Transcription

Investing monthly in US dollars made easyREC URRI NG D O L L AR E N DO WME N T P L ANA

B

The Recurring DollarEndowment PlanThe content in this brochure does not include the full detail. Certain terms and conditions apply. This brochure must be read with the relevant fact files.

Making it easy for youto invest in US dollarsOverviewIn today’s economic environment and considering the current volatility of therand, diversification of your investments into offshore assets is key to protect againstmarket uncertainty. Discovery Invest is the only company that allows you to diversify yourinvestments offshore on a monthly basis. With the Discovery Recurring Dollar Endowment Planyou can invest monthly in US dollars with ease.Monthly investingSimplified fund choiceConvenient investingThe Recurring Dollar EndowmentPlan allows you to save monthlythrough an offshore endowmentpolicy, at a minimum contributionof 200 a month. There is nomaximum entry age.You can choose from threerisk-profiled funds for easymapping to your risk profileaccording to your specific risktolerance. Each of the riskprofiled dollar-denominatedfunds dynamically rebalancethe mix of underlying assetclasses to maximise performanceaccording to your risk profile.Discovery Invest will facilitatemonthly contributions in USdollars, where contributionsare deducted from your SouthAfrican bank account in randsthrough a debit order paymentand invested globally in USdollars. The rand deduction eachmonth may change based onthe rand-dollar exchange rateat the time. You also don’t haveto apply for tax clearance onthe amount invested offshorebecause this investment usesthe annual R1 million SingleDiscretionary Allowance (SDA).The content in this brochure does not include the full detail. Certain terms and conditions apply. This brochure must be read with the relevant fact files.2

The Recurring Dollar Endowment Plan– in actionCase study 1James contributes 200 per month to thenew Discovery RecurringDollar Endowment Plan.His monthly contributionwill escalate yearlyby US CPI assumedto be 2% per year.Investment projection after 10 years 26 279 R943 918Assumptions Rand-dollar exchangerate R14.78/ . Rand-dollar depreciation 5% per year. * Assumed investmentreturn in US dollars 8% per yearafter fees. 39 207 12 928James receives13.4% returnincluding currencyexposure profitContributions Growth oncontributionsFundvalue after10 yearsJames receives8%* return beforeaccounting forcurrency exposureAt the end of 10 years, James would have a Recurring DollarEndowment Plan fund value of 39 207. In rand terms thisis equal to R943 918. James therefore earned an investment returnof 8%* in dollar terms, however, when converting to rand andallowing for the currency exposure profit, his investment returnin rand is 13.4%.The content in this brochure does not include the full detail. Certain terms and conditions apply. This brochure must be read with the relevant fact files.3

Fund offeringInvesting made simplerThe funds available on the Recurring Dollar Endowment Plan are the three Discovery USDrisk-profiled funds, which can be easily mapped to your individual risk profile.These risk-profiled fundscomprise a portfolio of iSharesexchange traded funds (ETFs)from leading global assetmanager, BlackRock. BlackRockis the world’s largest providerof ETFs traded on exchangesworldwide and span a varietyof asset classes.Each fund’s asset allocation isdone through a sophisticateddynamic asset allocation model,developed by RisCura forDiscovery Invest, to maximiseperformance according to yourrisk profile.The current iShares ETFs andtheir associated asset classesare shown on the next page.As can be seen, the assetallocation spans developed anddeveloping markets, both equityand property, as well as bondsand cash.The content in this brochure does not include the full detail. Certain terms and conditions apply. This brochure must be read with the relevant fact files.4

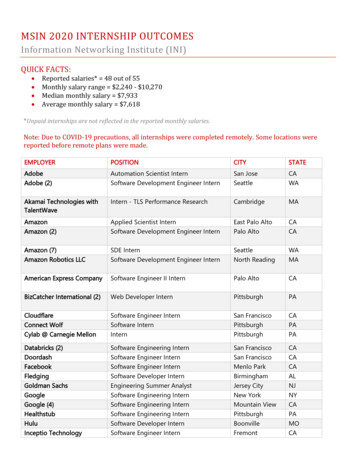

iShares ETFiShares Global Government Bond UCITS ETFiShares Global Inflation-linked Government Bond UCITS ETFiShares Global Corporate Bond UCITS ETFiShares High Yield Corporate Bond UCITS ETFiShares Developed Markets Property Yield UCITS ETFiShares MSCI Core World UCITS ETFiShares MSCI Core Emerging Markets UCITS ETFAsset classGovernment BondsGovernment Inflation-linked BondsCorporate BondsHigh Yield Corporate BondsHigher Yield DevelopedMarkets PropertyDeveloped Markets EquityEmerging Markets EquityThe content in this brochure does not include the full detail. Certain terms and conditions apply. This brochure must be read with the relevant fact files.5

What’s nextAsk your financial adviser for our fact file formore detailed information on fees and terms andconditions applicable. Our quotations will show youhow the choices you make will affect the benefitsyou qualify for and the fees you will pay.Please note if you change the various productsyou have with us, you could affect the existingbenefits and features on your investment plans.For example, if you cancel your contract early,you may pay an early exit fee and lose out on anyfurther growth on your investment. Please speak toyour financial adviser before making any changes toyour investment plan.6

About the licensesand regulationsThe Recurring Dollar EndowmentPlan is issued by Discovery LifeInternational, the Guernseybranch of Discovery Life Limited(South Africa). Discovery LifeInternational is licensed by theGuernsey Financial ServicesCommission, under the InsuranceBusiness (Bailiwick of Guernsey)Law 2002, to carry on long-terminsurance business. The SouthAfrican Long-term InsuranceAct of 1998 also applies to theRecurring Dollar EndowmentPlan. Discovery Life is a registered7long-term insurer and anauthorised financial servicesprovider, registration number1966/003901/06. The RecurringDollar Endowment Plan isadministered by DiscoveryLife Investment Services (Pty)Limited trading as DiscoveryInvest, a subsidiary of DiscoveryLimited. Discovery Invest is anauthorised financial servicesprovider. The trustee appointedby the Branch must holdthe licensed insurer’s assetsrepresenting at least 90%of planholder liabilities in trust.This is a standard condition onthe license of the Insurer undersection 12 of the InsuranceBusiness (Bailiwick of Guernsey)Law, 2002 (as amended).The information given in thisdocument is based on ourunderstanding of current lawand practice in South Africa andGuernsey. We do not acceptresponsibility for the effectof any future legislativeor regulatory changes.

Notes8

Discovery InvestContact centre 0860 67 57 77 invest support@discovery.co.za www.discovery.co.zawww.discovery.co.za@Discovery SADiscoveryInvestSADiscovery SAThese are not unit trusts, therefore these funds are not regulated by the Collective Investment Schemes Control Act. These funds are a sub-fund of BDP Limited, administeredby R&H Fund Services (Jersey) Limited. These funds are duly registered by the Jersey Financial Services Commission.The Jersey Financial Services Commission is protected by theFinancial Services (Jersey) Law 1998 against liability arising from the discharge of its functions under that Law. The value and performance figures are based on valuation pricesreceived from R&H Fund Services (Jersey) Ltd. This information is not advice as defined and contemplated in the Financial Advisory and Intermediary Service Act, 37 of 2002,as amended. Discovery will not be liable for any actions taken by any person based on the correctness of this information. Discovery Life is an authorised Financial ServicesProvider and registered Long-term Insurer. The information provided in this brochure should not be seen as advice. The investor confirms that neither Discovery Life Ltd or anystaff provided him/her with any advice (as defined in the FAIS act) and that he/she has taken particular care to consider on his/her own or with the assistance of his/her financialadviser whether the investment chosen is appropriate considering his/her individual needs, personal objectives and financial situation. These funds invest in foreign ExchangeTraded Funds (ETFs) and the investor would be subject to international market movement as well as any movement in the Foreign Exchange rates.GM 38808DI 06/05/16 V14

Investing made simpler These risk-profiled funds comprise a portfolio of iShares exchange traded funds (ETFs) from leading global asset manager, BlackRock. BlackRock is the world’s largest provider of ETFs traded on exchanges worldwide and span a variety of asset classes. Eac