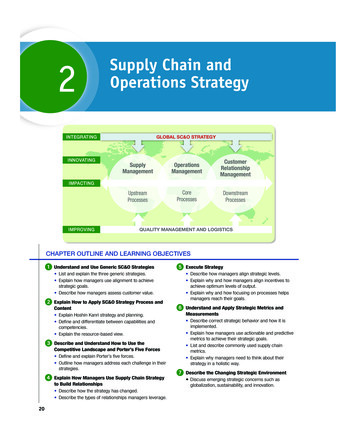

Transcription

M&A Making the deal workStrategy

Table of contentsStrategyM&A: A Critical Tool for Growth4The Crux of Corporate Strategy: Building an advantaged portfolio6Winning in M&A: How to become advantaged acquirer19Due diligence for synergy capture: Building deals on bedrock24Deal-making in Downturns: The “big, black cloud of slowdown” has a silver lining28Authors41

M&A Making the Deal Work StrategyM&A: A critical tool for growthBy William Engelbrecht and Tanay ShahGlobal merger and acquisition (M&A) activityhit a record high of 4.7 trillion in 2015 andcontinued its momentum in the first half of2016 reaching 1.7 trillion.1 Although thatmay prove to be the high-water mark fordeal flow, a majority of corporate executivesand private equity (PE) professionalsnonetheless expect deal activity to remainstrong in 2016.2 Conducive macroeconomicconditions have helped fuel the boom,but astute observers can see an evolvingstrategic rationale for deal-making.M&A can be an important means forbuilding scale, improving a target’sperformance, or removing excess industrycapacity, and can fuel long term, profitablegrowth. M&A’s numerous potential benefitsdictate that it be viewed as an importantarrow in the corporate quiver; ready to beloosed when needed. However, companiesshould not wait until an attractive target isin view to sharpen their M&A capabilities;proactive planning can improve the odds ofhitting a strategic bulls-eye. In fact,Deloitte’s M&A Trends Report 2016: Ourannual comprehensive look at the M&Amarket,3 found that corporations are placingmore emphasis on developing an M&Astrategy in 2016.The sluggish pace of global economicgrowth enhances the attractiveness ofM&A. In addition, sustained low interestrates, strong US equities markets, cash-richbalance sheets, and increasing businessconfidence give companies the ability andattitude to pursue deals as a means to grow.In fact, executives’ most commonly citedreasons for engaging in M&A are growthoriented: accessing new customer bases,gaining entry into new geographic markets,4and expanding products and services.524Access to new intellectual property (IP) isalso an important driver of growth-orienteddeals, especially in highly innovativeindustries such as pharmaceuticals andtechnology, where IP is a company’slifeblood. Case in point: Over the past fiveyears, the cost to develop a pharmaceuticalasset has increased by roughly a third, whileaverage peak sales for the industry havefallen by 50 percent over the same period.6M&A provides an additional means ofbringing promising therapies into a pharmacompany’s portfolio.Meanwhile, big technology firms aremaking headlines for their deal activity(and a fair number of deals are notdisclosed or publicized). For instance, amajor social media platform company hascompleted more than 50 deals in its shorthistory, with recent acquisitions addingcapabilities in e-commerce, virtual reality,speech recognition, and other fields.Some companies’ portfolio of IP-relatedacquisitions is even more eclectic. Addingcredence to this trend, Deloitte’s latestcorporate development survey reveals thatthe pursuit of innovation is transformingthe M&A landscape. Roughly two thirdsof corporate development leaders whoresponded to the survey said their functionhas become a more important source ofinnovation over the past two years, andnearly 60 percent of executives believe thatthe volume of innovation-centered deals willincrease over the next two years.7In the midst of this boom, it is worthremembering that not all M&A deals addvalue. Thirty-nine percent of corporaterespondents and 56 percent of privateequity (PE) respondents said that more thanhalf of their transactions completed over thepast two years had not generated expectedreturns.8 However, reported failures shouldnot necessarily discourage companiesfrom pursuing M&A. Well-developeddue diligence, valuation, and integrationcapabilities can anchor an effective riskmitigation strategy. There is enoughknowledge and experience among the M&Acommunity and associated professionalsthat properly prepared acquirers canexpect to gain considerable financial andcompetitive value from their M&A pursuits.M&A is expected to remain a critical toolfor growth and long-term shareholdervalue-creation. Management teams planningto engage in strategic deal-making shouldfocus on building internal M&A capabilitiesand partnering with experienced advisors toimprove their chances of hitting a bulls-eye.

M&A Making the Deal Work StrategyEnd Notes1.“Will the New Year be ‘Sweet ‘16’ for Deals?” The Wall Street Journal, December 31, 2015, weet-16-fordeals-1451557804. Cited in M&A Trends Report 2016: Our annual comprehensive look at the M&A market, Deloitte, 20162.M&A Trends Report 2016: Our annual comprehensive look at the M&A market, Deloitte, 20163.From February 19 through March 15, 2016, a Deloitte survey conducted by OnResearch, a market research firm, polled 2,292 executives at US companies and privateequity firms to gauge their expectations, experiences, and plans for mergers and acquisitions in the coming year.4.M&A Trends Report 2015: Our annual comprehensive look at the M&A market, Deloitte, 20155.M&A Trends Report 2016: Our annual comprehensive look at the M&A market, Deloitte, 20166.Measuring the return from pharmaceutical Innovation 2015: Transforming R&D returns in uncertain times, rmaceutical-innovation.html7.Corporate development strategy: Thriving in your business ecosystem, Deloitte University Press, 2016, strategysurvey/8.M&A Trends Report 2016: Our annual comprehensive look at the M&A market, Deloitte, 201635

M&A Making the Deal Work StrategyThe Crux of Corporate StrategyBuilding an advantaged portfolioBy Mike Armstrong, Jonathan Goodman and Gavin McTavishOne of the central objectives of corporatestrategy is for executive managementto think holistically about a company’sportfolio of businesses—conceiving andspearheading ways to make the aggregatevalue of a company’s holdings durable overtime, and greater than the sum of its parts.This vital mission comprises two centralquestions: In which businesses should weparticipate? And, how do we create valuewithin and across1 our businesses? In otherwords, where will we play and how will wewin2, at the portfolio level?In this paper, we explore the characteristicsof an Advantaged Portfolio and the trio ofattributes that constitute each (Figure 1).These attributes in aggregate are key to fullyassess, assemble and maintain atop-performing corporate portfolio. Acompany may need to include additionalcompany-specific criteria to meet its specificgoals and aspirations,4 and the specificweighting of attributes will vary by company.But the nine attributes noted in Figure 1 are“default” criteria that may be relevant in awide range of portfolio contexts.Monitor Deloitte has found3 that the mostsuccessful portfolios typically exhibit threebroad characteristics: They are strategicallysound, value-creating and resilient. Perhapsthis seems obvious. But in our experience—maybe because it requires considerationand testing across a wide range ofattributes—companies seldom apply thistripartite “Advantaged Portfolio” approach.Executives, academics and consultantshave devised numerous frameworks forbuilding and sustaining an optimal corporateportfolio. Our experience suggests that anysuccessful portfolio design framework (asdistinct from the portfolio itself) should havethree important features: It should be multidimensional in its criteria because portfolioevaluation and construction cannot bereduced to a simple 2 x 2 matrix; it shouldfocus on the performance of the portfolioas a system (i.e., how the parts interact),not just on the individual components; andit should be tailorable to the company inquestion, since each company has differentgoals and aspirations. The AdvantagedPortfolio framework is designed to meetthese criteria.Figure 1: Characteristics of an Advantaged Portfolio1Strategically SoundCompetitively PositionedBalances InnovationCreates Synergies462Value- CreatingMaximizes Intrinsic ValueAddresses Market ValueFinds the Right Owner3ResilientSurvives ScenariosBuilds OptionalityWeighs Feasibility and Risk

M&A Making the Deal Work StrategyWhat Is a Portfolio?In a corporate strategy context, a portfolio is the collection of businesses than an organization chooses to own or invest in.Portfolios can exist at multiple levels within a company. In a corporate-level portfolio, the unit of analysis is the strategicallydistinct business (SBD), each of which has distinct competitors, geographies, etc. SBDs may or may not correspond to acompany’s organizational business units or reporting units. Portfolios also can exist within a business unit, a division, or even aproduct line, as depicted in Figure 2 by Bayer AG’s multiple sets of portfolios. The correct unit of analysis for a portfolio willchange based on the level of the portfolio being assessed.Figure 2: Portfolios Can Exist at Multiple Levels of an OrganizationHOLDINGCOMPANYBayer AGBayer CropScienceBayer HealthCareBayerMaterialScienceAnimal HealthConsumer CarePharmaceuticalsMedical careSUBGROUPSDIVISIONSTHERAPEUTICAREAS57

M&A Making the Deal Work StrategyAn advantaged portfolioshould be strategically sound1Strategically SoundCompetitively PositionedBalances InnovationCreates Synergies2Maximizes Intrinsic ValueAddresses Market ValueFinds the Right OwnerAn Advantaged Portfolio, first and foremost,should be strategically sound. That means itshould foster a strong competitive position,support multiple levels of innovation, andcreate synergy.Competitively PositionedWhen a portfolio is competitively positioned,its businesses in aggregate participatein more structurally attractive marketsand can more effectively compete in theirchosen markets. Even in the context ofblurring industry boundaries, the conceptand applicability of structural attractivenessendures. According to Michael Porter, inhis book Competitive Strategy, industryattractiveness is a function of five forces:competitive rivalry, the bargaining powerof buyers and suppliers, the threat of newentrants, and the threat of substitution.7The simple fact is that some industries orsegments are more likely to support higherreturns over time than others.8 Of course, acompany is able to realize the full potentialof any industry or segment by winning—i.e.,being better than competitors at bothcreating and capturing value for customers.68Value- Creating3ResilientSurvives ScenariosBuilds OptionalityWeighs Feasibility and RiskThus, an effective portfolio is weighted infavor of structurally attractive markets inwhich the company has a demonstratedability to win (Figure 3). Portfolios thatare more widely distributed—or worse,weighted toward structurally unattractivemarkets with no (or no enduring)advantage—are far less likely to produceattractive returns over time.In their recent book, Playing To Win, A.G.Lafley and Roger Martin set out a clear andpragmatic strategic framework based on theStrategic Choice Cascade, a demonstratedapproach to addressing strategy as a setof five interrelated questions, including:Where will an organization play? And, howwill they win? The framework was developedover 20 years by strategy consulting firmMonitor Group and used by hundredsof organizations. It provides a powerfulapproach to thinking about strategic choiceand action.

M&A Making the Deal Work StrategyFigure 3: Competitive Position MatrixHighHighINDUSTRY ATTRACTIVENESSWell-positioned portfolioINDUSTRY ATTRACTIVENESSPoorly positioned portfolioLowHighABILITY TO WINBalances InnovationTo be strategically sound, portfoliosshould also reflect an appropriate blend ofinnovation opportunities. The idea is to sowthe seeds for growth across various timehorizons (short, medium, and long-term) andvarious levels of risk and reward in line witha company’s ambition and risk tolerance. Asshown in Figure 4, innovation opportunitiescan be classified as core, adjacent ortransformational, depending upon how farthey diverge from existing offerings andcustomer base. A “core innovation” is anincremental improvement to an existingproduct targeted at existing customers. A“transformational innovation”is an initiative focused on offering newproducts to new customers or to serveneeds that have never been ILITY TO WINThere is a “Golden Ratio” for allocatinginnovation investments. According toMonitor Deloitte research published inthe Harvard Business Review,9 companiesthat allocated about 70 percent of theirinnovation activity to core initiatives, 20percent to adjacent initiatives, and 10percent to transformational initiativesoutperformed their peers—typicallyrealizing a P/E premium of 10 to20 percent. The ratio is an average acrossindustries and geographies and the rightbalance will vary by company. A technologycompany, for example, likely will finda greater investment in adjacent andtransformational innovations to be optimal.Interestingly, the same research data showthat the ratio of returns on investment isroughly the inverse of the ideal investmentallocation: core innovations typicallygenerate 10 percent of the returns oninnovation investment, adjacent effortsgenerate 20 percent and transformationalgenerate 70 percent.An Advantaged Portfolio will support aspread of innovation initiatives across core,adjacent and transformational horizons,consistent with the degree of threat andopportunity presented by disruptivetechnologies, disruptive business models,or competitive activity in the industriesrepresented in the portfolio.In so doing, the portfolio will typicallyimprove the competitiveness of theenterprise in the short, medium and l

respondents and 56 percent of private equity (PE) respondents said that more than half of their transactions completed over the past two years had not generated expected returns. 8: However, reported failures should not necessarily discourage companies from pursuing M&A. Well-developed due diligence, valuation, and integration capabilities can anchor an effective risk mitigation strategy .