 8 48 000 114 000 4000 8.40 ( 33 600) 6000 8 ( 48 000) 1000 8.40 ( 8 400) 24 0009A10D11D12CWorking 13A14D15D2 30 000 203WorkingSafety stock (maximum expected usage for the week – average usageper week) lead time (150 – 100) 3 150Reorder point (lead time average weekly usage) safety stock (3 100) 150 4502.1.5 Elements of Cost: LabourNo.Answers Further explanations1C2C22 HarperCollins Publishers 2017

No.3Answers Further explanationsAWorkingNormal hours – idle hours rate per hour 40 – 3 3737 18 6664BWorkingIdle time rate per hour total direct labour 3 18 666 7205D6A7CExplanationThese are alternative treatments; they cannot be applied simultaneously.Period costs is not an option in this case because it refers to productionworkers.8B9A10C11BWorkingNumber of hours rate per hour 40 50 200012CWorkingTime and half overtime hours 50 1.5 40 300013D14BWorking600 0.50 300100 0.55 5545 0.60 27 38215B23 HarperCollins Publishers 2017

2.1.6 Elements of Cost: OverheadsNo.1Answers Further explanationsDWorkingHousehold department total space occupied (500 1000) 28 000 14 0002DWorkingAllocation basis: Janitorial Mixing Baking 10 50 80 140Allocation: (10 140) 800 000 57 1423D4A5A6BWorkingBudgeted overhead costs budgeted direct labour hours 550 000 20 000 27.507C8D9D10B11A12D13CWorkingTotal overhead Assembly (8 8 64) Finishing (15 15 225) 28924 HarperCollins Publishers 2017

No.14Answers Further explanationsDWorkingDirect material ( 130 35) 165Direct labour ( 40 90) 130Overhead (from previous question) 289 58415A2.1.7 Decision Making – Relevant CostingNo.1Answers Further explanationsBWorkingCost per unit for direct material 37 500 7500 5.00Cost per unit for direct labour 60 000 7500 8.00Variable manufacturing overhead ( 20 000 30%) 7500 0.80Variable selling overhead ( 25 000 0.5 60%) 7500 1.00Total unit cost 5 8 0.80 1 14.80Cost to produce special order (200 14.80) 400 [additional fixedcost] 33602DWorkingPrice per unit to earn 1000 ( 3360 1000) 200 21.803B25 HarperCollins Publishers 2017

No.4Answers Further explanationsBWorkingMake 80 000080 000Direct labour40 000040 000Variable manufacturingoverhead10 000010 0005000250025000112 500(112 500)135 000115 00020 000Purchase price(75 000 1.50)C6D7C8B9C10D11C12AWorkingExpected decrease in revenue13Net incomeincrease(decrease) Direct materialsFixed manufacturingoverhead5Buy ( 100 000)Expected decrease in total variable cost 40 000Expected decrease in fixed cost (50%) 20 000Expected decrease in total cost 60 000Expected decrease in operating income( 20 000)A26 HarperCollins Publishers 2017

No.1415Answers Further explanationsBAWorkingDirect material 2 500Direct labour 1000Variable manufacturing overhead 200Total variable costs 3 700WorkingMake Outsource Difference Variable cost:Direct material25002500Direct labour10001000200200Variable manufacturingoverheadPurchase price (7 500)03500(3500)37003500200Module 2: Costing Systems2.2.1 Traditional Costing and Activity Based CostingNo.Answers Further explanations1C2D3A4C5B6AWorking4000 units 2.5 hrs 10 000 hours27 HarperCollins Publishers 2017

No.7Answers Further explanationsBWorkingOHAR Total estimated overhead cost Total estimated activity 250 000 ((4000 units 22.50) (6000 units 31.50)) 250 000 279 000 0.90 per direct labour dollar8CWorking4000 units 2.5 hrs 9 90 0009DWorking 281 000 / 10 000 hrs 28.1010DWorking 46 000 / 1150 phone calls 40.0011C12CWorkingPOHAR Total estimated overhead cost Total estimated activity Total estimated overhead cost Total labour hours 252 000 (4200 10 800) 16.8013BWorkingOverhead absorbed POHAR Activity for product 16.80 4200direct labour hours 70 56014AWorkingCost TotalactivityOverhead Custom tabletsactivityoverhead costrate using ABCSet ups171 000 300 set ups 570/set up 570 120 68 400Machine81 000 90009/mhr 9 3600 maintenancemachine 32 400hoursTotal252 000 68 400 32 400manufacturing 100 800Overhead costs28 HarperCollins Publishers 2017

No.15Answers Further explanationsDWorkingCost Total OverheadSlimline tabletsactivity activityoverhead cost usingrateABC Set ups171 000 300570/set up 570 180 102 600set upsMachine81 000 90009/mhr 9 5400 48 600maintenancemachinehoursTotal252 000 102 600 48 600 manufacturing 151 200Overhead costsDifference in overhead ABC cost – traditional costing cost 151 200– 70 560 80 6402.2.2 Job CostingNo.Answers Further explanations1B2D3A4C5AWorkingOverhead applied Activity for the job *POHAR Labour cost 60% (* 120 28 hours) 60% 2016*Labour rate per hour 3 600 000 30 000 hours 1206DWorkingSelling price of Job 121 *Cost of Job 121 110% 12 144 110% 13 358.40*Cost of Job 121 Direct materials Direct labour Manufacturingoverhead 6000 ( 120 32 hours) ( 120 32 hours 60%) 12 14429 HarperCollins Publishers 2017

No.Answers Further explanations7B8D9CWorkingOverhead application rate (Total cost of Job P123 – Direct costs) Total Direct labour costs 100 ( 34 000 – ( 25 000 5000)) 25 000 100 16%10BWorkingOverhead application rate (Total cost of Job 2 34 – Direct costs) TotalDirect costs 100 ( 16 800 – {[32 hours 250] 6000}) {[32 hours 250] 6000} 100 ( 16 800 – 14 000) 14 000 100 20%11CWorkingTotal overhead applied Total labour cost Predetermined overhead rate ( 120 130 300 240 250 230 260) 120% 183612BWorkingEnding WIP inventory Job 620 Job 623 ( 100 240 240 120%) ( 390 260 260 120%) 159013DWorkingRemember to include all the elements of cost, not only direct costs.Jobs 617, 618 and 621 were sold during the period. The calculation is asfollows.Job No.Opening Direct Direct Overhead applied Totalwork in materials labour process 617120100120120 120% 144 484618200–130130 120% 156 486621–420250250 120% 300 970Total cost320520500600 1940of goodssold30 HarperCollins Publishers 2017

No.Answers Further explanations14D15B16BWorkingB 200 000 75% 150 000WorkingA 175 000 – 150 000 25 000 under-appliedWorkingBOverhead % for Job N75 Overhead applied Total cost of job 100 (4000 labour hours 25.00) (66000 84000 (4000 25.00)) 100 40%WorkingCTotal over/under applied overhead Actual overhead – overhead applied 160 000 – (4000 hrs 1800 hrs) 25 160 000 – 145 000 15 000under appliedWorking17181920Gross profit percentage (Selling price – Cost of Job) Selling Price 100 { 280 000 – [ 66 000 84 000 (4000 25.00)]} 280 000 100 11%2.2.3 Process CostingNo.Answers Further explanations1A2B3D31 HarperCollins Publishers 2017

No.4Answers Further explanationsAWorkingBeginning work-in-process inventory (80% to complete):4000 80%3200Units started and completed during the period:(Total units accounted for – *ending WIP inventory – *beginning WIPinventory)(12 000 units – 3000 units – 4000 units)5000Units completed and transferred out8200Ending work-in-process inventory (40% complete): 3000 40% 1200Total equivalent units9400*This does not consider the percentage of completion5CWorkingBeginning work-in-process inventory (80% to complete):4000 80%3200Units started and completed during the period:(Total units accounted for – *ending WIP inventory – *beginning WIPinventory)(40 000 units – 6000 units – 4000 units)30 000Units completed and transferred out33 200Ending work-in-process inventory (40% complete): 6000 40%Total equivalent units240035 600*This does not consider the percentage of completion6AWorkingWhen using weighted average, the percentage on completion forbeginning inventory is ignored.Units completed and transferred out(Total units accounted for – *ending WIP inventory)(40 000 – 6000)34 000Ending work-in-process inventory (40% complete): 6000 40%Total equivalent units240036 400*This does not consider the percentage of completion32 HarperCollins Publishers 2017

No.7Answers Further explanationsDWorkingUsing both FIFO and weighted average methods the answer is the same.This part of the production report does not consider the percentage ofcompletion.Total units to account for Beginning WIP inventory Units startedduring the period 4000 units 36 000 units 40 000 units8DWorkingUsing both FIFO and weighted average methods the answer is the same.This part or the production report does not consider the percentage ofcompletion.Total units to account for Beginning WIP inventory Units startedduring the period 4 000 units 36 000 units 40 000 units9CWorking(4000 80%) 6000 2000 (2000 30%) 780010DWorking4000 6000 2000 (2000 30%) 860011DWorking4000 6000 10 00012B13B14D15D33 HarperCollins Publishers 2017

No.16Answers Further explanationsCWorkingBeginning work-in-process inventory (30% to complete):15 000 30% 4500Units started and completed during the period:(Total units accounted for – *ending WIP inventory – *beginning WIPinventory)(165 000 units – 45 000 units – 15 000 units)105 000Units completed and transferred out109 500Ending work-in-process inventory (60% complete): 45 000 60%Total equivalent units17B27 000136 500WorkingBeginning work-in-process inventory (60% to complete):15 000 60% 9 000Units started and completed during the period(Total units accounted for – *ending WIP inventory – *beginning WIPinventory)(165 000 units – 45 000 units – 15 000 units)105 000Units completed and transferred out114 000Ending work-in-process inventory (20% complete): 45 000 20%Total equivalent units18199000123 000BWorkingCEquivalent unit cost: Direct Materials Cost added during the period Equivalent units 297 000 136 500 2.176WorkingEquivalent unit cost: Conversion Cost Cost added during the period Equivalent units 273 600 123 000 2.22420ATotal Equivalent Unit Cost Equivalent unit cost: Direct Materials Equivalent unit cost: Conversion Cost 2.176 2.224 4.40Working15 000 30% 450034 HarperCollins Publishers 2017

2.2.4 Marginal Costing and Absorption Costing TechniquesNo.Answers Further explanations1C2B3C4D5D6A7D8CExplanation and workingTo calculate the fixed manufacturing overhead unit cost, remember todivide the total fixed manufacturing overhead by the number of unitsproduced. Remember this unit cost can change based on the level ofoutput. The calculation for this question is as follows.Total fixed manufacturing overhead Number of units produced 150 000 7500 units 20.009DWorkingAbsorption costing: total unit costDirect materials 20Direct labour 40Variable manufacturing overhead10A 8Unit fixed manufacturing overhead 20Total unit cost 88WorkingVariable costing: total unit costDirect materials 20Direct labour 40Variable manufacturing overheadTotal unit cost 8 6835 HarperCollins Publishers 2017

No.11Answers Further explanationsBWorkingAbsorption costing closing inventory cost Closing inventory units totalunit product cost *700 units 88 total unit product cost 61 600*Closing inventory units Opening Inventory units units produced –Units sold 0 7500 – 6800 700 units12BWorkingAbsorption costing closing inventory cost Closing inventory units totalunit product cost *700 units 68 total unit product cost 47 600*Closing inventory units Opening Inventory units units produced –Units sold 0 7500 – 6800 700 units13D14B15B2.2.5 Service Sector CostingNo.Answers Further explanations1C2B3C4D5C6A7BWorkingPOHAR Total Estimated Overhead Total Estimated Activity ( 1 923 750 645 000 555 000) 3 675 000 0.8536 HarperCollins Publishers 2017

No.8Answers Further explanationsCWorkingAlexander Caterers POHAR Actual auditor direct labour costsTotal overhead applied 0.85 (360 [ 3 675 000 29400 hours]) 38 2509CWorkingCost of Alexander Job Direct Labour cost Overhead Applied (360 hours 125 per hour) 38 250 83 250 3 675 000 / 29 400 hrs 125 ph10CModule 3: Planning and Decision Making2.3.1 BudgetingNo.Answers Further explanations1C2D3D4D5A6CWorkingSales120Ending inventory (60% 140) August7D8D9A84Opening inventory(50)Budgeted purchases for July15437 HarperCollins Publishers 2017

No.Answers Further archBudgeted sales in units50 00060 00080 000 selling price 20 20 20 1 000 000 1 200 000 1 600 000WorkingJanuaryAccounts receivable600 000Sales January (25%, 75%) 1 000 000250 000Sales February (25%, 75%) 1 200 000February750 000300 000Sales March (25%, 75%) 1 600 000D16A17D900 000400 000850 00015March1 050 0001 300 000WorkingCash balance 25 000Cash collections 90 000Cash available 115 000Cash disbursementCash deficit (150 000) (35 000)Ending cash balance required is 10 000. Therefore, the company mustborrow 45 000 to make up the cash deficit of 35 00038 HarperCollins Publishers 2017

No.18Answers Further explanationsA19D20CWorkingJuly 40 000August 60 00060 000September 90 00036 000126 0002.3.2 Standard Costing and VariancesNo.Answers Further explanations1A2A3A4D5DWorkingActual cost(AH SR) 15 000 (1600 10) 1 000 F6A7D8D9D10A11D12C39 HarperCollins Publishers 2017

No.Answers Further explanations13A14B15A16D17B18C19AWorkingD5000 2.5 12 500WorkingDSR(AH – SH) 5(13 000 – 12 500) 2500 UWorkingD(AH AR) – (AH SR) (30 000) – (15 000 3) 15 000 FWorking202122SR(AH – SH) 3(15 000 hrs – (2.5 5000 units)) 7500 U2.3.3 Cost Volume ProfitNo.Answers Further explanations1A2D3BWorking 200 000 – ( 80 000 / 0.5) 40 0004DWorkingSelling price – variable cost ( 1 000 – 700) 300Fixed cost Contribution margin per unit 300 000 300 1 0005DWorking 100 000 500 000 30%Variable cost 70% 1 400 000Therefore sales 2 000 00040 HarperCollins Publishers 2017

No.Answers Further explanations6A7D8C9B10D11D12D13B14AWorking(62 500 units 3) – 100 000 – 25 000 62 500 therefore variablecost 115D16C17C18DWorkingBreak-even in dollars fixed expenses contribution margin ratio 100 000 50% 200 000Margin of safety Sales – breakeven sales 500 000 – 200 000 300 00019BMargin of safety % Margin of safety sales 300 000 500 000 100 60%WorkingSelling price( 150 000 5 000)Variable expense( 90 000 5 000)Contribution20DPer unit ( )30%10018601240WorkingFixed expenses / Contribution margin % 30 000 / 0.4 75 00041 HarperCollins Publishers 2017

2.3.4 Capital Budget Techniques on Investment Decision MakingNo.1Answers Further explanationsCWorkingAnnual average investment ( 200 000 20 000) 2 110 000Accounting rate of return 40 000 110 000 100 36.4%2B3C4C5A6C7D8D9D10D11A12C13D14BWorkingInitial investment expected annual net cash flows 800 000 200 000 4 years15A42 HarperCollins Publishers 2017

No.16Answers Further explanationsAWorkingNumber of years01234Total value ofdiscounted cashflowsInitial investmentNPV17B18D19A20CDiscount0.893 25000.797 20000.712 20000.636 1500 (5 000)2232.50159414249546204.50(5 000)1204.5043 HarperCollins Publishers 2017

No. Answers Further explanations 15 A 16 B 17 C 18 A 19 C 20 C 21 B 22 B 23 B 24 A 25 D 26 C 27 B 28 D 29 D 1.1.2 Recording Financial Information No. Answers Further explanations 1 B 2 BExplanation The body of the question says, “an equivalent value of ordinary shares” and makes n